- Ace in the Hole

- Posts

- Ace in the Hole - Edition #76

Ace in the Hole - Edition #76

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

I hope everybody enjoyed the Memorial Day weekend and got a break from the charts.

It was much needed for me to take a step away this weekend and not really look at any charts, but we have a BIG week ahead.

Let’s dive into it.

Market Thoughts

This rally continues to be the most hated rally we’ve seen in a long time. Everybody looking for tops and trying to short this strength, but continued to get ran over time and time again.

The market is way more bullish than people care to admit at the moment. I hope it makes sense why I stay away from headlines and thoughts from the majority on social media.

That doesn’t benefit us one bit.

What does benefit us is having clarity on the higher time frame and lining it up with the lower time frame to find precise entries.

$NQ_F ( 0.0% ) Analysis

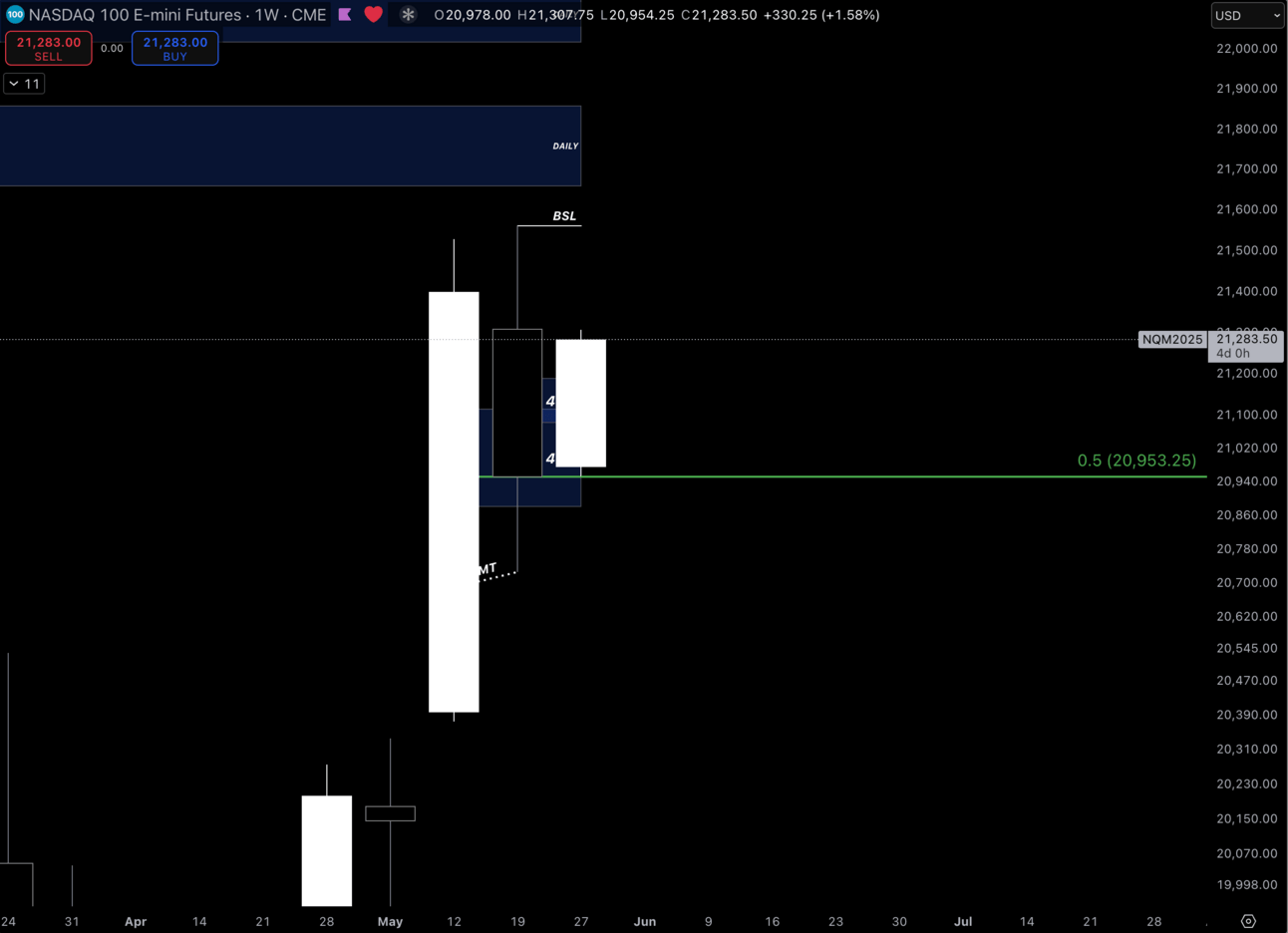

$NQ_F ( 0.0% ) Weekly Chart

In last week’s newsletter, I talked about how I wanted to see a pullback to the previous week’s Equilibrium which we did see.

Now I want to see continuation into the previous week’s highs, but let’s zoom in to get more clarity.

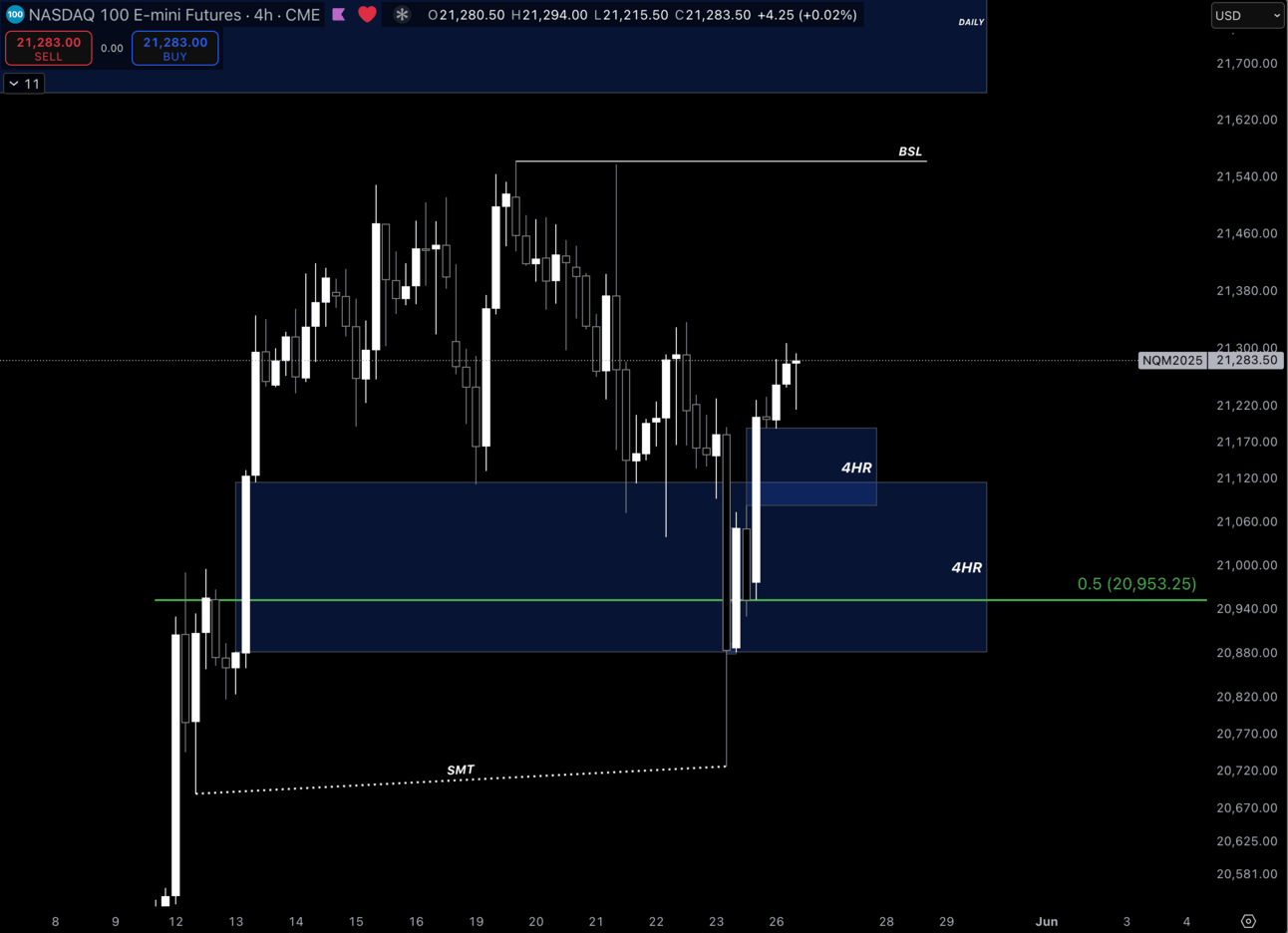

$NQ_F ( 0.0% ) 4hr Chart

Zooming into the 4hr, many of you might already see what you hear me preaching all of the time.

Accumulation —> Manipulation —> Distribution.

Markets CANNOT reverse from accumulation without manipulating price action. We saw zero manipulation from the highs to support any kid of bearish reversal.

So what does this mean for me?

This means the move down we’ve seen from the accumulation is manipulation IMO. Nasdaq manipulated to the downside to rebalance to higher time frame inefficiencies to stop tons of people out to go higher later.

How do I know this?

Look at your timeline from last week my friend, everybody scared and worried about the downside we saw, when it’s just manipulation of price to stop out the dumb money so smart money can fill their orders and push price where they want.

This is how the market works, anybody telling you different needs a class in stock market basics.

Nasdaq manipulated into 4hr Bullish order flow while creating 4hr Bearish order flow on the way down. Sunday night futures opened up and inversed 4hr Bearish order flow turning it to Bullish.

So we have:

Delivery out of a 4hr Bullish FVG

4hr Bearish order flow gets inversed delivering from 4hr Bullish order flow

SMT with $ES_F ( 0.0% ) and a CISD on a higher time frame from Sunday night.

I’ve seen absolutely everything I need to see to think we can go back to previous week high which sits at 21,562.25.

The only thing that I’d be cautious of early in the week is a potential move down to sweep previous week lows if the market needs to, but seeing the price action I’ve already seen, I’m not so sure that needs to happen.

Either way, that’s really the only uncertainty I see going into the week. I’m wrong if we start to disrespect Bullish order flow on a big time frame such as the 4hr and Daily.

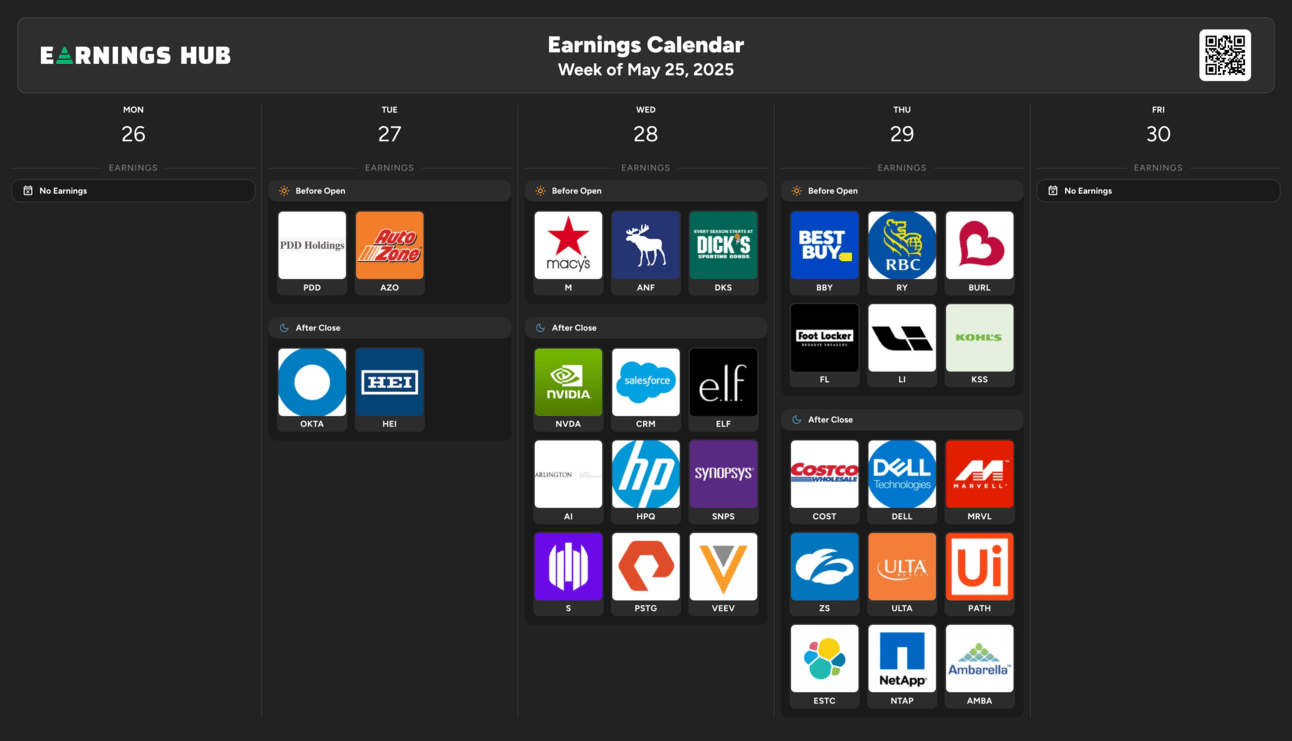

Earnings Calendar

Not many companies reporting this week, but we do have one BIG company…

Nvidia $NVDA ( ▼ 2.21% ) is reporting Q1 2026 Earnings Wednesday night and looking for $43.35B in revenue and $0.93 in EPS.

Listen to the earnings call LIVE on EarningsHub:

AI Trading App

If you’re not using AI to help you make money in the stock market, you’re behind.

But it’s okay, Prospero.ai has you covered.

Not only is their mobile app extremely user friendly, it actually teaches you how to use the platform to form winning ideas.

Download the FREE AI App here:

Weekly Gems:

They also have a weekly newsletter where they send YOU the best setups they have from the platform directly to your inbox.

I recommend checking out both the app and the newsletter.

It’s FREE, you have nothing to lose: https://prosperoai.substack.com/about

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST: Durable Goods Orders

Wednesday 10:00 EST: Richmond Manufacturing Index

Wednesday: 2:00 EST, FOMC Meeting Minutes

Thursday 8:30 EST: GDP & Unemployment Claims

Thursday 10:00 EST: Pending Home Sales

Friday 8:30 EST: PCE

Friday 10:00 EST: Consumer Sentiment

Trending Sectors

Healthcare, Utilities, and Consumer Defensive were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Tactical Traders Discord:

Live trade alongside professionals, access custom curriculum, trading psychology support, and join a community focused on your success. Learn, grow, and Profit Together.

Watch me and my peers trade LIVE!