- Ace in the Hole

- Posts

- Ace in the Hole- Edition #66

Ace in the Hole- Edition #66

Your Secret Weapon To Beat the Market

Happy Monday Traders!

And Happy St. Patrick’s Day to my fellow Irish people out there! I hope you all enjoyed the weekend and got some time away.

It’s going to be a big week in the market and you probably know why, if not stay tuned…

Market Thoughts

The downside in the market has been an absolute blessing. I’ve been playing a ton of shorts and trying to capitalize on the volatility as much as possible.

Most people are complaining about the volatility when they should be grateful. This volatility brings the ability to catch bigger moves faster without having to put on nearly as much risk as normal.

If you know how to size properly in this environment, you are loving it.

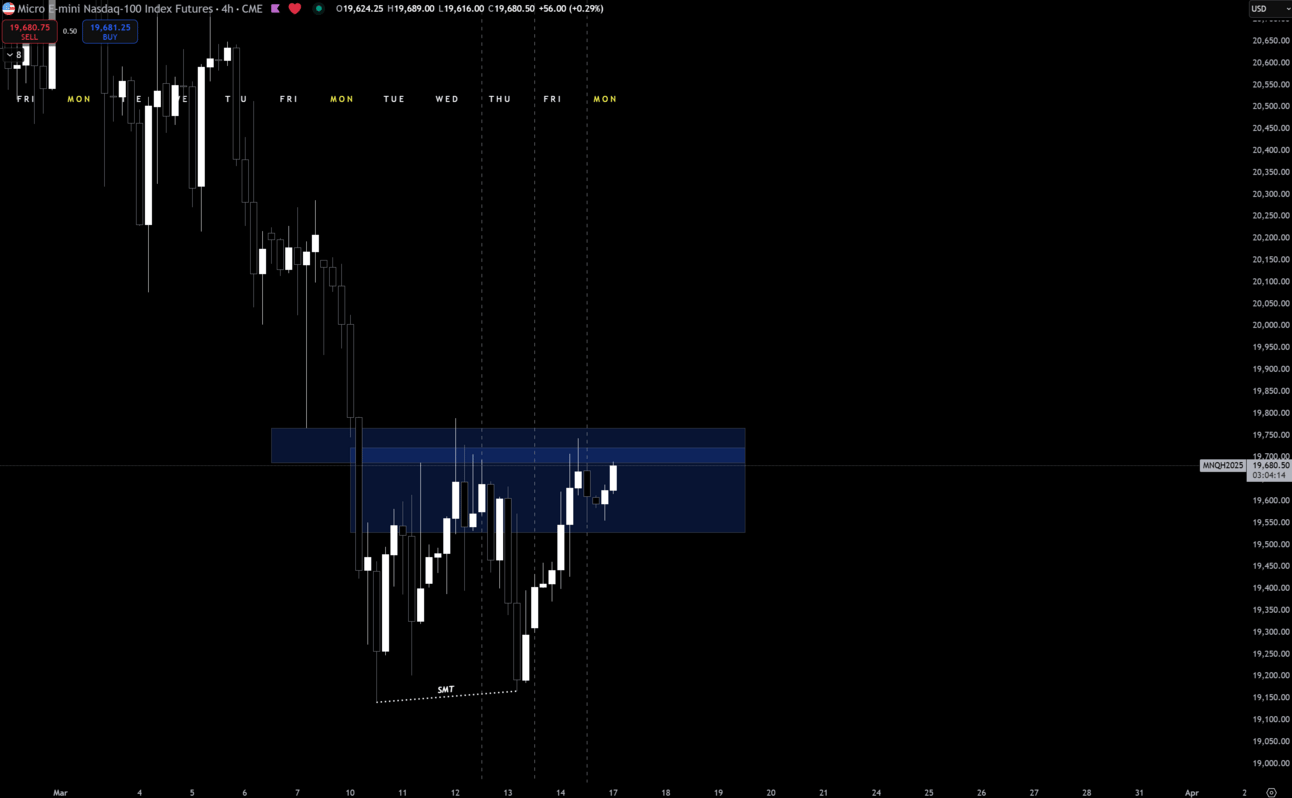

$NQ_F ( 0.0% ) Analysis

I personally am not bullish until we can see aggression through these PD Arrays.

Until then, I have to continue to be bearish and expect manipulation in this area.

If we continue to respect these high time frame PD Arrays, I think we go back to the lows.

If NQ wants to run through these with aggression, I could see $20,286.75 coming into play this week.

I chose this spot because the is the next recent high, so if we do get momentum to the upside, I expect that level to be hit.

Long-Term Positions

I personally have sold every single individual name in my long-term account. Taking profits on all individuals except for Tesla and holding $VOO ( ▲ 0.5% ) and $QQQ ( ▲ 0.75% ) .

No other names are held in my portfolio anymore and on the next real bear cycle, I will be dumping this cash into the $VOO ( ▲ 0.5% ) and $QQQ ( ▲ 0.75% ) .

So, this means I’m not really actively looking for names to buy into. I am an active trader anyways, so it’ll be easier for me personally to just invest into the S&P 500.

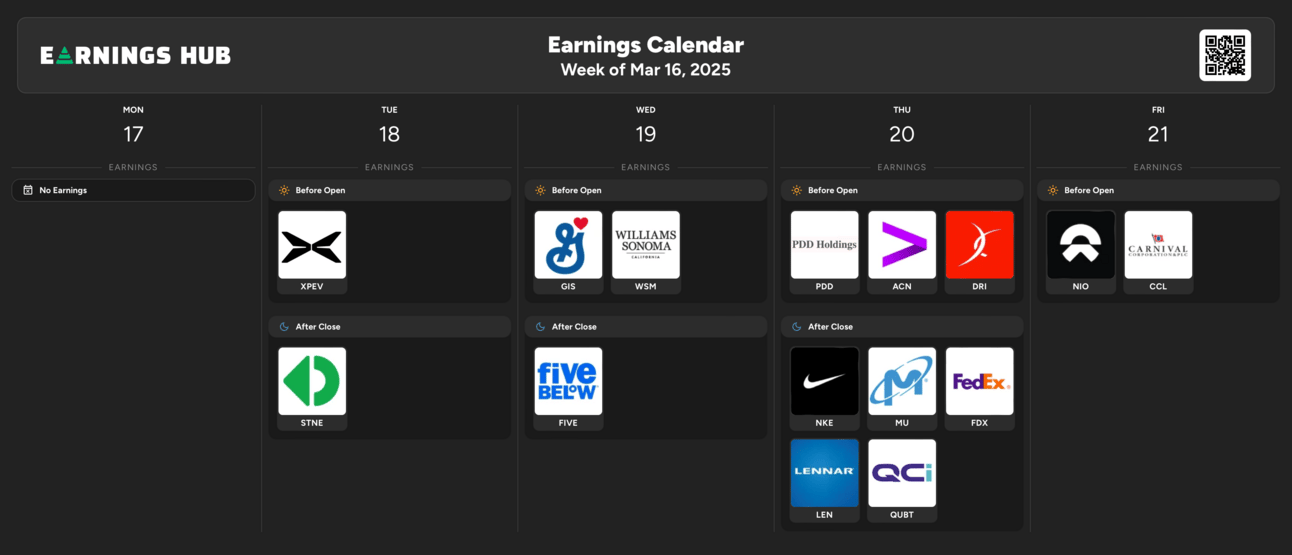

Earnings Calendar

Earnings are super light until we kick off Earnings Season again in April, so don’t expect too much from this area until then.

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 8:30 EST, Retail Sales

Wednesday 2:00 EST, FOMC Statement

Wednesday 2:30 EST, FOMC Press Conference

Thursday 8:30 EST, Unemployment Claims

Thursday 10:00 EST, Existing Home Sales

Trending Sectors

Technology, Consumer Staples, and Financials were at the top of the list for trending sectors last week.

Top trending tickers from the past week:

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.