- Ace in the Hole

- Posts

- Ace in the Hole - Edition #26

Ace in the Hole - Edition #26

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend and is ready for another great week!

This market has felt unstoppable with $SPY making another new all time high last week, closing the week up 1.26%.

Also $NVDA has done their split today and is now sitting at $120.

It did get over $1200 last week just before the split.

Market Thoughts

I’ve been pretty bullish on the $SPY still, but iI’m feeling more cautious now that $NVDA has split.

I’m interested to see if we get a bit of a sell off from $NVDA splitting.

It would make sense to me that they sell it a bit now that people with little investment accounts can finally buy some shares.

If this were to happen it would bring $SPY down with it, but nobody knows the future.

Either way, I’m still felling bullish until $SPY shows me not to be, but definitely feeling much more cautious.

Short-Term Setups This Week:

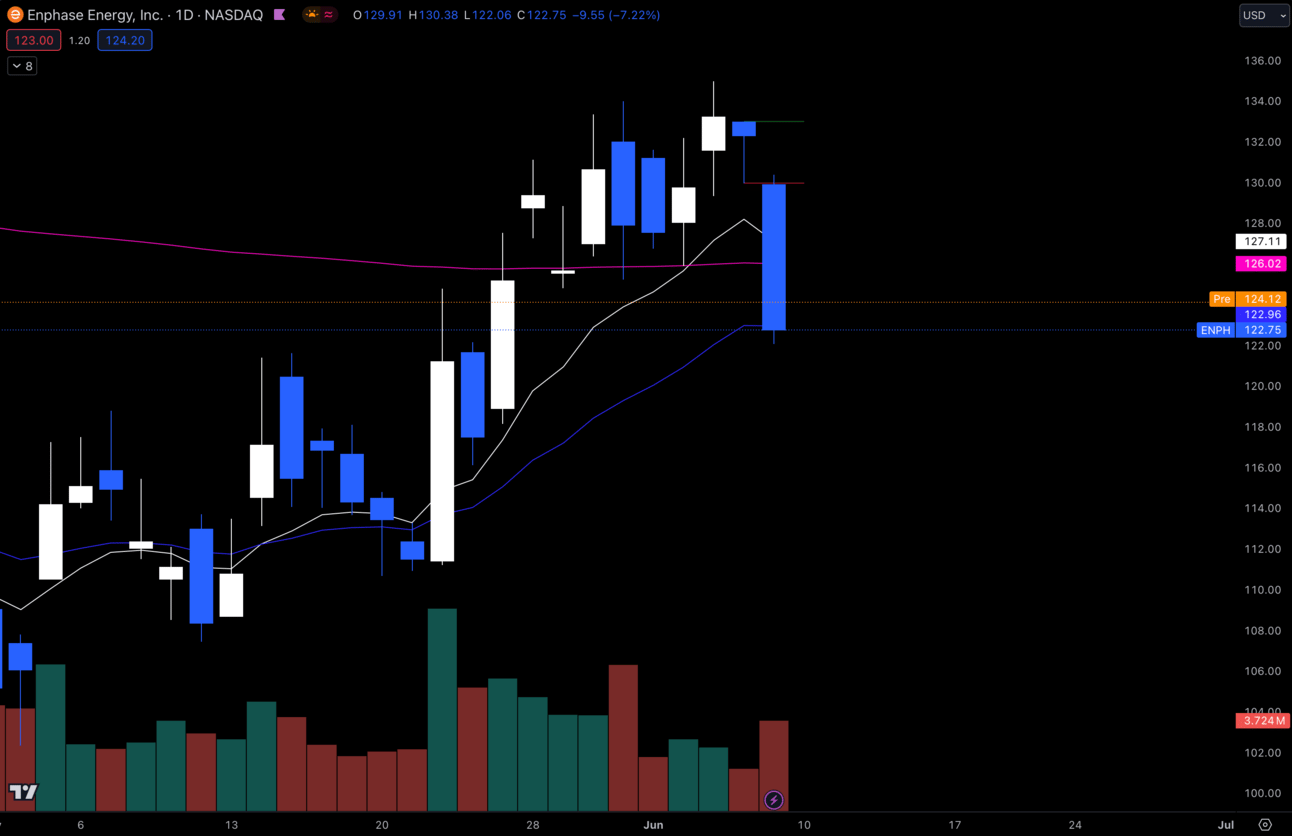

1. $ENPH

$ENPH Daily

I’ve been trading $ENPH a lot lately.

It is getting its first dip to the 21 EMA on the daily after breaking out of the 200 EMA for the first time since 2022.

I’m expecting bulls to buy it up off of the 21 EMA.

I personally already have a position in this in my long-term and short-term swings.

Under $120 my thesis is invalidated.

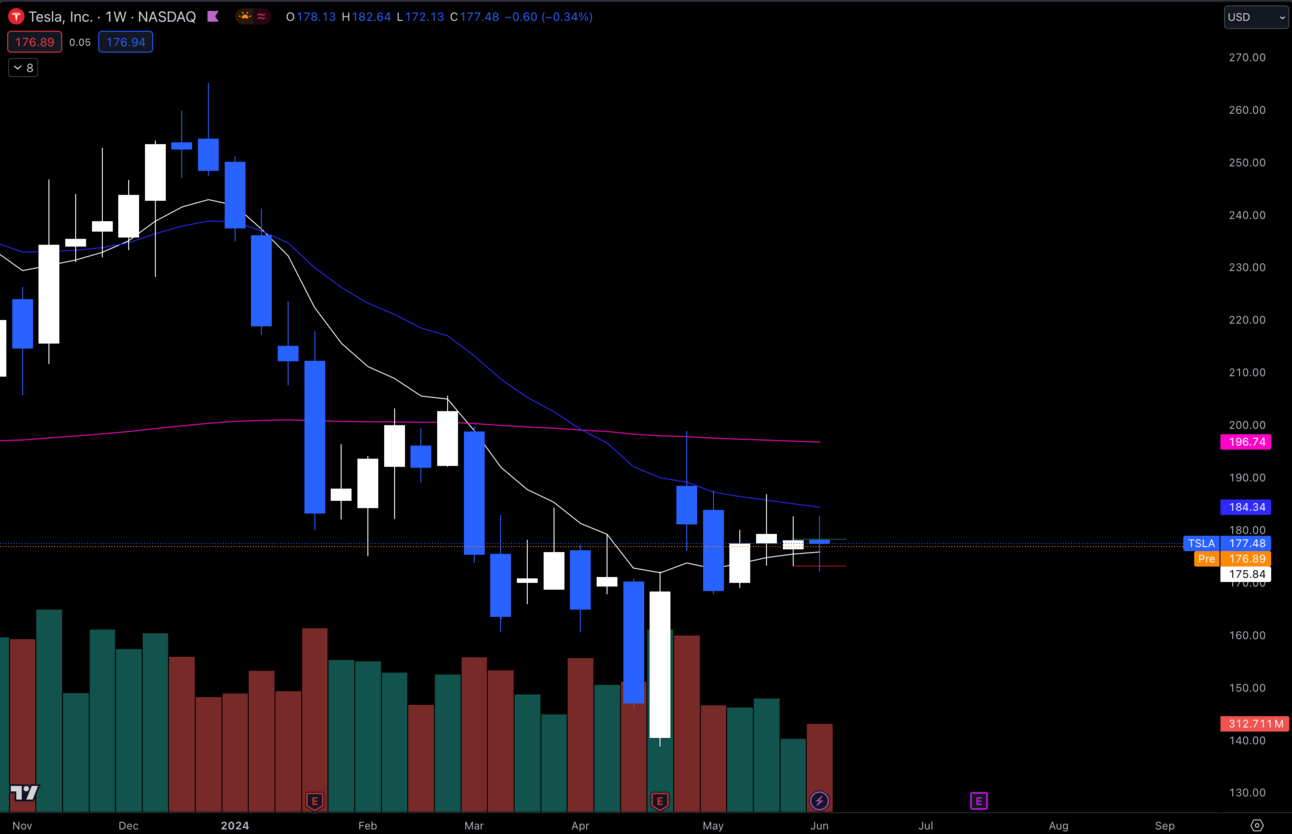

2. $TSLA

$TSLA Weekly

$TSLA has been consolidating on the weekly here, but I think she is ready to make a move soon.

I was long last week a few times, but realized these weekly candles and it makes more sense for a move to happen this week.

It could really break either way here, but I’m betting it’s to the upside personally given the healthy consolidation above my weekly 9 EMA.

Under $167.80 I wouldn’t be long.

Long-Term Setups This Week:

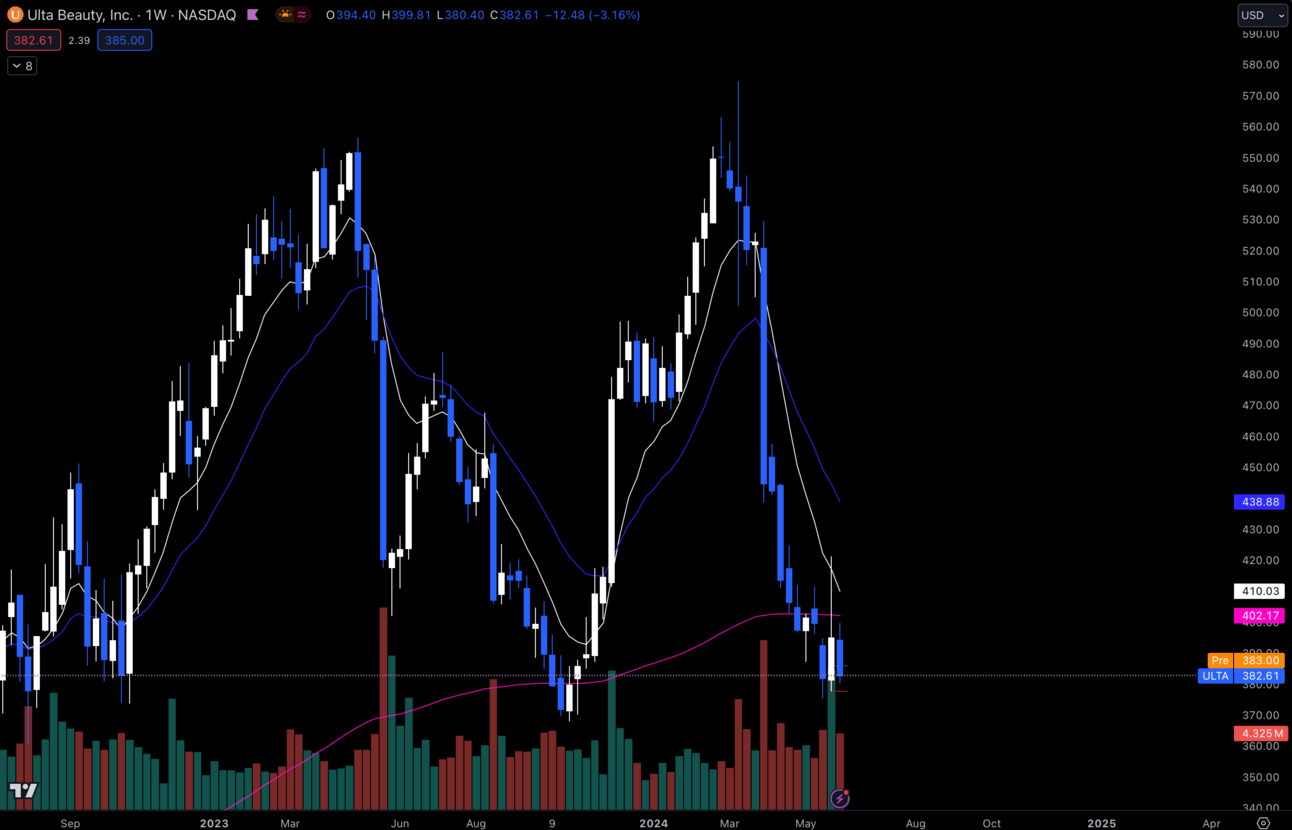

1. $ULTA

$ULTA Weekly

$ULTA has made some effort to hold this $380 level, so I’m interested here and keeping eyes on it.

If this truly looks like its holding here, I’d be happy to pick up some more shares, but it could very easily lose that $380, so I’m waiting to see more here before I do anything.

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 1:00 EST, 10-Year Note Auction

Wednesday 8:30 EST, CPI

Wednesday 2:00 EST, FOMC Statement

Wednesday 2:30 EST, FOMC Press Conference

Thursday 8:30 EST, PPI

Trending Sectors

Information Technology, Consumer Discretionary, and Energy were the top trending sectors last week.

Top trending tickers from last week:

$NVDA

$AAPL

$AMC

$PYPL

$ERF

$PFE

$T

$MLGO

$CORZ

$META

Have A Great Week!

Enjoy the week everybody and trade safe.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.