- Ace in the Hole

- Posts

- Ace in the Hole - Edition #57

Ace in the Hole - Edition #57

Your Secret Weapon to Beat The Market

Happy Monday Traders!

Welcome back everybody! I hope the weekend treated you well and you got a break from the charts because we have a busy week ahead of us.

Bank earnings are kicking off and we have plenty of economic data coming out, so we should see continued volatility.

Let’s dive in!

Market Thoughts

This market has seen some decent downside into the new year which I’ve actually been enjoying very much.

Why?

Volatility. This market brings a ton of it and makes for cleaner intraday moves. I am interested to see if we keep drilling or get a bit of a relief bounce this week before going lower.

I feel like it would make more sense for us to make one more all time high and then fade, but I could very well be wrong with that thought, so I’m staying open minded and just playing what comes to me day by day.

Short-Term Setups This Week:

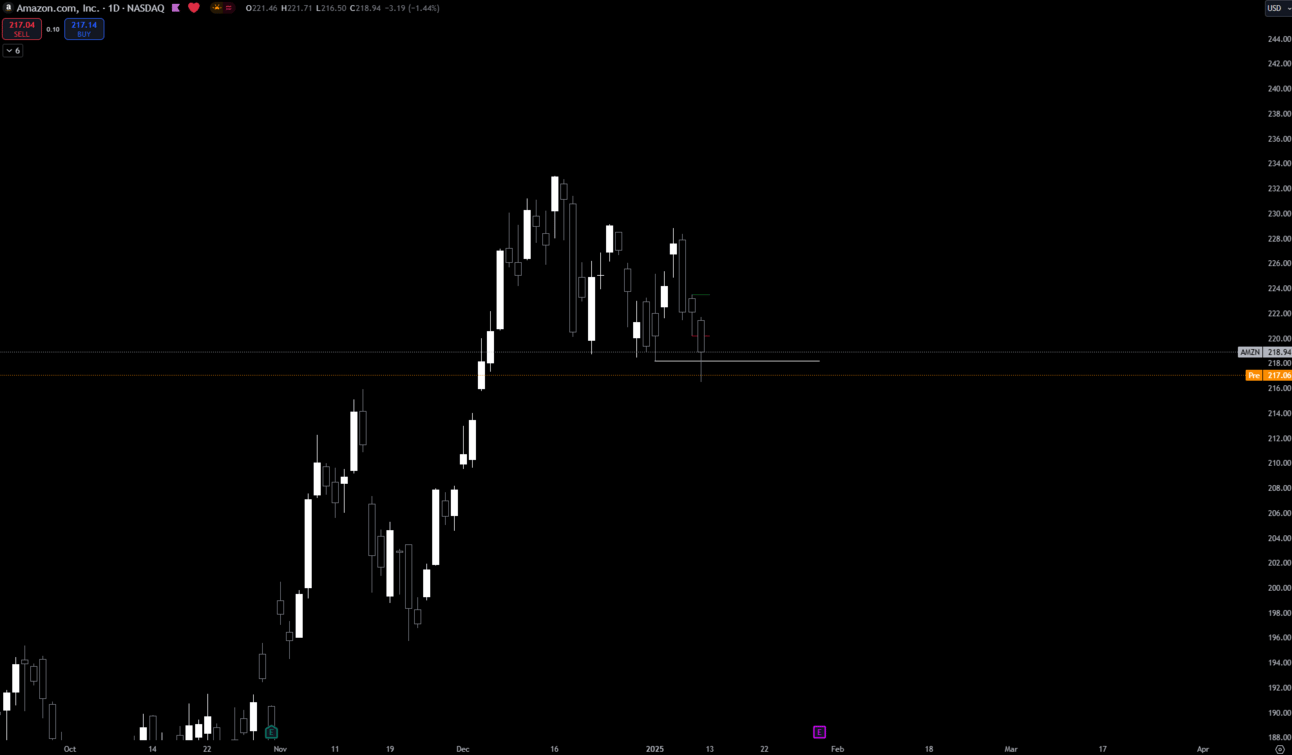

1. $AMZN

$AMZN Daily

Amazon looks interesting to me here in this consolidation period. Since this has been in an uptrend I do think they will manipulate lows to take it back to highs, but this could very well keep selling especially if the entire market is weak.

If this does get going I’d be targeting most recent highs on the daily and then into all time highs.

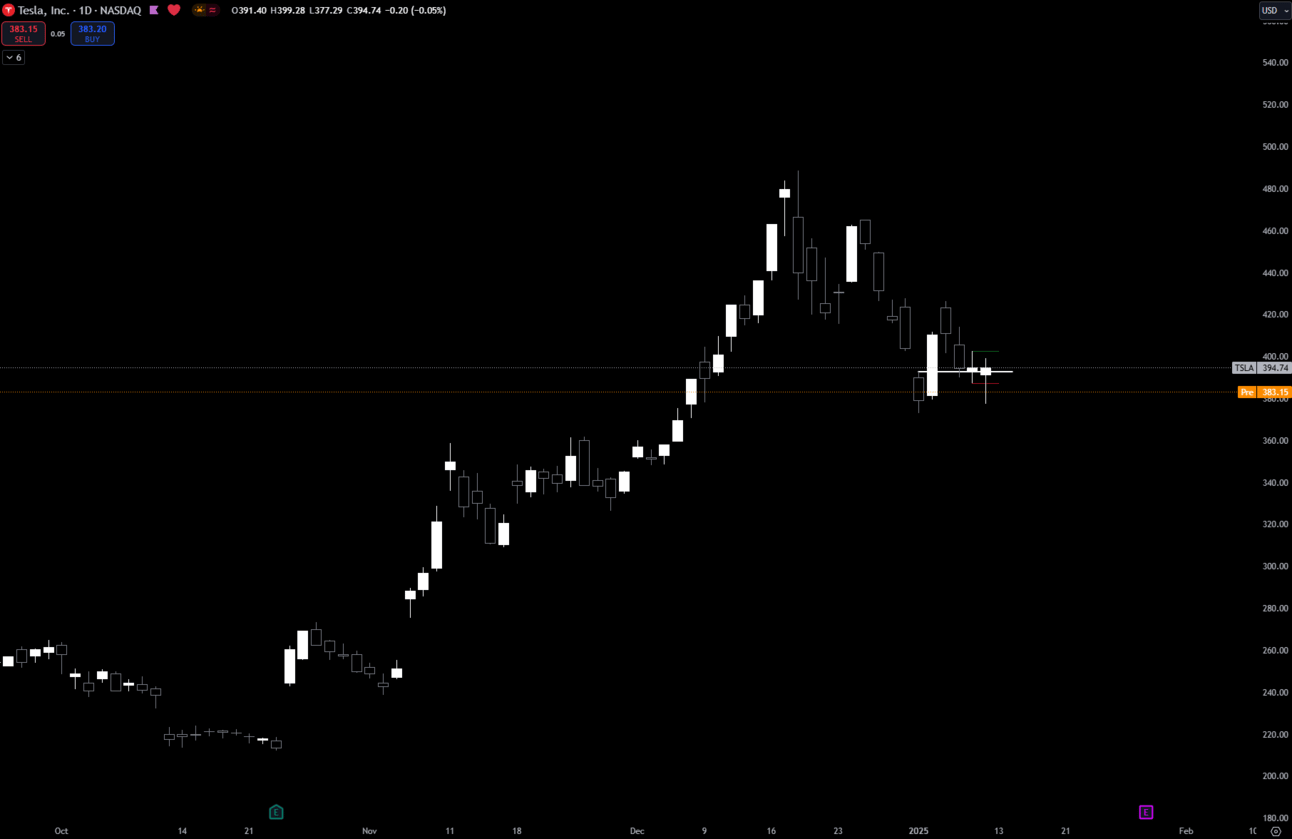

2. $TSLA

$TSLA Daily

Tesla is interesting here and not really doing much. I need to see over $424 for any real bullish action. Until then this could continue rejecting that area and go lower.

Either way I’m okay with it, happy to play either direction here, but any shorts will be short-term setups for bigger longs in the future.

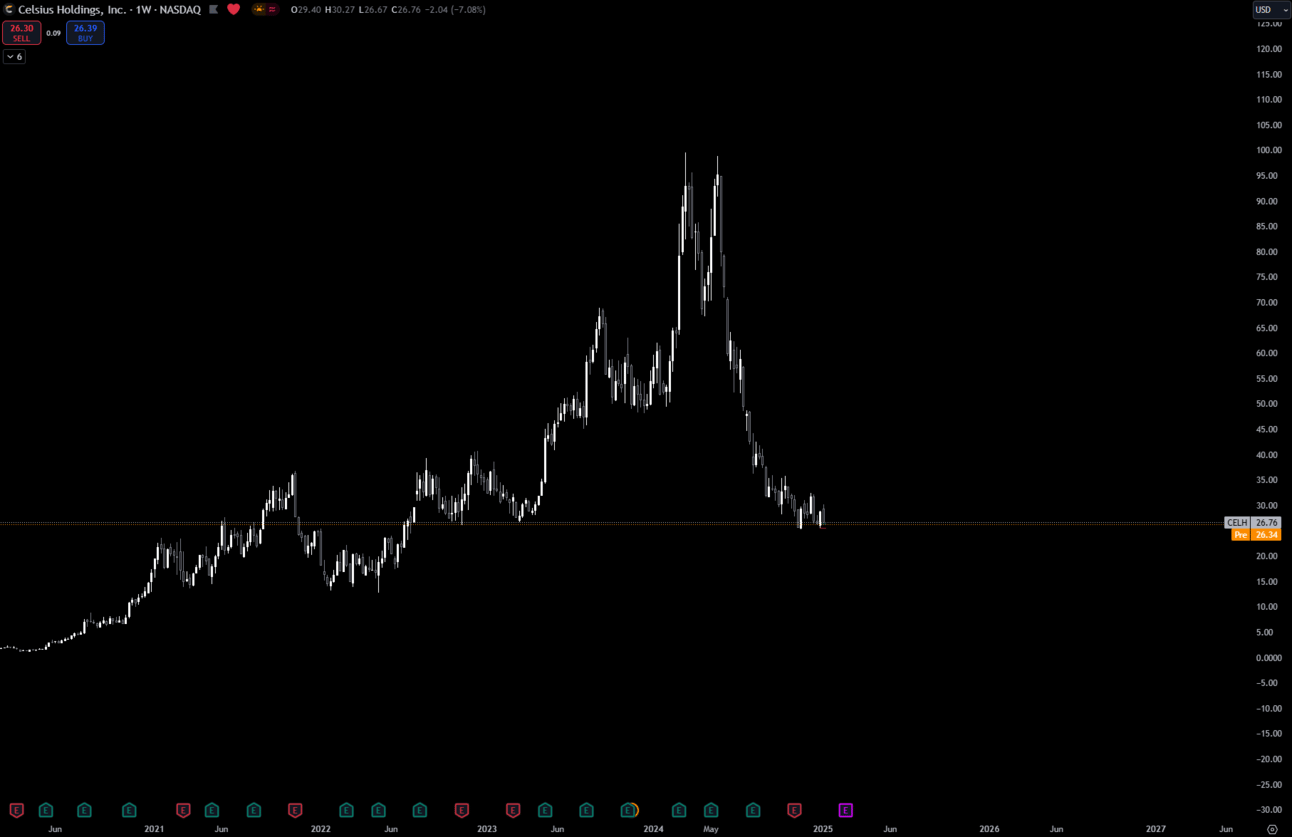

$CELH Weekly

Celsius is very cheap here, but I would be cautious taking adds right this second. The structure is still looking very bearish and we could definitely see this continue to sell.

I did add some the first week of 2025, but significantly smaller than the position I had last year.

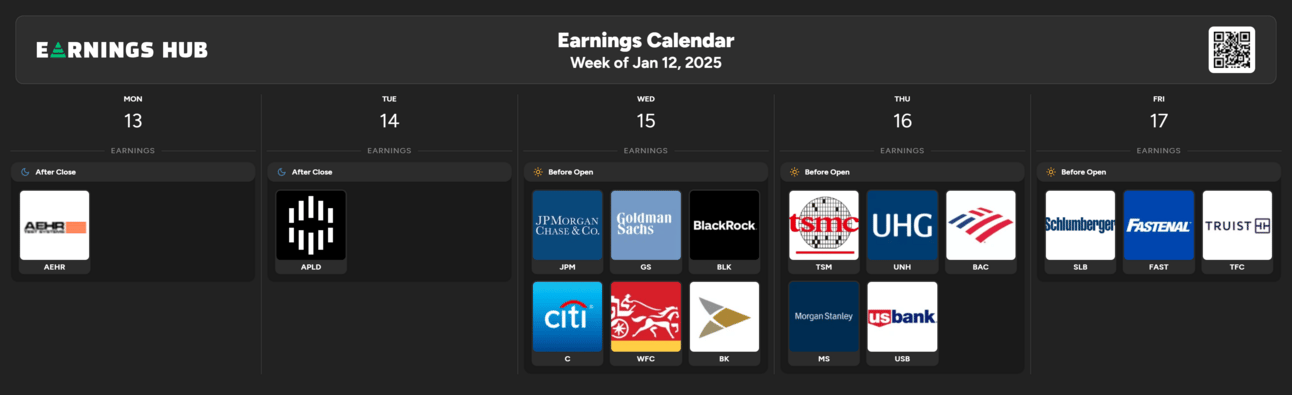

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, PPI

Wednesday 8:30 EST, CPI

Thursday 8:30 EST, Retail Sales

Thursday 8:30 EST, Initial Jobless Claims

Trending Sectors

Technology, Energy, and Healthcare were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

$NVDA

$CVNA

$TSLA

$PLTR

$RGTI

$AMD

$FUBO

$MSTR

$META

$RKLB

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.