- Ace in the Hole

- Posts

- Ace in the Hole - Edition #42

Ace in the Hole - Edition #42

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend and got some time away to relax.

Last week was really uneventful for the S&P 500.

We rose 0.57% and basically chopped back and forth all week.

We have a big week ahead of us with some data coming out throughout the week as well as Non-Farm Payrolls on Friday, so it should be an interesting week!

Let’s jump into it.

Market Thoughts

Even with market being slow at all time highs, I am still very bullish.

Again guys, until I see something that is actually telling my bearish, why am I going to try and fade this massive strength?

Makes no sense.

I won’t be the guy to pick top, but when it is time to flip I will be ready.

That time is not now.

I will continue to play bullish until it stops working and scalp short-term pullbacks with futures.

Short-Term Setups This Week:

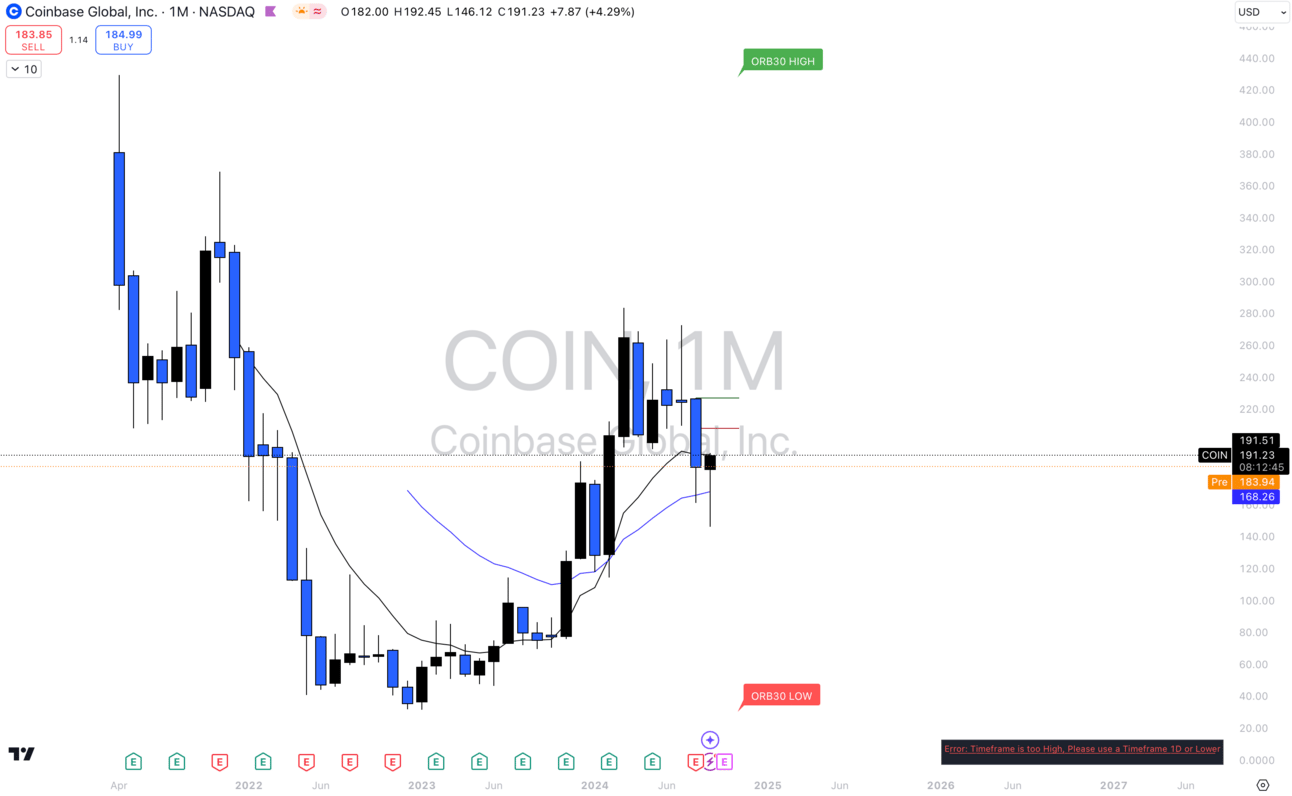

1. $COIN

$COIN Monthly

$COIN has been consolidating for a while now, but IMO looks very good here off of the monthly 21 EMA.

As long as this is holding that EMA, I see no reason to be scared out of long positions.

I’m not long yet, but will very likely get long this week.

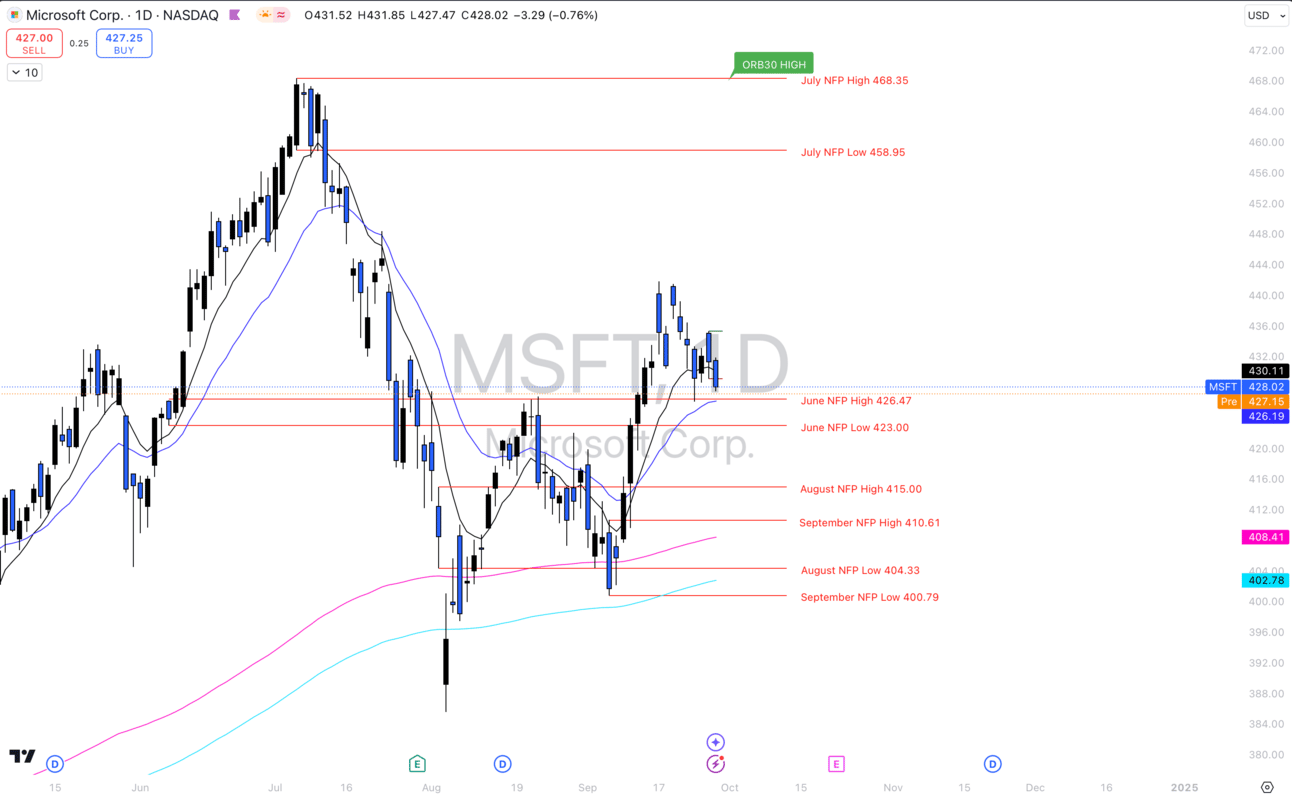

2. $MSFT

$MSFT Daily

$MSFT is backtesting previous highs and the daily 21 EMA.

I’m interested to see if that holds, but I wouldn’t be mad if we had to go slightly lower into that $415-$410 area to make another higher low.

Either way I’ll keep eyes on it and if we are getting big buys off of the 21, I might just take it there.

Long-Term Setups This Week:

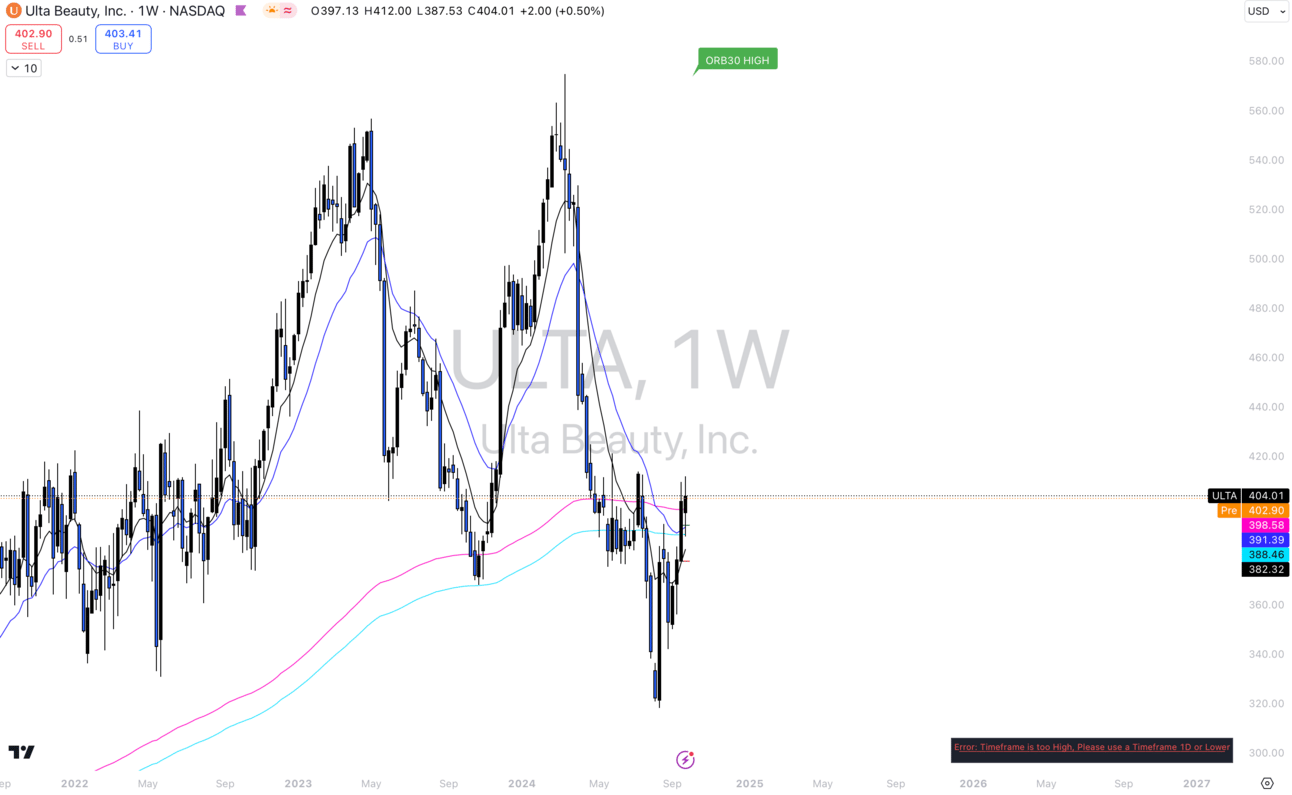

1. $ULTA

$ULTA Weekly

You guessed it, $ULTA again lol.

Sitting in the same spot, but looking good here for more adds IMO.

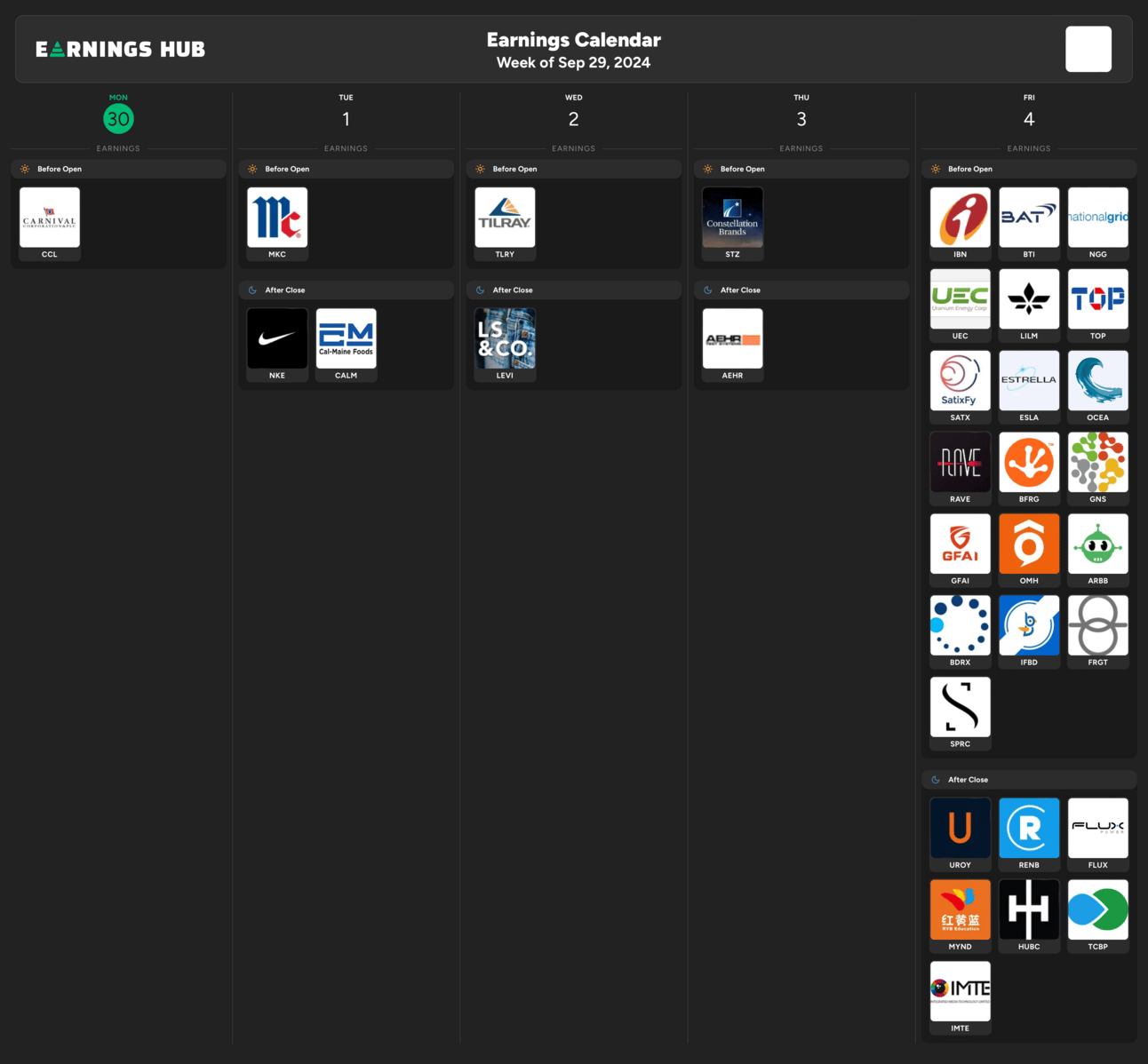

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 9:45 EST, Chicago PMI

Monday 1:00 EST, Fed Powell Speaks

Tuesday 9:45 EST, S&P Manufacturing PMI

Tuesday 10:00 EST, JOLTs Job Openings

Thursday 8:30 EST, Initial Jobless Claims

Thursday 10:00 EST, ISM Services PMI

Friday 8:30 EST, Non-Farm Payrolls

Trending Sectors

Technology, Utilities, and Consumer Staples were at the top of the list for trending sectors last week.

Top trending tickers from last week:

$NVDA

$TSLA

$MU

$AAPL

$BABA

$INTC

$META

$AMD

$AVGO

$PLTR

Have A Great Week!

As always, enjoy the week and trade safe everybody.

Let’s make some $$!

Discord:

Access to all of my trades as well as 10+ other analysts’ trades.

Weekly classes from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.

This is truly the only discord you will ever need, thank me later!