- Ace in the Hole

- Posts

- Ace in the Hole - Edition #25

Ace in the Hole - Edition #25

Your Secret Weapon to Beat The Market

Happy Monday Traders!

Last week was a crazy last week of the month for the market.

The reversal that happened on Friday was absolutely insane, so congrats to anyone who caught the move on that.

I personally didn’t because I was already done for the day and wanted to lock in my gains for the month, but after seeing that I definitely wish I played it.

Market Thoughts

In my opinion, $SPY is still looking great for bulls.

Last week, it came down to test the daily 21 EMA and it held that while getting strong buyers on Friday into the close.

Above this 21 EMA with bullish volume and I have to be leaning towards the bull side.

Under the 21 EMA on the daily and I will lean more towards shorts.

Short-Term Setups This Week:

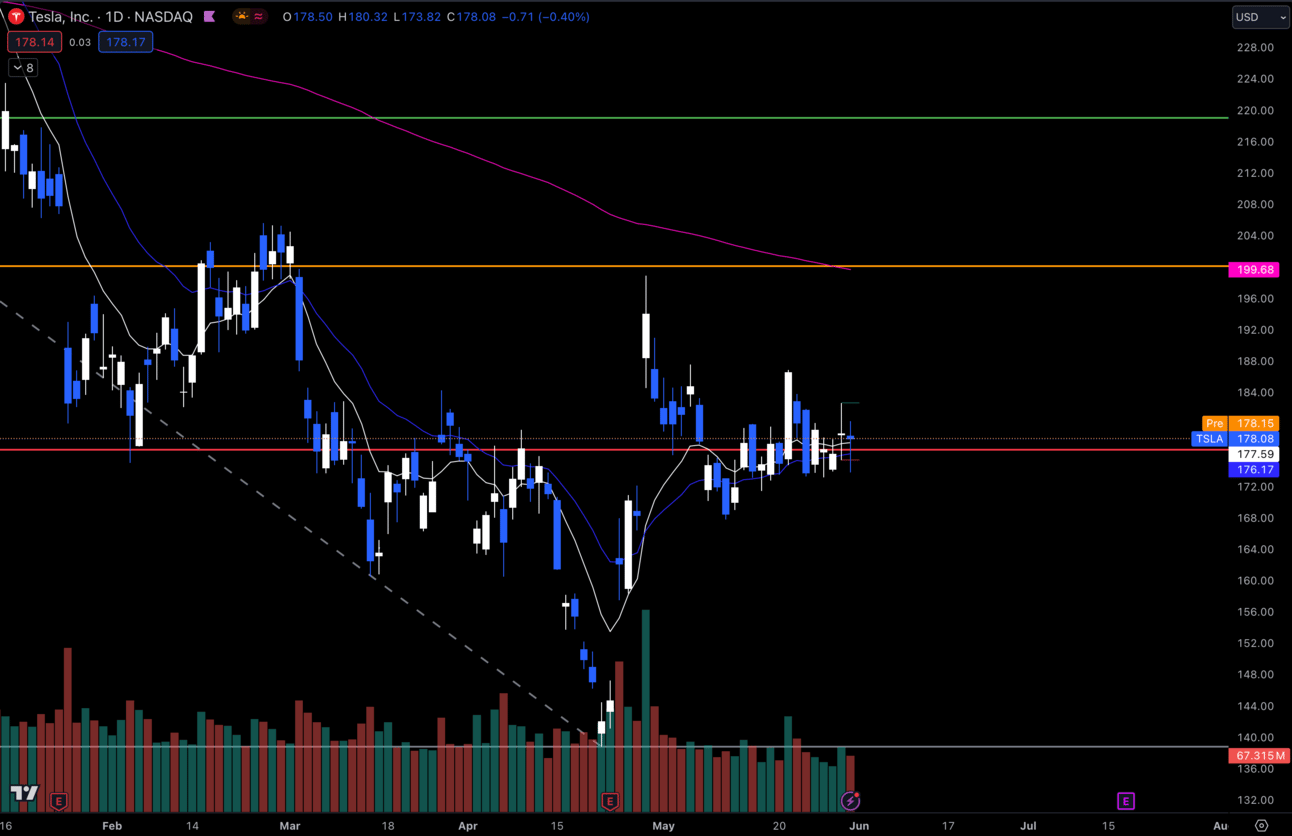

1. $TSLA

$TSLA Daily

$TSLA is still in this consolidation on the daily.

I’m getting ready for a breakout or breakdown, but I personally think it will break to the upside given the consolidation above the EMAs while making higher lows.

This needs to make higher highs out of this range above $186.88.

Under $173 I wouldn’t be long.

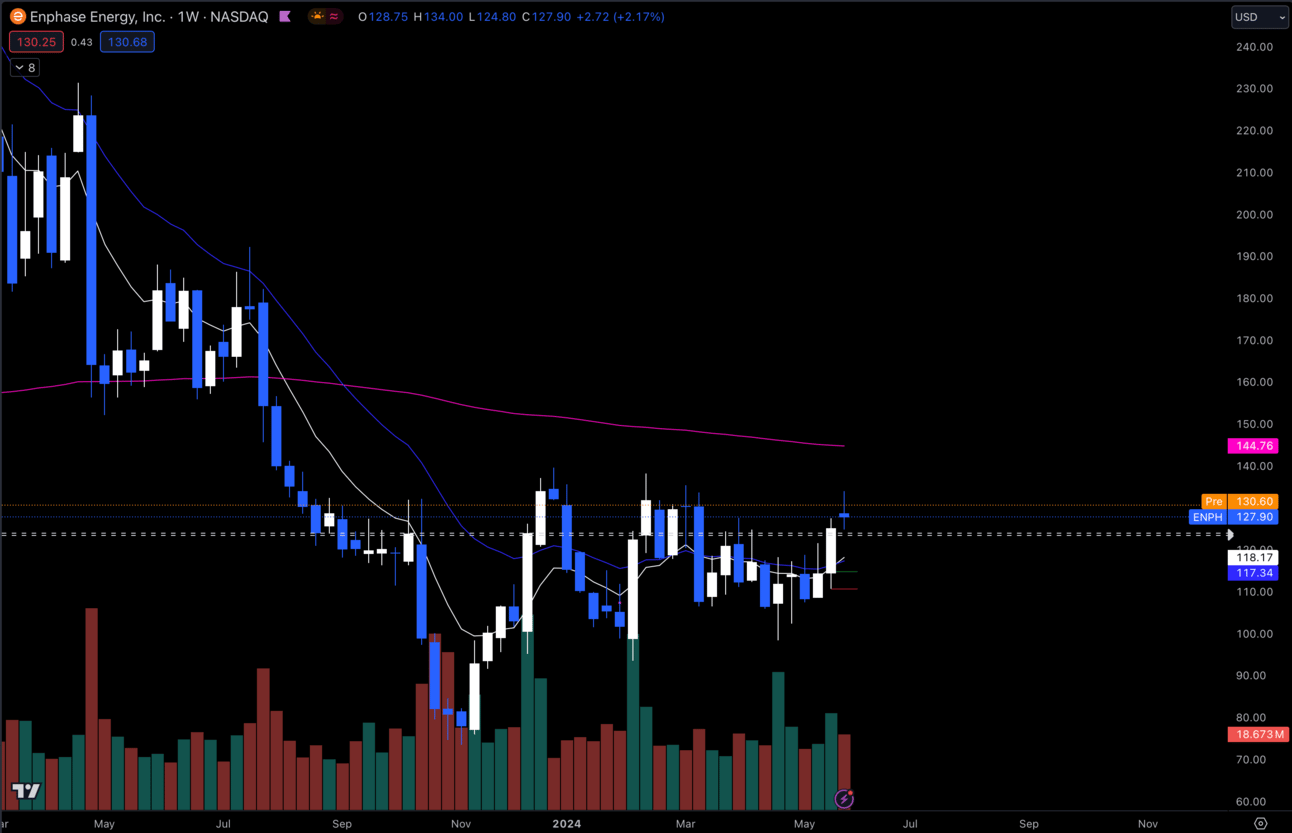

2. $ENPH

$ENPH Weekly

$ENPH has gotten over its daily 200 EMA for the first time since over a year ago.

It’s headed to the top of the weekly range and I think it gets the continuation it needs to make higher highs and really get moving to the upside.

Under $120 I wouldn’t be long.

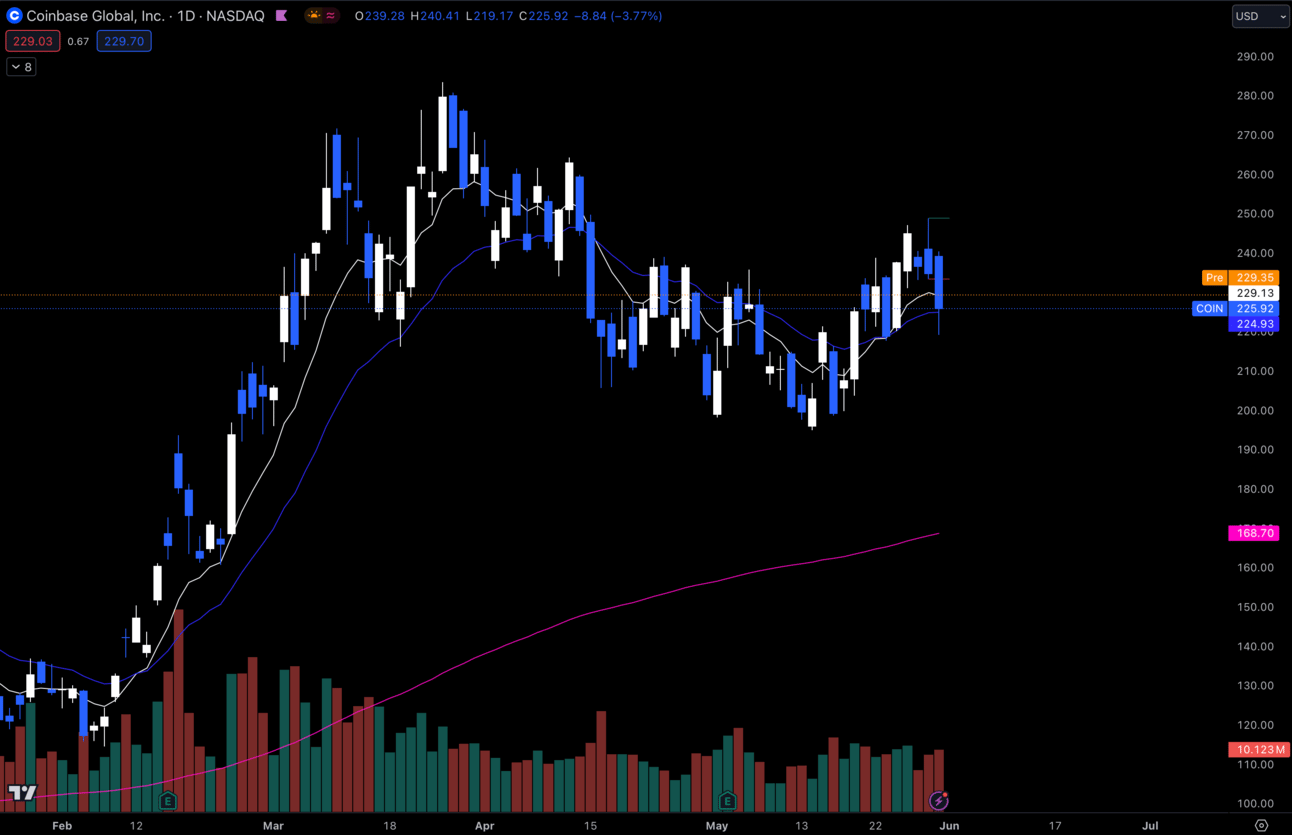

3. $COIN

$COIN Daily

$COIN has taken a dip down to the 21 EMA on the daily and had buyers off of it.

I think this could be a great dip to buy up and look for higher highs out of this range.

Below $220 I wouldn’t be long.

Long-Term Setups This Week:

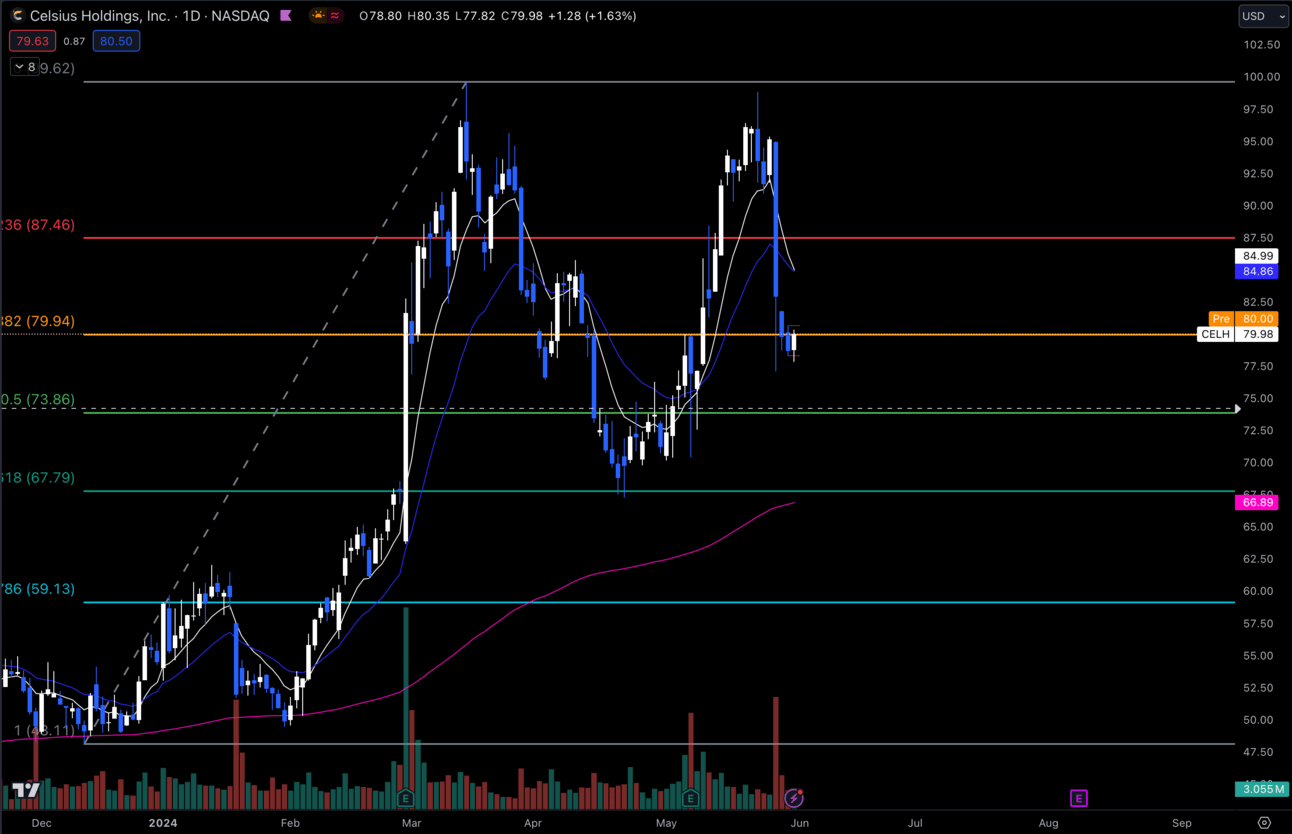

$CELH

$CELH Daily

If you were looking for a dip to buy up on $CELH you are finally getting it.

I personally still need to let this come lower if I want to add more shares, but I do think this is a decent spot to try and pick up some shares.

I’m trying to keep my cost basis as low as possible, so I don’t really want to add here, but we’ll see how it’s looking this week and decide then.

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, ISM Manufacturing PMI

Tuesday 10:00 EST, JOLTs Job Openings

Wednesday 9:45 EST, S&P Global Services PMI

Wednesday 10:00 EST, ISM Non-Manufacturing PMI

Friday 8:30 EST, Nonfarm Payrolls

Trending Sectors

Biotech, Semiconductors, and Software Applications were trending last week.

Top trending tickers from last week:

$AVGO

$JPM

$LLY

$V

$XOM

$JNJ

$HD

$DJT

$DELL

$SMMT

Have A Great Week!

As always, I hope everybody trades safe and has an amazing start to the new month.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.