- Ace in the Hole

- Posts

- Ace in the Hole - Edition #67

Ace in the Hole - Edition #67

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope you all had an amazing weekend and are prepared for a new week! Plenty of economic data to look forward to, so expect volatility.

Market Thoughts

Market has found a short-term bottom and has been consolidating for the past 2 weeks.

Until we get out of this consolidation we can continue sideways. To me this seems like a short-term bounce before going lower, but I’m happy to be wrong.

I’m continuing to take the market day by day and capitalize on the short-term price action, whether that is up or down.

Short-Term Setups This Week:

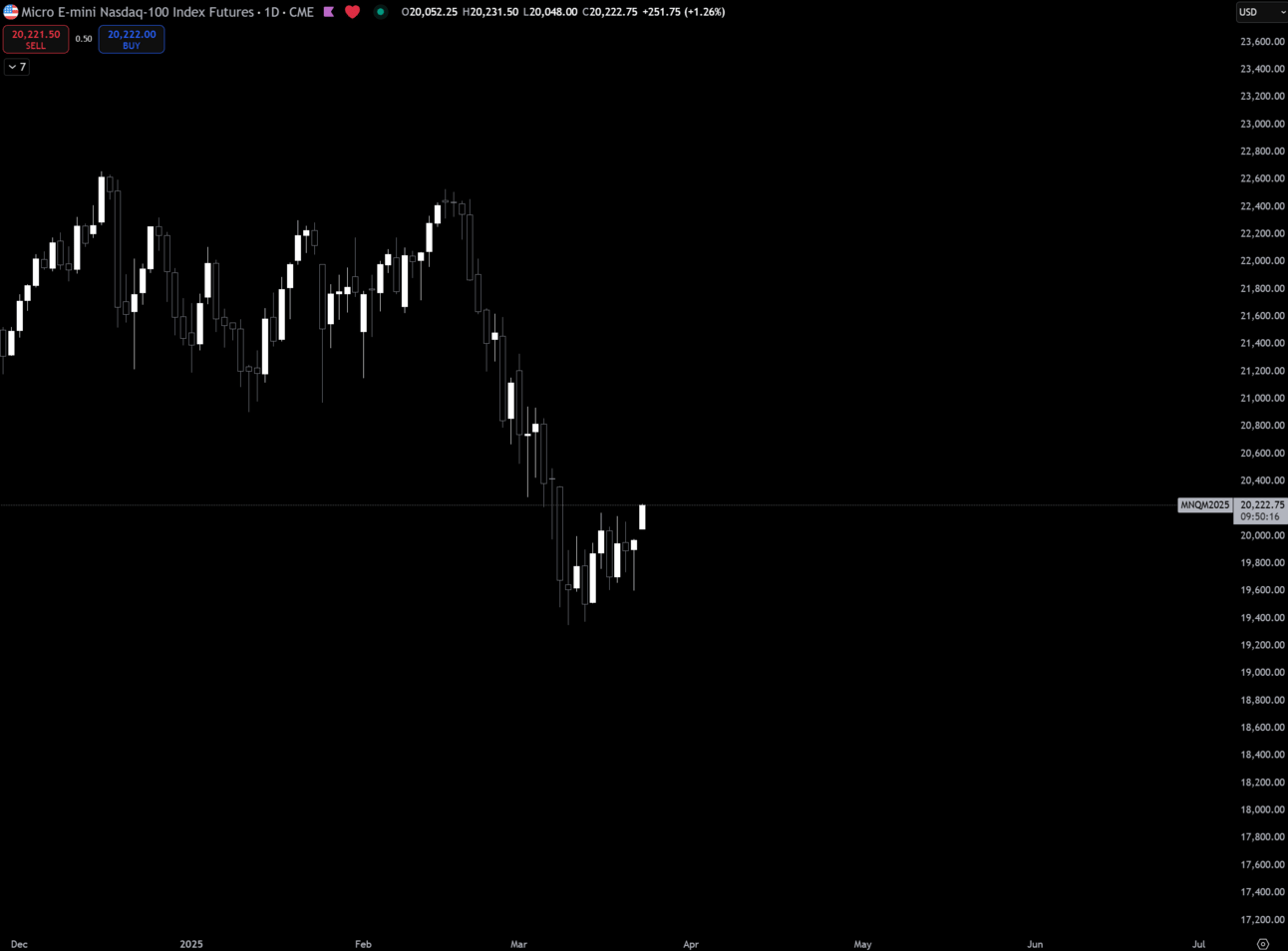

$NQ_F ( 0.0% ) Daily

Nasdaq has been consolidating for the past 2 weeks. We really need to find some direction this week so I’m playing it by ear.

I would expect some sort of relief bounce to then go lower this week, but we’ll see what happens.

If we do get some bullish action this week, I think the farthest we go is $20,800.

Long-Term Positions

Like I mentioned in the last newsletter, I only hold $VOO ( ▲ 0.18% ) $QQQ ( ▼ 0.1% ) $TSLA ( ▼ 1.63% ) and I’m NOT buying the current dip.

I personally have looked back on the charts from a monthly view and you will see that every time we had a REAL correction in the market, we went down for multiple consecutive months.

This is the first month we’ve really had a down market, so I’m not so quick to throw my cash into the market here.

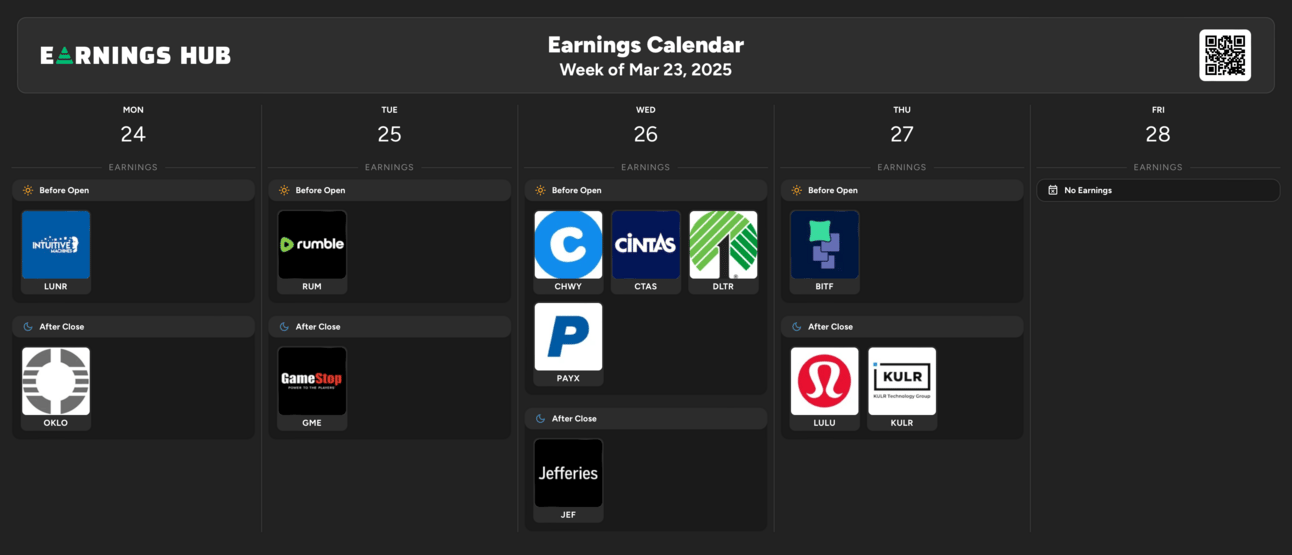

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 9:45 EST, Flash Services PMI

Tuesday 10:00 EST, New Home Sales

Wednesday 8:30 EST, Durable Goods Orders m/m

Thursday 8:30 EST, GDP & Unemployment Claims

Thursday 10:00 EST, Pending Home Sales

Friday 8:30 EST, PCE

Trending Sectors

Technology, Consumer Discretionary, and Real Estate were at the top of the list for trending sectors last week.

Top trending tickers from the past week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.