- Ace in the Hole

- Posts

- Ace in the Hole - Edition #60

Ace in the Hole - Edition #60

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope you all enjoyed the weekend and are prepared for another crazy week of earnings and economic data.

The volatility is not over and I think we continue to see clean setups play out.

Let’s get into it!

Market Thoughts

I’ve been playing much more to the downside recently rather than upside, but regardless I do not have a longer time framer directional bias.

I’m continuing to take trading day by day and not be guessing where the market is going. Last year it was as clear as buy the dip, but this year I don’t believe there is the same clarity.

I don’t care if I make my money to the upside or downside, I just want to see clean models playing out.

With that said, I am keeping my eye on a few individual names for potential setups.

Short-Term Setups This Week:

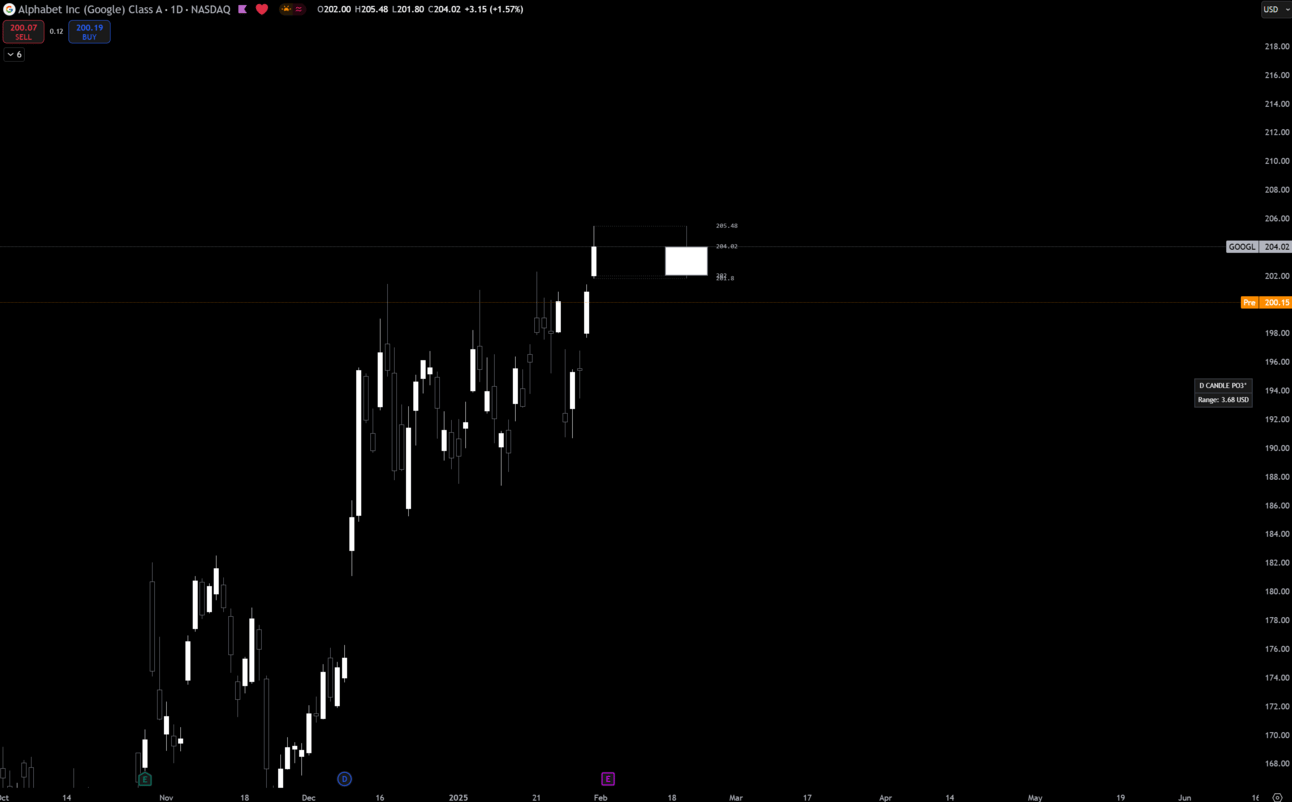

1. $GOOGL

$GOOGL Daily

Google broke highs last week, but wasn’t able to close aggressively over those highs. I would like to see this trade back down to the daily range lows and fill the gaps we’ve made to the upside.

This would be a move back to $190.68. Continued selling could bring Google down into the gap made from $181.05 —> $176.26

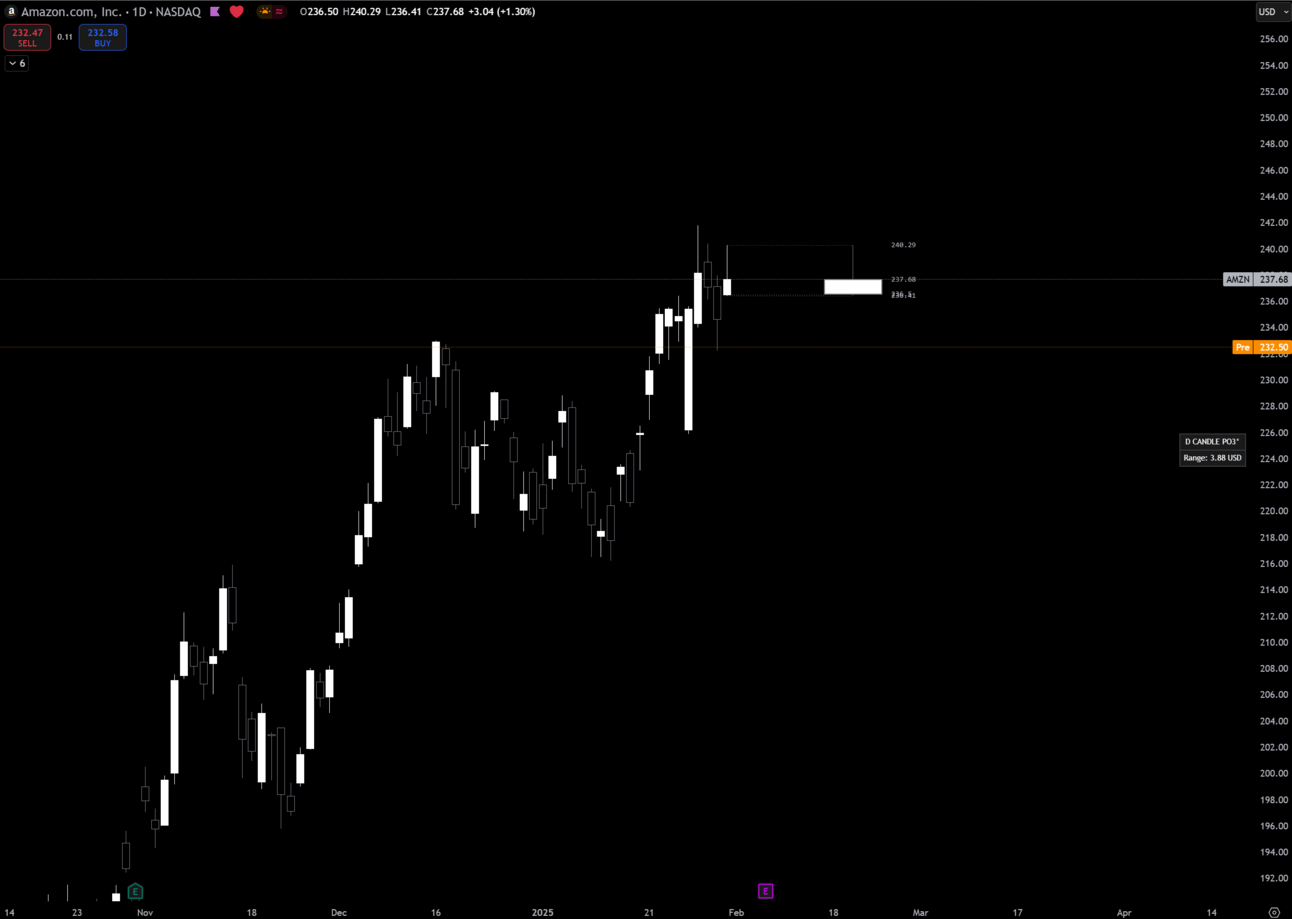

2. $AMZN

$AMZN Daily

Amazon is in a similar setup for me, peeking its head above previous highs. This is currently still holding previous all time high which could absolutely get bought up this morning, so watch out.

If we do end up losing that area, I would like to see this trade towards Monday low at $225.86 and then get into range lows at $216.20.

Long-Term Setups This Week:

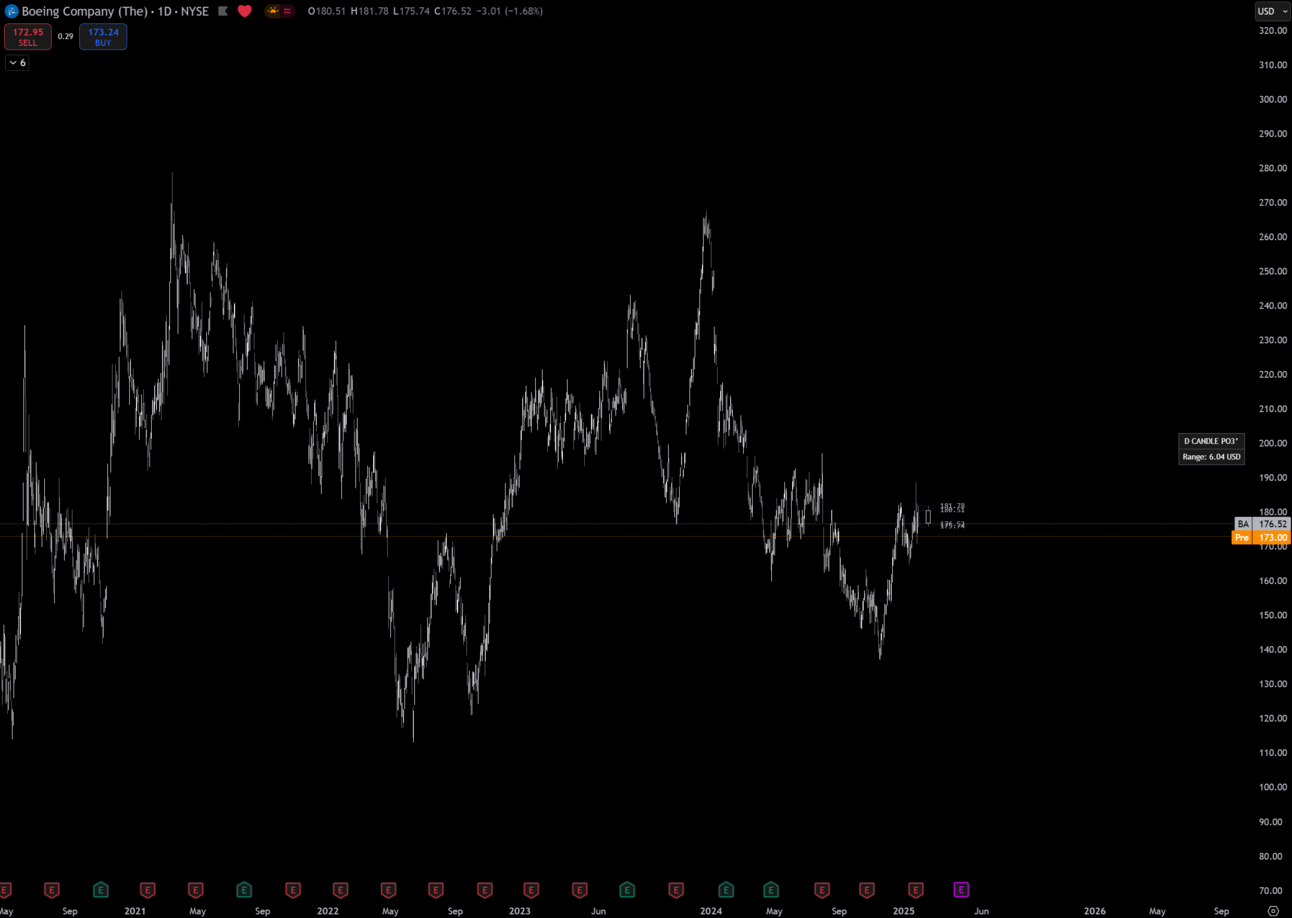

1. $BA

$BA Daily

I personally added Boeing back into my long-term account after selling it last year for tax loss harvesting.

I’m looking to further build this position anywhere under $200.

You Don’t Want To Miss This!

Just a quick reminder—your early bird opportunity to join the X Mastermind at the lowest possible price is closing soon!

🔥 Why Join?

✔ Learn and implement winning strategies for consistency

✔ Get direct coaching from top trading experts

✔ Join an exclusive, results-driven community

💰 Act Fast! The 20% discount on the early bird price ($2,250) expires on February 5th. After that, the price jumps to $2,500.

Use promo code [JORDAN] at checkout for your exclusive discount.

👉 Secure your spot now & get all the info here: [https://papergains.mykajabi.com/a/2148052266/BSzFvwrp]

Still on the fence? Let’s chat—book a call with me here: [https://api.leadconnectorhq.com/widget/booking/iDiZMg7uRDKPLomtbciW]

Talk soon!

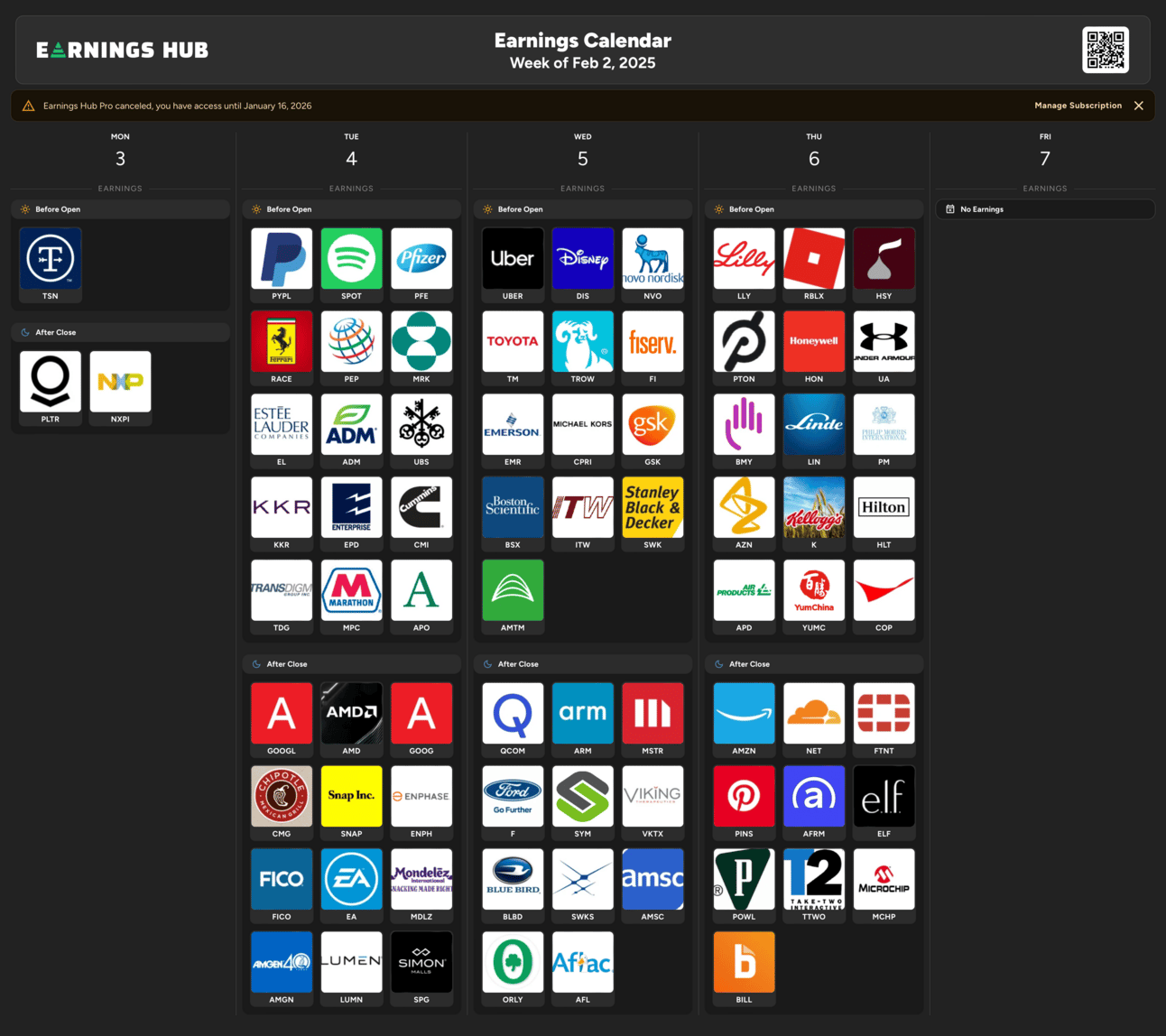

Earnings Calendar

Economic Data

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, ISM Manufacturing PMI

Tuesday 10:00 EST, JOLTS Job Openings

Wednesday 9:45 EST, S&P Services PMI

Thursday 8:30 EST, Initial Jobless Claims

Friday 8:30 EST, Non-Farm Payrolls

Trending Sectors

Healthcare, Financials, and Materials were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

$NVDA

$TSLA

$AAPL

$MSFT

$META

$AMD

$INTC

$ASML

$BABA

$SOFI

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.