- Ace in the Hole

- Posts

- Ace in the Hole - Edition #7

Ace in the Hole - Edition #7

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope you all had an amazing weekend and took some time away from the charts. We have a BIG week ahead of us, so get ready!

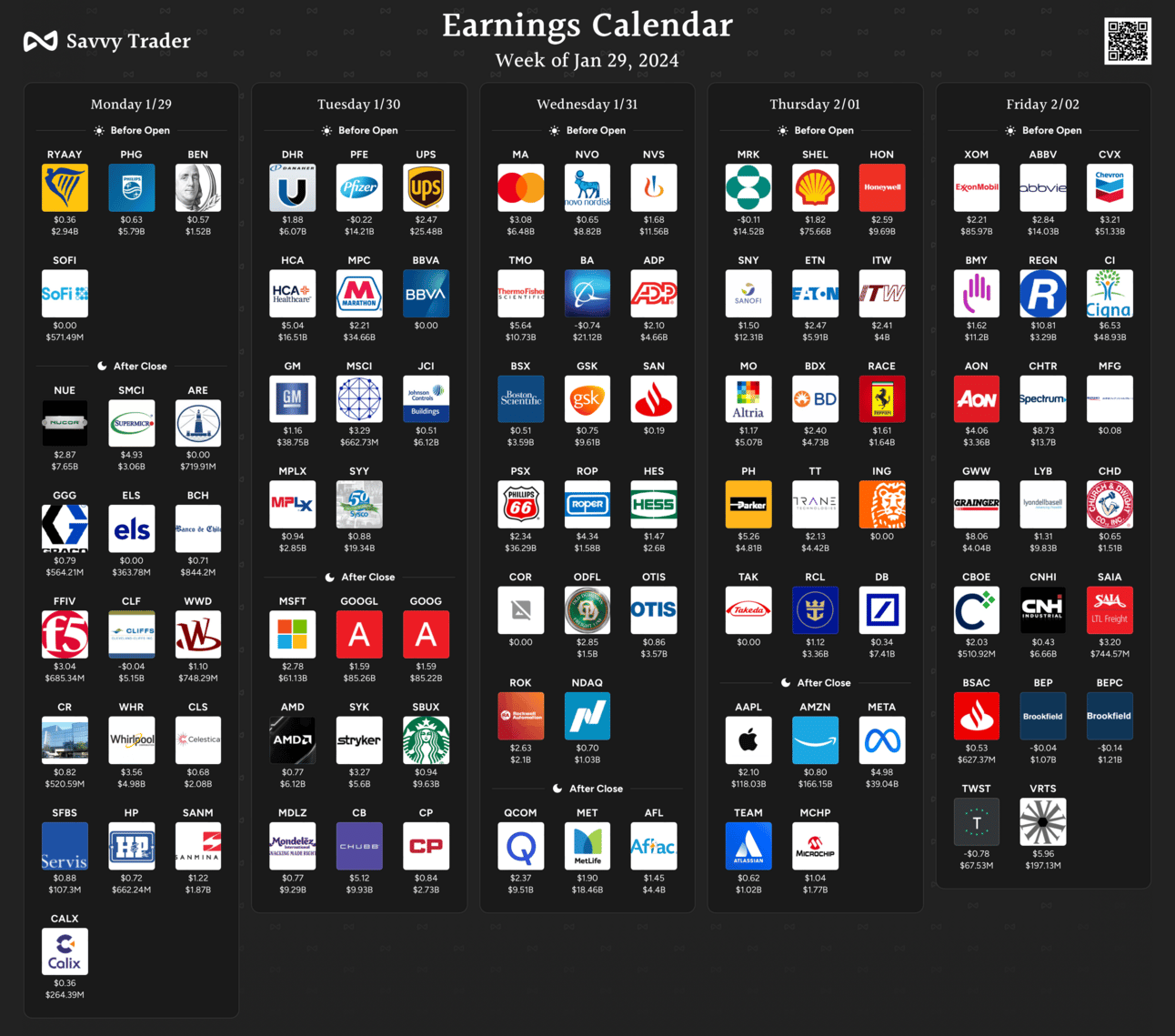

There are earnings coming out for some of the biggest names in the S&P 500 and a significant amount of economic data. I’m expecting a pretty volatile week because of this.

What Does This Mean For Day Traders/Investors?

As a day trader, expect plenty of volatility to provide you with intraday opportunities. Although I want to remind everyone that we have been trending quite nicely on the daily for about a week and a half.

Sadly markets don’t stay trending forever, so we have to be realistic and expect some volatility especially with earnings.

This back and forth action can catch a lot of traders off guard, so adapting is key when the environment around you switches.

I’m expecting less trendy moves and more volatile back and forth price action.

As an investor, this volatility can be something that is tough to stomach. I’m personally not really selling anything up here, but instead will likely be purchasing protection against my long-term positions.

Lower risk tolerance might mean you would think about selling some up here as we are at all time highs, but I personally like building positions more then selling them when speaking about the long term.

Short-Term Setups For This Week:

1. $SNOW

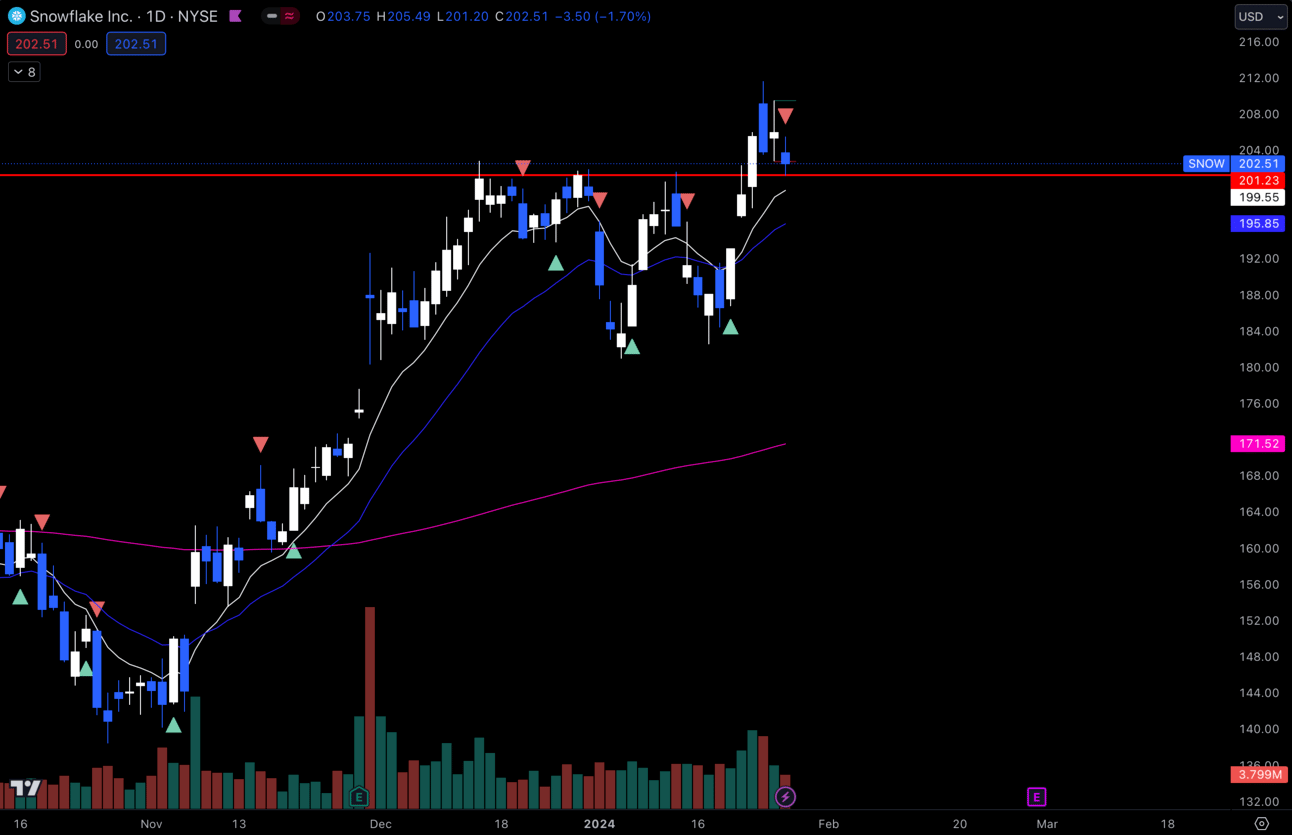

$SNOW Daily

$SNOW broke out of its daily consolidation last week and we are getting a retest of the breakout level. I’m watching to see if we can hold the daily 9 EMA at $199.55 which I do like longs off of.

Although I like longs there, i’m going to see how price action holds that level. If we end up losing the 9 EMA, I will look for the 21 EMA to hold at $195.85.

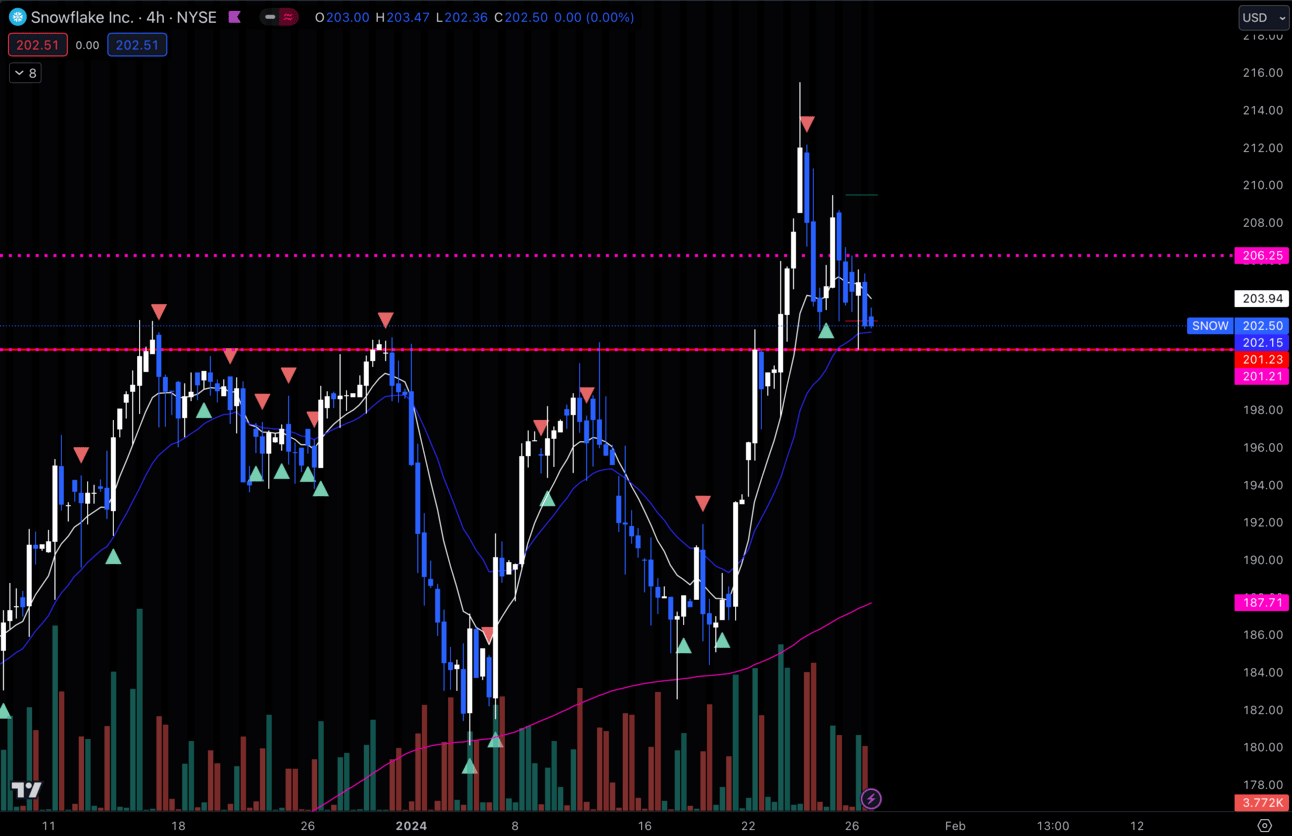

$SNOW 4 Hour

Zooming into the 4 hour chart, you can see a beautiful pull back from the impulsive uptrend. We are at a super pivotal point around this $200, so i’m definitely expecting a move soon.

Risk/Reward for longs is great on this pullback in my opinion. As long as that daily 9 EMA at $199.55 holds I will still like this, but if it loses that I wouldn’t touch it until we reach the daily 21 EMA at $195.85.

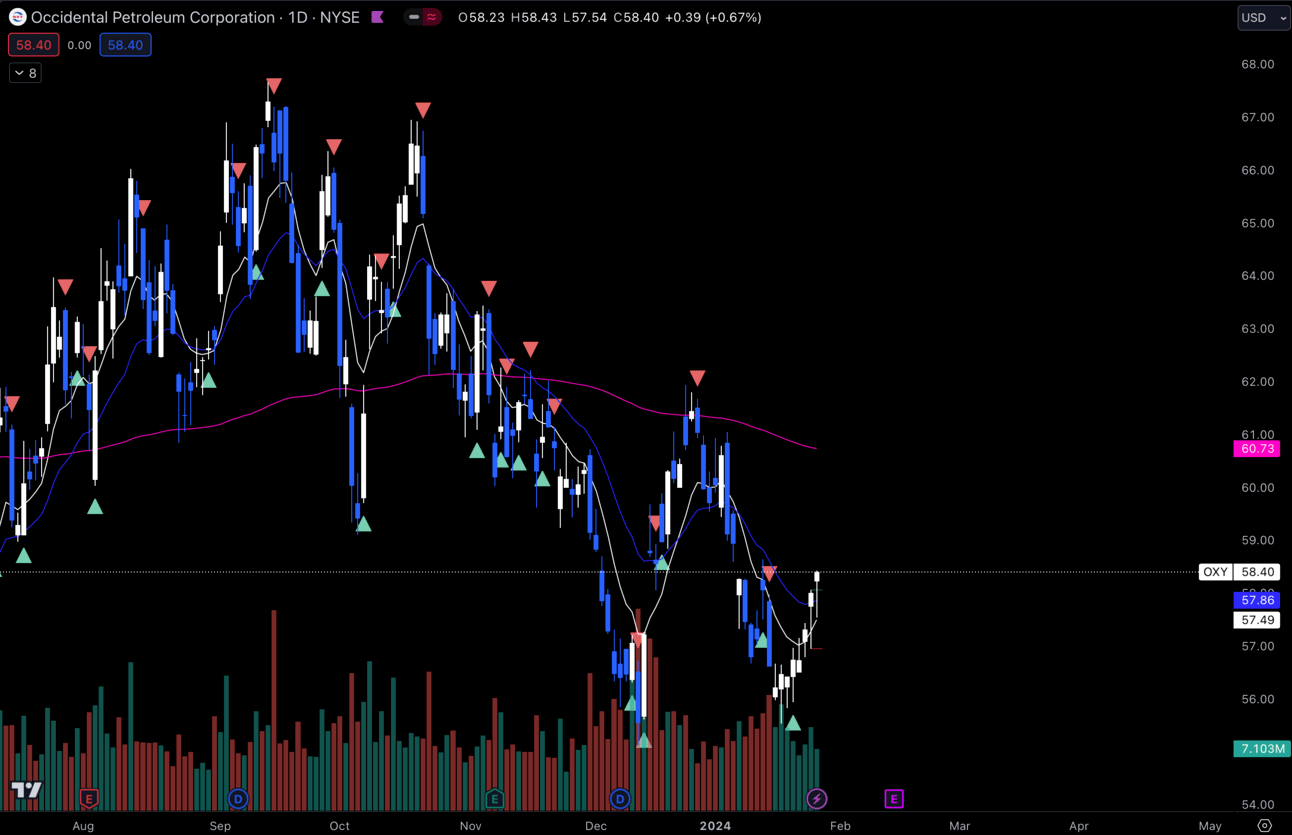

2. $OXY

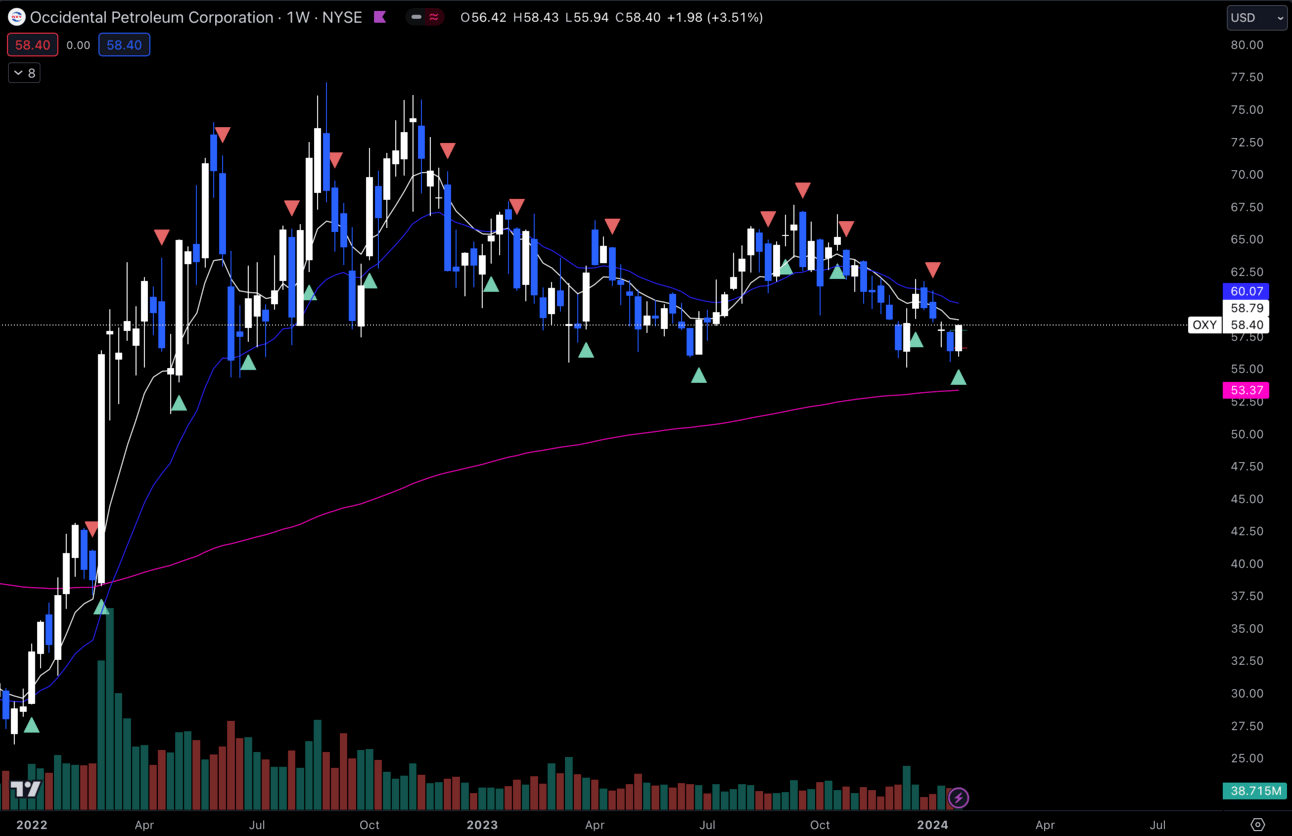

$OXY Weekly

Oil in general has been getting beat up lately, but the past week things have really been picking up. Now I know these are short-term setups, but the weekly chart is really starting to look primed and ready to me.

It’s been in this consolidation since March 2022 and it looks very healthy to me. There is a beautiful weekly higher low while closing last week with a lot of momentum to the upside.

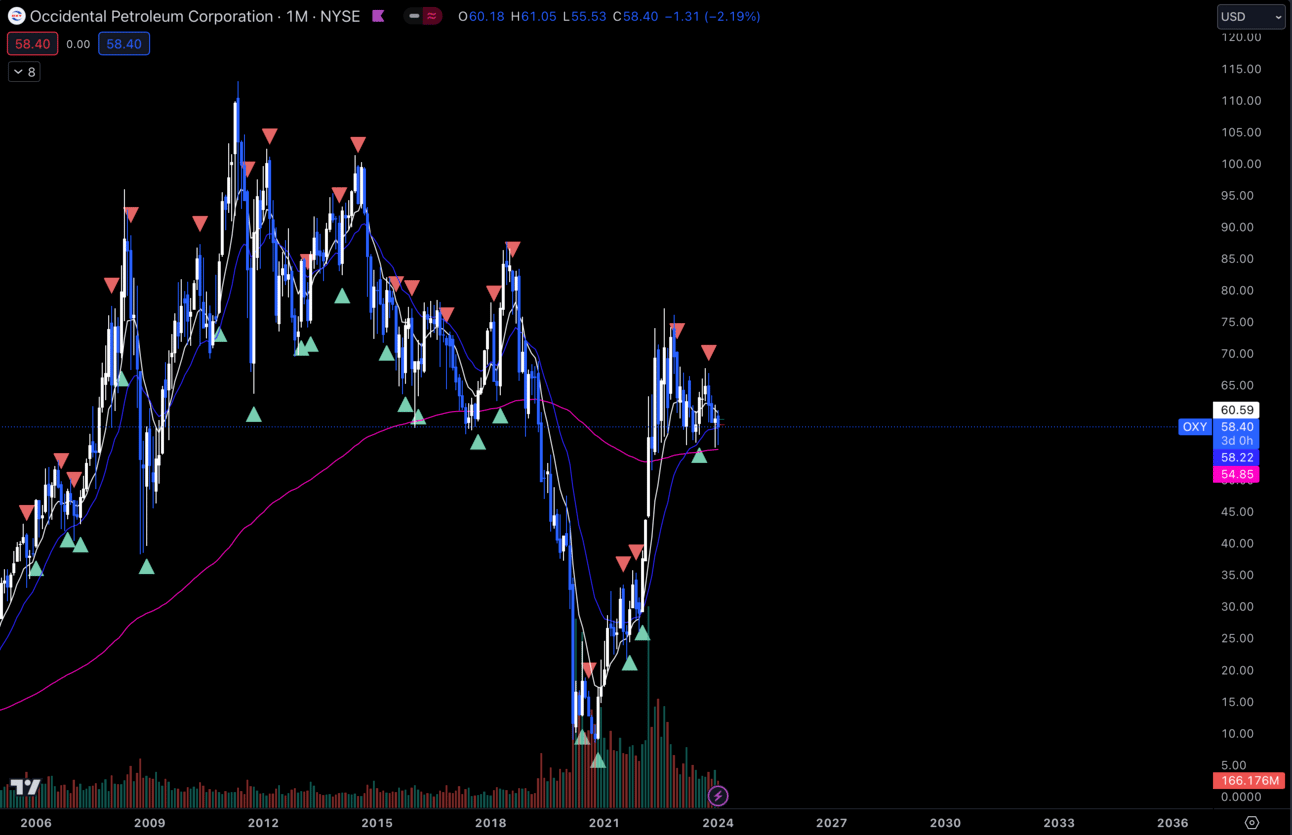

$OXY Monthly

The monthly chart looks even cleaner. Of course with any setup, it doesn’t matter how good it looks. We always come in with the mindset that this can go either way, but I will definitely be keeping my eye on this one.

$OXY Daily

Zooming into the daily chart I’m seeing a lot of momentum off of that $56 area. I think we see $60 soon it keeps the momentum up and then $60.73 where my daily 200 EMA is.

Reminder that you can trade $XOM, $USO, $CVX as sympathy plays.

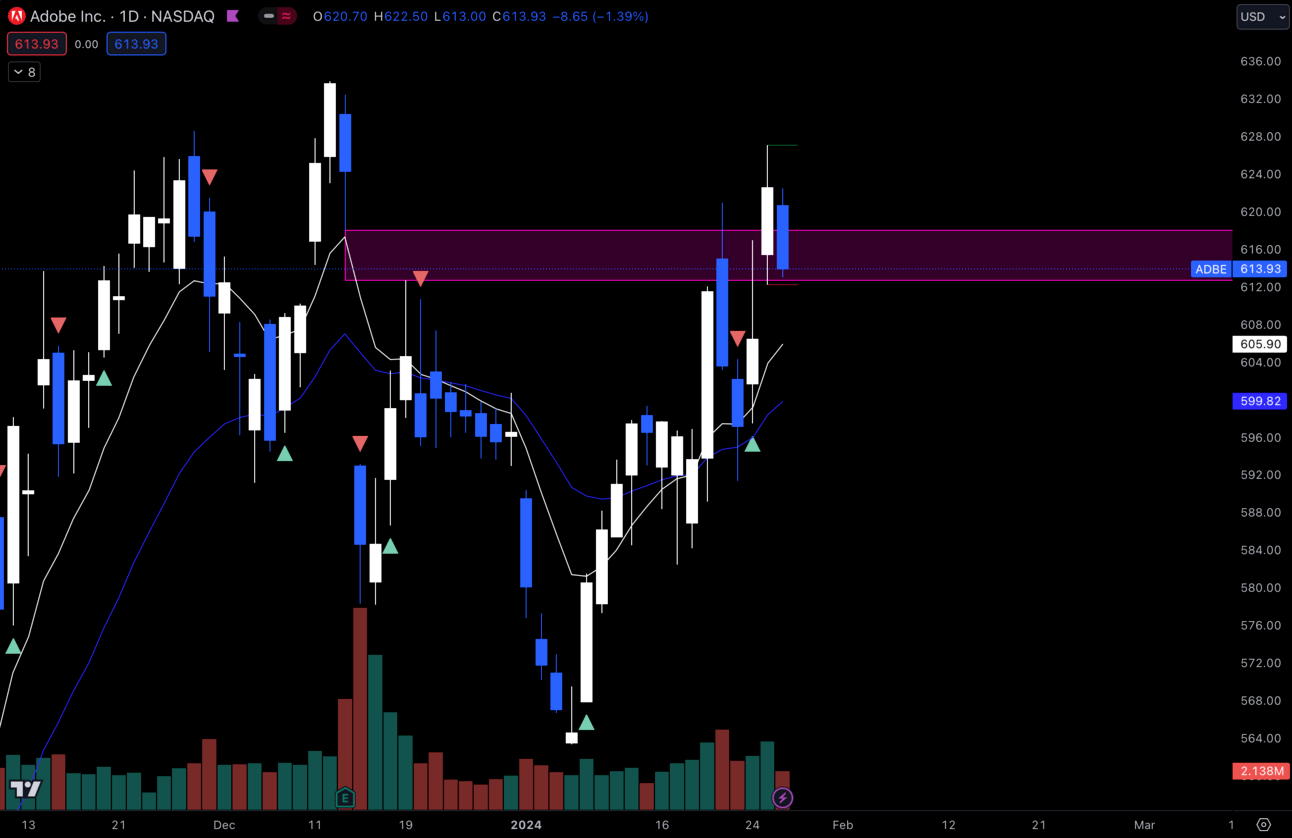

3. $ADBE

$ADBE Daily

This is a name i’ve mentioned in the newsletter plenty of times which has been doing really good lately. It filled the gap I had on the daily, but seeing a little profit taking towards the end of last week.

I would really like to see it hold the bottom of the gap at $612.71, but there is definitely a possibility it needs to test the daily 9 EMA at $605.90.

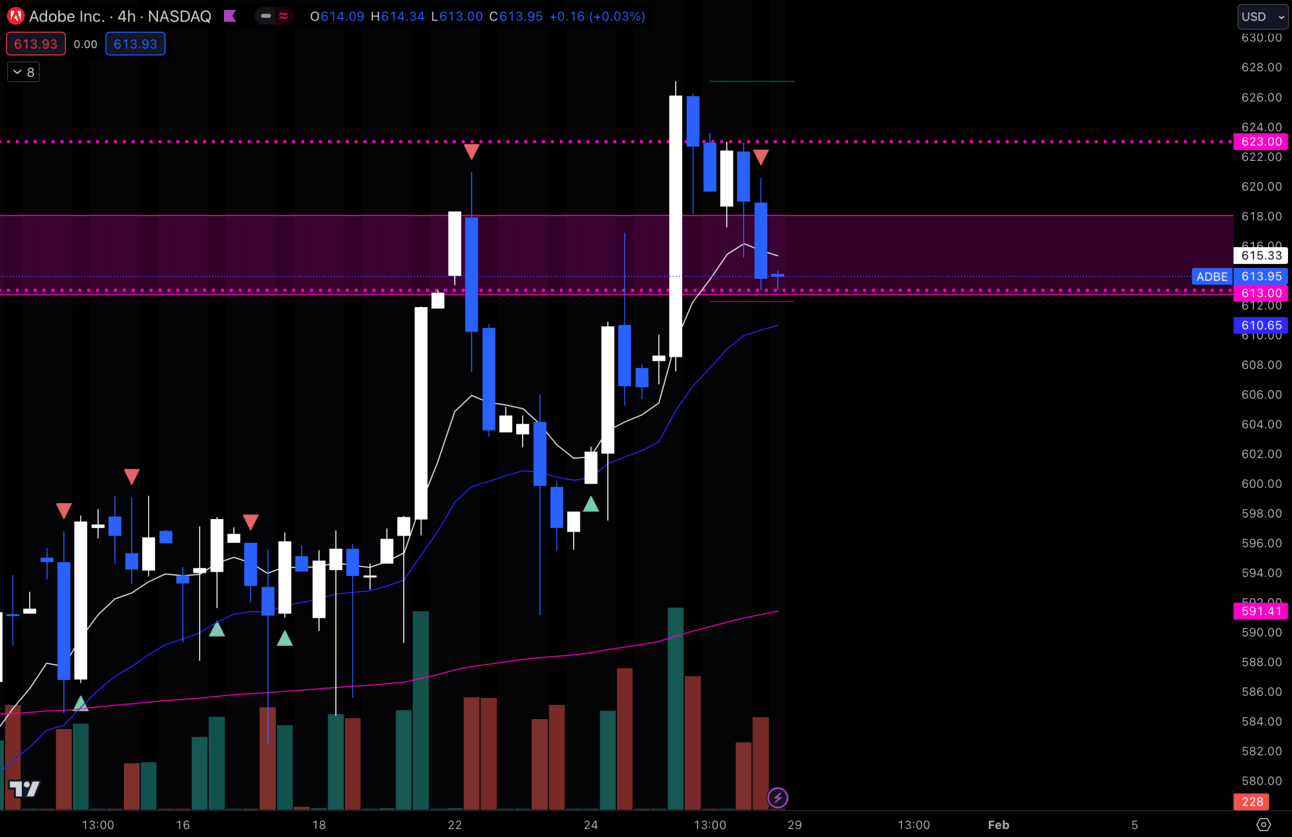

$ADBE 4 Hour

Zooming into the 4 hour chart, i’ll be watching to see if we hold the 21 EMA at $610.65 to make a higher low on the daily.

Aside from technicals, i’m also seeing a lot of positive options flow and sentiment towards $ADBE for the short-term.

Long-Term Setups For This Week:

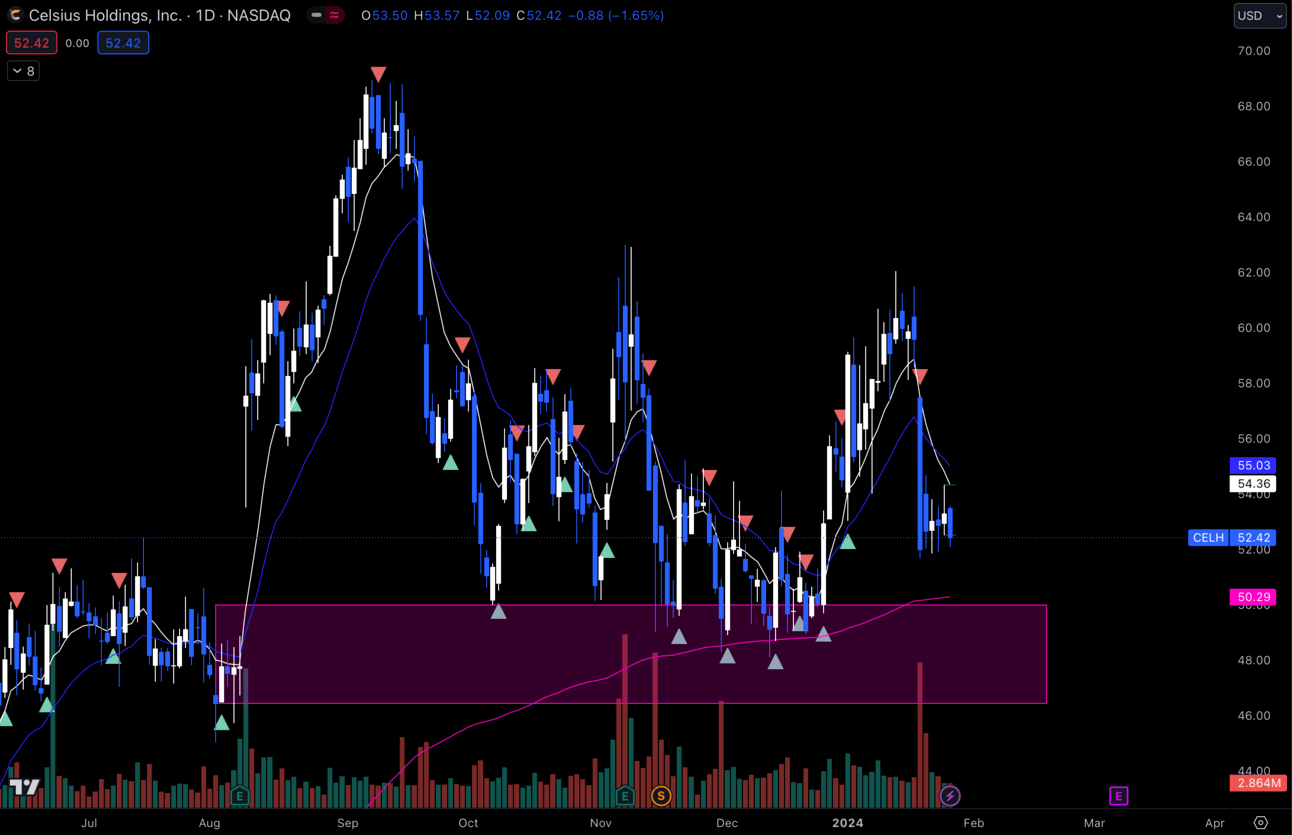

1. $CELH

$CELH Daily

Most of you know the drill on this name for me, but if you don’t then let me lay it out for you.

Every time this name gets under $50, I like to add some shares to my long-term portfolio. You can see that we’ve held very well in the past, so I continue to do this whenever it gives me the opportunity.

Let’s see if she can come down a little bit more and give me those prices again.

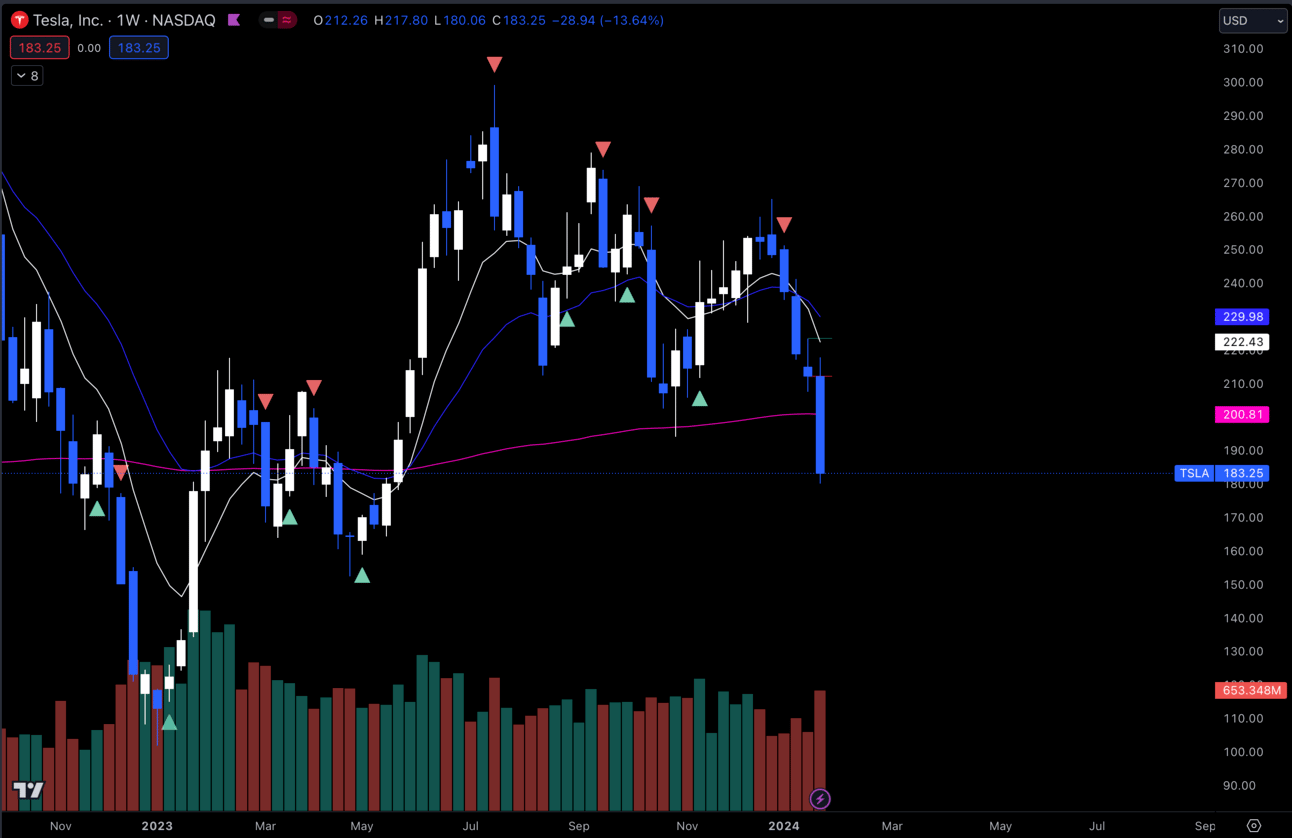

2. $TSLA

$TSLA Weekly

Well, it looks like I was wrong about that rally I wanted, but that’s okay. Can’t win them all and either way I still love this name for my long-term portfolio.

The sell off has been brutal, but I always remember that this is just another beautiful buying opportunity for myself.

I’ll likely be adding more shares soon, but trying to wait for a bit of a trigger to tell me we are done selling.

Earnings Calendar:

Economic Calendar:

These data points are known to bring volatility during the intraday.

Tuesday 10:00 EST, JOLTs Job Openings

Wednesday 9:45 EST, Chicago PMI

Wednesday 10:30 EST, Crude Oil Inventories

Wednesday 1:00 EST, FOMC Statement

Wednesday 1:30 EST, FOMC Press Conference

Trending Sectors:

Technology, Utilities, Materials, Oil/Gas, and Telecom Equipment were all trending with a positive sentiment.

Tickers that had the most inflow:

$SPRC

$NVDA

$LRCX

$TSLA

I find it interesting that even with all the downside, $TSLA was on this list for most inflow throughout the week and $RIVN was on the list for most outflow.

Have A Great Week!

This week is going to be really crazy, so I hope that everyone trades safe and smart. Enjoy the week and thank you for reading!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.