- Ace in the Hole

- Posts

- Ace in the Hole - Edition #33

Ace in the Hole - Edition #33

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend!

Another big week of earnings reports and economic data, so let’s dive in!

Market Thoughts

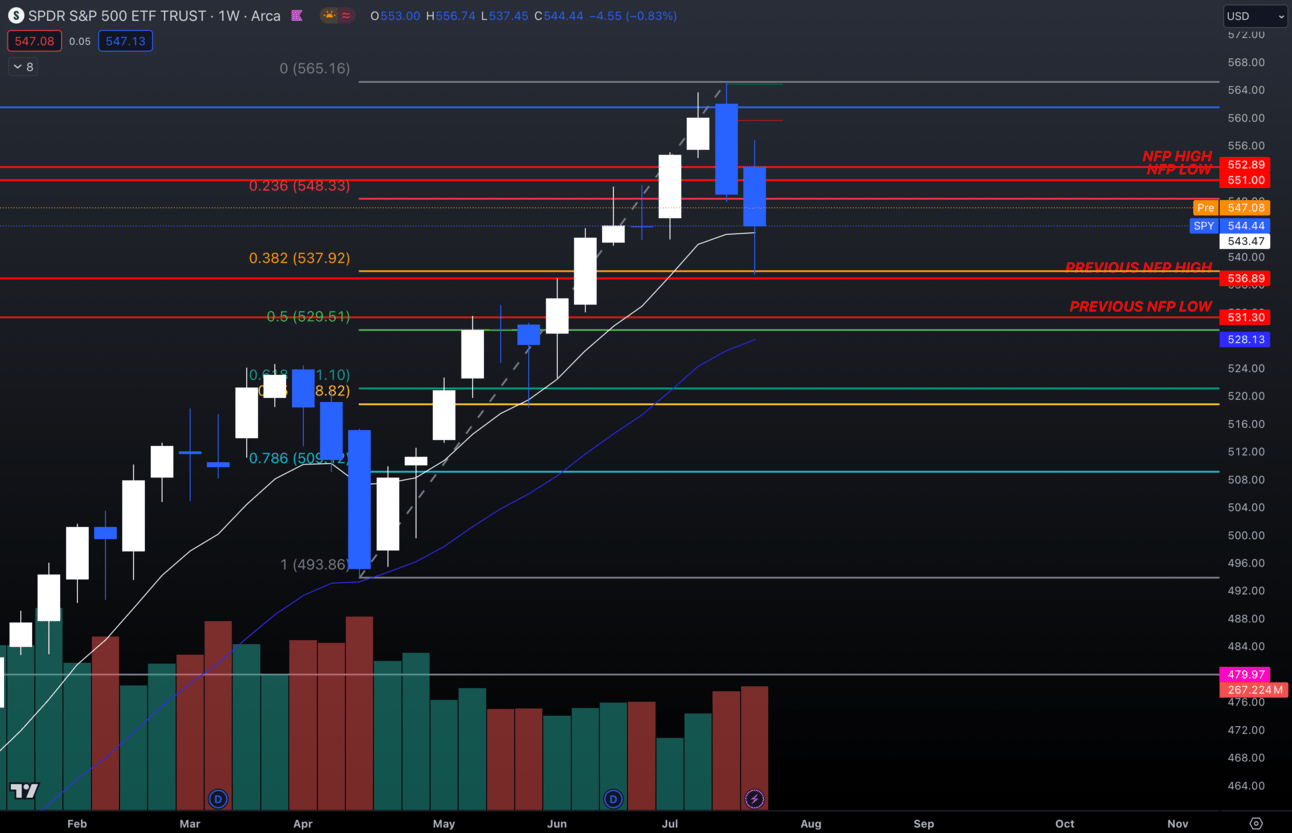

Since all time highs, $SPY has pulled back a total of 2.79% in the past 2 weeks.

Also the first 2 red weeks since May.

I’m personally still feeling bullish with $SPY holding its weekly 9 EMA and my .382 Fib.

$SPY Weekly

I have no reason to be bearish here. Even if $SPY broke down to that $524.60 area I still think everything would be fine.

Short-Term Setups This Week:

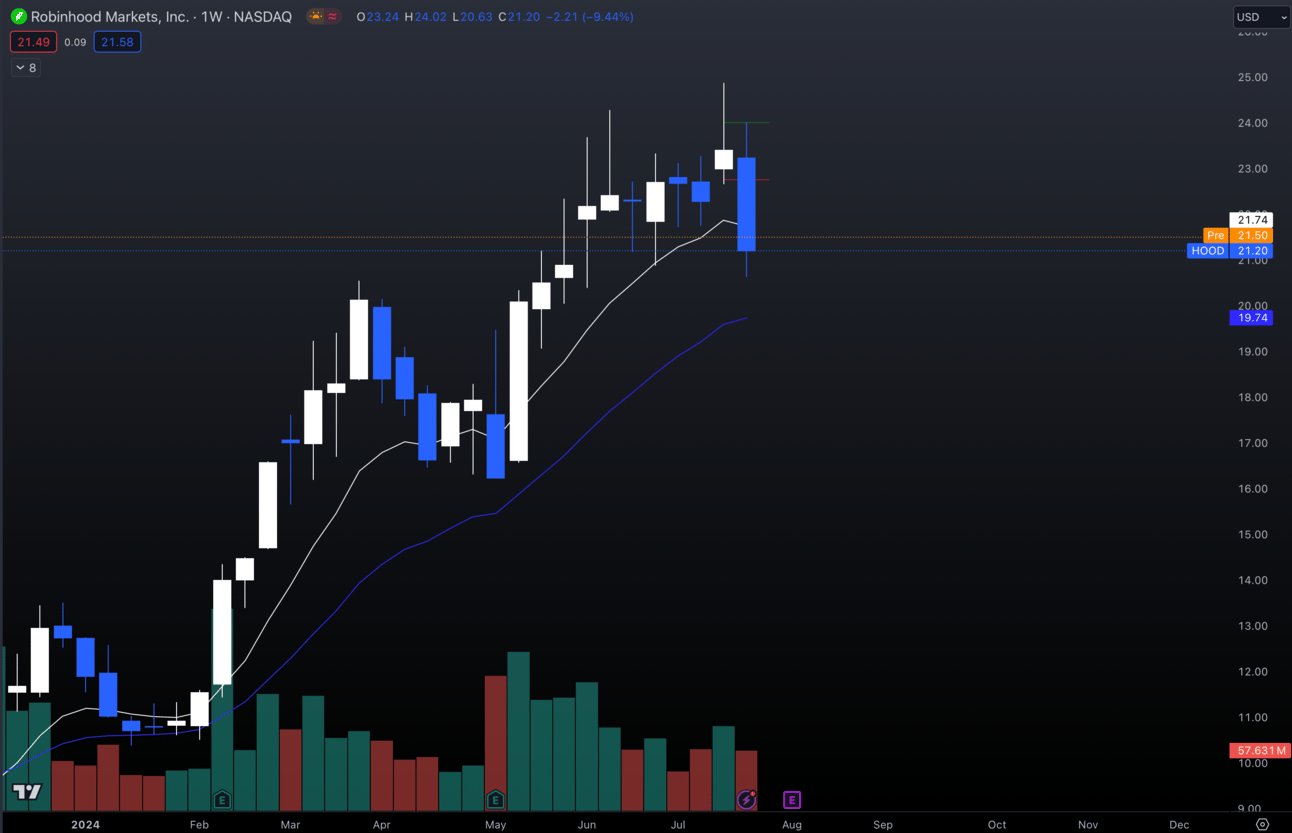

1. $HOOD

$HOOD Weekly

I like this dip down towards the 21 EMA which has been holding up on $HOOD.

I’d like to see this hold $19.74 and retrace back to recent highs.

Under that 21 EMA, my thesis gets invalidated.

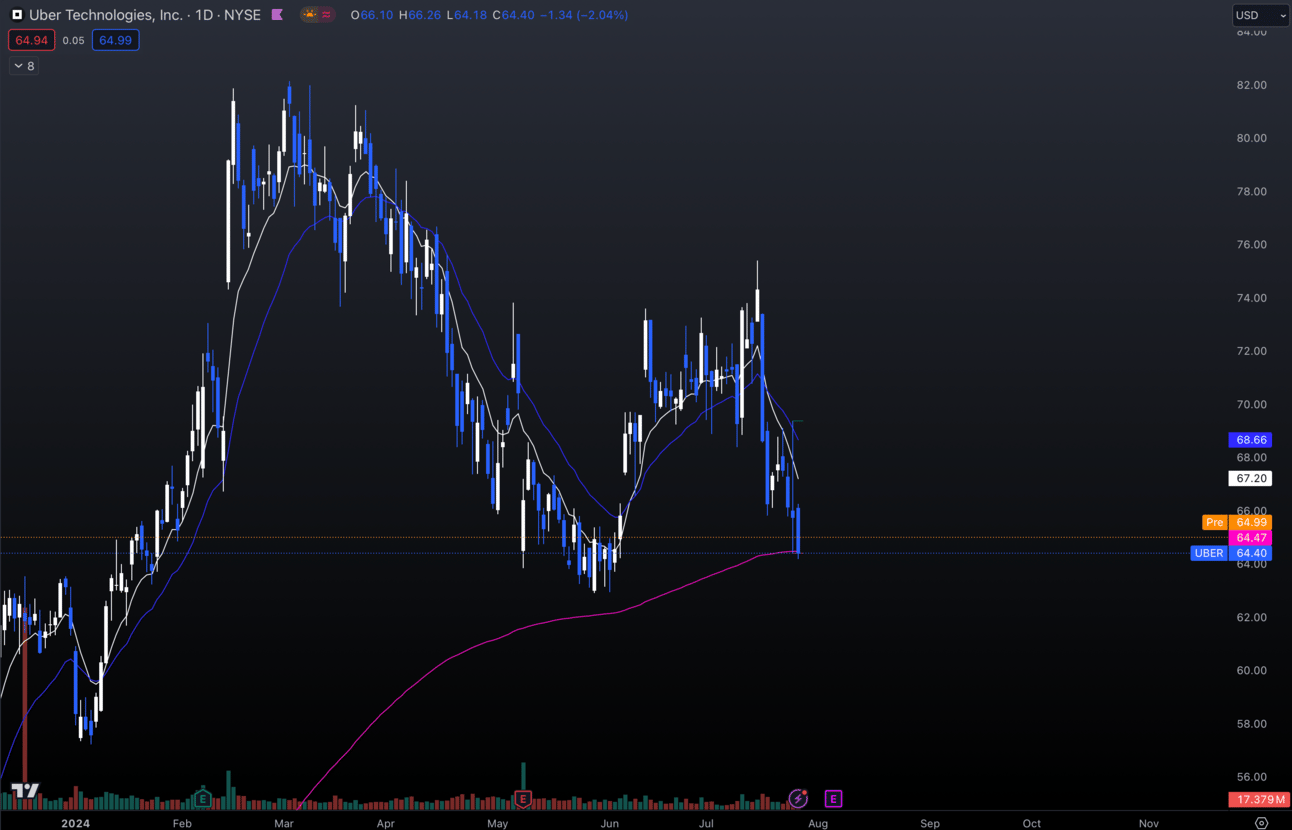

2. $UBER

$UBER Daily

I’m liking $UBER at this daily 200 EMA for a bounce to make a higher low at this range.

This ideally needs a decent bounce on Monday to start the week.

Above $64 and I want to be long this name, but if it loses that $64 my thesis would be invalidate.

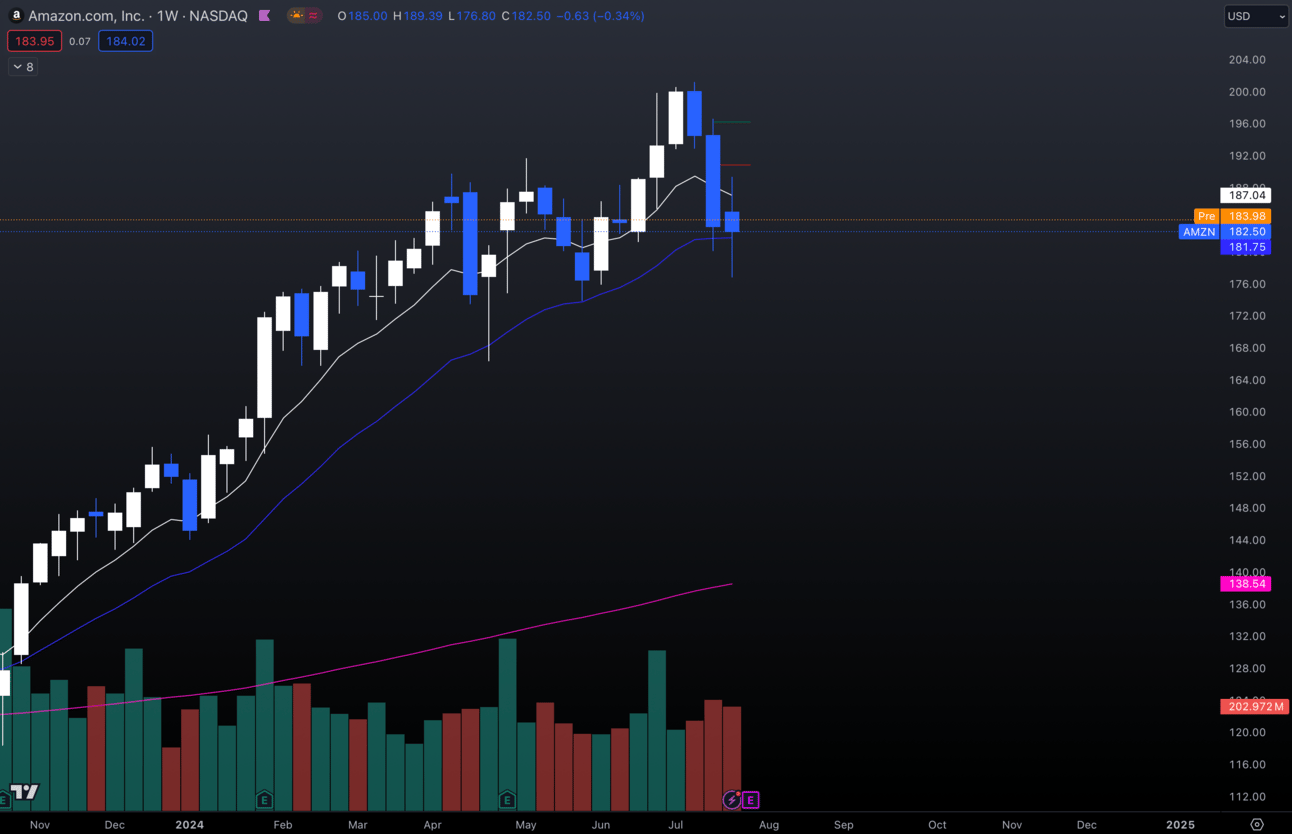

3. $AMZN

$AMZN Weekly

$AMZN is still holding this 21 EMA on the weekly.

I cannot be bearish until this breaks with momentum.

Earnings coming up on this name as well, so that could be a bit of a catalyst, but I still like this long until the weekly 21 EMA breaks with momentum.

Long-Term Setups This Week:

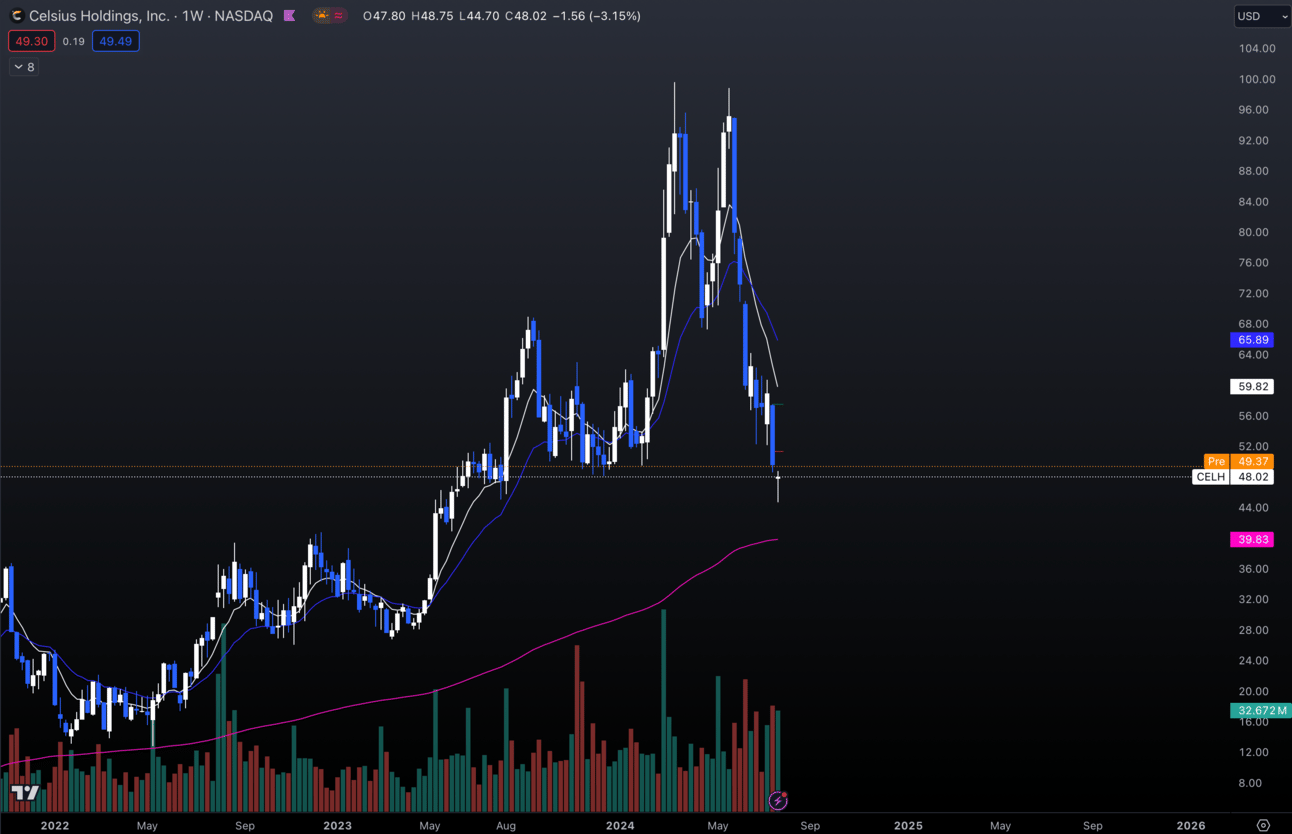

1. $CELH

$CELH Weekly

I haven’t touched $CELH in a while, but I do think these prices are pretty solid to pick up some shares in the long-term.

For a while I was buying every time this dropped below $50 and it looks like its trying to hold up around $45.

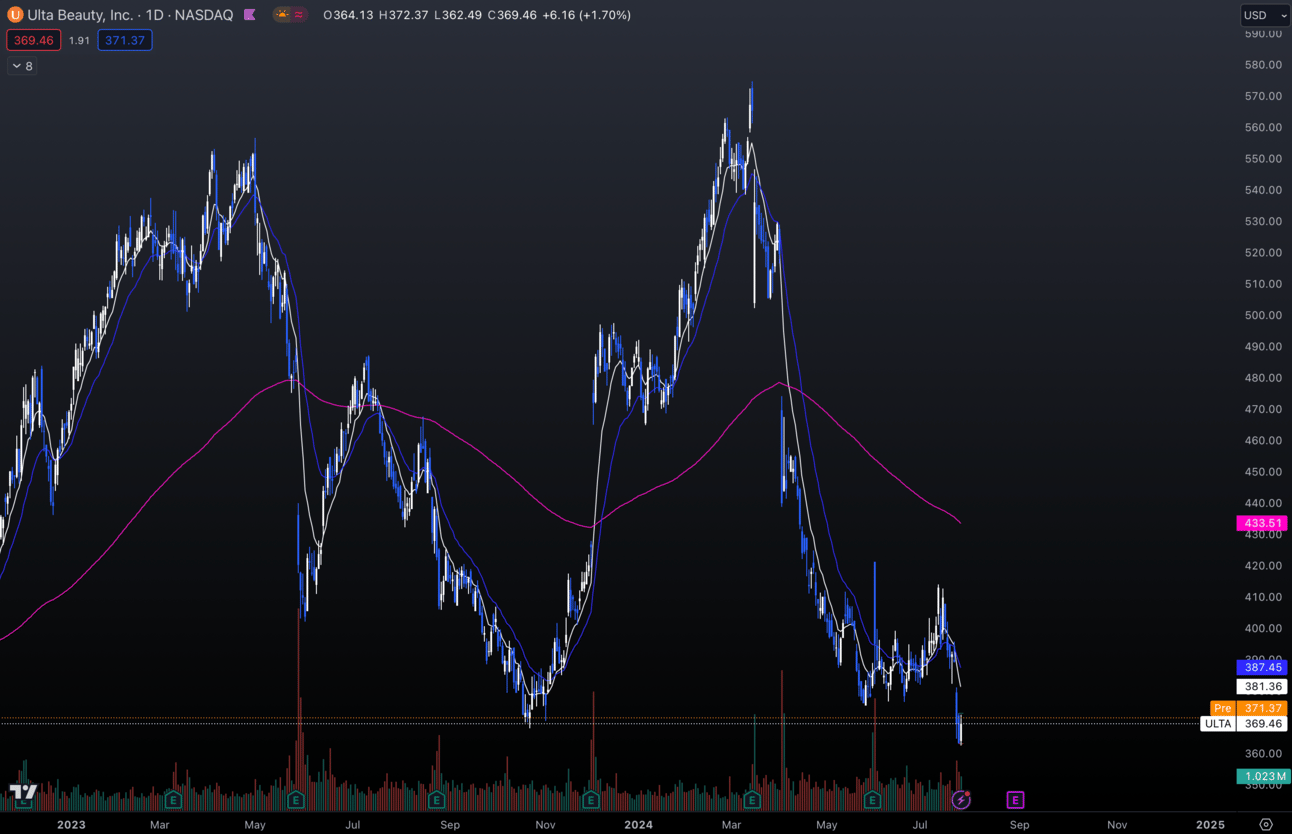

2. $ULTA

$ULTA Daily

$ULTA ended up breaking its daily base to the downside, but I still like these prices for long-term adds.

Not a ton out there for me that I’d be buying at these levels.

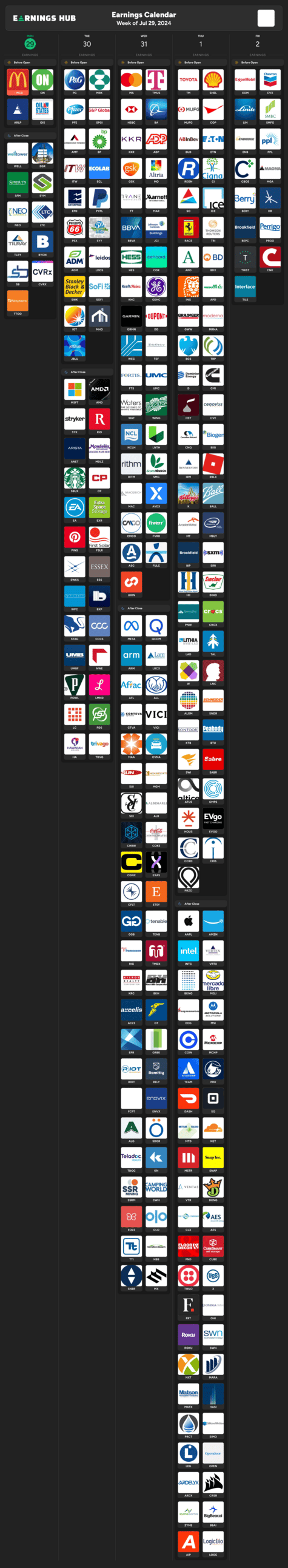

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, CB Consumer Confidence

Tuesday 10:00 EST, JOLTs Job Openings

Wednesday 9:45 EST, Chicago PMI

Wednesday 2:00 EST, FOMC Statement

Wednesday 2:30 EST, FOMC Press Conference

Thursday 10:00 EST, ISM Manufacturing PMI

Friday 8:30 EST, Nonfarm Payrolls

Trending Sectors

Technology, Healthcare, and Communication Services were at the top of the list for trending sectors last week.

Top trending tickers from last week:

$NVDA

$TSLA

$CRWD

$AZTR

$MSFT

$SERV

$AAPL

$RGC

$GOOGL

$AMZN

Have A Great Week!

I hope everybody trades safe and has an amazing week.

Let’s kill it and make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.