- Ace in the Hole

- Posts

- Ace in the Hole - Edition #75

Ace in the Hole - Edition #75

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everyone is having a great morning and enjoyed the weekend!

Some big things happened last week…

$NQ_F ( 0.0% ) ripped 6.22% on the week, just to get surprised Friday night with Moody’s downgrading the U.S. credit rating for the first time in history.

The only other times we’ve been downgraded is from Standard and Poor and Fitch, but never from Moody’s.

Let’s dive in.

Market Thoughts & $NQ_F ( 0.0% ) Analysis

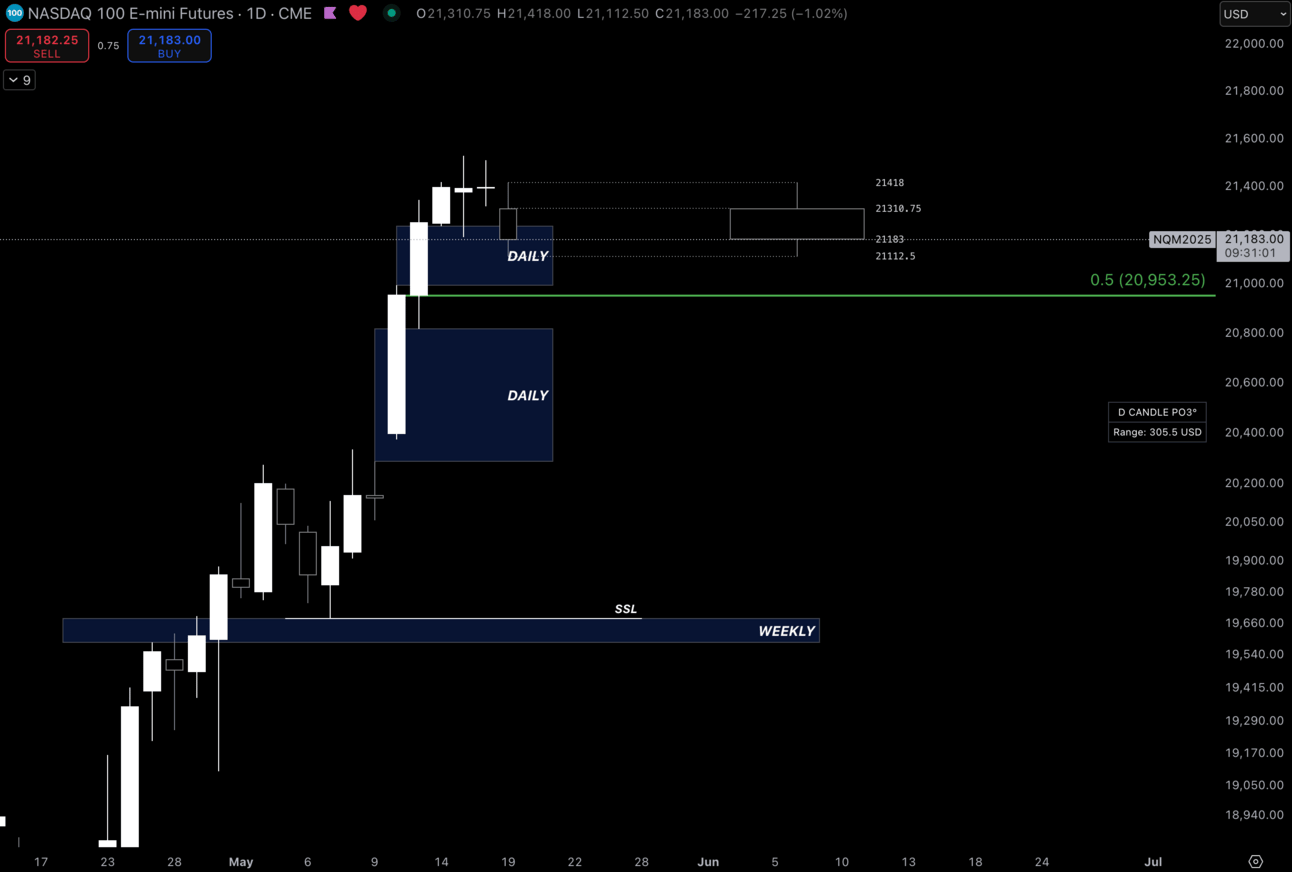

$NQ_F ( 0.0% ) Daily

I’m expecting a pullback to Equilibrium of last weeks range which is that green line you see above at 20,953.25.

To continue to stay bullish, I need to see a sweep of Tuesday’s low and respect the Daily FVG I have drawn in Discount.

As long as we are respecting these areas, I have reason for us to continue to trade higher, but price runs through this area, I expect to see SSL (Sell Side Liquidity) that lines up with an untapped weekly FVG.

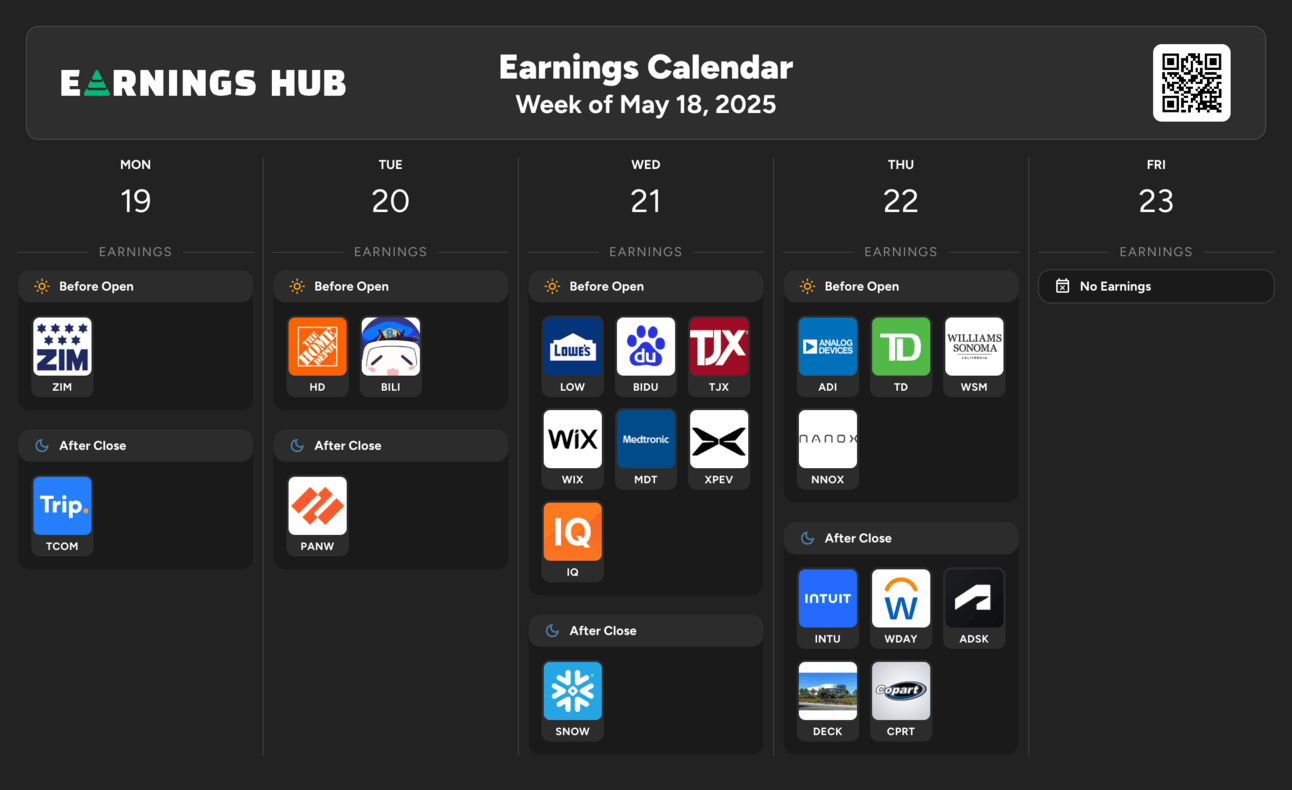

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Thursday 8:30 EST, Unemployment Claims

Thursday 9:45 EST, Flash Manufacturing & Services PMI

Thursday 10:00 EST, Existing Home Sales

Friday 10:00 EST, New Home Sales

Trending Sectors

Consumer Discretionary, Technology, and Utilities were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!