- Ace in the Hole

- Posts

- Ace in the Hole - Edition #68

Ace in the Hole - Edition #68

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope you all had an amazing weekend and got a chance to get away from the screens.

This week will be a bit chaotic with all of the economic data that’s being released, so get ready for a volatile week!

Earnings are extremely light this week, but the season is kicking back off in April.

Market Thoughts

The downside in the markets have been a blessing lately and I don’t think its fully over yet.

You see everybody freaking out and that’s fine, this happens every time the market comes in, so I’m not surprised.

Overall I think we are in a downtrend on higher time frames and are not done trending yet. We will likely get short-term bounces (usually at the beginning of week) but overall we are trading in a downtrend.

Let’s keep enjoying the volatile markets!

Short-Term Setups This Week:

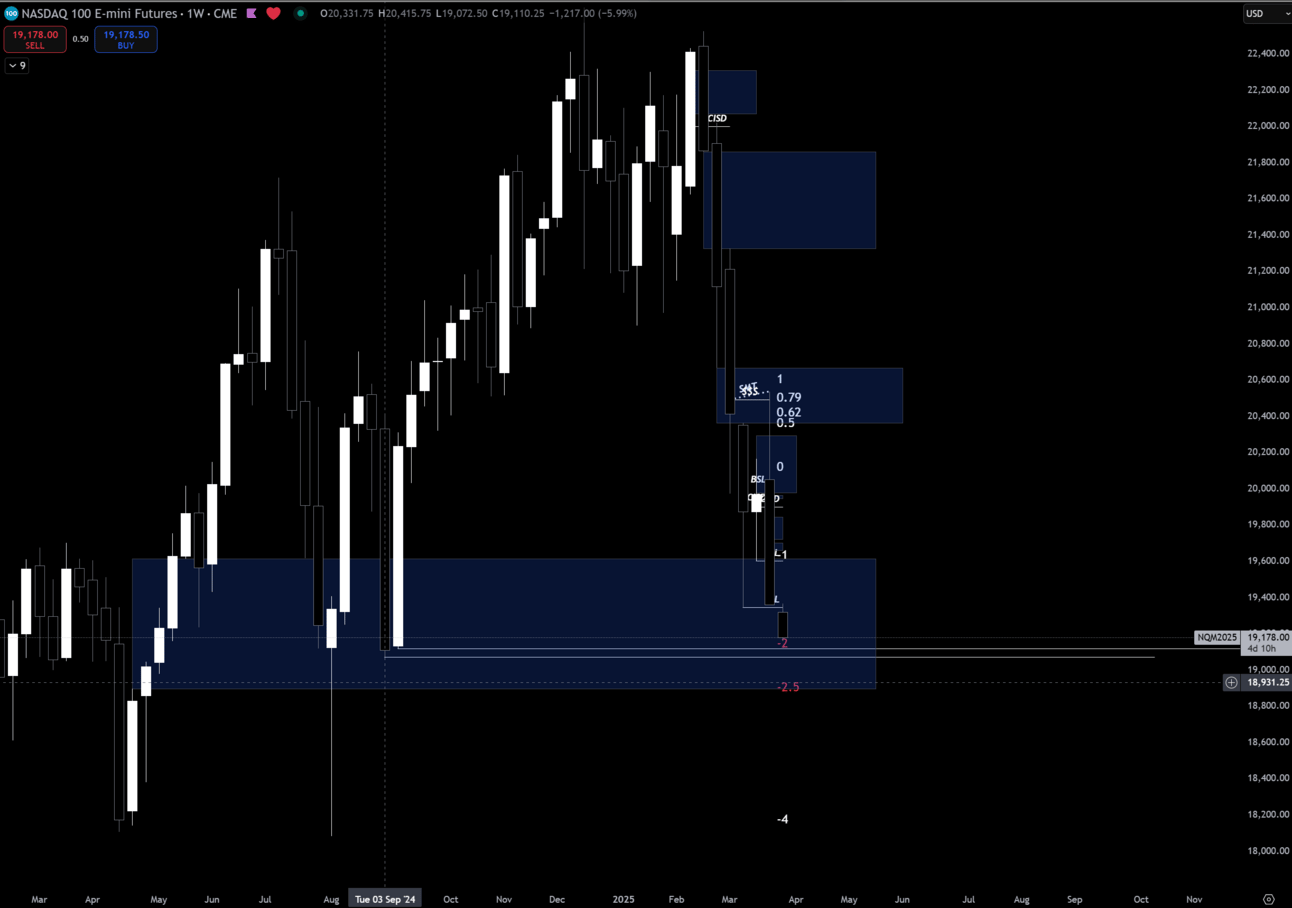

$NQ_F ( 0.0% ) Weekly

In terms of setups, I’m really only focused on trading Nasdaq Futures at the moment. This has benefited me in this market and I’m going to continue to do so.

As of now nothing is very clear on $NQ_F ( 0.0% ) except for we are reaching into September lows from last year that could provide a decent bounce.

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, ISM Manufacturing PMI & JOLTS

Wednesday 8:15 EST, ADP Non-Farm Employment Change

Thursday 8:30 EST, Unemployment Claims

Friday 8:30 EST, Non-Farm Payrolls & Unemployment Rate

Trending Sectors

Technology, Automotive, and Consumer Staples were at the top of the list for trending sectors last week.

Top trending tickers from the past week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.