- Ace in the Hole

- Posts

- Ace in the Hole - Edition #53

Ace in the Hole - Edition #53

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the time off and got a break from the charts. We have a very fun week ahead of us with the FOMC rate decision going on. We will see if Jerome Powell and the FED go with the consensus to cut rates.

Going to be a fun week, get ready!

Market Thoughts

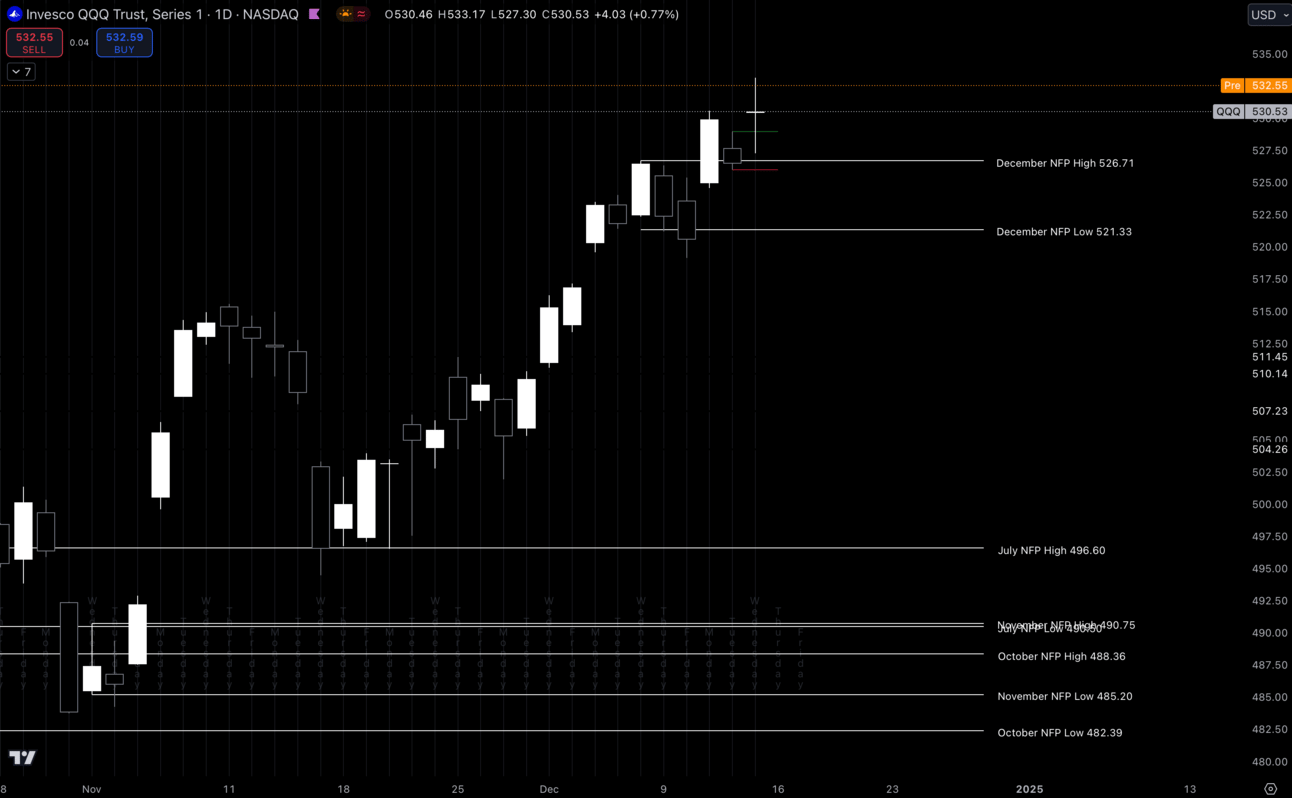

This market has continued to shown its strength, so I’m still trading the majority of my positions to the upside. However I do think the market could see further pullbacks than what it has endured recently.

Either way I always play the price action in front of me and follow the trend best possible. $SPY is already trading underneath its NFP levels, but I need to see $QQQ trading under December NFP low.

$QQQ Daily

I’m still very bullish, but I would not mind seeing our normal assets trade a little bit lower and pullback into the new year.

Short-Term Setups This Week:

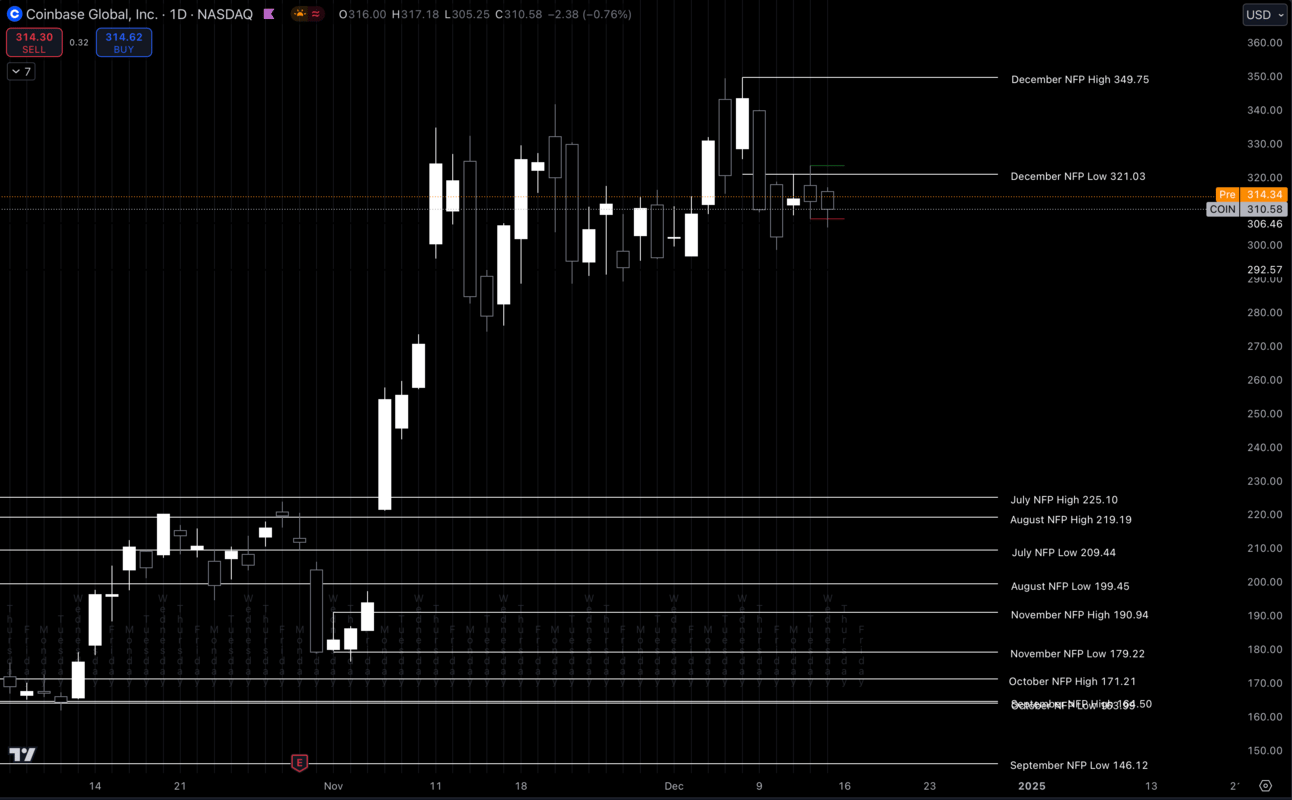

1. $COIN

$COIN

Again, I’m not trading much into the end of the year, but I did want to put at least 1 chart on your radar that I’m keeping an eye on right now.

Coinbase has been consolidating for a while now and I personally think it needs a move. I want to see some sort of break of structure before I get involved, but I thought this was worth noting given how $COIN generally trades.

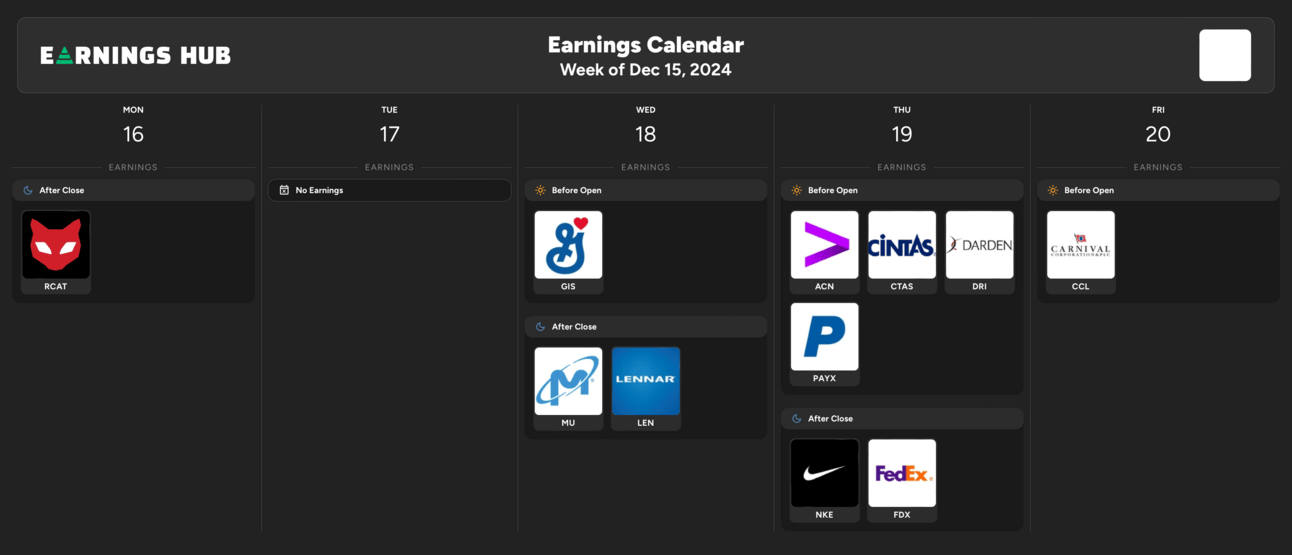

Earnings season is pretty quiet at this time, but you can get all the info on any calls or companies reporting here:

Economic Calendar

/

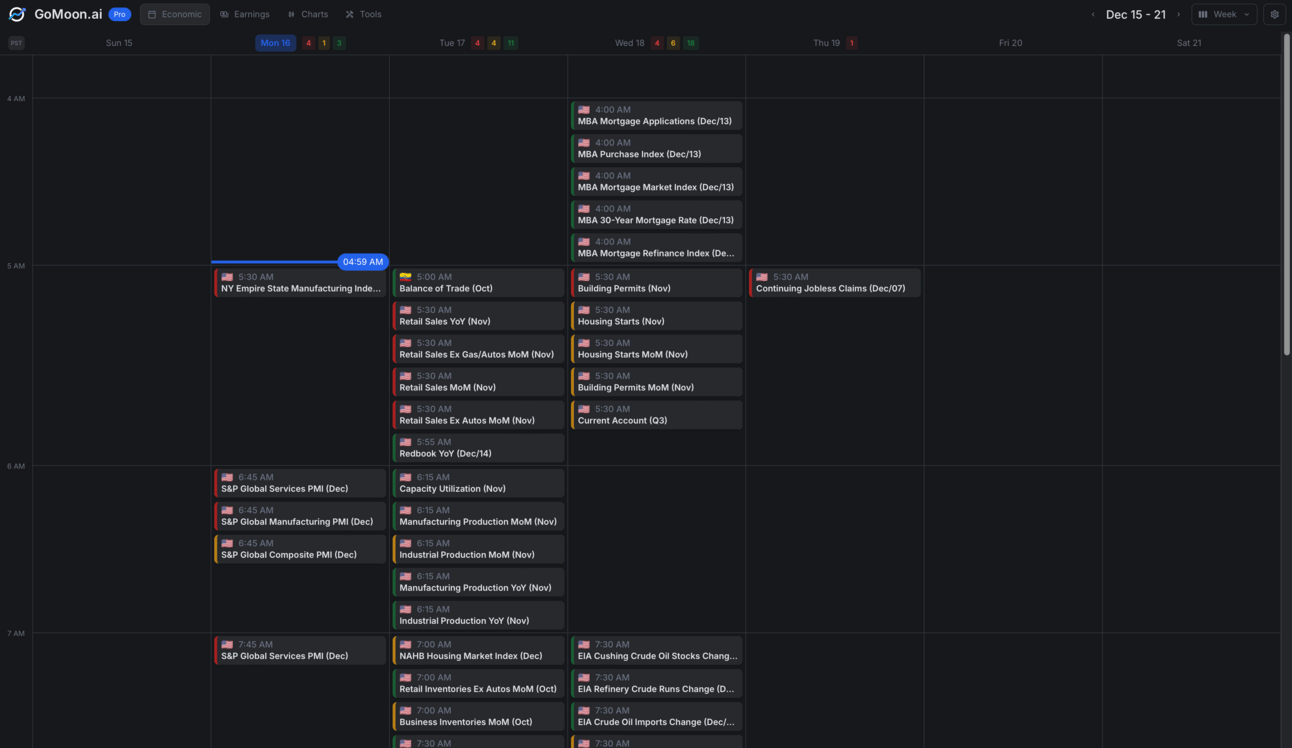

These data points are known to bring volatility during the intraday:

Monday 9:45 EST, S&P Global Manufacturing PMI

Tuesday 8:00 EST, Retail Sales

Wednesday 2:00 EST, Fed Rate Decision

Thursday 8:30 EST, Continuing Jobless Claims

Trending Sectors

Technology, Consumer Discretionary, and Communication Services were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

$TSLA

$NVDA

$GOOG

$AMD

$INTC

$MSTR

$AAPL

$ADBE

$ACHR

$PLTR

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.