- Ace in the Hole

- Posts

- Ace in the Hole - Edition #55

Ace in the Hole - Edition #55

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the weekend and had a Merry Christmas/Happy Holidays! We are coming into the last 2 days of 2024 in the stock market. I am ready to wrap it up and get going with 2025!

New Year’s Day (Wednesday) will be closed, but New Year’s Eve will be a full trading day. This week can feel a little weird since half of the week is 2024 and the other half is the start of 2025, so if you don’t feel comfortable taking trades, DON’T!

I’m personally open to putting risk on if I see something clear, but it will likely be a slow start for options from my side and will focus more on futures.

Market Thoughts

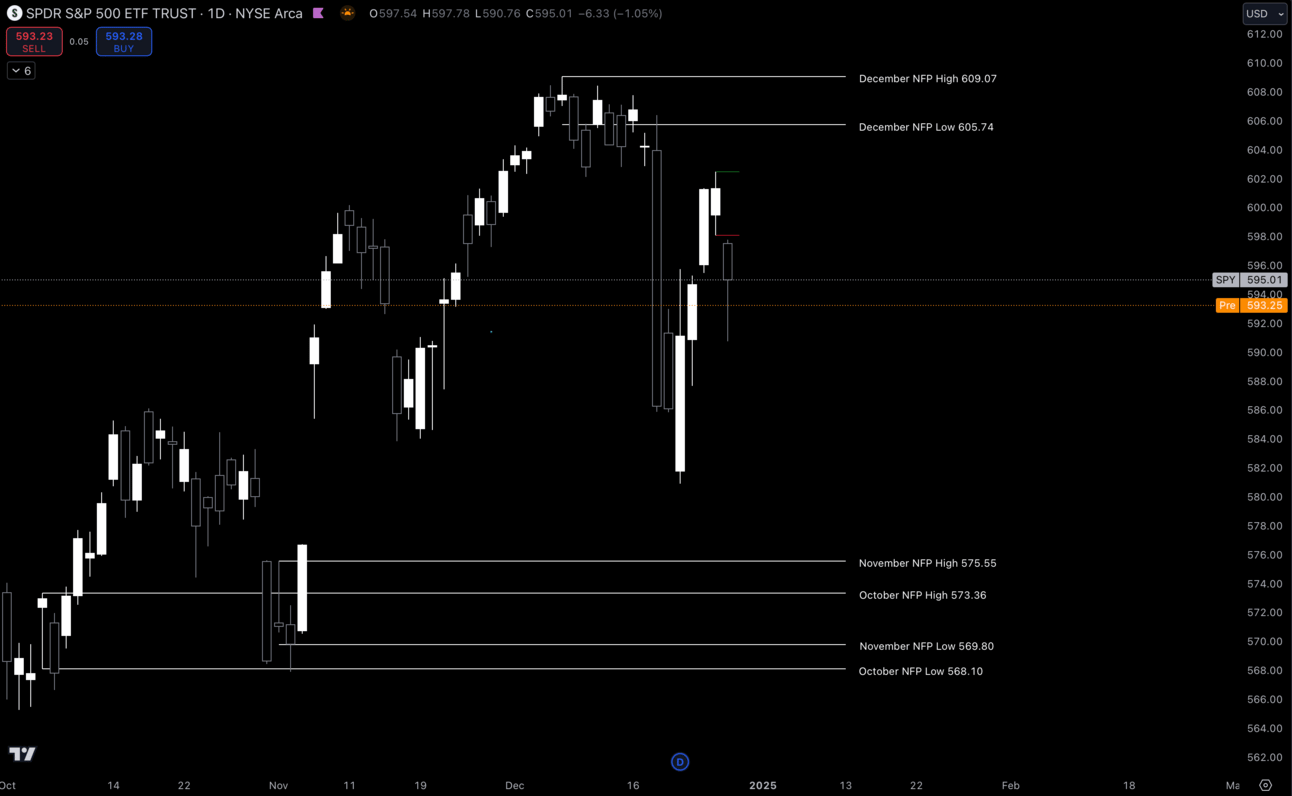

Taking a look at $SPY, I would love to start seeing some lower prices and for things to really get a nice dip. However, I don’t think it’s super clear yet and bulls can very much still be present at some of these lower levels.

$SPY Daily

Going into 2025 I personally expect a pullback on the entire market. I think this because there are plenty of people that are waiting until 2025 to sell their positions so they don’t have to claim short-term capital gains tax.

This is just a thesis though, if price action doesn’t align with this and we keep ripping higher, I will just have to follow the trend.

Short-Term Setups This Week:

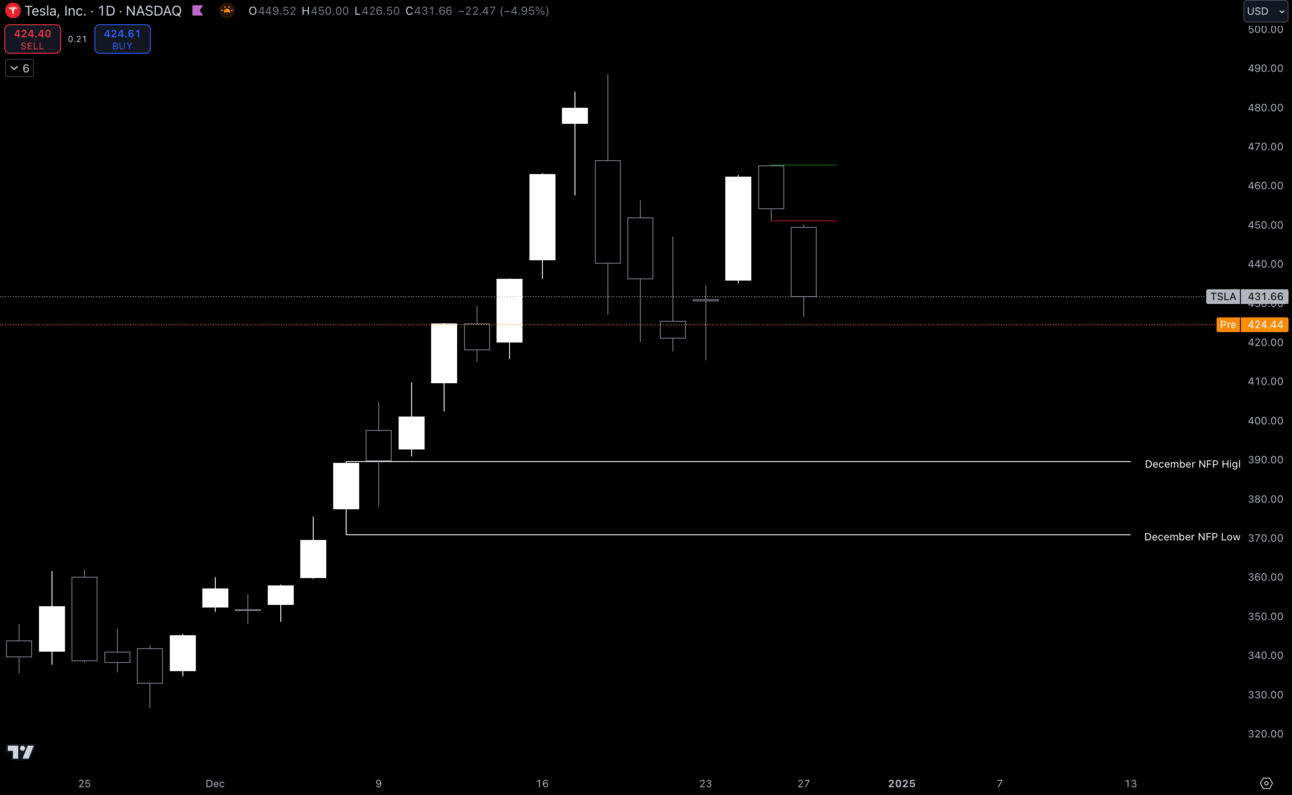

1. $TSLA

$TSLA Daily

The strength in Tesla has been ridiculous lately and even with the market pulling back, it seems to be holding bullish structure pretty well.

I’m personally looking for a move back into December NFP levels to then go higher, but if we consolidate in a range above those levels I might have to take a trigger above NFP instead of at it.

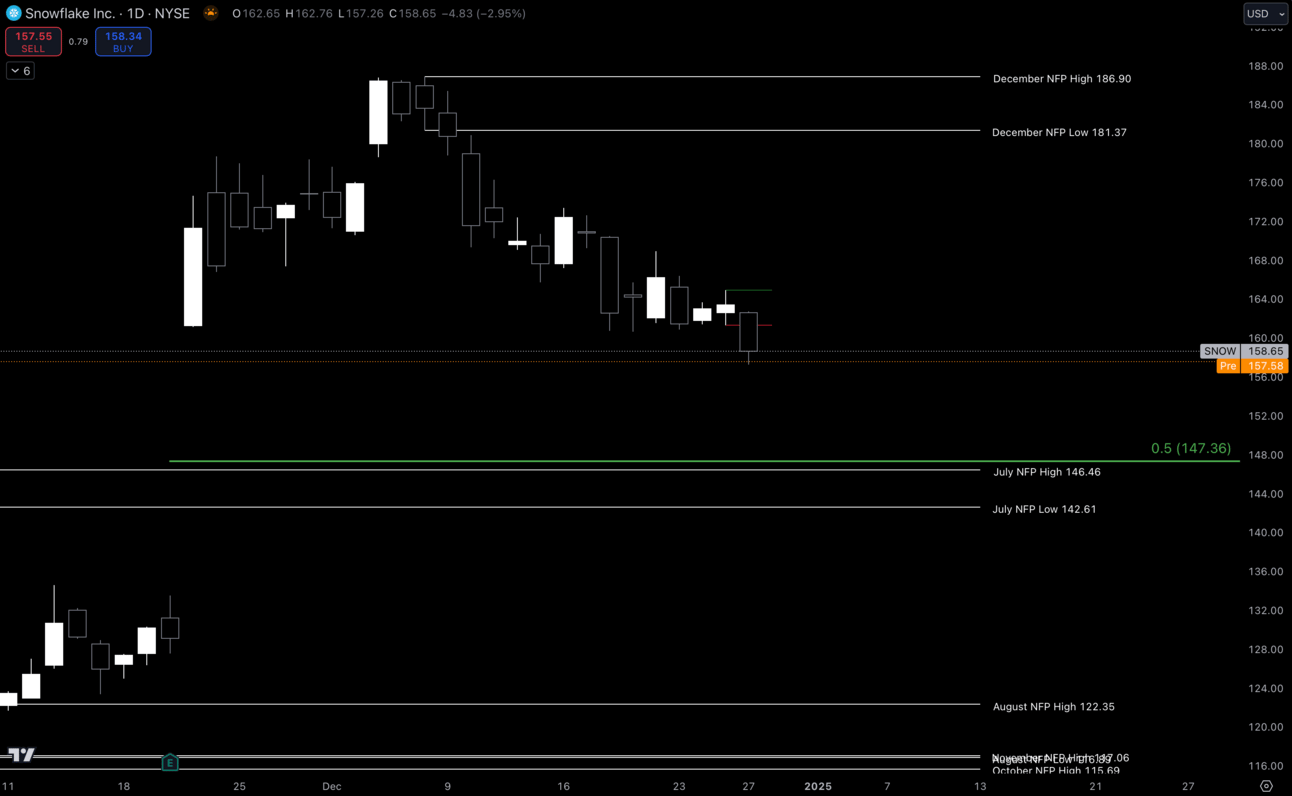

2. $SNOW

$SNOW Daily

Snow has entered this big daily gap to the downside where I drew a 50% retracement of the gap range. You can see that retracement also lines up with July NFP which gives us a little more confidence.

If we can see bulls step in I like longs here instead of waiting for a gap fill. If we get displacement through these levels I will look for buyers off of the gap fill.

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 9:45 EST, Chicago PMI

Monday 10:00 EST, Pending Home Sales

Thursday 8:30 EST, Initial Jobless Claims

Thursday 9:45 EST, S&P Manufacturing PMI

Friday 10:00 EST, ISM Manufacturing PMI

Trending Sectors

Technology, Consumer Discretionary, and Healthcare were at the top of the list for trending sectors last week.

Top trending tickers last week:

$AMD

$TLRY

$TSLA

$LUNR

$NVDA

$PLTR

$RCAT

$MSTR

$QQQ

$ACHR

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.