- Ace in the Hole

- Posts

- Ace in the Hole - Edition #8

Ace in the Hole - Edition #8

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend! Last week was absolutely crazy with FOMC and all of the Tech earnings.

We have a decent amount of economic data ahead of us that should bring some volatility during the intraday. Most of the Tech earnings are out of the way, but I still have a few names that I am interested in and will be keeping an eye on.

Along with some economic data, there are FOMC speakers Monday —> Thursday and 2 separate bond auctions.

What Does This Mean For Day Traders/Long-Term Investors?

Day trading last week we saw a ton of volatility during FOMC and Tech earnings which gave us day traders plenty of opportunities to capitalize on beautiful price action.

I’m personally still expecting some volatility throughout this week with some of the bond auctions we have going on, but i’m honestly not too sure how the price action will be so always be cautious.

As always play your plan no matter what happens. I never switch up my plan because of a certain type of economic data point coming out. I’d rather just size down and play my plan like normal.

I’ll likely be sizing back to full positions this week, but the beauty of FOMC is that you don’t have to size as big to make roughly the same amount that you normally do due to the volatility.

Long-term investors that are subscribed to my Savvy Trader portfolio know that I added shares of $SQQQ as one of my positions the day before FOMC. I did this to protect my portfolio of any downside we might take during the hectic week.

A nice intraday sell off happened after Jerome Powell spoke, but was quickly bought up the next day and continued the upside momentum into Friday.

I’m personally still holding my $SQQQ because i’m only down 3% and haven’t hit my stop loss yet, so i’m comfortable holding it for now.

Investors should be smiling as they see their portfolios sky rocketing, but i’m still just being cautious and do think we see a pullback coming.

You notice how everyone is now bullish and buying? That tells me it’s time for me to start being cautious. I’m not sitting here saying I want to sell my long-term positions, but I sure will protect my account with some downside exposure.

Either way, I will follow my rules and if need be, I will sell my $SQQQ and reposition later.

Short-Term Setups For This Week:

1. $AAPL

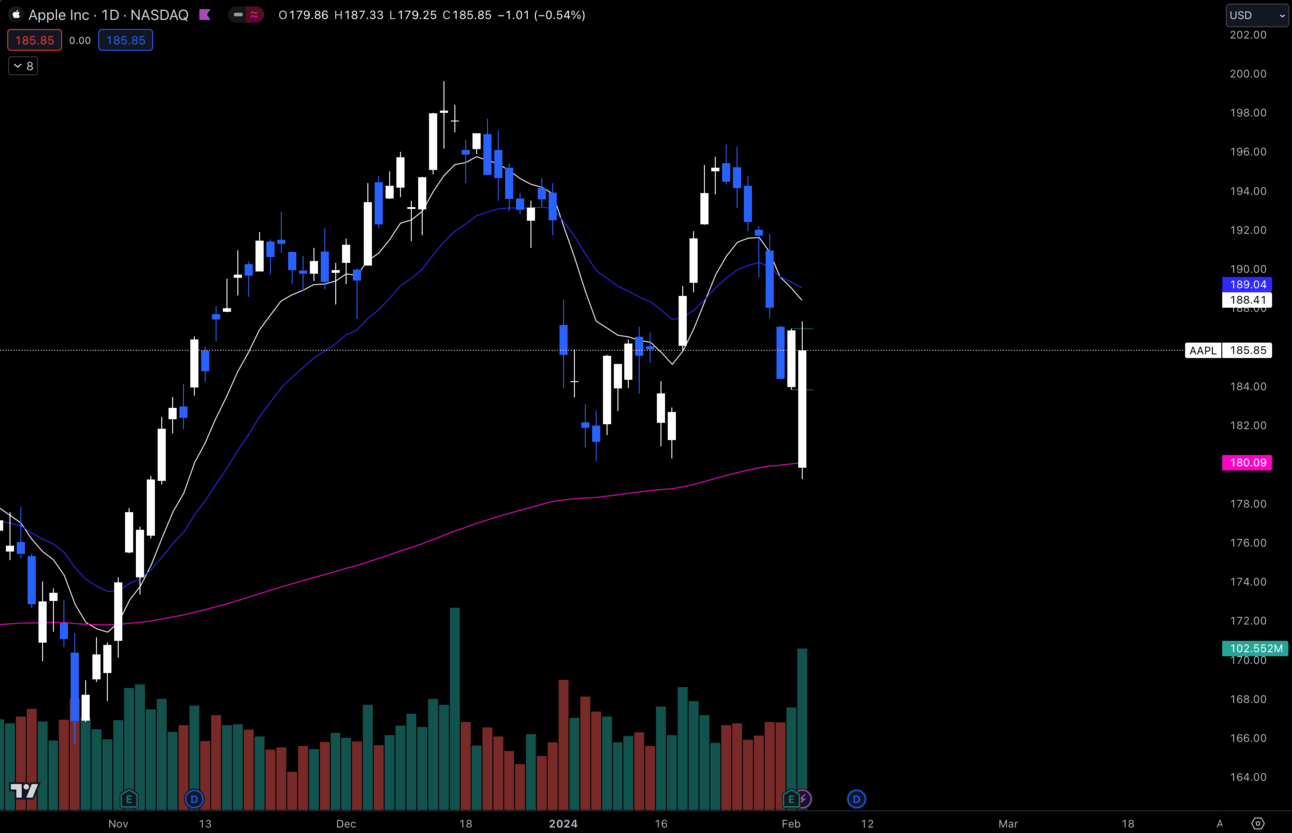

$AAPL Daily

Friday’s candle was pretty insane as you can see on the chart. Dipped down to $180 which is roughly where my 200 EMA is at and got a strong bounce closing the day at $185.85.

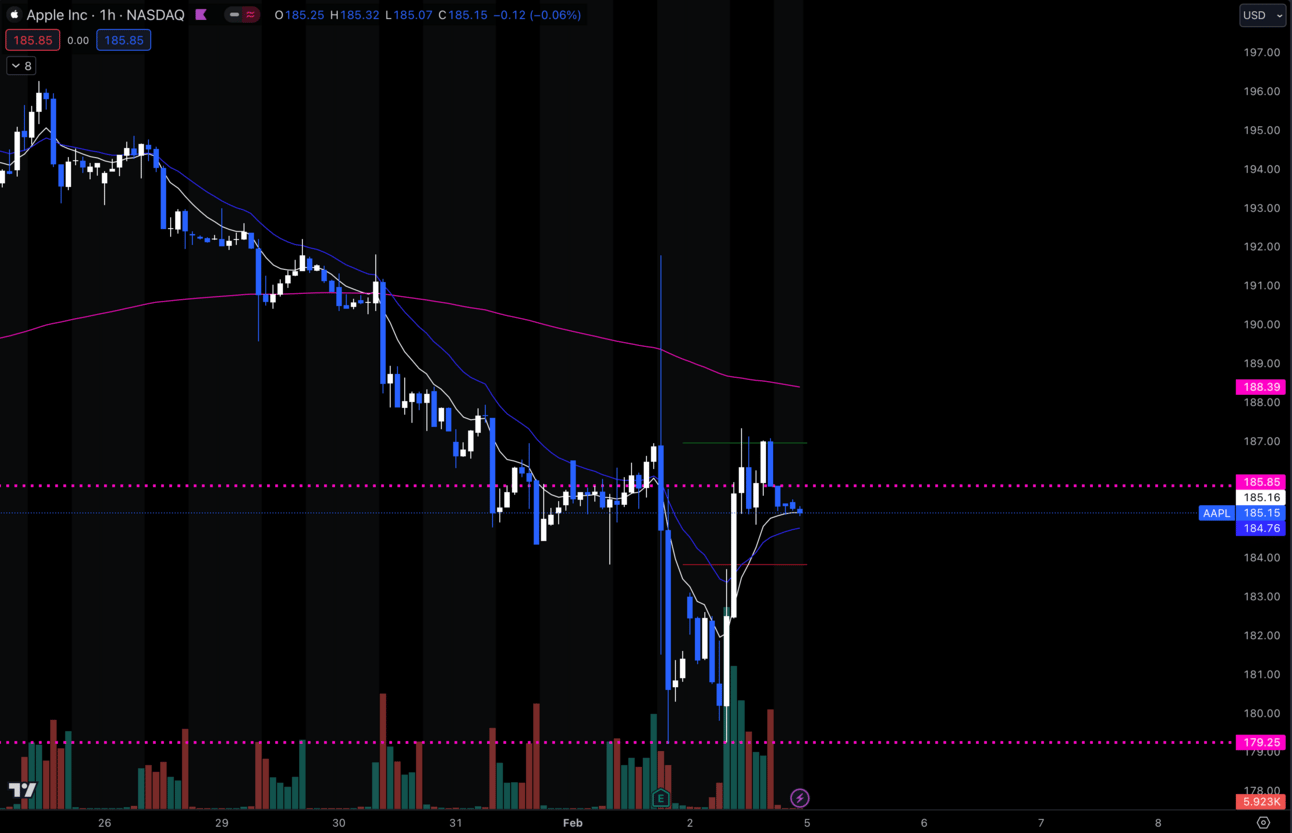

$AAPL 1 Hour

I’m liking the double bottom with lots of buyers off of $180 and $AAPL has started to pull back in after hours.

I’m interested to see if this first dip starts to get bought up and I might be looking to take a position on it. My only concern is that we are still trading below the 200 EMA at $188.39.

Either way if this dip doesn’t get bought up, then it will prolly lose the 21 EMA at $184.76. I’d look for bids off of $183.80 as well, but if it can’t hold there I would just leave it alone until it gets momentum to the upside again.

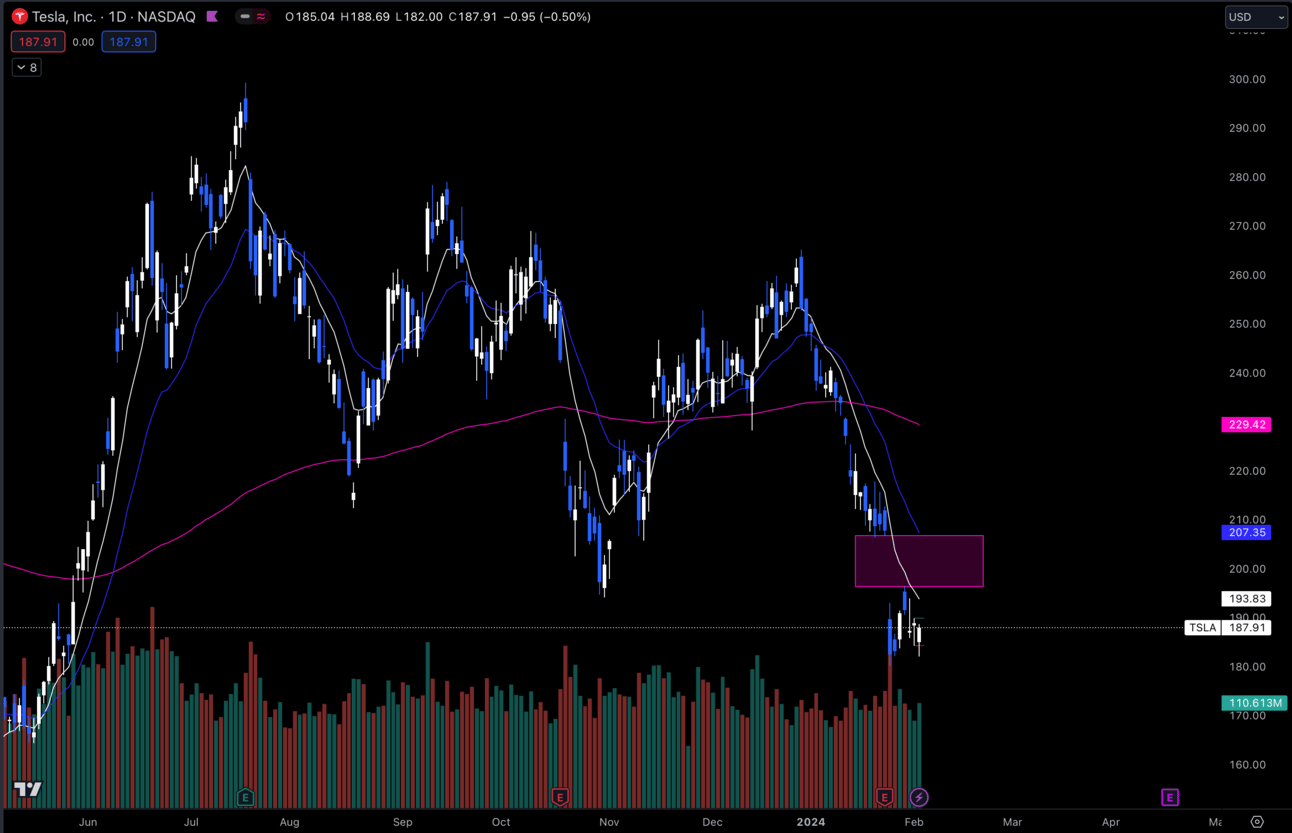

2. $TSLA

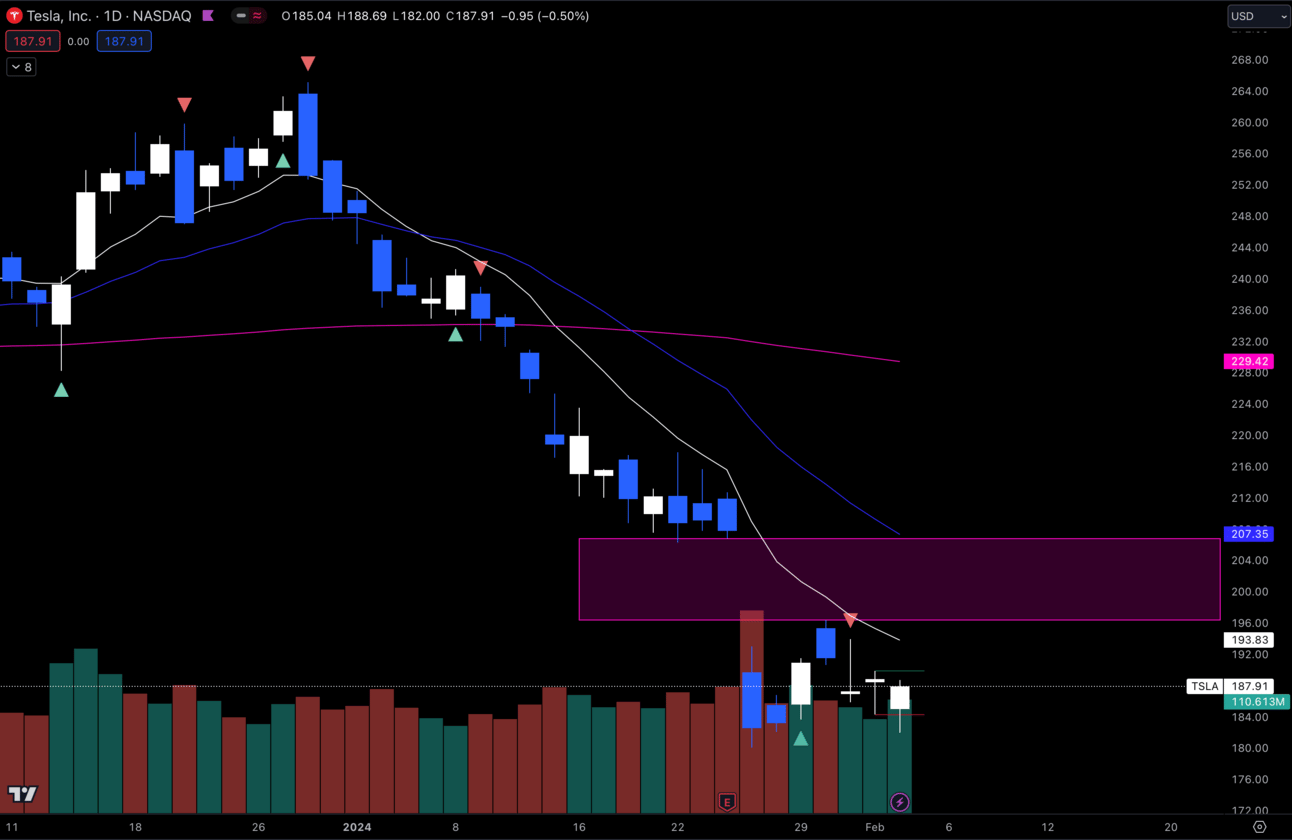

$TSLA Daily

The daily chart on $TSLA is really sparking my interest. Everybody hates it right now, but I think this is an opportunity for both long-term investors and short-term traders.

On the short-term, I really like the higher low off of $182 and there is a gap I drew from $196.36 —> $206.77 that i’d love to see $TSLA test this week.

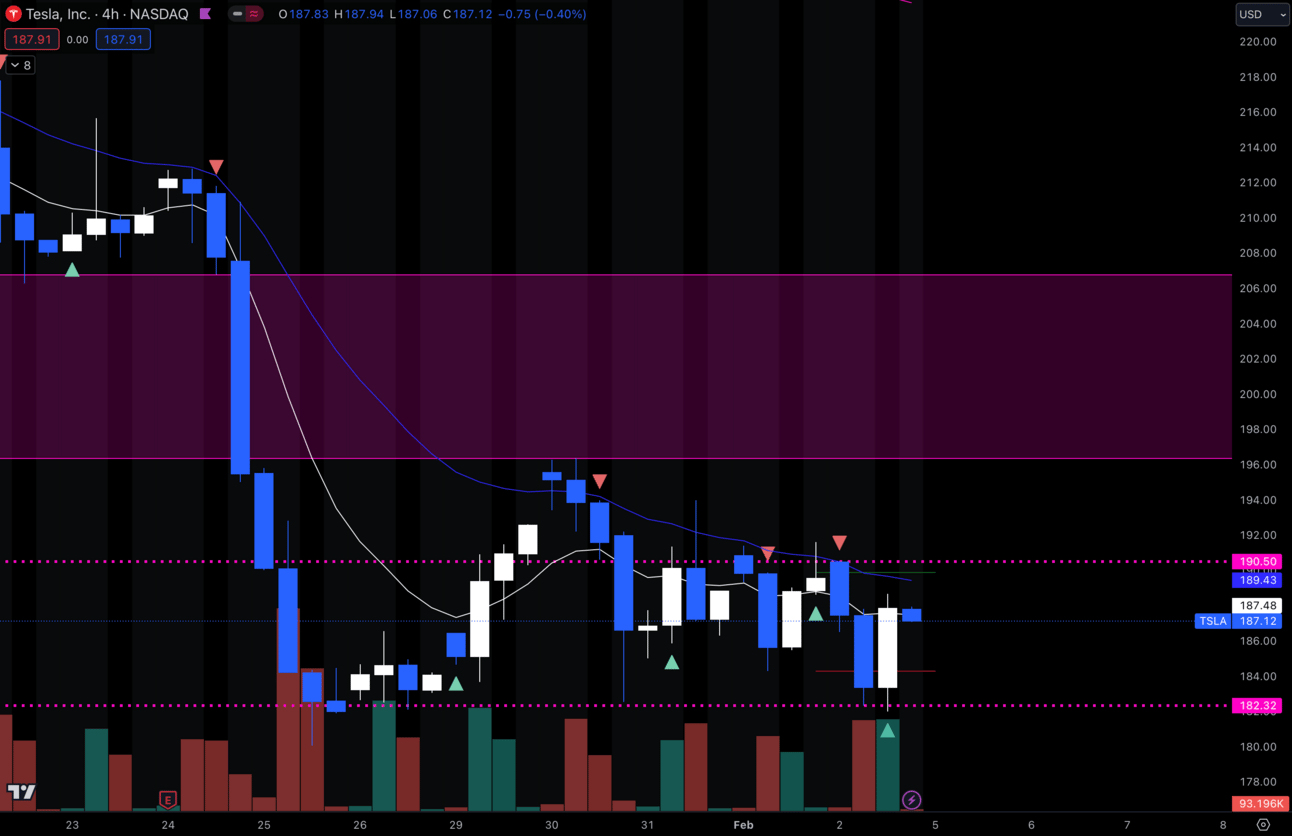

$TSLA 4 Hour

Zooming into a 4 hour chart, $TSLA got a CBC flip bullish on the previous 4 hour candle.

My thesis of this higher low would be invalidated if $TSLA made a new low below $182.

3. $ADBE

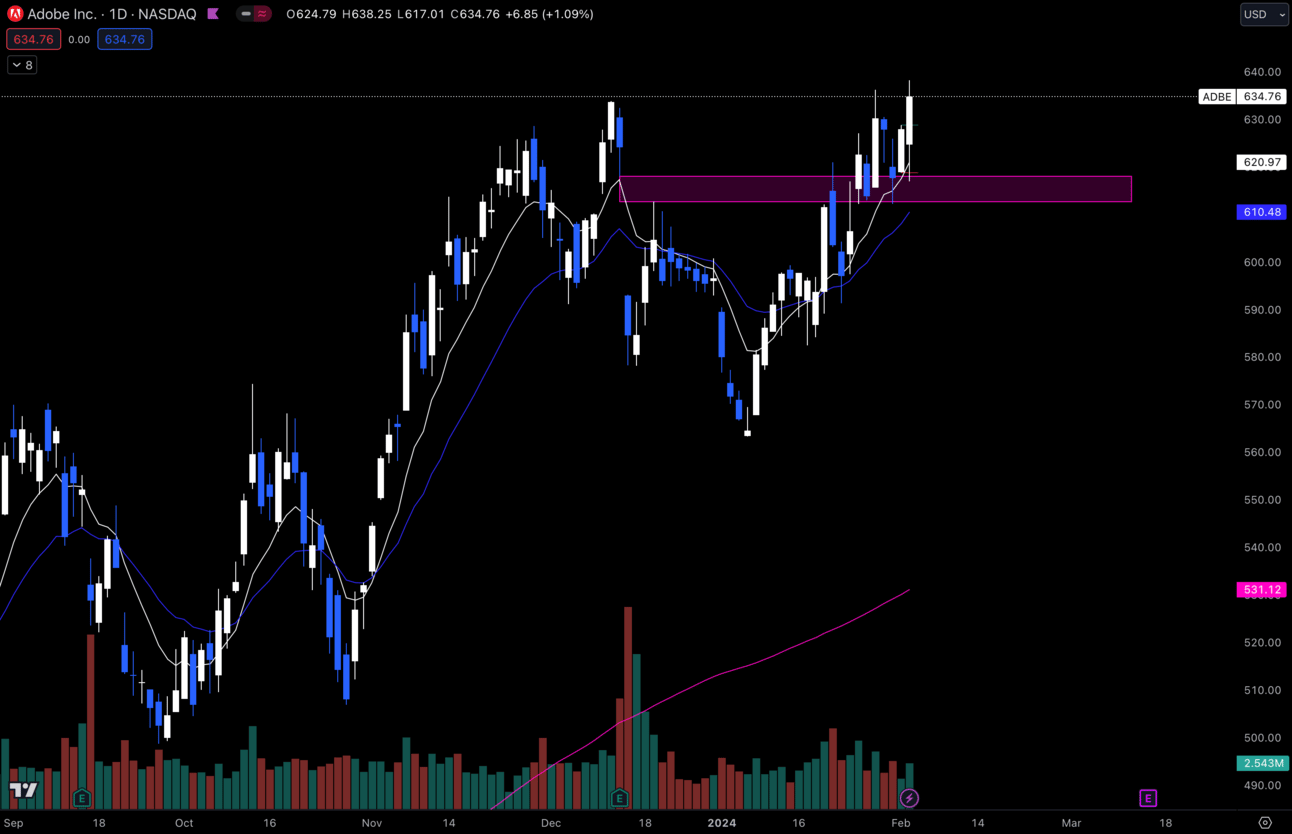

$ADBE Daily

$ADBE continues to perform very well after talking about it multiple times in the newsletter. Holding that gap I have drawn and made a higher high on Friday.

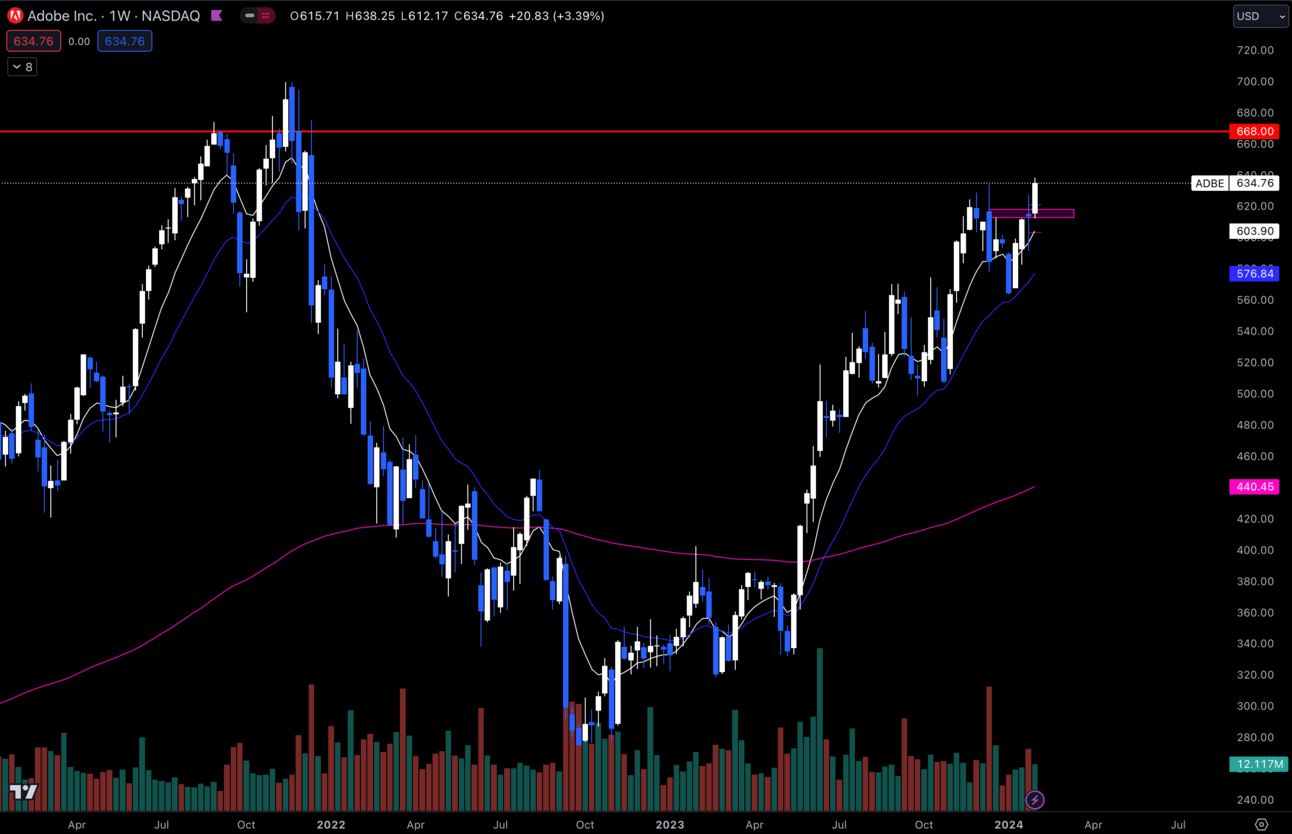

$ADBE Weekly

Zooming out to a weekly chart, I still see potential for $ADBE to continue higher. The next big level I have on the weekly chart is $668.

This name has already done so well, but I very much think it can provide us with some more opportunities in the short-term.

4. $RBLX

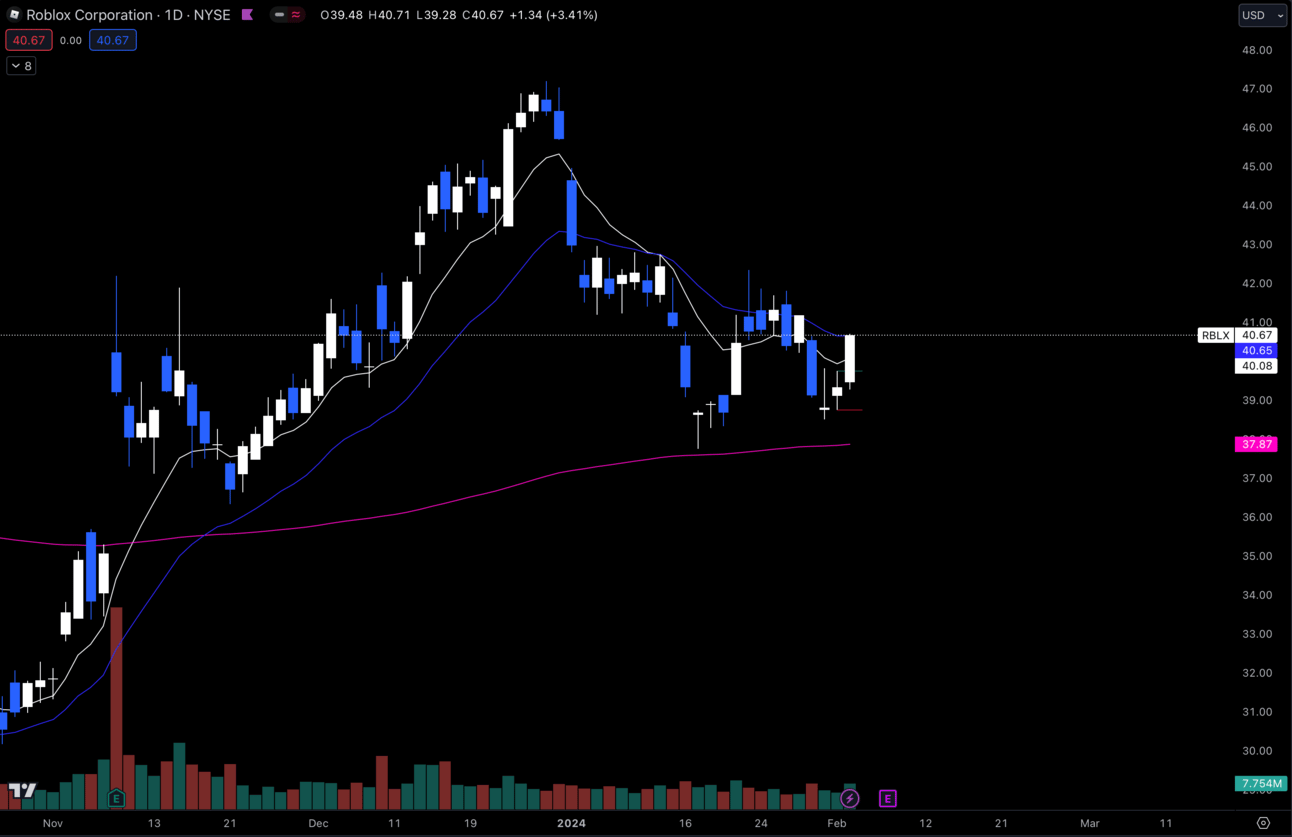

$RBLX Daily

Another higher low play potentially on $RBLX. Holding that $38 range perfectly and getting a CBC flip bullish on the daily above the 200 EMA at $37.87.

I think there is potential here, especially if it can break and hold over $42.

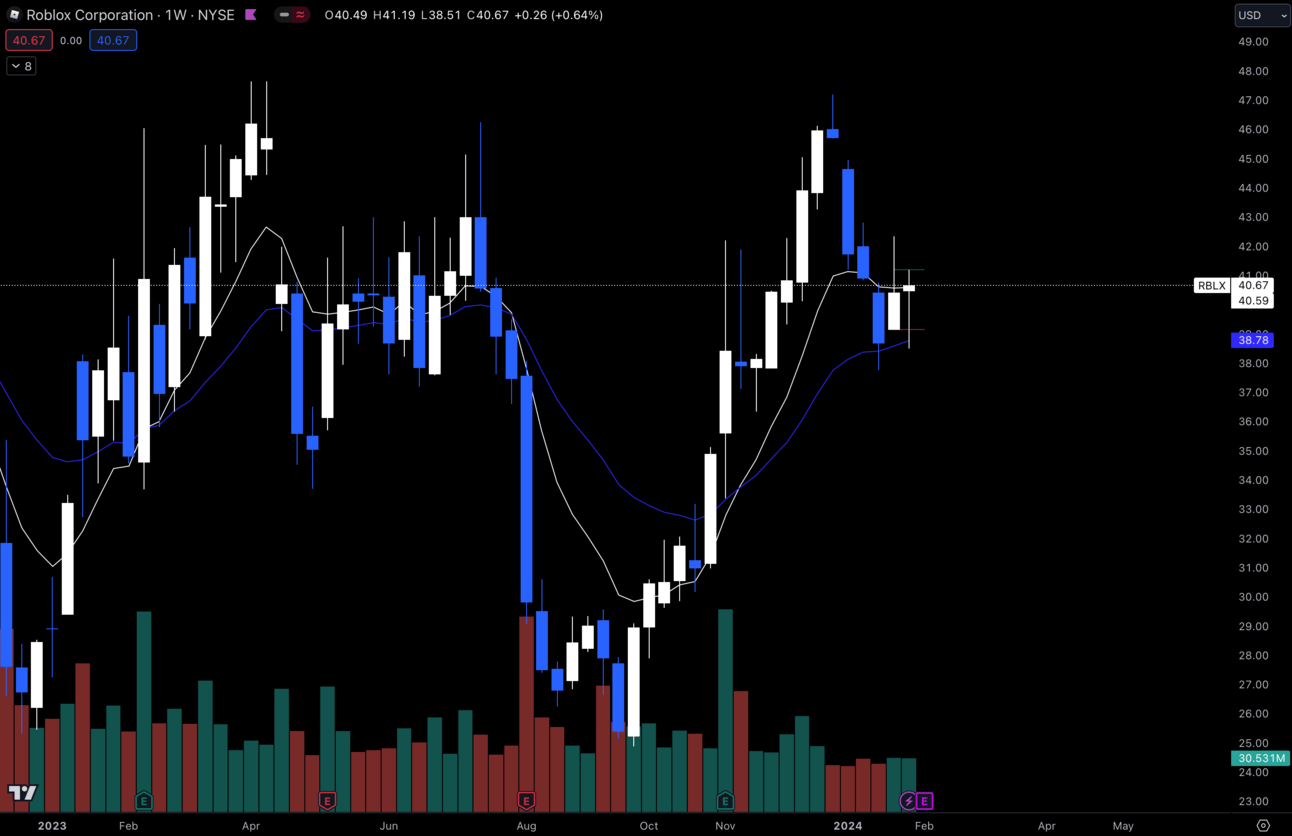

$RBLX Weekly

I’m also liking how price has held my 21 EMA at $38.78 and reclaiming my 9 EMA at $40.59.

If $RBLX lost $37.76 it would invalidate my thesis here.

Long-Term Setups For This Week:

1. $TSLA

$TSLA Daily

Same analysis from up top, but as well as this being a good short-term opportunity. I think its also an even better opportunity for long-term adds.

I’m very likely adding more shares because exactly what I want is starting to happen. Hoping we see continuation of the momentum this week to confirm my thesis.

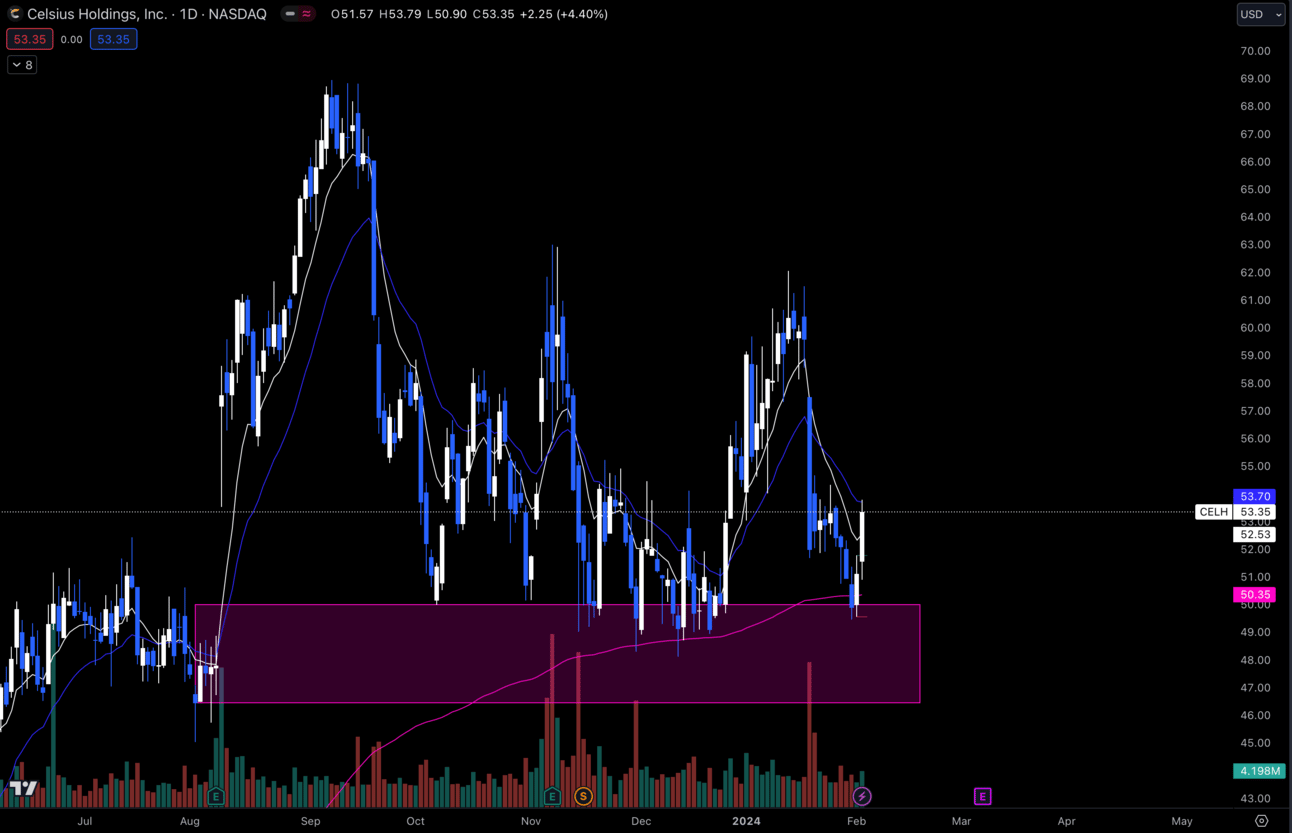

2. $CELH

$CELH Daily

Another week that $CELH makes the newsletter. I added when we got under $50 again. My cost basis is in that $48 and if it wants to fall under $50 again I will add some more shares.

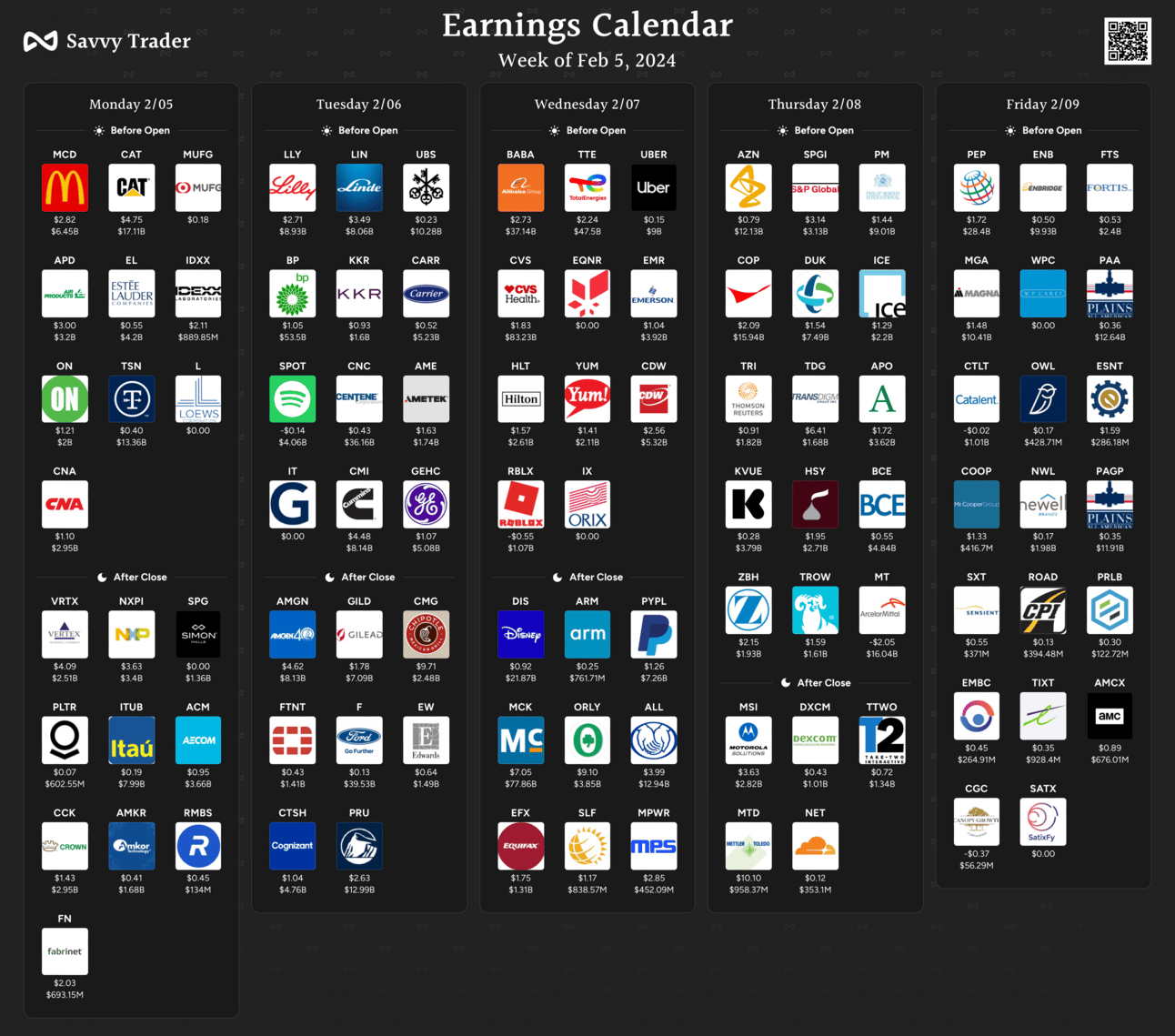

Earnings Calendar:

Economic Calendar:

These data points are known to bring volatility during the intraday.

Monday 2:00 EST, FOMC Member Bostic Speaks

Tuesday 12:00 EST, FOMC Member Mester Speaks

Tuesday 1:00 EST, 3-Year Note Auction

Wednesday 10:30, Crude Oil Inventories

Wednesday 1:00, 10-Year Note Auction

Wednesday 2:00, FOMC Member Bowman Speaks

Thursday 1:00, 30-Year Bond Auction

Trending Sectors:

Biotech has been heating up on the charts as well as Technology and Semiconductors continuing to perform very well.

Highest trending tickers from last week:

$MINM

$T

$GOTU

$NRBO

$C

Have A Great Week!

As always, I hope everybody has an amazing week trading. Be safe and stick to your plan/rules!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.