- Ace in the Hole

- Posts

- Ace in the Hole - Edition #20

Ace in the Hole - Edition #20

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend!

This is our 20th week in a row making the newsletter, I hope ya’ll have been enjoying!

I appreciate every single one of you taking the time to read this.

Last week in the market was a lot of fun for me personally.

Had my best week in the markets since the new year started and I’m ready to keep that good energy going!

Let’s get this new week started.

Market Thoughts

All of last week was a relief bounce to the upside after the downside moves we’ve had.

I’m trying to see whether we are getting dip bought off of the weekly 21 EMA or if we are bouncing to setup for a lower high and get some more downside towards that $480.

Either way I’m ready for both sides, but I personally hope we do get more downside.

A retest of previous all time highs is needed and that sits right around $480 on $SPY.

No matter what happens, I’ll be playing what’s in front of me and will likely keep paying more attention to individual names rather than $SPY.

Short-Term Setups This Week:

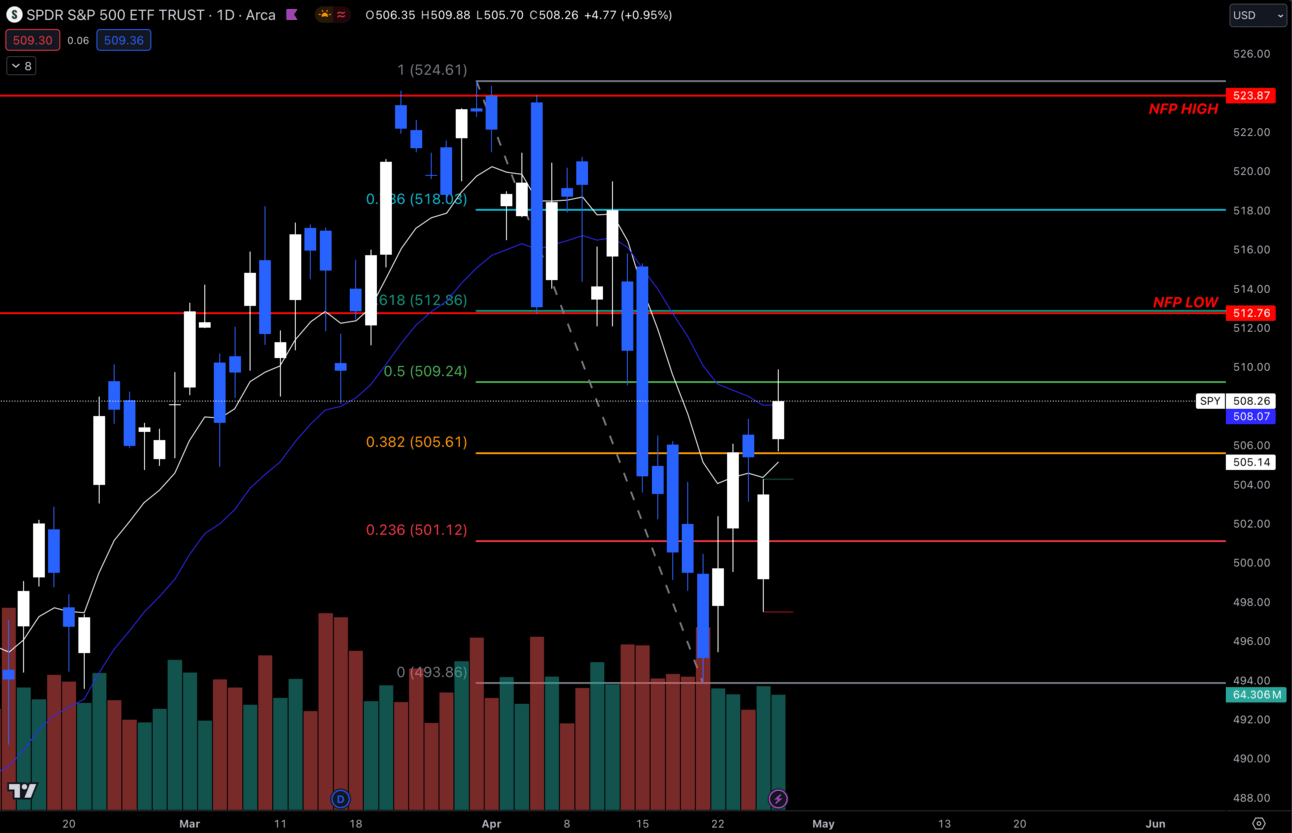

1. $SPY

$SPY Daily

I drew some fibs from the recent high to last week’s lows and $SPY is retesting the .5 fib right now.

I’m interested to see if we can clear this to the upside or get rejection and start heading for the next leg down.

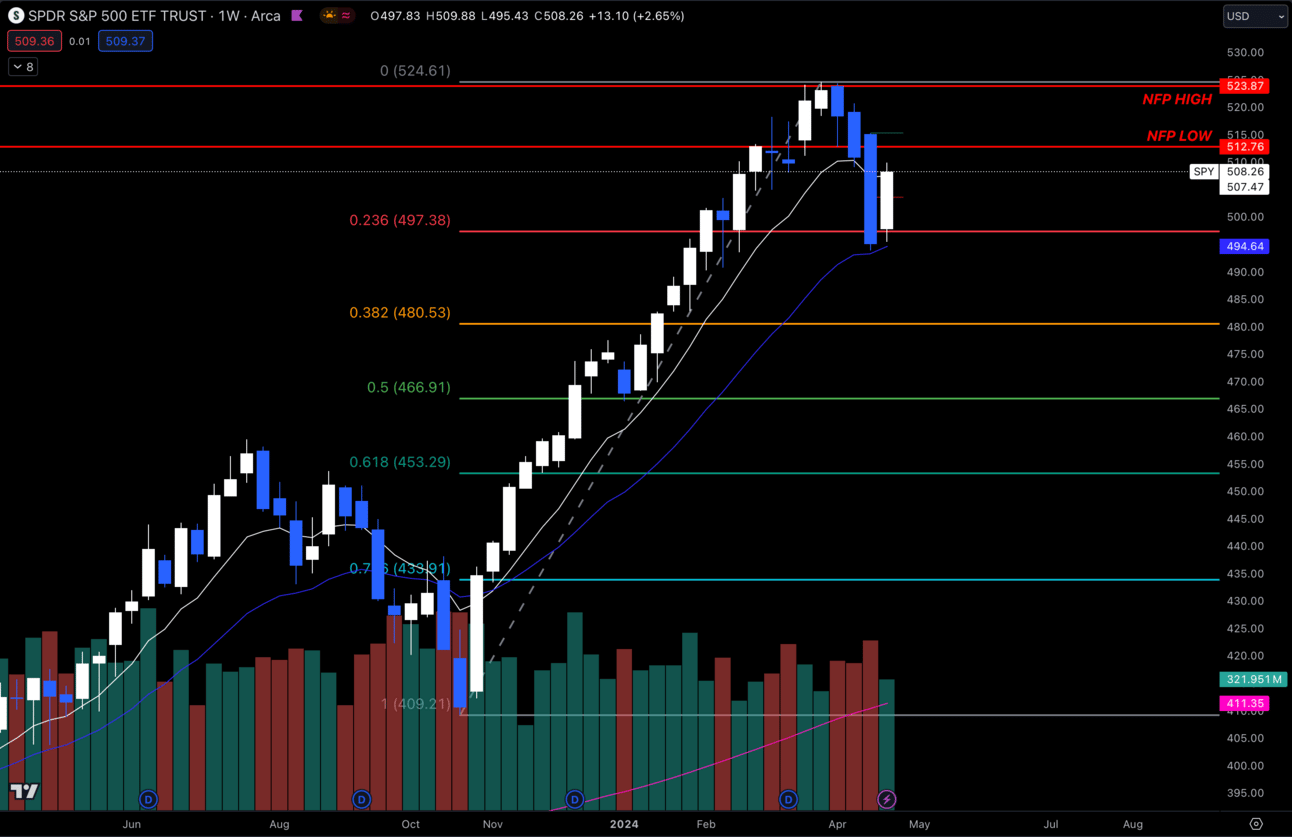

$SPY Weekly

Zoom out to the weekly where I have my fibs from October low to recent highs and you can see that $SPY is holding my .236 fib so far.

This is why I’m thinking $SPY is coin flippy here. It really could pick either direction, but again I’m leaning towards being a bit more bearish.

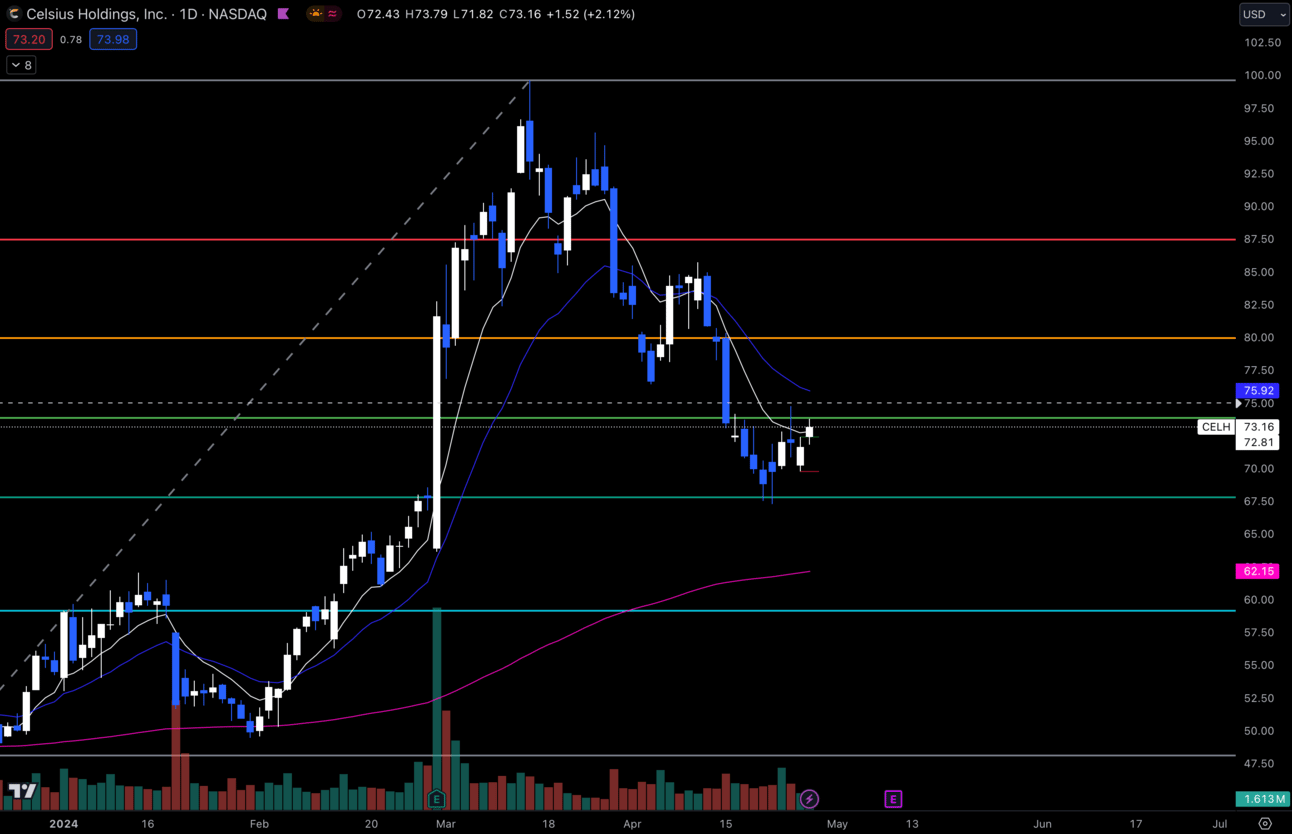

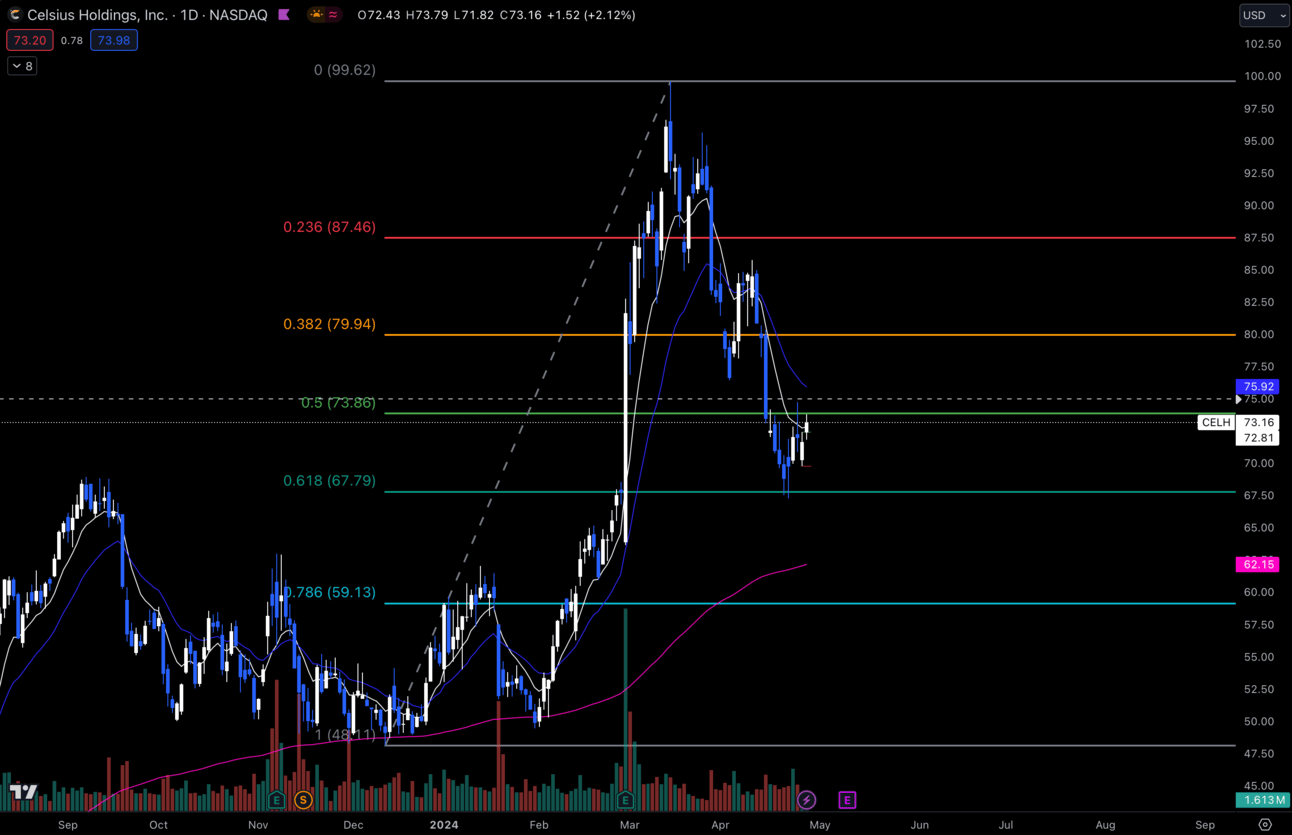

2. $CELH

$CELH Daily

$CELH is retesting my .5 fib currently.

It really needs a solid higher low put in before I’m more confident with this going to the upside.

I’d like to see us clear this .5 fib this week and hold. $76.42 is a previous low that we would also need to reclaim for this to not be another lower high.

I expect rejection at this level at first.

If this can’t get more bullish momentum this week, I think it’s possible we make another lower high and head towards my 200 EMA at $62.15.

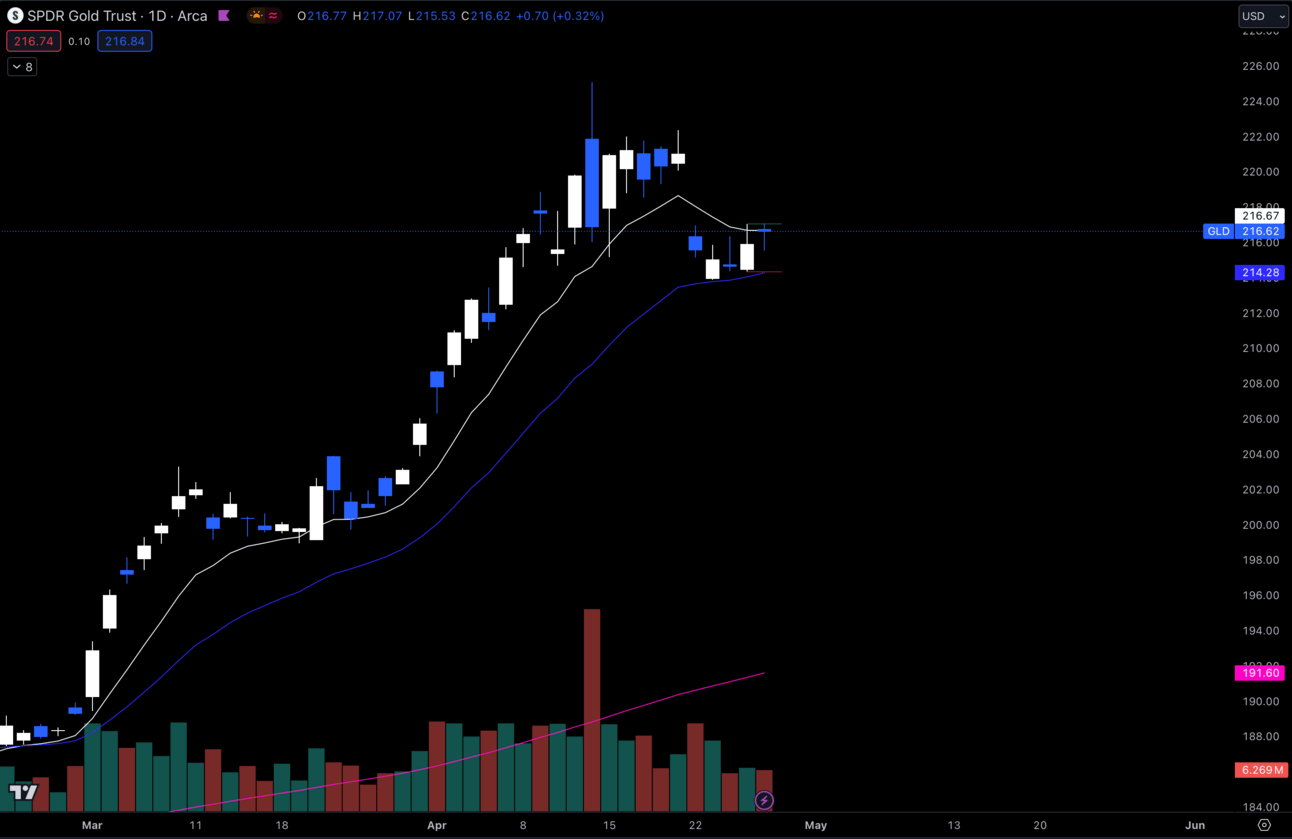

3. $GLD

$GLD Daily

$GLD is looking interesting here. I want to see this gap fill to the upside since this has held its daily 21 EMA.

Under 213.87 I wouldn’t be long, but as long as that is holding I like this for a gap fill to the upside which would bring a decent move to capitalize on.

Long-Term Setups This Week:

1. $CELH

$CELH Daily

I personally still like these prices for long-term adds.

I added at my .618 fib last week and brought my average slightly above $55.

I think waiting for a dip back towards $70 is probably smart as I think it’s very possible we need to come back down to make a higher low.

Either way I love this name for the long-term and it is at some decent prices at the moment.

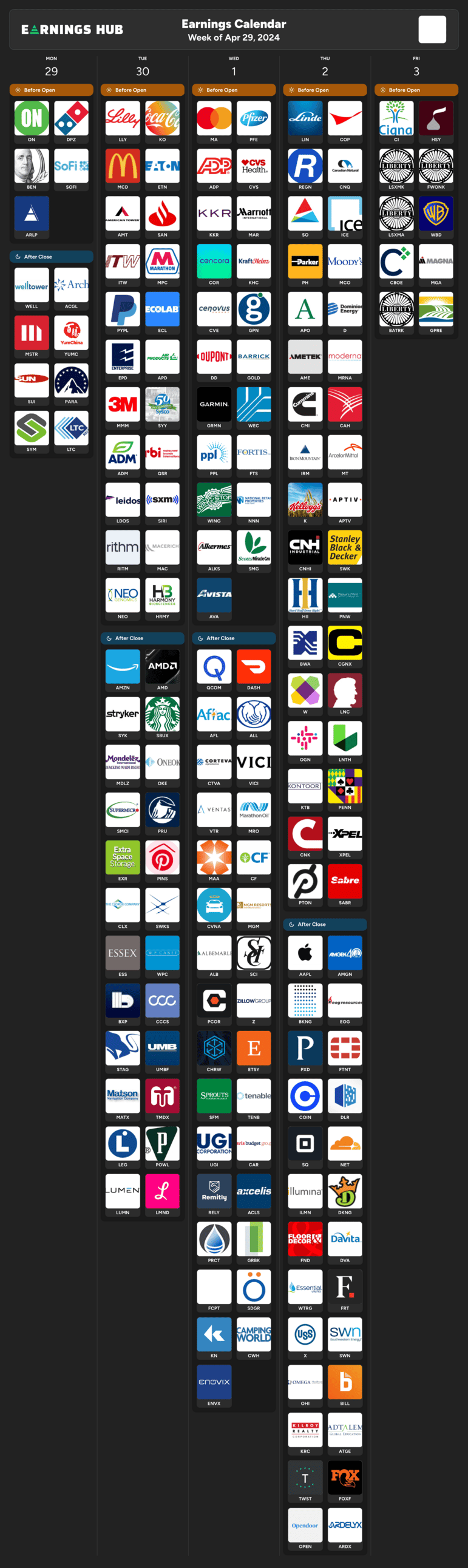

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 9:45 EST, Chicago PMI

Tuesday 10:00 EST, CB Consumer Confidence

Wednesday 9:45 EST, S&P Global US Manufacturing PMI

Wednesday 10:00 EST, ISM Manufacturing PMI

Wednesday 10:30 EST, Crude Oil Inventories

Wednesday 2:30 EST, FOMC Press Conference

Friday 8:30 EST, Nonfarm Payrolls

Trending Sectors

Airlines and Internet Content & Information were the most trending sectors from last week.

Most trending tickers from last week:

$UAL

$DAL

$NVDA

$TSLA

$SPOT

$SHOP

$META

$GOOGL

$MSFT

$INTC

Have A Great Week!

As always, enjoy the week and trade safe.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.