- Ace in the Hole

- Posts

- Ace in the Hole - Edition #38

Ace in the Hole - Edition #38

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

I hope everybody enjoyed the long 3 day weekend!

Usually these short weeks I play a little more chill, but we’ll see what opportunities arise.

Let’s dive in!

Market Thoughts

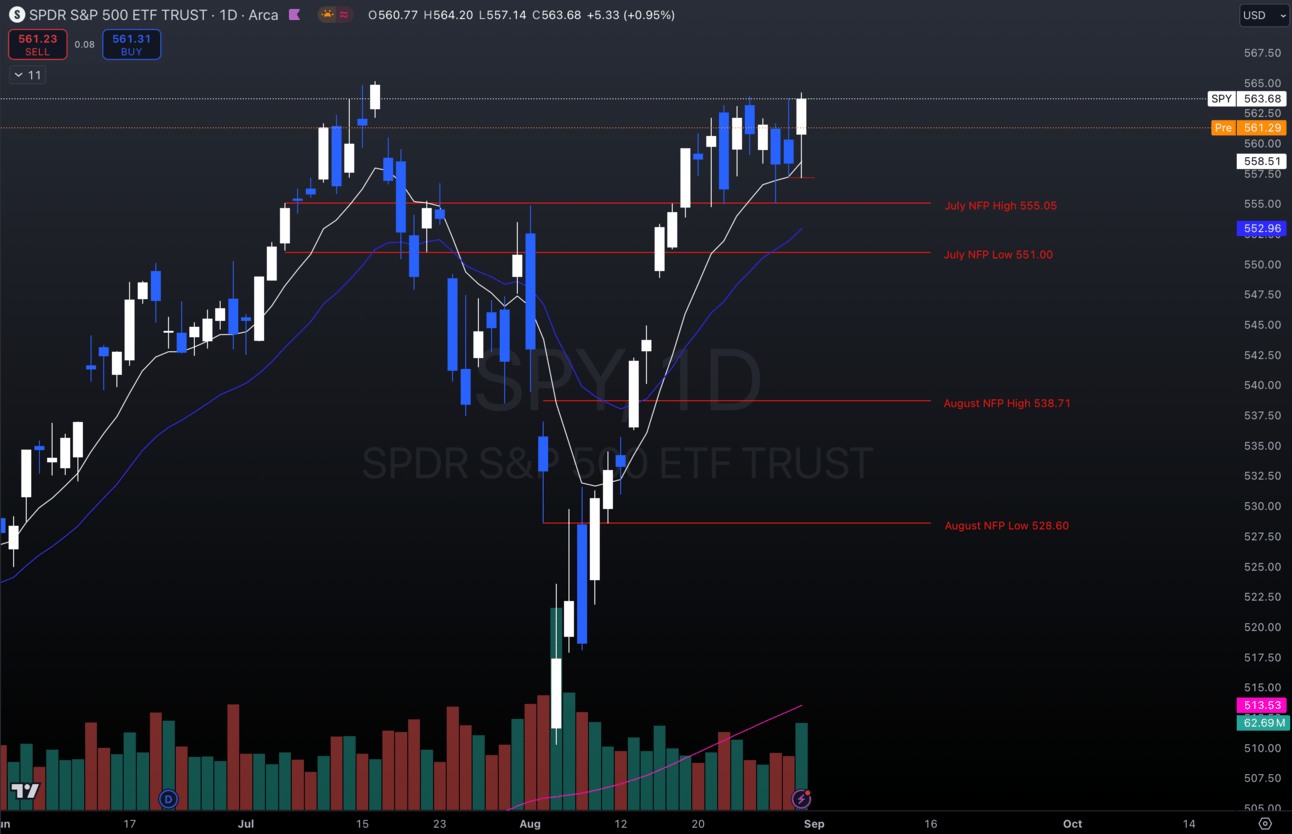

$SPY has been consolidating just under all time highs.

I personally think we see new all time highs soon, I am NOT thinking that this will be a lower high or a double top.

Why?

Because, look at what the market has done all year.

$SPY Daily

You really want to be the one to pick top?

I don’t.

I will follow the sentiment of us making higher highs and higher lows until $SPY proves me otherwise.

Short-Term Setups This Week:

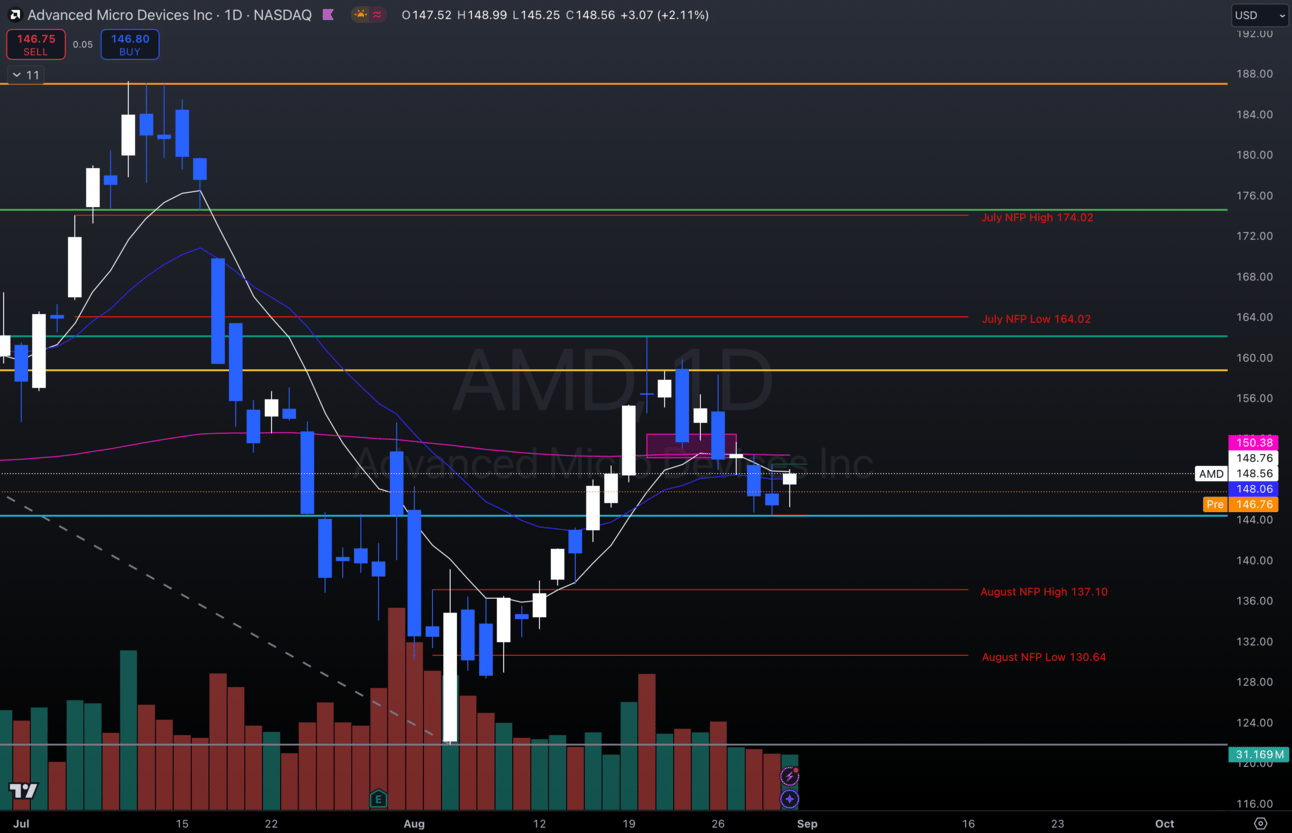

1. $AMD

$AMD Daily

Over $145 on $AMD and I like the longs for a move up to my July NFP low at $164.02

Under $145 would invalidate my thesis here.

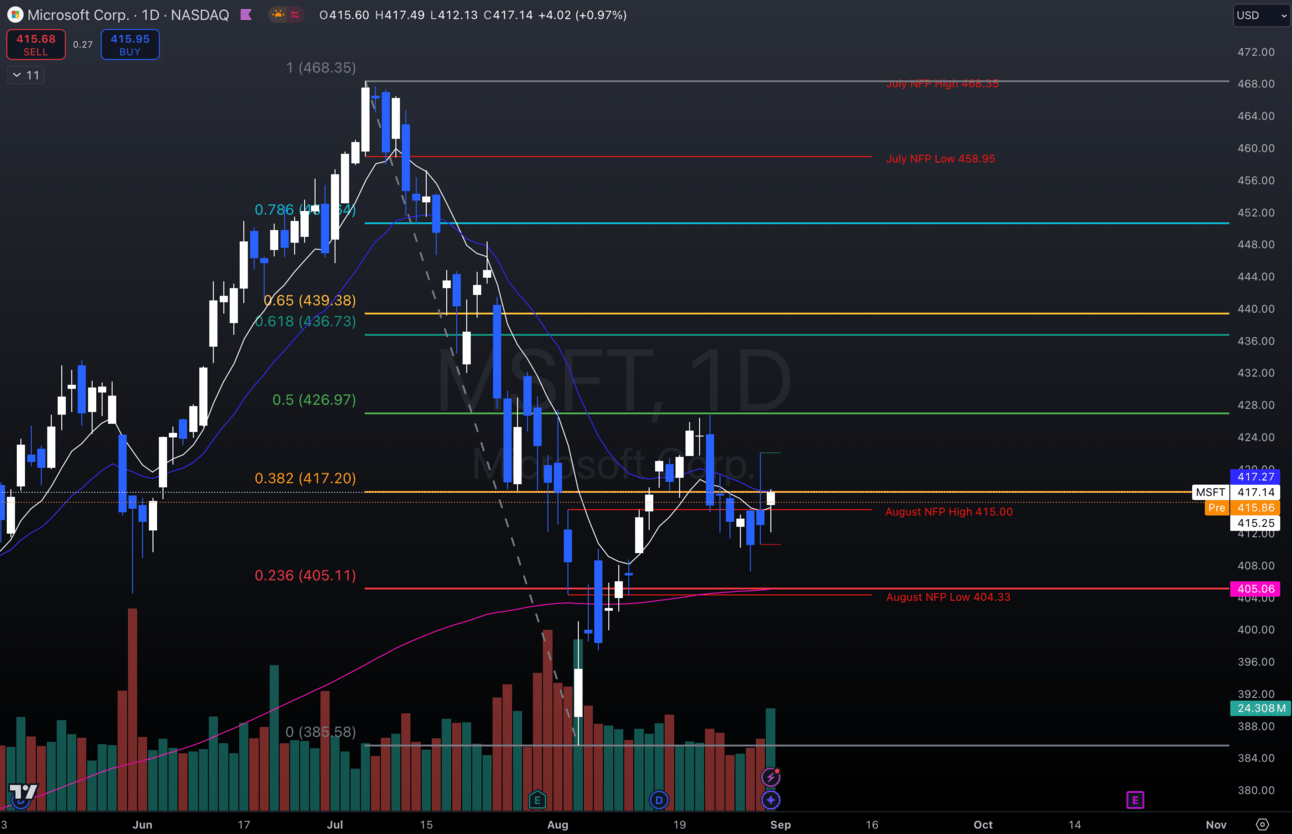

2. $MSFT

$MSFT Daily

As long as this is above $410, I like the long to recent highs at $27 and potentially into $436.

Under $410 would invalidate my thesis.

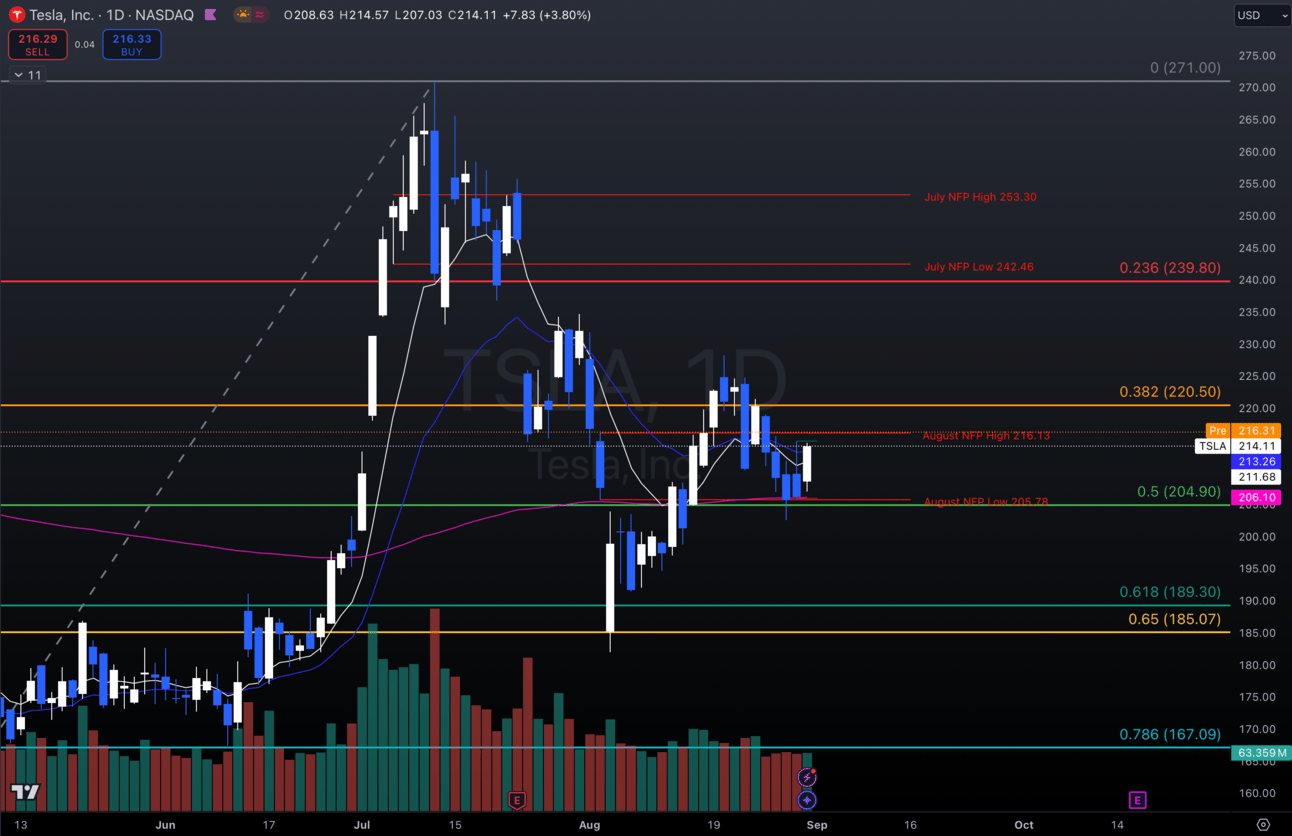

3. $TSLA

$TSLA Daily

As long as $TSLA is trading over that $205 I still like it long up to $225 and potentially July NFP low at $242.46.

Under $205 would invalidate my thesis here.

Long-Term Setups This Week:

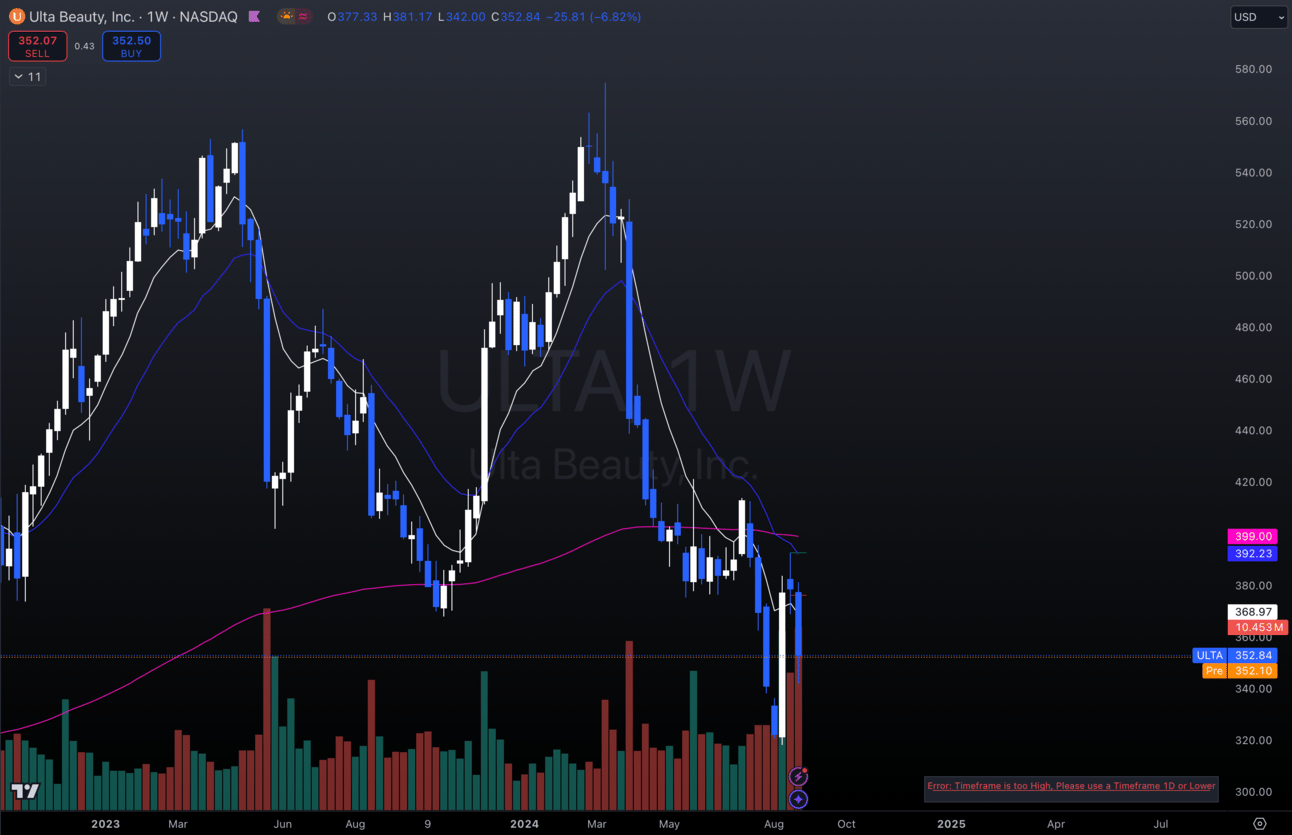

1. $ULTA

$ULTA Weekly

I still like $UTLA at these prices after earnings here to pick up some shares in the long-term portfolio.

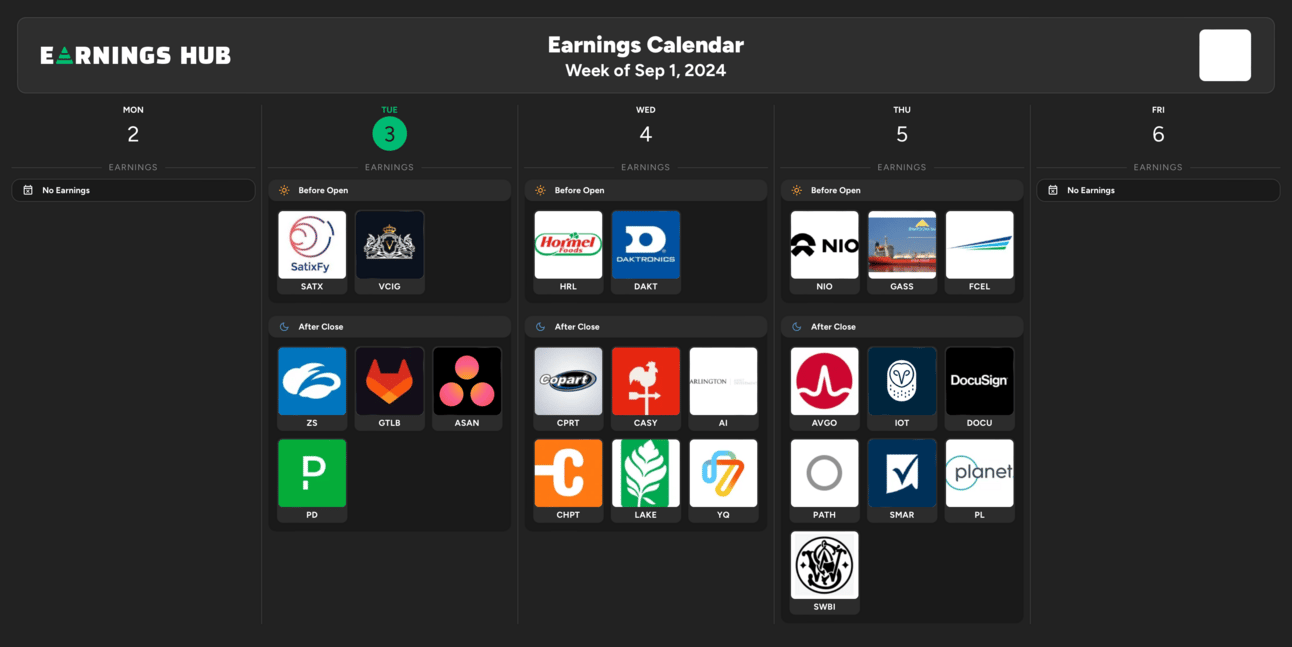

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, ISM Manufacturing PMI

Wednesday 10:00 EST, JOLTs Job Openings

Thursday 8:30 EST, Initial Jobless Claims

Friday 8:30 EST, Nonfarm Payrolls

Trending Sectors

Consumer Staples, Energy, and Real Estate were the top trending sectors last week in the market.

Top trending tickers from last week:

$NVDA

$AAPL

$INTC

$TSLA

$MSFT

$AMZN

$AMD

$SMCI

$PLTR

$AVGO

Have A Great Week!

I hope everybody trades safe and follows their plan.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.