- Ace in the Hole

- Posts

- Ace in the Hole - Edition #19

Ace in the Hole - Edition #19

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend!

Last week was pretty crazy with all the downside in the market.

The $SPY fell 3.07% last week and is now down 5.61% from all time highs.

Market Thoughts

I’ve been pretty bearish over the past week, playing a lot more puts than I was a week ago.

I’m still thinking we fall more on $SPY, but we’ve had some big moves in the market over the past 2 weeks.

With that, I think it’s very possible we get a bounce and chop a bit this week around that $500 level.

Ultimately I think we pull back to previous all time highs around $480.

Short-Term Setups This Week:

1. $CVNA

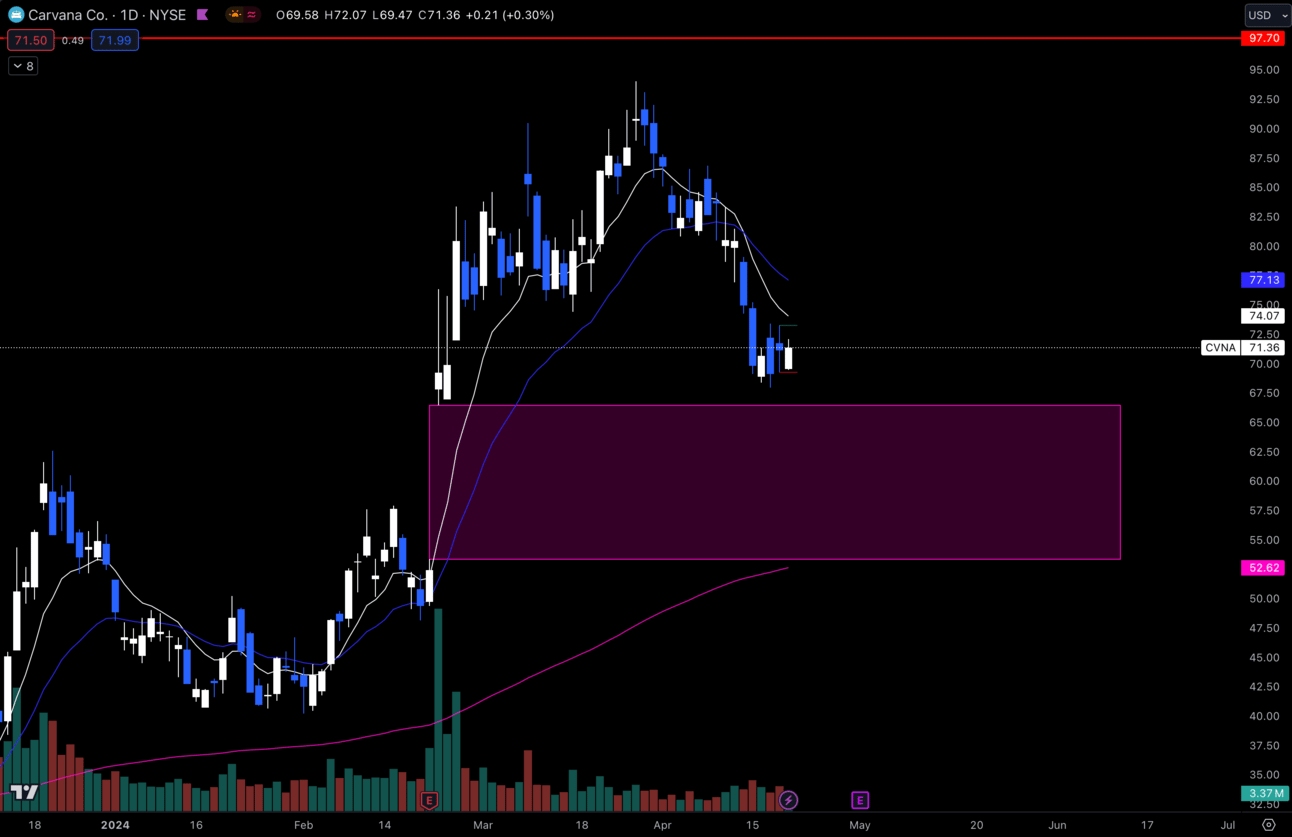

$CVNA Daily

I’ve been playing a lot of puts on $CVNA over the past week, but I think it wants more downside.

I have this gap from $66.50 to $53.33 which I think $CVNA will fill.

I’m watching for a bounce closer to my daily EMAs to get my put position.

If it does start trading in the gap, I’ll be watching the $60 level for a possible bounce.

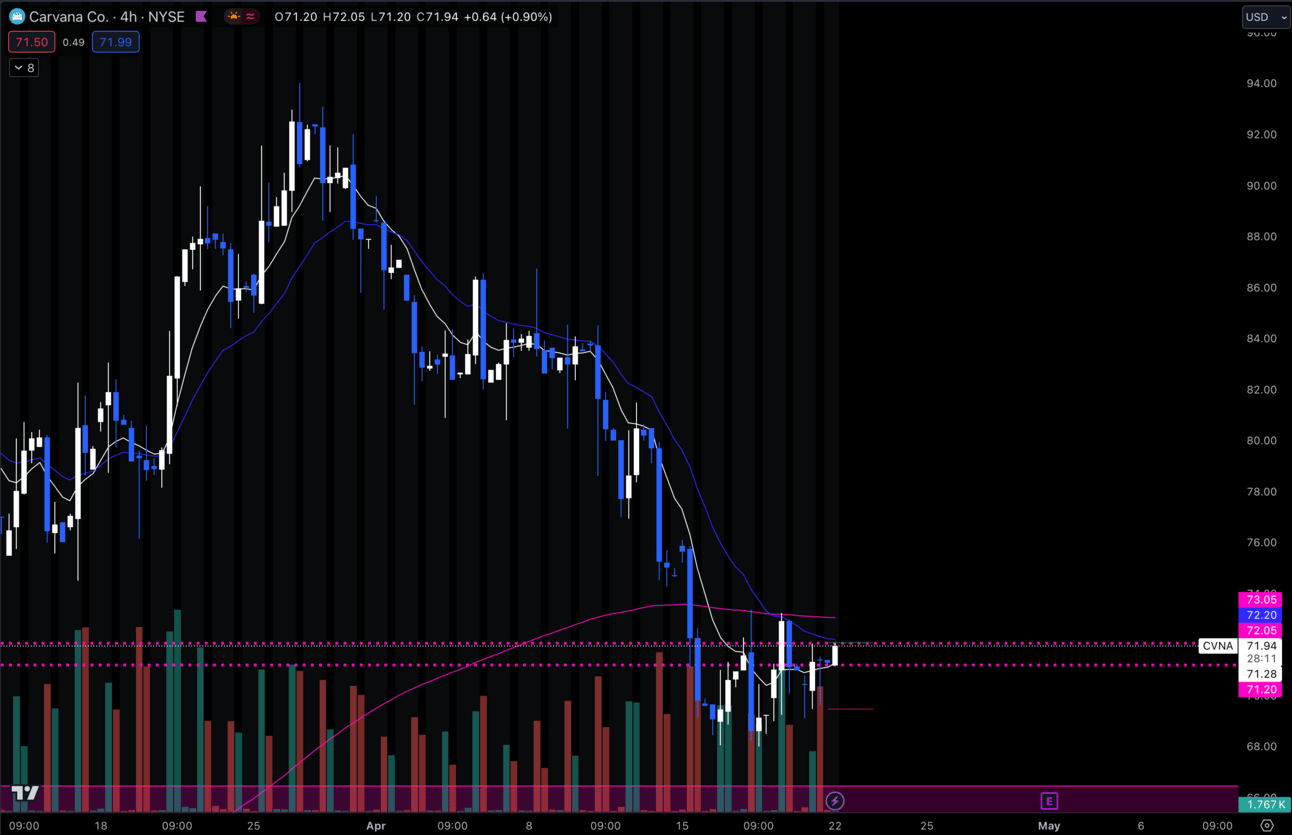

$CVNA 4 Hour

The most I want to see this bounce is into $74.27 which is a previous low of support now resistance.

This would mean it pops above the 4 hour 200 EMA and fails it for a bit of a fake out breakout.

Above $77 and my thesis will be invalidated.

2. $UBER

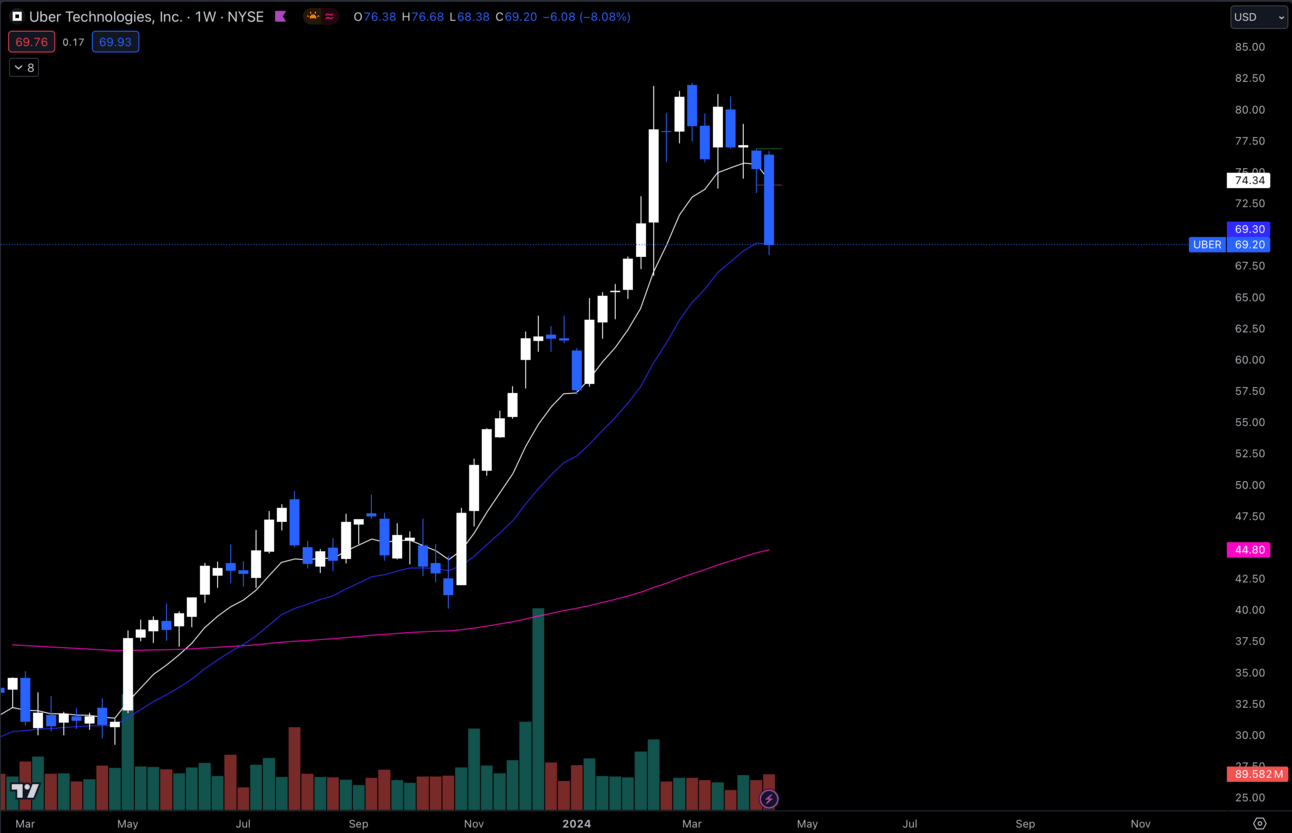

$UBER Weekly

$UBER is interesting here.

I’ve been playing puts on this name over the past week, but now it is hitting its weekly 21 EMA.

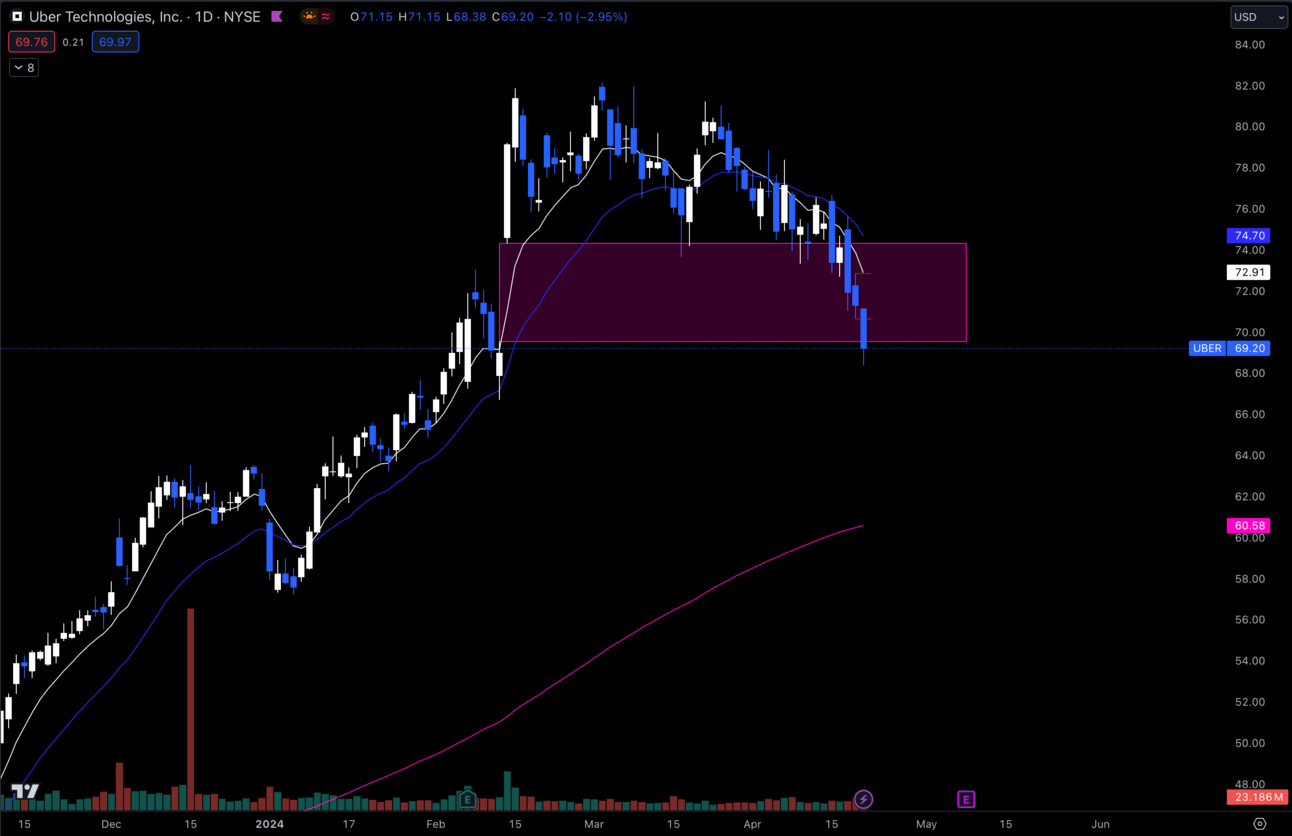

$UBER Daily

It also just filled this gap down to $69.55.

I’m interested to see if we bounce here and go for the next leg up in the trend, so I’m going into this week on $UBER with a more bullish mindset.

Under $66.70 my thesis would be invalidated.

Long-Term Setups This Week:

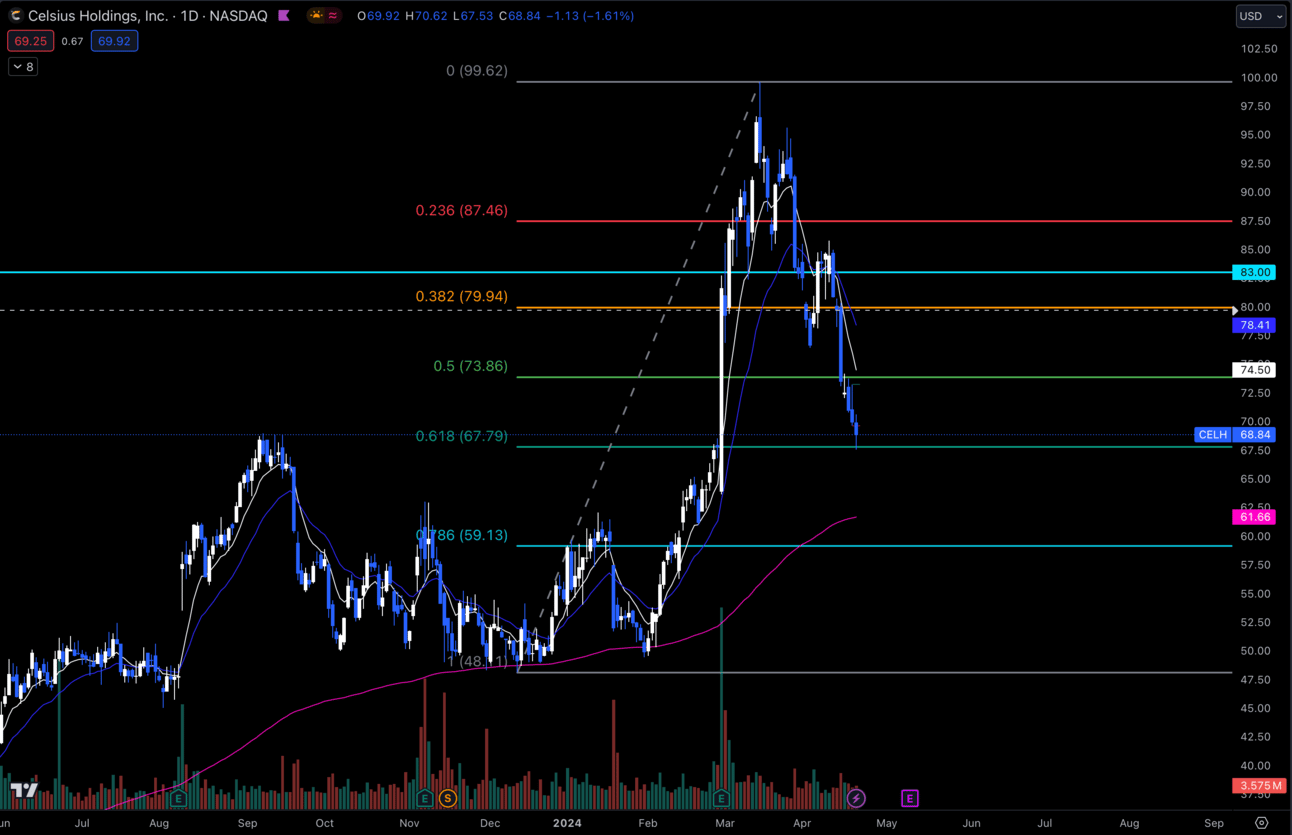

1. $CELH

$CELH Daily

I am personally loving $CELH here to add shares into my long-term portfolio.

I’ve always gotten my shares under $50, but I don’t know if we will see those prices again.

Pulling back to my .618 fib on the daily which I think holds.

This might be the time that I actually start buying some shares over $50 as this is a very healthy pullback from the highs.

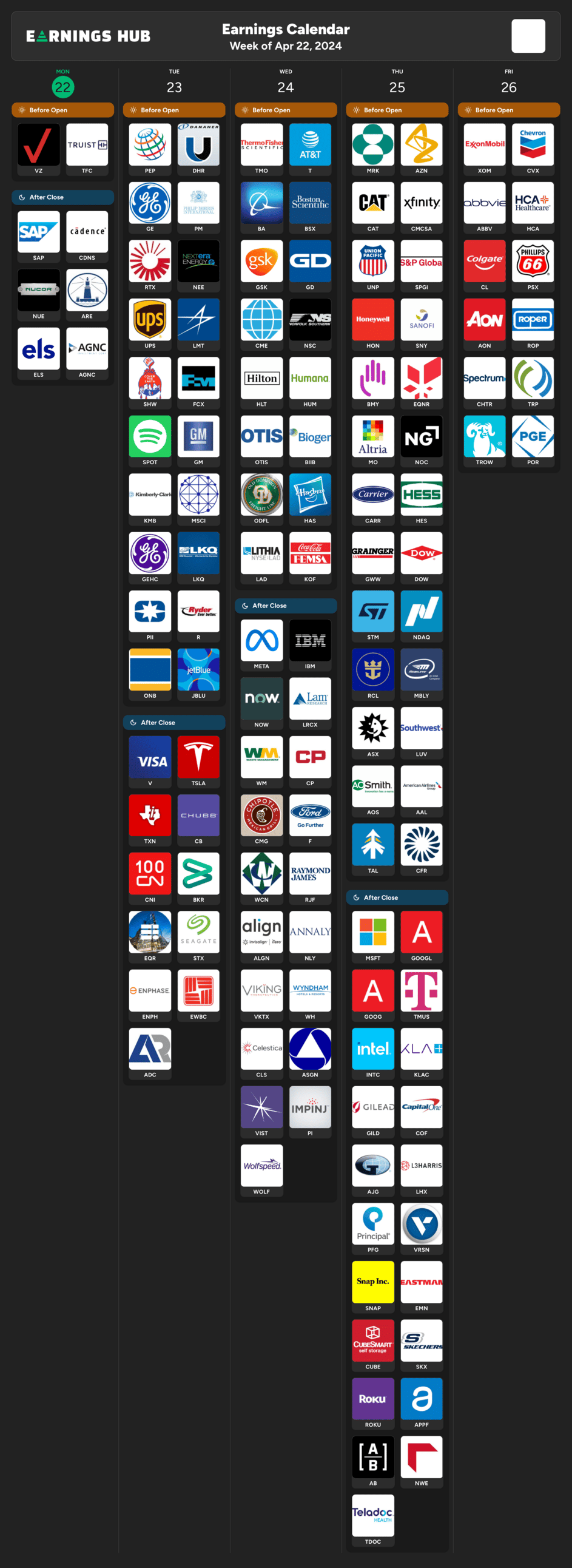

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 9:45 EST, S&P Global Service PMI

Tuesday 10:00 EST, New Home Sales

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 8:30 EST, GDP

Friday 8:30 EST, PCE

Trending Sectors

Technology and Utilities were trending most this past week. Technology had a decrease of over 7% while Utilities had a positive performance of almost 2% higher.

Most trending tickers from last week:

$PG

$ORCL

$MRK

$ADBE

$TM

$MSTR

Have A Great Week!

I hope everybody trades safe and makes some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.