- Ace in the Hole

- Posts

- Ace in the Hole - Edition #69

Ace in the Hole - Edition #69

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great weekend and got some time away from the charts, as I’m sure it’s needed.

These past couple weeks have been crazy and there has been so much uncertainty. People are freaking out about their long-term investments and questioning whether or not this is a dip to buy.

I’m going to lay out all of my thoughts here.

Market Thoughts

So obviously the market hasn’t been doing so well with tariffs introduced. Stock prices are driving down and people are being left wondering if they should hold their bags or let them go.

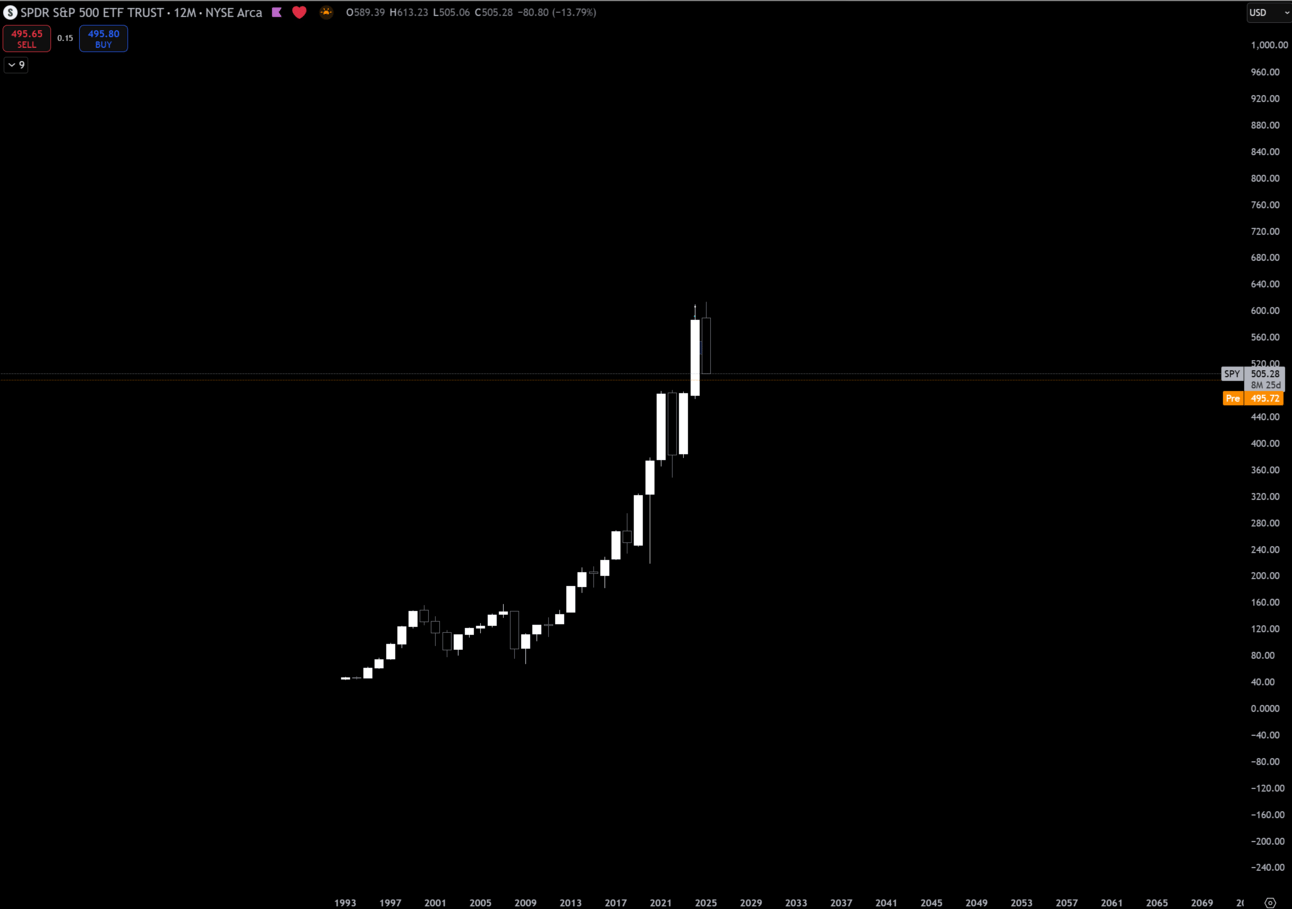

To those I ask you to put $SPY ( ▲ 0.5% ) on a yearly chart and tell me what you see.

$SPY ( ▲ 0.5% ) Yearly

When you look at the market from this perspective you can see that every single negative catalyst for the market was a buying opportunity to go back to all time highs.

Whether it be the 2008 crisis, Covid, it doesn’t matter.

The market has a 100% success rate of recovering and moving higher and until I see different I’m going to keep thinking that way.

I am personally buying this dip in my long-term on the way down. DCA on the big down days and setting myself up for the future.

I sold all of my individual names towards the beginning of the year except for $TSLA ( ▲ 0.17% ) and I will now be taking that cash and buying $VOO ( ▲ 0.5% ) & $QQQ ( ▲ 0.75% )

$VOO ( ▲ 0.5% ) is the S&P 500, but it’s the Vanguard ETF that gives a slightly better expense ratio on your investment.

Short-Term Setups This Week:

I’m not putting any short-term thoughts in this week. The volatility is crazy and most people can’t trade because of funded accounts being breached due to the price limit rule.

If a relief bounce on $NQ_F ( 0.0% ) occurs that would be nice, but I will be very patient this week and waiting for A+ setups only.

Get your shopping list out and start making your long-term account. Now is the time!

Economic Calendar

Wednesday 2:00 EST, FOMC Meeting Minutes

Thursday 8:30 EST, CPI

Friday 10:00 EST, Prelim UoM Consumer Sentiment & Inflation Expectations

Trending Sectors

Energy, Technology, and Consumer Discretionary were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.