- Ace in the Hole

- Posts

- Ace in the Hole - Edition #34

Ace in the Hole - Edition #34

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the weekend and is excited for a new week!

Everything this morning is going haywire with the VIX sitting at $52.

We haven’t seen this since 2020.

Let’s dive in!

Market Thoughts

Initially I was coming into this week bullish off of the weekly 21 EMA on $SPY, but with this move down it will be opening below that level.

This changes things for me because $SPY has been holding this since October 2023.

The strategies I’ve been using to capitalize on this trending market might not work so well if the environment changes.

This is why it’s so important to be able to adapt to different trading environments and position yourself correctly according to the conditions.

Am I automatically super bearish on this market?

No, but…

The fact that we lost the EMA that we’ve been holding during this whole rally definitely has me cautious at these areas and ready to change my bias if needed.

Short-Term Setups This Week:

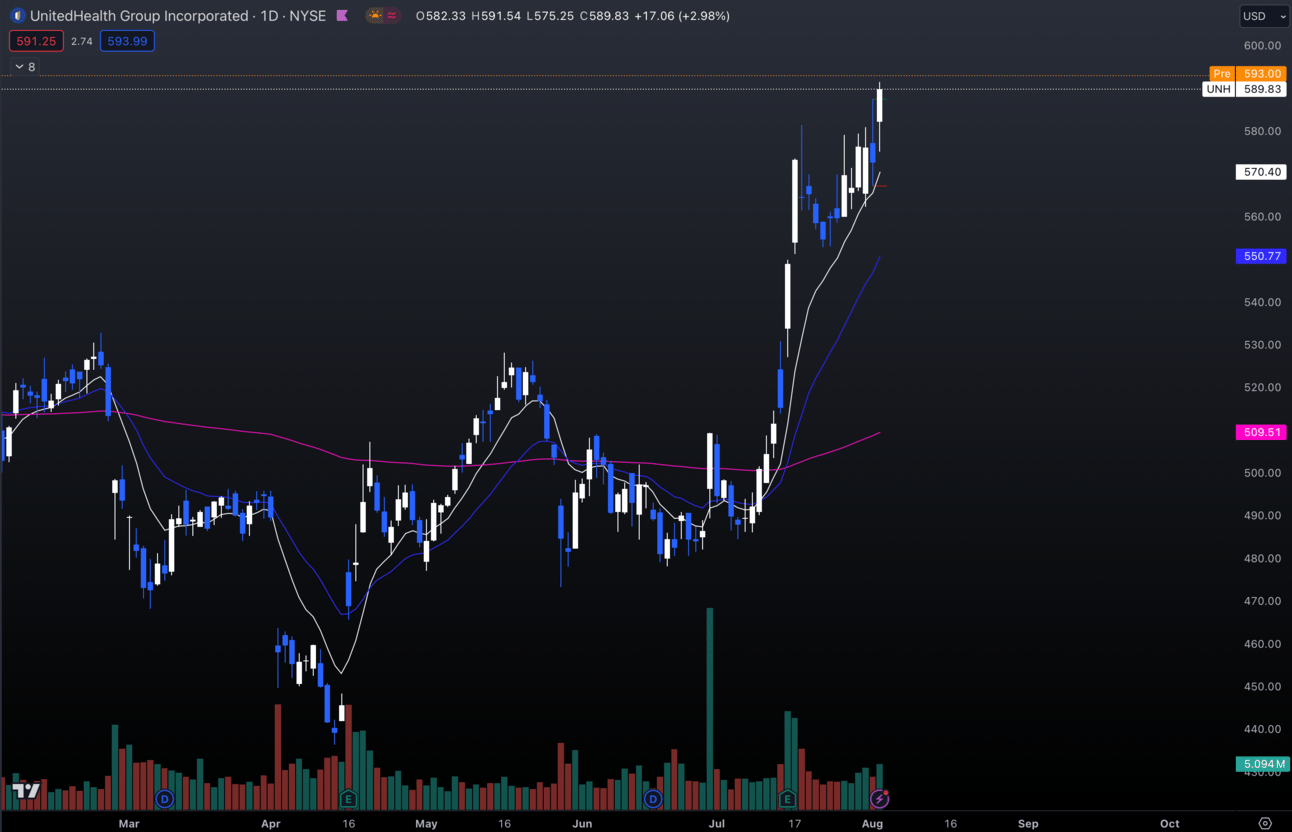

1. $UNH

$UNH Daily

$UNH is holding strength during all of this downside.

I want to see if this can get continuation to $600 and possibly above.

If you’ve already been in this, $600 is a great price target.

Under $570 I wouldn’t be long this name.

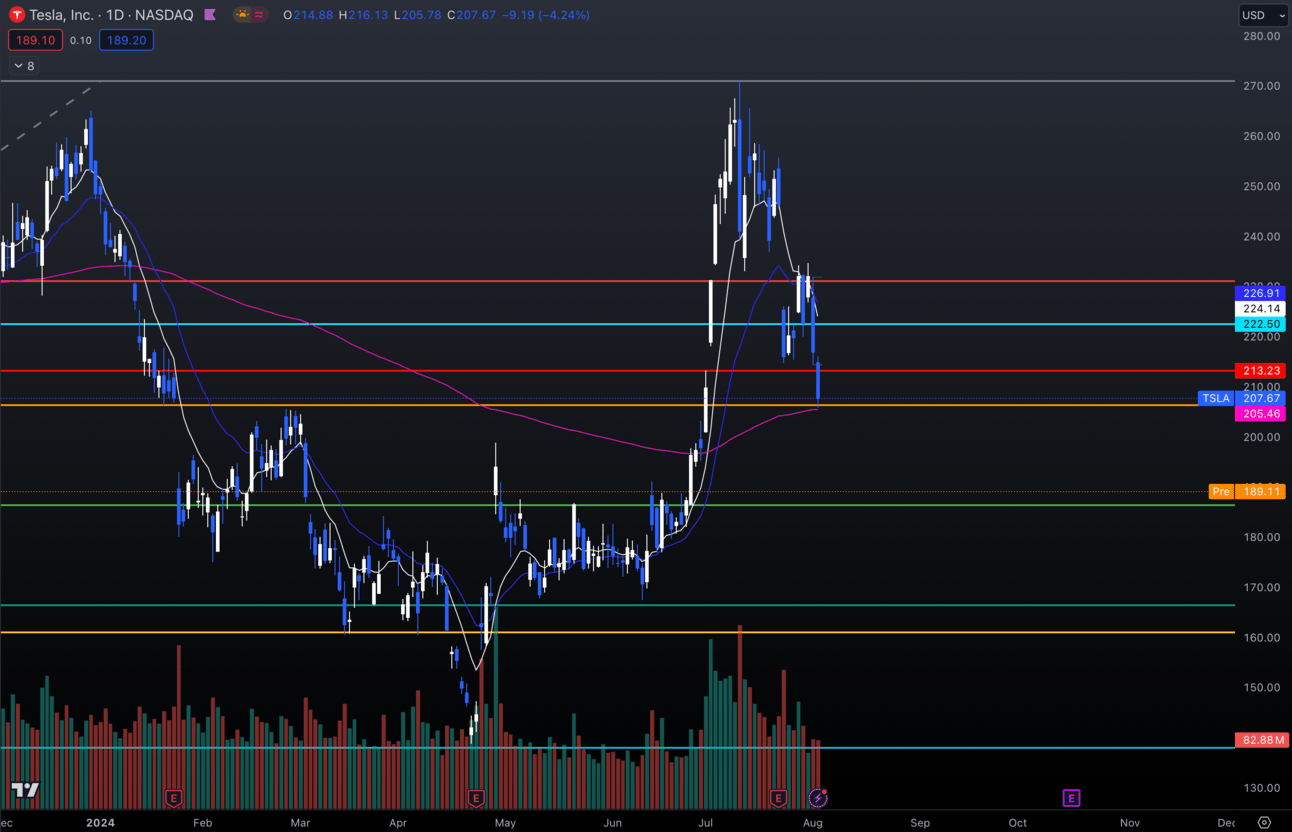

2. $TSLA

$TSLA Daily

$TSLA is dipping right back to the start of its rally.

I think it tests my .5 Fib at $186.41 and holds there.

It would be a retest of the breakout, so I do expect bulls be present off this area.

If $TSLA can’t hold that .5 Fib and gets trading under it I wouldn’t be long.

Long-Term Setups This Week:

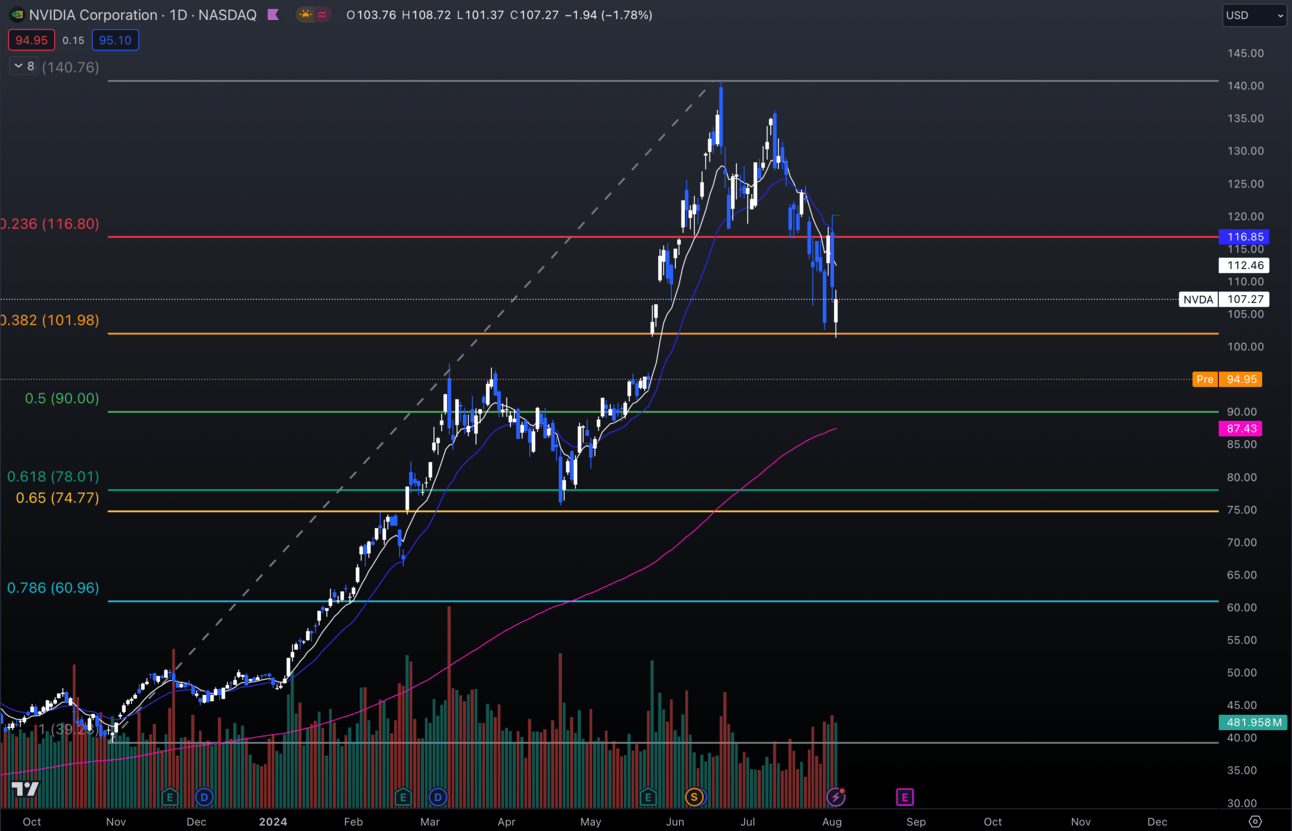

1. $NVDA

$NVDA Daily

I’ve been waiting for $NVDA to get back under $100 and retest previous all time highs.

I personally own shares much lower, but I do think this retest is a decent spot to DCA especially if you don’t own $NVDA yet.

Ultimately I think this tests $90 and if it loses that I think this goes to $75.

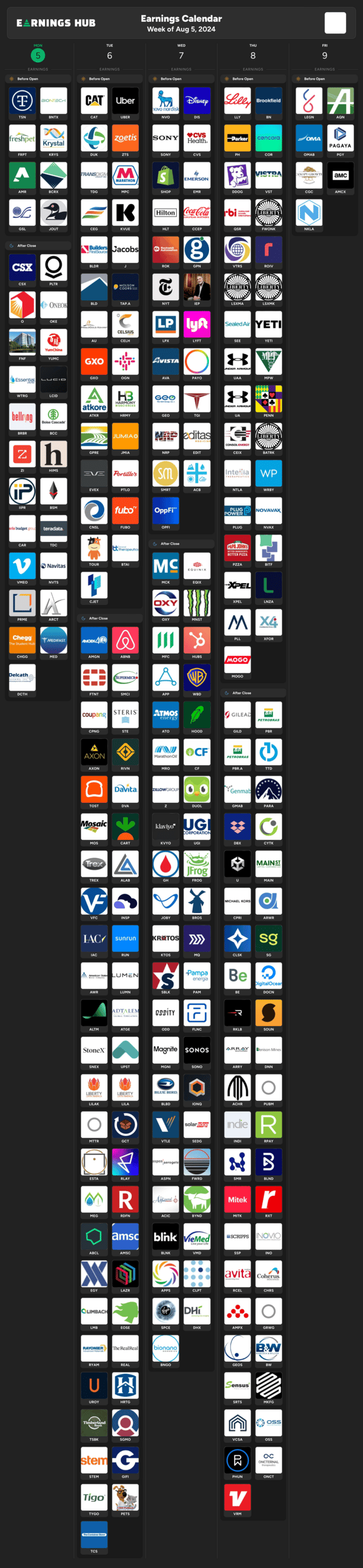

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 9:45 EST, S&P Global Services PMI

Monday 10:00 EST, ISM Non-Manufacturing PMI

Thursday 8:30 EST, Initial Jobless Claims

Trending Sectors

Telecom, Healthcare, and Utilities have been outperforming over the past week.

Top trending tickers from last week:

$NVDA

$TSLA

$CRWD

$AZTR

$MSFT

$SERV

$AAPL

$RGC

$GOOGL

$AMZN

Have A Great Week!

I hope everybody stays safe this week and I hope you have some great trades!

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.