- Ace in the Hole

- Posts

- Ace in the Hole - Edition #40

Ace in the Hole - Edition #40

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend.

Cheers to the 40th weekly newsletter in a row, 52 coming soon!

Let’s dive in.

Market Thoughts

Last week was pretty eventful, watching the S&P 500 gain 4.01% surpassing previous week highs and closing above them.

This is extremely healthy for the market and should NOT be ignored. This is even more bullish than you think because it came from a failed bear move.

There is nothing more bullish than a failed bearish move.

FOMC this week is going to bring a ton of volatility, so if you are new to trading, this is the week to sit out, watch, and learn.

Let’s dive into the setups I’m looking at for this week.

Short-Term Setups This Week:

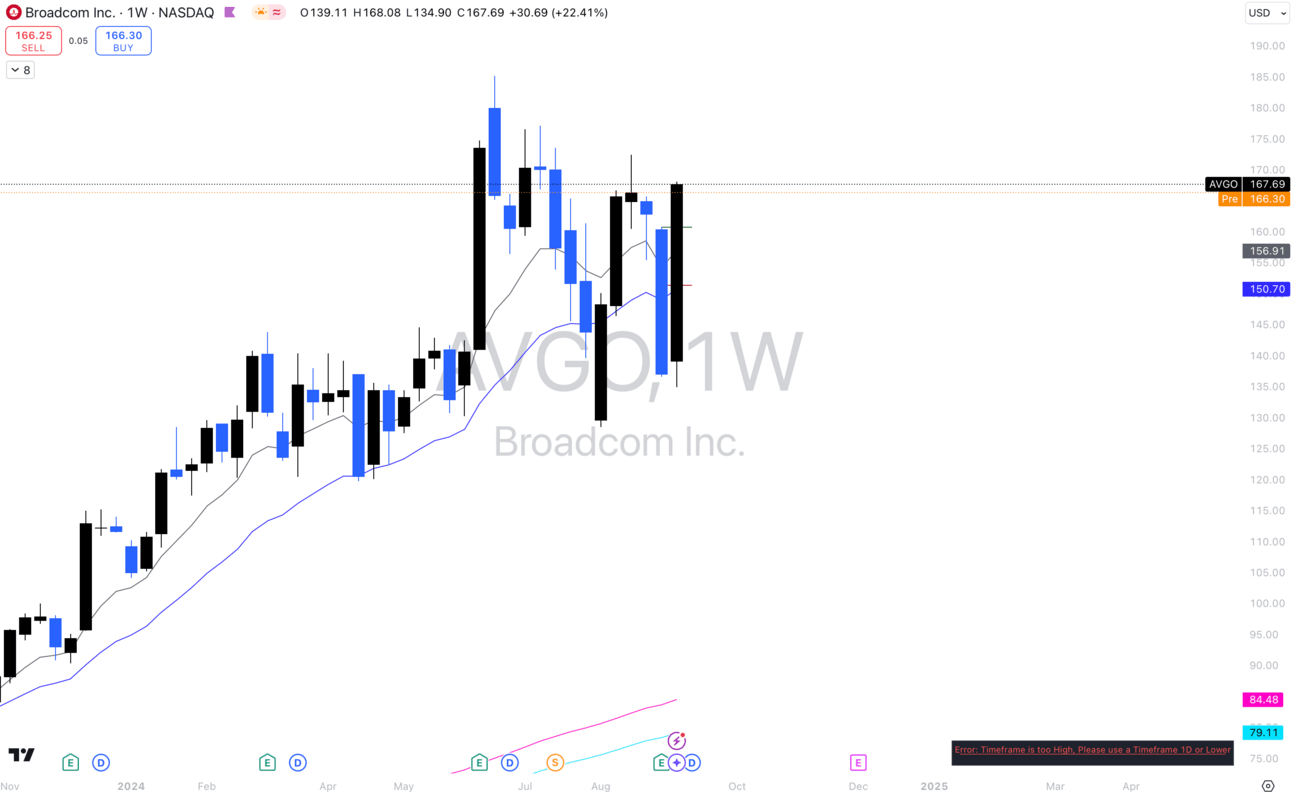

1. $AVGO

$AVGO Weekly

$AVGO had a really strong week last week closing above previous week highs.

I think that this is the start of a breakout here and I would NOT be shorting this name.

I would say you don’t want to see under $160 this week to see continuation of this move right away.

Below $160, I still think this will go, but it may need to take longer to consolidate.

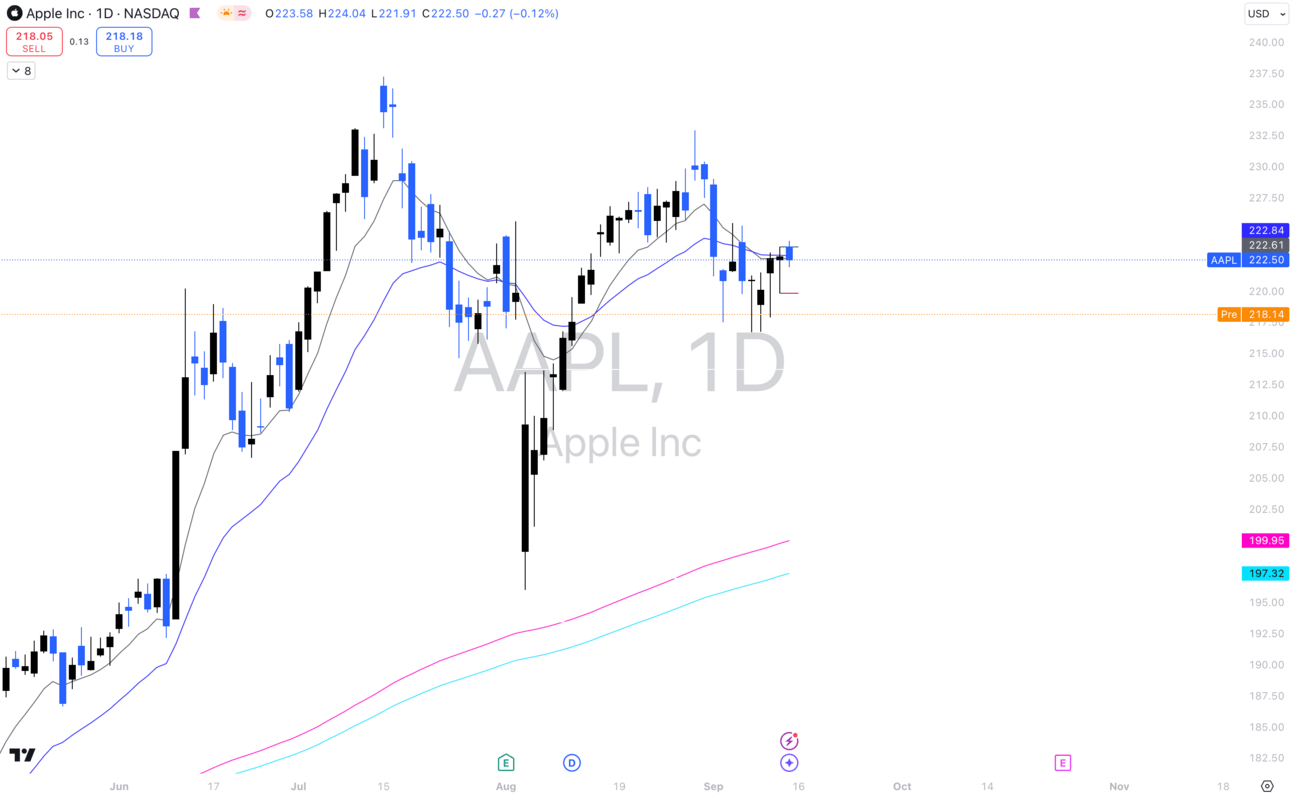

2. $AAPL

$AAPL Daily

I’m personally already long Apple with calls, but I love the higher low we made of the dip and I think this goes back to highs with FOMC this week.

Under $220 I think this is going lower and I wouldn’t be long.

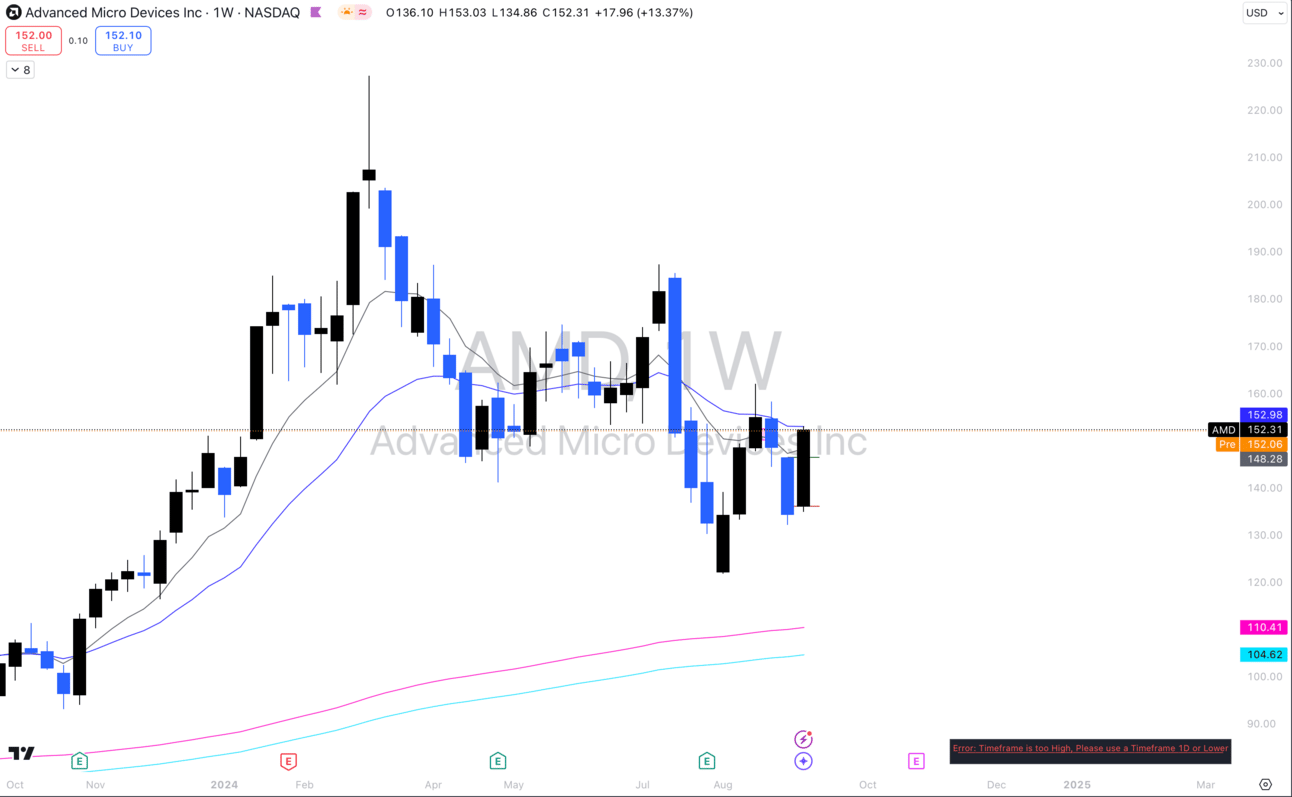

3. $AMD

$AMD Weekly

$AMD closing last week over previous week higher with a higher low put in.

I think we see over $160 in the near future and would love to see into $180s.

Under $140 I would NOT be long this.

Long-Term Setups This Week:

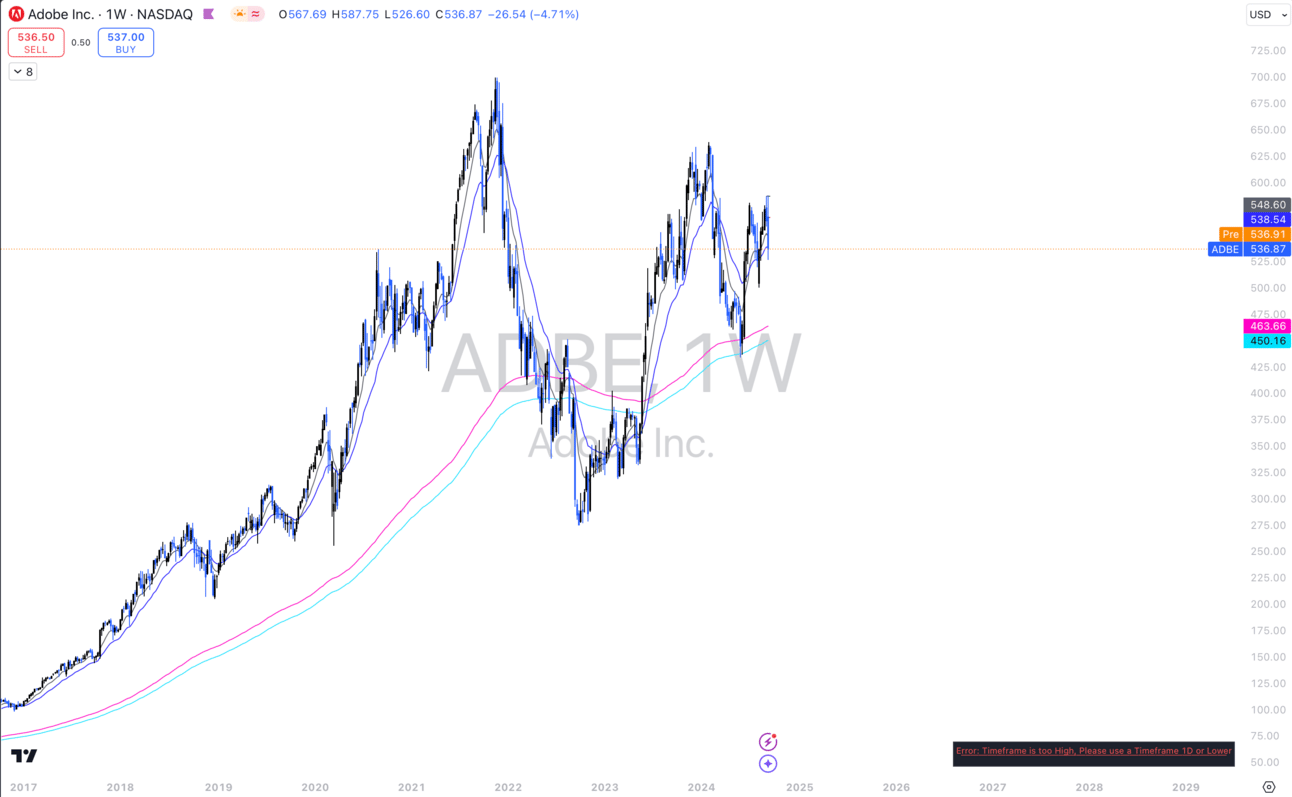

1. $ADBE

$ADBE Weekly

I like $ADBE at these prices. Just stuck in consolidation on the higher timeframes, but something will happen at some point.

I think accumulating shares until a big catalyst comes is not a bad idea.

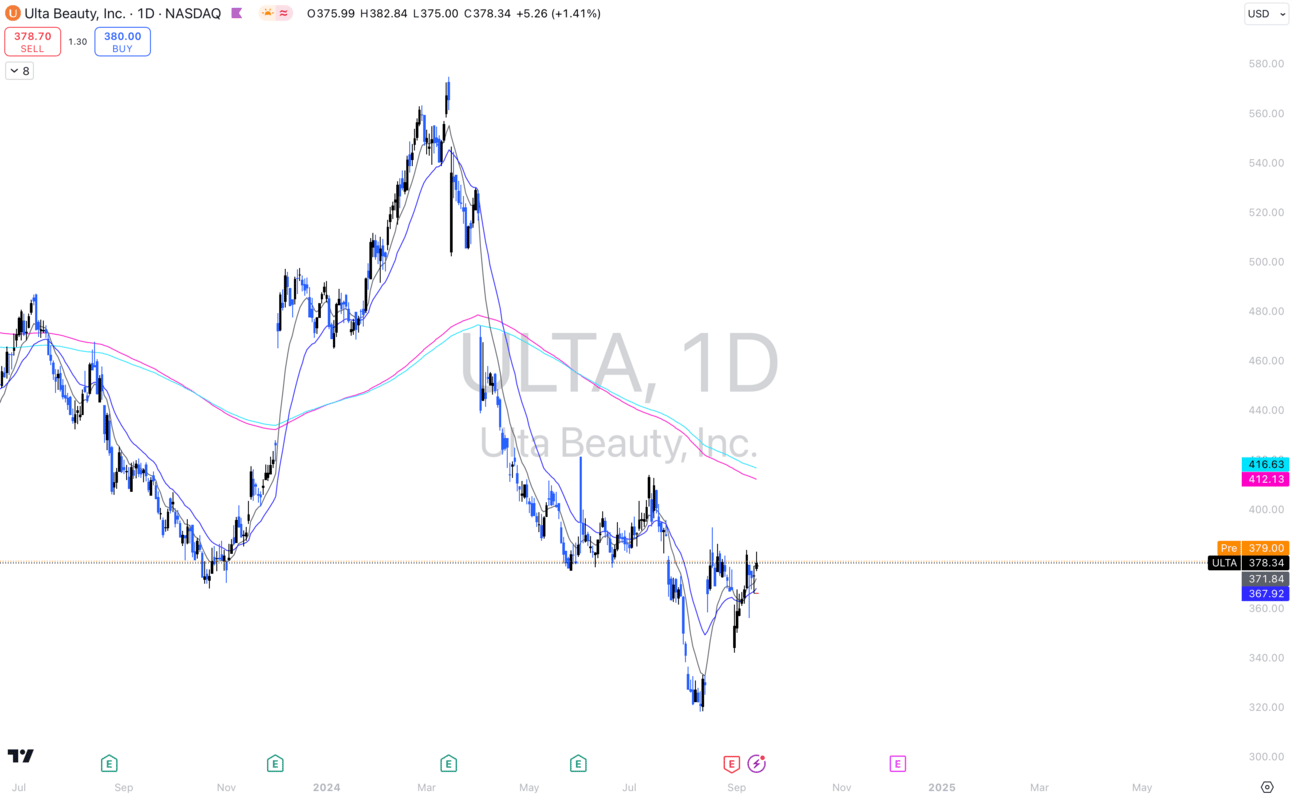

2. $ULTA

$ULTA Daily

Yes, I still like $ULTA here and I think picking up shares here is still solid.

I will continue to slowly add when I feel its right.

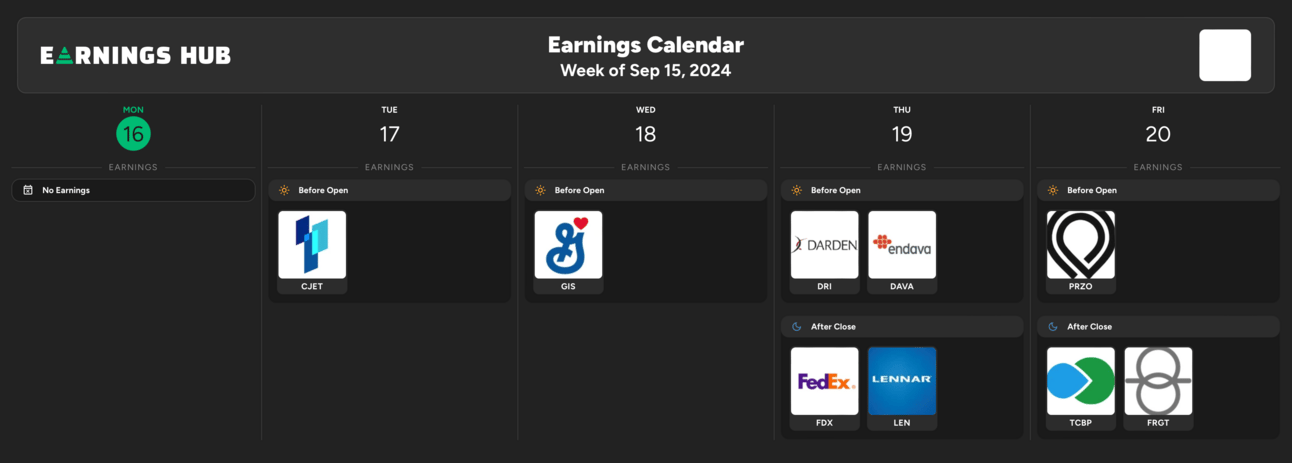

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, Core Retail Sales

Tuesday 1:00 EST, 20-Year Bond Auction

Wednesday 2:00 EST, FOMC Statement

Wednesday 2:30 EST, FOMC Press Conference

Thursday 8:30 EST, Initial Jobless Claims

Thursday 10:00 EST, Existing Home Sales

Trending Sectors

Technology, Semiconductors, and Financials were at the top of the list for most trending sectors last week.

Top trending tickers from last week:

$NVDA

$AAPL

$TSLA

$PLTR

$AMZN

$ORCL

$SMCI

$AMD

$INTC

$MSFT

Have A Great Week!

I hope everybody trades safe this week! Remember, you don’t have to trade FOMC.

I don’t even usually trade it.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.