- Ace in the Hole

- Posts

- Ace in the Hole - Edition #5

Ace in the Hole - Edition #5

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

Another short week in the market greets us!

Last week was a strong one with the $SPY gaining 1.76% on the week. We had CPI come out which showed a higher than expected increase in inflation. This took the market down on a dip, but was quickly bought up.

PPI data come out last week with PPI coming in at 1% year over year which was lower than the expected 1.3%. Core PPI came in at 1.8% expecting 1.9%.

What Does This Mean For Daytraders/Investors

This data wasn’t too concerning for us day traders, but it does bring some great volatility for us to capitalize on.

Overall for investors, last week was a bit of a mixed bag from a data standpoint. Inflation moderated less than expected, which could potentially have a poor impact on the bullish moves we’ve had.

However this market is still very resilient and managed to close the week up 1.76%

Short-Term Setups For This Week:

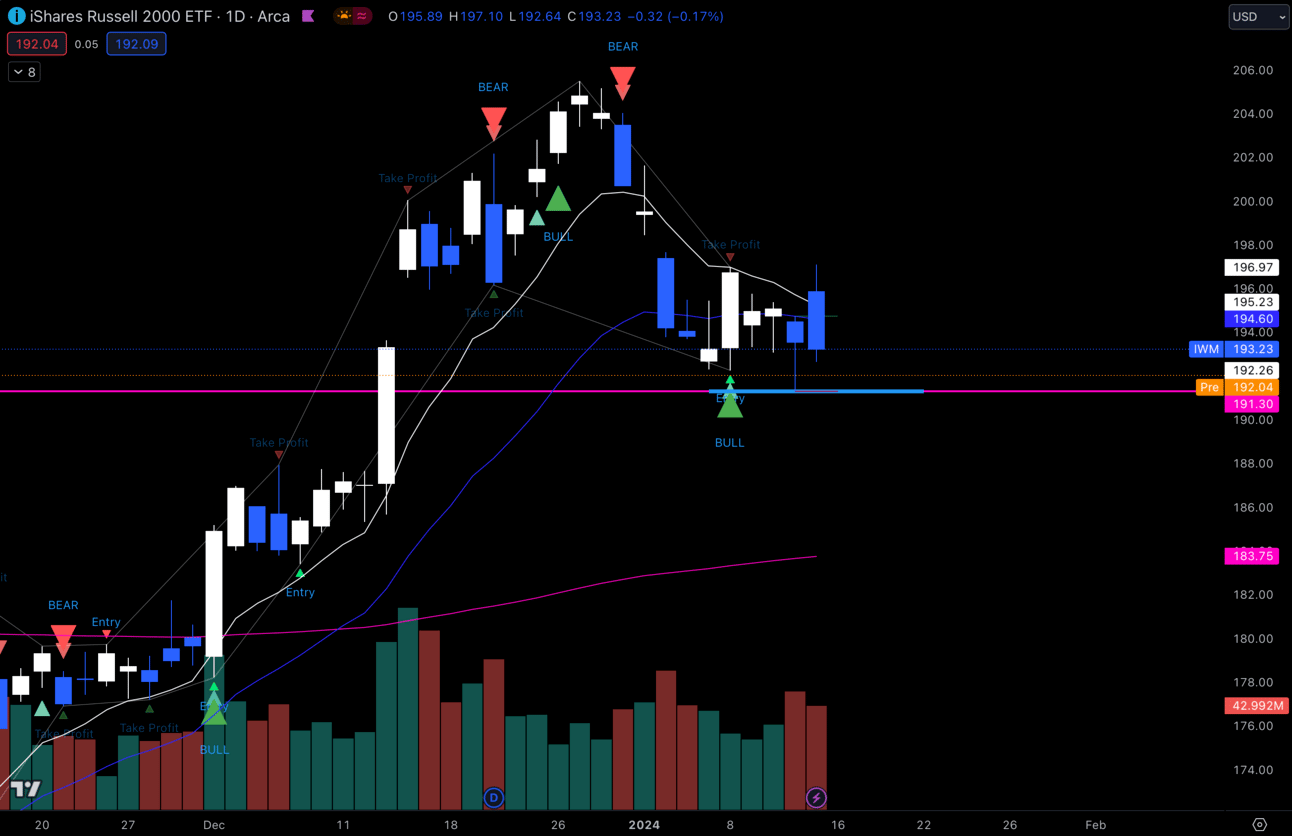

1. $IWM

$IWM Daily

Looking like a pretty constructive pullback on the daily for $IWM. I like this $191.50 —> $192 area to try some longs anticipating that we start making moves back up towards the EMAs.

If we were to lose $191.50 and start selling from there, that would invalidate my thoughts on this, but I personally think we hold this.

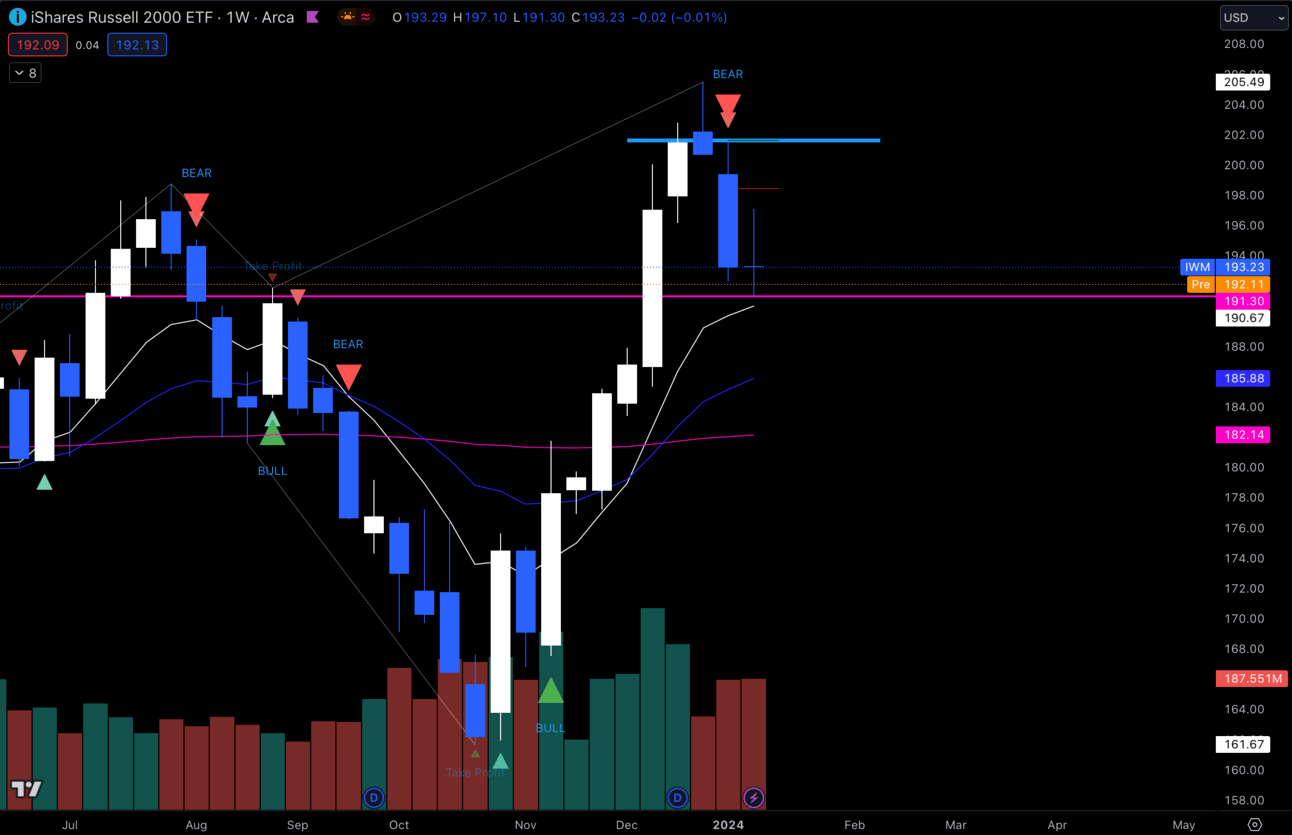

$IWM Weekly

The weekly is also looking healthy retesting the 9 EMA on the weekly. Also retesting a high from August here, so there is a good amount of confluence trying to hold us here.

Would love to see this get back towards $200 as the week progresses.

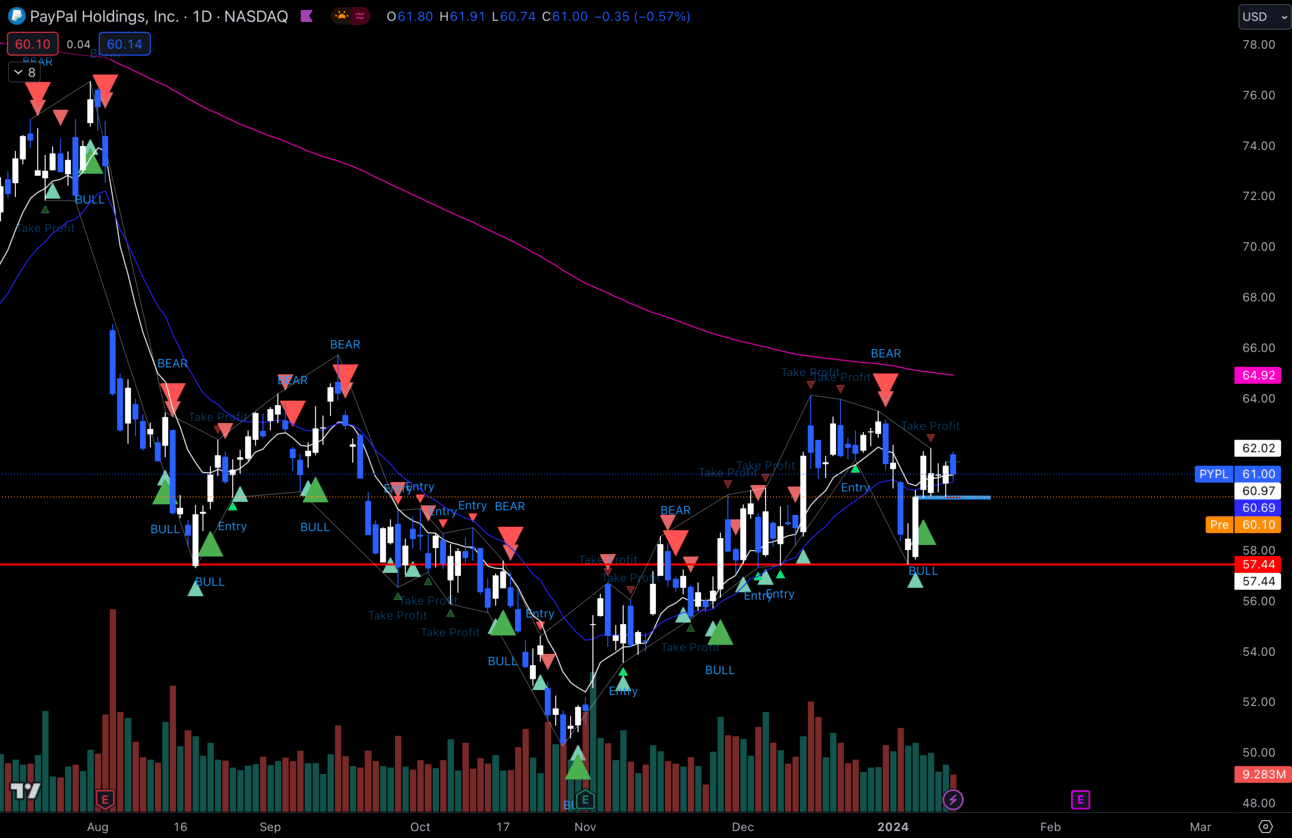

2. $PYPL

$PYPL Daily

Still liking the $PYPL daily here. Last week we caught some solid trades off of it from our thesis, but I still think there’s more here.

Haven’t really made the move I wanted quite yet, but still holding $57.50

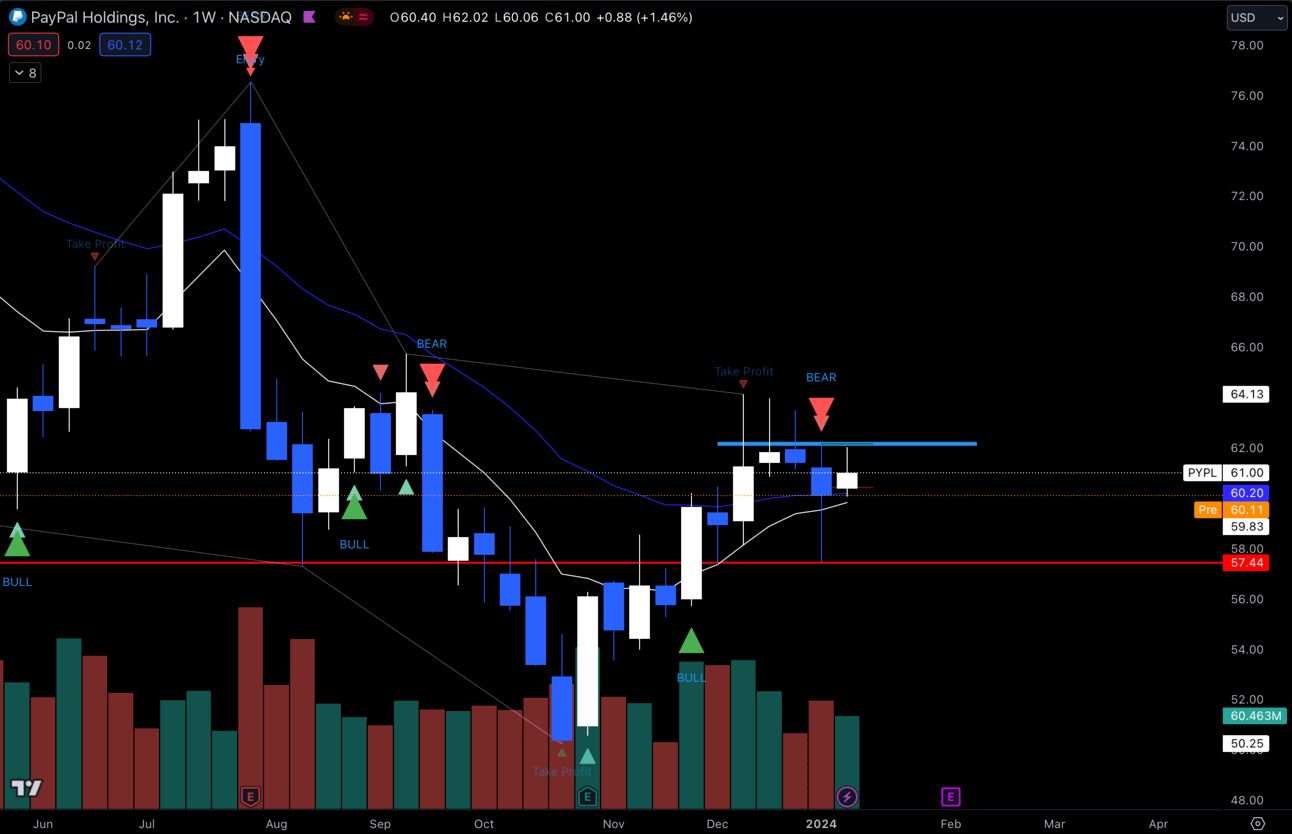

$PYPL Weekly

I want to see this hold the EMAs now and retest $64 for the breakout. I’ll be watching closely this week, although it might take another week before this one goes.

Not too many setups for me this week!

Long-Term Setups For This Week:

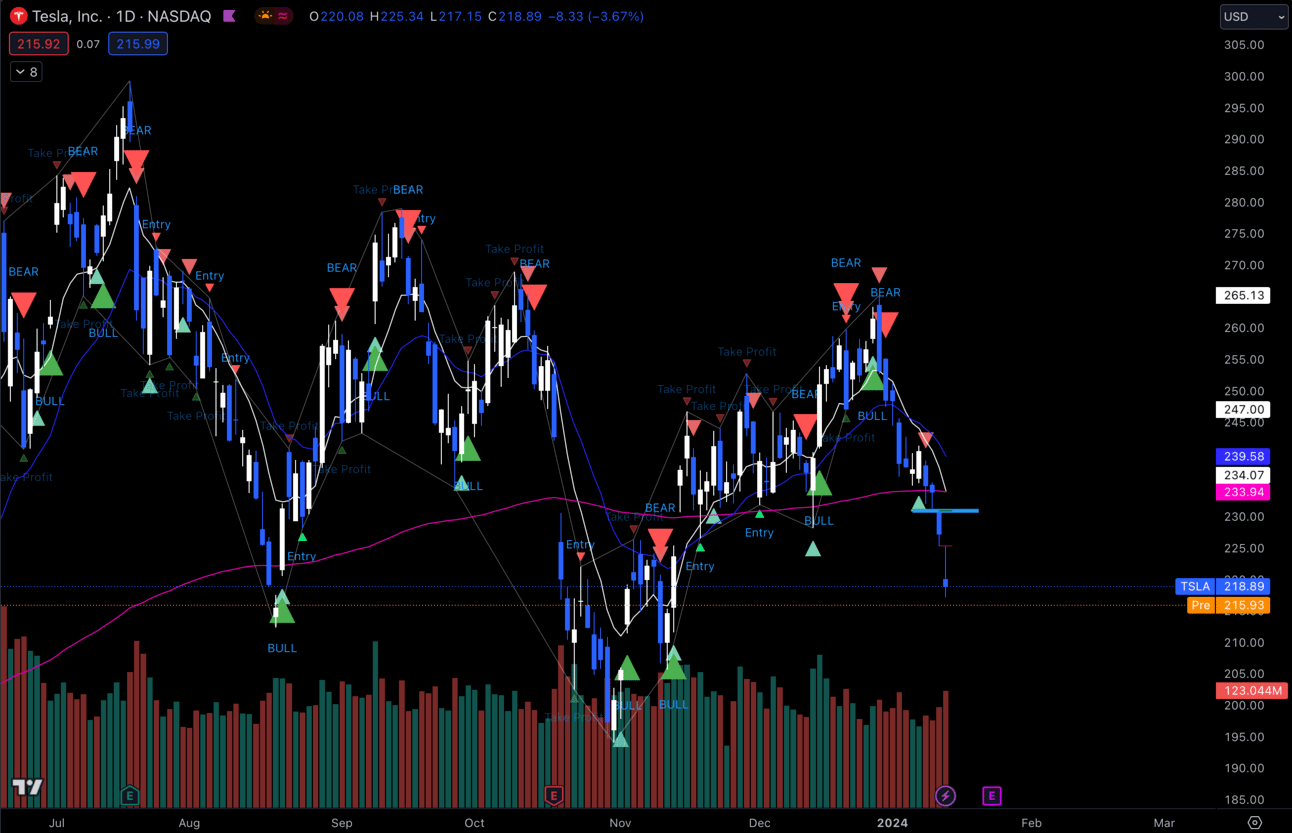

1. $TSLA

$TSLA Daily

$TSLA has taken a huge dive from the highs. I was really looking for the rally on this name, but it didn’t happen.

After getting under $220 last week, I started adding more shares to my long-term portfolio. If we get all the way back to $200 i’ll be adding more.

Im looking for $300 at least by end of this year, so I definitely think she is on sale right about now.

IMO, if you believe in $TSLA as a company, this is a huge opportunity for you own it for very cheap.

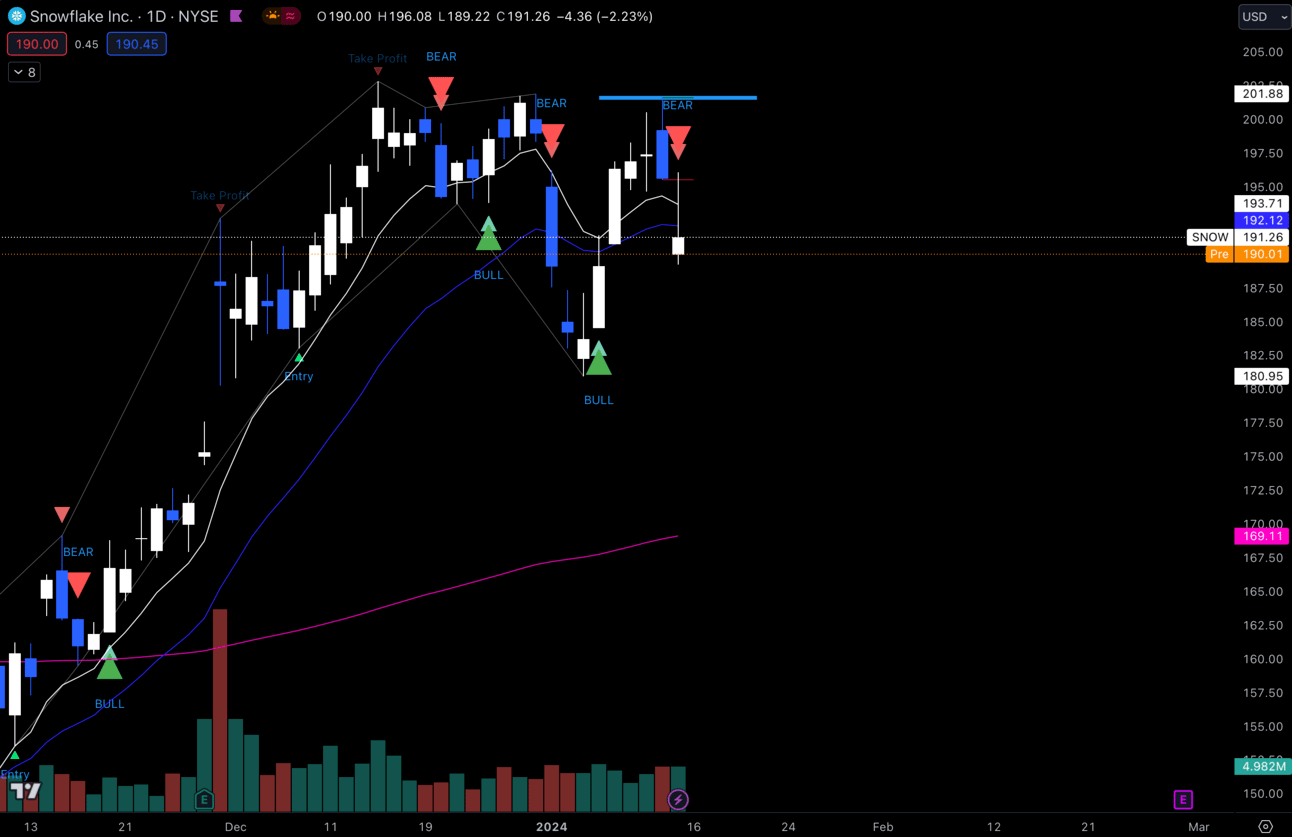

2. $SNOW

$SNOW Daily

I love $SNOW for the long-term portfolio as I think it has huge upside potential this year, but I want to see if I can get it cheaper.

Hitting resistance on the daily, I’m wondering if we could get back down towards that 200 EMA at roughly $170. If we dip down there I will definitely pick up more shares.

$180 is another spot where we could hold up and it might be a spot where I add some shares as well.

Economic Calendar:

These data points are known to bring volatility during the intraday.

Wednesday 1:00 EST, 20-Year Bond Auction

Thursday 11:00 EST, Crude Oil Inventories

Thursday 1:00 EST, 10-Year Tips Auction

Friday 10:00 EST, Existing Home Sales

Trending Sectors:

Last week we saw AI and Semiconductors trending with strength with $NVDA making new all time highs. Cannabis stocks also showed some promise.

On the flip side, Healthcare and Energy saw notable outflow last week.

Here are the tickers that saw the most inflow last week:

$NVDA

$TSLA

$MARA

$AI

$MSFT

Have A Great Week!

Let’s have a great week everybody! Trade your plan, be safe and follow your rules!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

Real-Time Live Market Talk. (No delay like there is with X Spaces)

EDU Channels/Access to EDU Content.

Easy access to talk with me.