- Ace in the Hole

- Posts

- Ace in the Hole - Edition #32

Ace in the Hole - Edition #32

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the weekend and got some time away from the charts.

We have a big week ahead of us in terms of economic data and earnings reports, so get ready!

Market Thoughts

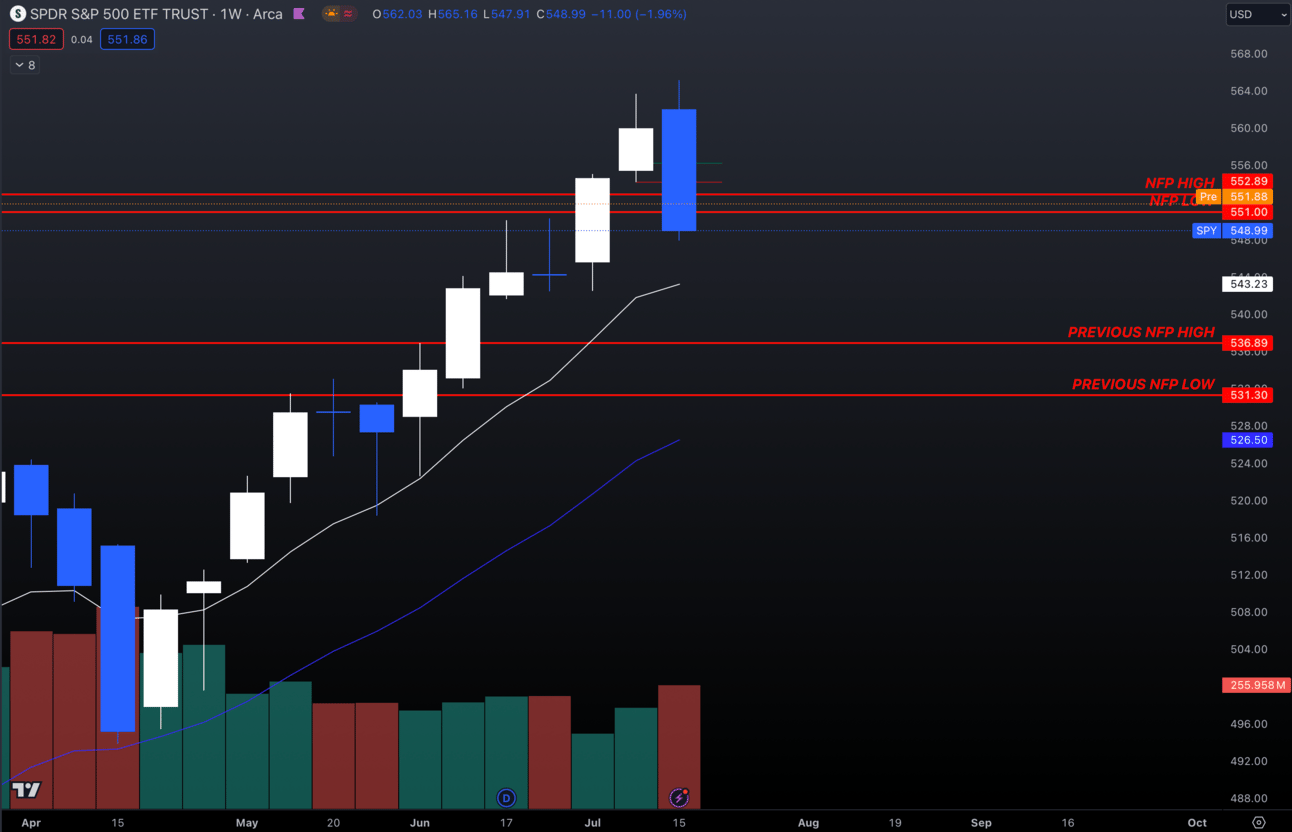

$SPY has finally started a bit of a pullback dropping 1.96% last week.

Most people have been freaking out seeing the red, I’m personally still bullish and will continue to play the majority of my positions on the call side.

Nothing about the charts has told me that there will be a reversal to the downside yet with $SPY not even touching the weekly 9 EMA.

$SPY Weekly

Trading some short-term puts intraday when the downside is there isn’t a bad idea in my opinion, but ultimately I will be a buyer off of these dips.

The reality is that $SPY could dip down to my weekly 21 EMA at 526.50 and the uptrend would still be intact.

Short-Term Setups This Week:

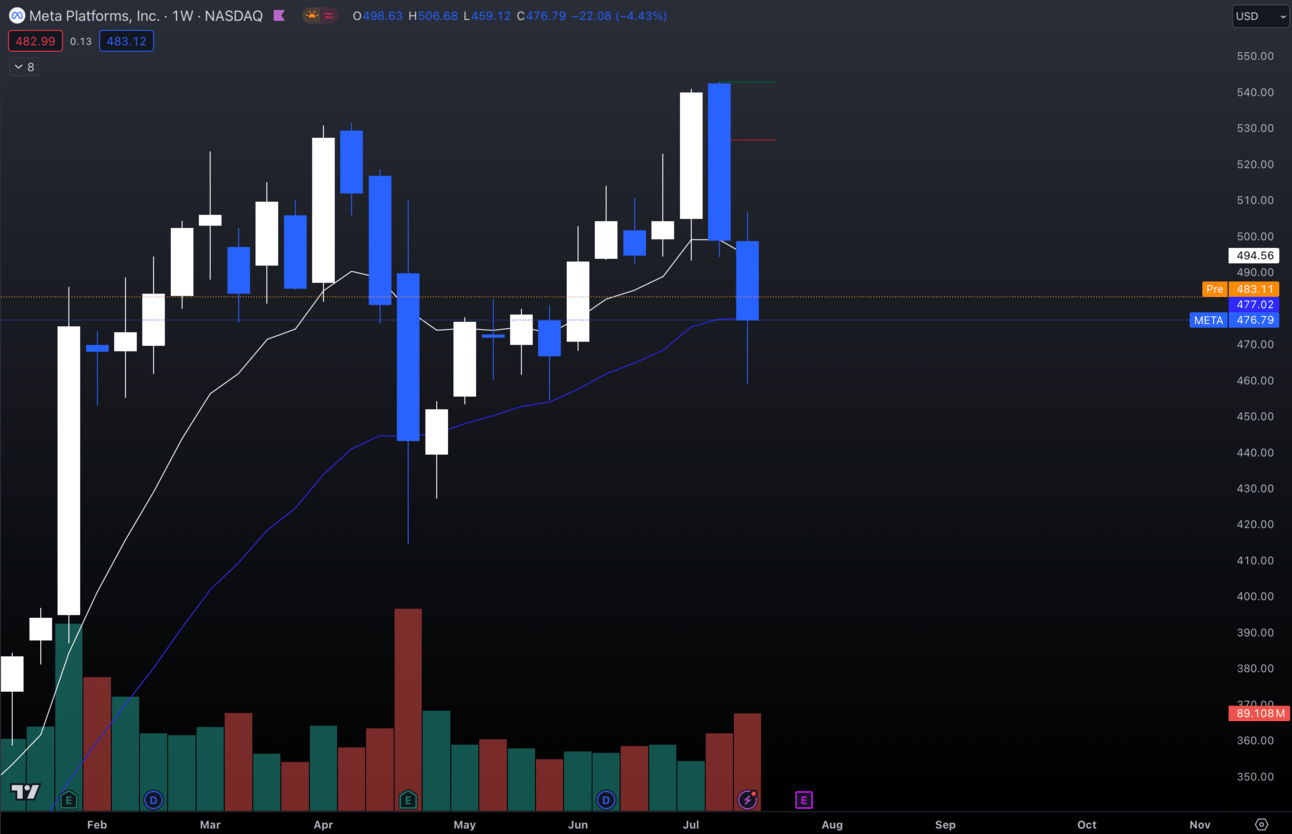

1. $META

$META Weekly

$META has dipped to its weekly 21 EMA and I see buyers there.

I’m personally long this name and want to continue to be long as long as it is holding this 21 EMA.

I think a retracement back to highs from here would make sense.

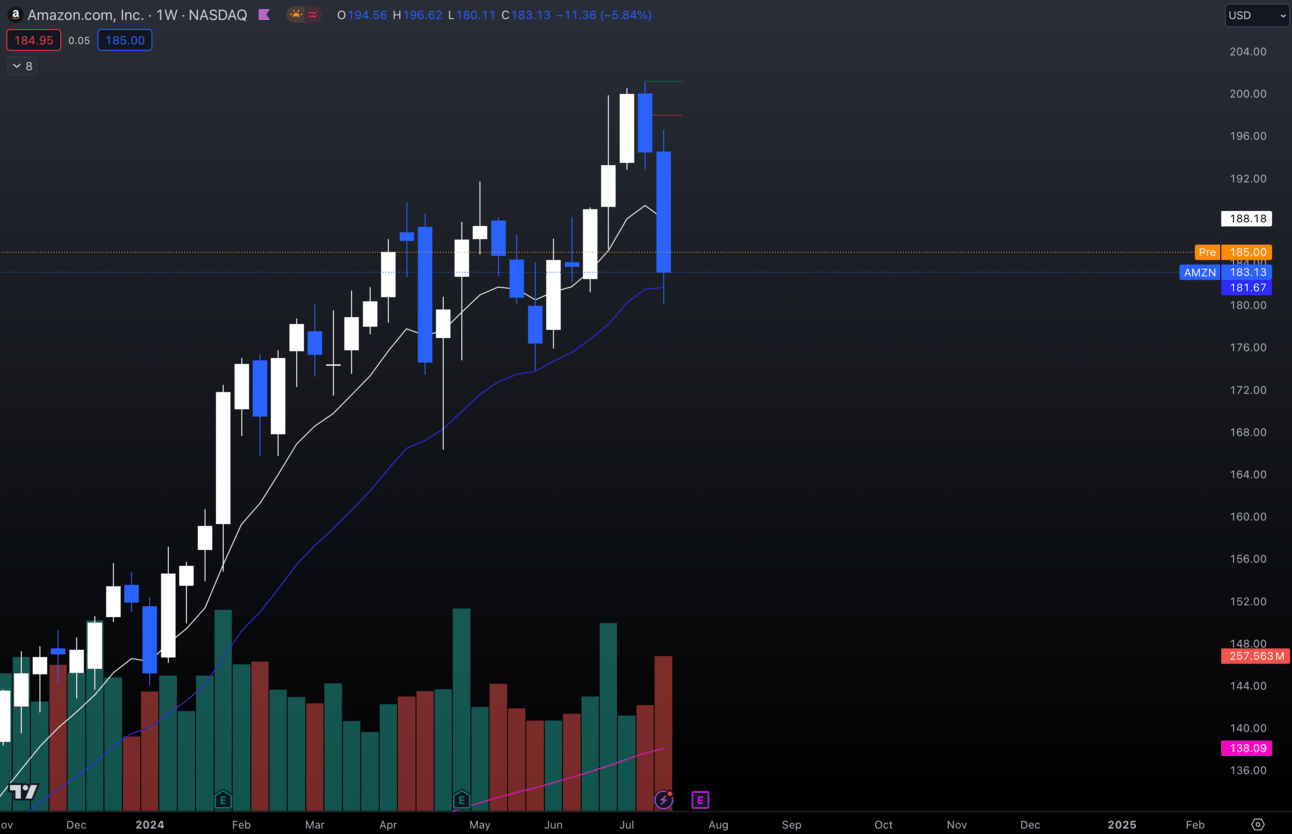

2. $AMZN

$AMZN Weekly

Very similar setups on $AMZN here, so I’m playing it the same.

As long as it’s holding my 21 EMA I want to be long.

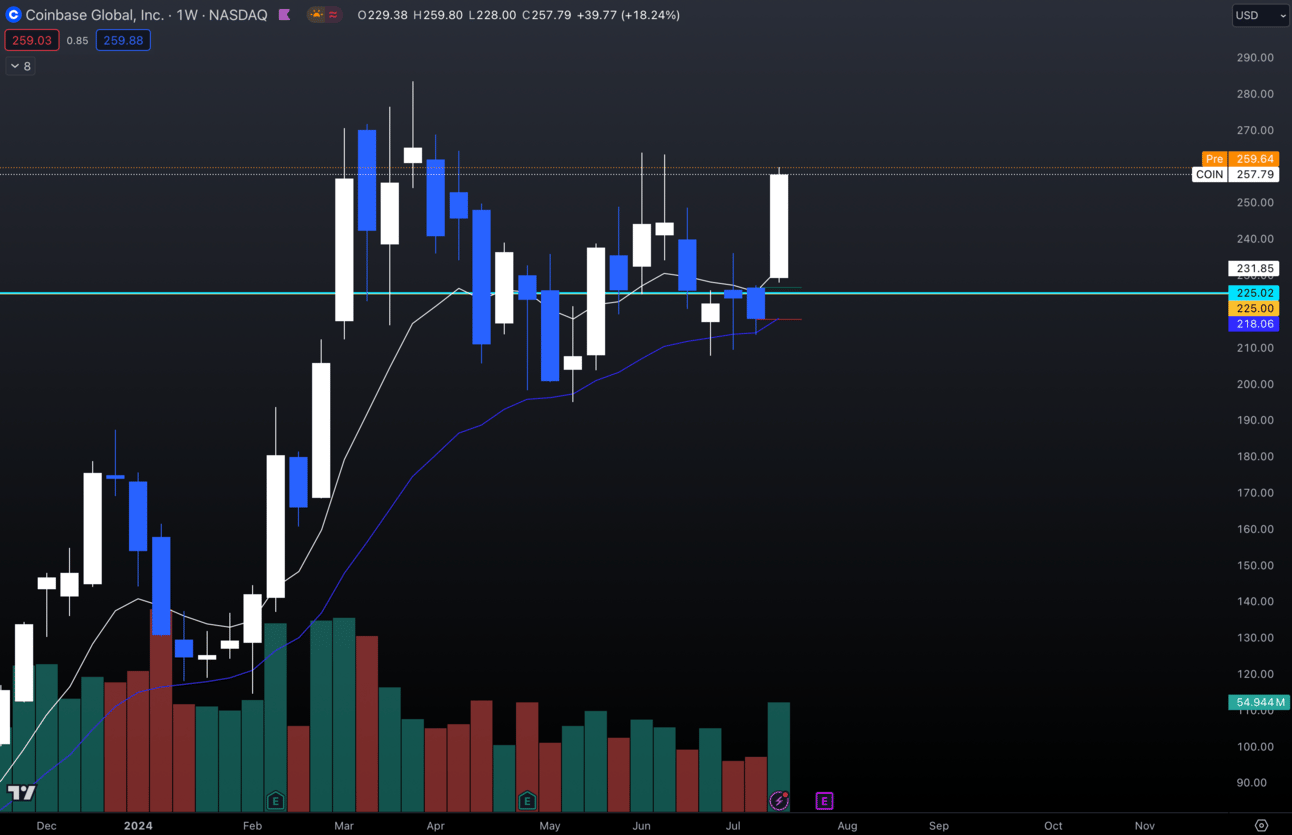

3. $COIN

$COIN Weekly

$COIN has done very well from my 21 EMA play, but I want to see if this can keep continuing.

Looking to see this break $264 and maybe even head to new highs.

Let’s see if we get continuation this week into this name.

Long-Term Setups This Week:

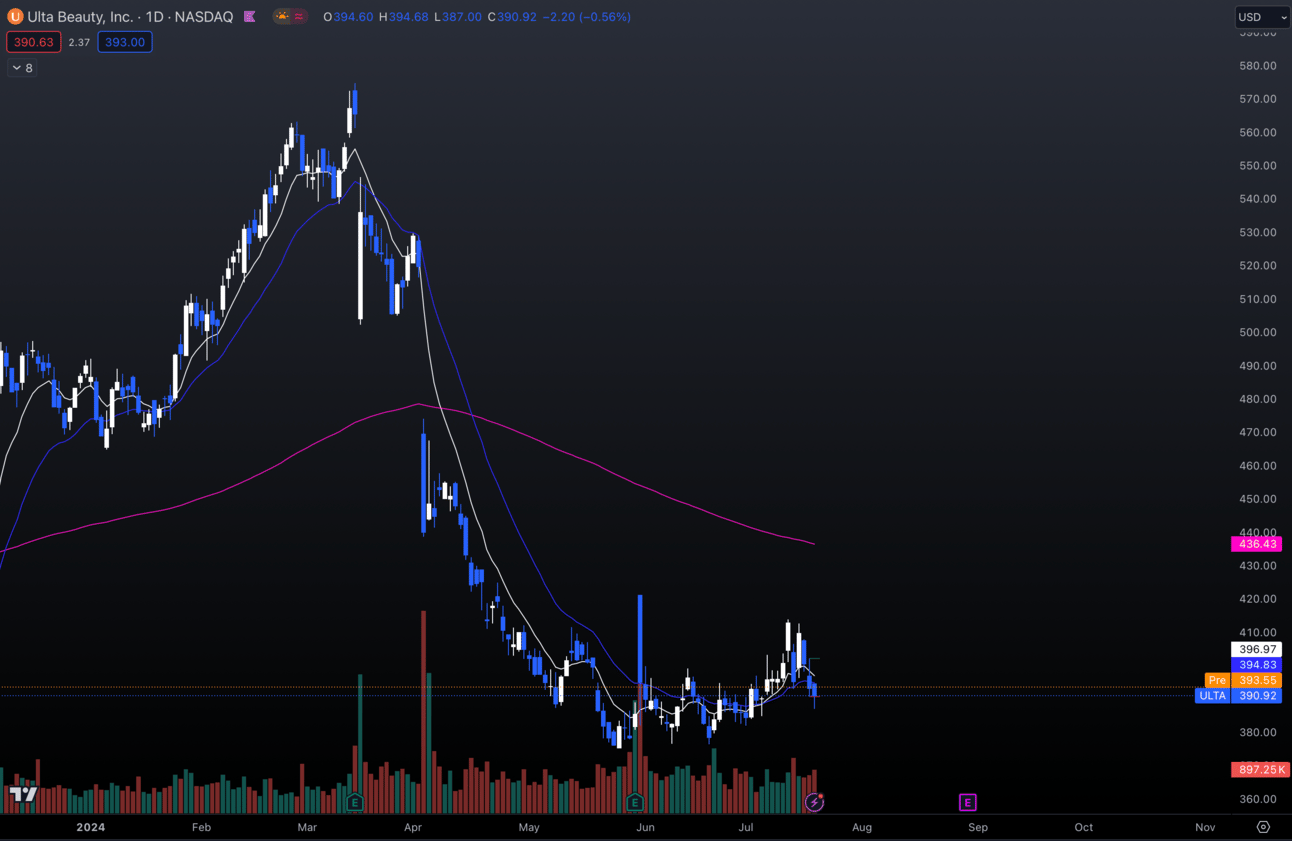

1. $ULTA

$ULTA Daily

$ULTA again for the long-term picks.

There aren’t many stocks that I have interest in that are at decent areas to add.

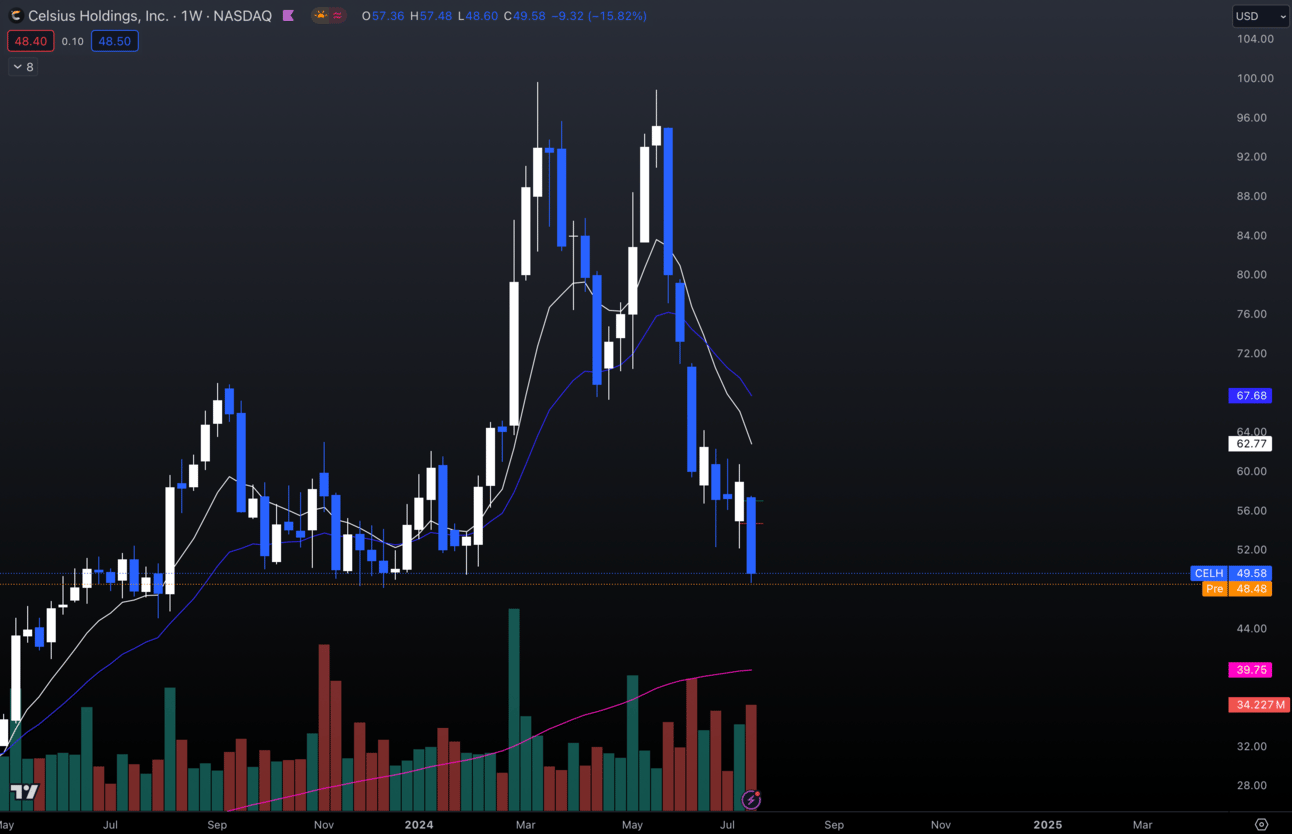

2. $CELH

$CELH Weekly

Every time $CELH gets under $50, I like to add some to my long-term portfolio.

It’s giving another chance to secure some shares under $50 here.

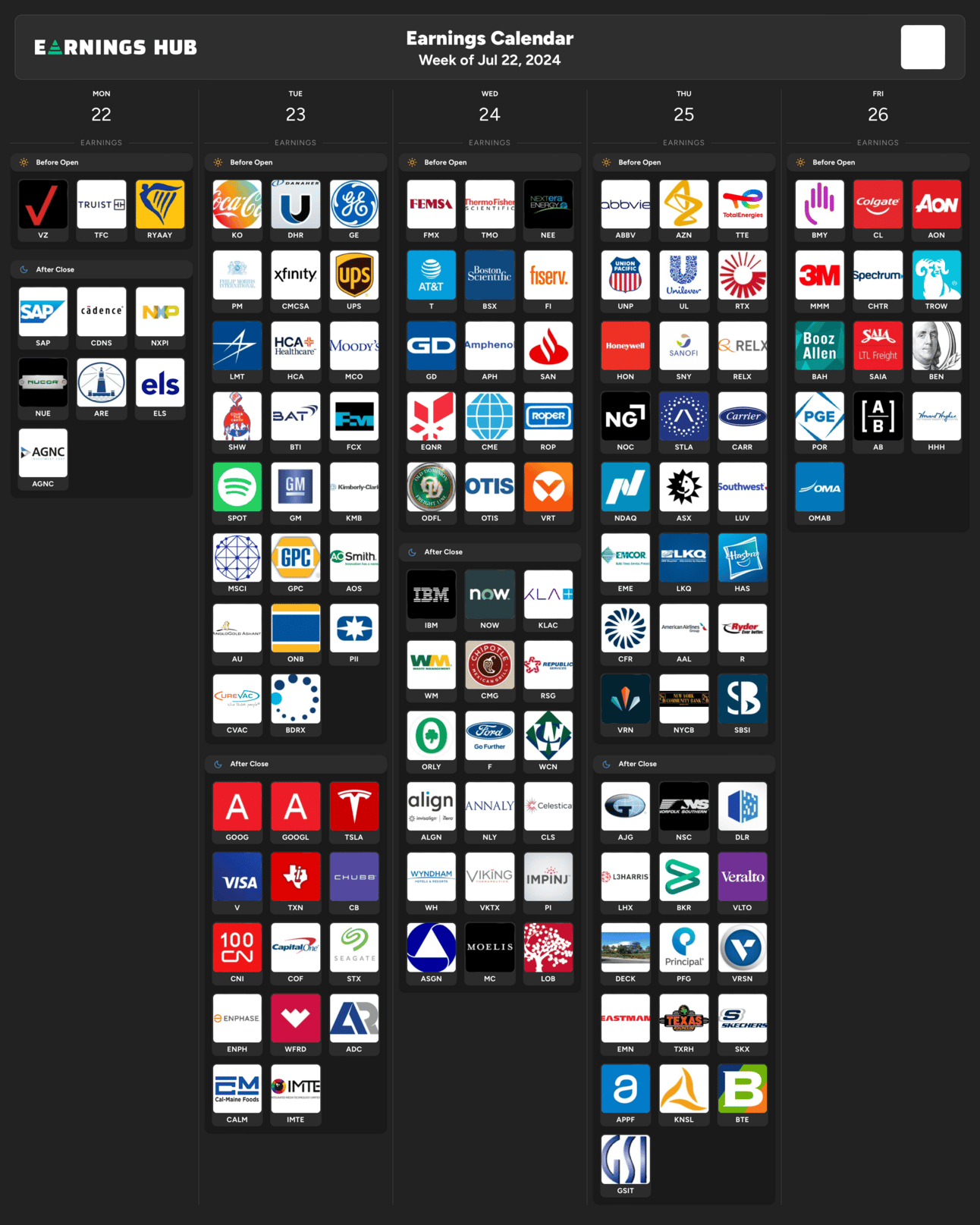

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, Existing Home Sales

Wednesday 9:45 EST, S&P Global Services PMI

Wednesday 10:00 EST, New Home Sales

Thursday 8:30 EST, GDP

Friday 8:30 EST, PCE

Trending Sectors

Commercial Real Estate, Information Technology, Consumer Staples, Financials, and Energy were the top trending sectors last week.

Top trending tickers from last week:

$TSLA

$AAPL

$AMZN

$DJT

$META

$NVDA

$QQQ

$SMCI

$WAY

$TSMC

Have A Great Week!

I hope everybody trades safe and has an amazing week.

Let’s kill it and make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.