- Ace in the Hole

- Posts

- Ace in the Hole - Edition #74

Ace in the Hole - Edition #74

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope you all have enjoyed the weekend and got some time off of the charts. Another BIG week lies ahead of us.

Tons of economic data coming out as well as a couple interesting earnings reports.

Let’s dive in.

Market Thoughts

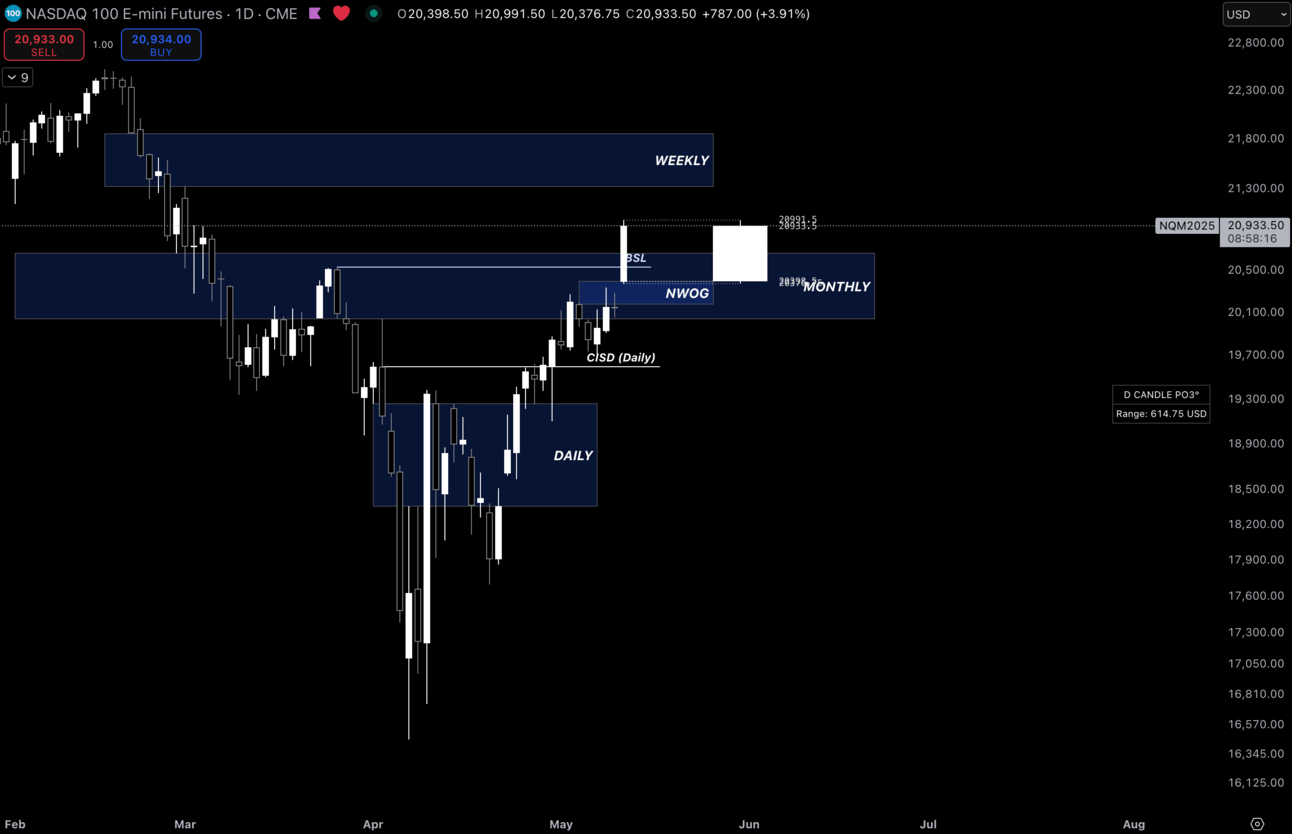

$NQ_F ( 0.0% ) Daily

We hit all my upside targets after futures opening last night. I do think this market can continue going higher, but why?

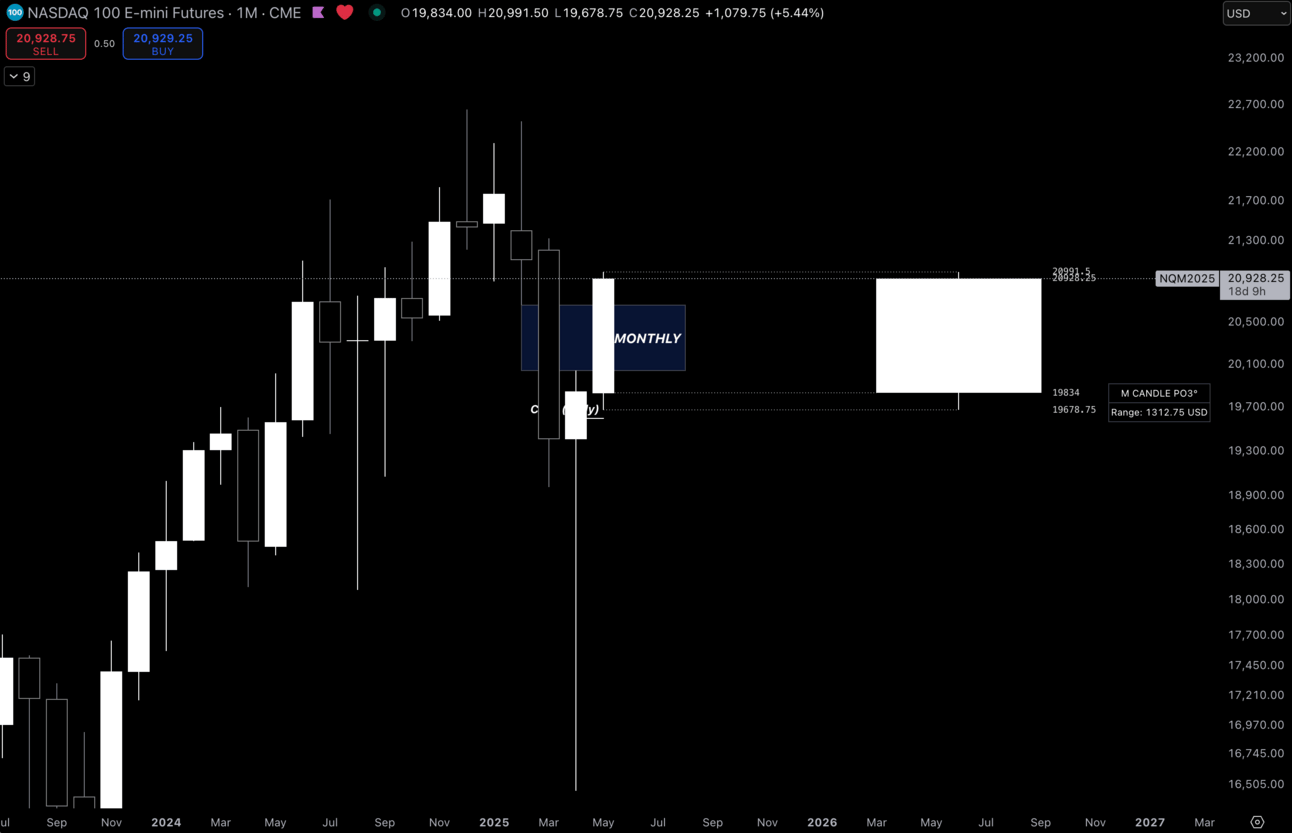

$NQ_F ( 0.0% ) Monthly

At the end of the day, if we close over this monthly PD Array with aggression, this market goes to all time highs IMO.

Sounds crazy right, with all the uncertainty. Again this is why I never look at a headline, it will never give me an edge.

Instead I let price tell me what’s happening. If we are completely violating bearish order flow on a monthly, I see no reason we don’t see all time highs again.

I need to see more structure on a lower time frame to be able to gather actionable thoughts for the market, but you know what I’m thinking on a higher time frame.

We will see how this month closes up.

Before I jump into anything else, I want to shoutout the new WOLF accounts that I am now running!

Follow @WOLF_TradingX on X/Twitter to listen to all of the Spaces I host, I no longer do the Spaces on my personal account and ONLY on the @WOLF_TradingX account.

Make sure you’re following!!

You should also be following the brand new @WOLF_TradingX Instagram account:

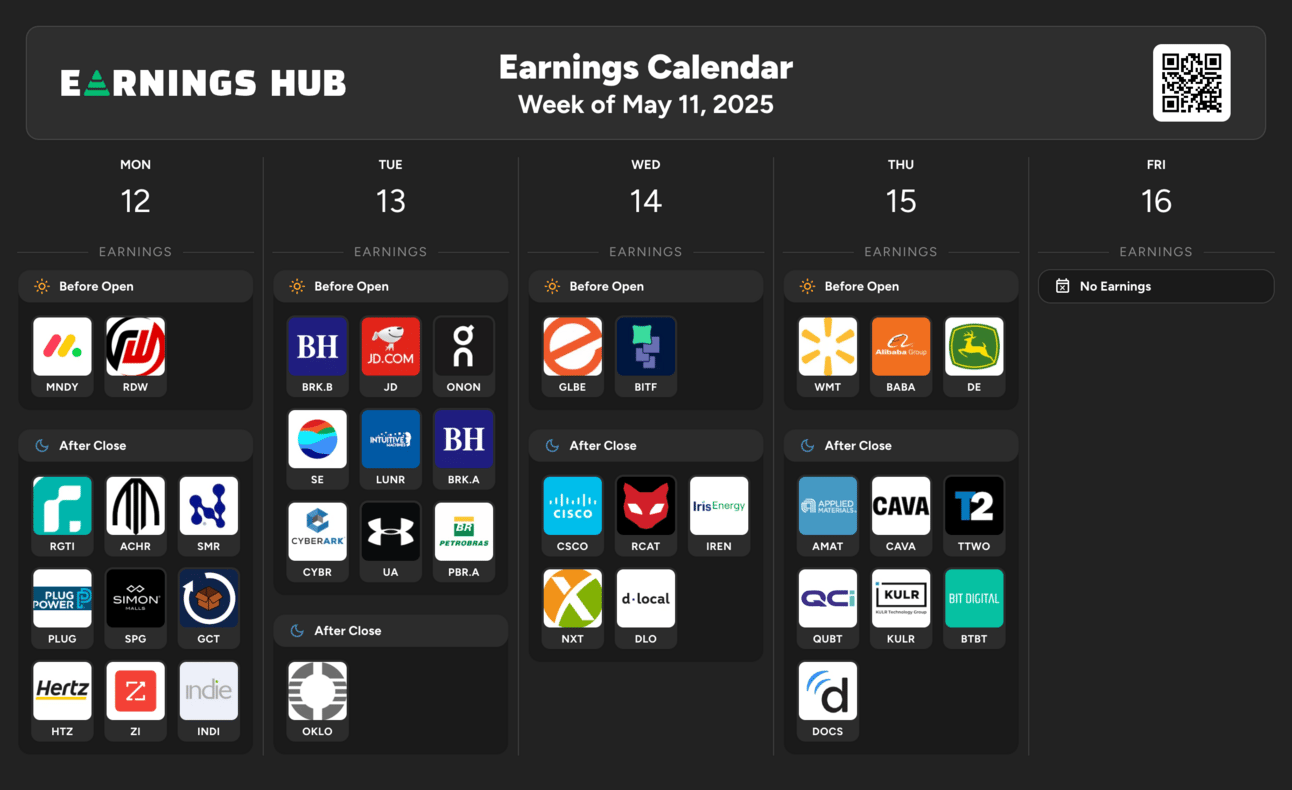

Earnings Calendar

If you aren’t taking advantage of Earnings Hub and all of the info that’s on here then I don’t know what you’re doing.

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, CPI

Thursday 8:30 EST, PPI, Retail Sales, & Unemployment Claims

Thursday 8:40 EST, Fed Chair Powell Speaks

Trending Sectors

Industrials, Financials, and Technology were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!