- Ace in the Hole

- Posts

- Ace in the Hole - Edition #71

Ace in the Hole - Edition #71

Your Secret Weapon to Beat The Market

Happy Monday Traders!

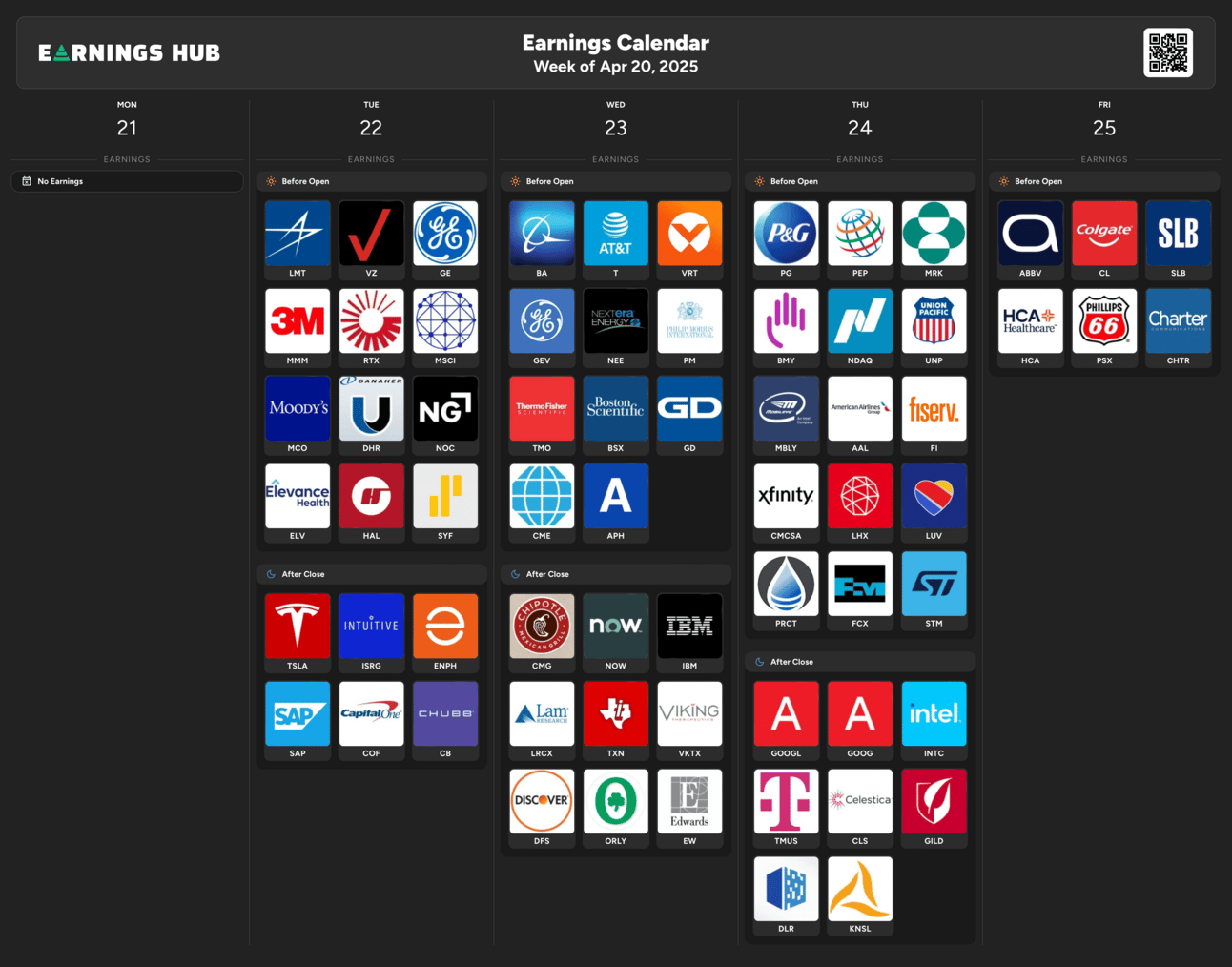

I hope you are all ready for a BIG week. We have a full week of earnings and economic data coming at you, so buckle up!

Let’s dive into it.

Market Thoughts

I’m and fairly bullish on this market at these areas, but I’ll talk about that more in depth soon.

The name of the game in this market is sizing and consistency. I haven’t changed my strategy during this market a little bit, but rather have changed sizing based on how high volatility is.

I’m also not trading every single day in this environment. I have my checklist of confluences and wait patiently until I see those.

I also have a definitive time that I’m allowed to trade everyday, so if I don’t see the confluences needed at the time I need it, I won’t trade.

Short-Term Setups This Week:

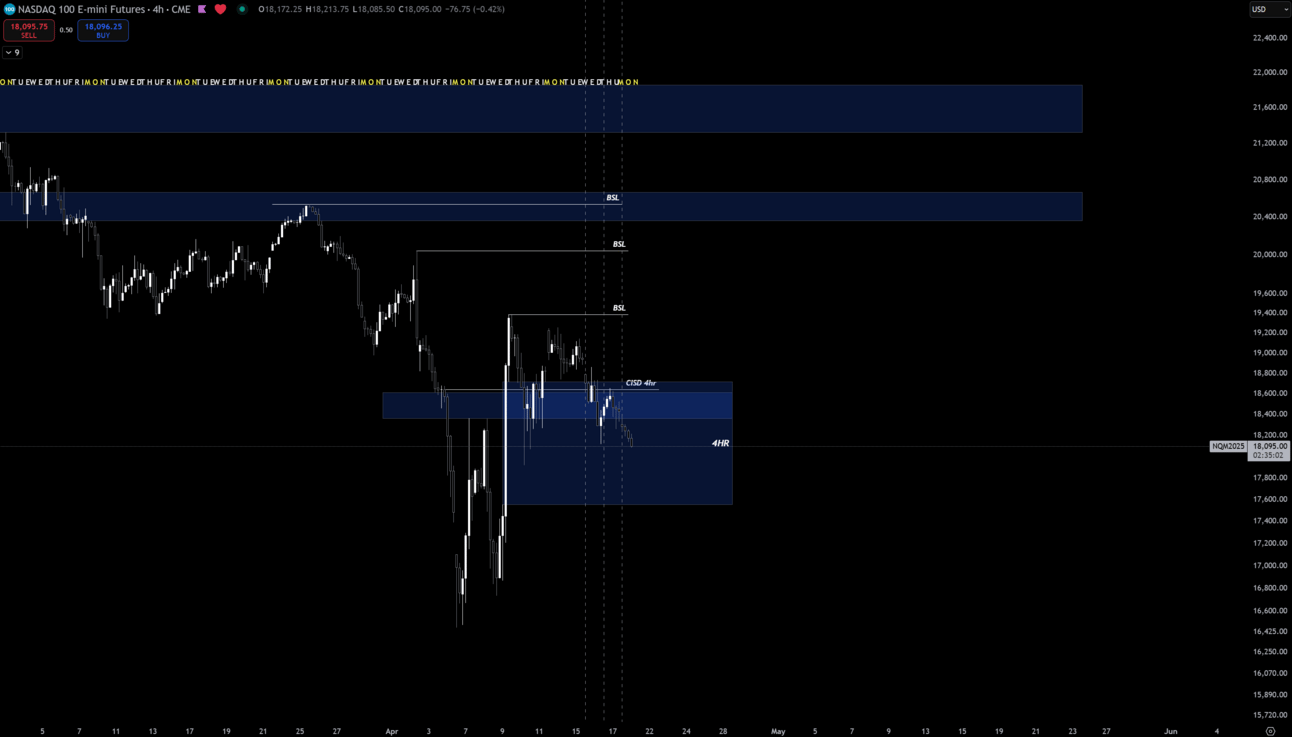

$NQ_F ( 0.0% ) 4hr

I am bullish on $NQ_F ( 0.0% ) until this shows me that it wants to disrespect this 4hr FVG. In that case I think we trade to range lows.

I’d rather see this market try and make a move higher, but either way this provide plays this week.

Above this imbalance and I think we see BSL levels.

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Wednesday 9:45 EST, Flash Services PMI

Wednesday 10:00 EST, New Home Sales

Thursday 8:30 EST, Unemployment Claims

Trending Sectors

Consumer Staples, Energy, and Materials were at the top of the list for trending sectors last week.

Top trending tickers from the past week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.