- Ace in the Hole

- Posts

- Ace in the Hole - Edition #27

Ace in the Hole - Edition #27

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend and Father’s Day!

We have an interesting week ahead with Wednesday being closed due to Juneteenth, so be aware!

Last week was another strong one for the market with the $SPY closing up 1.64% making another new all time high at $544.12

Market Thoughts

This market has continued to be unstoppable.

I’m still feeling cautious here as I was last week due to $NVDA splitting 10/1.

Last week $NVDA continued to the upside and had no price action to support my thesis of it going down.

I do think that this could be a week where we see that downside starting, but only if price action supports it.

Historically $AAPL and $TSLA have done similar moves after a split.

Up/sideways to bring the sell off the next week, so let’s see if this happens!

Either way, if price action doesn’t support this thesis then there is no trade to the downside, it’s that simple.

Short-Term Setups This Week:

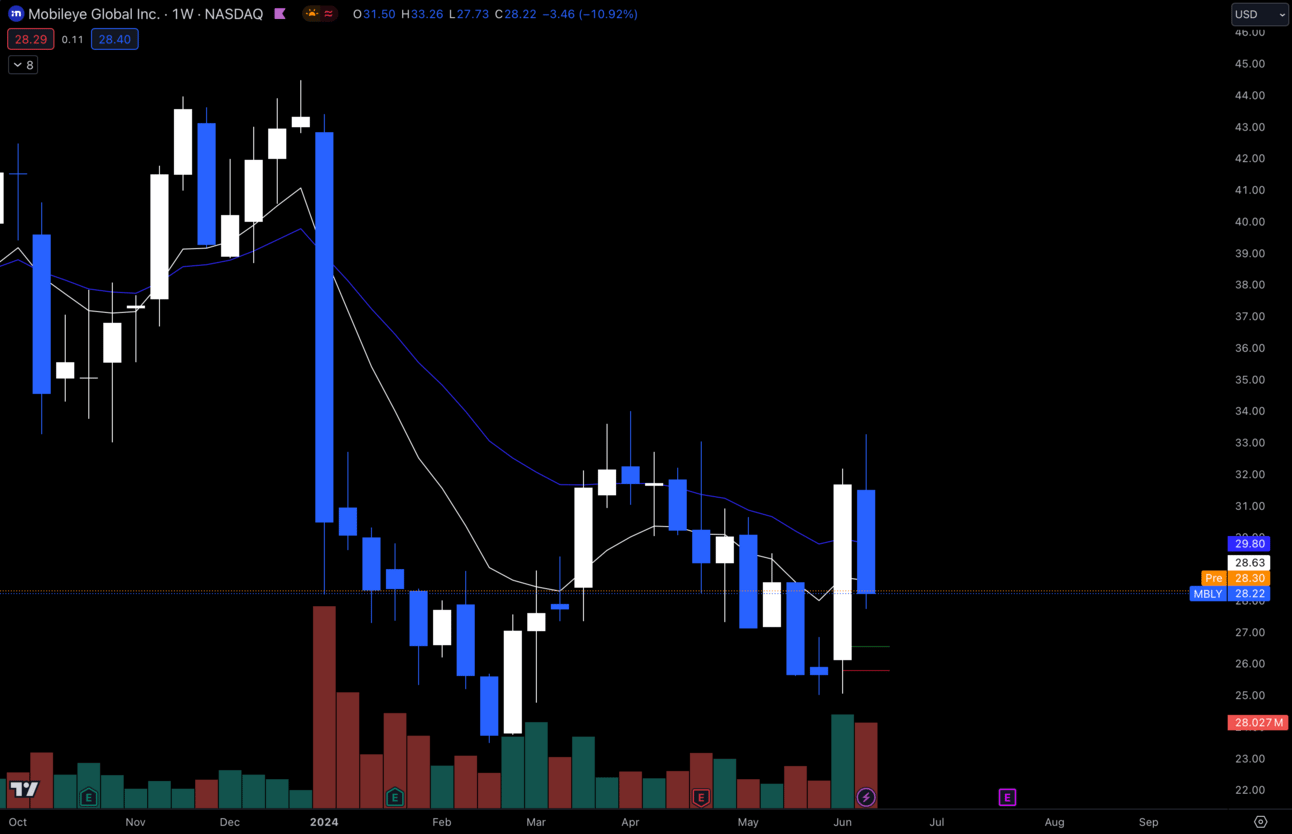

1. $MBLY

$MBLY Weekly

$MBLY has began the start of a beautiful reversal so far.

Strong higher low on the weekly with momentum back to the highs.

Currently rejecting the highs, but I personally think this is a setup to break out of those highs.

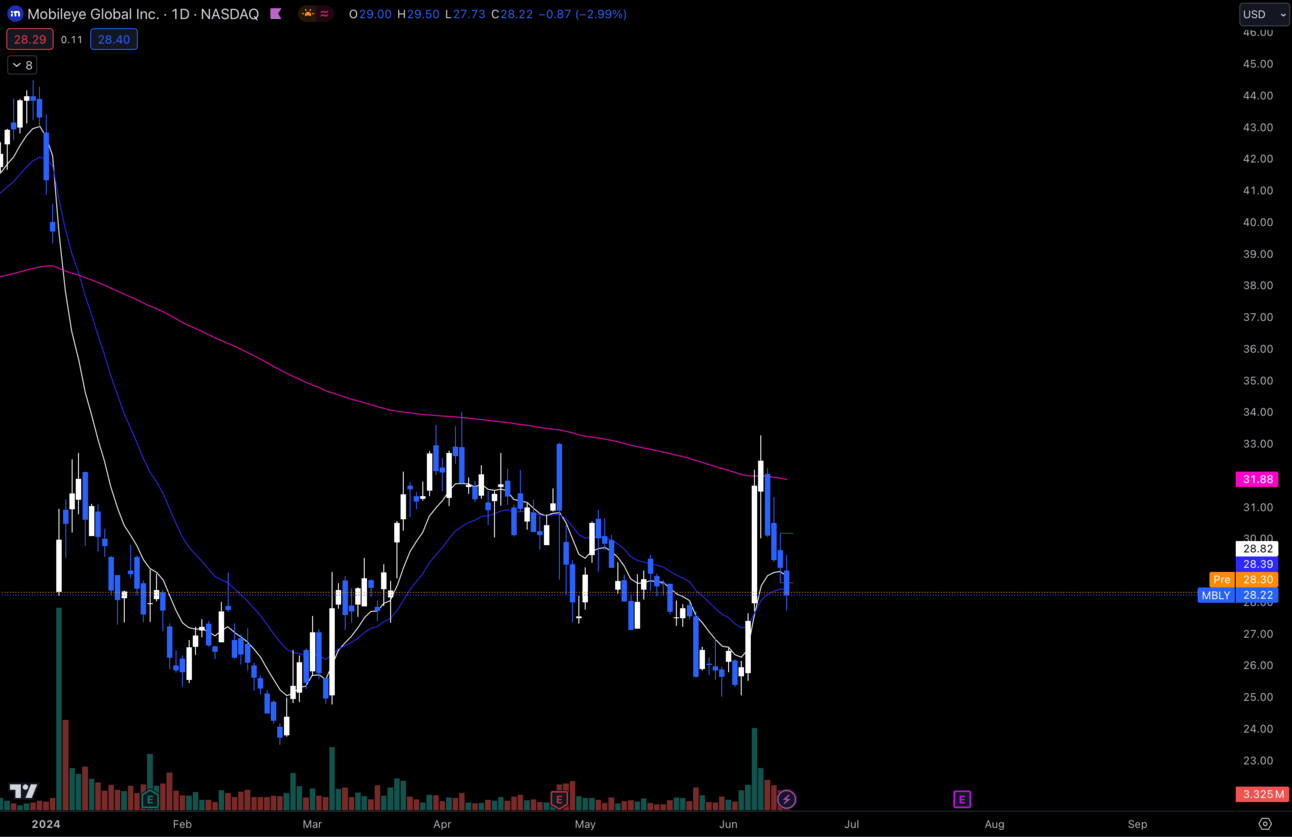

$MBLY Daily

$MBLY is giving a dip opportunity to the daily 21 EMA which is where I personally took a long position.

Under $27 and my thesis is invalidated.

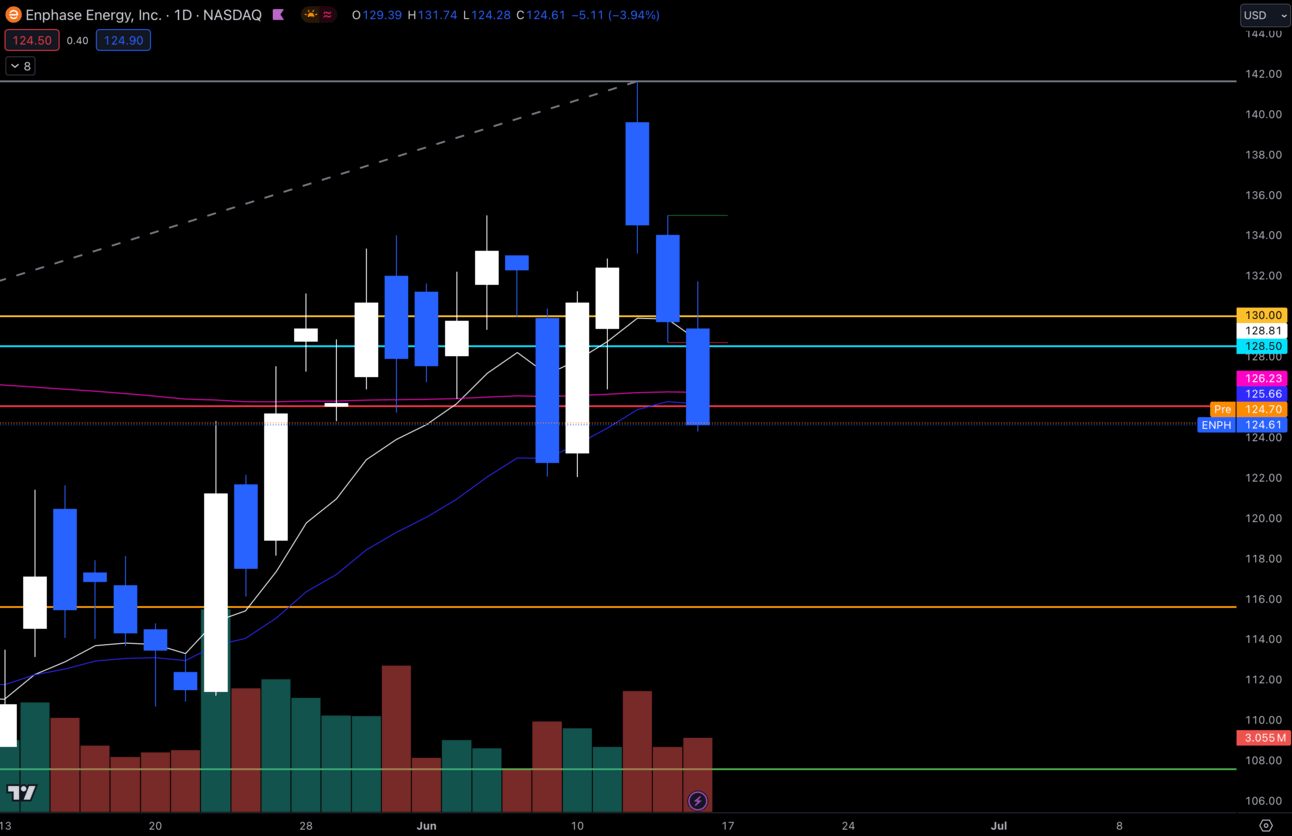

2. $ENPH

$ENPH Daily

I’ve caught some great moves on $ENPH lately, but I’m interested to see if she wants to keep it going.

It dipped back to the daily 21 EMA as well as the 200 EMA and a big fib level I have at $125.50.

I’m interested to see if this starts retracing from the 21 back to the upside.

I am in long positions and will have to cut if this starts getting below $123.

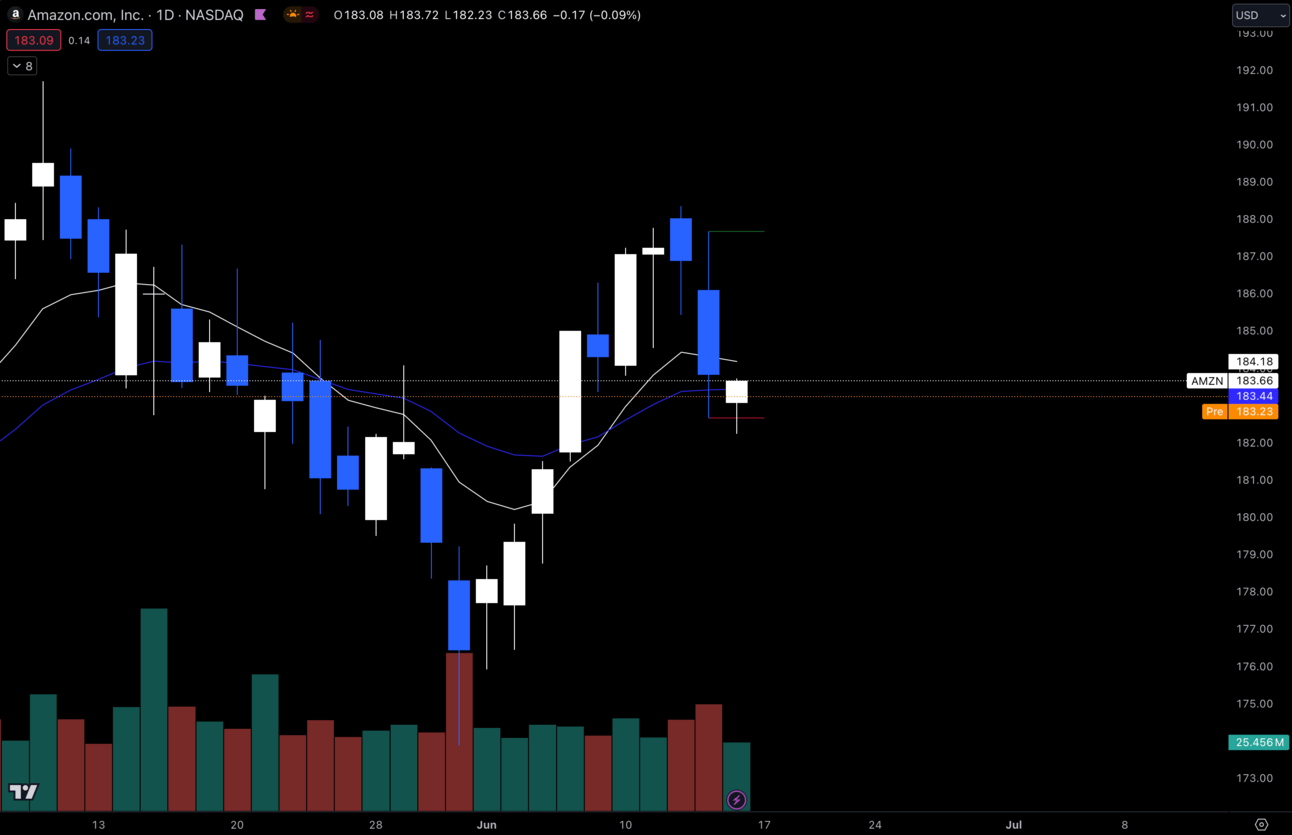

3. $AMZN

$AMZN Daily

$AMZN has had some decent moves lately and it’s giving us a dip down to the daily 21 EMA.

I personally like longs on this off this area until this gets under $182.23 and am currently in long positions on this name.

Long-Term Setups This Week:

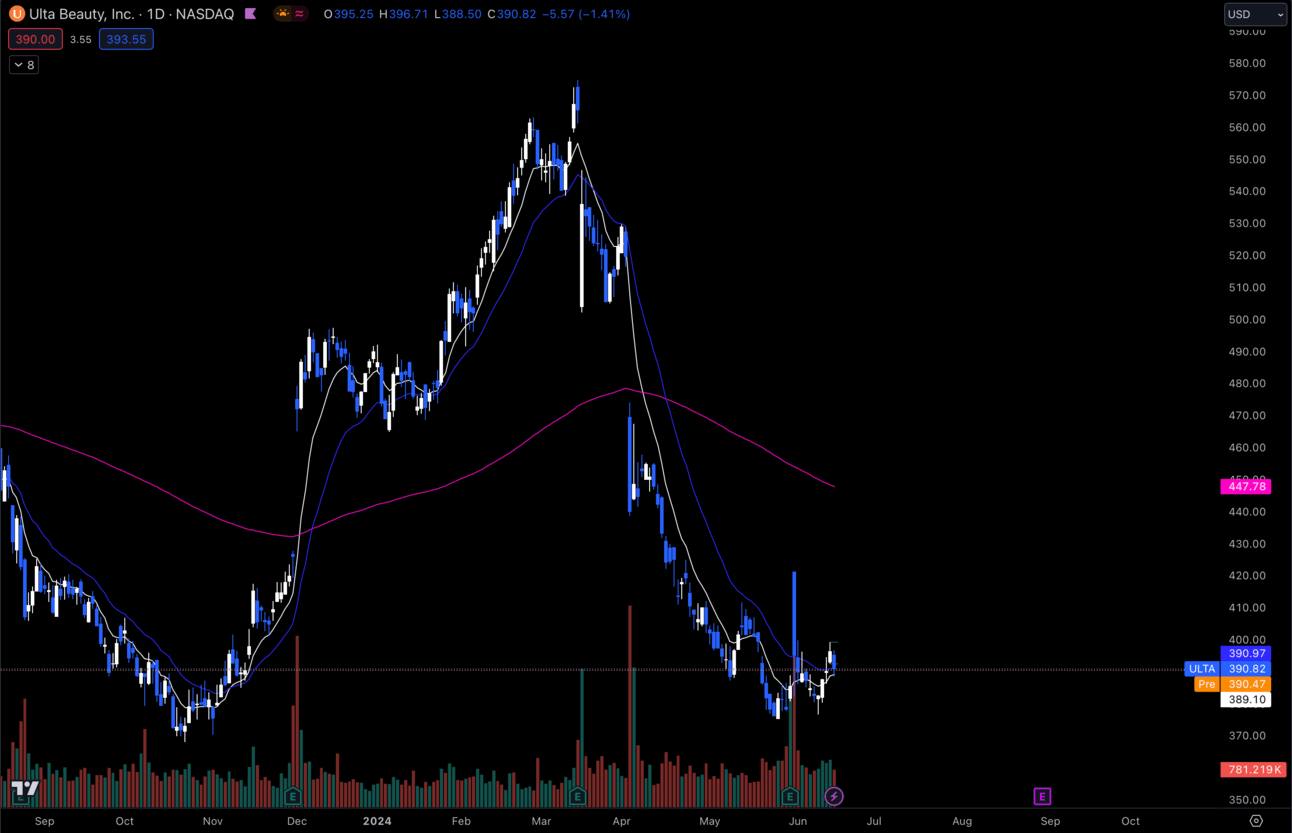

1. $ULTA

$ULTA Daily

Since last week, $ULTA has made a pretty decent base at the lows here that I'm very likely to buy up this week.

I personally think a DCA at these prices isn’t bad at all if you like this company.

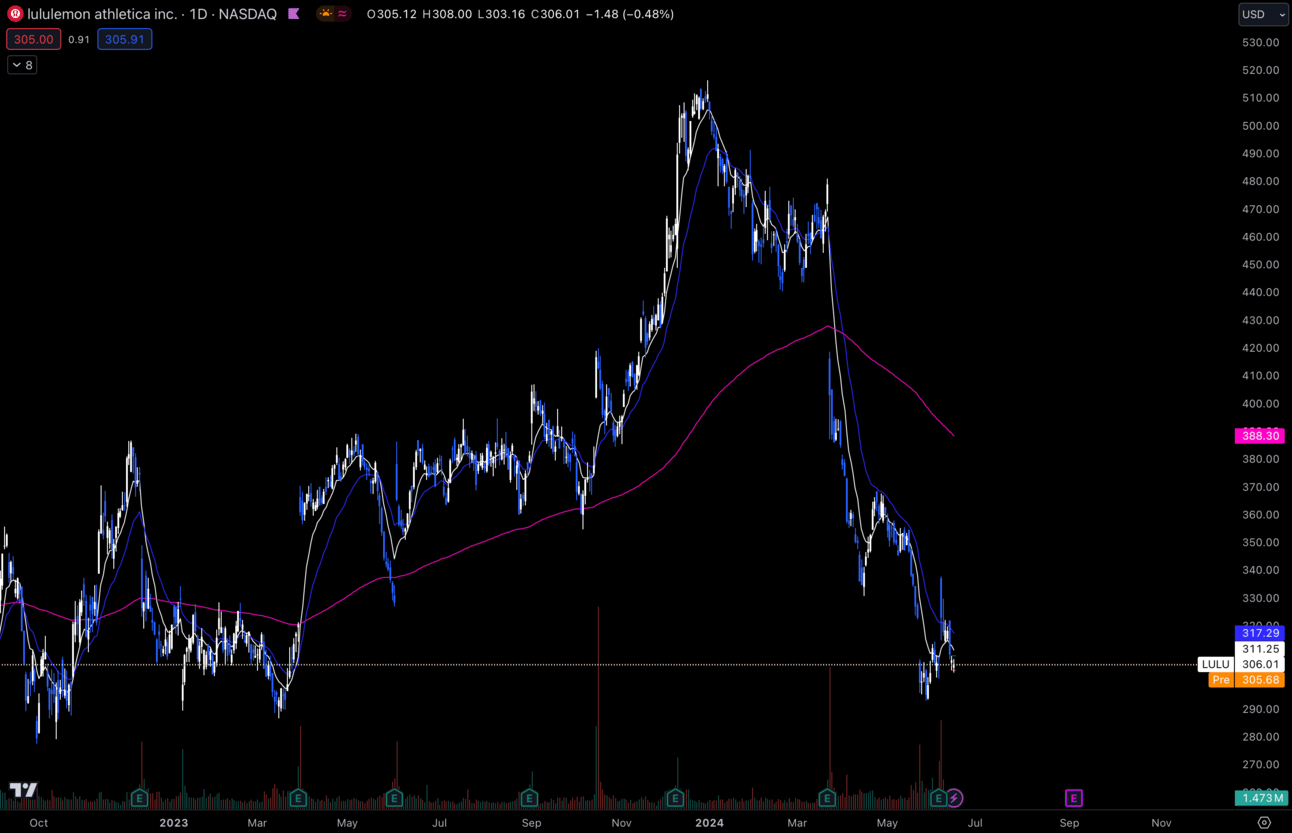

2. $LULU

$LULU Daily

$LULU is pretty much the exact same as $ULTA for me.

Same thoughts and thesis.

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, Retail Sales

Tuesday 1:00 EST, 20-Year Bond Auction

Thursday 8:30 EST, Initial Jobless Claims

Friday 9:45 EST, S&P Global US Manufacturing PMI

Friday 10:00 EST, Existing Home Sales

Trending Sectors

Most of the big cap growth sectors were doing well this week with $SPY making new all time highs.

Top trending tickers from last week:

$BABA

$ADBE

$RIVN

$RH

$ATNM

$OCUL

$VRNA

$DIS

$SOFI

$EDIT

Have A Great Week!

As always my friends, have an amazing week and trade safely!

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.