- Ace in the Hole

- Posts

- Ace in the Hole - Edition #54

Ace in the Hole - Edition #54

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great weekend and is excited for this week! It’s going to be boring in terms of earnings in the market, but I think with the recent added volatility we can get some nice moves.

Merry Christmas and Happy Holidays to everybody that reads this! The market is closed for Christmas on Wednesday.

Market Thoughts

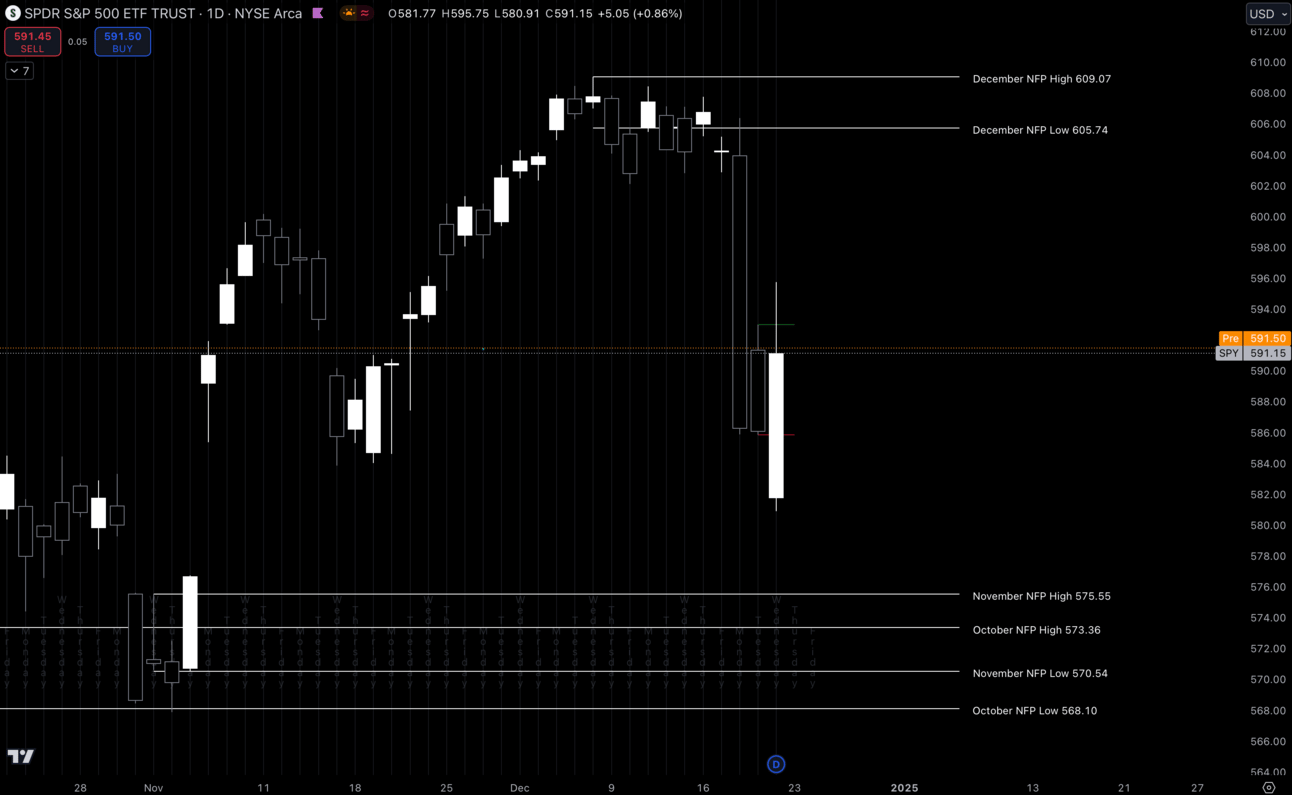

Last week we had a BIG FOMC Meeting where rates were cut by 25 basis points. $SPY fell 2.98% on Wednesday. For many people this was scary, but for me this is opportunity.

Not necessarily opportunity to buy up this dip for long-term, we aren’t there yet. But opportunity for the VIX to get some upside momentum and bring some volatility back into this market.

We all know how tough it can be to be day trading when the market is sitting at all time highs, so this dip is bringing us more trades in that area which I am excited for.

Overall we are still in a bull market and 1 day does NOT tell the whole story, but it was refreshing seeing some big downside moves in the market.

$SPY Daily

Short-Term Setups This Week:

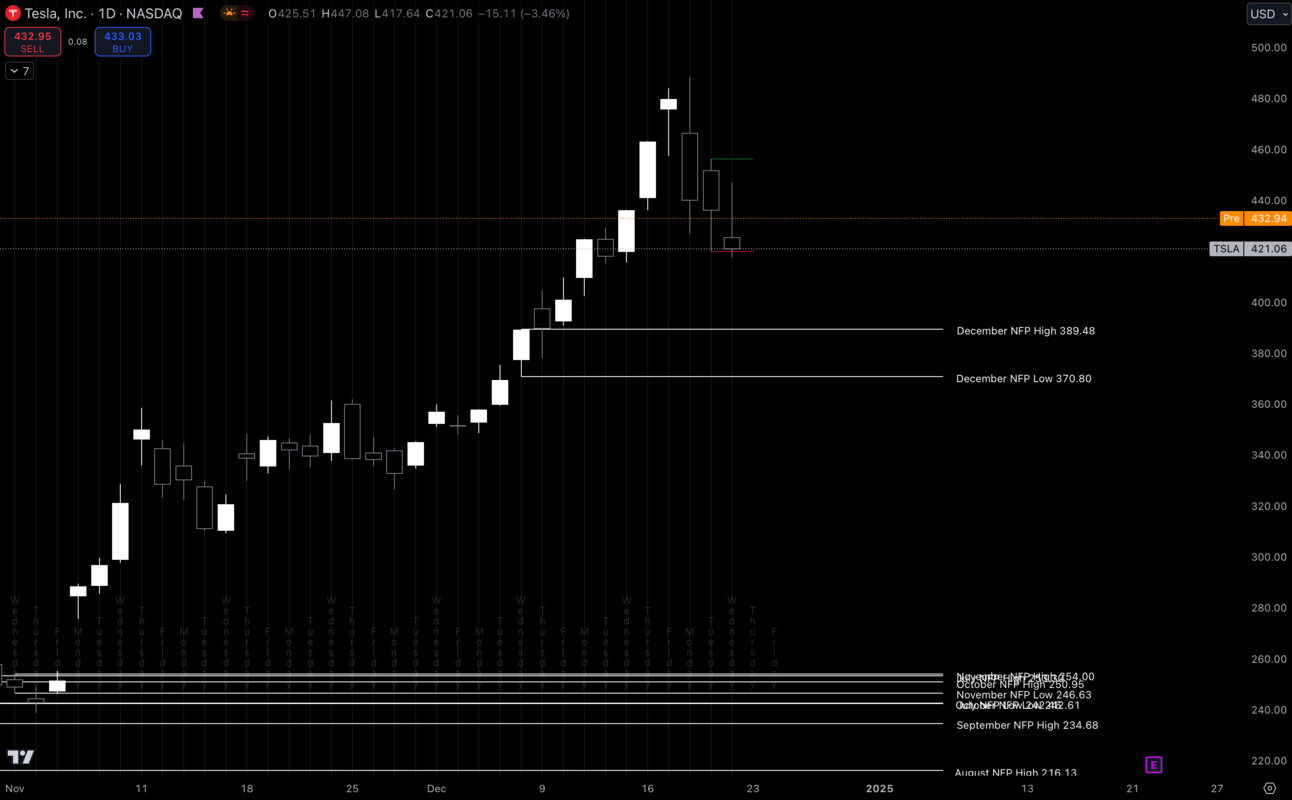

1. $TSLA

$TSLA Daily

Tesla has had so much strength lately and is holding up very well on this dip. I would personally play off of this strength and be looking to buy up dips and keep riding the momentum.

It looks decent here, but i’d be more interested in a dip to December NFP levels to get long.

Under December NFP low would invalidate my thesis and I would have to reevaluate my setup.

This is going to be the only setup this week as I’m not even trading options into the end of the year and I genuinely don’t see many high quality setups.

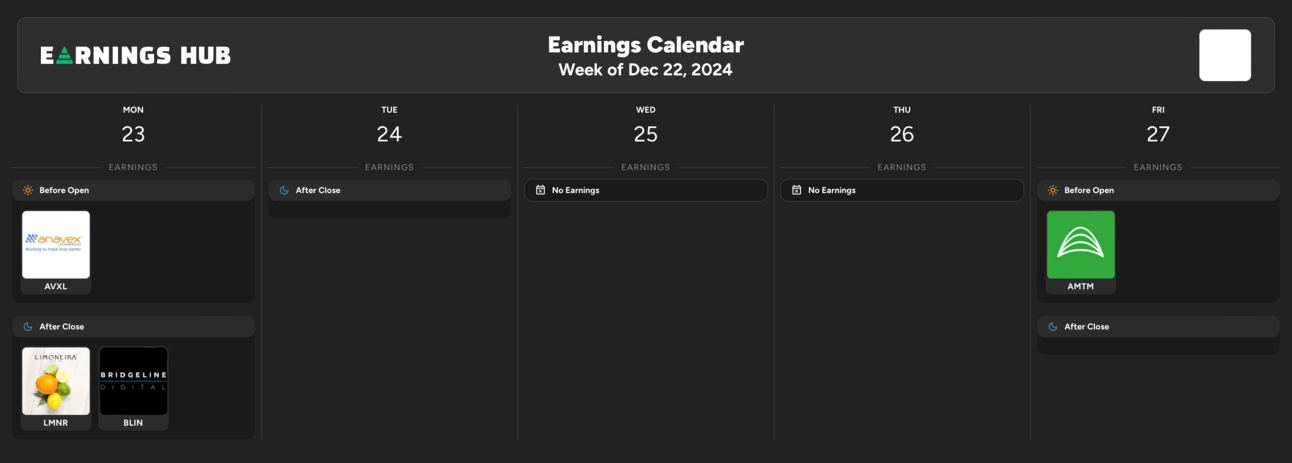

Earnings Calendar

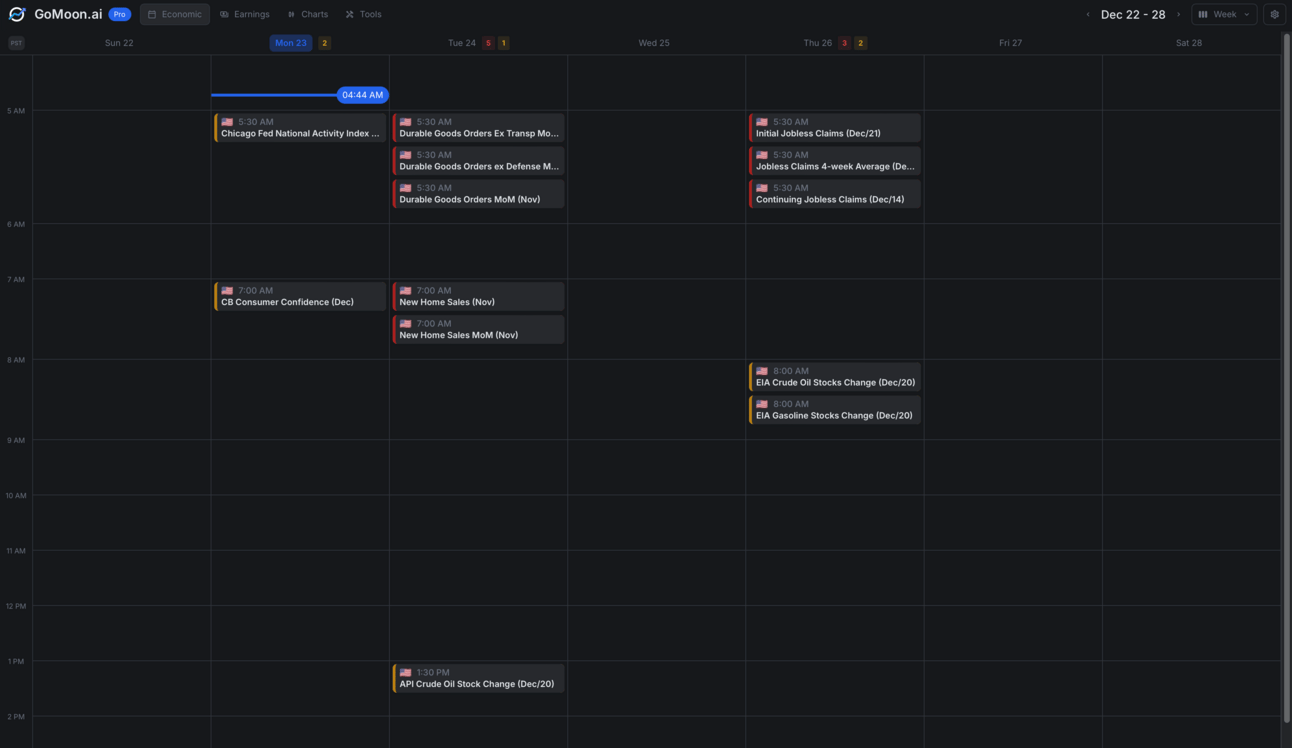

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, CB Consumer Confidence

Tuesday 10:00 EST, New Home Sales

Thursday 5:30 EST, Initial Jobless Claims

Trending Sectors

Consumer Discretionary, Technology, and Utilities were at the top of the list for trending sector last week.

Top trending tickers from last week:

$TSLA

$NVDA

$MU

$AMD

$AVGO

$GOOG

$MSTR

$SMCI

$ACHR

$HOOD

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.