- Ace in the Hole

- Posts

- Ace in the Hole - Edition #47

Ace in the Hole - Edition #47

Your Secret Weapon to Beat The Market

Happy Monday Traders!

Last week was arguably the most important week for the market in terms of earnings. Majority of the big names we watch were reporting such as, $AMD $GOOGL $MSFT $META $COIN $AAPL and $AMZN.

This made the market pretty interesting over the week and had $SPY down 1.38%. While the thick of earnings is over, we now have Election Day to look forward to, as well as some other economic events that we’ll go over.

Market Thoughts

I still have no reason to go and switch my thesis up and be a bear. I have been playing the short-term downside when it’s there with futures, but other than that I am long every position I take.

That will change, but again that time is not now at least for me. We have to see some sort of big market shift in structure and I just haven’t seen that yet.

Overall, I will continue to play all swings on options to the upside and if I want to play downside I will capture it with futures.

Short-Term Setups This Week:

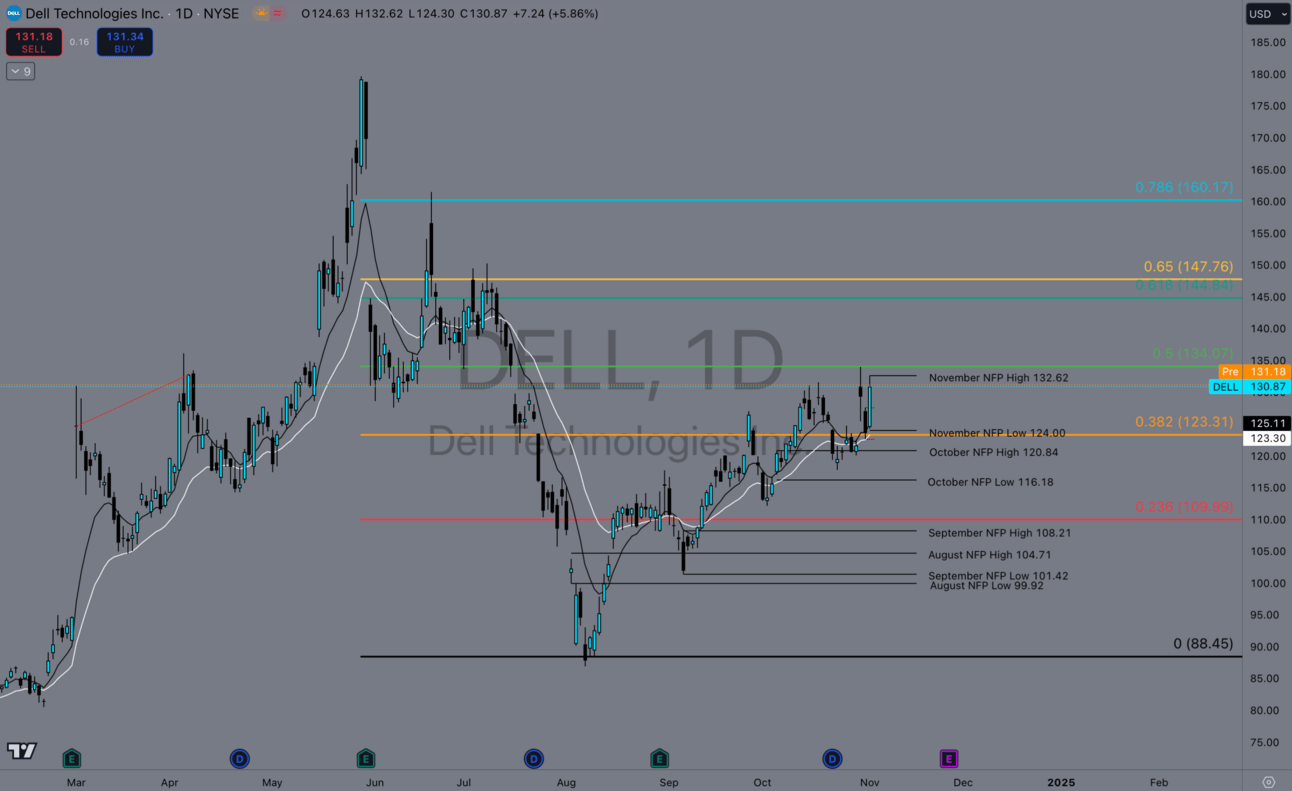

1. $DELL

$DELL Daily

Dell has been making some nice moves lately through this gap. If this can break over my .5 Fib, I think it has a good chance to go to my golden Fib and fill the next gap up.

Something to keep an eye on if we clear over $134. Market structure is higher highs and higher lows, so until that changes, I like the bull case here.

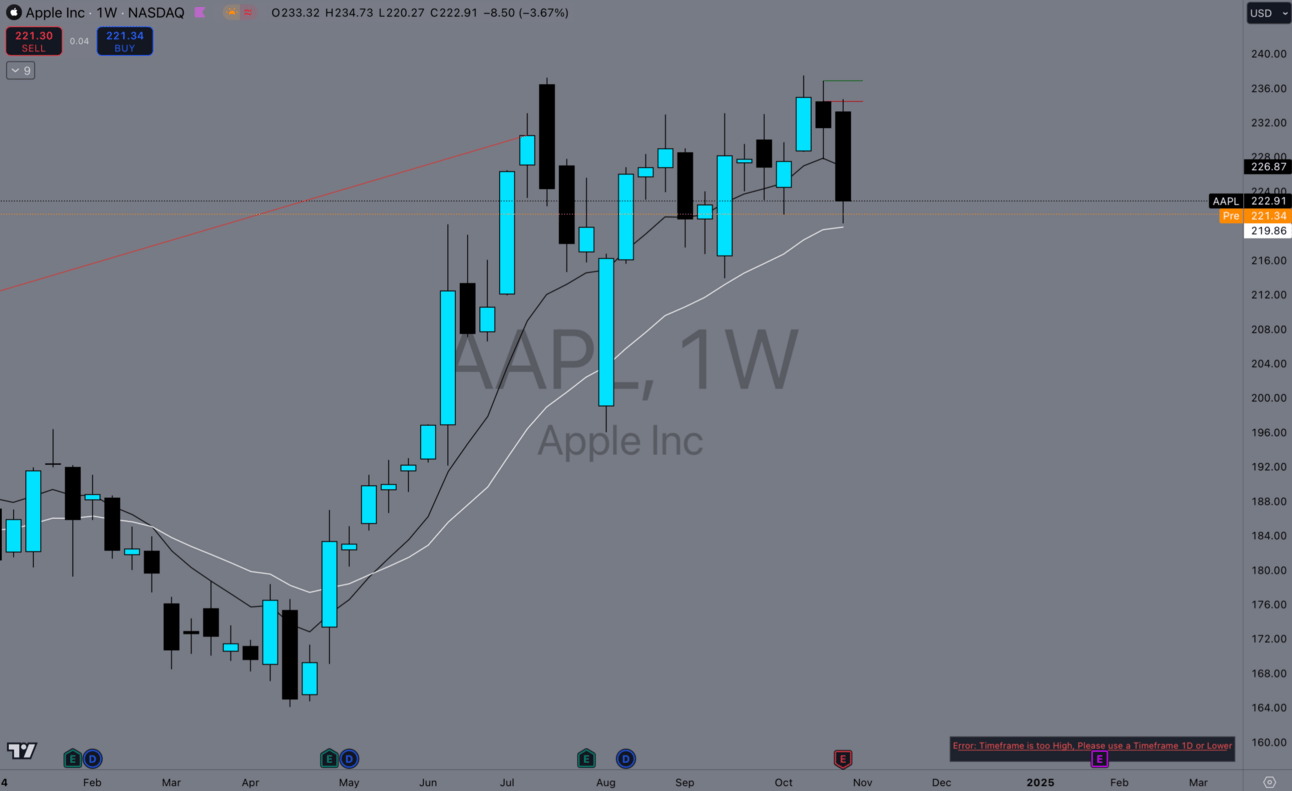

2. $AAPL

$AAPL Weekly

Apple has been consolidating on the weekly for a while now. Higher lows up to the top, until this structure breaks I like this for the breakout. If we start breaking that higher low structure to the downside, that might be a tell that we need to go lower.

At a big spot with the weekly 21 EMA here, so let’s see if it holds!

Long-Term Setups This Week:

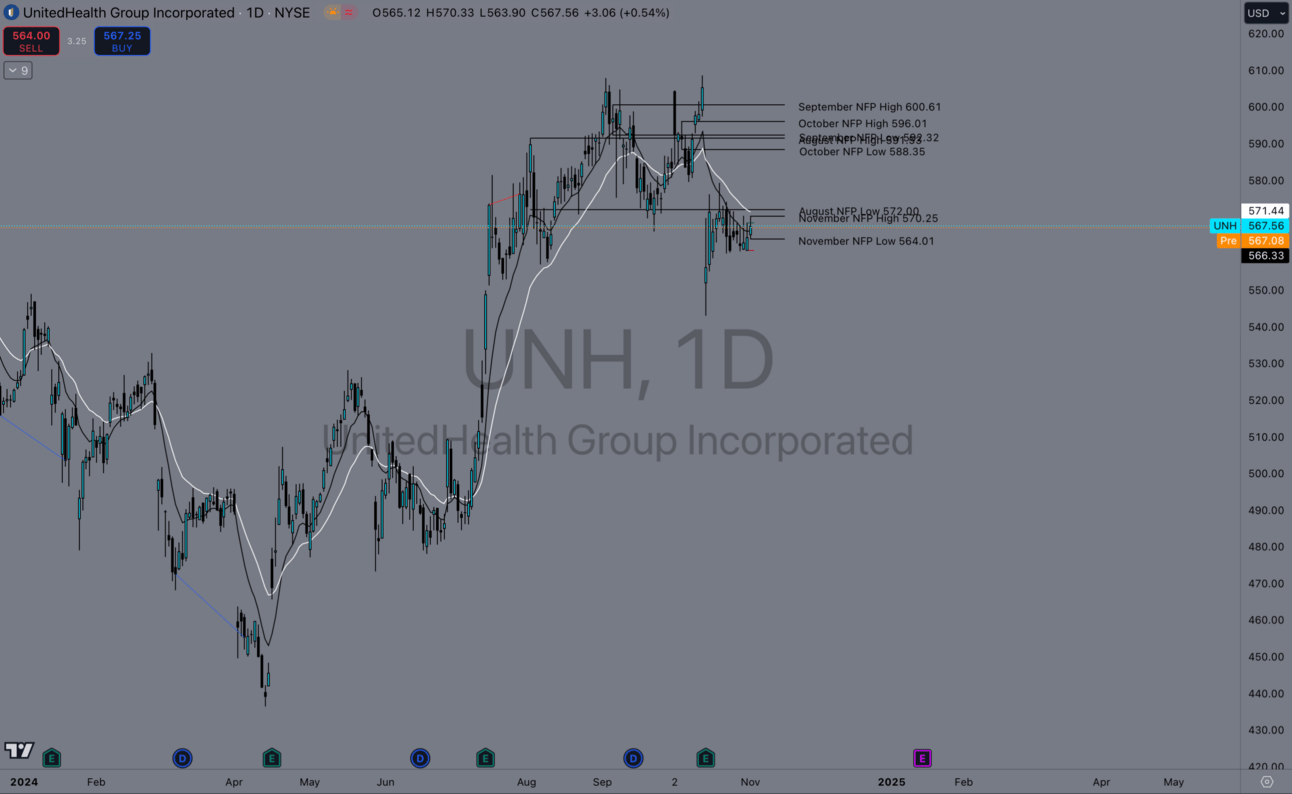

1. $UNH

$UNH Daily

$UNH still needs to drop more in my opinion, but I like this to start adding shares to for the long-term around the $530 area if we get there.

I want to see this break down from the spot we are in, but the bulls have been strong on this name, so I’m not sure I’ll get the prices I want.

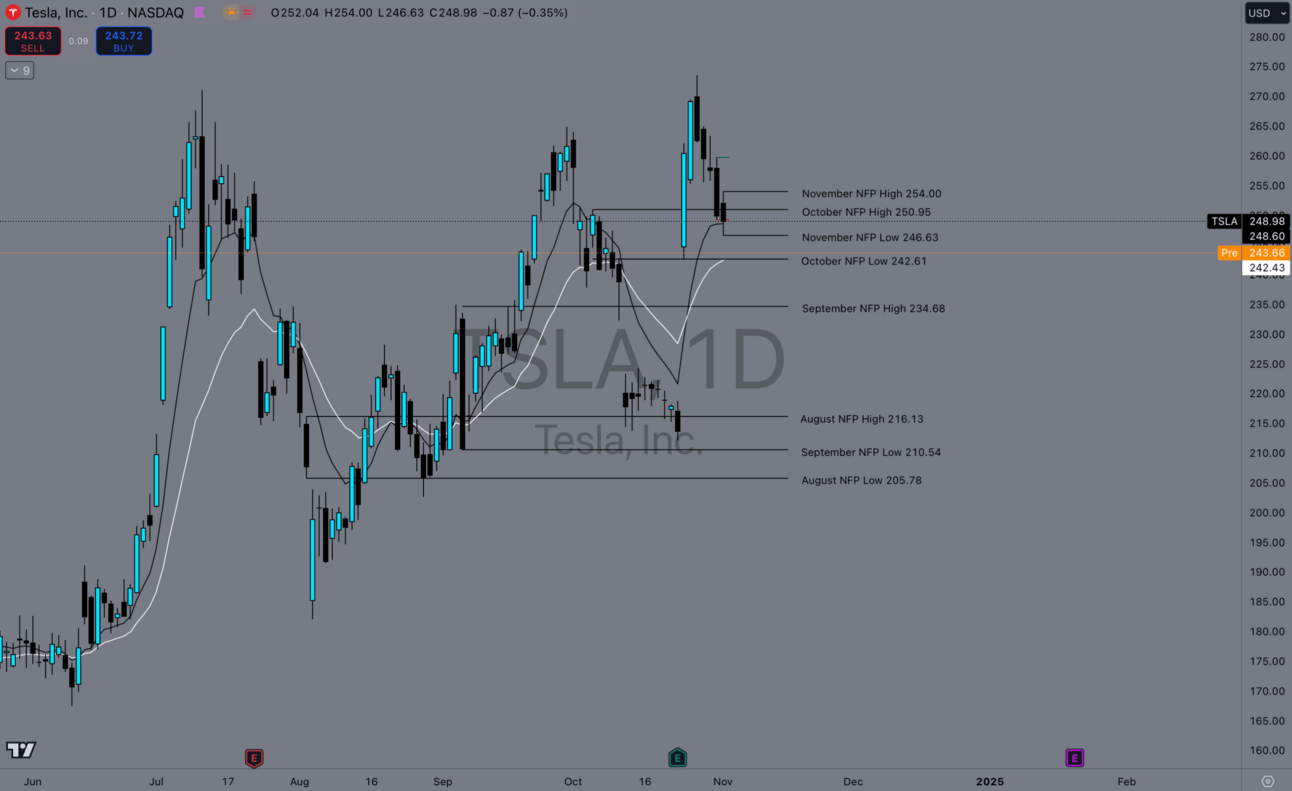

2. $TSLA

$TSLA Daily

If Tesla comes back into the $220 range, I think it’s a big add for the long-term. I personally don’t think these prices will be here much longer.

I’ll be watching for spots to add this week.

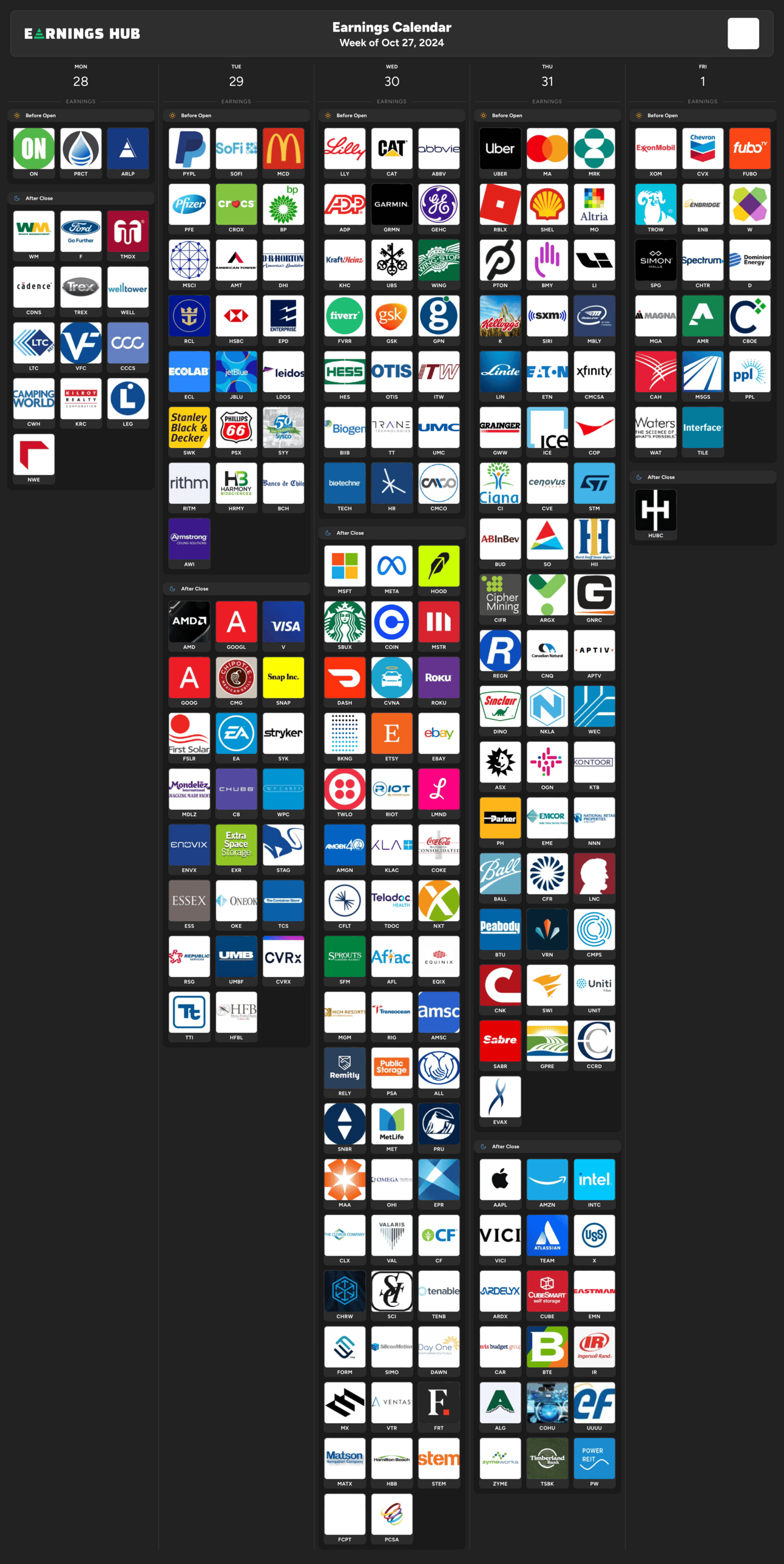

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, ISM Services PMI

Wednesday 9:45 EST, S&P Services PMI

Thursday 8:30 EST, Initial Jobless Claims

Thursday 2:00 EST, FOMC Rate Decision

Trending Sectors

Technology, Financials, and Consumer Discretionary were at the top of the list for trending sectors this past week.

Top trending tickers from last week:

$AMD

$TSLA

$GOOGL

$NVDA

$MSFT

$META

$LLY

$PAYC

$HOOD

$SMCI

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.

This is truly the only discord you will ever need, thank me later!