- Ace in the Hole

- Posts

- Ace in the Hole - Edition #24

Ace in the Hole - Edition #24

Your Secret Weapon to Beat The Market

Happy Tuesday Traders!

I hope everybody enjoyed the long Memorial weekend!

Last week was a big one for the market because $NVDA decided to save the market again and absolutely rip to the upside on earnings.

Overall $SPY pretty much went sideways all week and didn’t really do anything, but there are some individual names I’m watching this week that have potential.

Market Thoughts

I’m still feeling pretty bullish on this market as of now.

Last week we saw $SPY retest previous all time highs and hold.

If bulls want another leg higher, they need to defend that $524.50 area. If they can’t, I think we are headed to the daily 21 EMA.

Under $524 I will lean more to the bear side.

Short-Term Setups This Week:

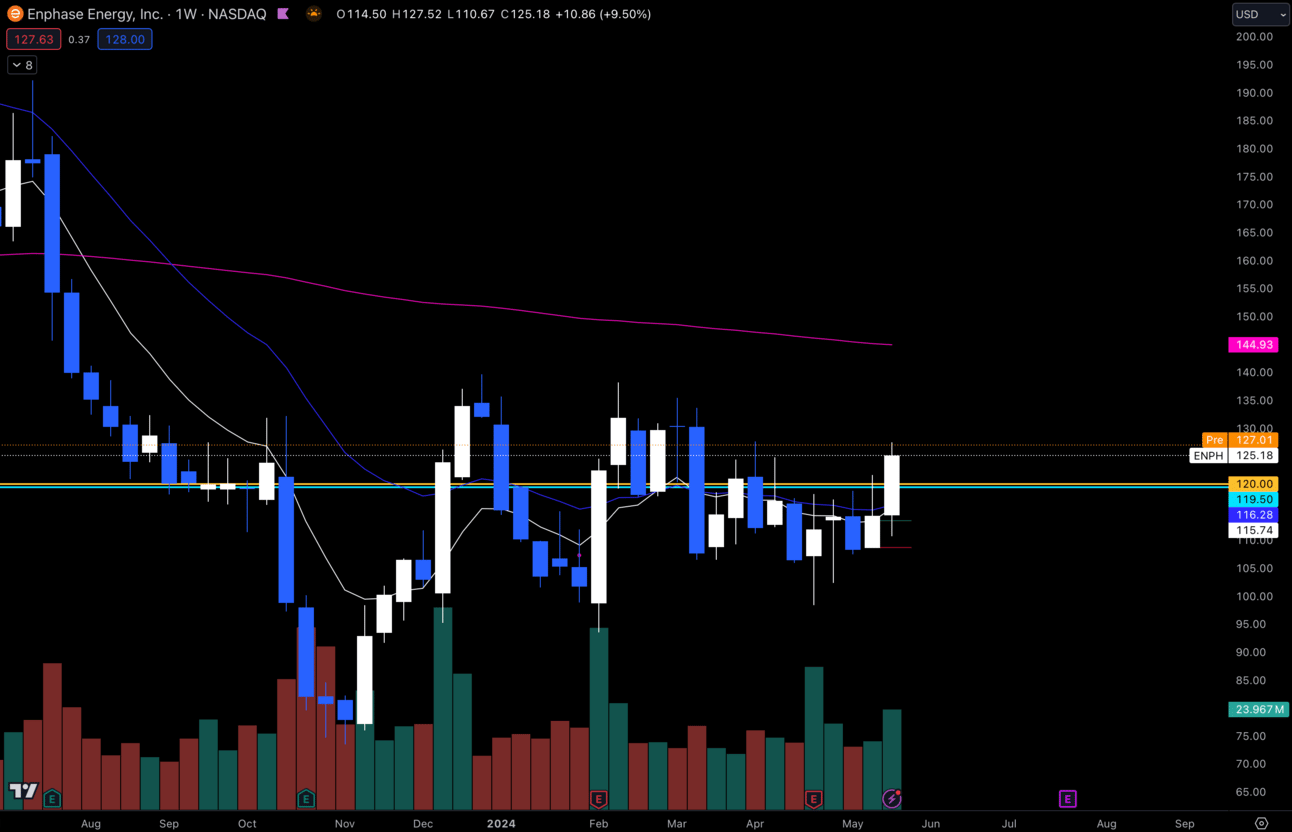

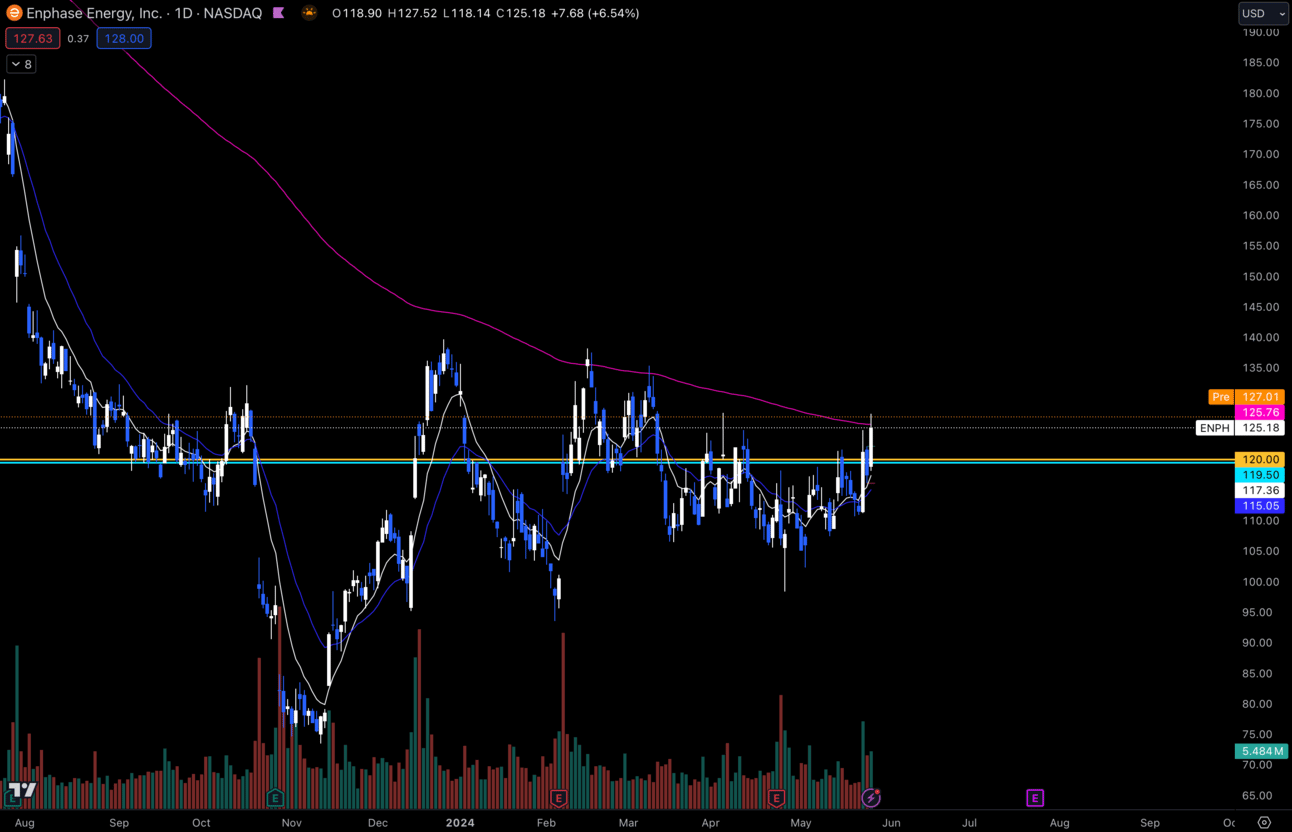

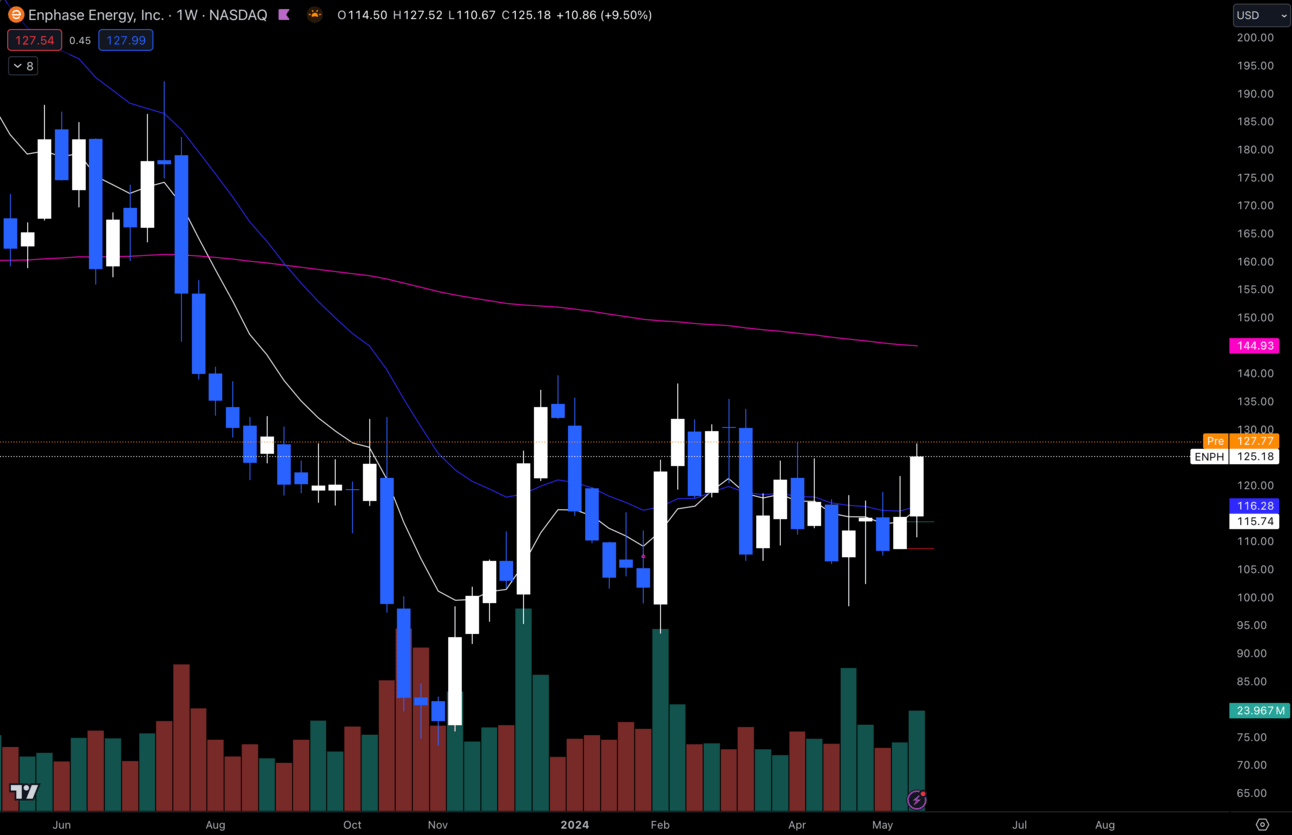

1. $ENPH

$ENPH Weekly

$ENPH has been performing really well the past week and I’m interested to see if it finally breaks out of this consolidation.

$ENPH Daily

It truly needs to clear $140 for this to be a real breakout, but I think it is looking good so far.

It’s the first time it has come up to the 200 EMA and has held price. Previous times it gets rejected hard off of that level and can never clear it.

Under $110 I wouldn’t be long this name.

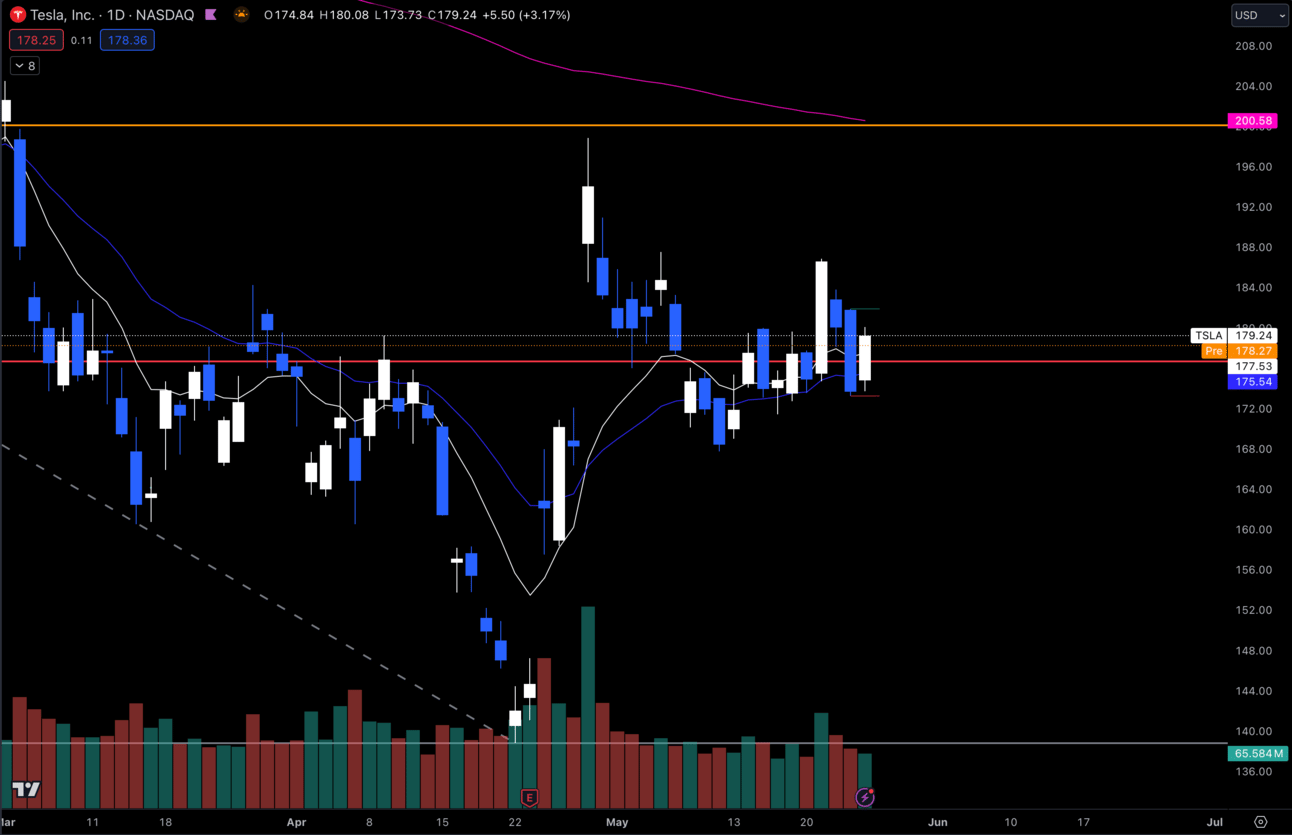

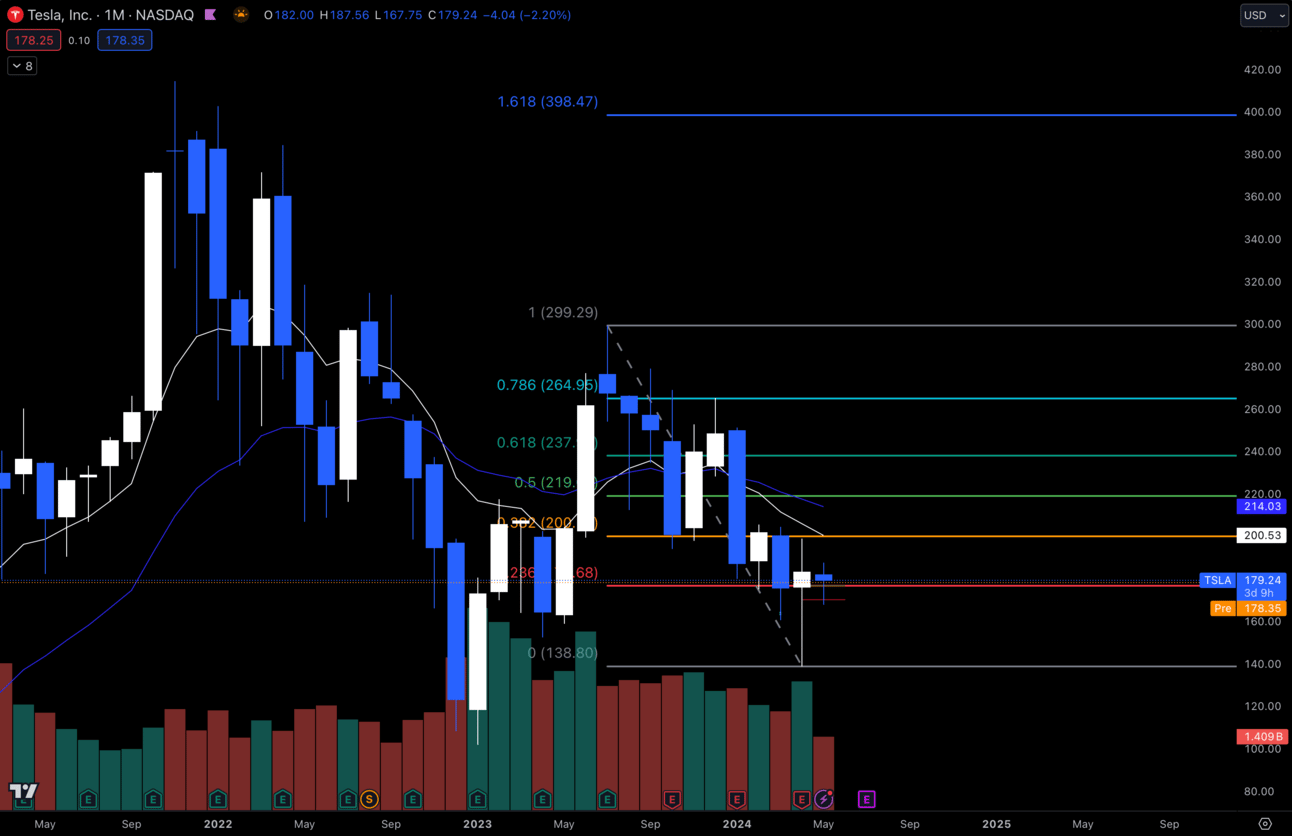

2. $TSLA

$TSLA Daily

I think $TSLA is looking decent here in this consolidation.

As long as this holds $173.50 I like it long.

It needs to make a higher high out of this range and head back towards $200.

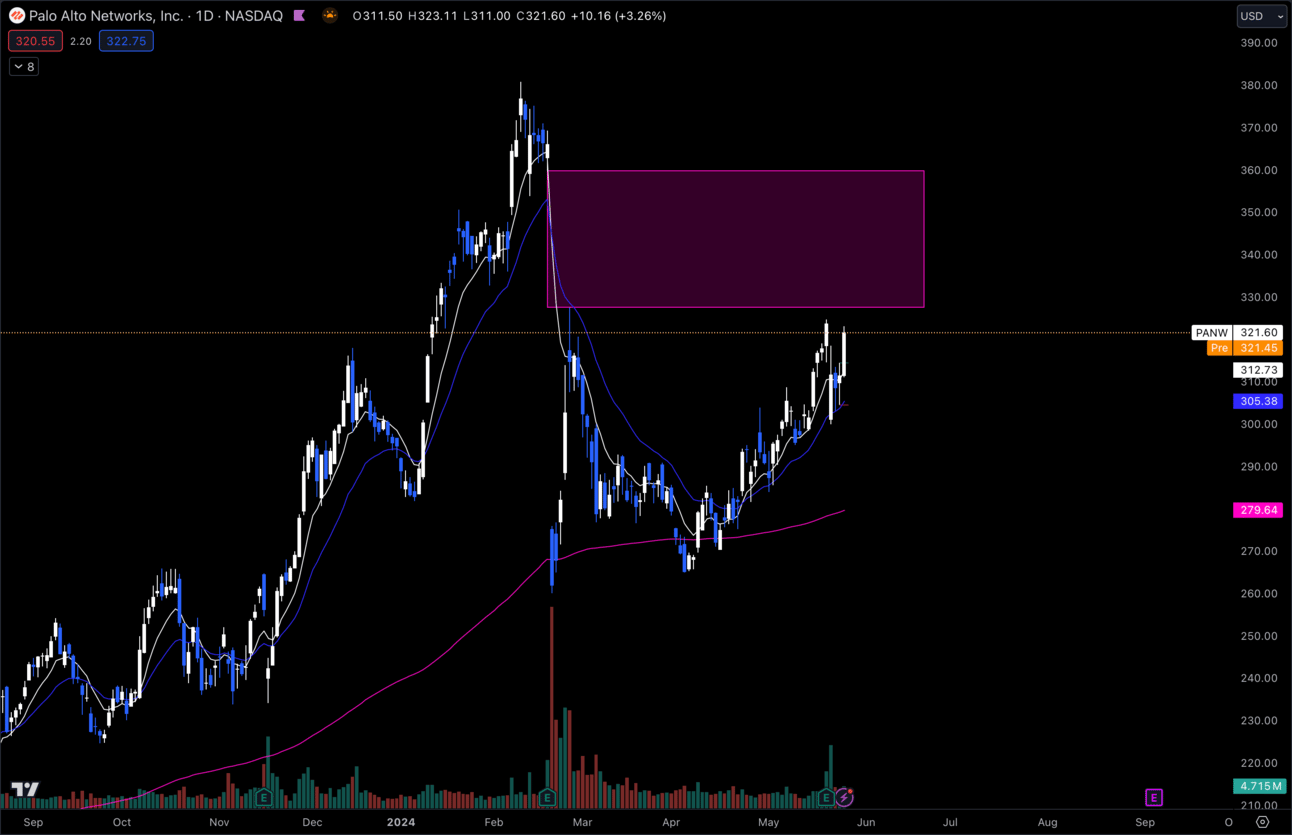

3. $PANW

$PANW Daily

I’m interested to see if $PANW fills this gap to the upside.

I wouldn’t be long under $305, but if that holds and we can make higher highs then I think this looks good.

$PANW contracts can move really fast, so please be careful if you are playing this name.

Long-Term Setups This Week:

1. $TSLA

$TSLA Monthly

I think $TSLA is finally looking better for some more adds to the long-term portfolio.

If it gets back under $170 it isn’t good, but I think we hold and finally start heading higher.

2. $ENPH

$ENPH Weekly

I’ve already added shares of $ENPH in my long-term at about $118, but I still think it looks good here for more adds.

If this gets under $100 I’d be a bit concerned about my shares.

I think we see this in the $140s soon.

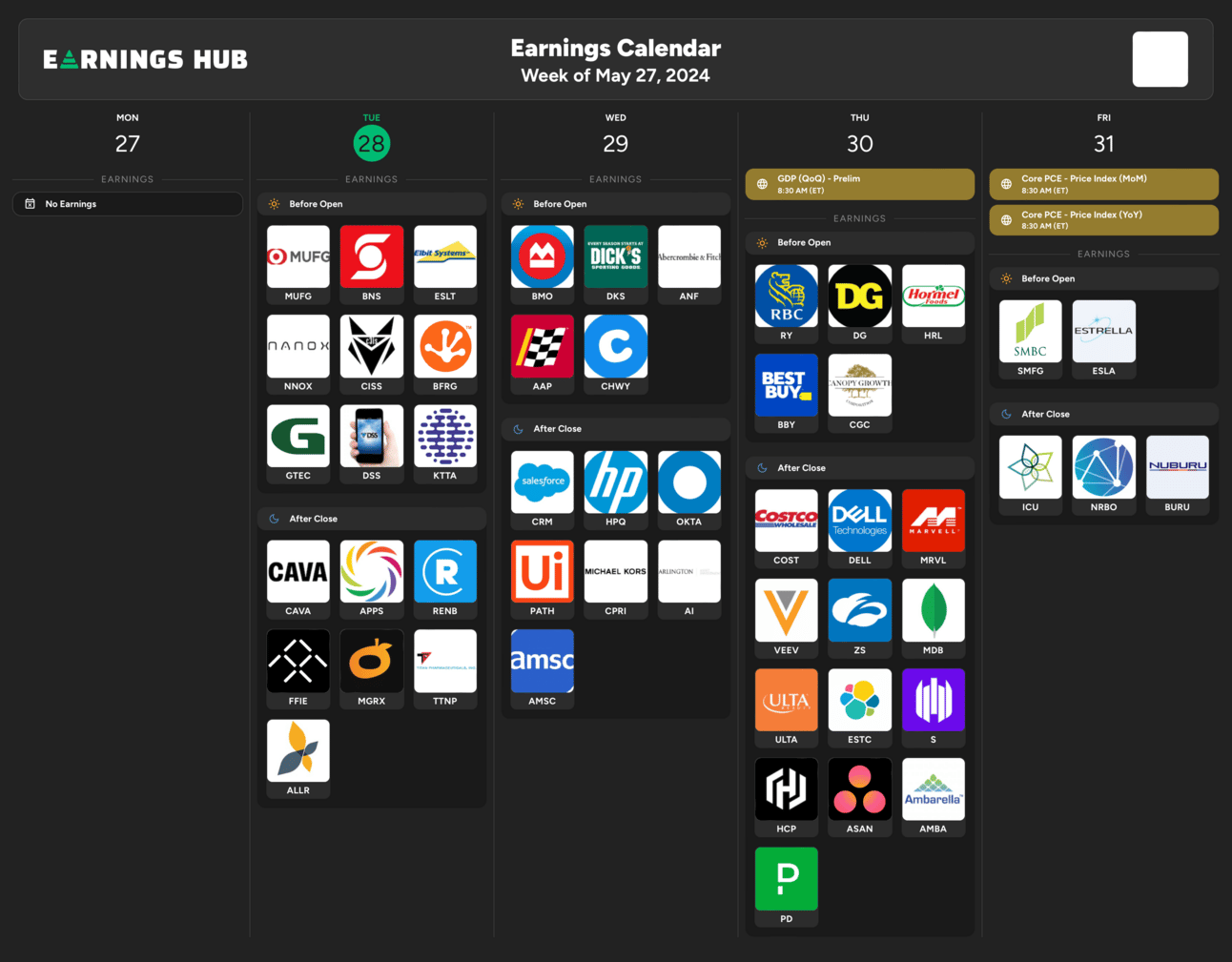

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 10:00 EST, CB Consumer Confidence

Thursday 8:30 EST, GDP

Thursday 11:00 EST, Crude Oil Inventories

Friday 8:30 EST, PCE

Friday 9:30 EST, Chicago PMI

Trending Sectors

Semiconductors, Biotech, and Software were the top trending sectors last week.

Top trending tickers from last week:

$TSLA

$NVDA

$AAPl

$MSFT

$AMD

$AMZN

$GME

$SMCI

$TSM

$ONMD

Have A Great Week!

As always enjoy the week and trade safe. I hope you all kill it!

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.