- Ace in the Hole

- Posts

- Ace in the Hole - Edition #3

Ace in the Hole - Edition #3

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

Happy New Years to everybody! We have another short week of trading due to the market being closed for the New Year. I hate it, but it’s been very nice to get away from the charts.

Time to get back to the charts and start attacking 2024, so let’s get to it.

Last week, the $SPY had its ninth straight weekly gain. This has been its biggest winning streak since 2004.

Even with the rallies, the market has been very slow this last week due to many of the bigger traders taking time off for the holiday season.

I’m hoping those bigger traders are now ready to step back into the market and bring some volume back. Especially with Monday being closed for New Years, I would expect people are eager to get back to the charts.

What Does This Mean For Us Traders?

Like I said I’m hoping we get some volume coming back into these markets, but i’m also in a position right now where I think a number of things could happen.

So what am I going to do? I’m going to wait and feel out the price action. I don’t think that there is any need to rush into the new year trying to make a ton of money the first week. Nothing good comes from trying to do that.

I will be feeling out the price action this week and likely be trying to take some setups that i’ve listed below.

Short-Term Setups For This Week:

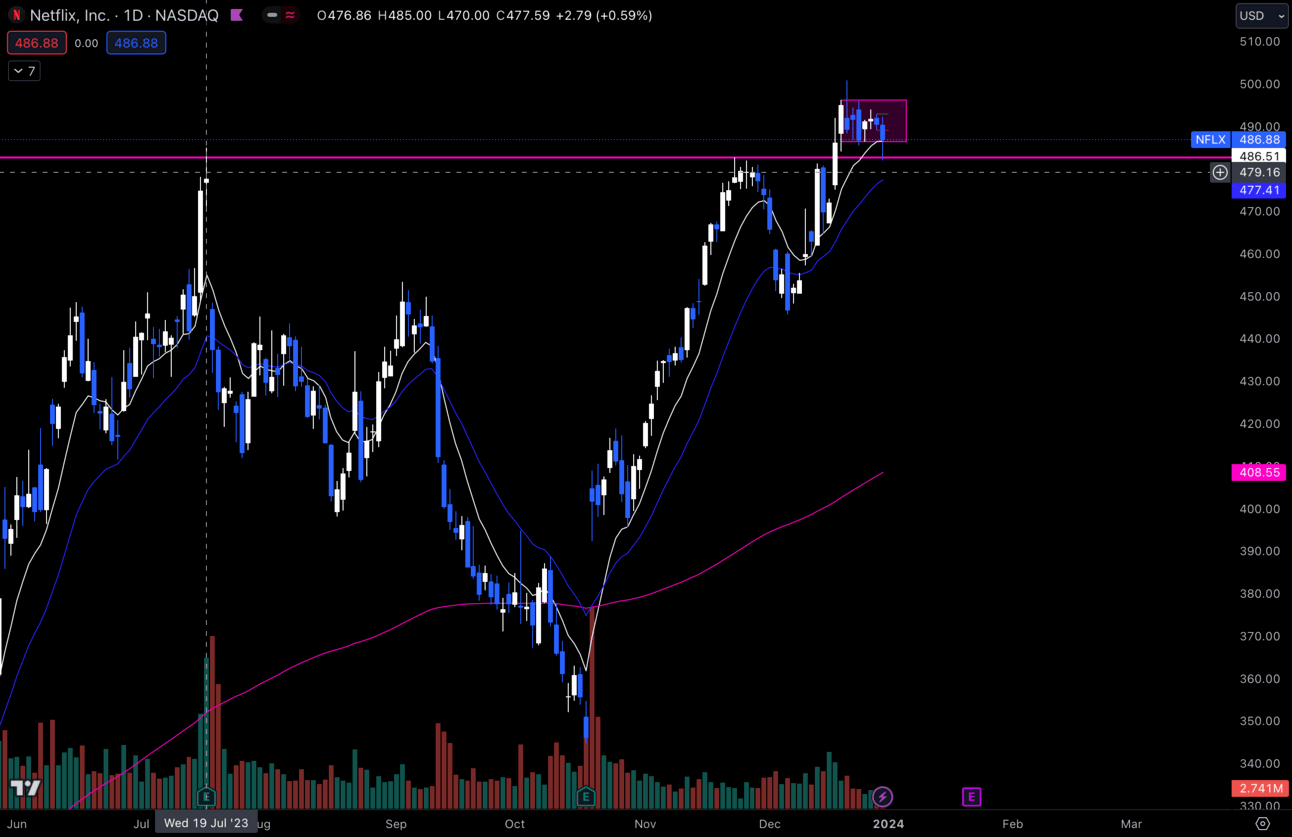

$NFLX

$NFLX Daily

I’m seeing a nice range forming on $NFLX. I’ve been waiting for the retest of previous highs along with July highs and we finally got it on Friday. I’m definitely looking for this range to hold and I think the lowest I would hold this name is $478.50.

This setup will be even better if we get some sort of news catalyst to really push it for the breakout, but we’ll have to wait and see if anything comes out.

I’ll likely be playing the $500 contracts on any long trades that I take.

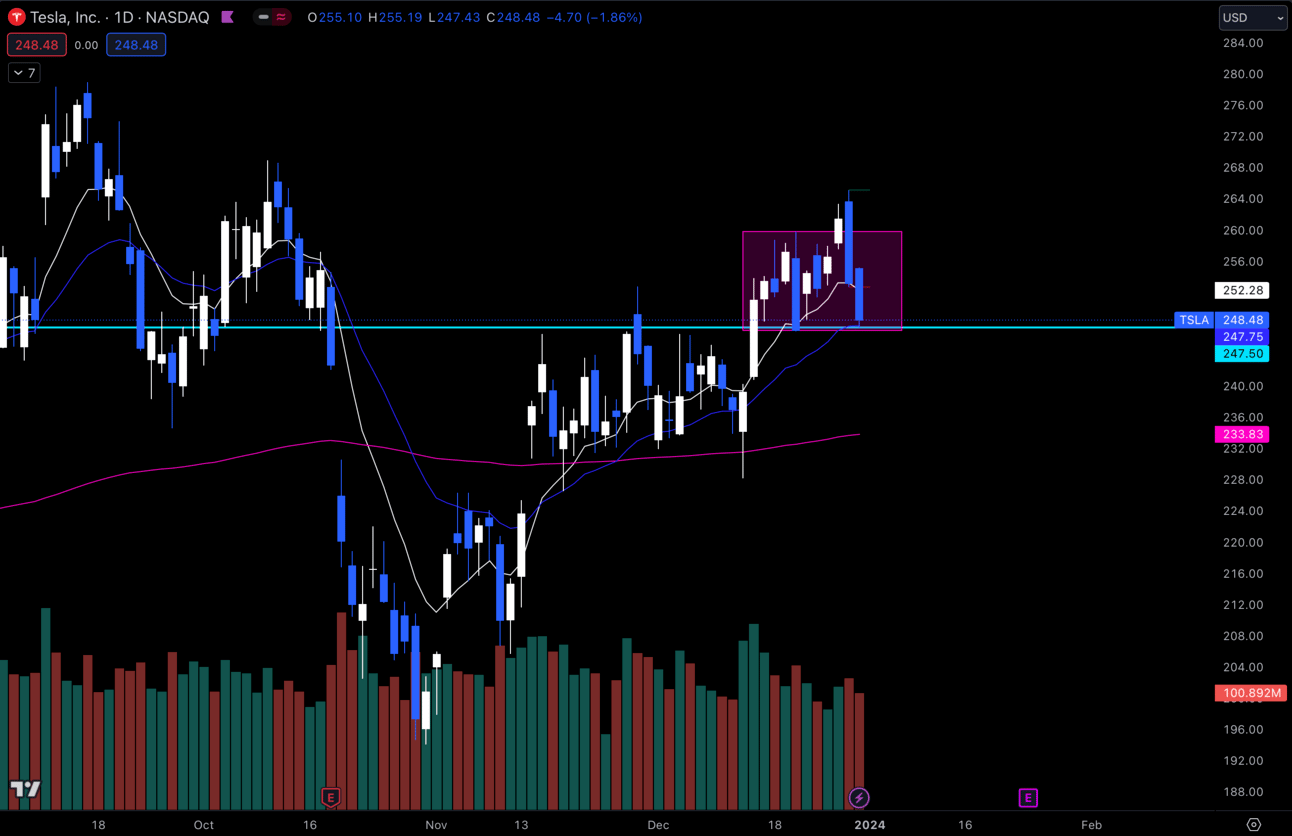

$TSLA

$TSLA Daily

$TSLA is still stuck in this range I have drawn on the daily. This is either a buying opportunity at the bottom of the range to make a higher low or it breaks the bottom of this range and heads towards the bottom of the previous range.

The level i’d be targeting for shorts if we broke to the downside would be $234, but i’m personally still feeling bullish on this name and will continue to think that this is a buying opportunity unless we break below the range.

No matter what, I still love this name for long-term and I don’t mind playing short-term puts if that’s how she wants to trade.

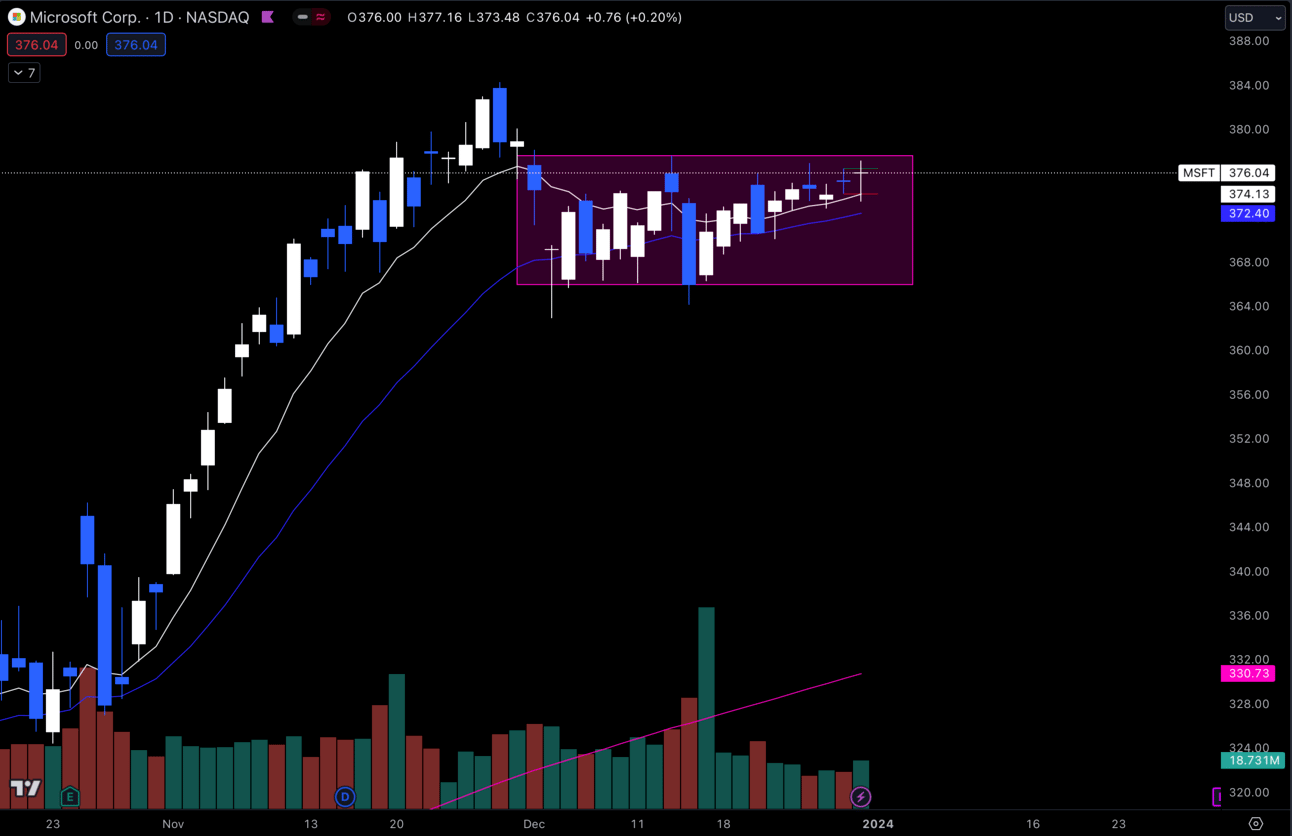

$MSFT

$MSFT Daily

I’m watching this $MSFT range on the daily, as i’m sure everyone else has. She’s has to make a move at some point, so I will continue to watch this range and wait for a breakout or breakdown to put size on.

We’ve been trading in this range for about a month now, so I definitely think it’s time to make a move here soon.

I strongly feel like the risk to reward to the short side is better here, but I won’t make a move until we see a real move outside of the range.

Long-Term Setups For This Week:

It’s going to be a dry week for the investment side of things. After adding to my favorite names in September and October, i’m not really looking to add/start any investments right now.

I’m enjoying riding out my gains on the names that I love and will buy dips when they present themselves, but until then I will be mostly hands off.

The only thing I am thinking of doing as the market keeps rising is slowly adding $SQQQ to my long-term account. Not as an investment, but rather a way to hedge my account without actually selling any of the positions i’ve built up.

$SQQQ is just the inverse of $TQQQ which is a 3x leveraged ETF of $QQQ. Buying this when markets are very high and the Fear and Greed Index is at Extreme Greed makes it so I can still earn money on the downside in my long-term.

Economic Calendar:

These data points are known to bring volatility during the intraday:

Tuesday 9:45 EST, S&P Global US Manufacturing PMI

Wednesday 10:00 EST, ISM Manufacturing PMI & JOLTS

Wednesday 2:00 EST, FOMC Minutes

Thursday 11:00 EST, Crude Oil Inventories

Friday 8:30 EST, Nonfarm Payrolls & Unemployment Rate

Expectations:

Like I said previously, I’m expecting the “big boys” to come back from holiday vacation and bring some volume into this market.

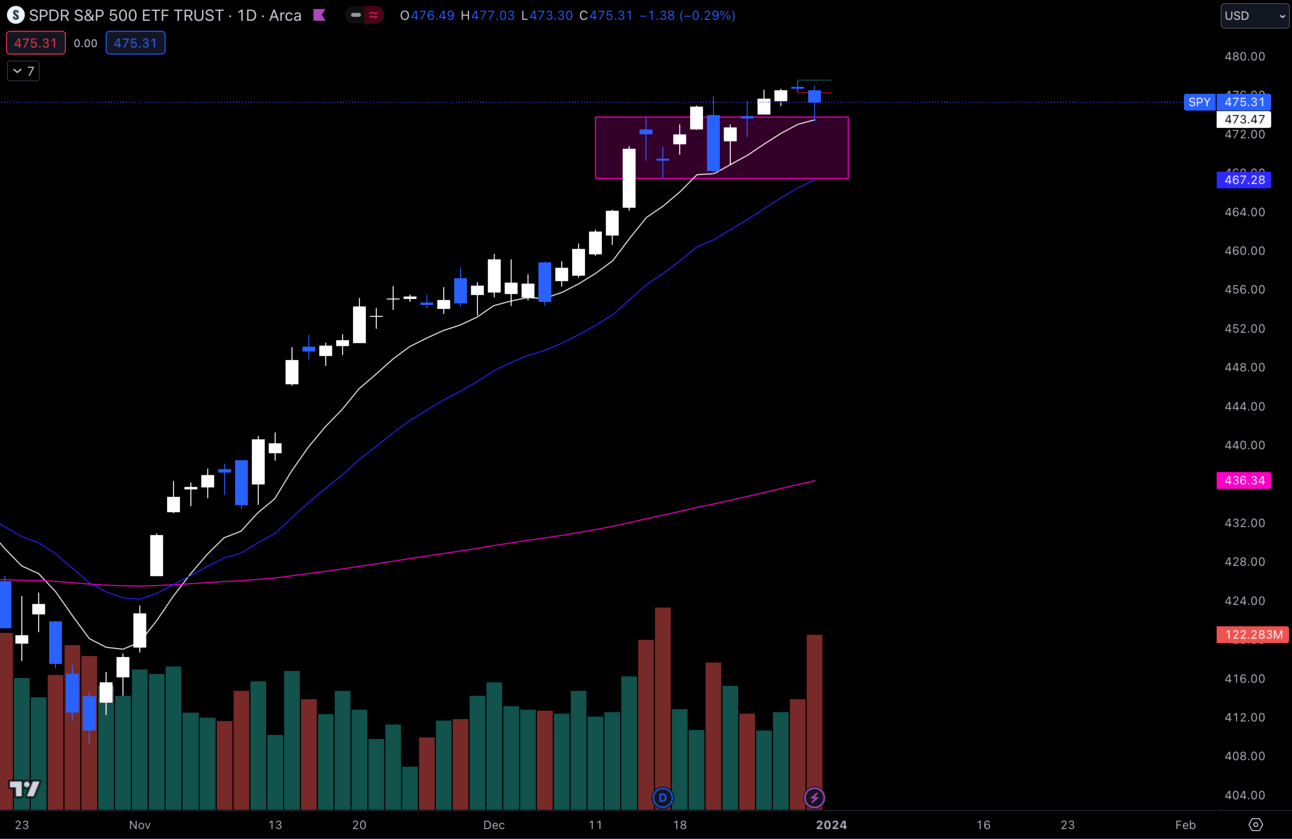

$SPY has pushed out of the range I had on the daily and we retested it Friday. I honestly wouldn’t be surprised if we broke back into the range, but if $MSFT and $AAPL can get some upside moves from their dips, we could see some more upside on $SPY.

$SPY Daily

I’m more expecting chop on $SPY and will likely focus on individual names instead.

Trending Sectors:

Last week, I noticed the Energy sector rising due to oil prices rising. Stocks such as Devon Energy ($DVN) and Diamondback Energy ($FANG) saw noticeable increases.

Technology and Software sectors performed well last week, as well as Payments and Bank sectors.

Tickers Trending Last Week:

$MARA

$TSLA

$AMD

$NVDA

$RIOT

A lot of these sectors have been doing good, but have also seen some notable outflow last week, so I would be aware of that.

Have a Great Week!

It’s been an amazing 2023, so let’s kick off 2024 with patience and consistency. Again, there is no reason to rush things.

Have a safe week trading everybody!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor

Real-Time Live Market Talk. (No delay like there is with X Spaces)

EDU Channels/Access to EDU content.

Easy access to talk with me.