- Ace in the Hole

- Posts

- Ace in the Hole - Edition #36

Ace in the Hole - Edition #36

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everyone had an amazing weekend.

Hopefully you got a break from the charts and are ready for the week ahead.

It’s going to be a BIG week, so let’s dive in!

Market Thoughts

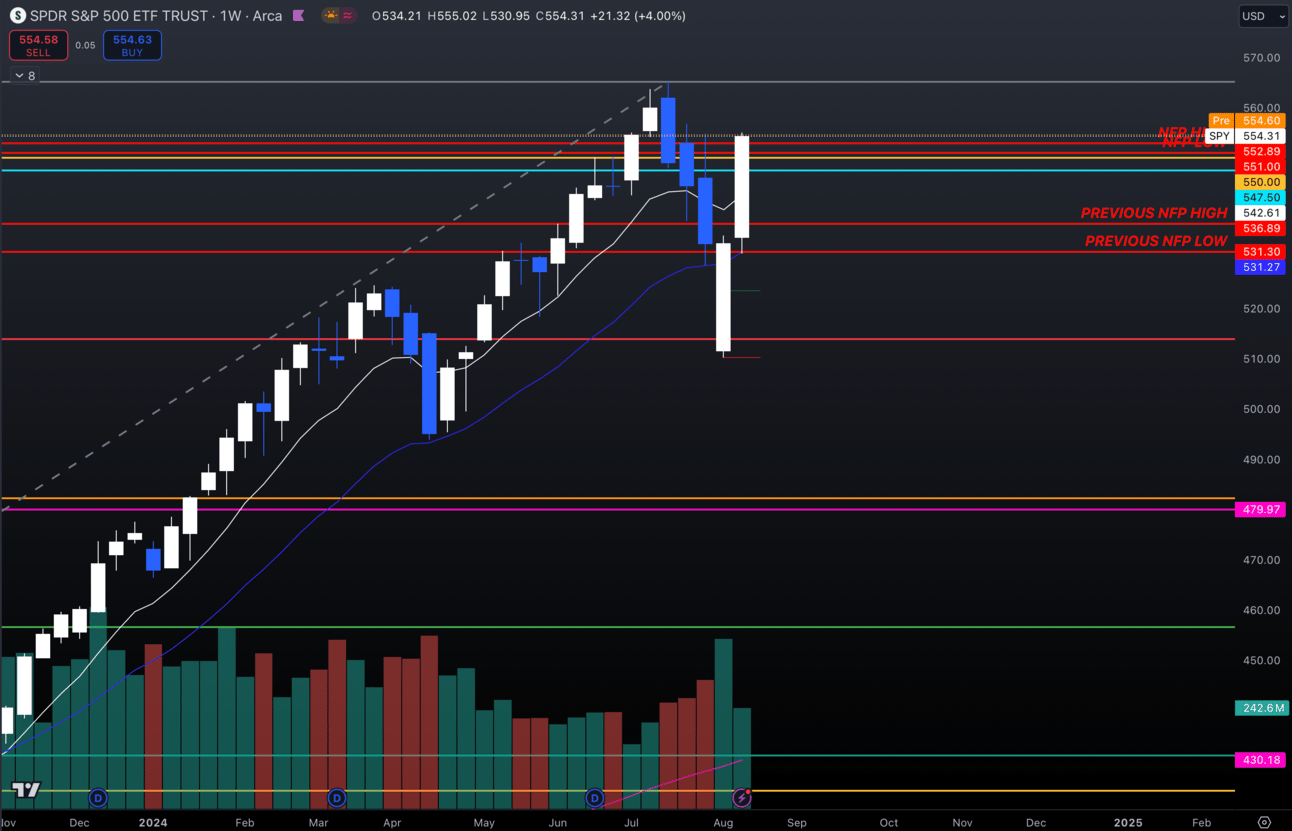

$SPY has been on a tear to the upside ever since we went down and tested that weekly 21 EMA, up last week 4%.

$SPY Weekly

I’ve personally been long throughout these dips on most individual names which has been paying off well.

I will continue to play longs heavily and keep shorts to a minimum as long as we keep trending off of this weekly 21 EMA.

There is no reason to be heavily short IMO.

Short-Term Setups This Week:

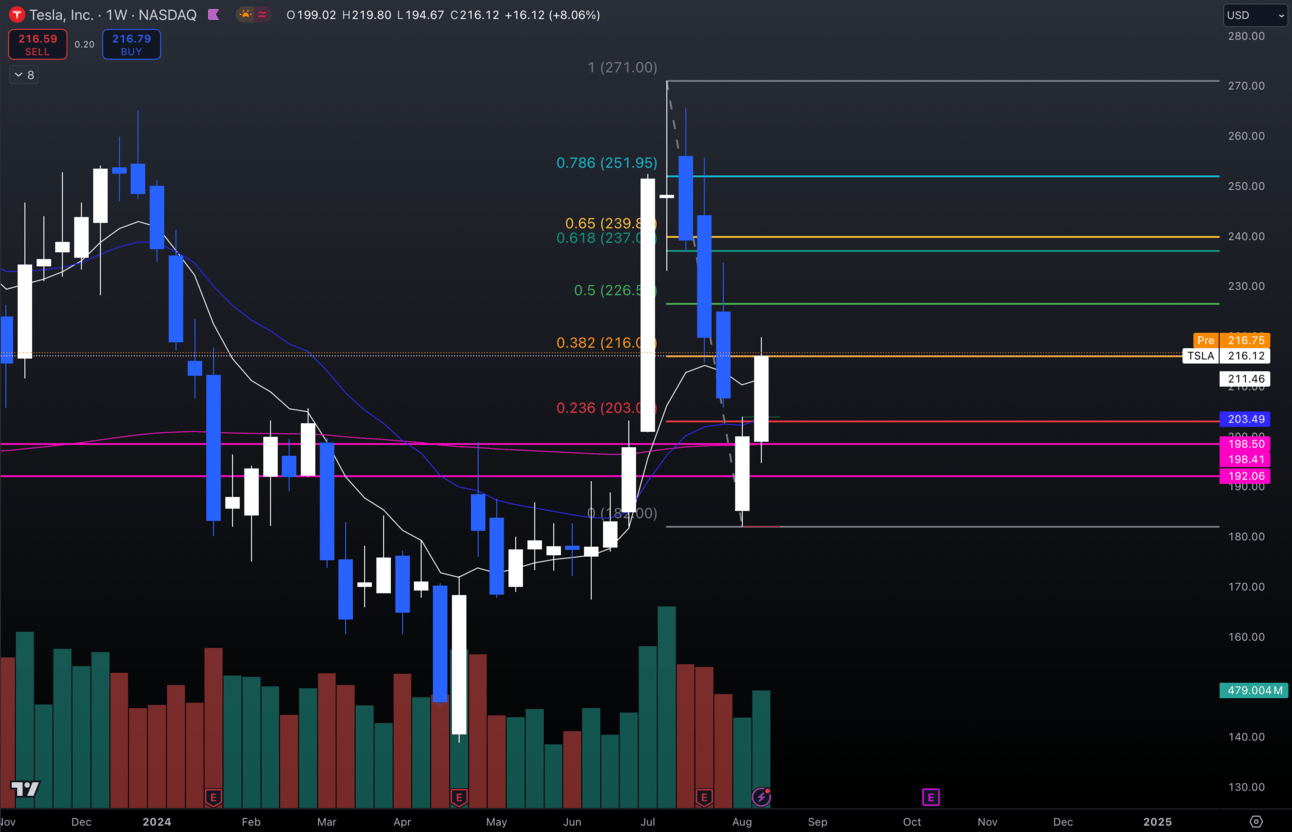

1. $TSLA

$TSLA Weekly

I’ve been long $TSLA for weeks, but I think this backtest of $200 has been perfect.

I still think we are at a decent spot to pick it up as long as it is holding the previous breakout area of $180.

I personally think the monthly candle that is currently red flips green, but we’ll see.

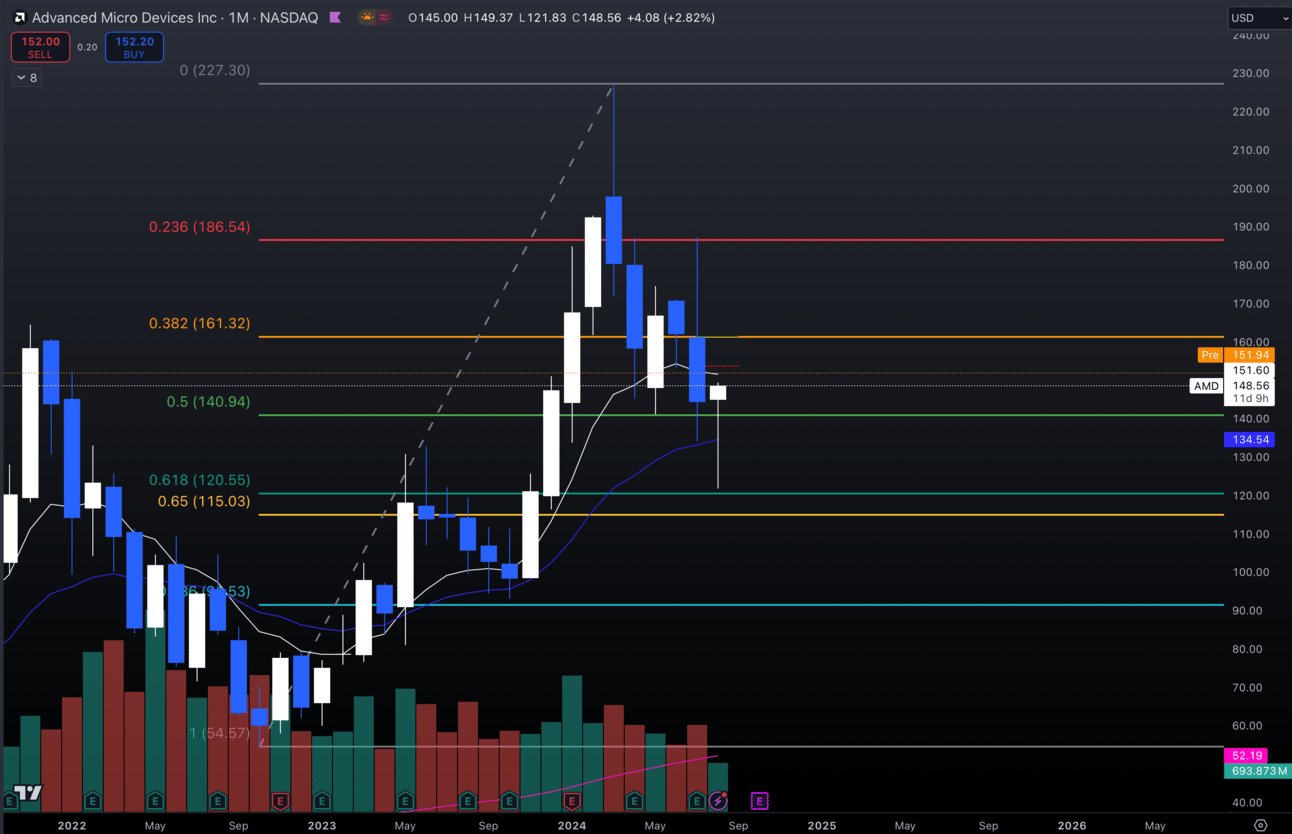

2. $AMD

$AMD Monthly

I’m personally long $AMD in swings right now and I still love it off of this monthly 21 EMA.

I think there is a lot of potential for upside off of this area and any upside you’ve seen the past few days is just the beginning IMO.

If this is holding its monthly 21 EMA, I will continue to be long.

Long-Term Setups This Week:

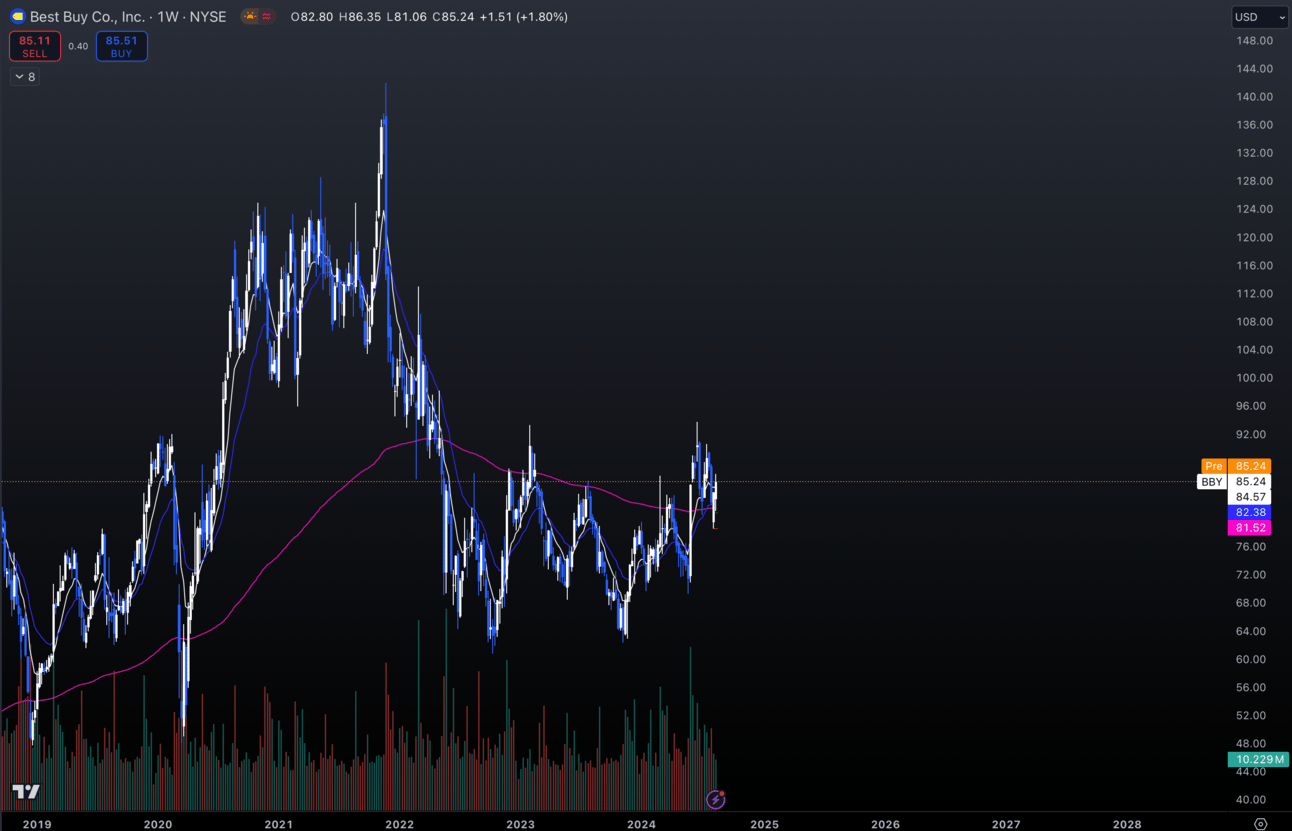

1. $BBY

$BBY Weekly

I still think $BBY is at great prices to be picking up for the long-term.

I personally just picked up some shares for the first time recently. Earnings are coming up, so this will be interesting!

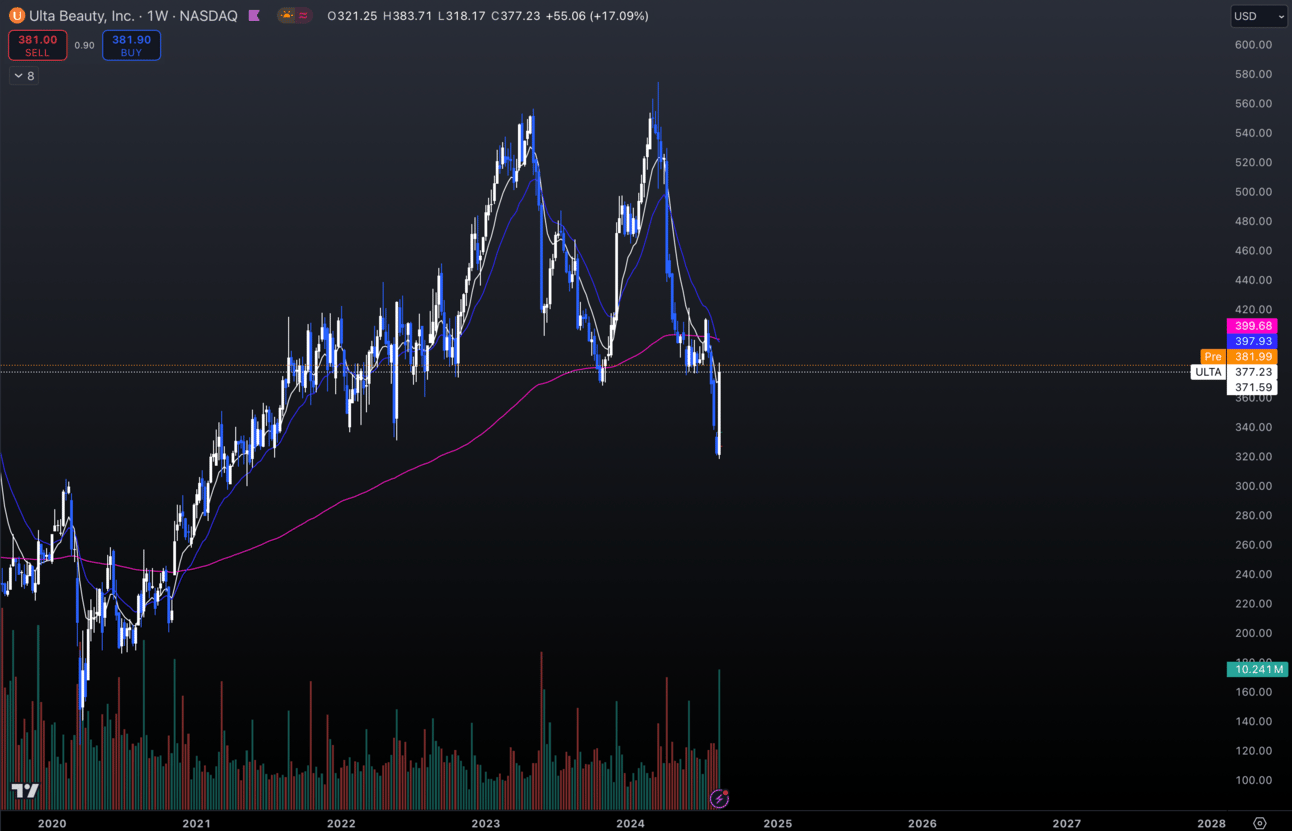

2. $ULTA

$ULTA Weekly

$ULTA has had some good momentum ever since Warren Buffet bought shares.

I’ve always loved this company or any other big companies in the area of makeup.

Why?

Because, it will never go out of business IMO and they have the biggest mass of consumers.

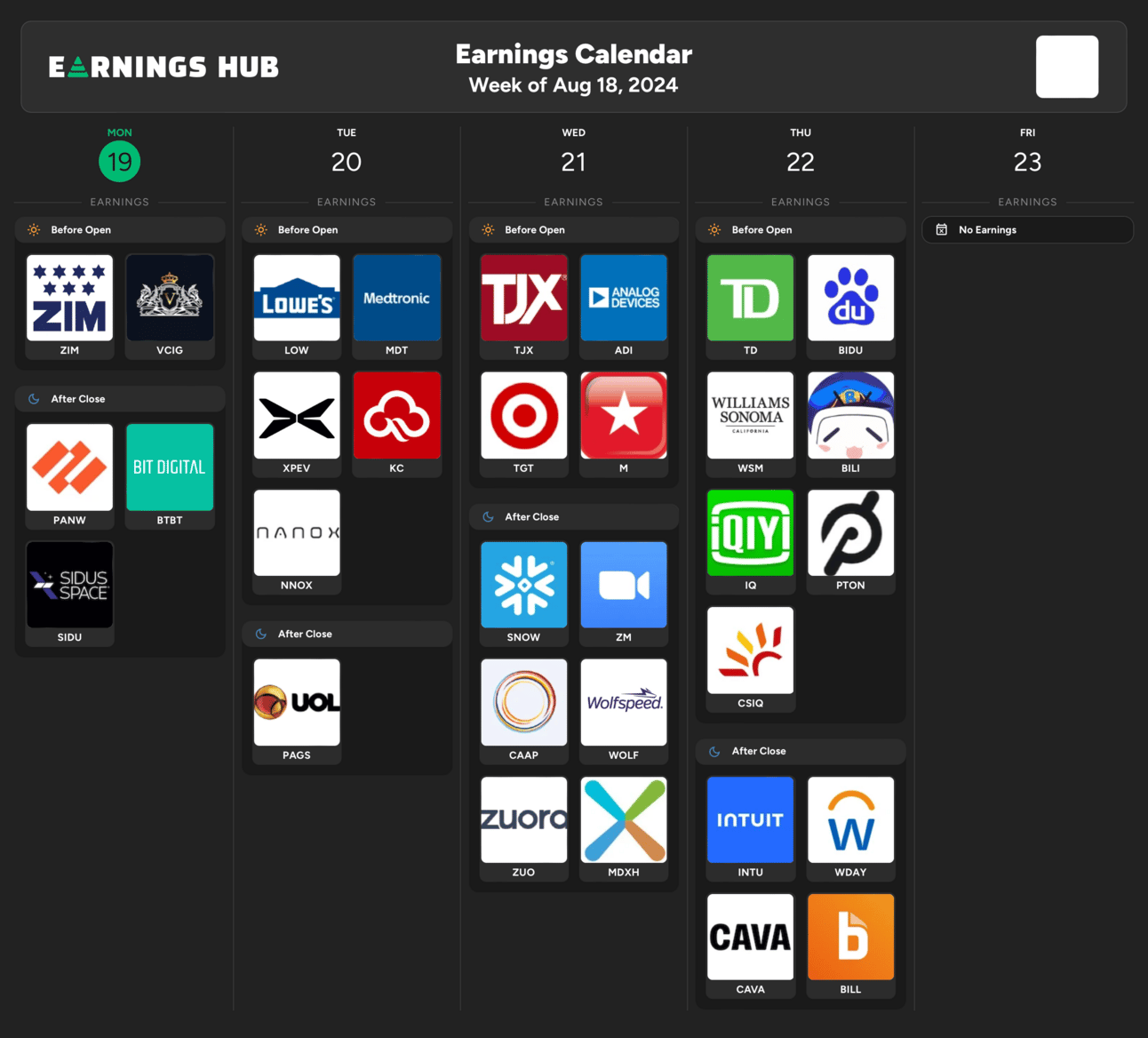

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Wednesday 1:00 EST, 20-Year Bond Auction

Wednesday 2:00 EST, FOMC Meeting Minutes

Thursday 8:30 EST, Initial Jobless Claims

Thursday 9:45 EST, S&P Global Services PMI

Thursday 10:00 EST, Existing Home Sales

Friday 10:00 EST, Fed Chair Powell Speaks

Friday 10:00 EST, New Home Sales

Trending Sectors

Technology and Financials were the most trending sectors last week.

Top trending tickers from last week:

$NVDA

$GOOGL

$AMZN

$TSLA

$CRWD

$SBUX

$BA

$INTC

$SMCI

$ASTS

Have A Great Week!

I hope everybody has an amazing week as always.

Play your plan and stick to your rules, let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.