- Ace in the Hole

- Posts

- Ace in the Hole - Edition #37

Ace in the Hole - Edition #37

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend and is ready to get back to the charts!

$SPY had another great week rising 1.41% and we have another big catalyst this week with $NVDA earnings.

Let’s dive in!

Market Thoughts

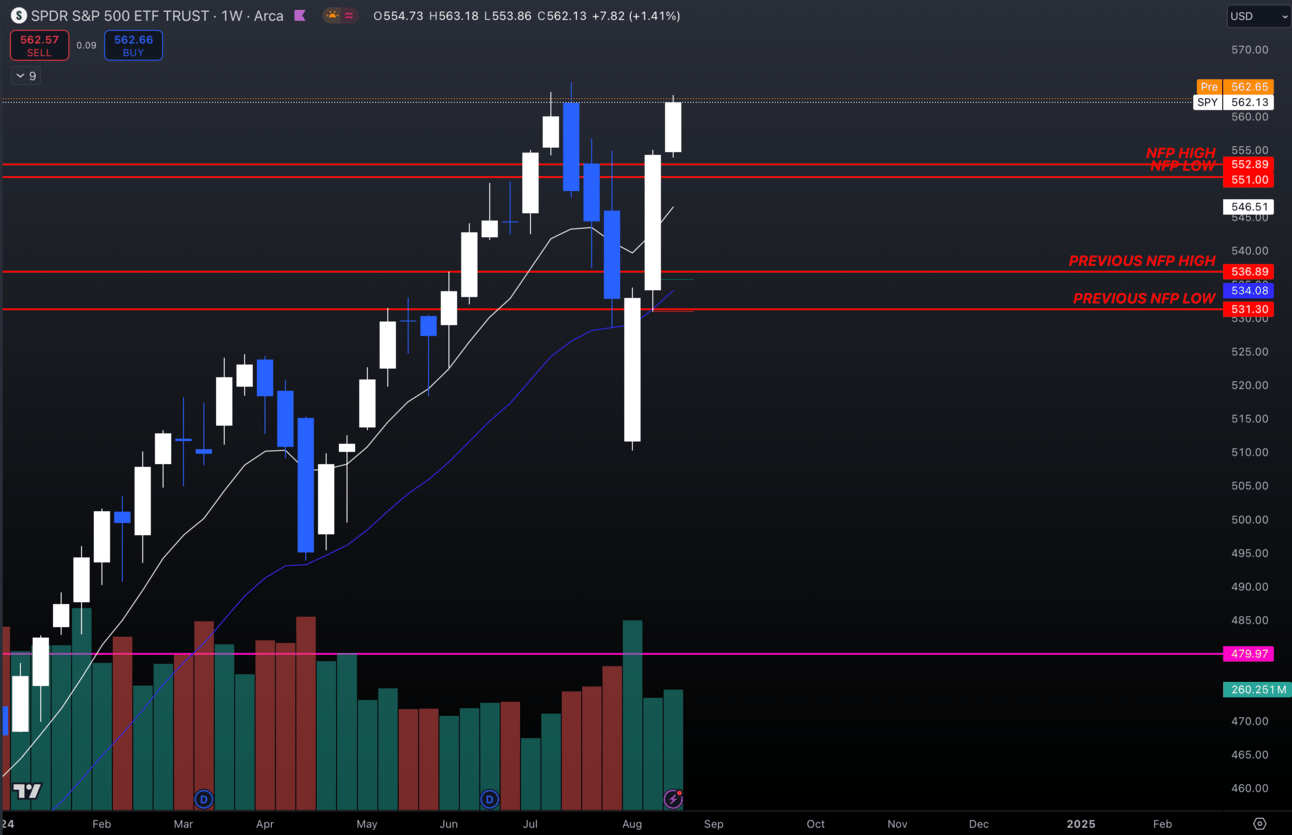

$SPY is right back to sitting just under all time highs here.

I think $NVDA earnings is going to be the deciding factor on whether we make new all time highs or try a short-term top.

$SPY Weekly

I’m more confident in this breaking out to the upside because that’s been the sentiment all year, but if that changes we will adapt.

I’m going to continue to play the market long majority of the time until I see something that actually concerns me.

Short-Term Setups This Week:

1. $DELL

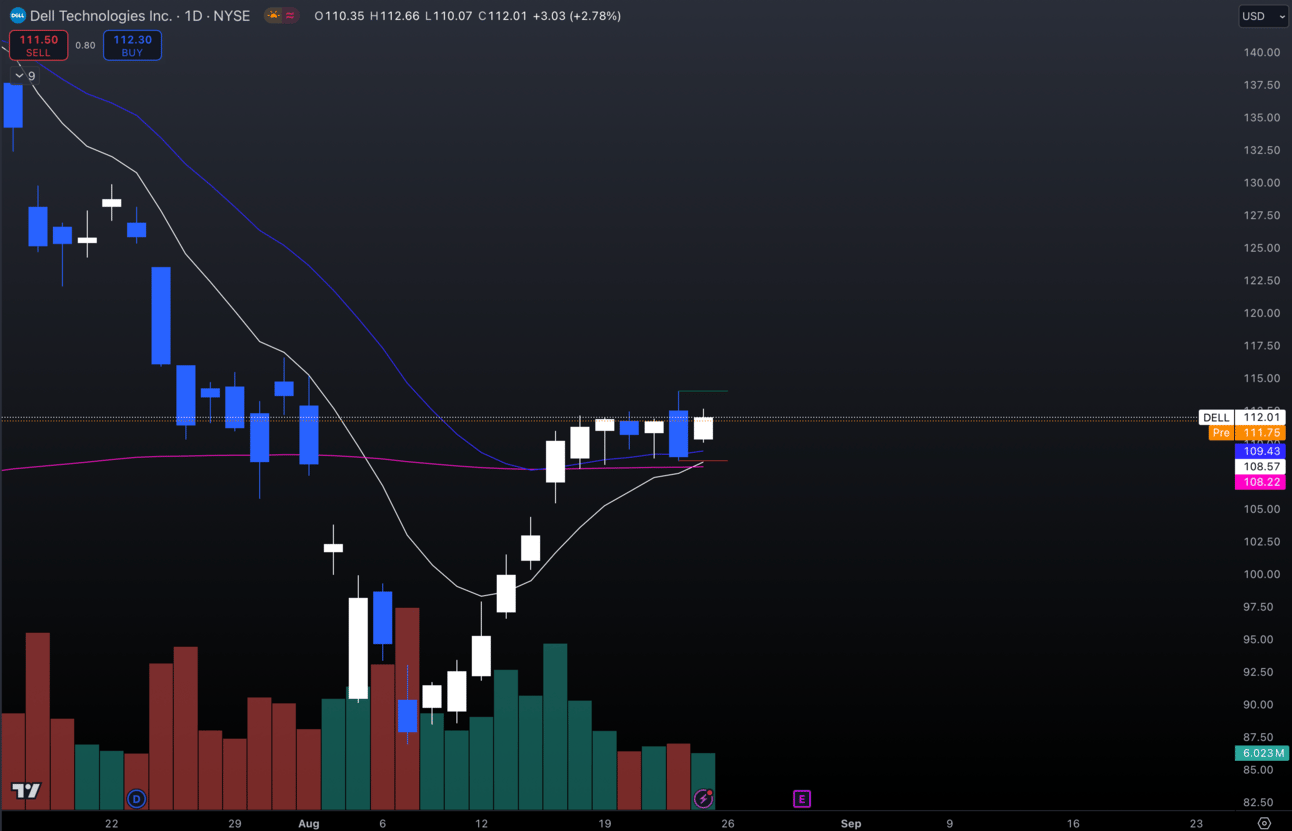

$DELL Daily

$DELL is consolidating after making a nice move off of the lows.

I personally started a long-term position on this dip, but I think a move outside this consolidation could be a potential move.

I anticipate this breaks to the upside over $114, but of course it can go either way.

2. $META

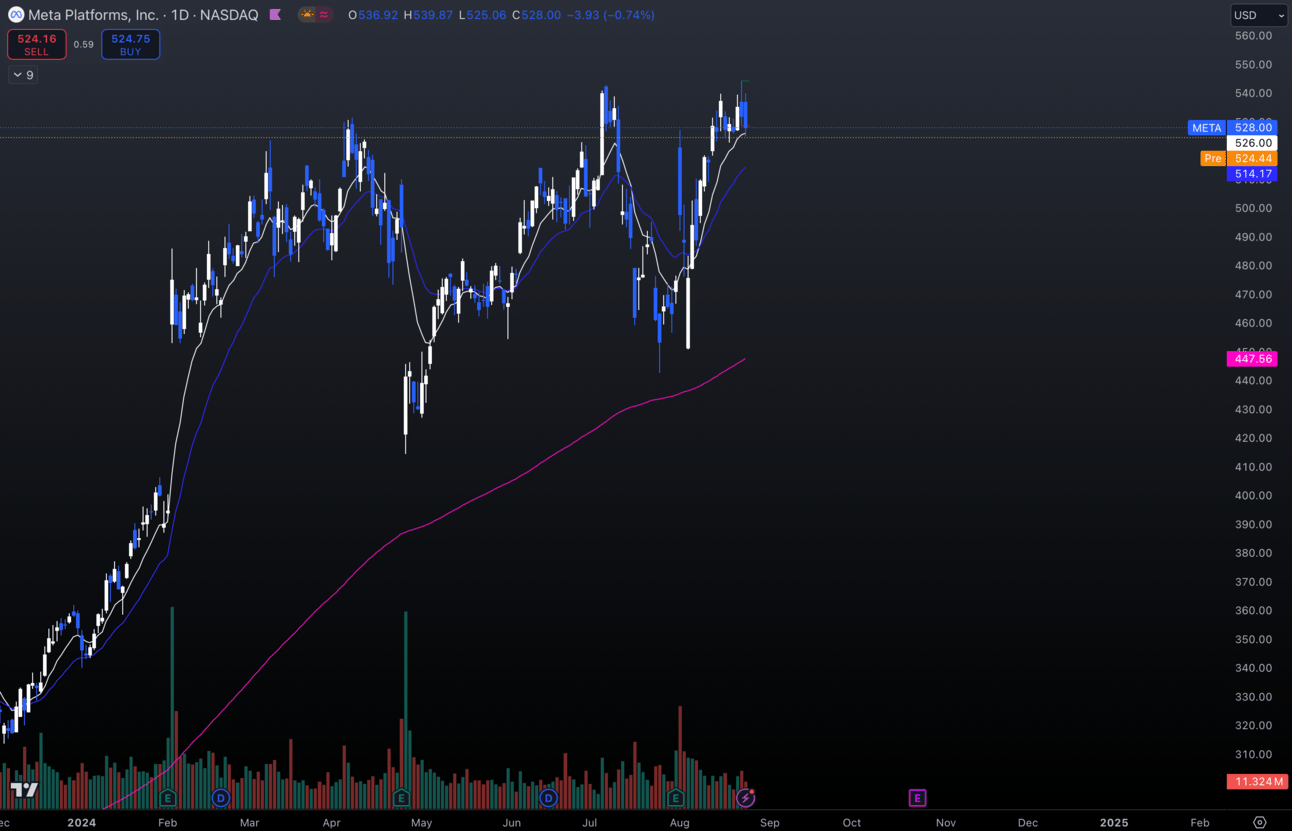

$META Daily

$META has been in this high time-frame consolidation waiting to breakout.

I think that time is coming especially if $NVDA earnings are good this week.

I’d be looking to pick some up off of that $514 —> $515 area.

Under $500 this would be invalidated for me.

3. $MSFT

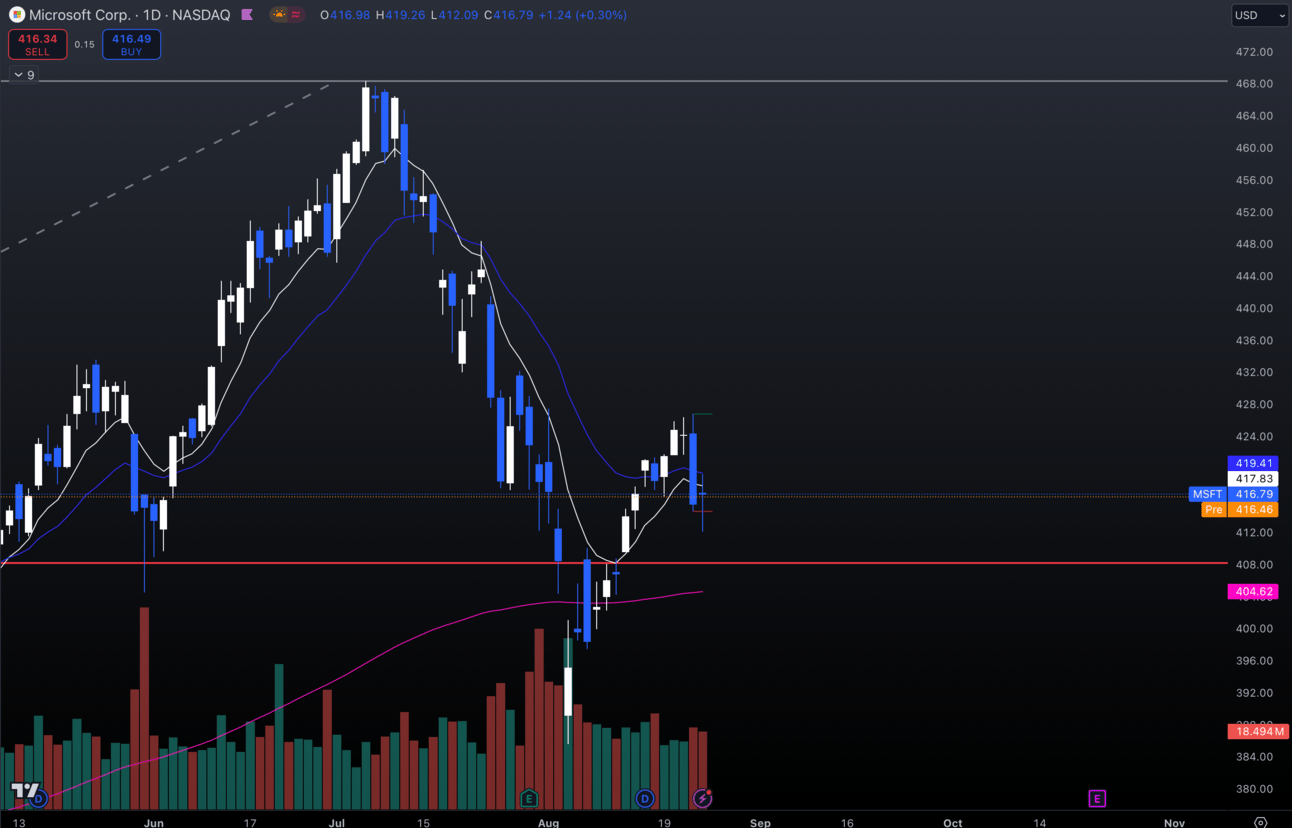

$MSFT Daily

I like $MSFT on this dip for a move back to highs as long as this is holding that $410 area.

Under $410 would invalidate my thesis and would be getting under one of my important Fib levels.

Long-Term Setups This Week:

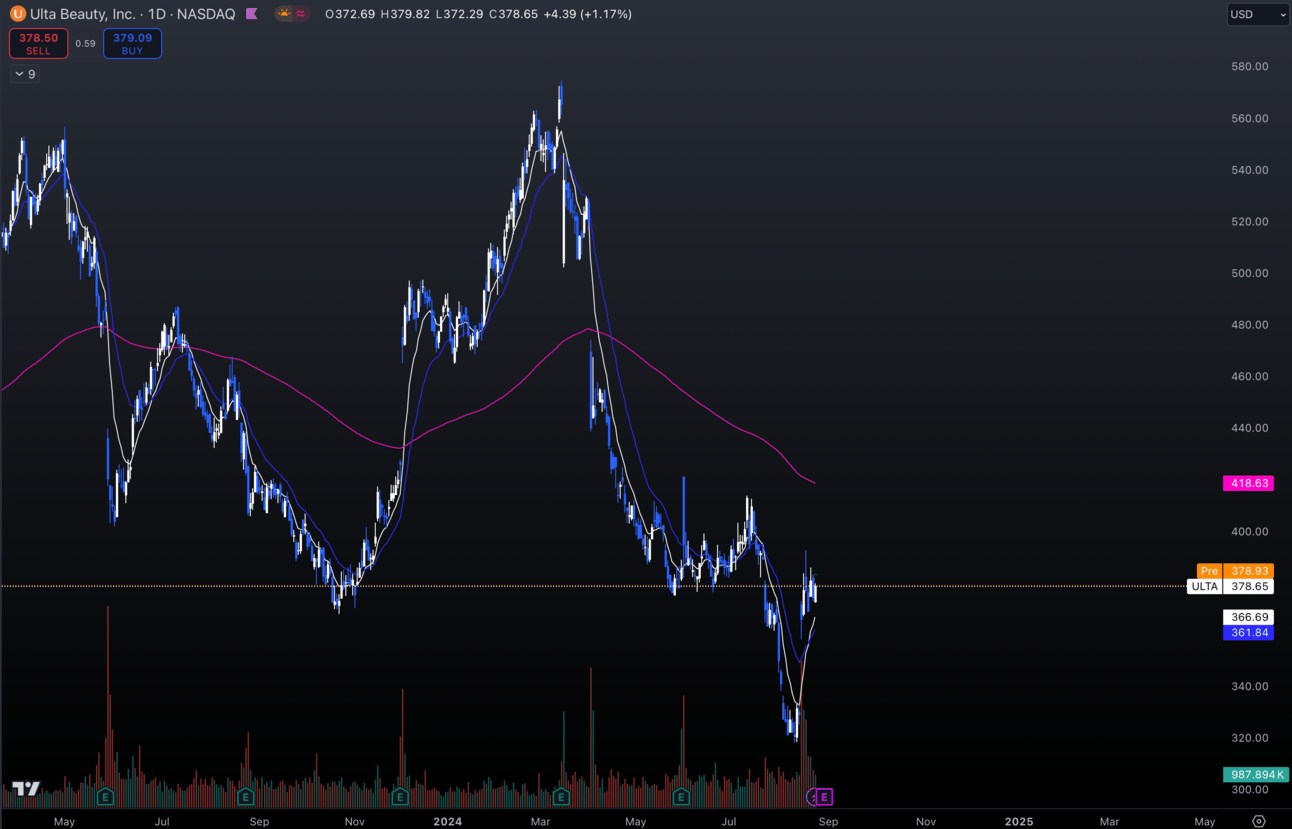

$ULTA Daily

I still personally like buying this $ULTA dip and think it is a good add at these prices.

I will continue to buy some slowly.

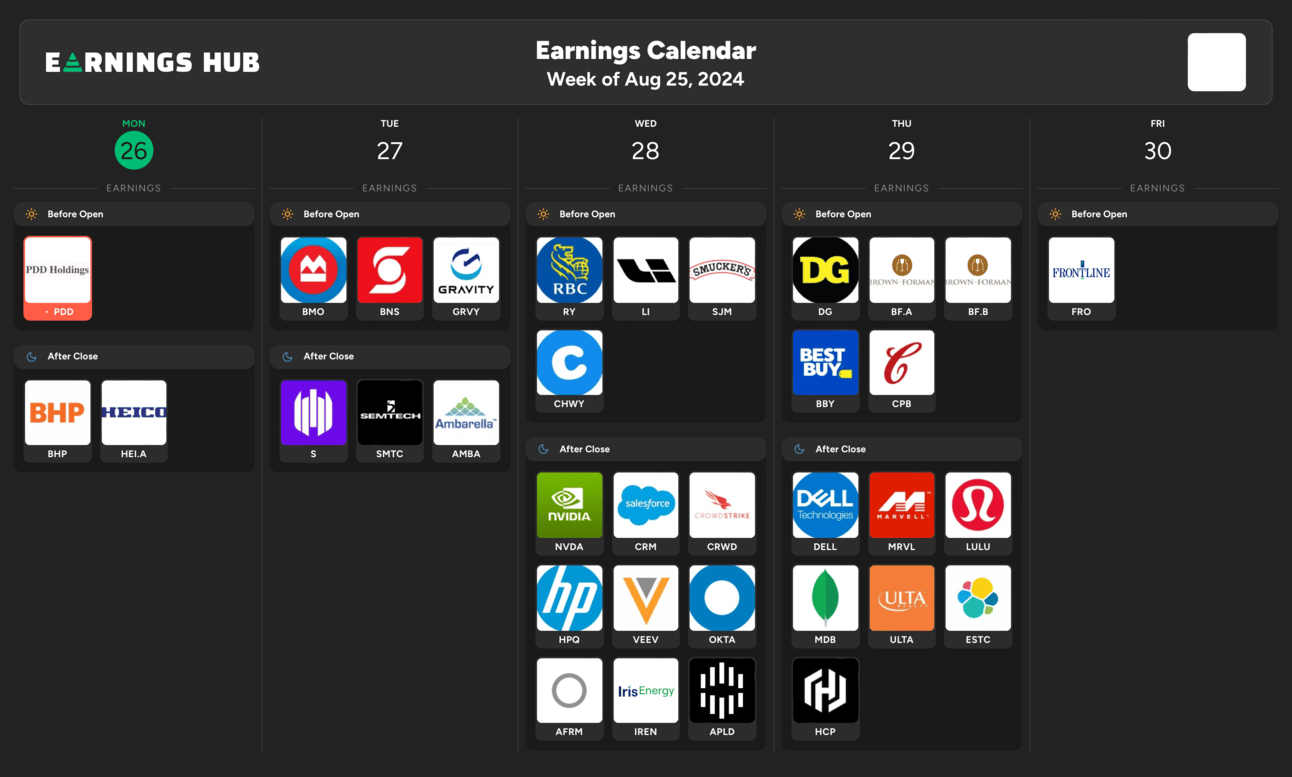

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, CB Consumer Confidence

Thursday 8:30 EST, GDP

Thursday 10:00 EST, Pending Home Sales

Friday 8:30 EST, PCE

Friday 9:45 EST, Chicago PMI

Trending Sectors

Technology, Healthcare, and Utilities were the top trending sectors last week.

Top trending tickers from last week:

$NVDA

$MSFT

$TSLA

$AMD

$AAPL

$AMZN

$INTC

$AVGO

$TSM

$PDD

Have A Great Week!

As always, enjoy the week and trade safe.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.