- Ace in the Hole

- Posts

- Ace in the Hole - Edition #22

Ace in the Hole - Edition #22

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great weekend and an amazing Mother’s Day!

Last week was a great week for the market as $SPY is very close to hitting all time highs again.

$SPY rose 1.87% last week even during a very low volume time with almost no economic data.

These past 3 weeks for me have been the best weeks for me all year, so I’m going to take it pretty easy.

Market Thoughts

$SPY is in a big spot coming into previous all time highs.

I’d love to see a breakout and next leg up, although I don’t think it will be that easy.

I think if $AAPL, $MSFT, and $NVDA continue to perform well then we will see new all time highs.

Either way I’m going to continue to play what’s in front of me and not worry too much.

Short-Term Setups This Week:

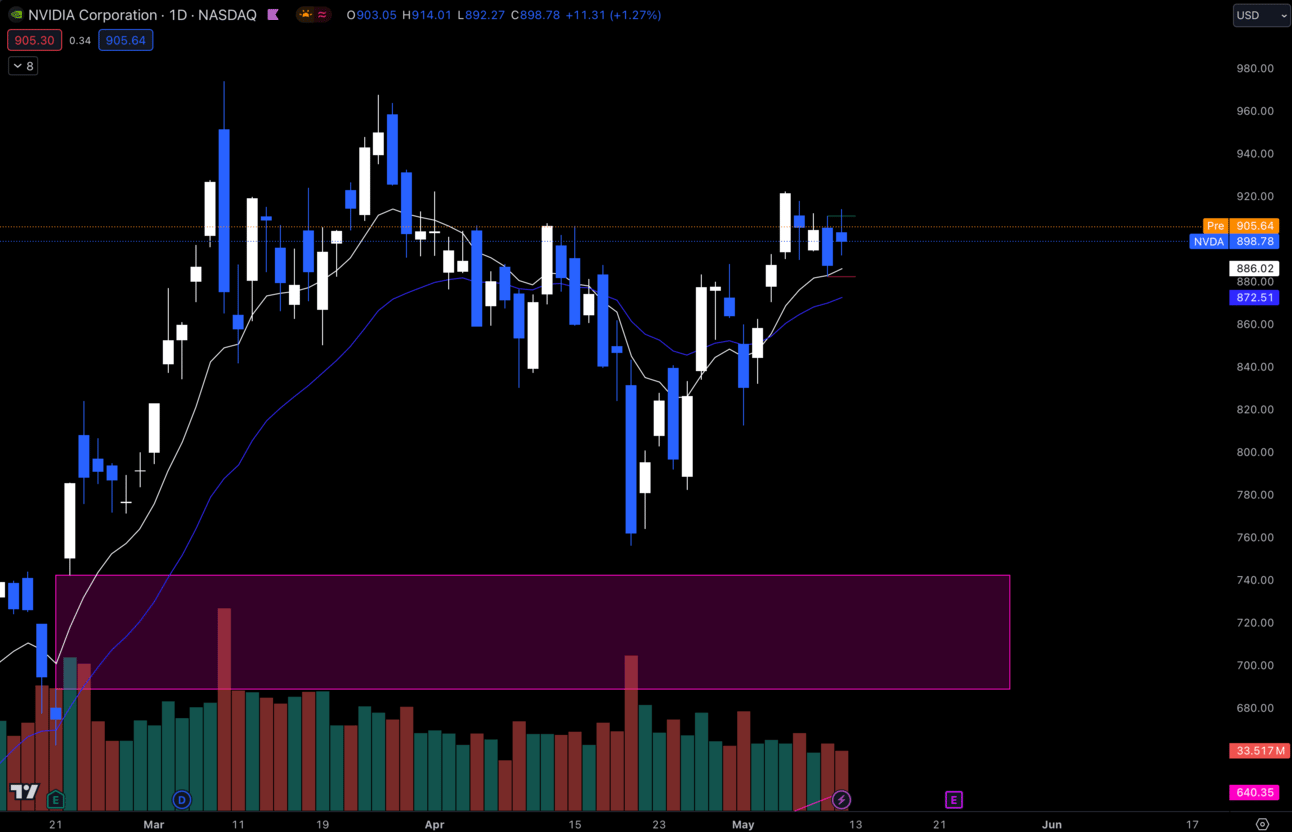

1. $NVDA

$NVDA Daily

I’m liking $NVDA here and think as long as it can hold $870, I like this for longs.

Earnings are next Wednesday, so I wouldn’t be surprised to see a bit of a pre-earnings run up on this name.

Under $870 I wouldn’t want to be long anymore.

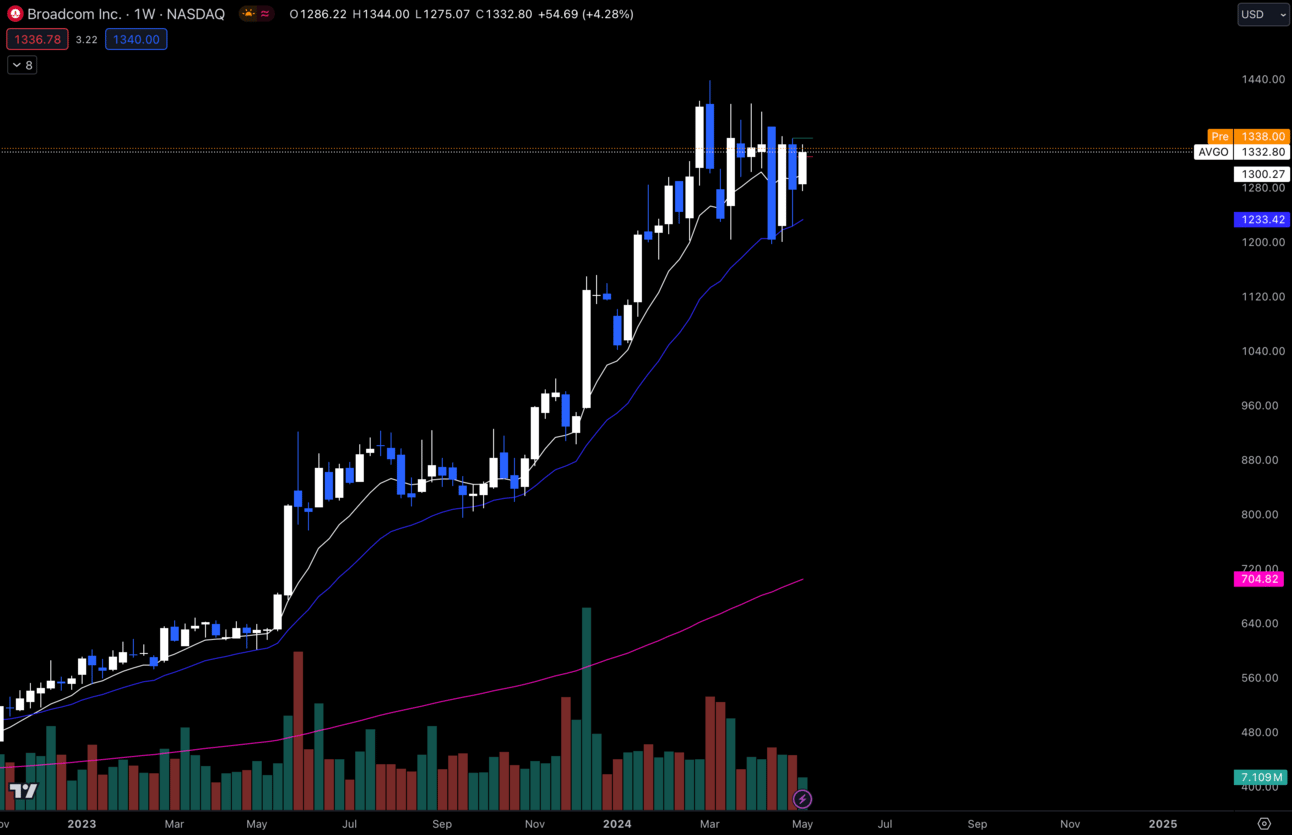

2. $AVGO

$AVGO Weekly

$AVGO has been in some heavy consolidation, but is looking very constructive in my opinion.

I like this for calls as long as it is holding $1300.

Under $1300 I wouldn’t be long as that is a big level that we should hold.

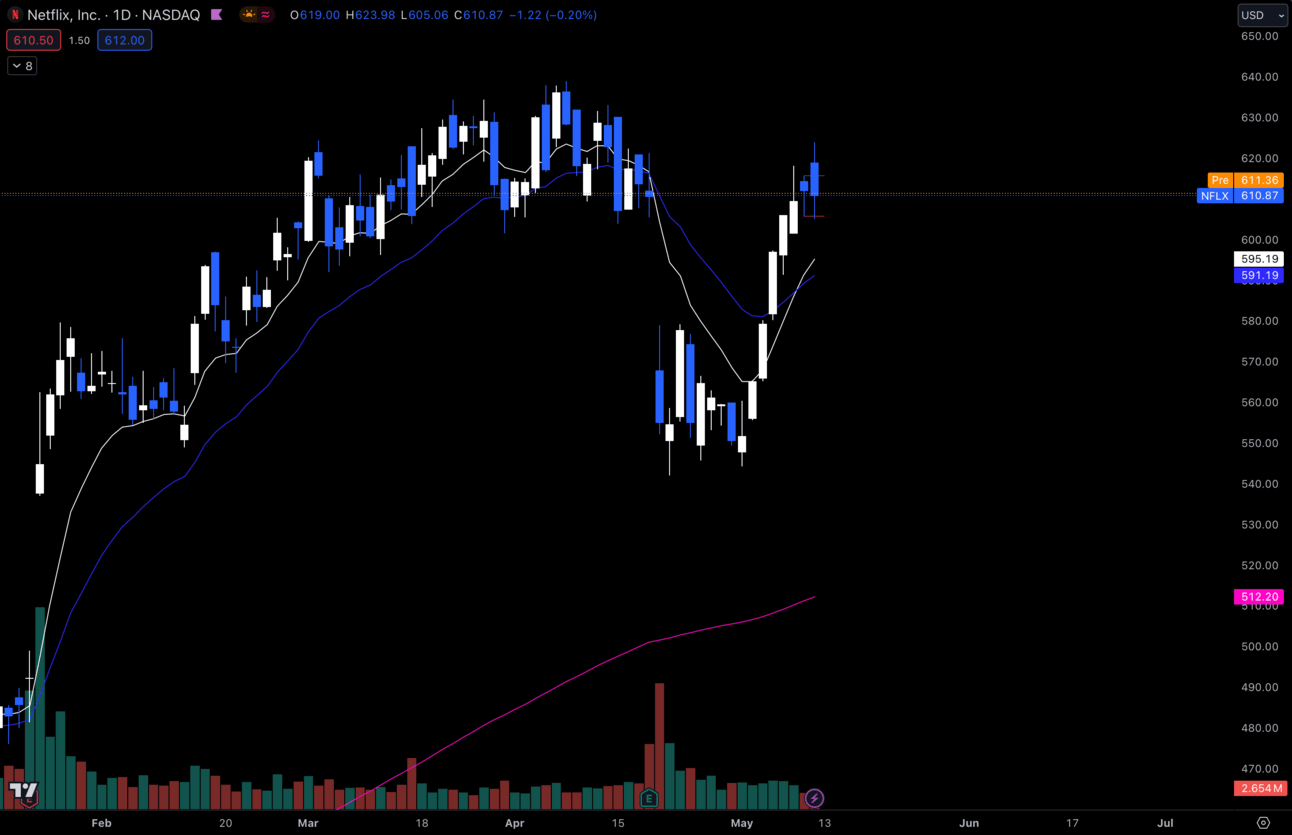

3. $NFLX

$NFLX Daily

$NFLX has had a beautiful retracement since earnings.

I’m looking for a pullback to the daily EMAs, but would like to buy that pullback.

I think any dips near those EMAs, especially if it starts to make a constructive looking bull flag, should be bought up.

Under $590 I wouldn't be long anymore.

Long-Term Setups This Week:

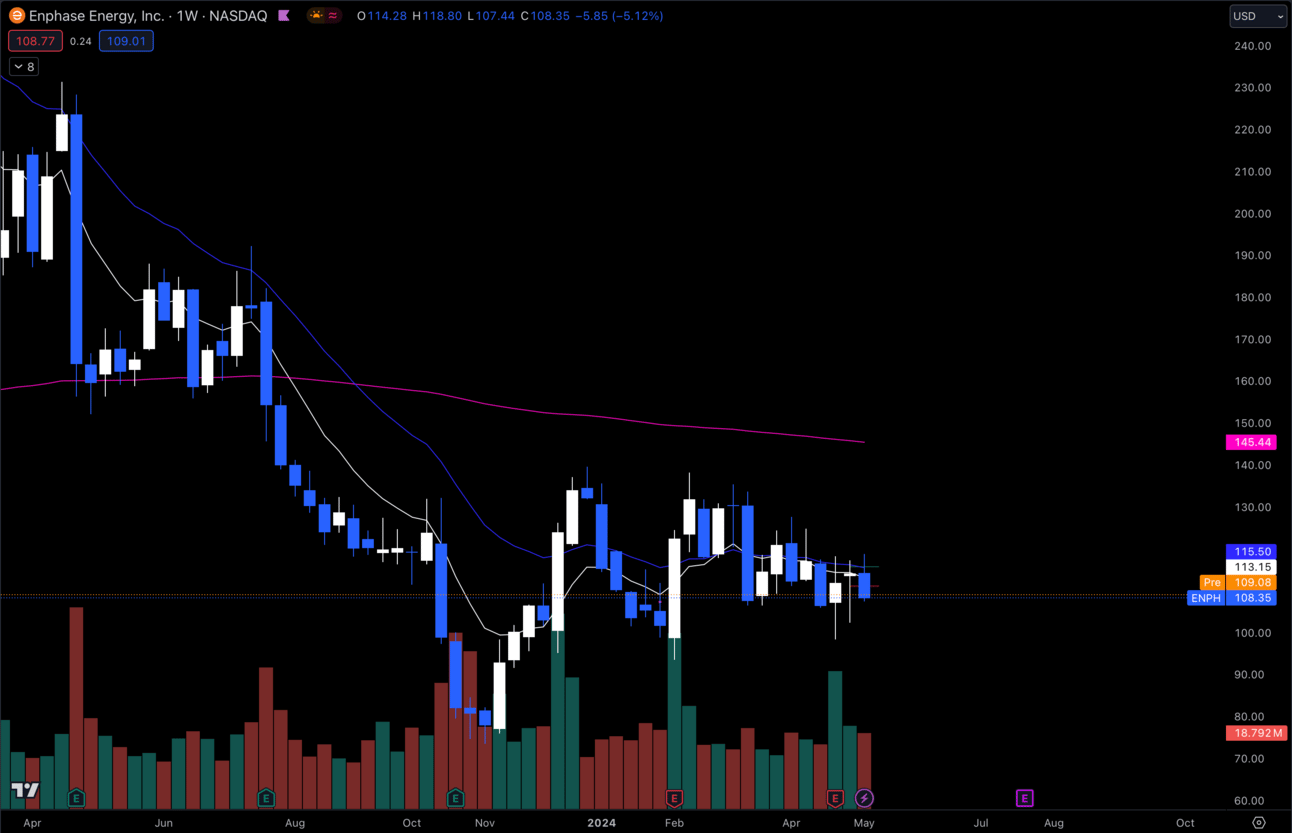

1. $ENPH

$ENPH Weekly

I’m considering starting a long-term position in $ENPH soon.

It’s been in heavy consolidation for quite awhile now and needs to break one way or the other.

I’m thinking it will break to the upside due to it continuing to make higher lows, but we don’t have higher highs yet.

Under $100 wouldn’t be good for this name, so I would want that to hold.

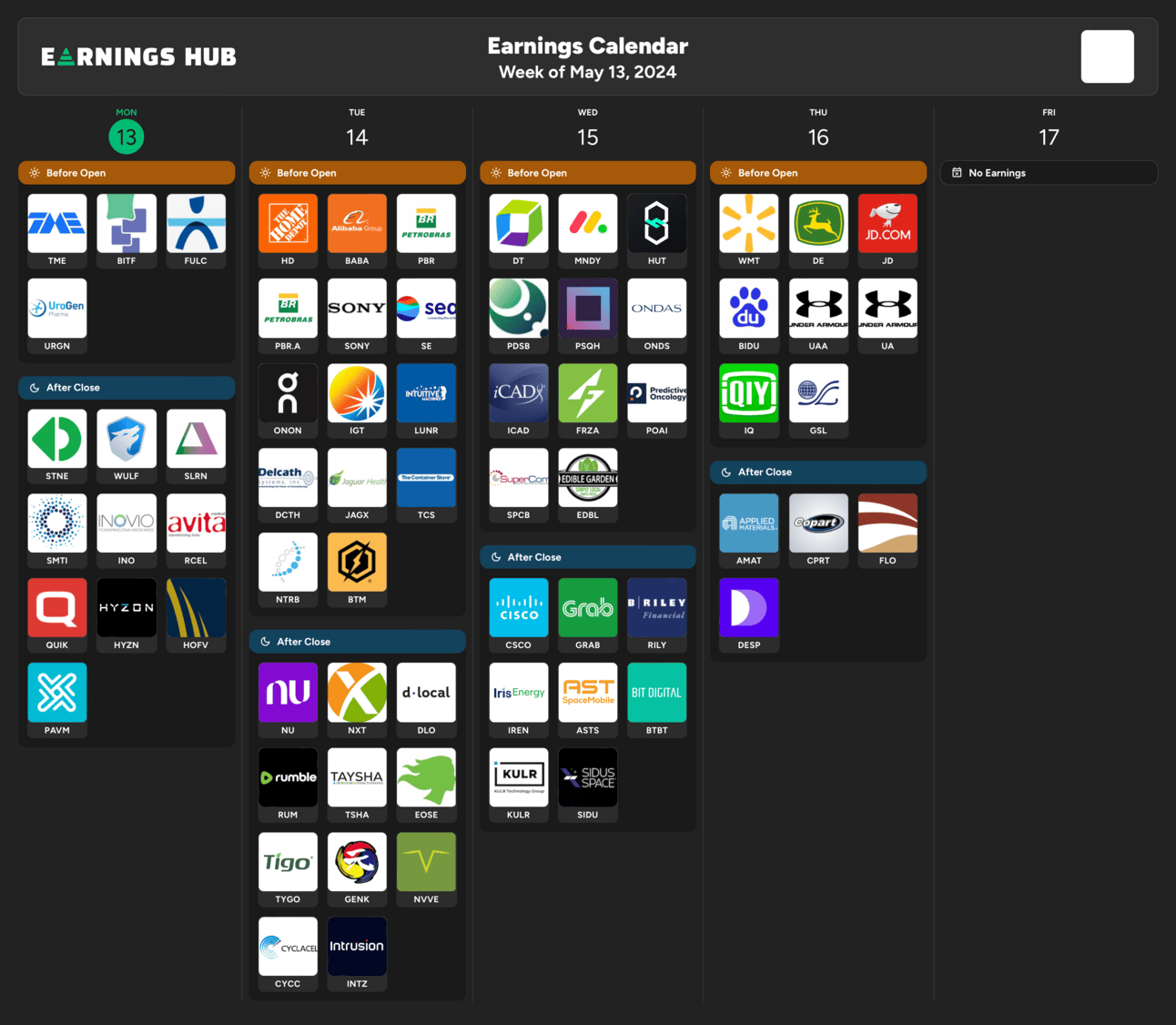

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, PPI

Tuesday 10:00 EST, Jerome Powell Speaks

Wednesday 8:30 EST, CPI

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 8:30 EST, Initial Jobless Claims

Trending Sectors

Semiconductors, Airlines, and Technology were trending the most last week with significant gains.

Most trending tickers last week:

$NVAX

$SOUN

$GME

$TSM

$SG

$BAC

$SRTS

$ZIM

$BE

$GEN

Have A Great Week!

I hope everybody trades safe and has an amazing week!

Let’s kill it and make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.