- Ace in the Hole

- Posts

- Ace in the Hole - Edition #64

Ace in the Hole - Edition #64

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope you all enjoyed the weekend and are ready for a brand new trading week!

Last week the market dropped pretty heavily to the daily range lows across the board.

$NQ down 903pts since Monday high to Friday close.

Let’s get into how we are feeling for the week ahead.

Market Thoughts

I was really bearish after the Friday from 2 weeks ago and all last week.

We have now hit range lows on $NQ and I’m flipping my bias which might be for a good time not a long time.

Regardless I think we need to bounce to retrace back to inefficiencies before going any lower.

For short-term traders, this downside has been a lot of fun and has brought a ton of opportunity.

Long-term traders shouldn’t even blink an eye here. I’ve seen so much fear on my timeline for absolutely no reason. The market has barely pulled back when you bump up your time frame.

On a bigger scale we’ve done nothing. Short-term I have been playing a lot of downside and loving the volatility.

Short-Term Setups This Week:

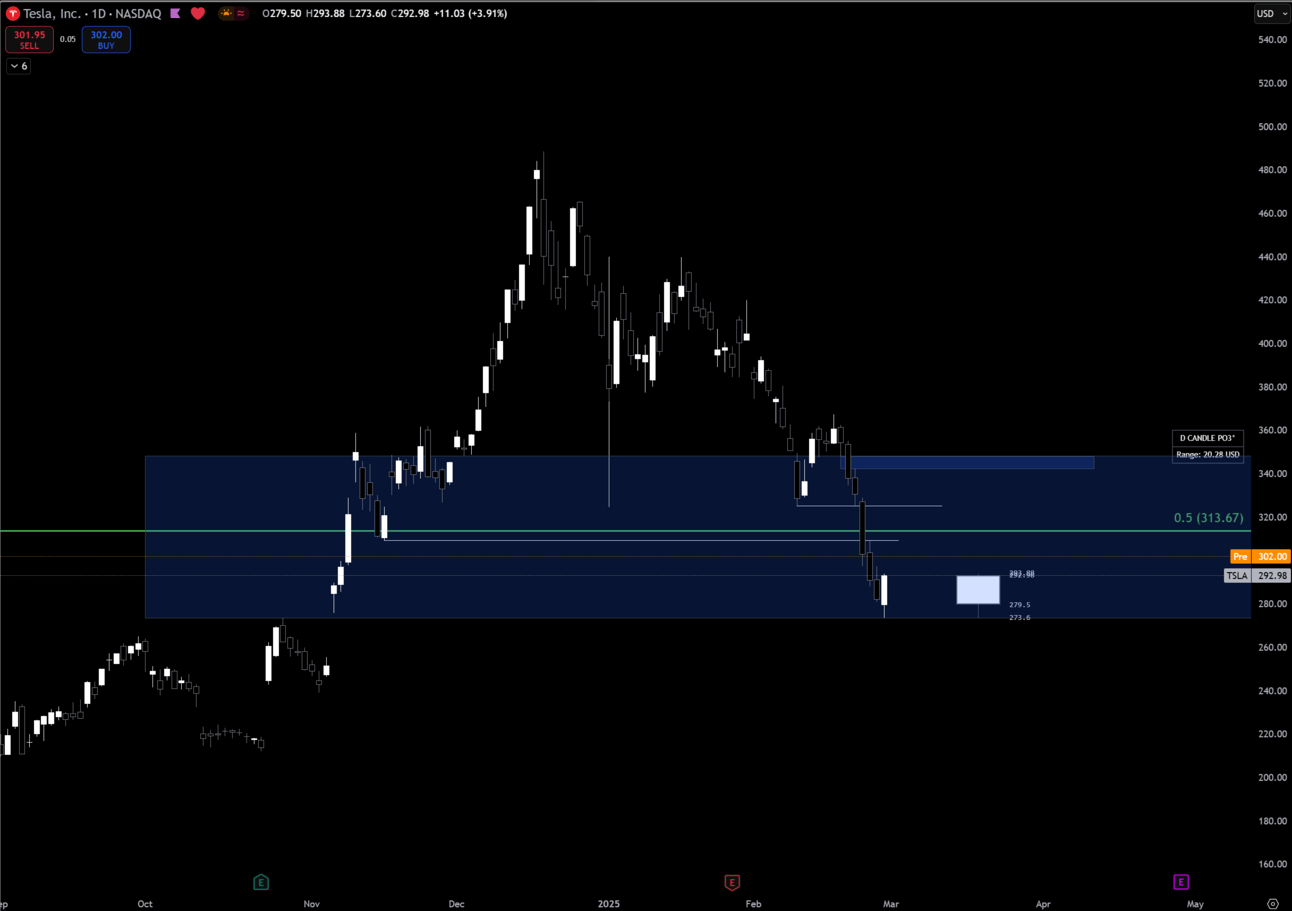

1. $TSLA

$TSLA Daily

Tesla has been drilling lately, but came right into this low from November 6th. That low has been swept as of Friday and could be a big spot of confluence.

I need to see more to be more certain of upside but if we get confluences, I want to see Tesla back to $340.

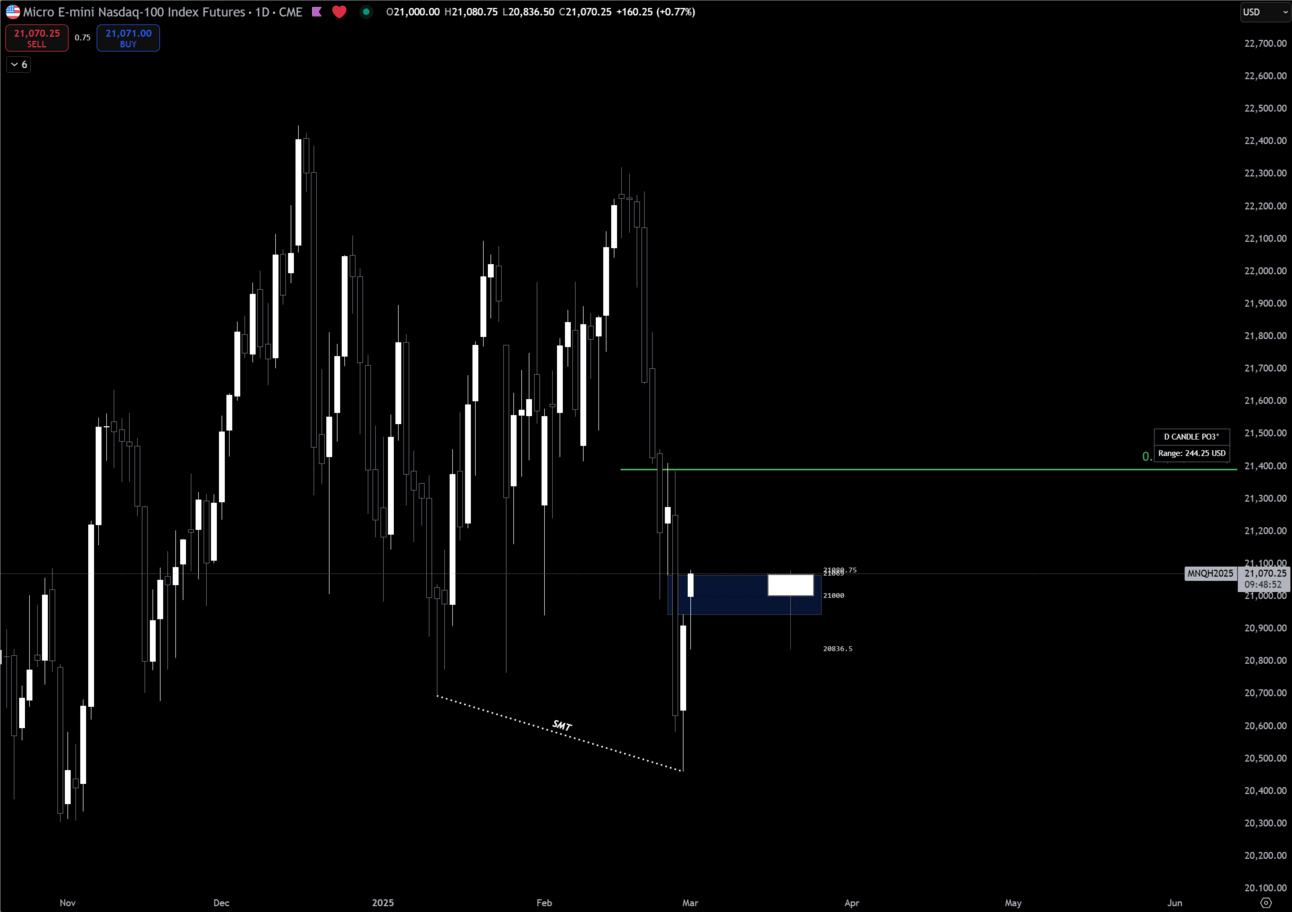

2. $NQ

$NQ Daily

Bullish on $NQ this week until my 50% retracement. If $NQ is strong over that I think the highs we just came from come back into play.

SMT at lows after taking higher time frame bearish target. Even if we end up going lower later, I think we need a retracement first.

If we end up going lower, I think 20,311 is the next spot for $NQ.

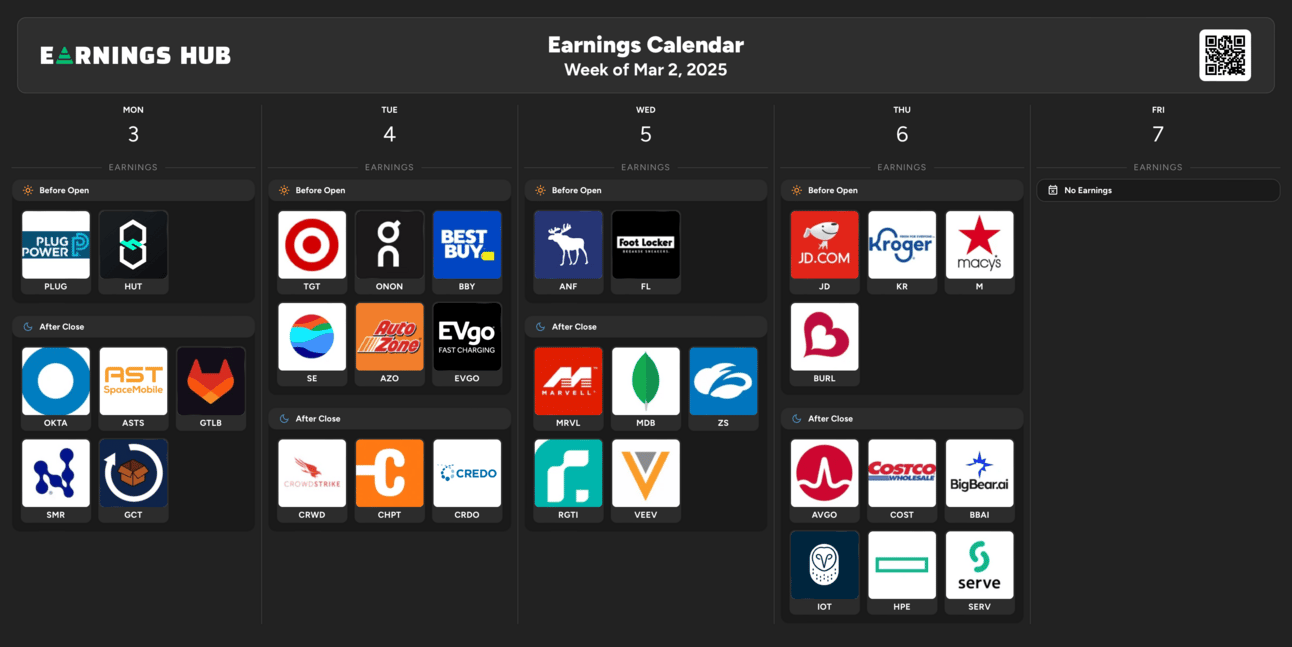

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, ISM Manufacturing PMI

Wednesday 10:00 EST, ISM Services PMI

Thursday 8:30 EST, Unemployment Claims

Friday 8:30 EST, Non-Farm Payrolls

Friday 12:30 EST, Fed Chair Powell Speaks

Trending Sectors

Financials, Communication Services, and Healthcare were at the top of the list for trending sectors last week.

Top trending tickers from the past week:

$NVDA

$TSLA

$SMCI

$LUNR

$PLTR

$AMD

$MSTR

$RKLB

$BABA

$HOOD

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.