- Ace in the Hole

- Posts

- Ace in the Hole - Edition #23

Ace in the Hole - Edition #23

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend and had some time away from the charts!

Now it’s time to get back to work!

Last week we saw $SPY make new all time highs, gaining 1.65%.

We are back in price discovery mode with $SPY and $QQQ.

Market Thoughts

I am a few thousand dollars away from making it my biggest month trading ever, so I personally will be taking things easy on this back half of the month.

I continue to play opportunities that have high probability and buying lots of time on my contracts which has paid off tremendously.

$NVDA earnings this week should be eventful. I’m personally expecting them to beat, but of course anything can happen.

We also have a lot of FED speakers this week and some data points coming out, so watch out for volatility at these times.

Short-Term Setups This Week:

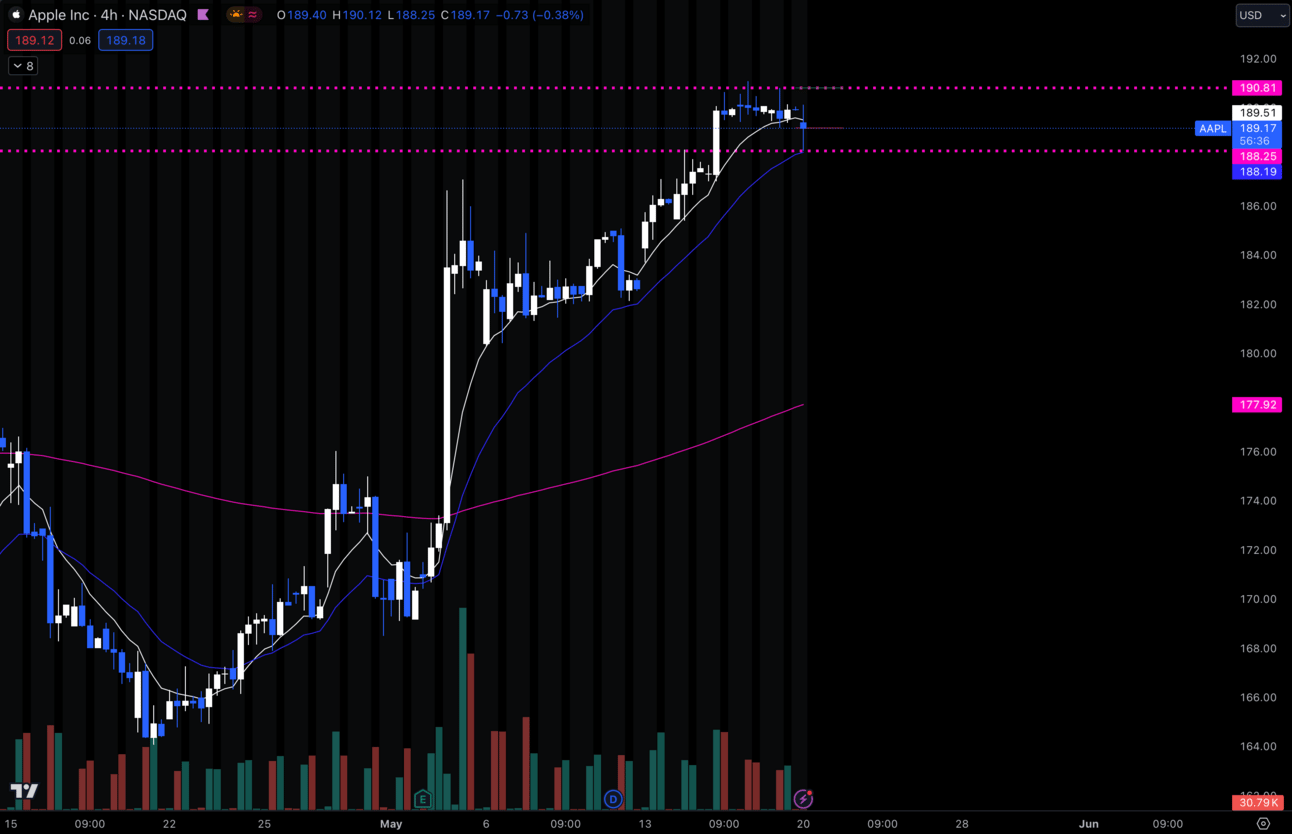

1. $AAPL

$AAPL 4 Hour

I’m liking $AAPL on this dip to the 4 hour 21 EMA.

This is the second pullback since the impulsive run it has started.

As long as this holds $188, I want to be long.

This is likely to be a play for the beginning of the week, but that can change.

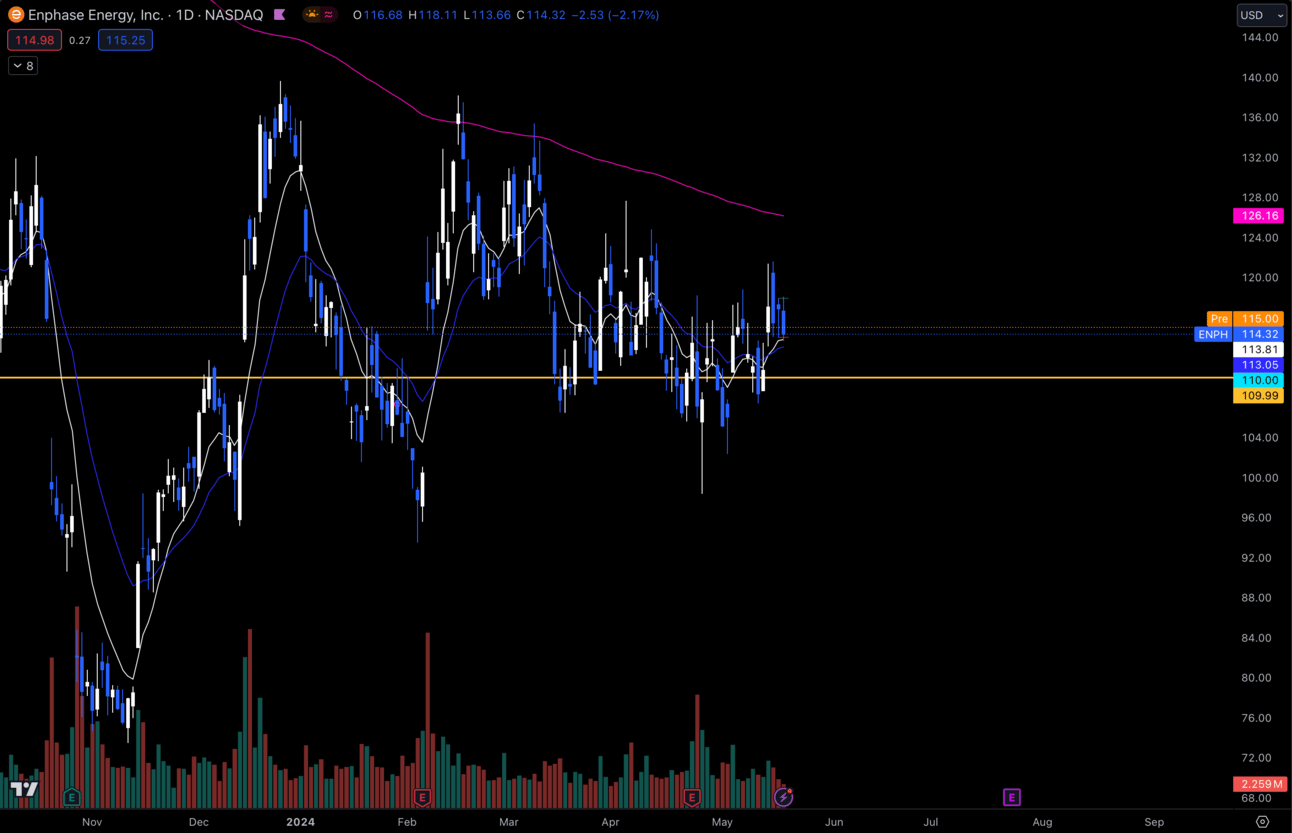

2. $ENPH

$ENPH Daily

I’m still watching $ENPH in this consolidation.

It is getting a dip to the daily EMAs and I would like to see it hold and start making moves higher.

As long as this is above $113, I want to be long.

Be aware, this name is known for fakeouts.

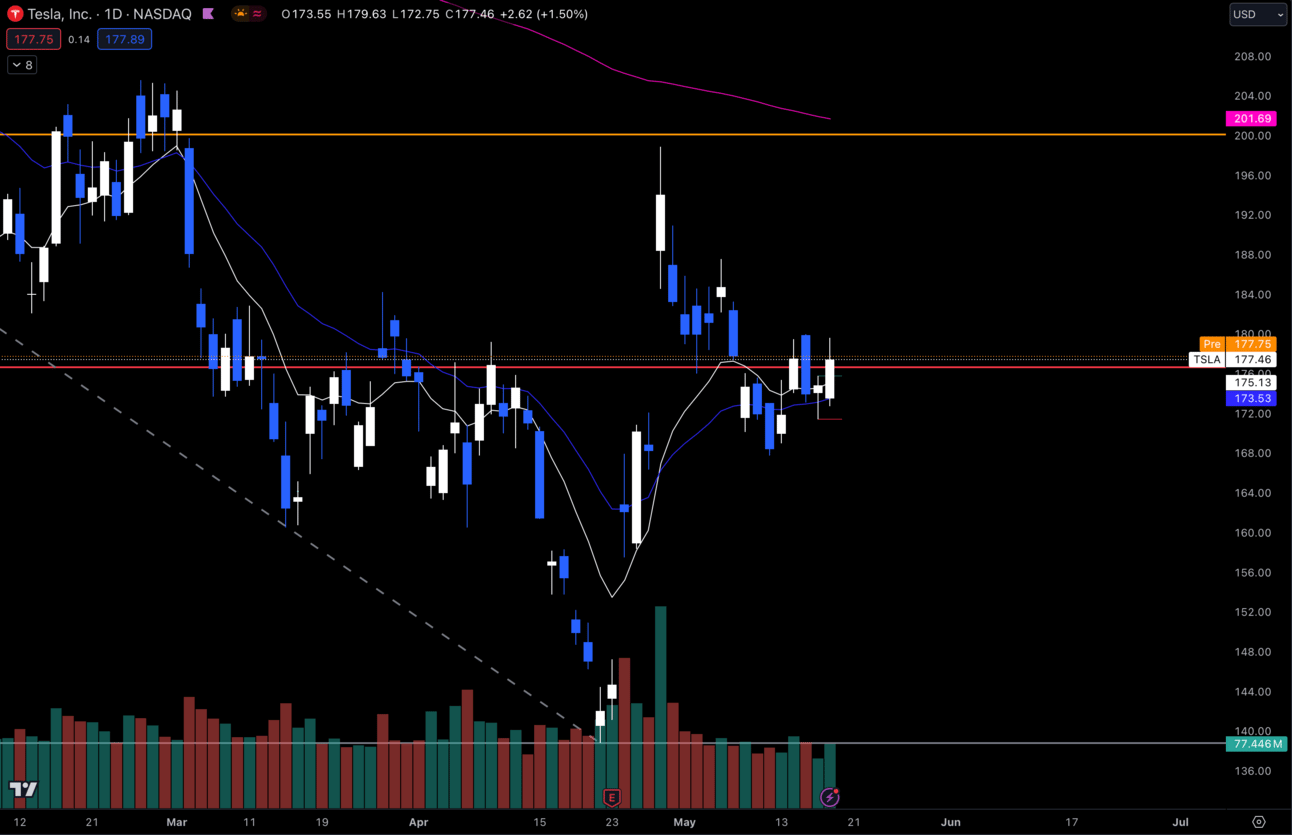

3. $TSLA

$TSLA Daily

$TSLA has been consolidating after this gap fill.

It had a decent day on Friday, but I want to see continued momentum to the upside after making that higher low on the daily.

As long as this is over $171.50, I want to be long.

Ideally, we get a higher high break and head towards $187 resistance.

Long-Term Setups This Week:

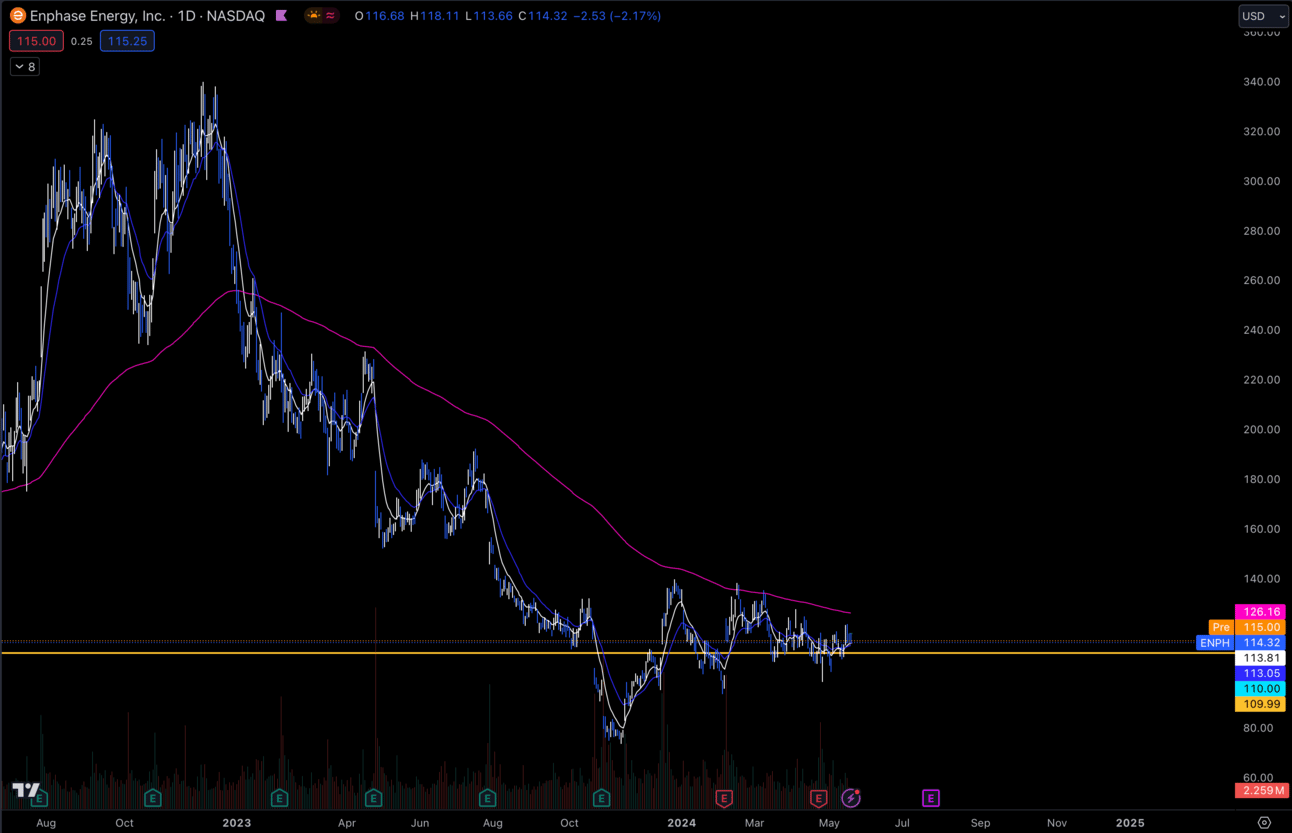

1. $ENPH

$ENPH Daily

$ENPH can really go either way when it finally does break this consolidation.

I think it will be up, but I could of course be wrong.

I personally added shares to the long-term last week and will continue to hold them as long as $ENPH is above $100.

Be aware that his can continue to chop in this range for as long as it wants to.

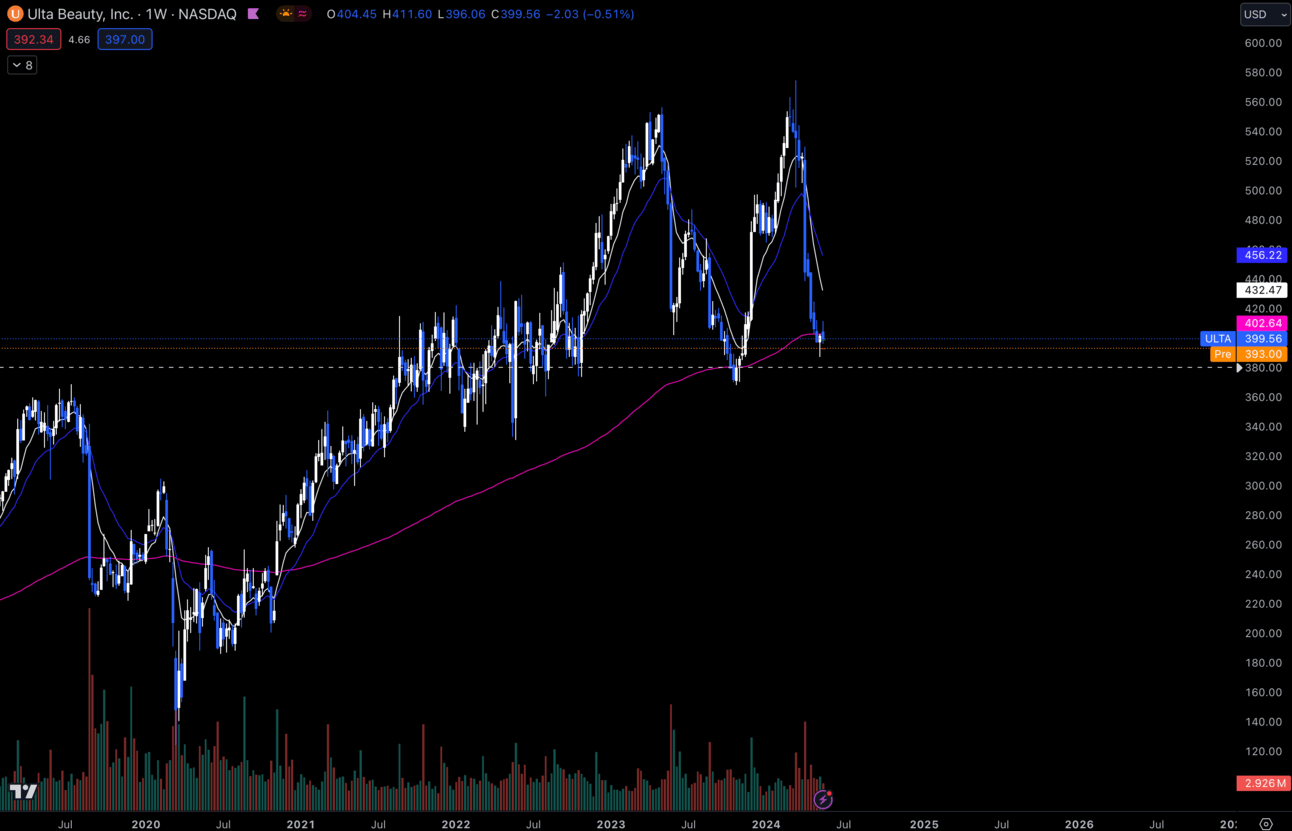

2. $ULTA

$ULTA Weekly

$ULTA is coming into some previous support and I’m interested to see if it holds.

I think this could be a good spot to get some more shares, but I might wait to see if it holds that $368 low.

If it does, I might add some more shares to my portfolio.

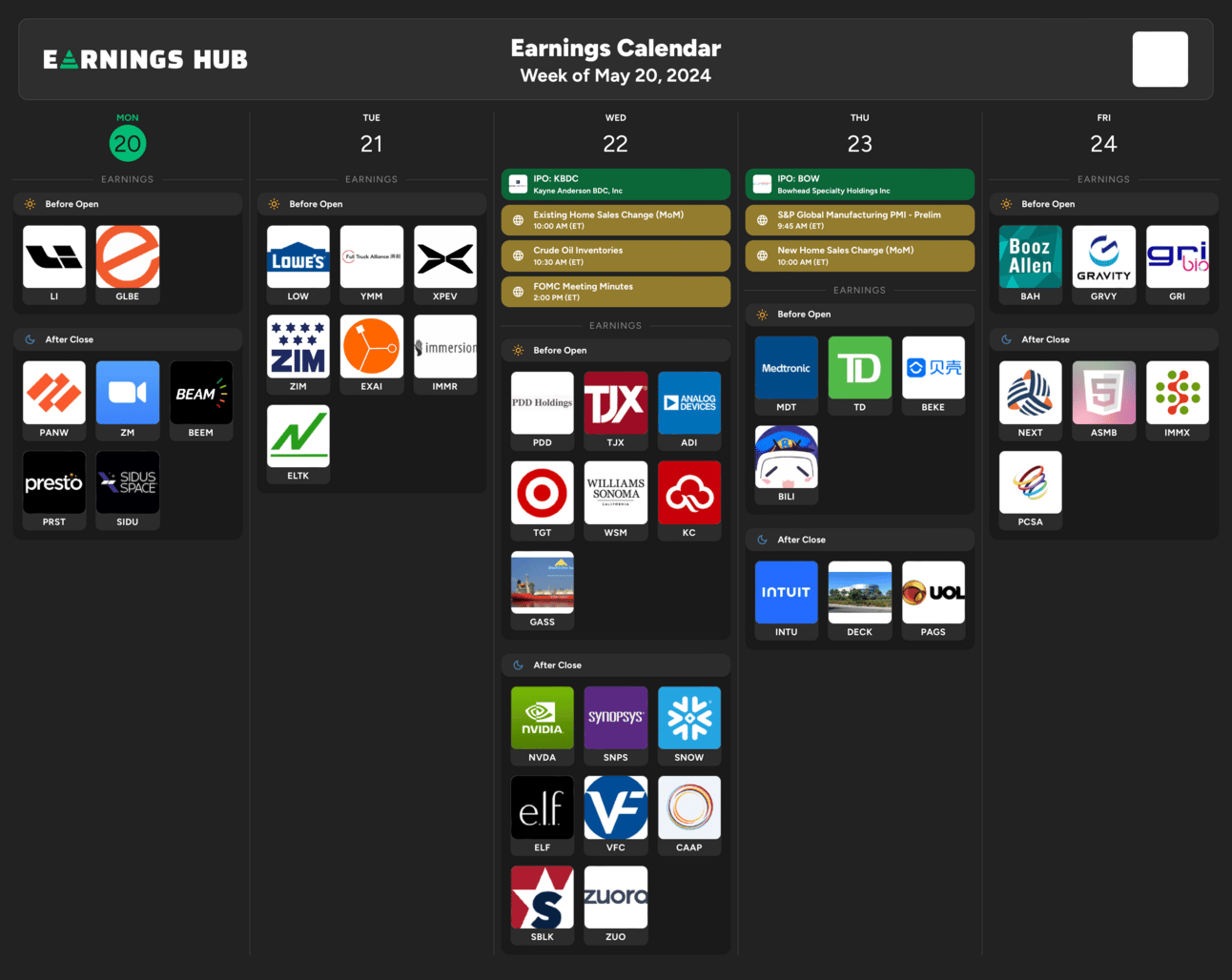

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Wednesday 10:00 EST, Existing Home Sales

Wednesday 10:30 EST, Crude Oil Inventories

Wednesday 1:00 EST, 20-Year Bond Auction

Wednesday 2:00 EST, FOMC Meeting Minutes

Thursday 8:30 EST, Initial Jobless Claims

Thursday 9:45 EST, S&P Global Services PMI

Thursday 10:00 EST, New Home Sales

Trending Sectors

Technology was the leading sector last week in the market.

Top trending tickers from last week:

$AVGO

$JPM

$LLY

$V

$XOM

$JNJ

$HD

Have A Great Week!

As always, enjoy the week, trade safe, and let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.