- Ace in the Hole

- Posts

- Ace in the Hole - Edition #18

Ace in the Hole - Edition #18

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody enjoyed the weekend!

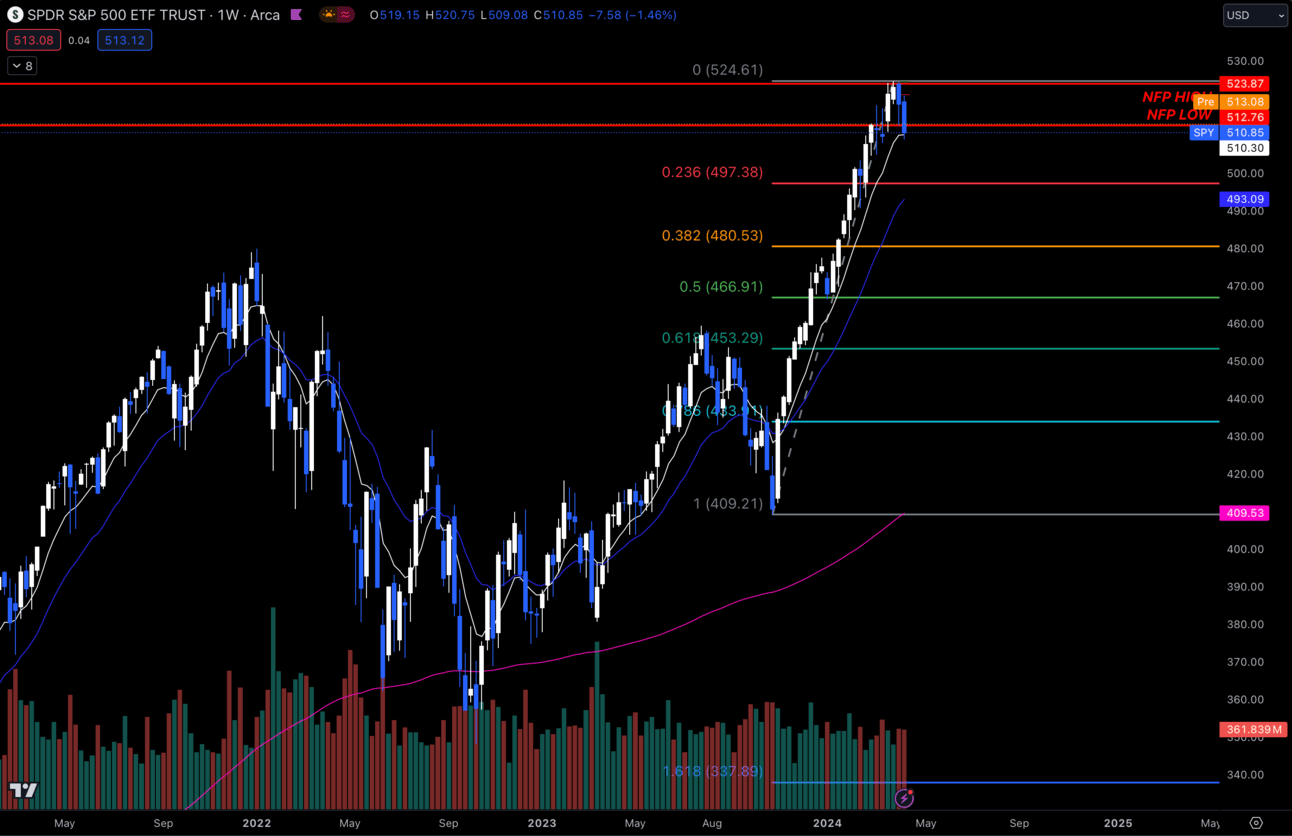

Last week we saw $SPY drop 1.46% which was the most red we’ve seen in a while.

Even with the markets getting some pretty significant downside moves, we are still only testing the weekly 9 EMA.

I’m very interested to see where this market wants to go from here, especially with $VIX starting to trade above $16.

The higher $VIX goes, the more volatility we will see.

Market Thoughts

I’m feeling pretty neutral at this moment.

This dip looks pretty constructive to get bought up, but on the other hand we have room to pullback much more in my opinion.

$SPY Weekly

Here are the pivot points I’m watching if $SPY wants to dip more.

Either way, I’m going to play what’s in front of me and not try to be guessing on where this wants to go.

Short-Term Setups This Week:

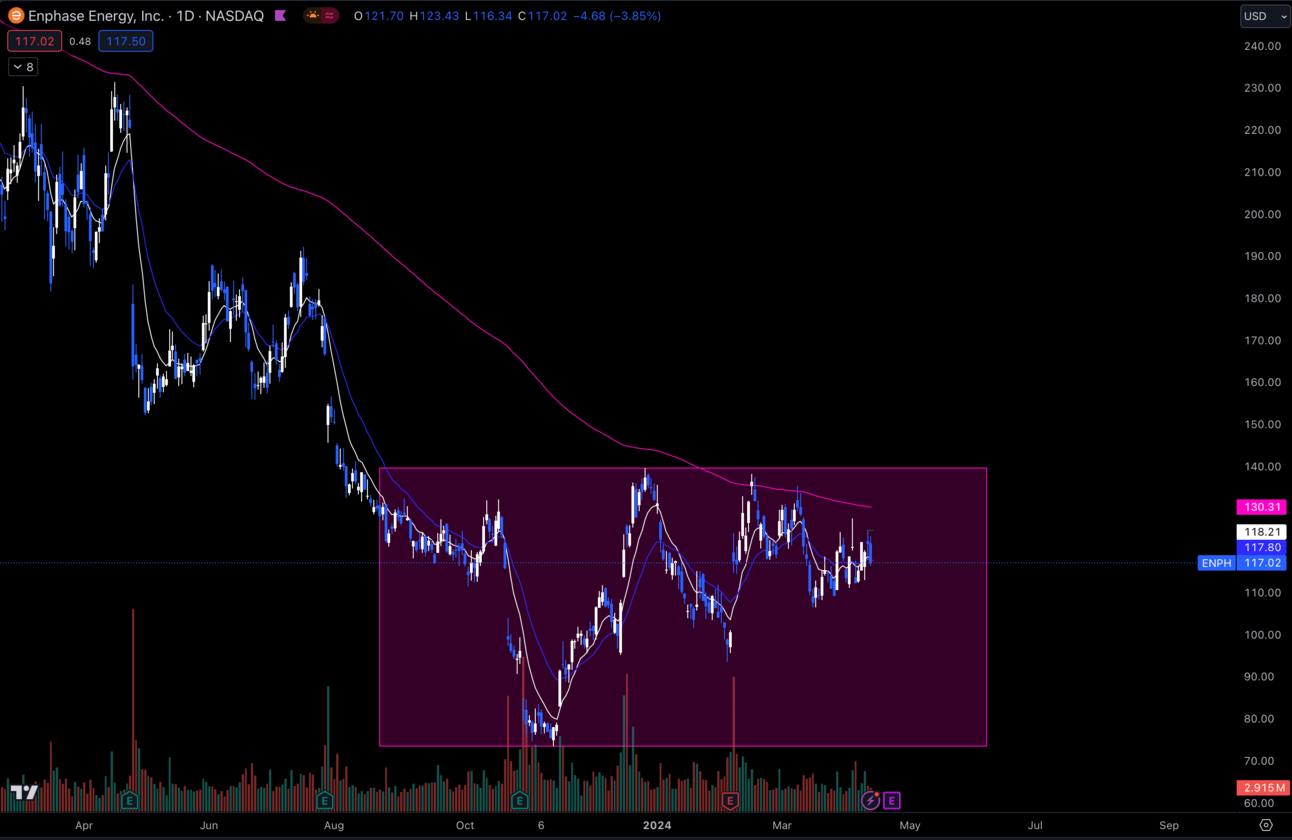

1. $ENPH

$ENPH Daily

$ENPH is an interesting one. I’ve constantly flipped back and forth playing the longs when they are there and the shorts.

At the end of the day this thing has been in some pretty heavy consolidation on the daily and weekly charts.

I think this is going to make a big move soon.

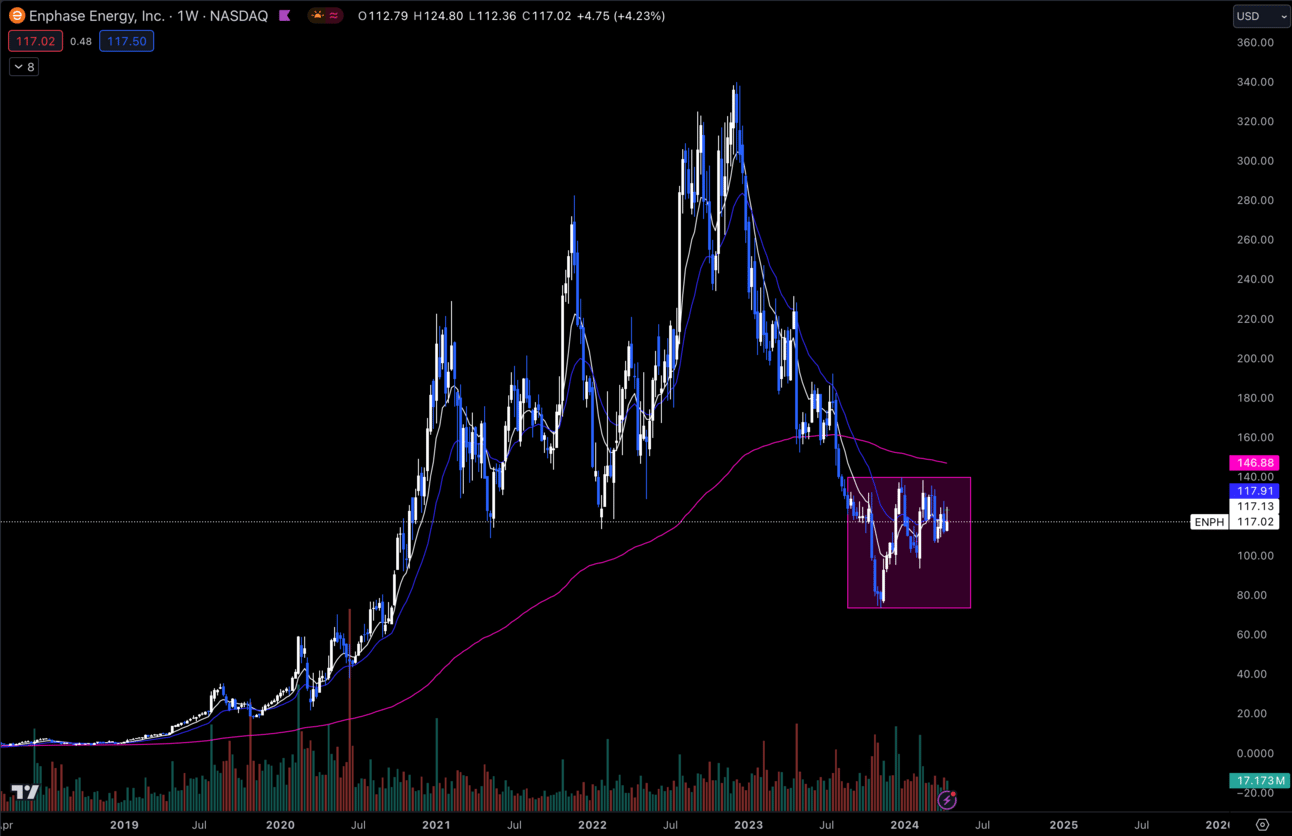

$ENPH Weekly

It’s tough to know which way it wants to go, but they report earnings on April 23rd, so I’m thinking that earnings report will be picking a direction outside this consolidation.

I’m leaning more bullish when I look at the chart, but that can all change so quickly with earnings.

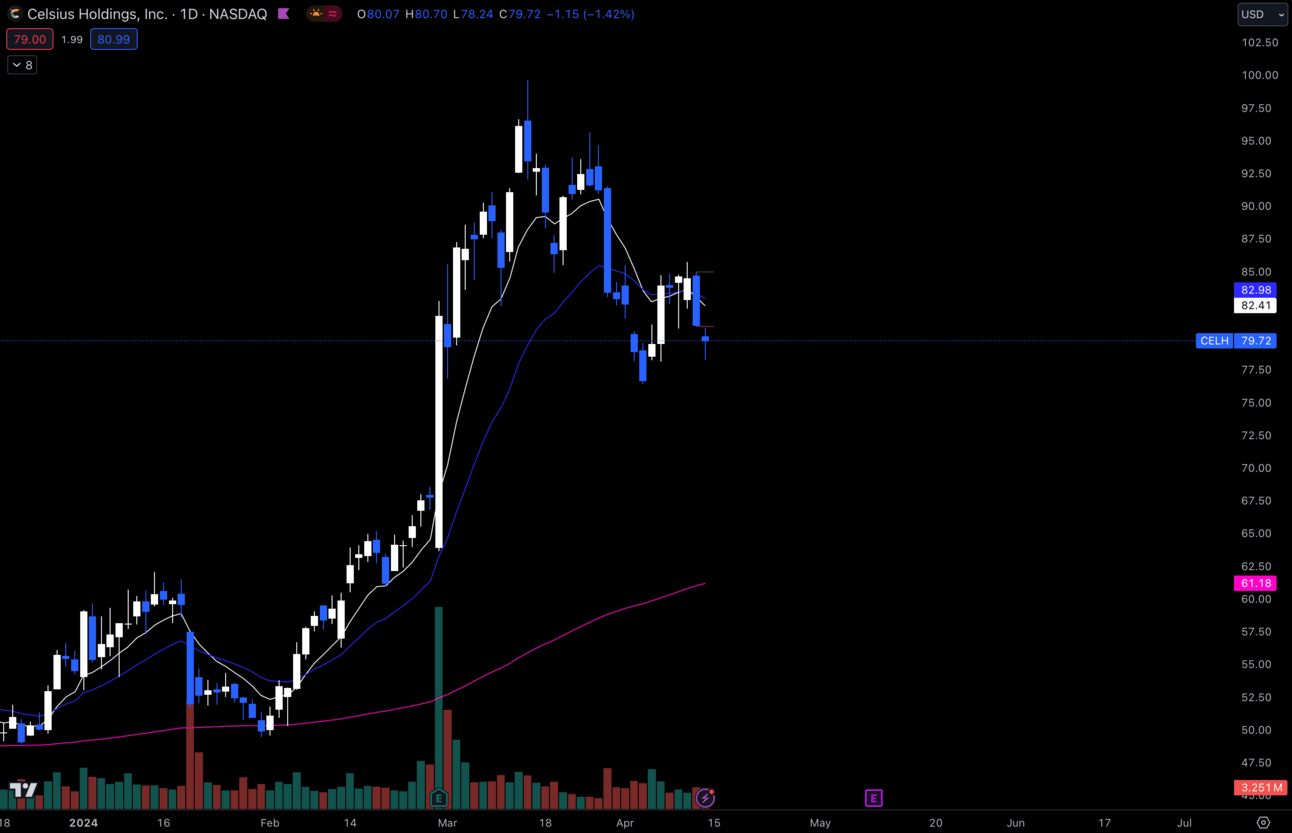

2. $CELH

$CELH Daily

I think this dip on $CELH is looking pretty constructive.

It got bought up towards the end of the day on Friday, which could’ve been what it needed to make a higher low on the daily.

I need to see this make a higher high above $85.75 or at least get a daily close over Friday’s high on Monday.

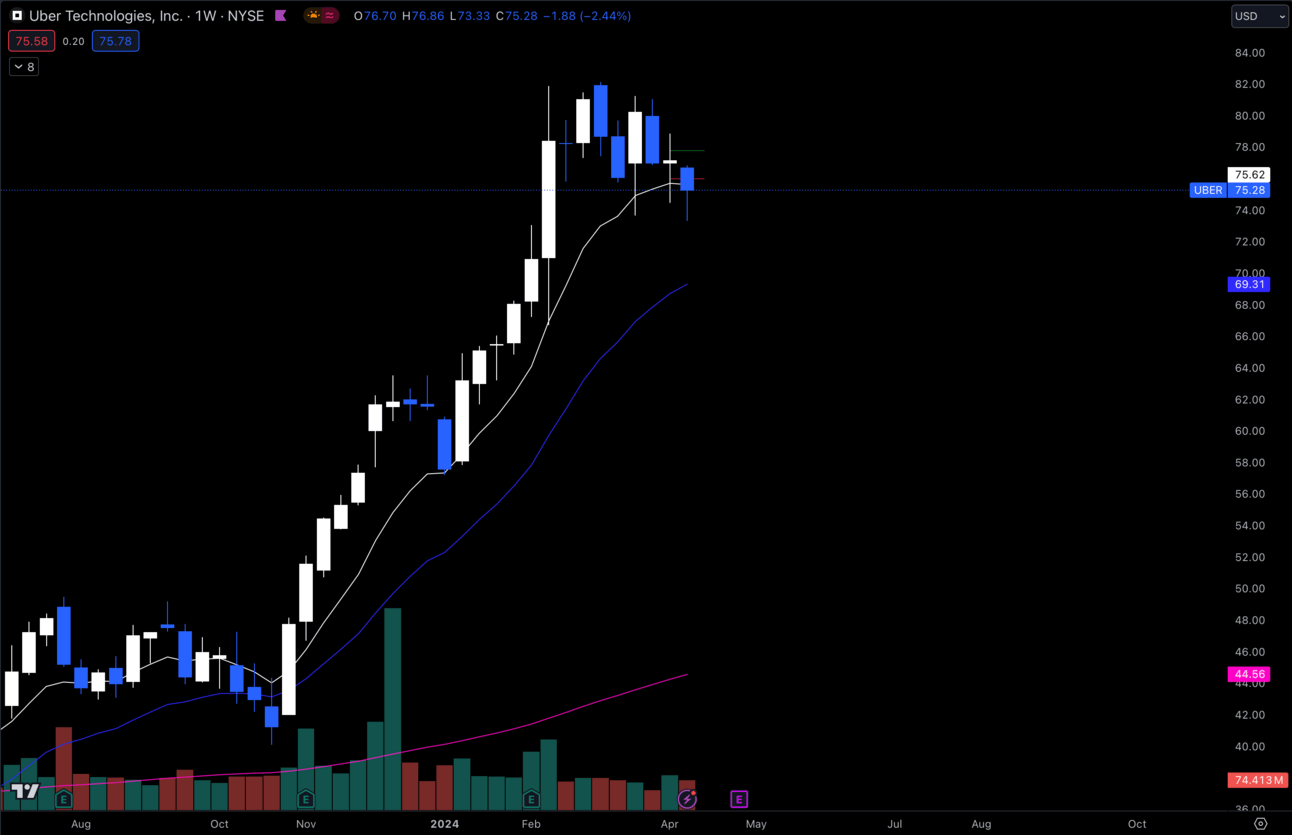

3. $UBER

$UBER Weekly

$UBER looks super constructive on the weekly chart. I’m interested to see if they buy up this pullback off of the 9 EMA or bring it down to the 21 EMA.

Either way, I think this looks great and will be watching for momentum to make the next leg up on this trend.

Long-Term Setups This Week:

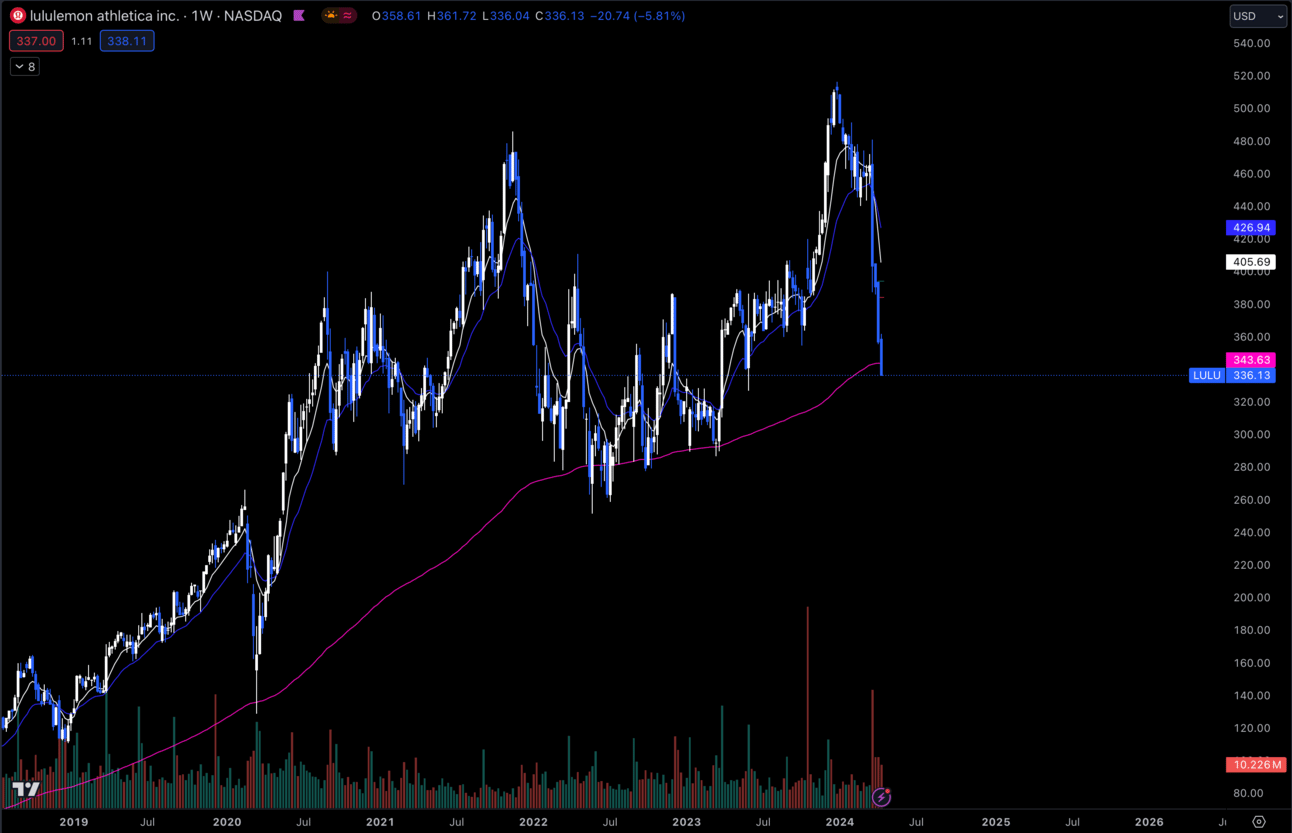

1. $LULU

$LULU Weekly

This poor stock has gotten wrecked from the highs so far.

We are getting close to some big demand around $300-$320.

I think this is a great name for the long-term portfolio, so I’m glad we are getting a significant dip.

I will likely be buying more towards that $320 range and definitely if we hit $300 even.

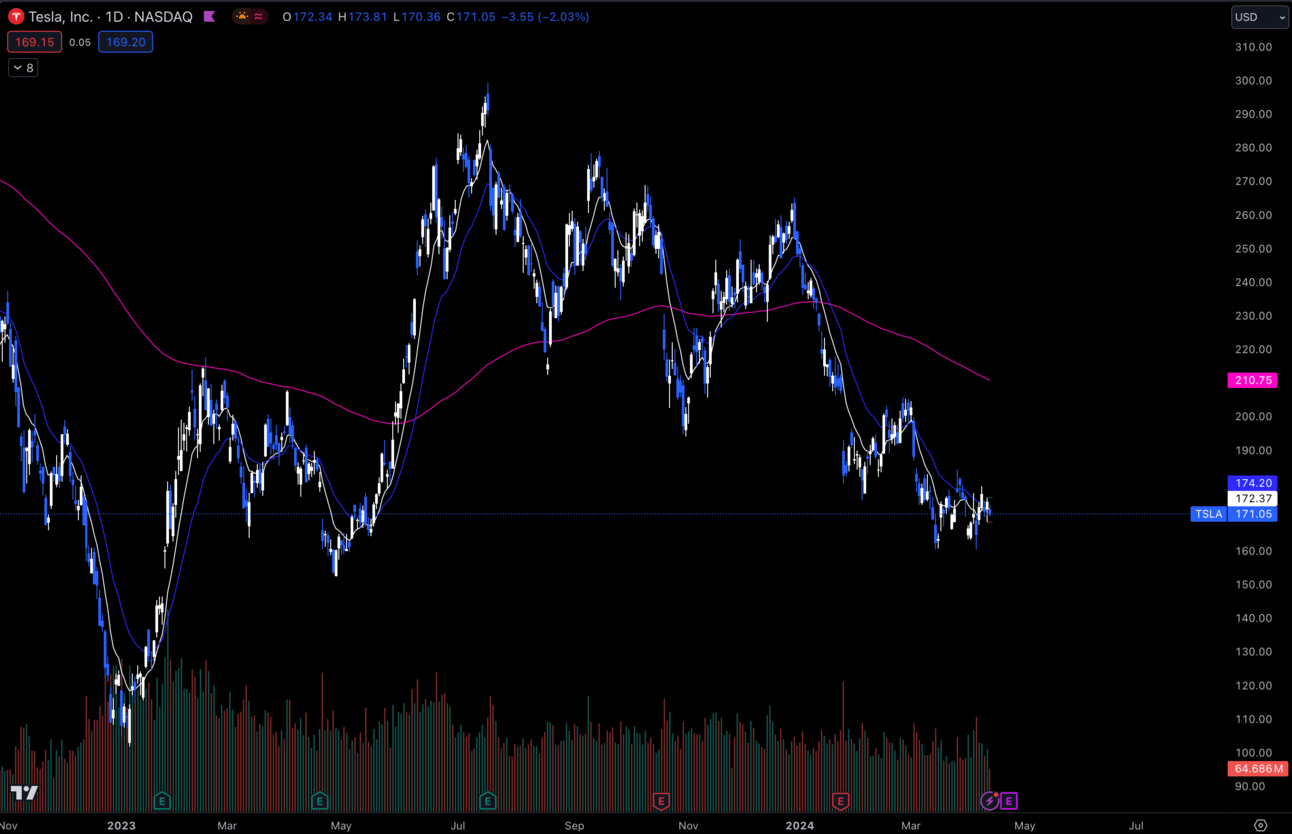

2. $TSLA

$TSLA Daily

$TSLA is still downtrending on the daily and rejecting the weekly 9 EMA.

I’m waiting to see if this thing wants to drop to $150 which would be the yearly 9 EMA or if we want to make a bullish move out of this consolidation we are in on the daily.

I haven’t bought a ton more here because I’m still just uncertain of where this wants to go as of now, but still one of my favorite long-term adds.

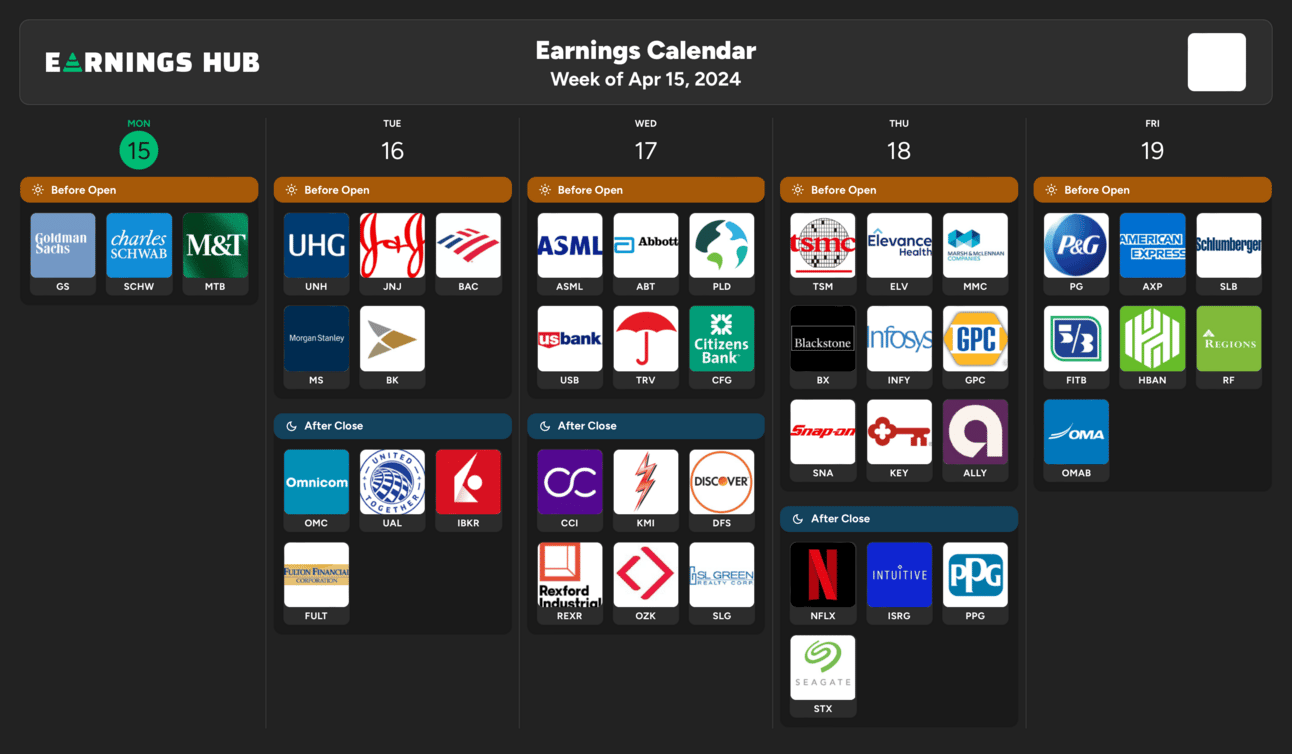

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 8:30 EST, Retail Sales

Tuesday 1:15 EST, Fed Chair Powell Speaks

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 10:00 EST, Existing Home Sales

On top of this we have FED speakers just about every day this week.

Trending Sectors

Biotech, Entertainment, and Defense sectors were at the top of the list for trending this past week.

$NVDA

$MSFT

$NFLX

$COST

$DIS

$NKE

$UNH

Have A Great Week!

Enjoy the week everybody and trade safe.

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.