- Ace in the Hole

- Posts

- Ace in the Hole - Edition #21

Ace in the Hole - Edition #21

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing week!

Last week was crazy with FOMC and NFP, but we get a little break from economic data this week.

Last newsletter post I said I had my best week in the market this whole year.

I then proceeded to beat that week this last week and I couldn’t be happier.

Let’s get into the new week!

Market Thoughts

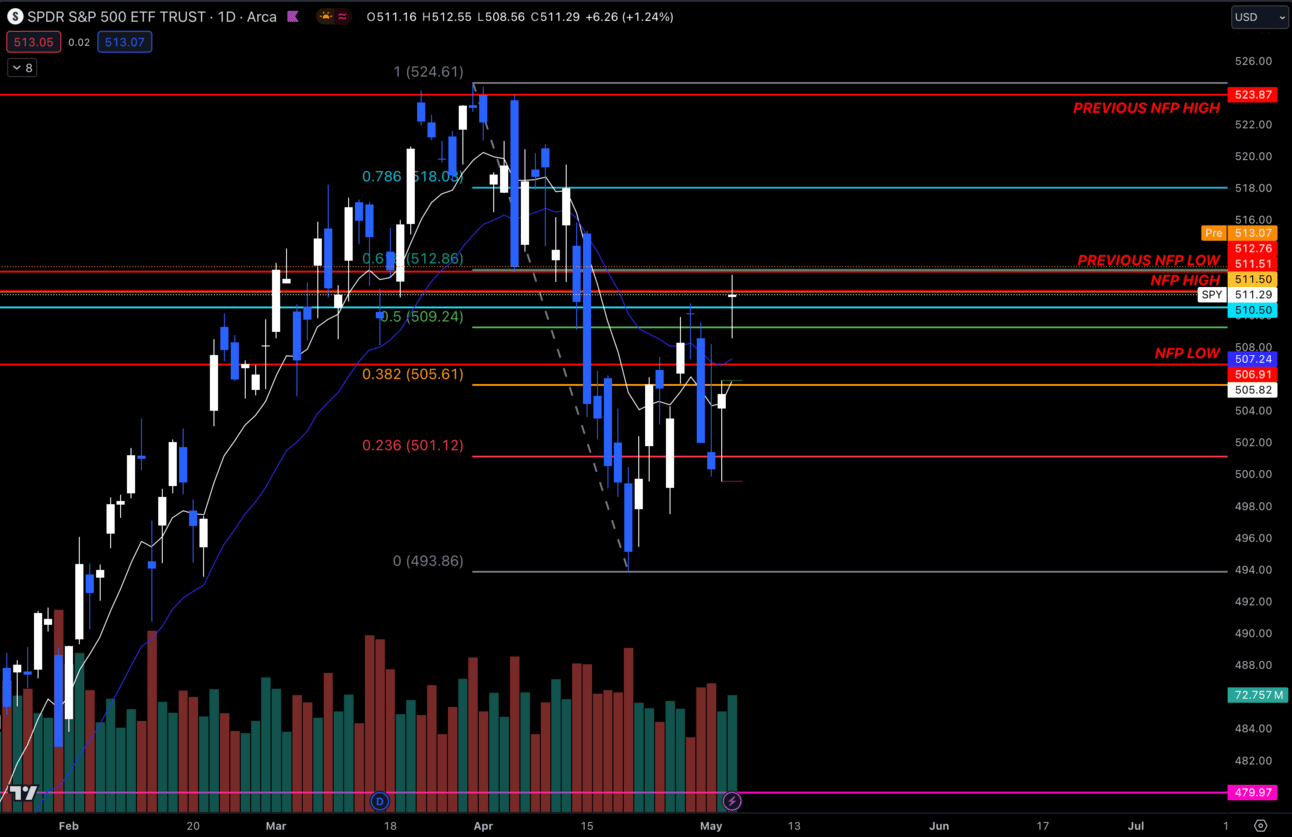

$SPY Daily

In terms of $SPY, I think we are at a make or break spot.

We are right at the spot where shorts can step in and bring another leg down.

Even if we don’t and this ends up being a dip buy situation, I still think we need to dip down from here.

So I am expecting a dip from here and am waiting to see whether or not bulls step in on the way down.

Either way, I will always play what’s in front of me, so we’ll see what happens!

Short-Term Setups This Week:

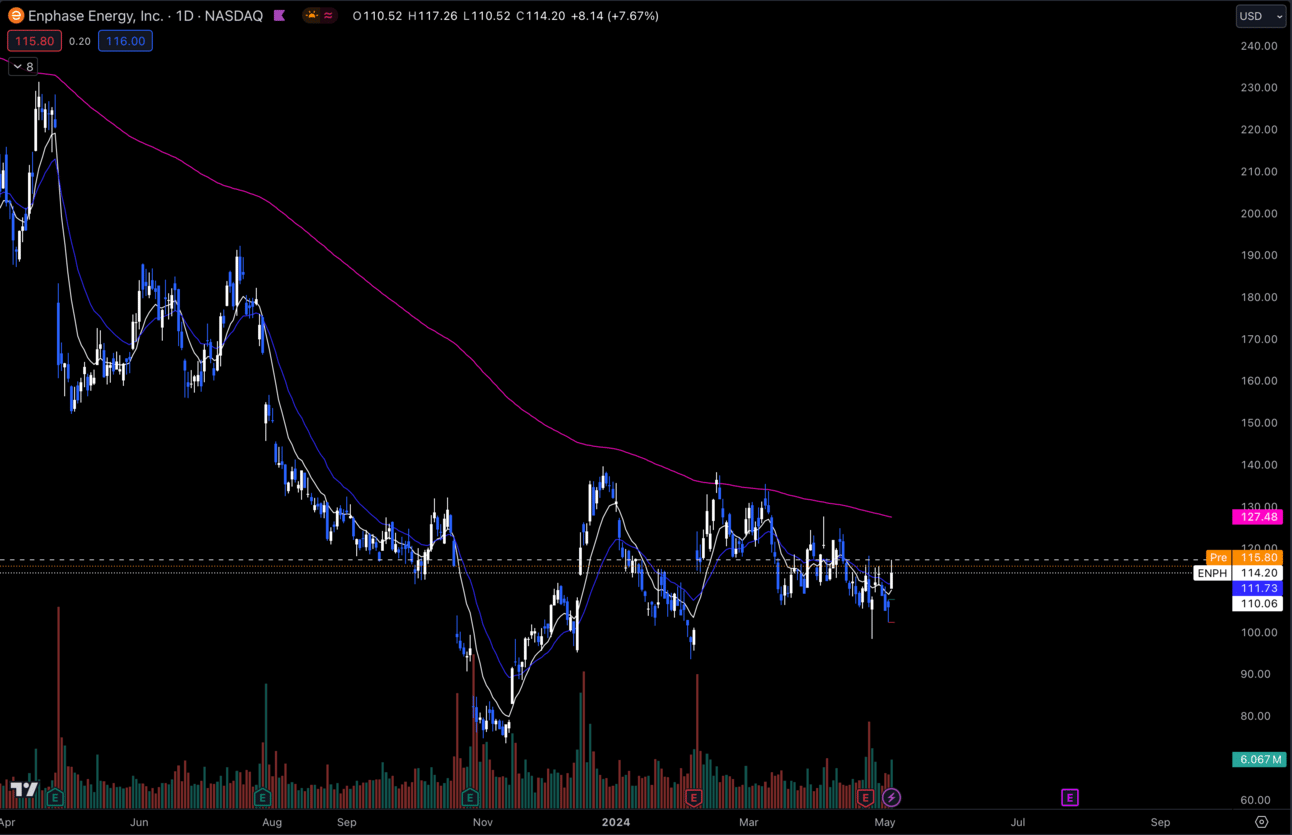

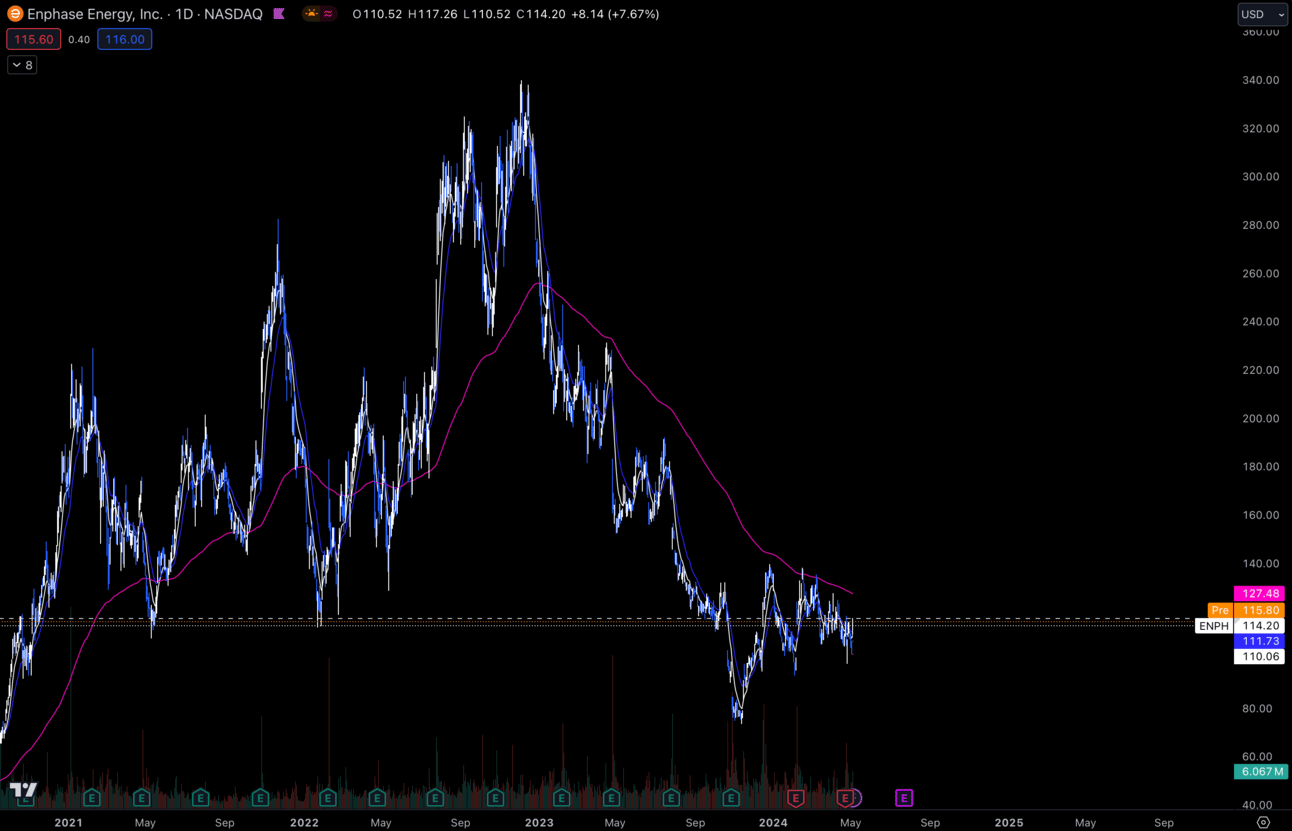

1. $ENPH

$ENPH Daily

I’m very interested in $ENPH here. It’s been consolidating since December of last year and I think it’s time to pick a direction.

I personally think the direction will be to the upside, but of course this can truly break either way, so you want to be ready for both.

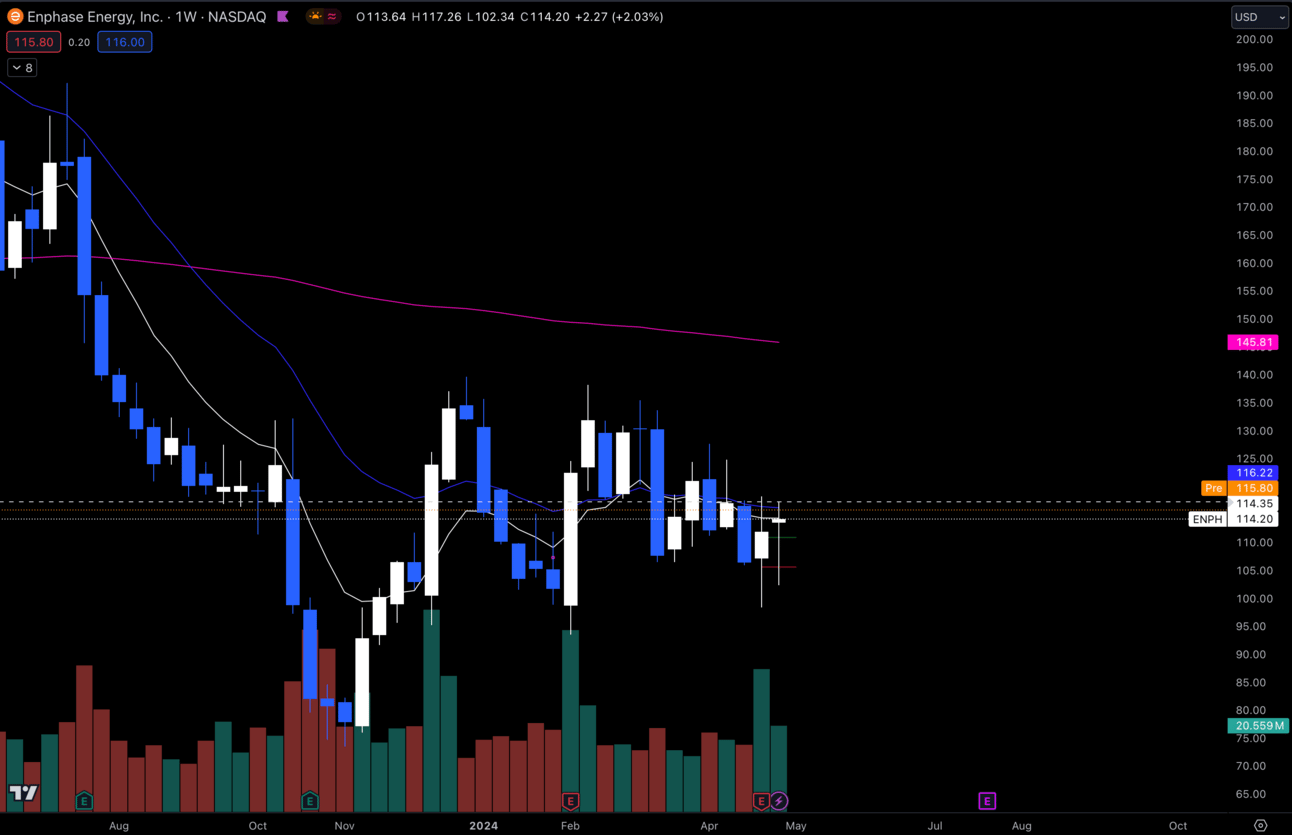

$ENPH Weekly

As long as this holds above $102 I’m bullish. I would love to see this make a move towards $135 resistance and see if it can break through.

If it can make a higher high above that resistance, I think this hits $150.

2. $CELH

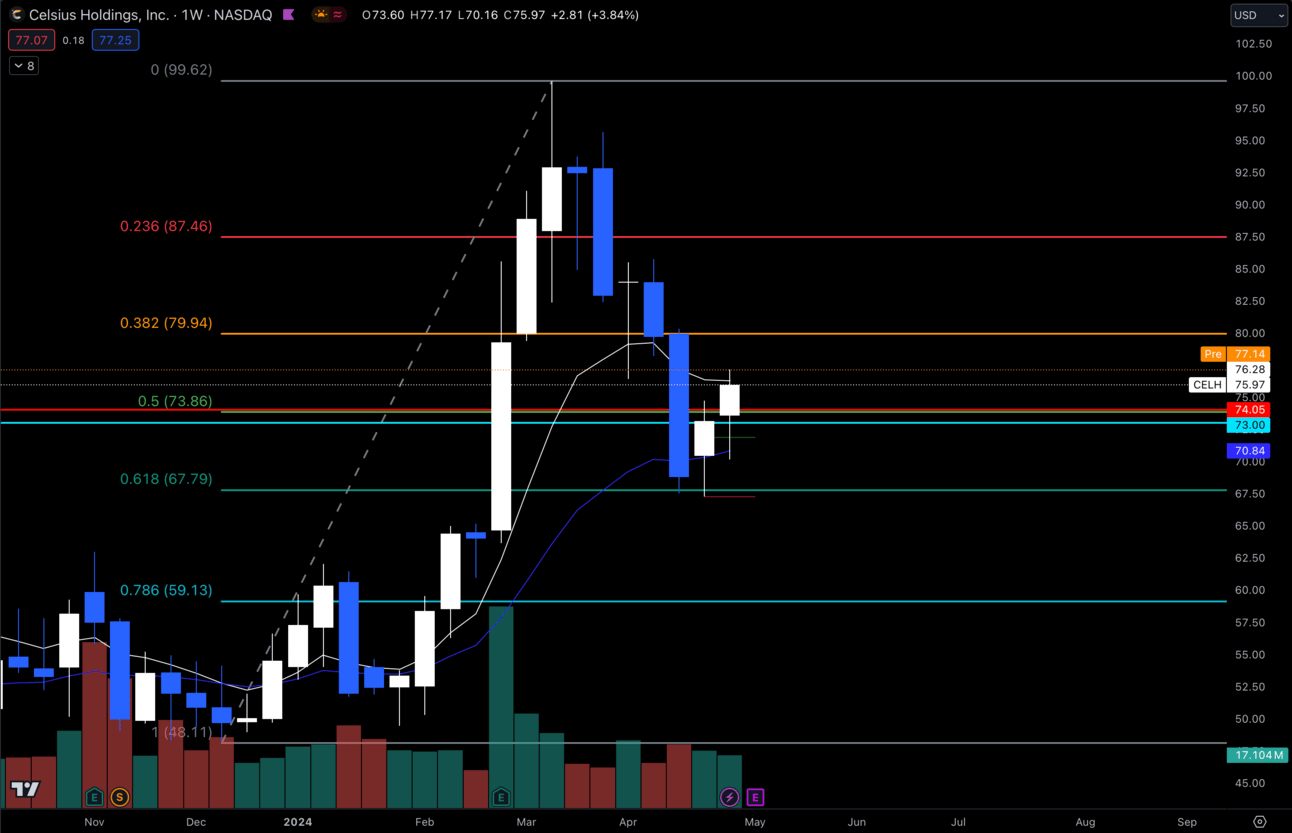

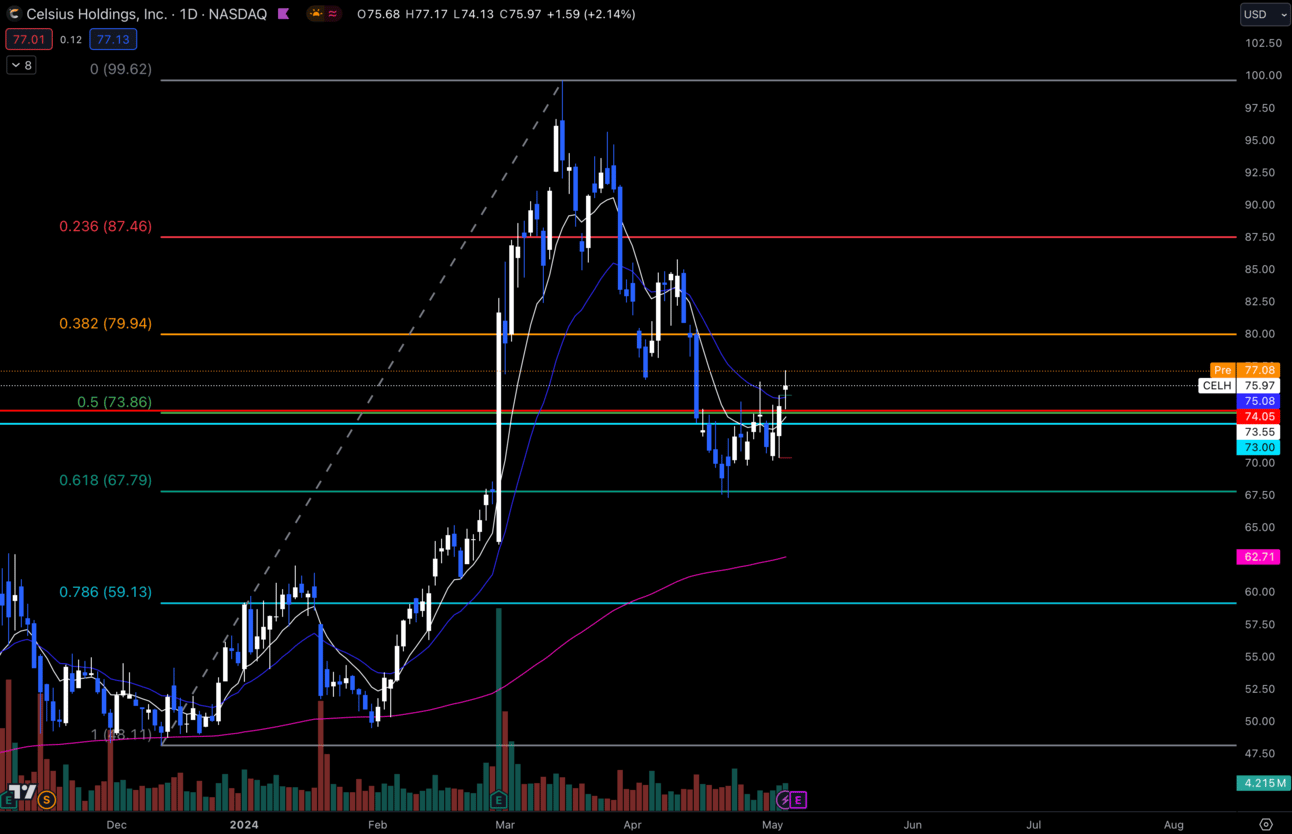

$CELH Weekly

I still love $CELH for longs at these prices. Areas of concern right now are my weekly 9 EMA at $76.28 and my .382 fib at $79.94.

I’m open to $CELH needing a dip before it goes and tests my fib, so as long as this holds $70 I will remain bullish.

Long-Term Setups This Week:

1. $TSLA

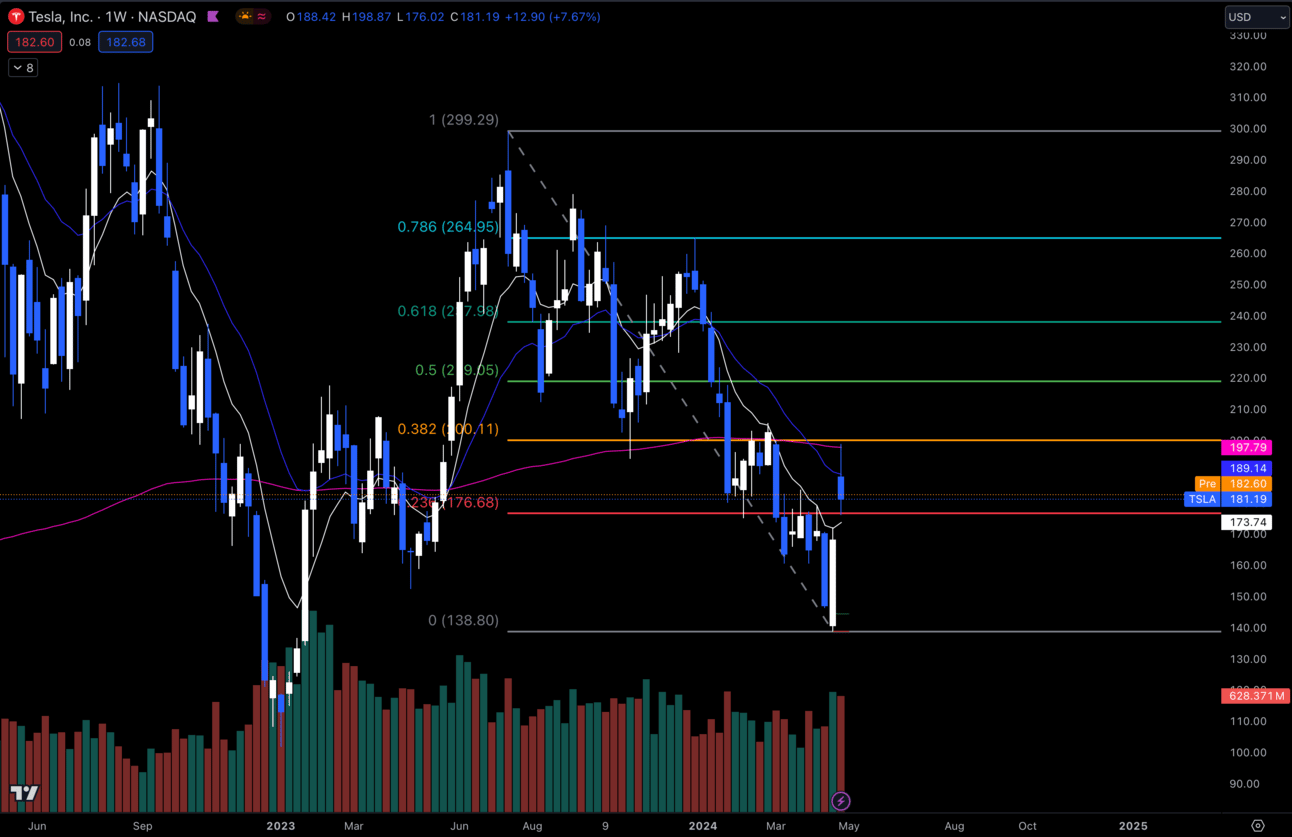

TSLA Weekly

$TSLA is looking very interesting here. I’m wondering if this is finally the bottom or not.

Prior to last week it had a beautiful week to the upside which put in a strong candle.

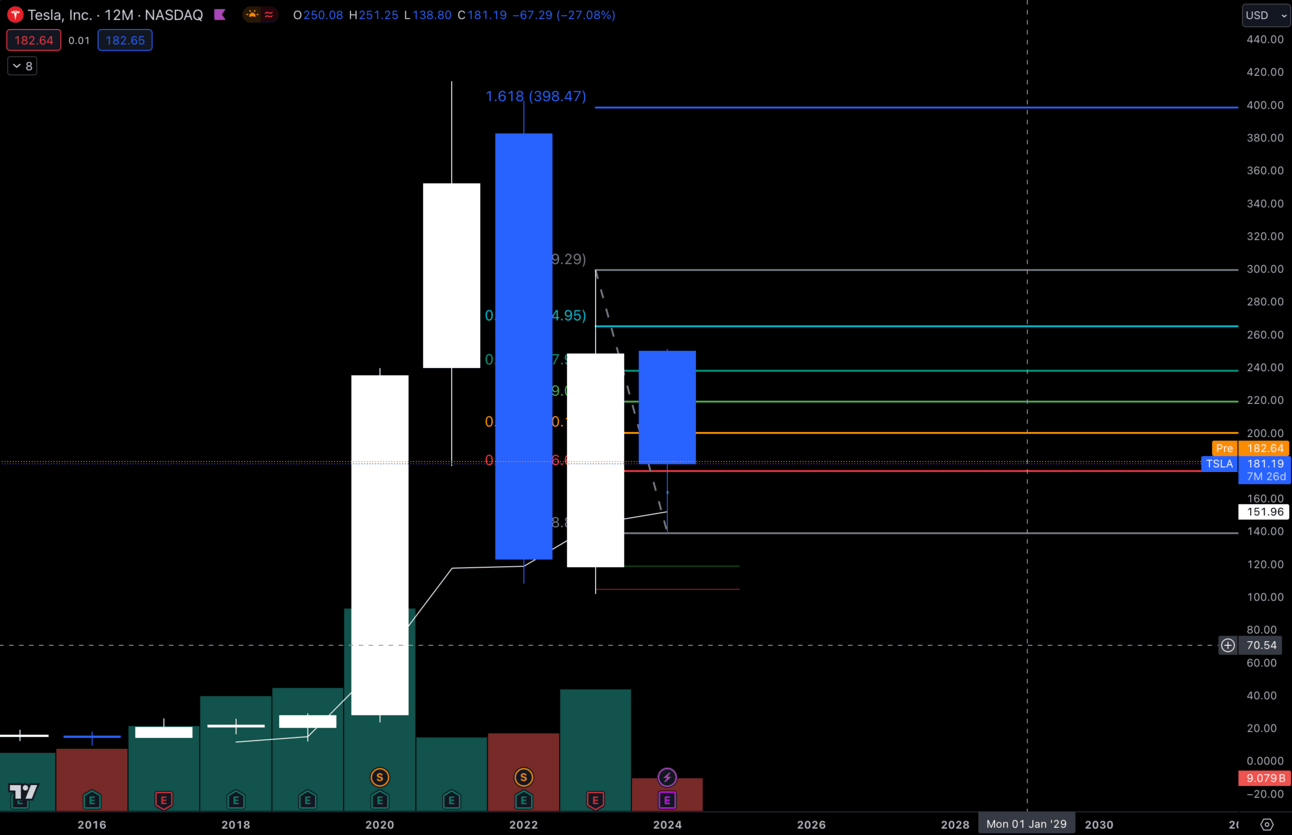

$TSLA Yearly

It has gone down and tested the yearly 9 EMA and held like I thought.

There seemed to be big buyers when we got down there, so I’m feeling pretty confident that this could be near bottom for $TSLA.

Either way I think it’s a solid add at these prices and I will likely pick up some more this week.

2. $CELH

$CELH Daily

Same as last week, I still love these prices for $CELH especially if you already have shares around $50.

3. $ENPH

$ENPH Daily

I’m thinking of starting a long-term position in $ENPH before this consolidation breaks out or down.

Since I personally think the break will be to the upside, I’d like to pick up some shares and hold them as long as we hold $100.

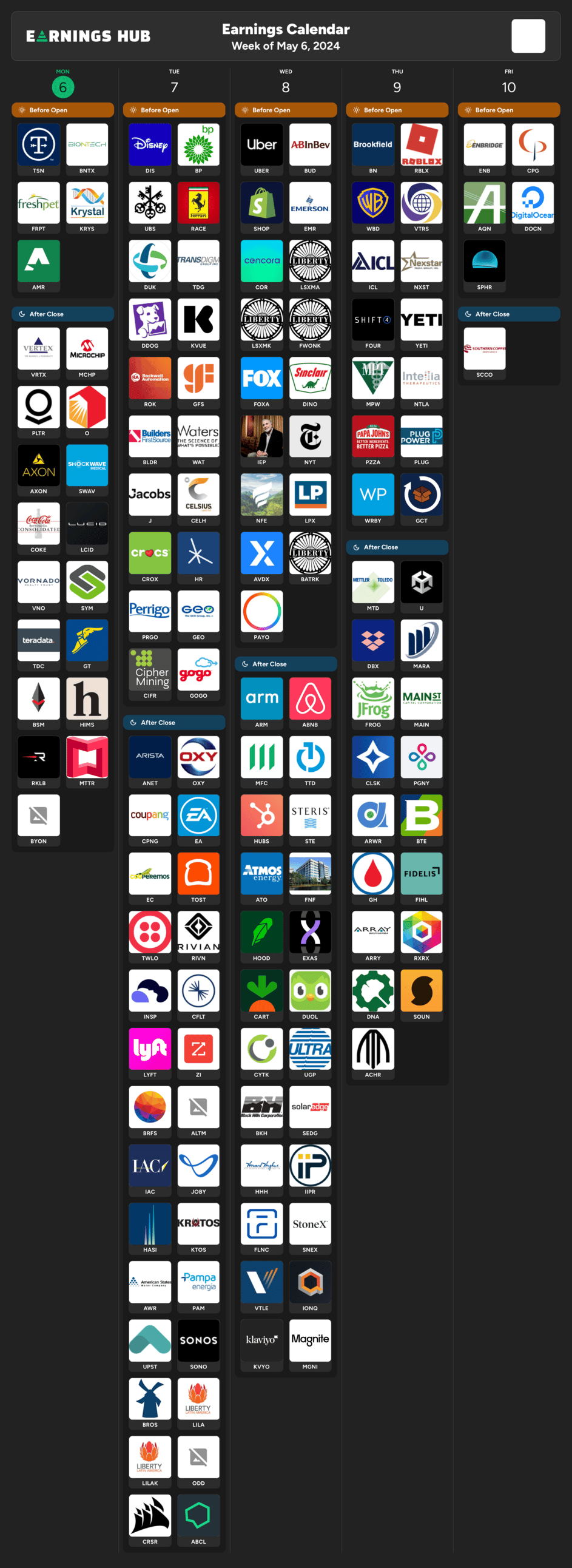

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 8:30 EST, Initial Jobless Claims

Trending Sectors

Biotech, Internet Retail, Semiconductors, and Internet Content were top trending sectors last week.

Most trending tickers from last week:

$AVGO

$JPM

$LLY

$V

$XOM

$JNJ

$HD

Have A Great Week!

As always, enjoy the week me beautiful people and let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.