- Ace in the Hole

- Posts

- Ace in the Hole - Edition #56

Ace in the Hole - Edition #56

Your Secret Weapon to Beat The Market!

Happy Monday Traders!

I hope everybody had a great first week of trading in 2025. Things are always kind of weird when we have these days off in the middle of the week, but regardless we’ve had some great price action.

Just a few weeks ago I was saying how much we needed some volatility in the market to bring some juicy moves and it did.

This week should be exciting as well, with some earnings kicking off at the end of the week and plenty of economic data to go through.

Market Thoughts

I’m pretty mixed in terms of higher time frame bias for $SPY. I’ve been playing both sides and have had great opportunities with longs and shorts, so I’m just going to continue playing what’s in front of me.

With that said, we are still in a Bull market, nothing about the downside moves we’ve seen have invalidated the higher time frame trend we are in. I am being aware that there are plenty of longer term investors that bought last year and are looking to sell now so they don’t have to claim short-term capital gains tax which would result in the market pulling back.

Short-Term Setups This Week:

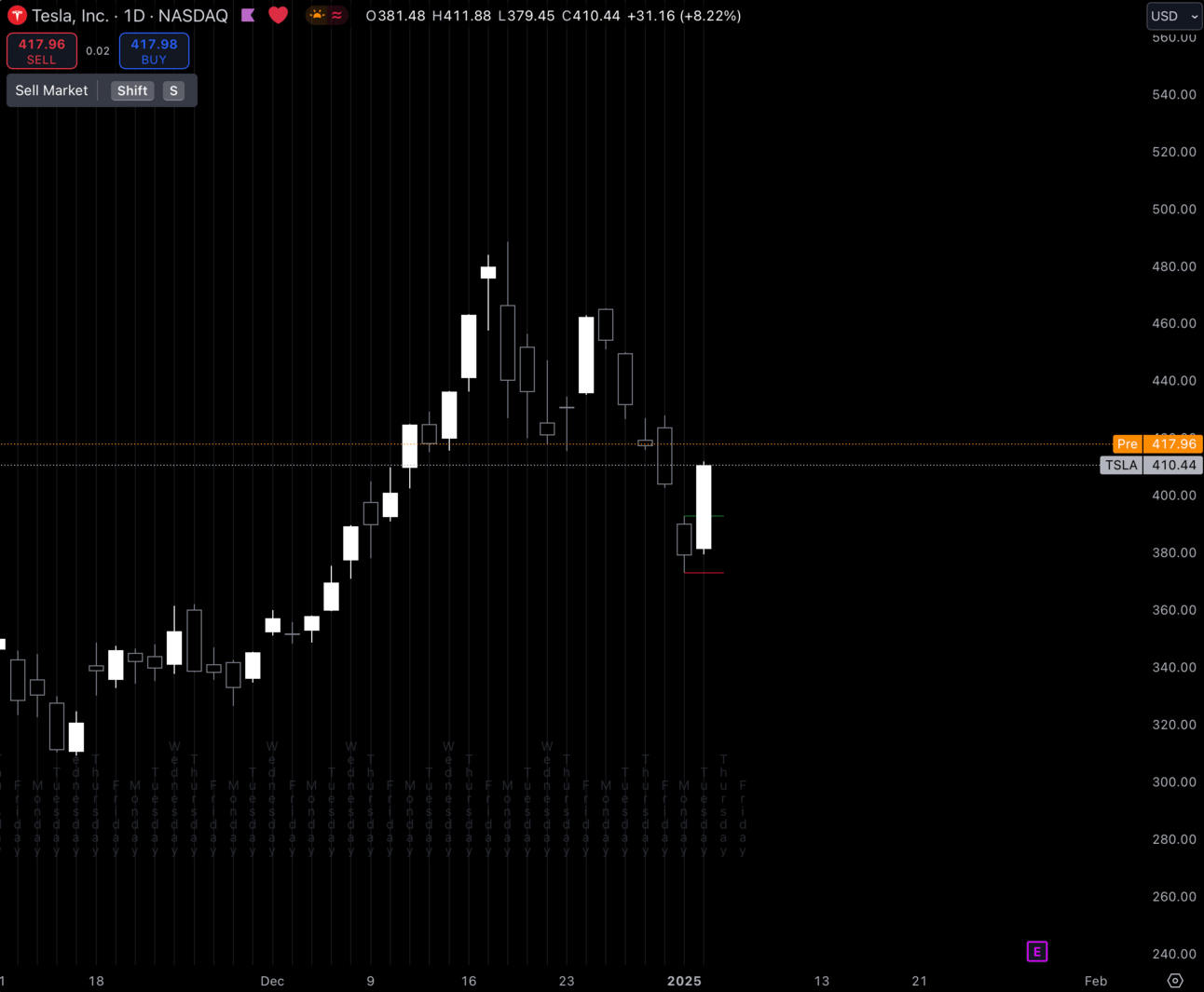

1. $TSLA

$TSLA Daily

Tesla did good out of the NFP range and traded exactly how I thought it would. I’d like to see any retests of previous day highs get bought and keep the momentum going from this NFP retest.

Would like to see this go test range highs this week or next.

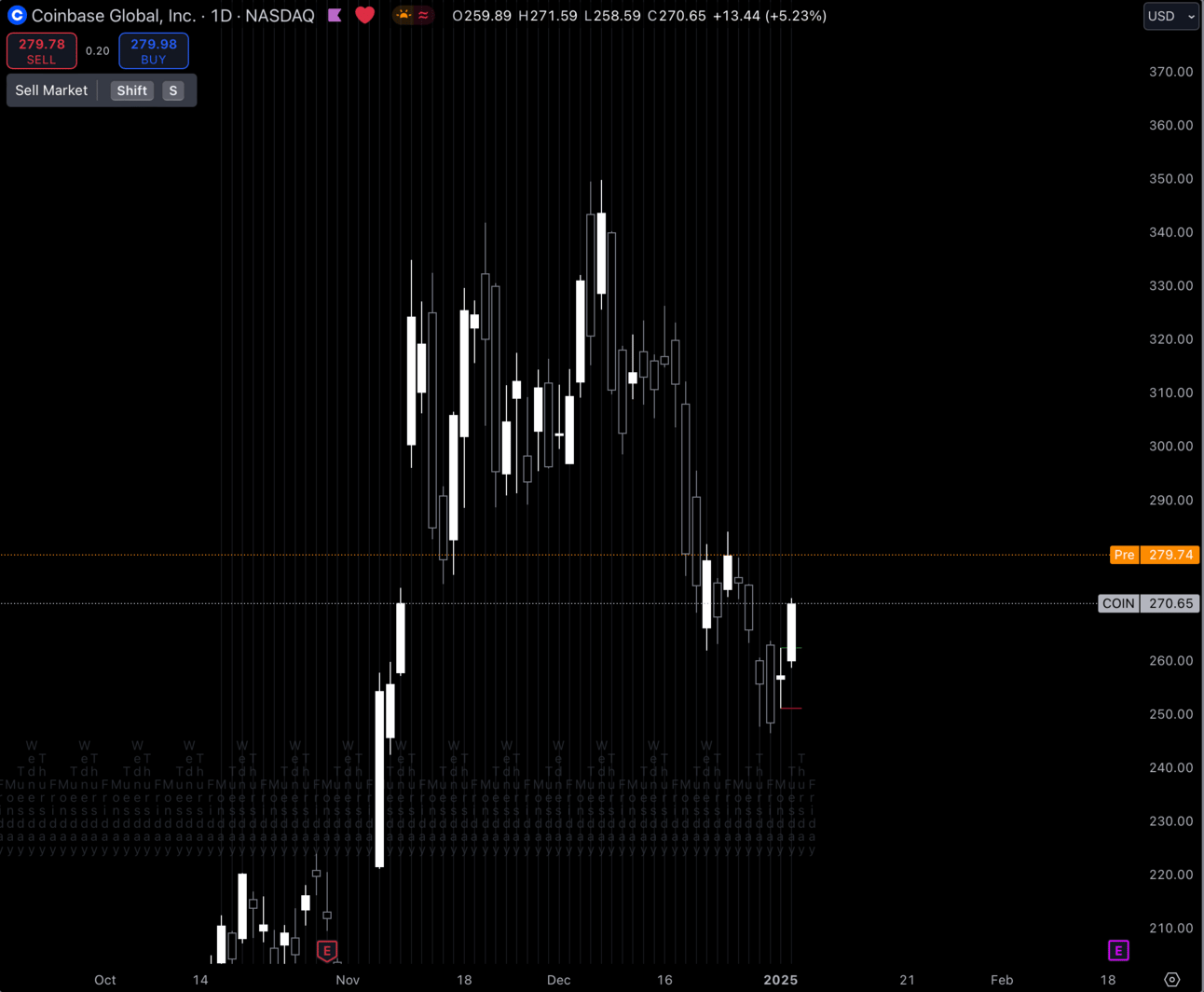

2. $COIN

$COIN Daily

Coinbase is starting to get some momentum off of these lows. I would like to see a retest of where we traded into the end of day on Friday and hold.

I personally want to see this trading back over $300 soon.

Long-Term Setups This Week:

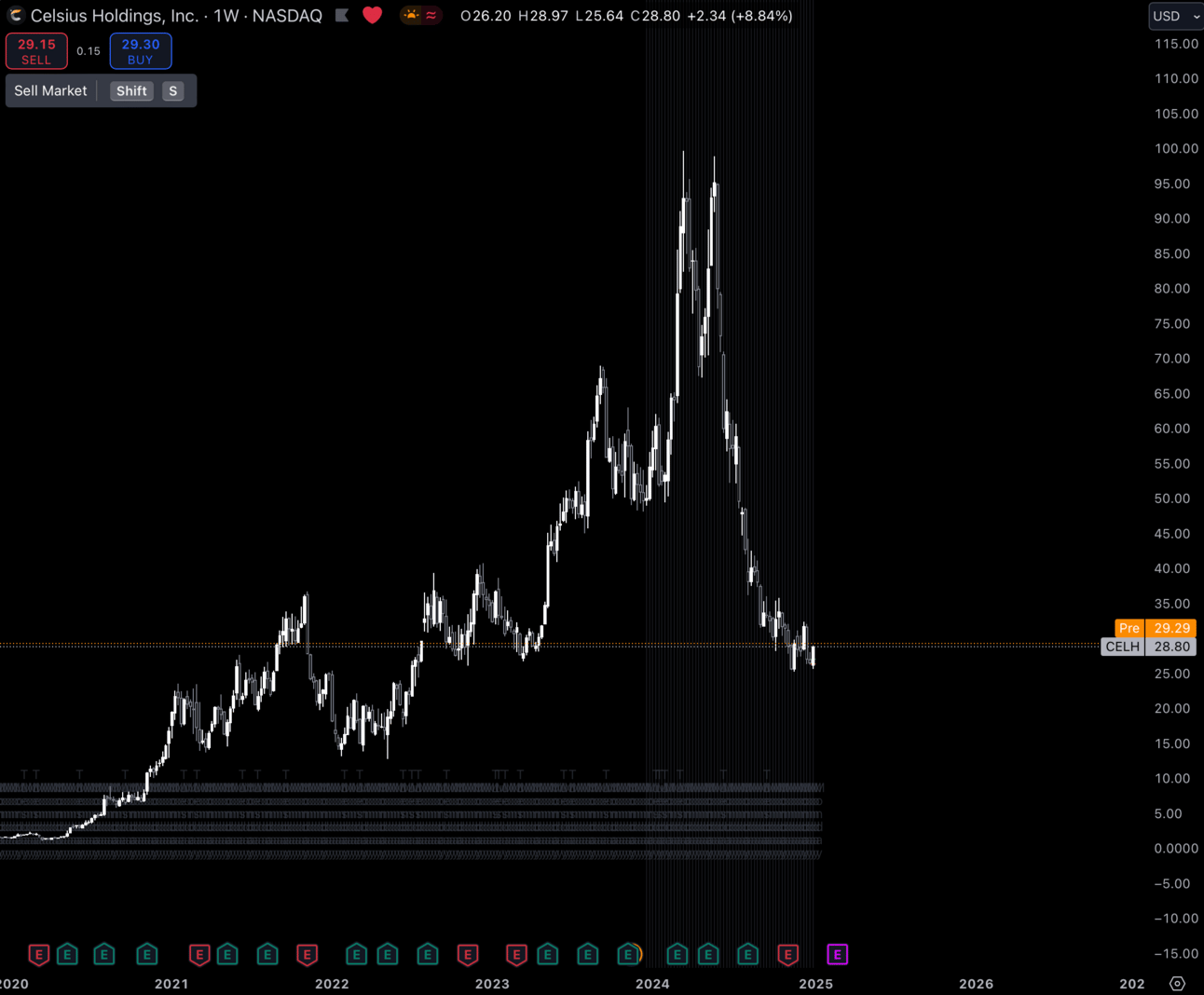

1. $CELH

$CELH Weekly

I recently sold my Celsius shares into the end of the year for tax loss harvesting, but I started a position back in last week.

My position now is smaller than it was and I will slowly add back to this as I feel that it is right.

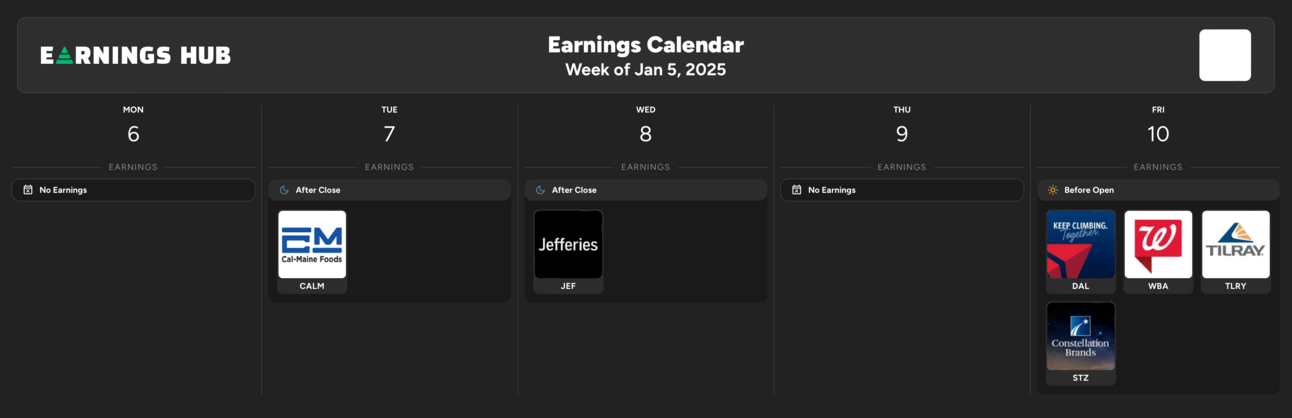

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 9:45 EST, S&P Services PMI

Tuesday 10:00 EST, JOLTS Job Openings

Wednesday 8:30 EST, Initial Jobless Claims

Wednesday 2:00 EST, FOMC Meeting Minutes

Friday 8:30 EST, Non-Farm Payrolls

Trending Sectors

Energy, Real Estate, and Materials were at the top of the list for trending sectors this past week.

Top trending tickers last week:

$LAES

$SPCB

$LUNR

$INTZ

$FNMA

$NRXP

$BFLY

$ET

$PDYN

$VSTM

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.