- Ace in the Hole

- Posts

- Ace in the Hole - Edition #61

Ace in the Hole - Edition #61

Your Secret Weapon to Beat The Market

Happy Monday Traders!

Welcome back everybody, I hope you all enjoyed the time off and are ready for another exciting week!

Last week we had Google and AMD earnings to look forward to, but earnings season isn’t over…

We have plenty more earnings to cover throughout this season, but not many that have a heavy weight in the S&P 500 except for Nvidia in a couple of weeks of course.

Let’s dive in.

Market Thoughts

In terms of bias for the S&P 500 and Nasdaq, it’s really tough in this area.

We have been consolidating back and forth since the new year in a massive range.

This has made a great environment for day traders, but a tough environment for swing traders. This makes it tough for me to have a clear higher time frame bias on the overall market.

It’s not very clear at the moment where we want to go in the future, so I am showing up everyday playing whichever way the market wants to trend.

If I get opportunities for swing trades I am more than happy to take them, but they are likely short trades and can’t be held very long.

Short-Term Setups This Week:

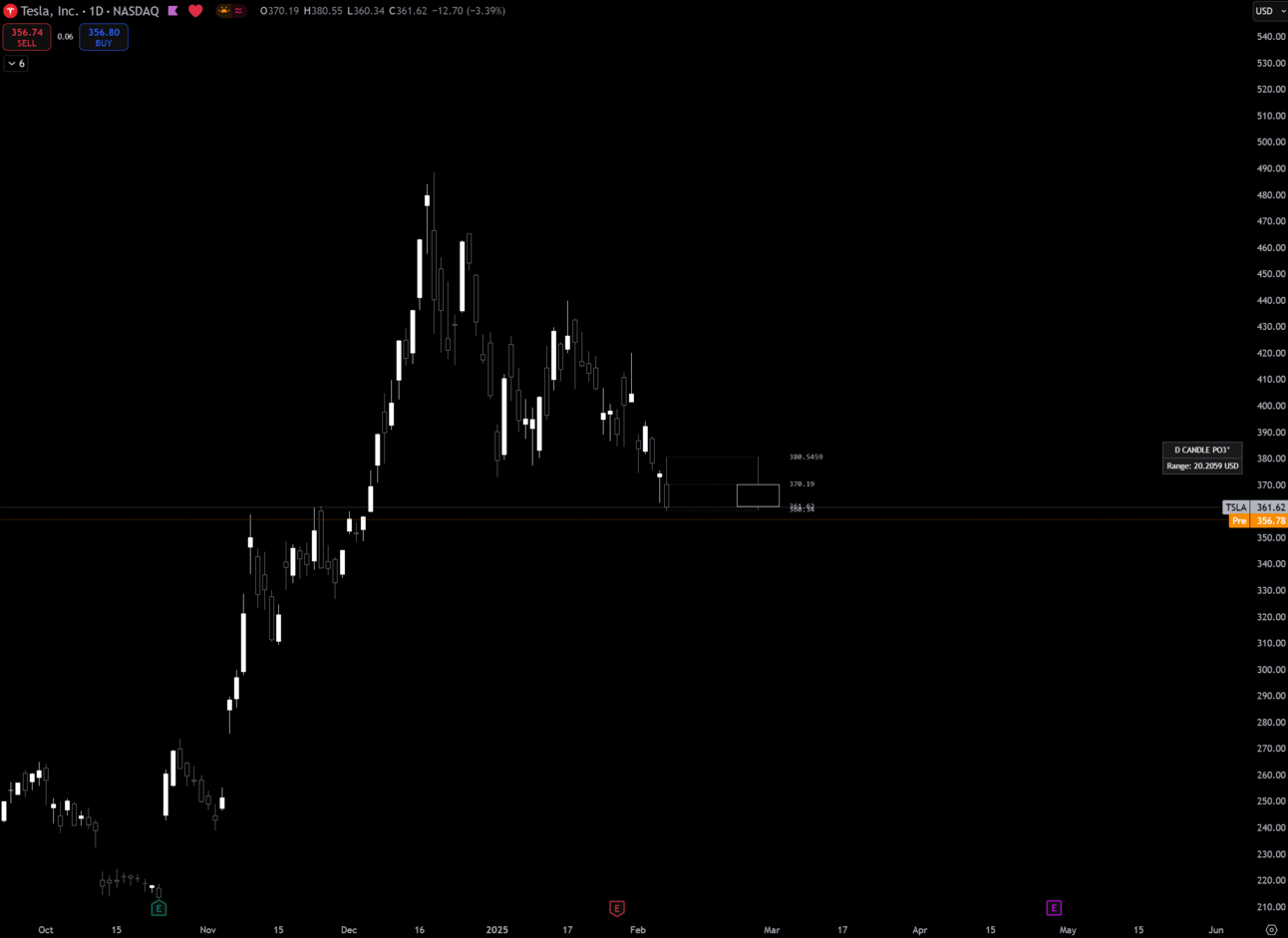

1. $TSLA

$TSLA Daily

Tesla has been in this consolidation pullback for a while now. I entered a swing last week, but will likely have to get out and reposition this week.

Coming into this previous area of consolidation, I’m watching for any setups potentially forming if we form a bit of a short-term bottom here.

Any longs that I do take the targets will be: $420, $439.74, and then all time highs at $488.54.

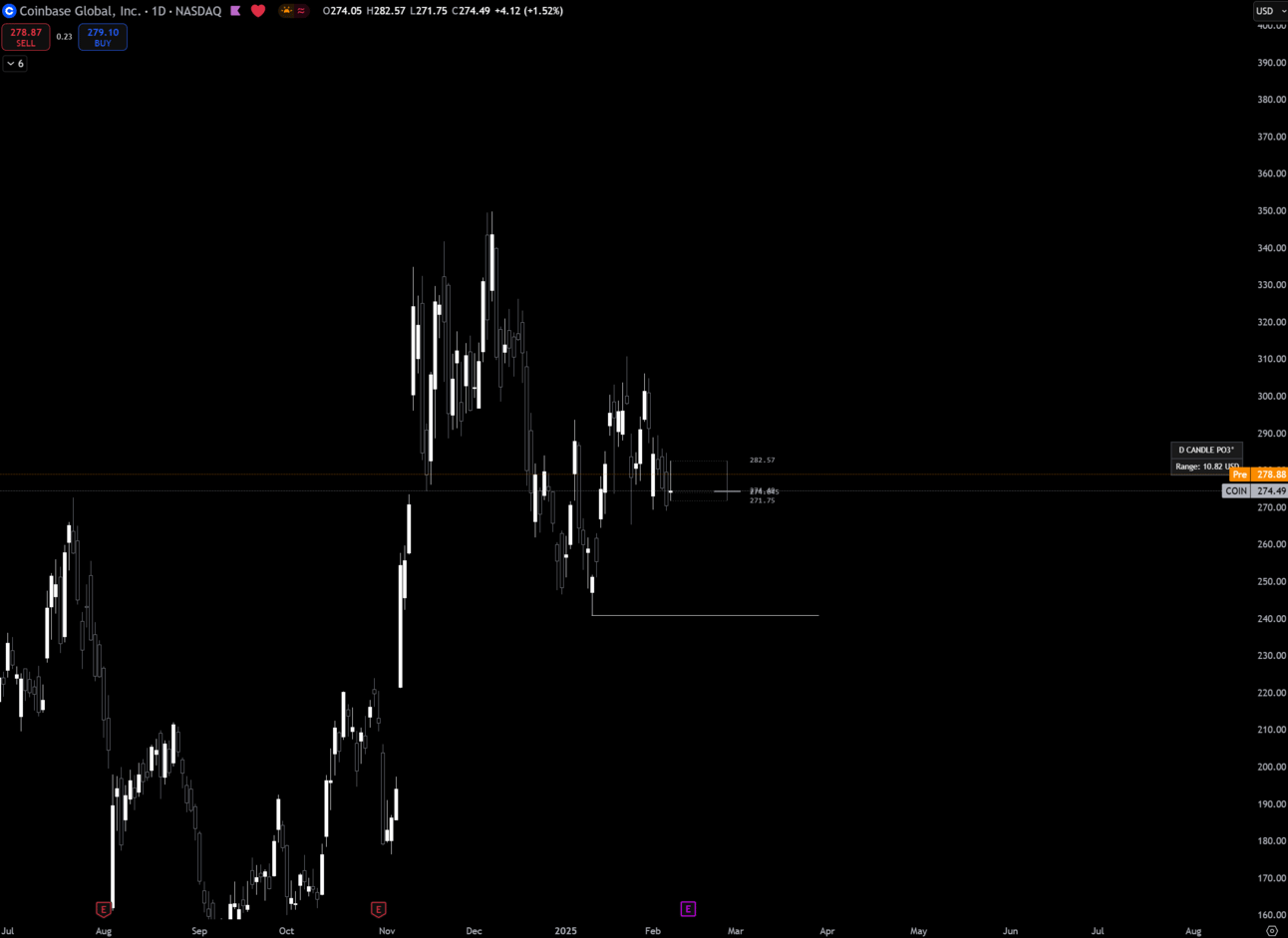

2. $COIN

$COIN Daily

Coinbase has been stuck in this consolidation since the new year, similar to the market.

I would personally like to see this push down to the daily lows and potentially get a sweep of liquidity at those range lows.

Not only is that the daily range low, but also the weekly range low. I would expect buyers to step in after that level getting broken to the downside.

If I see the bullish reaction I want, I will look to take a play long.

Targets for any positions taken will be: $306, $310.61, $326.23.

You Don’t Want To Miss This!

🚀 We’re Live! X Mastermind Enrollment is Officially Open

The moment is here—X Mastermind is officially open!

Traders like you are securing their spots right now to:

✅ Master proven strategies for consistent success

✅ Get live coaching from trading experts

✅ Join a community of serious traders leveling up in 2025

💰 The price is now $2,500, but you can still get 20% off with promo code [JORDAN].

🔹 This page has all the details you need about the program, pricing, and how to join:

👉 [https://papergains.mykajabi.com/a/2148052265/BSzFvwrp]

Or book a call with me before doors close: https://api.leadconnectorhq.com/widget/booking/vmUARVkBu4vPK2Jhijgu

Let’s make 2025 your best trading year yet.

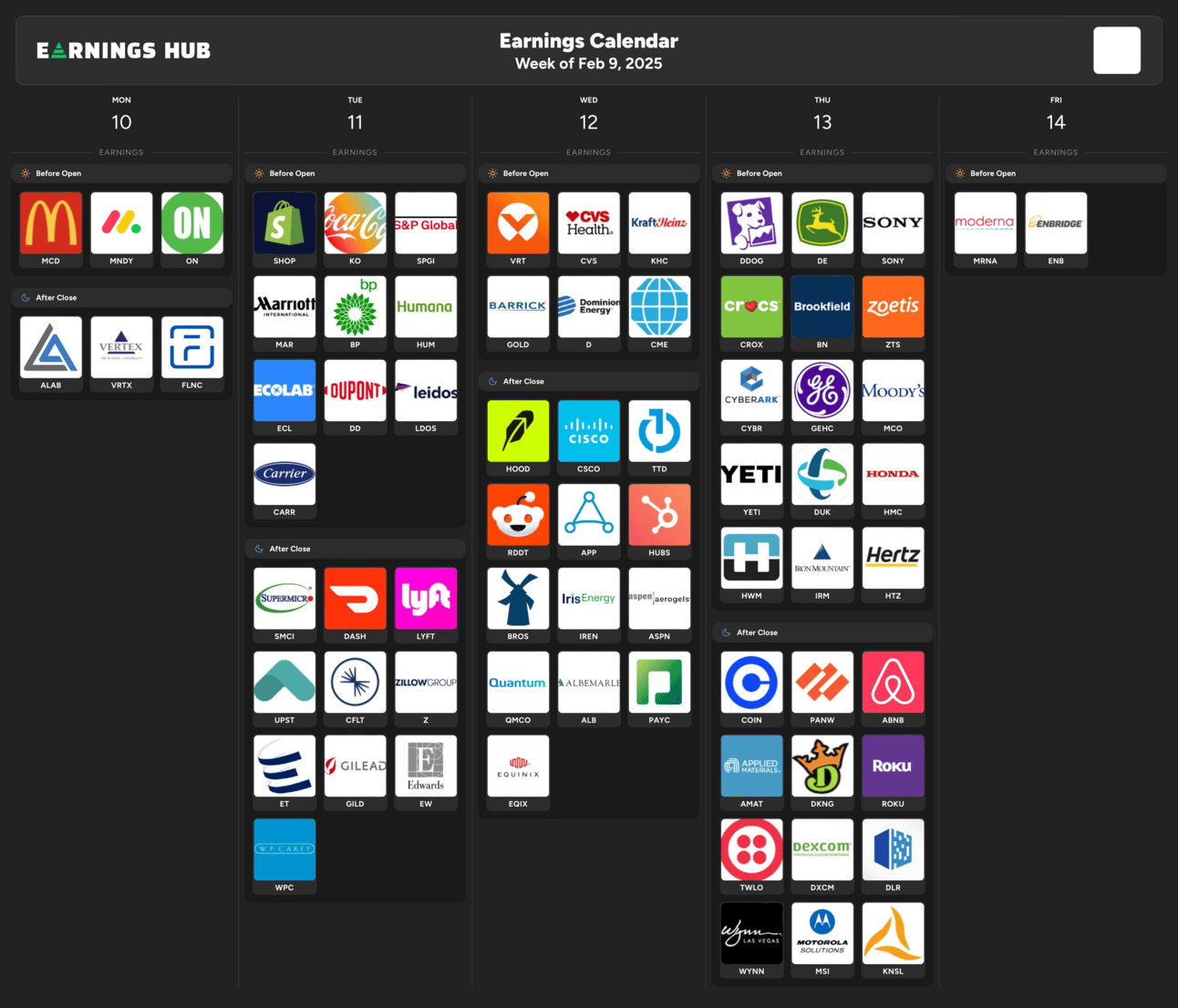

Earnings Calendar

Economic Data

These data points are known to bring volatility during the intraday:

Wednesday 8:30 EST, CPI

Wednesday 10:00 EST, Fed Powell Testifies

Thursday 8:30 EST, PPI

Thursday 8:30 EST, Initial Jobless Claims

Friday 8:30 EST, Retail Sales

Trending Sectors

Healthcare, Metal, and Technology were at the top of the list for trending sectors from this past week.

Top trending tickers from last week:

$NVDA

$AMD

$GOOG

$GOOGL

$TSLA

$PLTR

$AMZN

$UBER

$RDDT

$MSTR

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.