- Ace in the Hole

- Posts

- Ace in the Hole - Edition #35

Ace in the Hole - Edition #35

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great weekend and got a break from the charts!

We have a big week ahead of us in terms of economic data coming out and some interesting companies reporting earnings.

Let’s dive in!

Market Thoughts

What a crazy last week in the market. $SPY gained a total of .02%, but it moved a ton throughout the week.

Last week $SPY was breaking under the weekly 21 EMA and I was saying how that changes things for me.

Well, that has been reclaimed since the last newsletter and $SPY closed above it on Friday.

What does this mean?

To me, I see bulls heavily buying this dip. Of course I could be wrong, but we are still in a bull market contrary to what some may believe on twitter.

Short-Term Setups This Week:

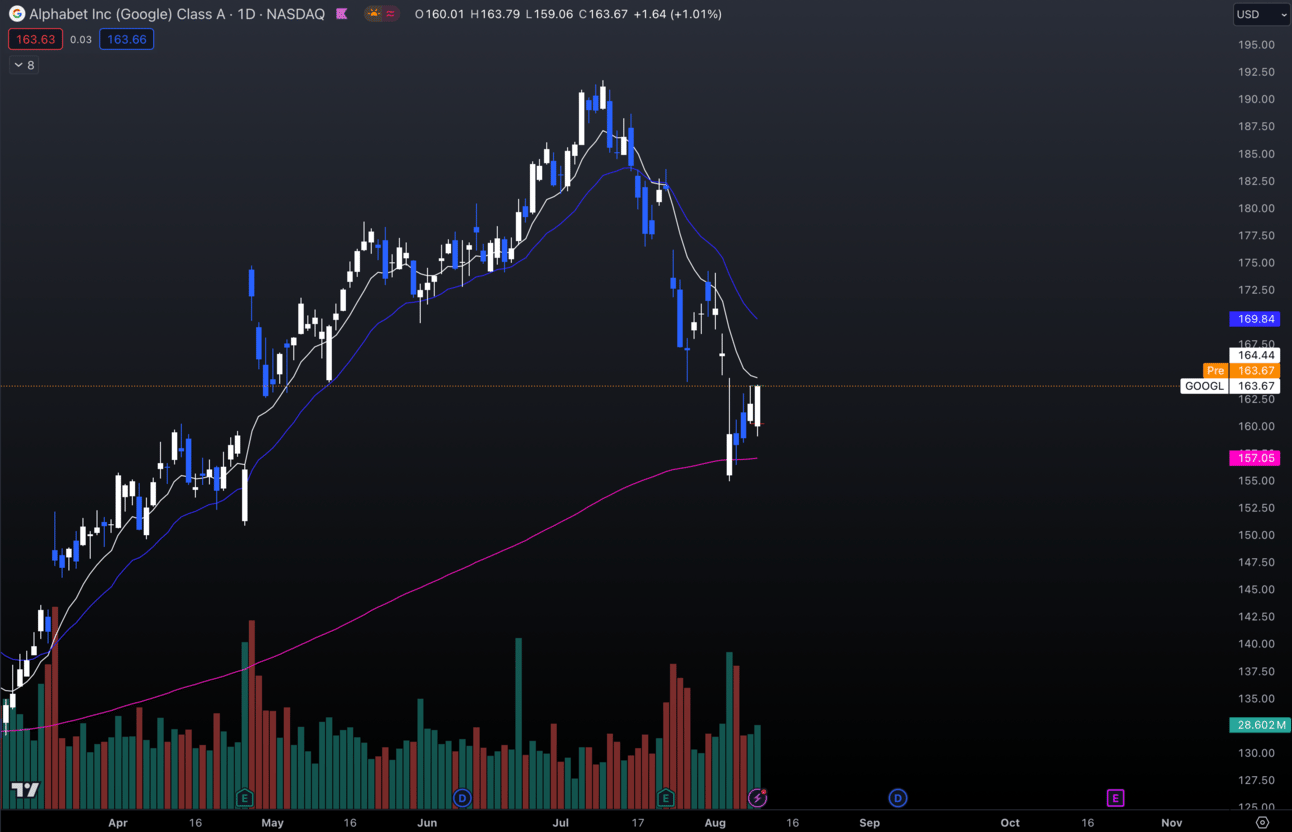

1. $GOOGL

$GOOGL Daily

$GOOGL has taken a decent dip down to its 200 EMA and is holding while making a higher low off this area.

I think this has potential to breakout of this downtrend and start making higher highs again.

Under $157 I can’t be long this name anymore.

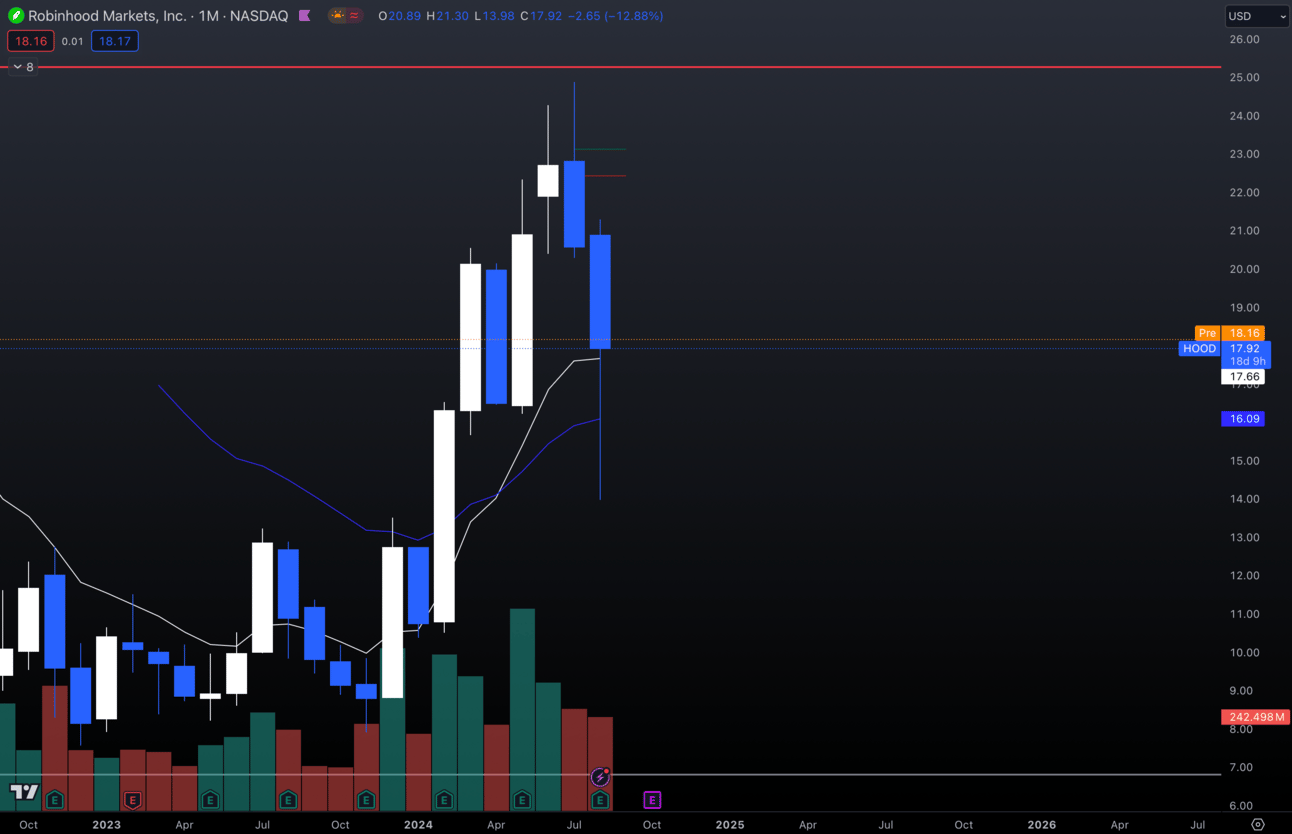

2. $HOOD

$HOOD Monthly

$HOOD has taken a significant dip down to its monthly 21 EMA and has gotten bought up from there.

I’m personally already long this but I think it has a ton of upside potential.

Under $16 I can’t be long anymore.

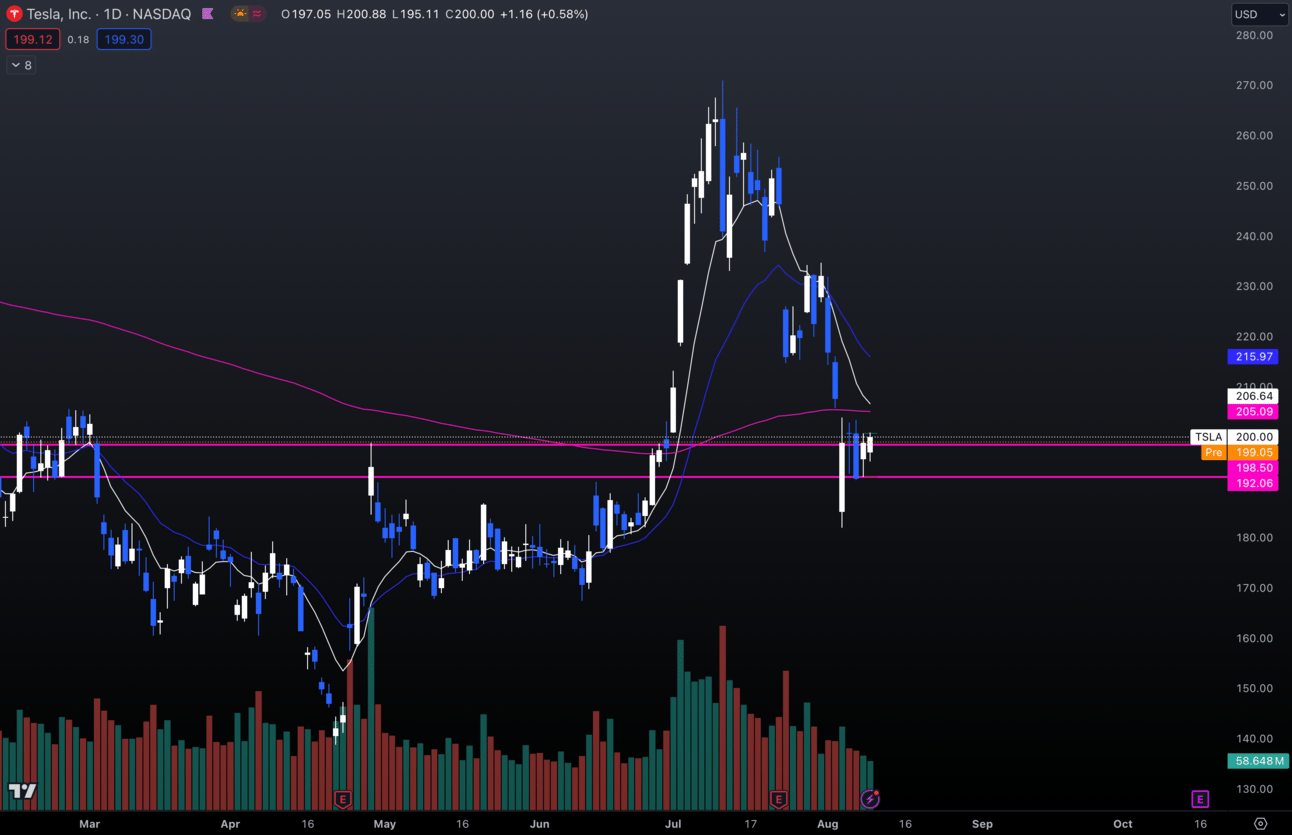

3. $TSLA

$TSLA Daily

$TSLA has dipped right back down to the area it broke out of on June 26th.

Bulls have bought off of this area so far and are holding.

I personally think that this is a short-term bottom and am positioned long.

Under $187 I can’t be long anymore.

Long-Term Setups This Week:

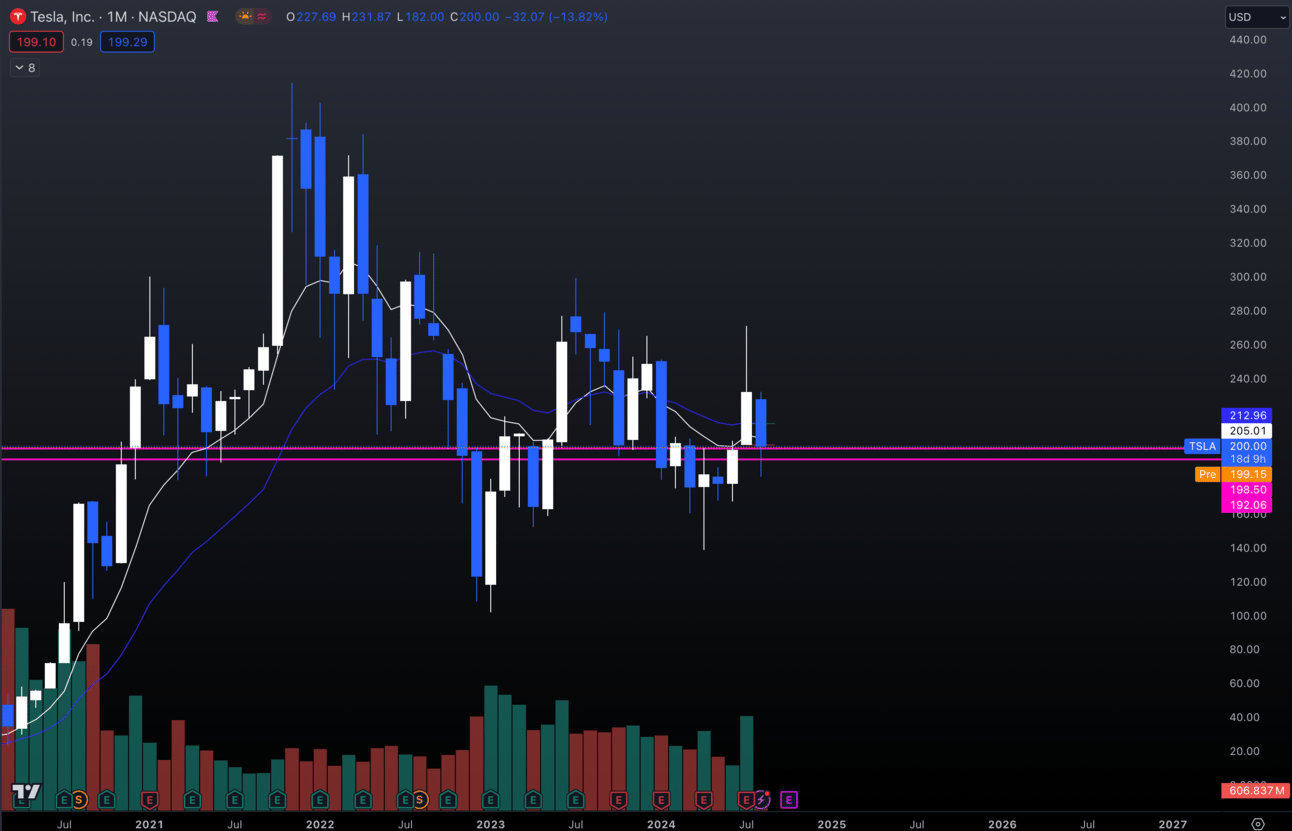

1. $TSLA

$TSLA Monthly

I think this dip on $TSLA is one to be bought.

I also think that this month ends up closing green, but we’ll see what happens.

I added more $TSLA to my long-term last week in this area.

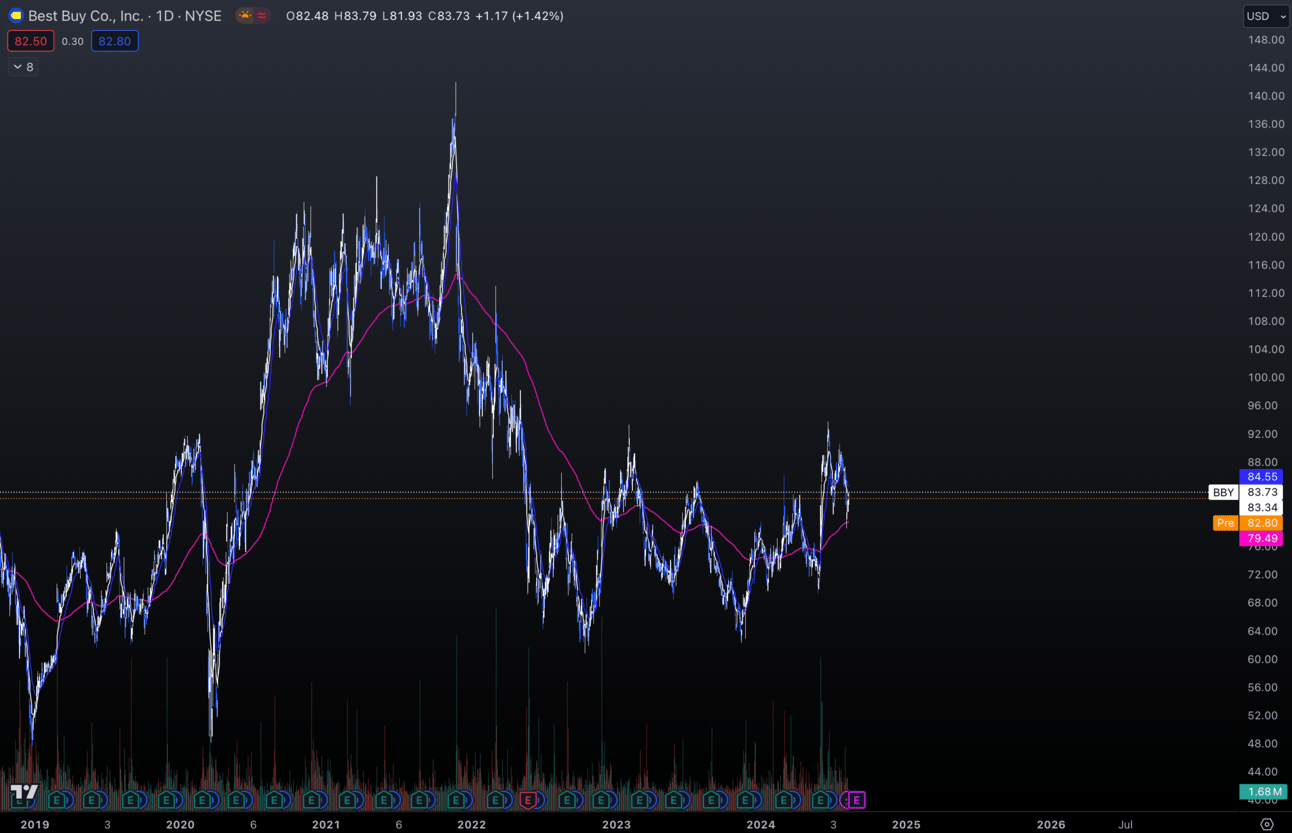

2. $BBY

$BBY Daily

Last week I started a long-term position in $BBY at these levels.

I think this is a great area to get some shares or DCA accordingly.

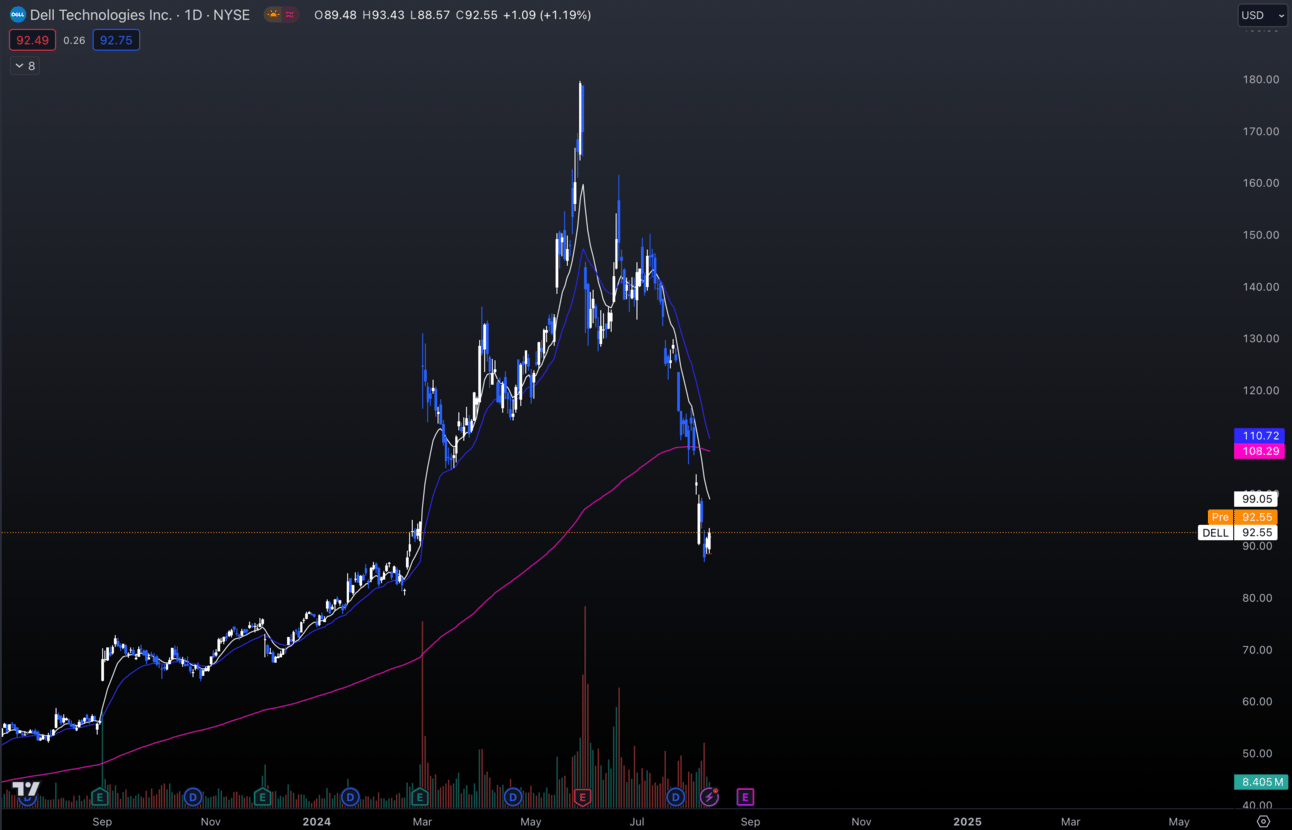

3. $DELL

$DELL Daily

$DELL has fallen off a cliff, so I thought this was a great time to pick up some shares for the first time in my long-term portfolio.

I do think it could drop more, but I wanted to start a position at these prices just in case it wanted to rip up from here.

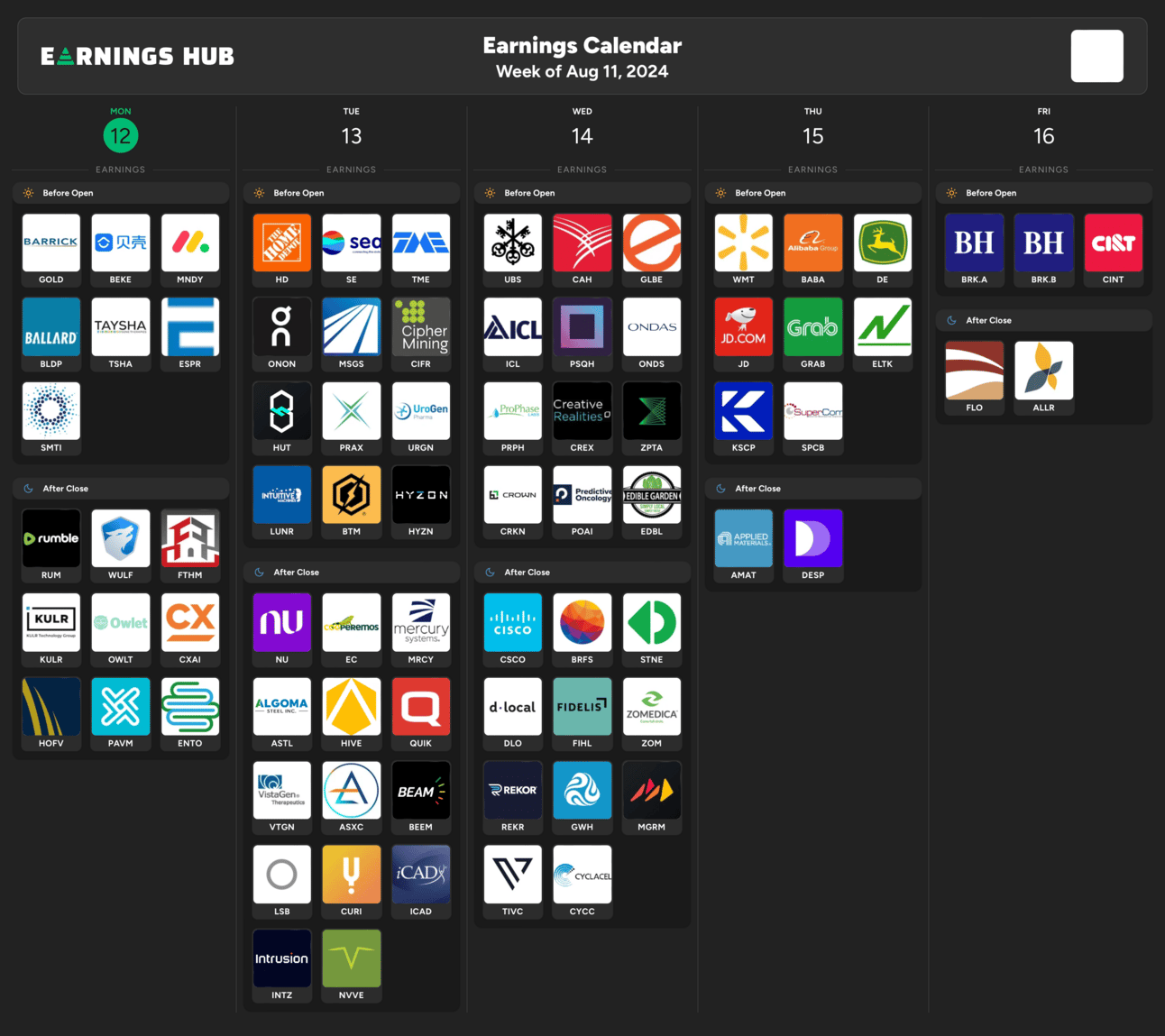

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, PPI

Wednesday 8:30 EST, CPI

Thursday 8:30 EST, Initial Jobless Claims

Thursday 10:00 EST, Business Inventories

Friday 8:30 EST, Building Permits

Friday 10:00 EST, Michigan Consumer Expectations

Trending Sectors

Software, Biotechnology, and Entertainment were at the top of the list for trending sectors last week.

Top trending tickers from last week:

$KOLD

$YANG

$TSLA

$COIN

$SPXS

$SOXS

$SQQQ

$TSN

$FRPT

$K

Have A Great Week!

As always, enjoy the week and trade safe everyone.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.