- Ace in the Hole

- Posts

- Ace in the Hole - Edition #62

Ace in the Hole - Edition #62

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

I hope all of you enjoyed the long weekend away from the charts!

Mondays are usually a no trade day for me anyways, but throughout the week we will have some earnings and data to watch out for.

Let’s get into it.

Market Thoughts

$SPY is back at all time highs and the market is looking healthy as a whole. I’m still not super biased either way and just playing what comes to me day by day.

I’m glad to see the market strong above highs again, but tread carefully. I do NOT think this year will be anything like 2024.

This doesn’t mean I think the market will “crash”, but you can’t ignore that the environment we’ve been trading in has 100% changed.

Short-Term Setups This Week:

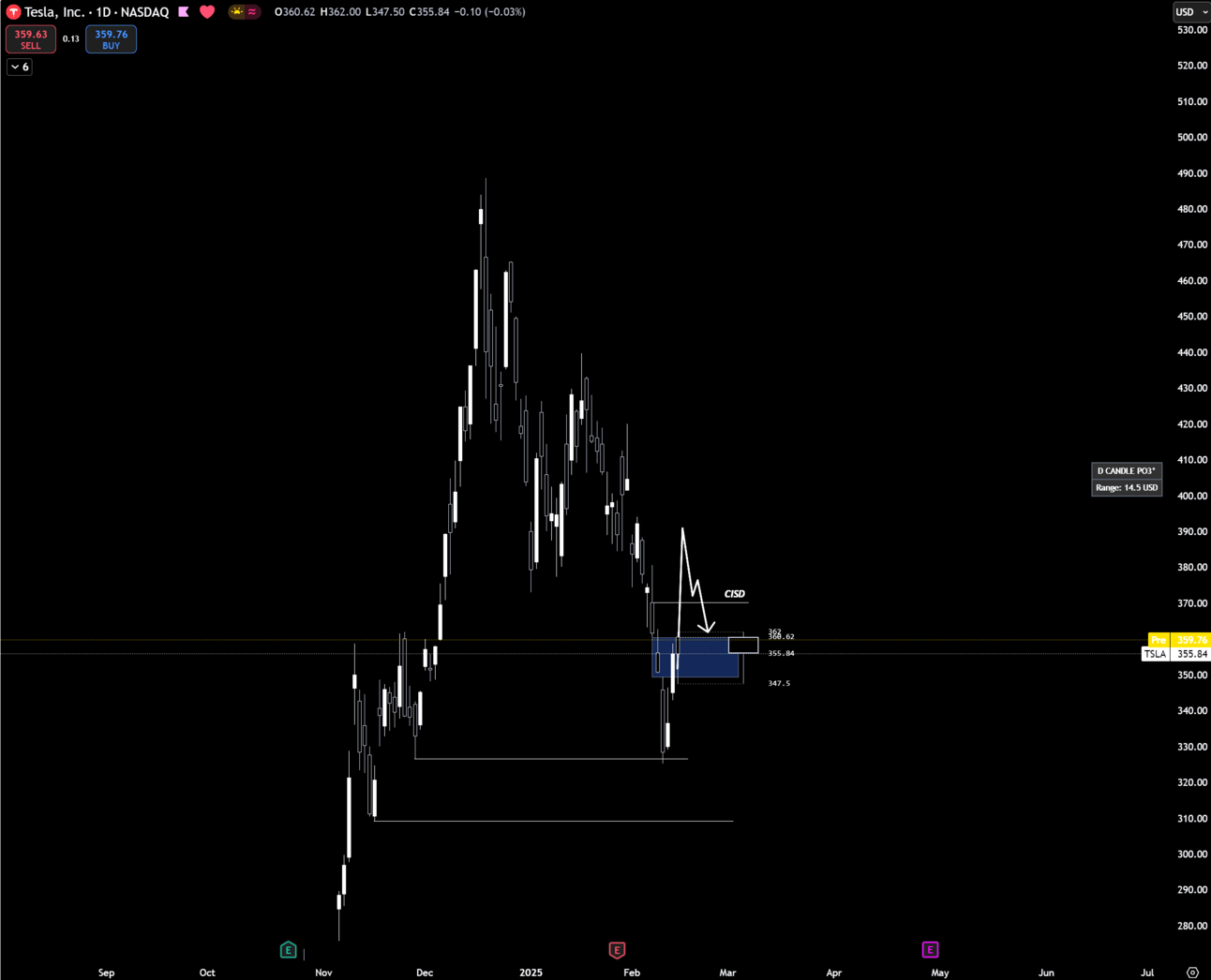

1. $TSLA

$TSLA Daily

I want to see Tesla stay strong over this imbalance we made and backtest this are with a change in the state of delivery.

We saw a beautiful sweep of the $326.59 lows and are holding that so far.

Targets for upside will be $440 and all time highs.

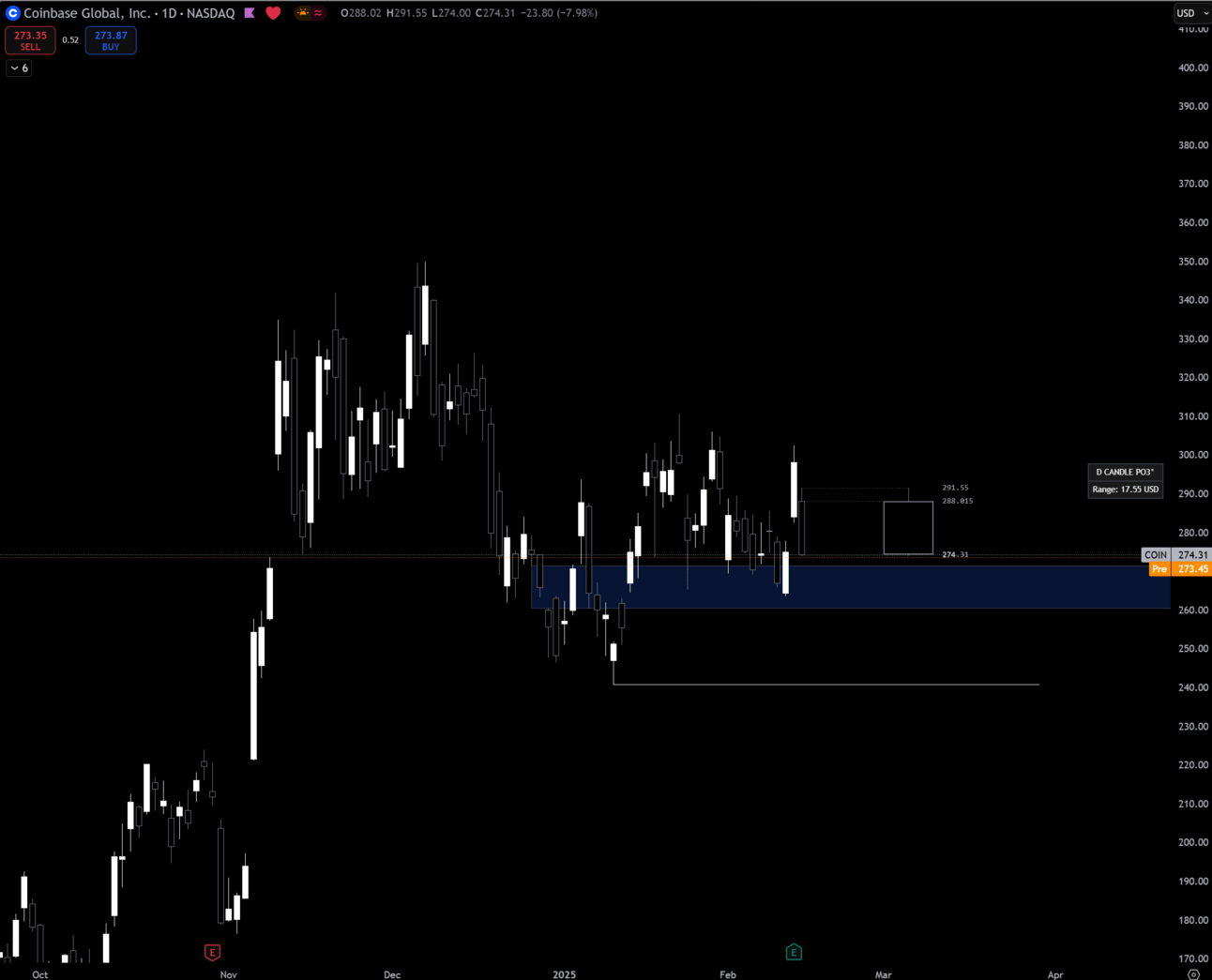

2. $COIN

$COIN Daily

Coinbase has been in consolidation sideways, but I think this looks healthy and I would like to see this hold the imbalance I have drawn to make higher moves into new all time highs.

First targets for any trades could be the internal range highs and then all time highs.

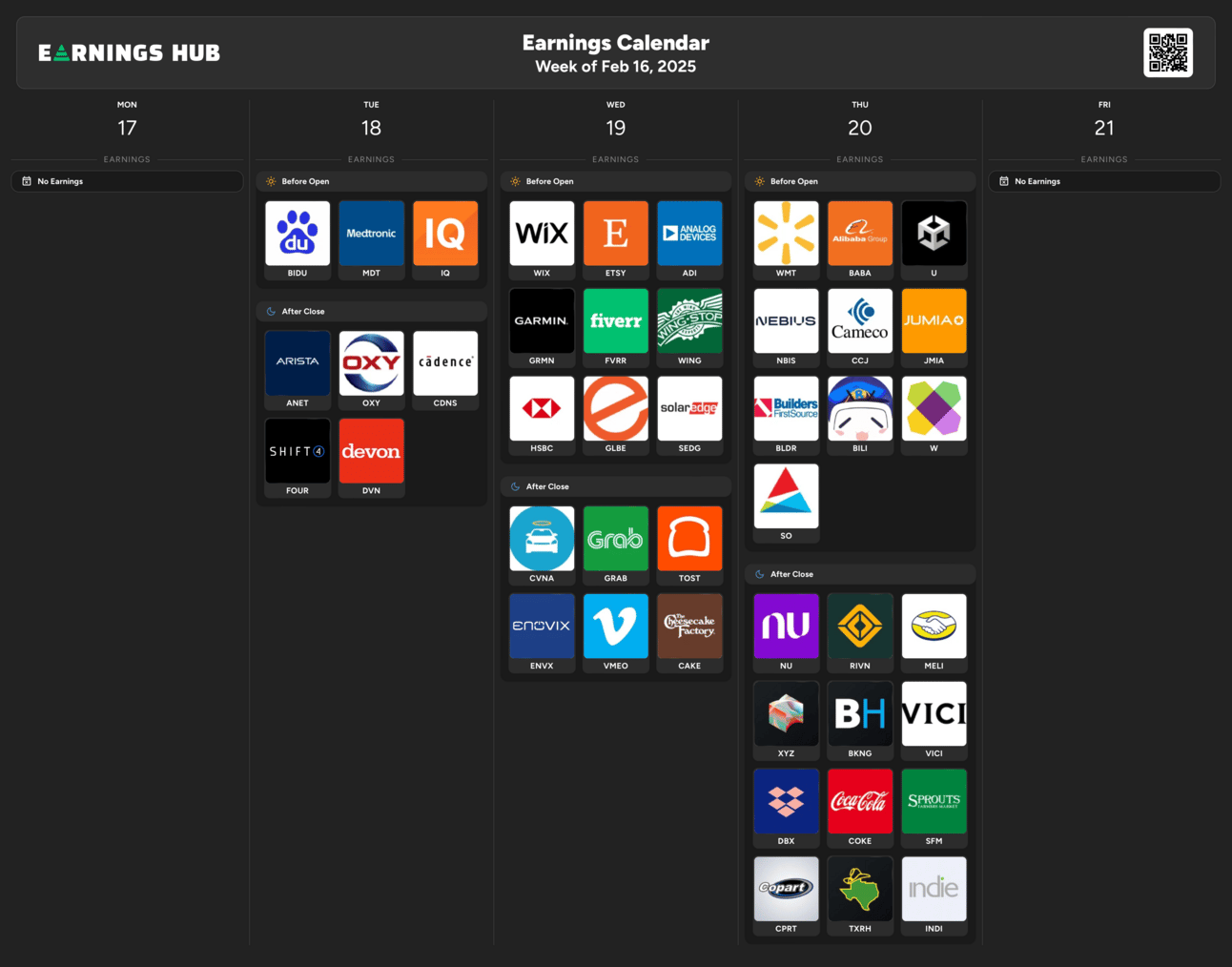

Earnings Calendar

Economic Data

These data points are known to bring volatility during the intraday:

Tuesday 9:00 EST, President Trump Speaks

Wednesday 2:00 EST, FOMC Meeting Minutes

Thursday 8:30 EST, Unemployment Rate

Friday 9:45 EST, Flash Services PMI

Trending Sectors

Technology, Consumer Discretionary, and Healthcare were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

$TSLA

$NVDA

$RDDT

$HOOD

$BABA

$INTC

$PLTR

$SMCI

$META

$AMD

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.