- Ace in the Hole

- Posts

- Ace in the Hole - Edition #2

Ace in the Hole - Edition #2

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

I hope everyone had a Merry Christmas/Happy Holidays!

We have a short week with the market being closed for Christmas. I generally dislike short weeks because the price action is usually not favorable for taking a lot of trades, but regardless we are going to have a great week!

Last week we had GDP and PCE numbers come out. GDP came out at 4.9% after forecasting 5.2% and PCE came out at 2.6% after forecasting 2.8%.

What Does This Mean For Traders?

For day traders, this just brings intraday volatility for us to capitalize on and it did. We had some solid moves in the market, but if you were watching it from a higher timeframe it may have looked like nothing happened.

DAY TRADERS SCROLL DOWN FOR SETUPS TO WATCH THIS WEEK!

For longer term investors, it’s smart to be aware that when GDP and PCE numbers come in lower than expected, it can signal a slowdown in economic growth which can lead to a decrease in consumer spending and a decline in corporate profits which can negatively effect the stock market.

On the other hand, if GDP and PCE numbers come in higher than expected, it can signal a strengthening in the economy and an increase in consumer spending which could lead to a rise in corporate profits and a boost to the stock market.

Short-Term Setups For This Week:

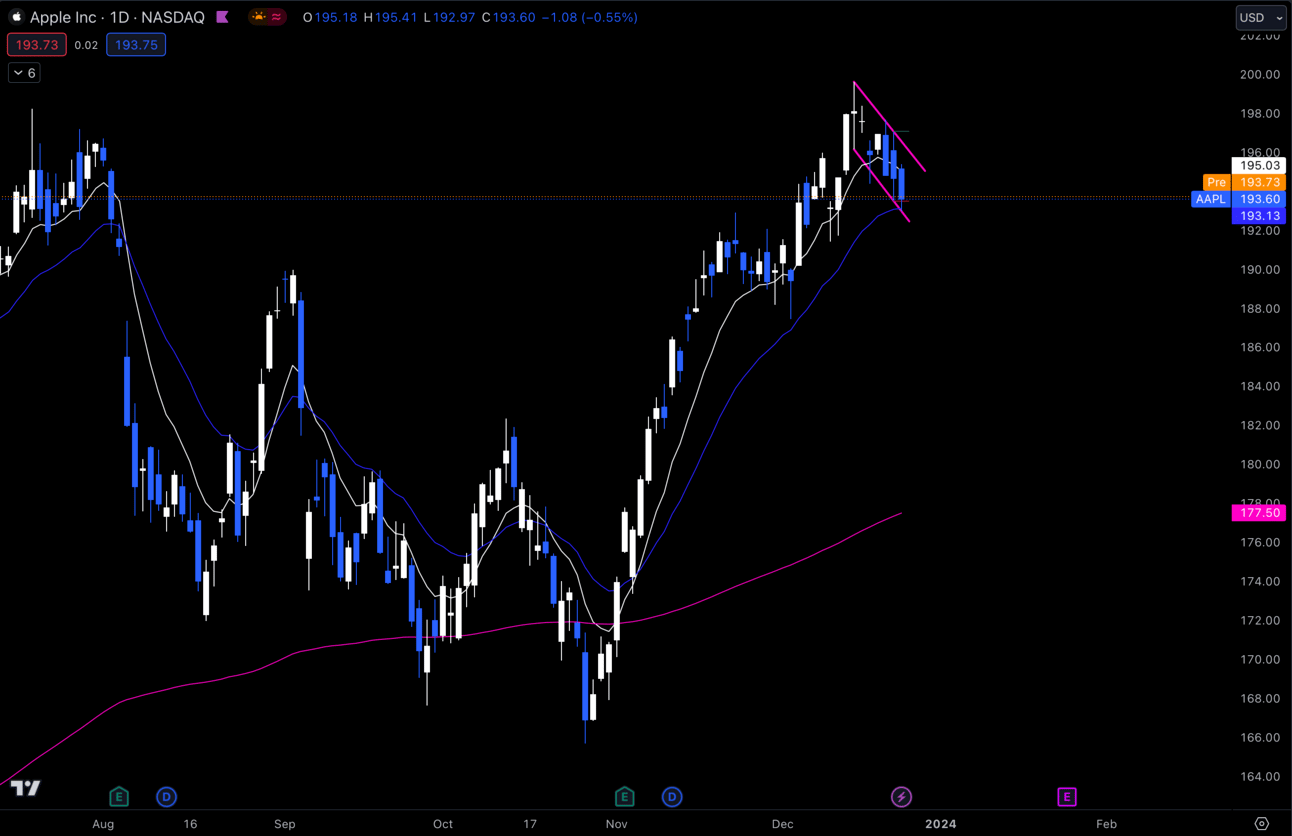

$AAPL

$AAPL Daily

The $AAPL Daily chart is looking pretty solid to me. I’m seeing a healthy pull back to the 21 EMA on the Daily. This is an area that I love to buy at if we are in a strong uptrend like we are here. I like this setup to catch intraday longs or possible swings long. Price targets/key levels I’m watching for us to get through are:

$194.39, $196.63, $198, $200

Getting a breakout of $200 would make a new all time high and trigger $AAPL to go into price discovery mode. I’ve found that there is generally a lot of volatility when this happens, so I definitely want to be in the trade if the opportunity is there.

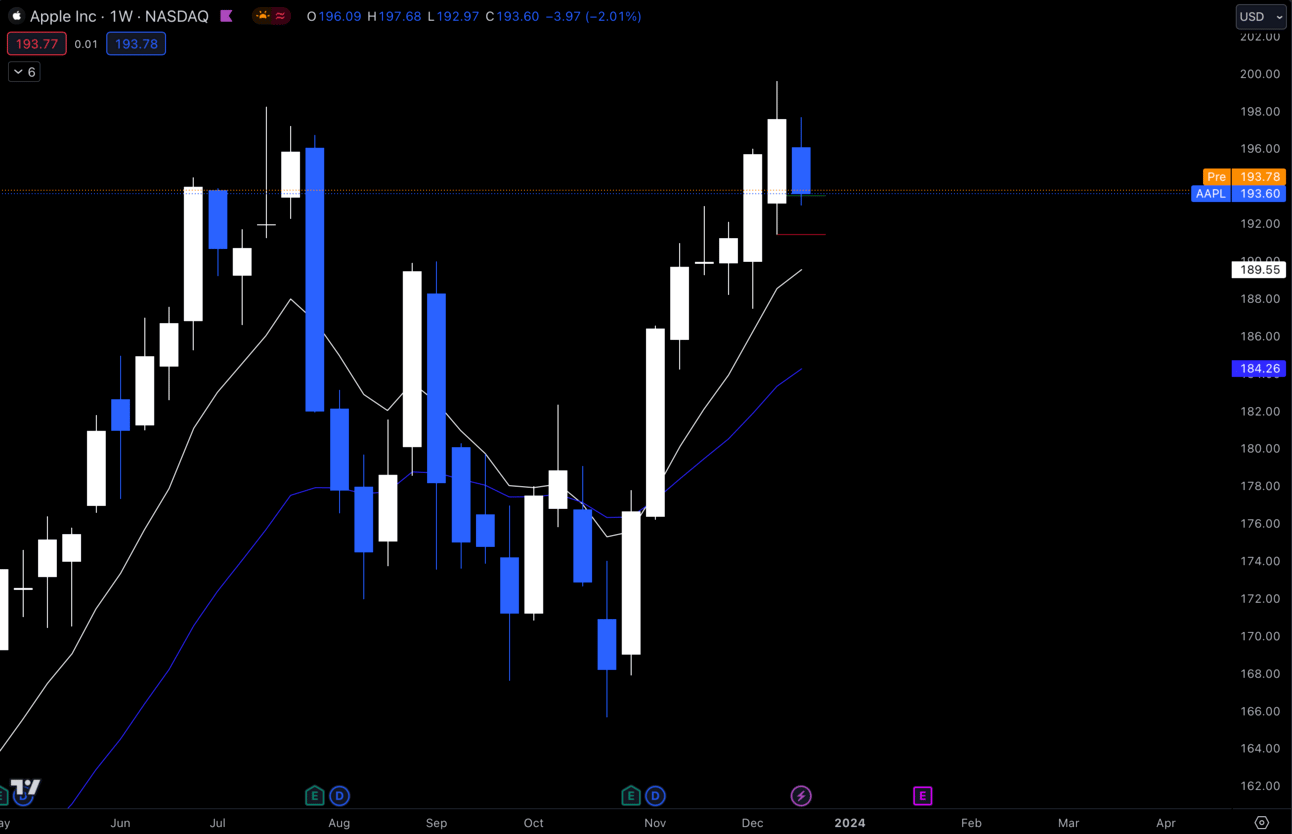

$AAPL Weekly

Also, the $AAPL weekly candle from last week is just an inside candle. This is by no means a bearish setup, so this is definitely adding confluence to my thesis above. Either way, any setup can fail, so I wouldn’t be long this name anymore if it got under $191.50.

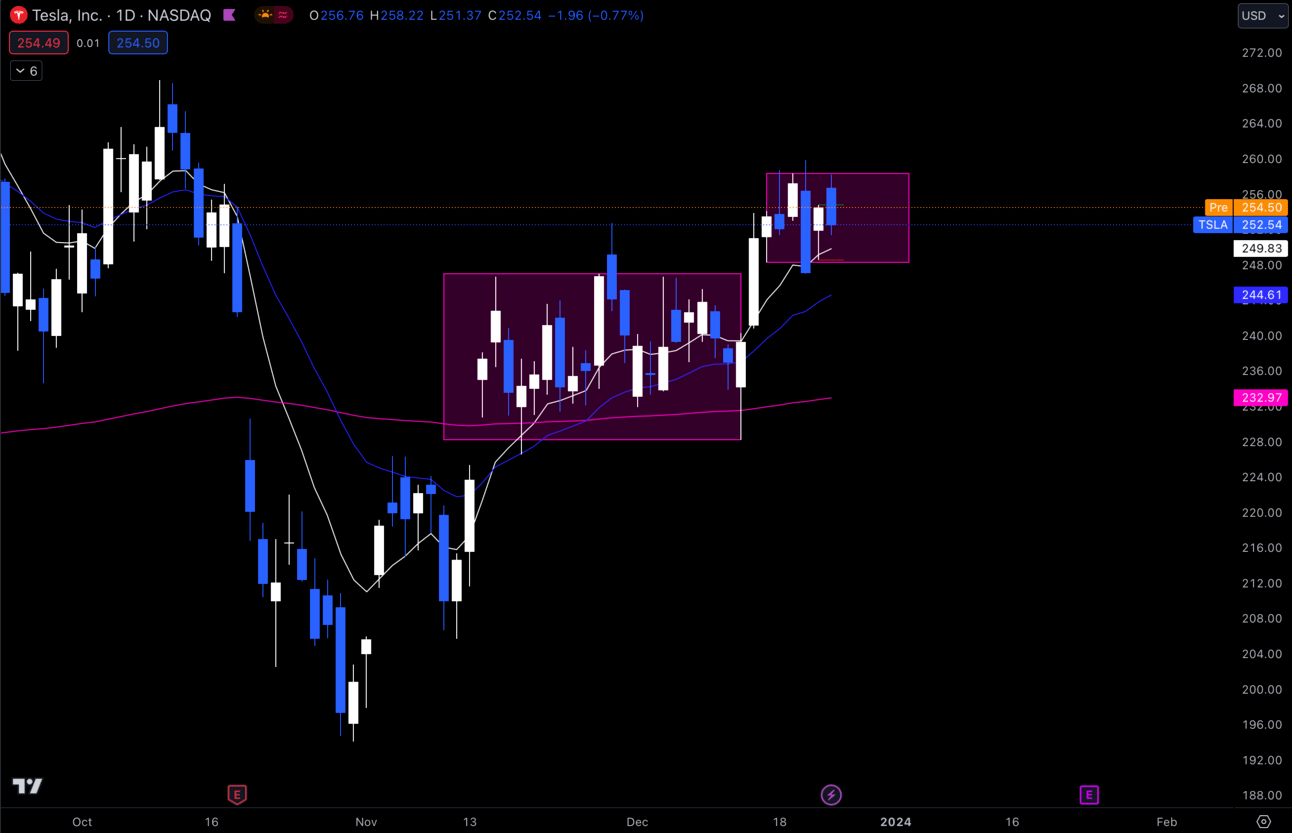

$TSLA

$TSLA Daily

Still watching this $TSLA setup from last week. We consolidated last week, so still no breakout of the range we are in, but we have retested the previous consolidation range and are holding it well so far. I’m looking to stay long this name and continue to make intraday trades on it anticipating the rally i’ve been talking about.

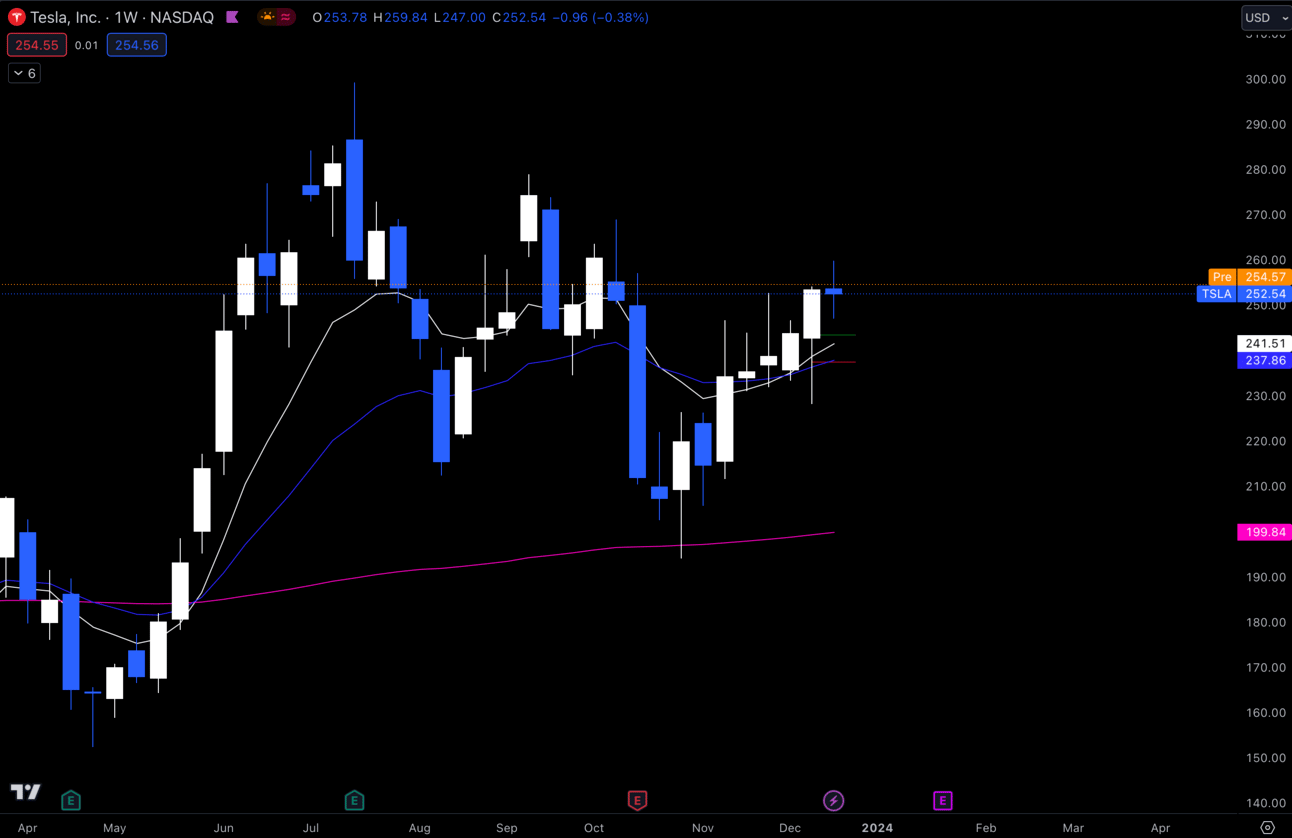

$TSLA Weekly

The weekly is still looking great with a strong close from the prior week and then last week we got a weekly doji candle. I personally think this is bullish because we have broken out of this weekly trend line and i’m anticipating a 3 bar play to the upside here, so that would mean that this week is strong and gets over last weeks high. I wouldn’t be long anymore under $242.50.

$MSFT

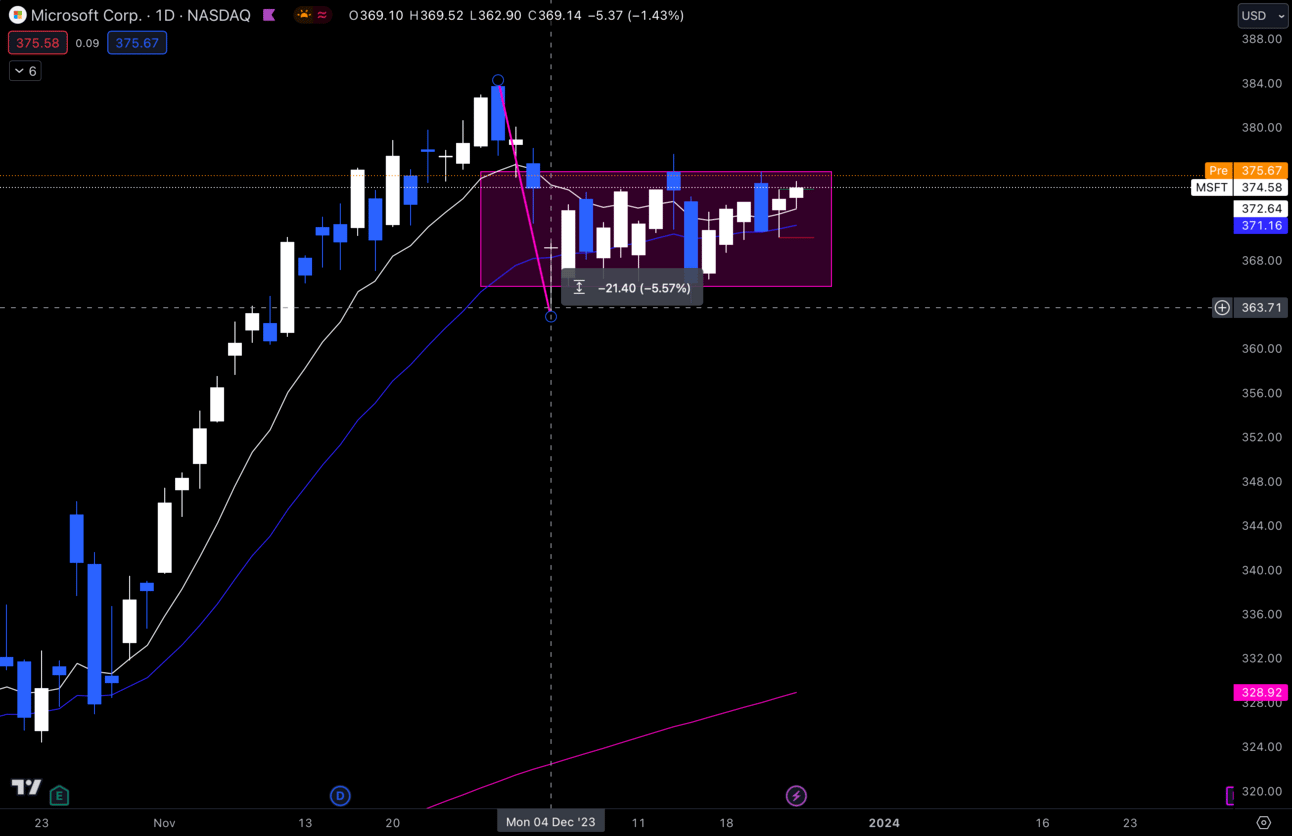

$MSFT Daily

I personally think $MSFT has a lot of potential for upside. It has already gotten a 5.57% pull back from highs and has had some healthy consolidation. I just have my range drawn and am waiting for a break of either side, but i’m definitely leaning bullish with the way this looks.

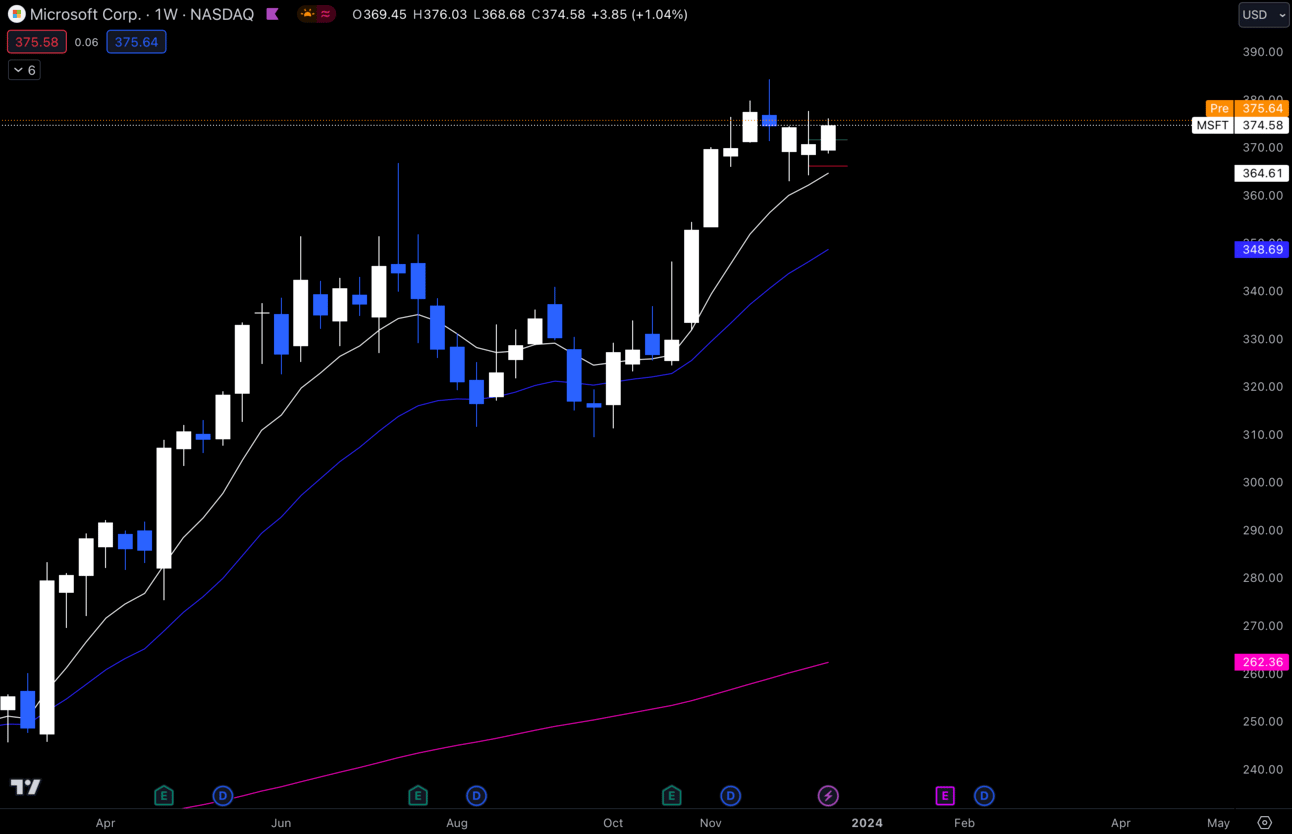

$MSFT Weekly

Weekly looks beautiful. A perfect pull back to the weekly 9 EMA and retesting July highs. Would like to see a strong candle close this week breaking the highs of last week and hopefully new all time highs or at least the top of this range. I wouldn’t be long anymore if this name got under $364.13

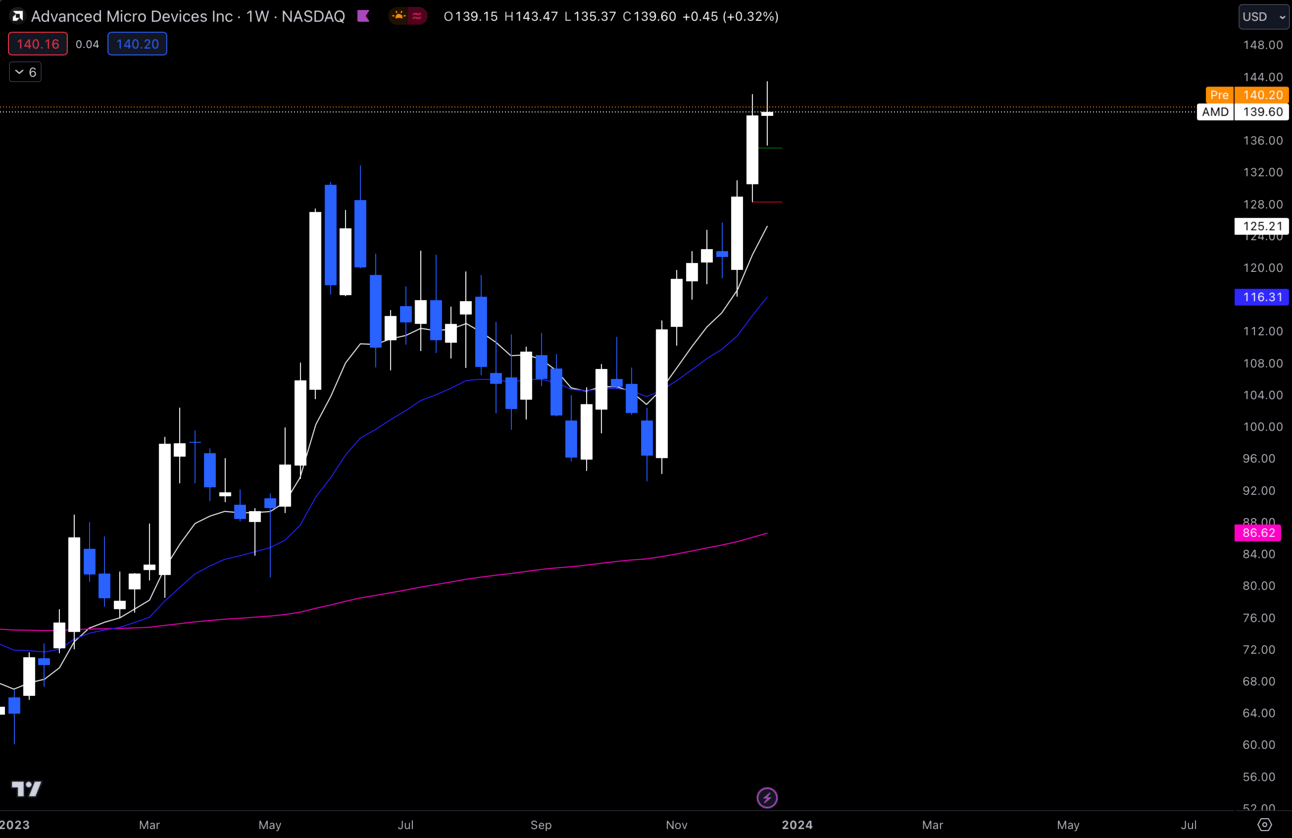

$AMD

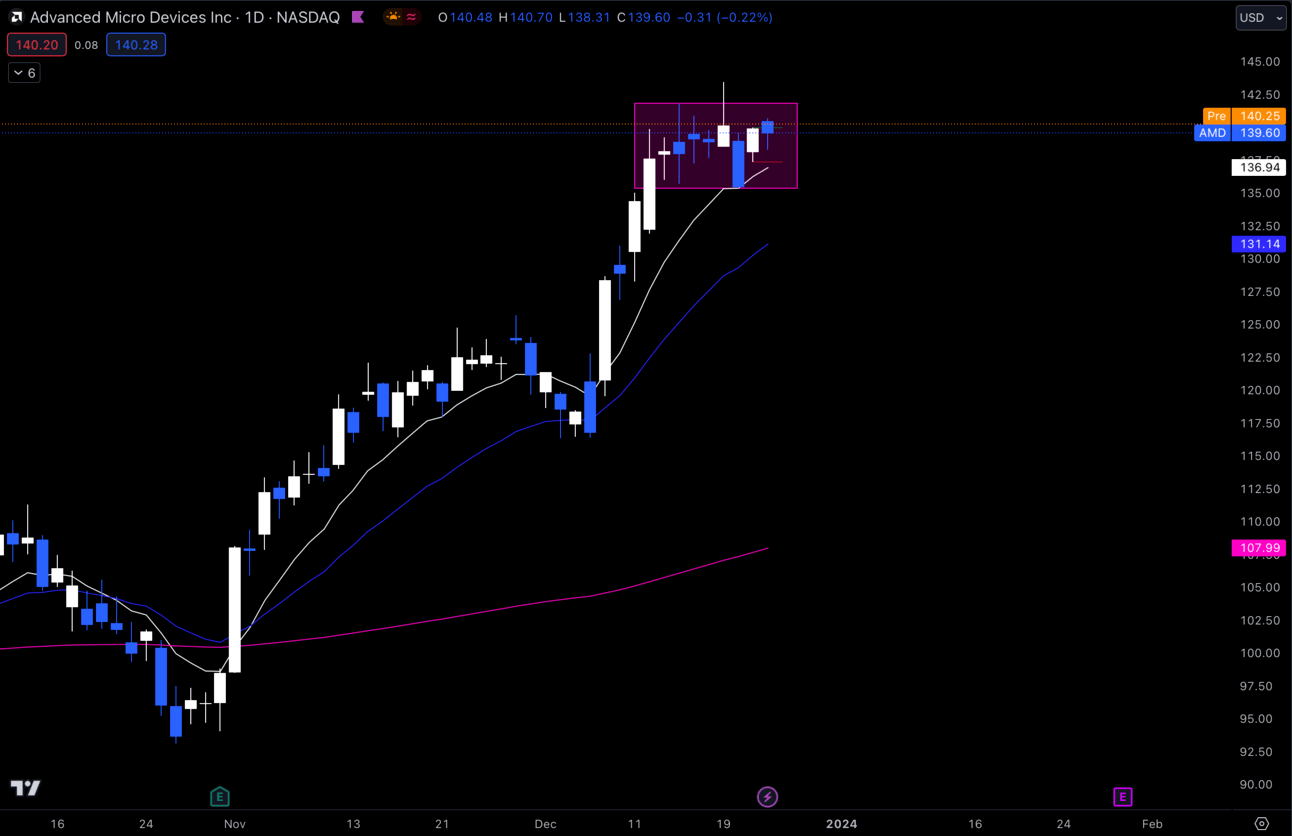

$AMD Daily

About 2 weeks ago, $AMD was going crazy with a massive breakout on the daily with lots of buying pressure. Since then, it’s pulled back 5.58% and is in healthy consolidation. I drew my range and am waiting for a breakout or breakdown.

This is another name where i’m leaning towards the bullish side, but like I always say. No matter how perfect the setup might be, it can truly go either way. So i’m prepared for both, but I think we get the leg up.

$AMD Weekly

Another weekly doji candle after breaking out of June highs which makes me thing that this is a similar setup to $TSLA and that I should be looking for that 3 bar play up. Sometimes it 3 bars, sometimes it extends its consolidation with more doji candles. Let’s just hope it’s not starting weekly consolidation. I wouldn’t be long this name anymore under $135.37

Long-Term Setups For This Week:

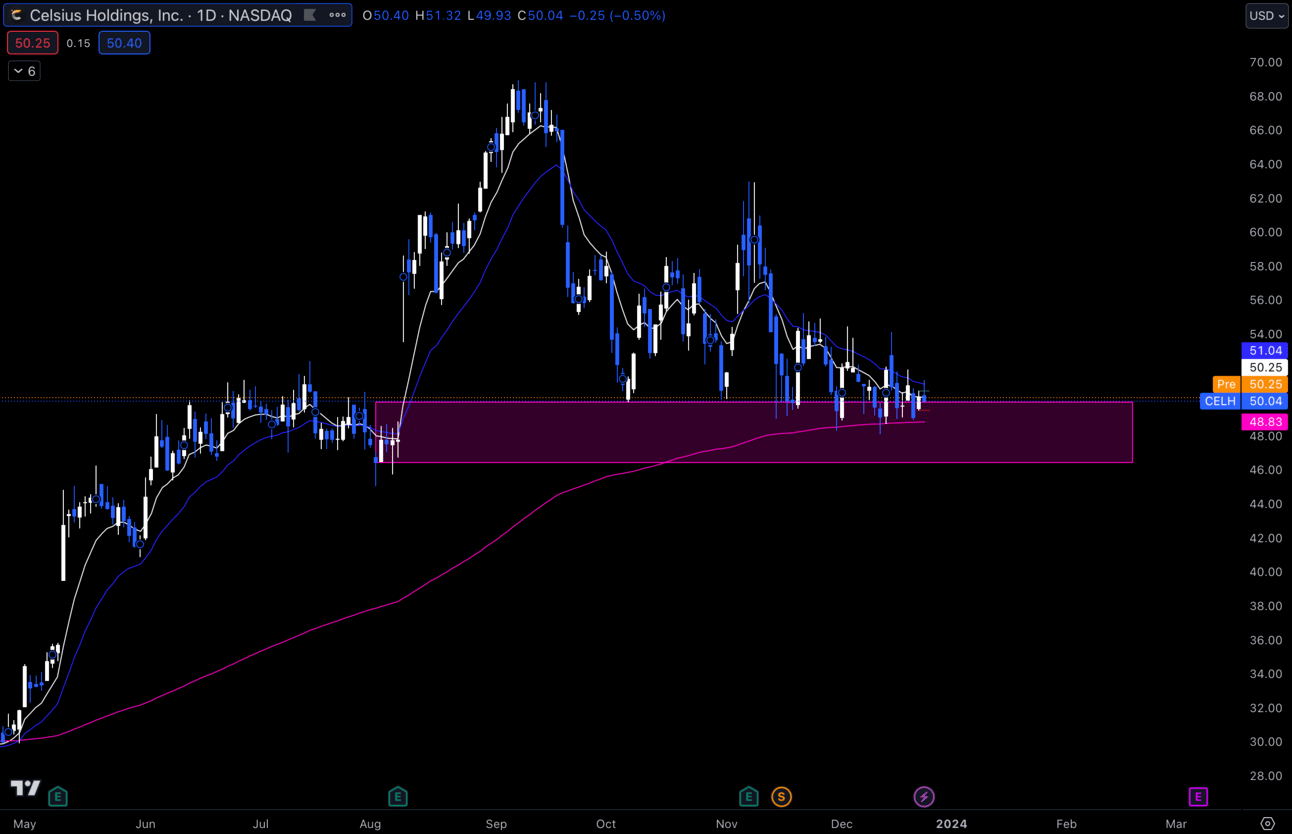

$CELH

$CELH Daily

I’m still watching $CELH for long-term adds and am adding small bits here and there under $50, but I think its possible we see this name start to break to the downside.

You can see continuous lower highs on the chart, but we are holding this bottom really well so i’m kind of torn. Under $48 I think we see $46, if we got under $46 i’d think this name is going to the $40 range.

To be honest though guys, I did many of my long-term adds during September and October when the market was down, so i’m not really looking to add to anything i’ve been watching quite yet. Although if we get to a point where I think the ceiling might be in, I will purchase protection against my long-term positions which I will share here.

Economic Calendar:

These data points are known to bring volatility during intraday trading:

Thursday 8:30 EST, Initial Jobless Claims

Thursday 10:00 EST, Pending Home Sales

Thursday 11:00, Crude Oil Inventories

Friday 9:45 EST, Chicago PMI

Expectations:

I’m expecting a decent week of trading, but we are at this spot where we could either be starting the Santa rally or the start of heavy chop/consolidation. There are a few economic events happening this week that could bring some intraday volatility, but we’ll have to wait and see.

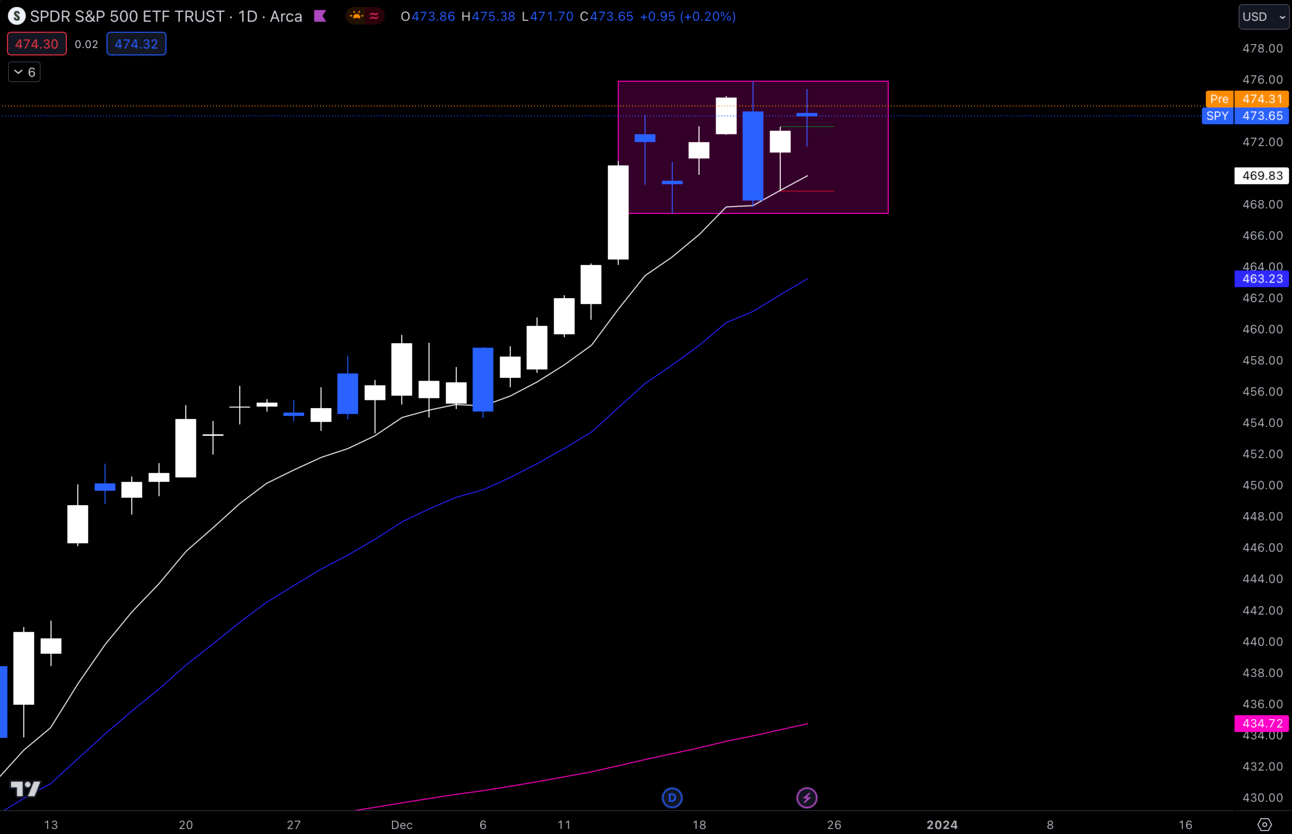

$SPY Daily

$SPY has been trading in a new range since last week just going back and forth, so I have my range drawn and waiting for a breakout or breakdown. If the $AAPL and $MSFT setups i’m watching end up going, we could definitely see another leg up on $SPY. I’m really hoping we don’t stay in the range too long.

Trending Sectors:

Top performers last week were the Energy, Consumer Discretionary and Technology. These sectors experience significant growth and positive movement with many stocks reaching new highs.

In Energy, oil and gas companies saw an increase in demand, Consumer Discretionary was driven by strong performance in retail and e-commerce, as well as travel and leisure companies. Lastly, Tech saw a surge in growth, particularly in the semiconductor and software industries.

Have a Great Week!

Lots of setups in the market this week, so lets have a great and safe week trading everybody!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

Real-Time Live Market Talk. (No delay like there is with X Spaces)

EDU Channels/Access to EDU content

Easy access to talk with me