- Ace in the Hole

- Posts

- Ace in the Hole - Edition #70

Ace in the Hole - Edition #70

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody got some much needed time away from the charts after last week’s craziness. 70 weeks ago, I made the decision to start this newsletter and haven’t missed a single week since. Let’s keep it going!

We have a BIG week ahead with economic data and earnings season kicking back off, so get ready!

Market Thoughts

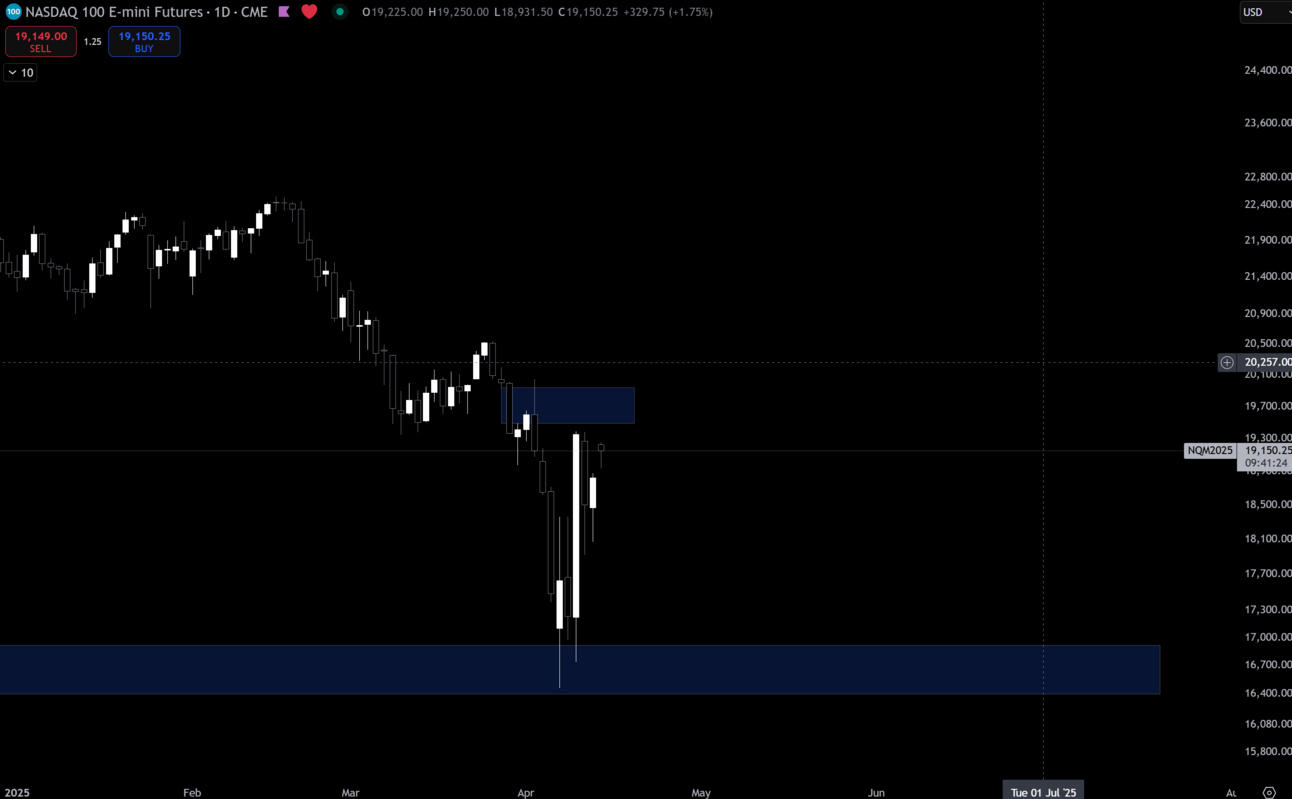

$NQ_F ( 0.0% ) Daily

The market has found some support from last week and got a huge bounce after Trump told everyone to buy.

I think we are looking decent, but I don’t think we are fully out of the woods just yet.

Things are setting up quite bullish into the previous daily highs at $20,044.25 and $20,536.75. Above that I don’t know how bullish I can be, it really all depends on whether we see strength over those highs or not.

Overall we just had massive moves to the downside into big bear targets and with earnings season coming up, I have a feeling it’s going to get very indecisive and choppy here.

As for long-term, I gave you guys my levels for $VOO ( ▲ 0.5% ) and I am buying on the nastiest days we have. I AM NOT INVESTING ON GREEN DAYS!!

Short-Term Setups This Week:

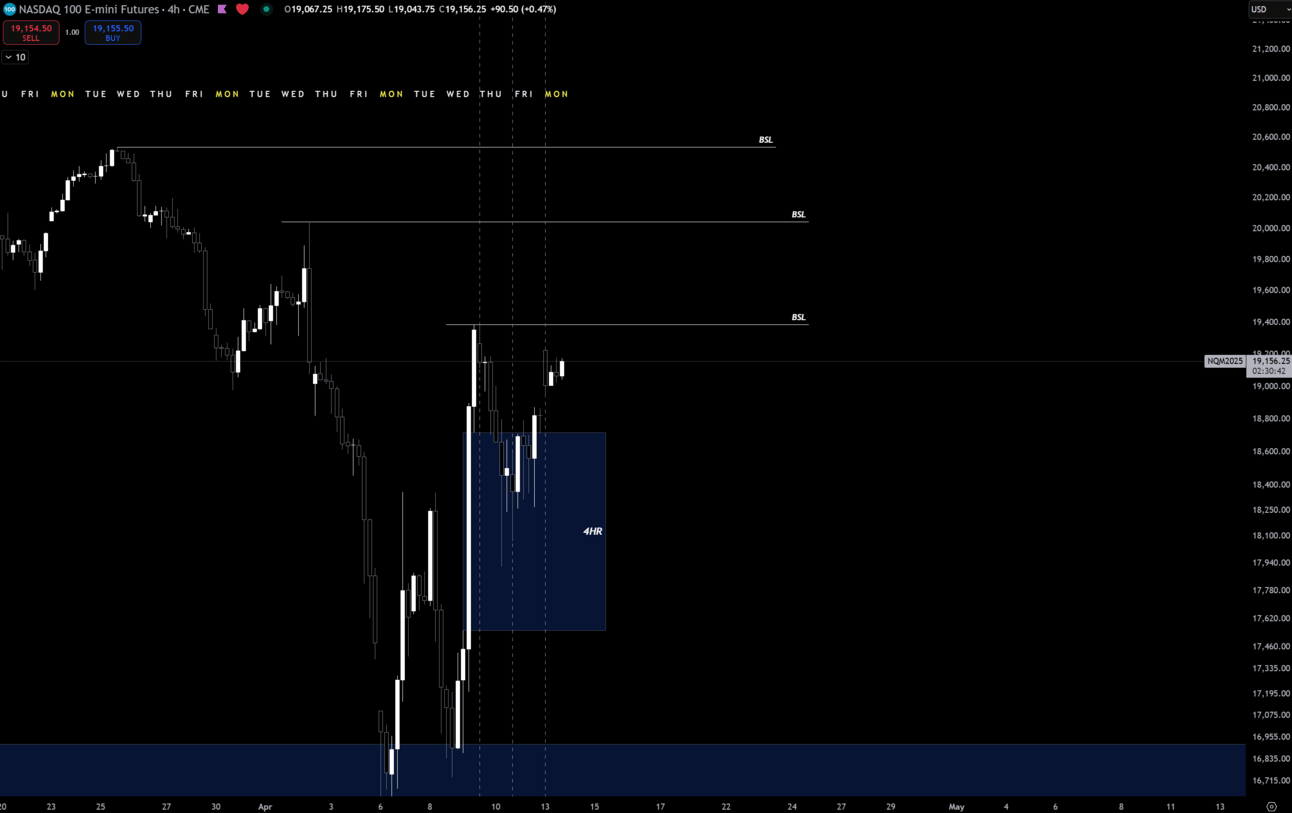

$NQ_F ( 0.0% ) Daily

On $NQ_F ( 0.0% ) I am bullish until we run through that 4hr bullish imbalance. As long as we are holding this I think we see those buyside highs this week. At each high I will look for displacement to go to the next high.

Basically the past 2 Wednesday highs is what I am targeting. I do think this market can trade lower, but a bit of relief seems needed.

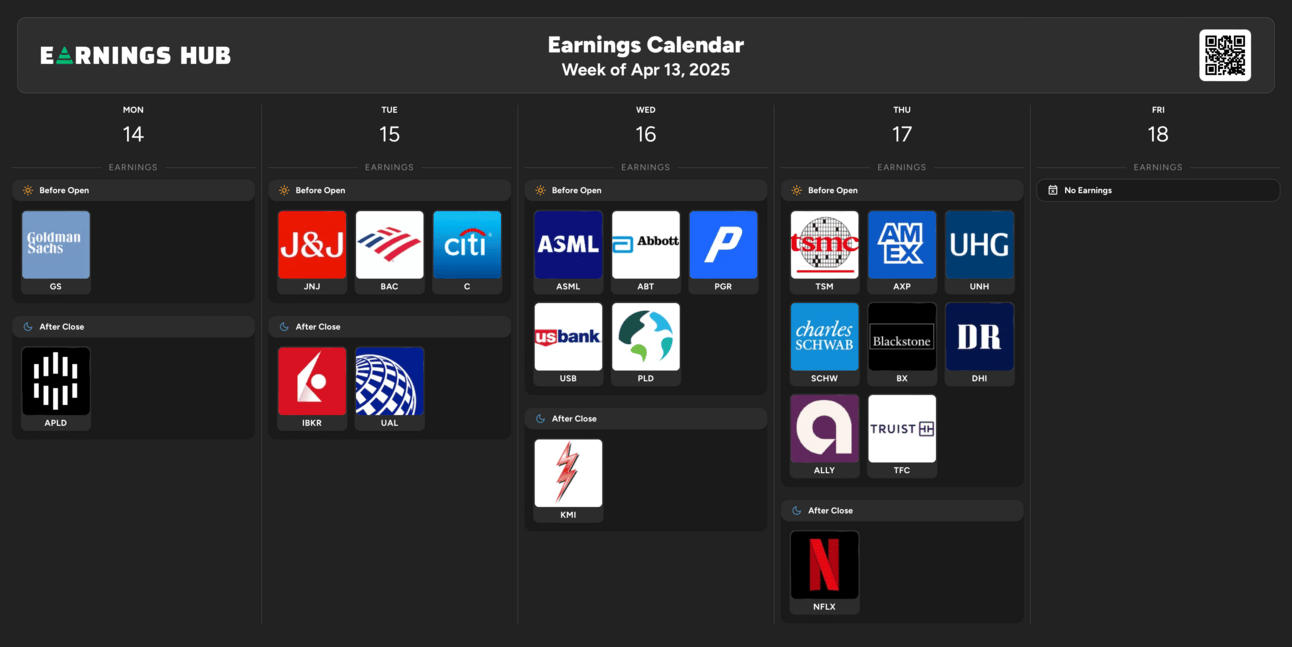

Earnings Calendar

Listen to every single earnings call live on Earnings Hub or read the AI summary of the earnings call if you are too busy to listen to it live!!

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 1:00 EST, FOMC Member Waller Speaks

Tuesday 8:30 EST, Empire State Manufacturing Index

Wednesday 8:30 EST, Retail Sales & Fed Powell Speaks

Thursday 8:30 EST, Unemployment Claims

Trending Sectors

Technology, Financials, and Industrials were at the top of the list for trending sectors last week.

Top trending tickers from the past week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.