- Ace in the Hole

- Posts

- Ace in the Hole - Edition #30

Ace in the Hole - Edition #30

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the weekend!

It’s looking like it will be a good week with lots of catalysts from data and earnings kicking back off.

Let’s dive in!

Market Thoughts

$SPY has continued to be unstoppable gaining 1.91% last week.

Again there have been times where I have been cautious, but I haven’t flipped bearish because the market is clearly telling us it wants to go higher.

Until I see a real reason to be bearish on this market, I will continue to play with the trend.

$SPY’s new ATH is now $555.05.

Short-Term Setups This Week:

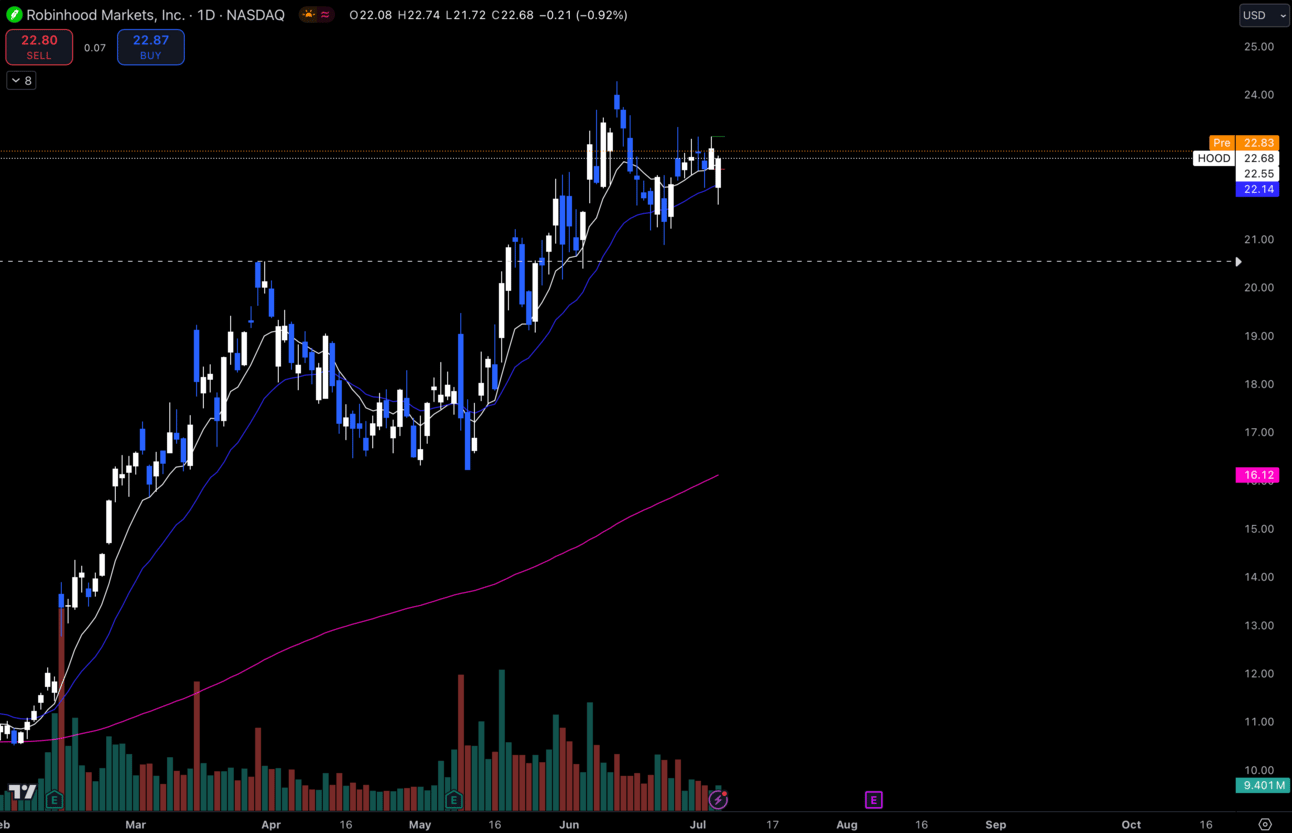

1. $HOOD

$HOOD Daily

$HOOD took a dip to its daily 21 EMA where there were buyers previously and made a higher low.

I like this for longs as long as it is holding that daily 21 EMA at $22.14

Friday on the dip would’ve been the best R/R, but I don’t think it’s a bad entry here.

I think this could go back to highs from here and potentially breakout.

Under the 21 EMA and my thesis is invalidated.

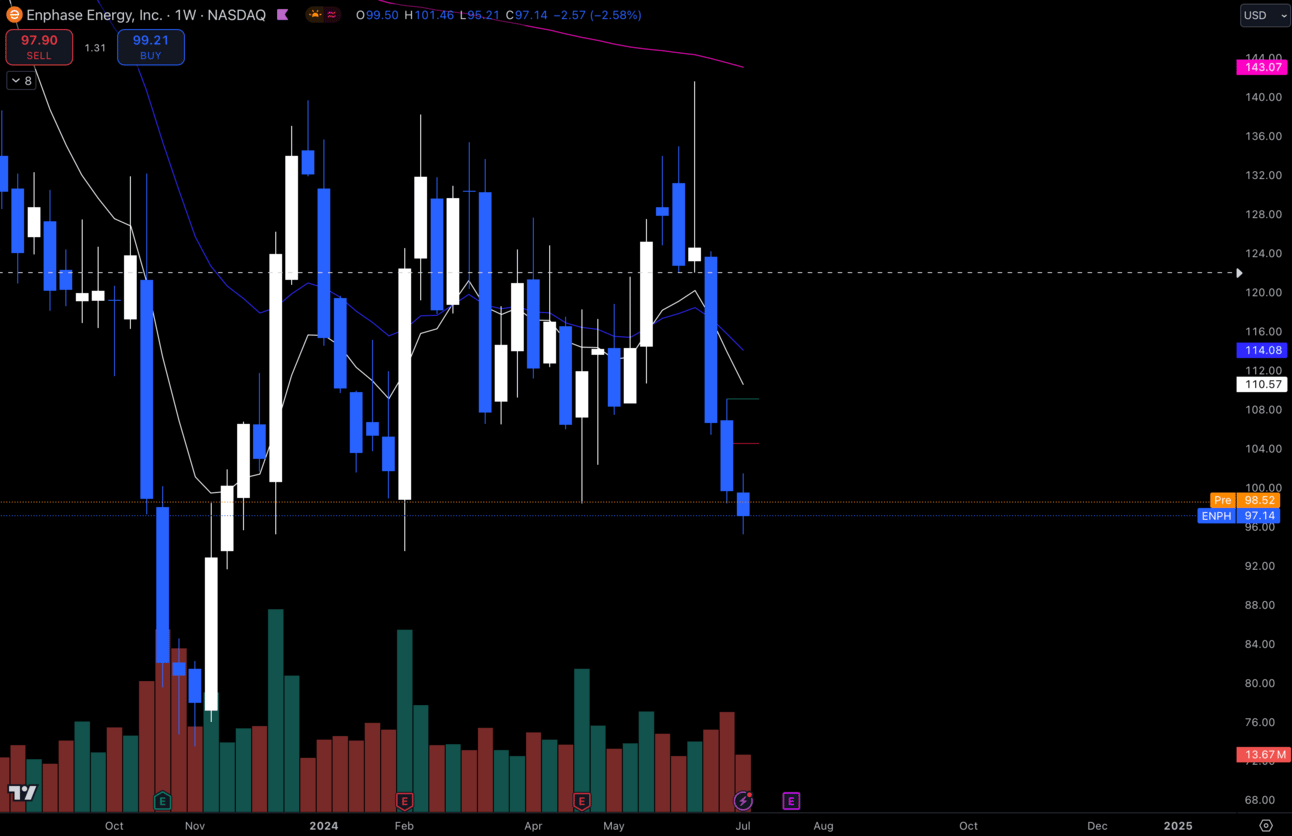

2. $ENPH

$ENPH Weekly

$ENPH has dipped just back under $100 at a big weekly support.

I’m interested in it here and have some calls, but I’m not super confident with this play just yet.

I want to see more momentum off of the lows this week.

Under $93.50 and my thesis is invalidated.

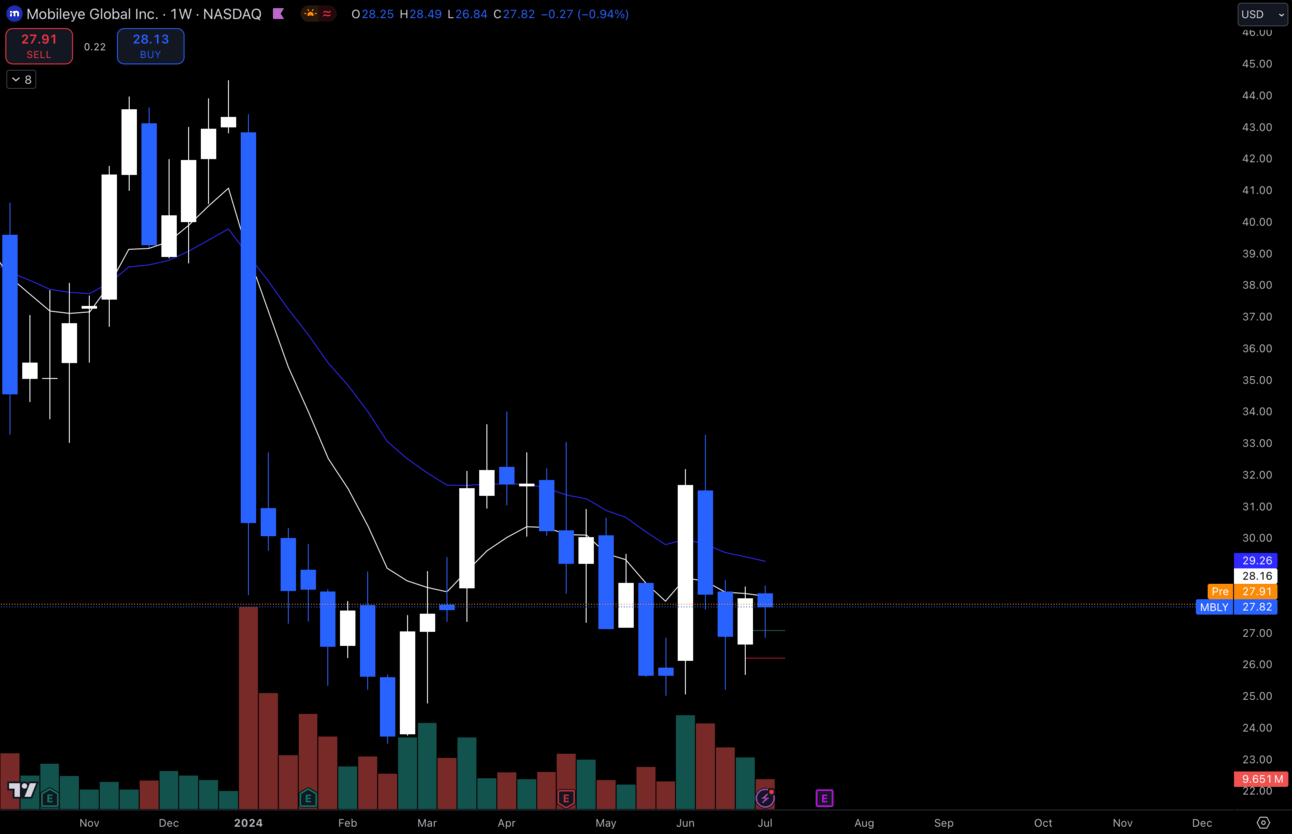

3. $MBLY

$MBLY Weekly

$MBLY has been consolidating down here, but I think it’s ready to pop soon.

I like the higher lows on the weekly, but ideally it needs to keep holding that $28 and get some momentum going to the upside.

Under $26.50 I wouldn’t be long anymore.

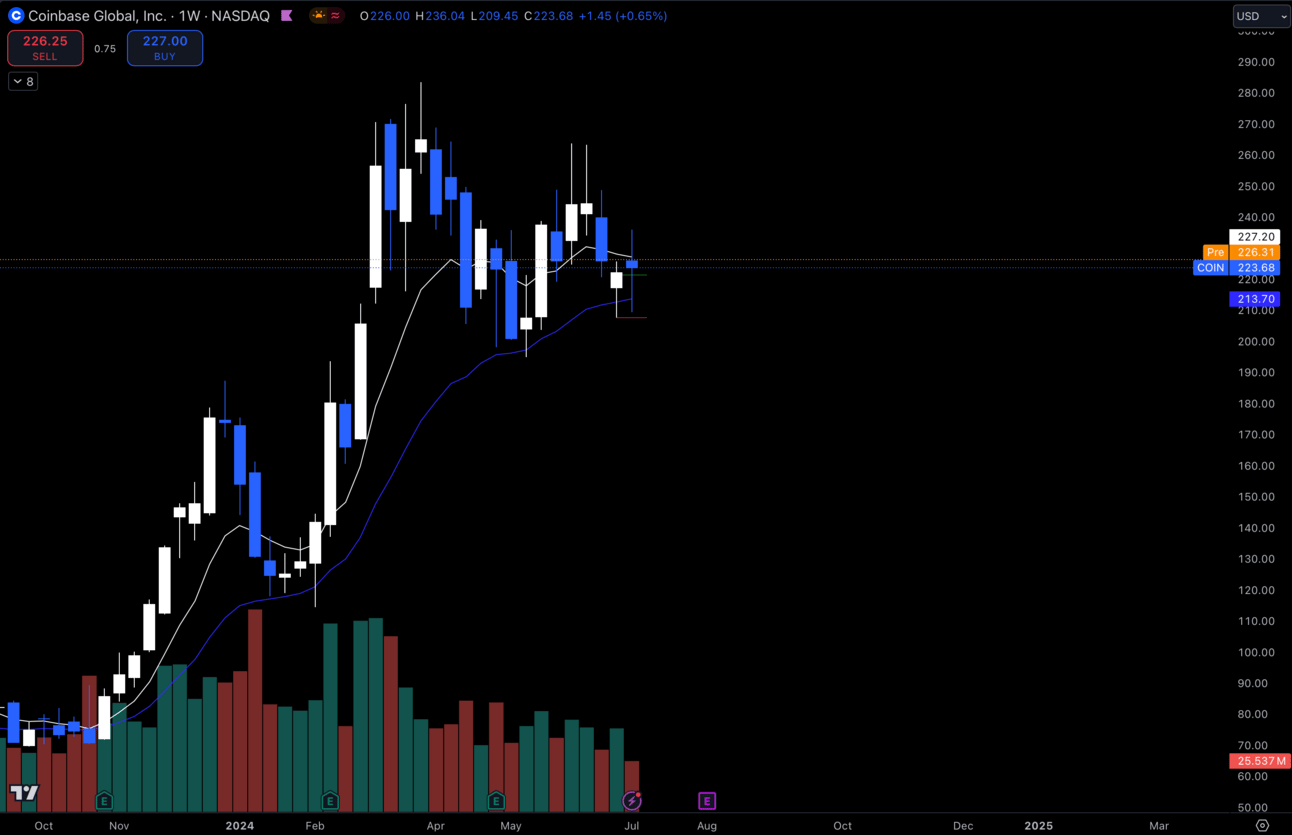

4. $COIN

$COIN Weekly

Similar to $HOOD, $COIN has dipped to its weekly 21 EMA and is holding so far trying to make a higher low.

I like calls down here as long as it’s holding that 21.

I’d target recent highs on the weekly, if this gets under the 21 EMA my thesis is invalidated.

Long-Term Setups This Week:

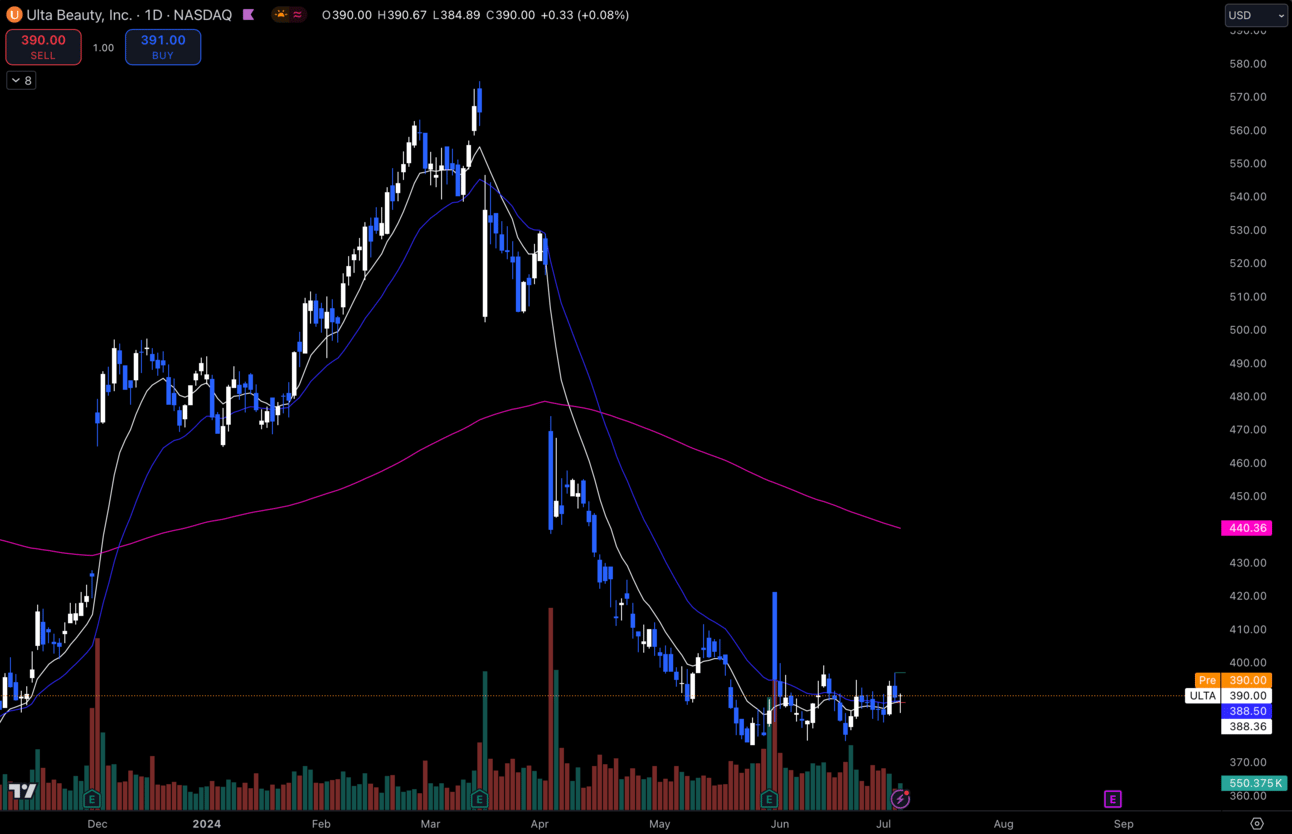

1. $ULTA

$ULTA Daily

I still like $ULTA down here at this base for longer term adds.

Same as the previous weeks.

I’d be careful if this got under $377.

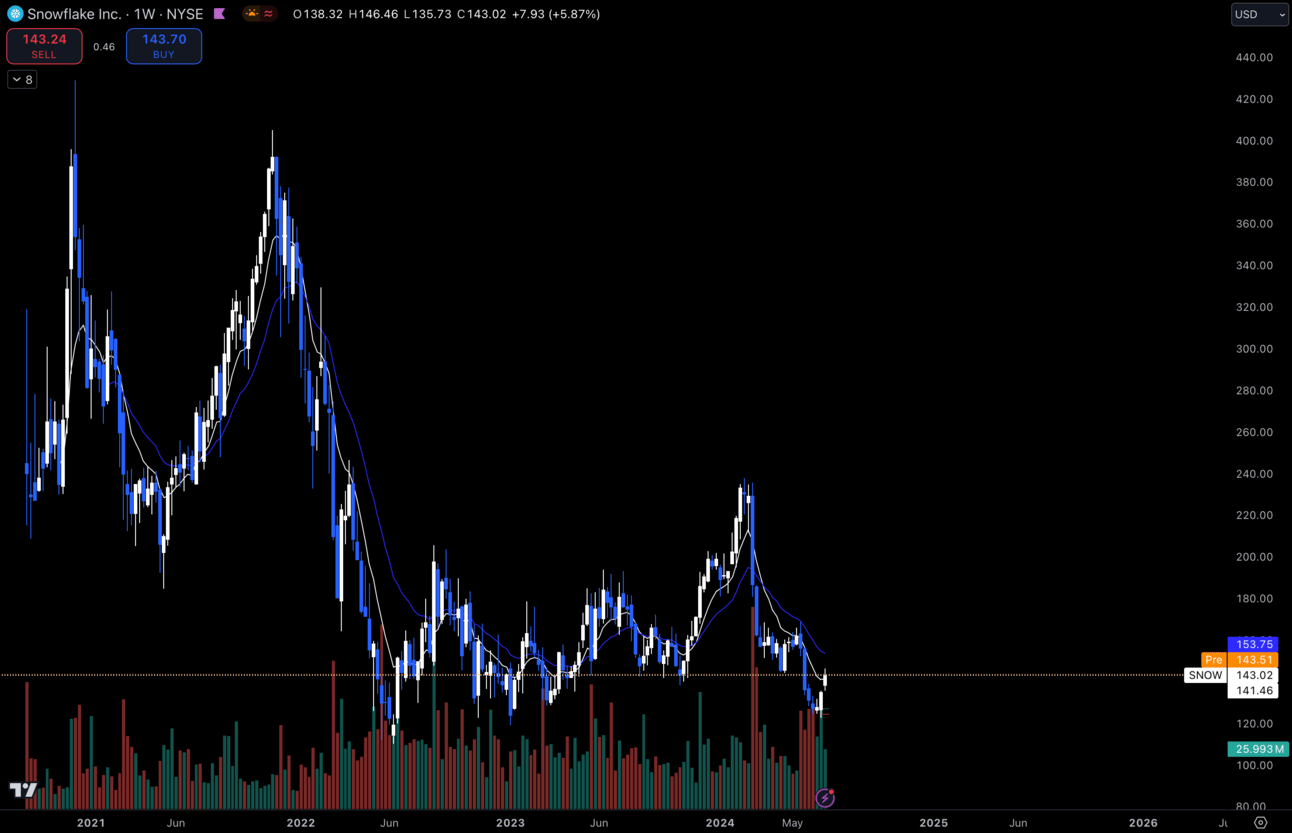

2. $SNOW

$SNOW Weekly

I’m starting to like $SNOW again at these levels and I think I will be picking some up this week.

Decent momentum off of the lows, but either way I think owning more $SNOW at these prices can be a solid opportunity.

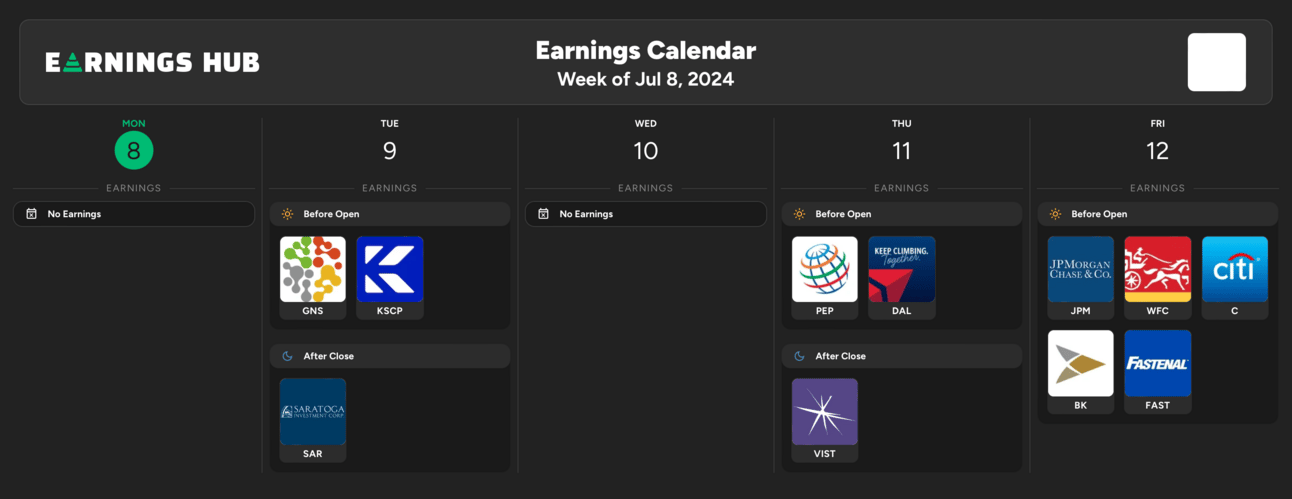

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, Fed Chair Powell Testifies

Wednesday 10:00 EST, Fed Chair Powell Testifies

Thursday 8:30 EST, CPI

Friday 8:30 EST, PPI

Trending Sectors

Technology was the leading sector in the market last week.

Top trending tickers from last week:

$TSLA

$PARA

$LLY

$AMZN

$ADBE

$NFLX

$RIOT

$MARA

Have A Great Week!

Enjoy the beautiful week in the market and trade safely everyone!

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.