- Ace in the Hole

- Posts

- Ace in the Hole - Edition #51

Ace in the Hole - Edition #51

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great Thanksgiving and enjoyed time with the family! Trading was relatively quiet, so it was a great week to spend time away.

There are more earnings and economic data to dive through this week so let’s get to it!

Market Thoughts

$SPY sitting at new all time highs once again. There is still nothing bearish about this market to me. Every dip continues to get bought and taken right back to highs.

Even though last week was relatively slow, the 2 best trading days were the 2 days everybody said to take off. Wednesday and Friday were arguably the best price action for all of last week.

This goes to show that no matter what is happening, you should always let price action tell you whether or not it’s a good environment to trade in. Yes it might have been super choppy on those days, but it wasn’t.

If you just took the day off because it’s the day before/after Thanksgiving, you missed out on the best trading days of the week.

Always let price action tell the story.

Short-Term Setups This Week:

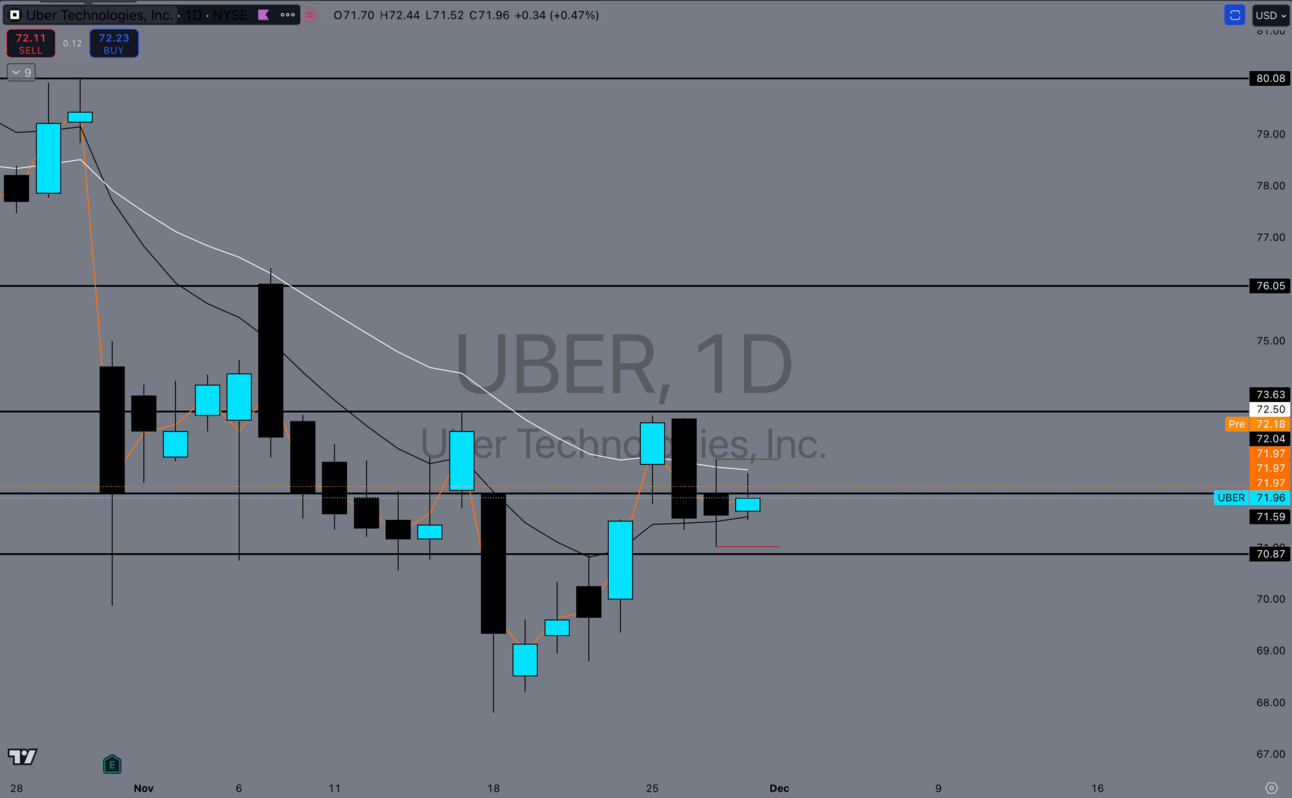

1. $UBER

$UBER Daily

I like Uber if it can break over Wednesdays high and hold targeting the levels I have marked above.

If this breaks Wednesdays low, it could be a potential short entry as well targeting the range lows.

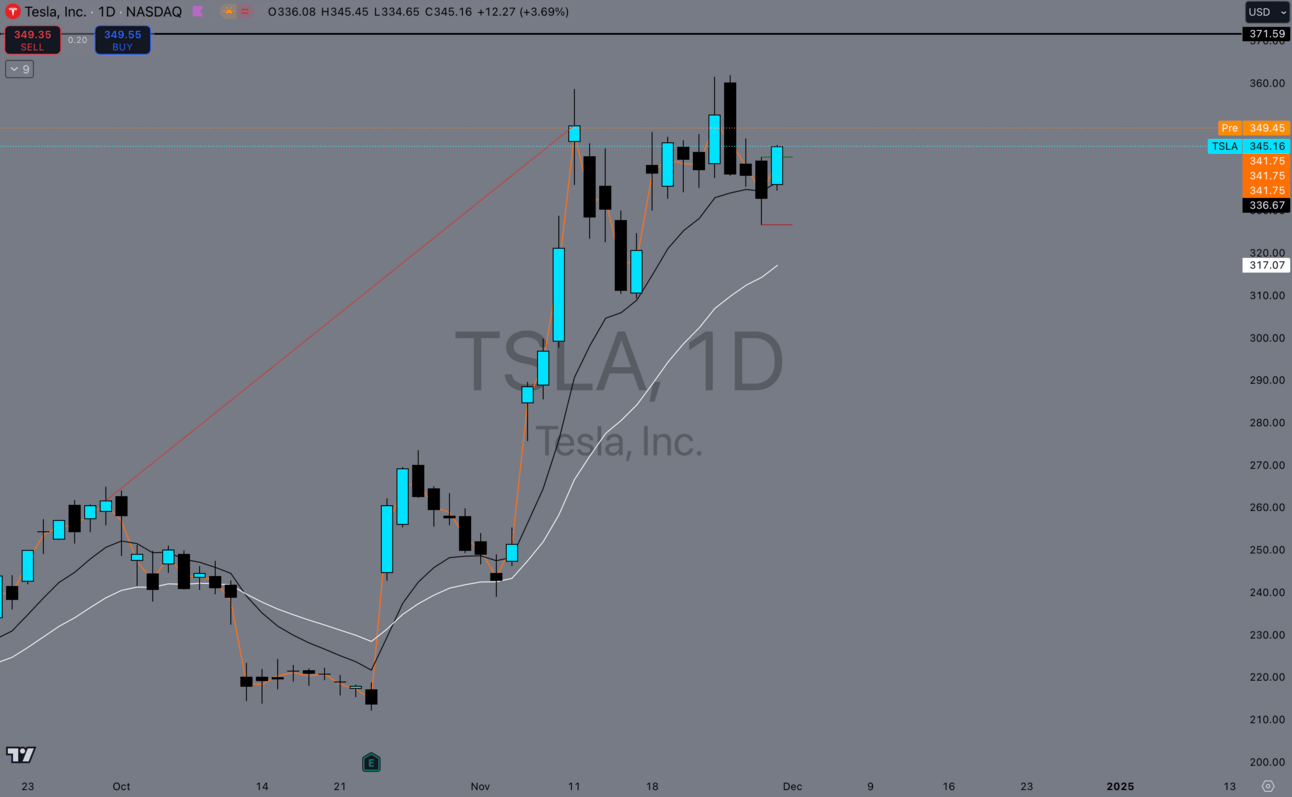

2. $TSLA

$TSLA Daily

Tesla has been in this consolidation going back and forth after those big moves.

This imo is very healthy and should not frighten anybody. You have price making higher highs and higher lows in consolidation. I expect a move to the upside from this consolidation, but the hard part is knowing when.

So I’ll keep my eyes on this for potential entries.

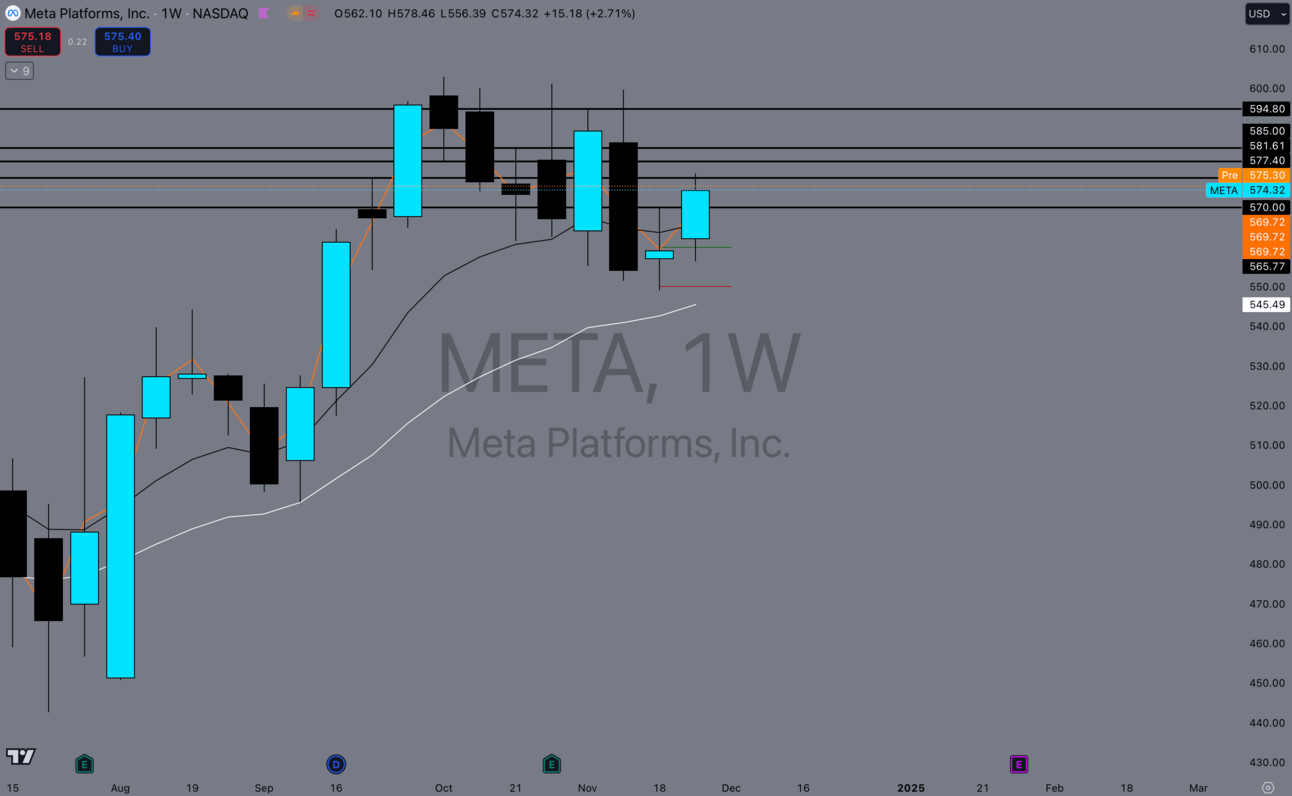

3. $META

$META Weekly

Meta has been in this healthy consolidation for a while now, but I do think we get a move soon.

Holding the weekly 21 EMA, if it were to lose this I wouldn’t like the bullish thesis anymore.

Last week we closed fairly strong, so I’m looking for continuation of that.

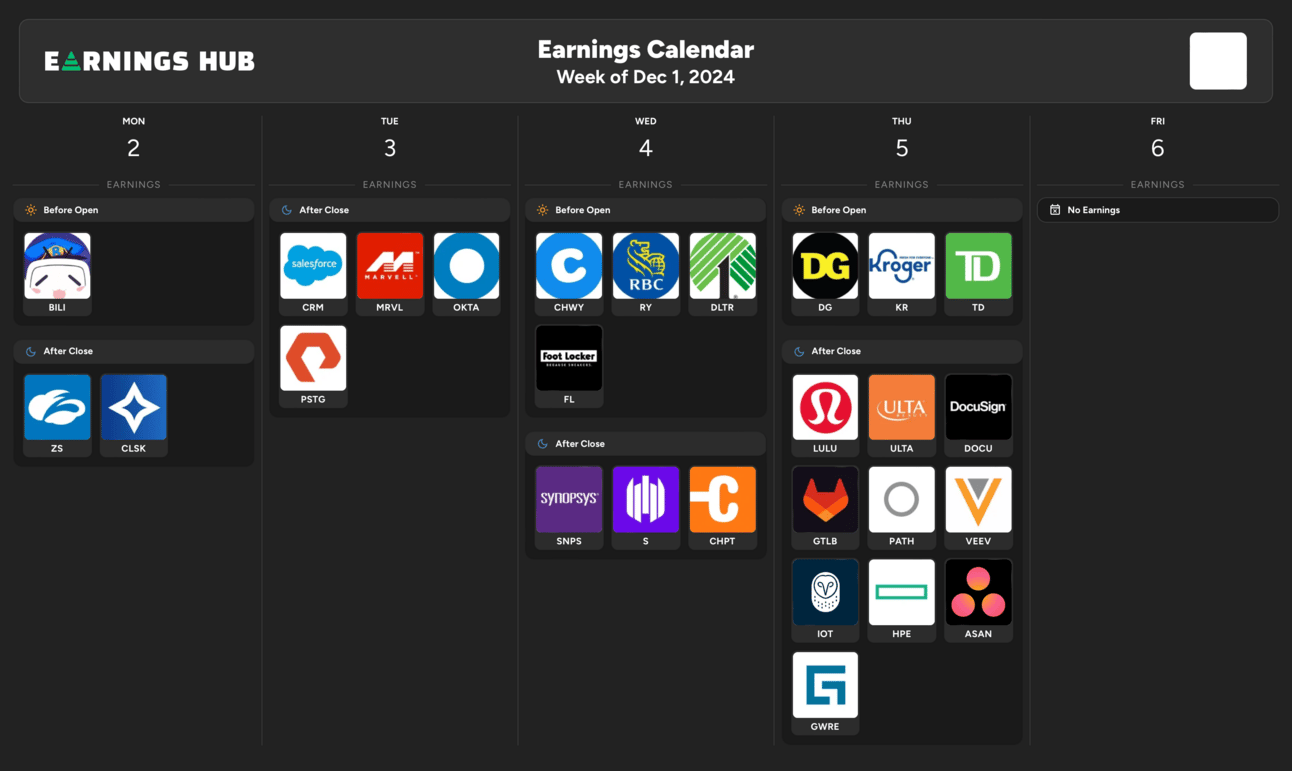

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, ISM Manufacturing PMI

Tuesday 10:00 EST, JOLTS Job Openings

Wednesday 10:00 EST, ISM Services PMI

Wednesday 1:45 EST, Fed Powell Speaks

Thursday 8:30 EST, Initial Jobless Claims

Friday 8:30 EST, Non-Farm Payrolls

Trending Sectors

Real Estate, Utilities, and Technology were at the top of the list for trending sectors last week.

Top trending tickers from last week:

$TSLA

$NVDA

$MSTR

$RKLB

$ACHR

$LUNR

$SMCI

$MARA

$INTC

$AMD

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.

This is truly the only discord you will ever need, thank me later!