- Ace in the Hole

- Posts

- Ace in the Hole - Edition #17

Ace in the Hole - Edition #17

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend!

I have been gone in Mexico, but i’ve still been keeping up to date with the market.

Last week we saw $SPY had its first red week since 3 weeks ago, losing -.89% on the week.

This week we have much to look forward to with GDP and PPI coming out this upcoming week.

Let’s dive into the details of what i’m looking at this week!

Market Thoughts

$SPY was pretty back and forth last week except for Thursday where we dropped 1.22% on the day.

Friday ended up reclaiming my daily 21 EMA, but I’m not as convinced as I was being buyer off the 21 EMA because we broke through it for the first time with decent momentum.

This for me is a little bit of a tell for some downside in the market because every single time $SPY has tested the 21 EMA it has respected it perfectly.

This being said, if bulls step back in I will happily play more longs, but I’m much more open to downside now that we’ve broken one of the major EMA’s $SPY has been holding.

At this point I’m feeling more neutral than bullish and if anything looking for more downside as $SPY retested its daily 9 EMA and rejected on Friday.

Short-Term Setups This Week:

1. $RBLX

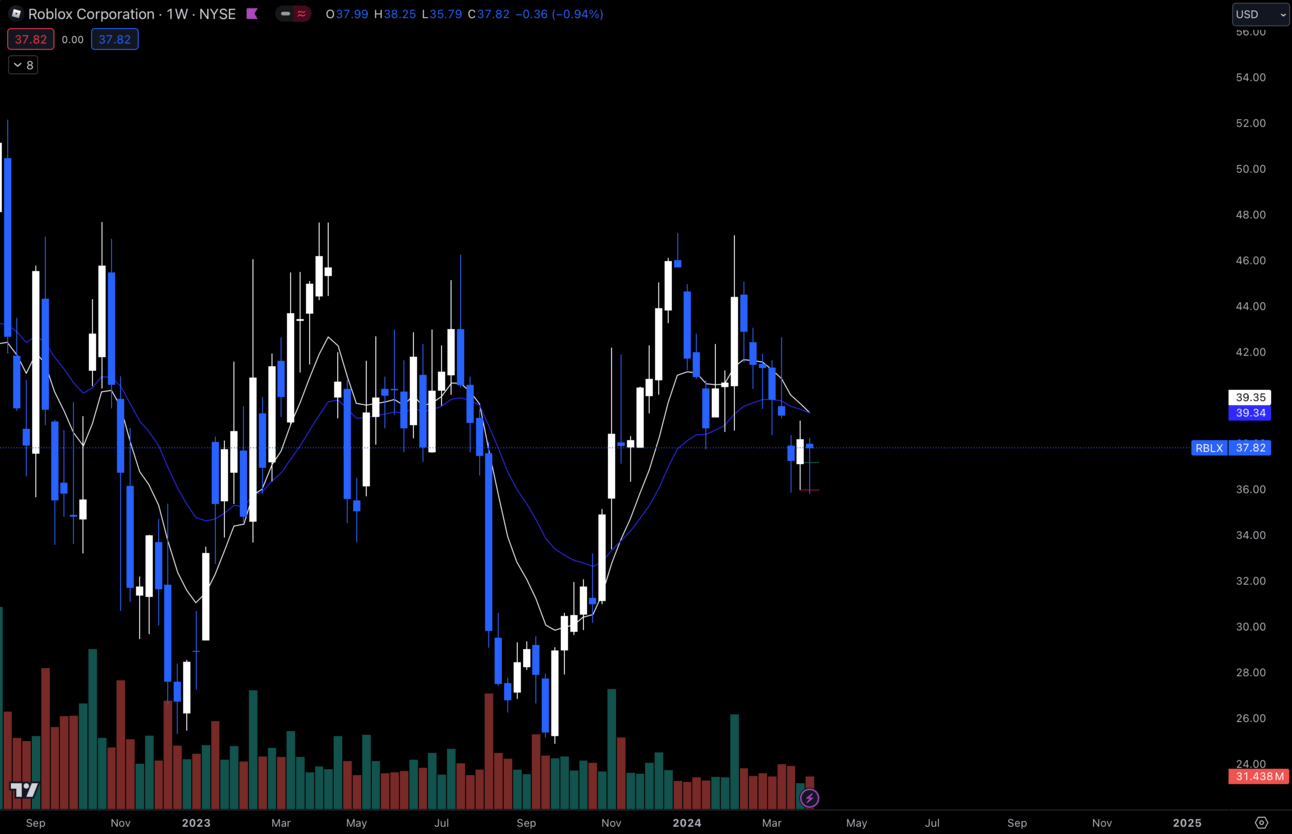

$RBLX Weekly

The $RBLX weekly is catching my eye, getting bought up off of that $36 area.

One thing to note about $RBLX is it has been in consolidation since May of 2022, so it could very well stay in that consolidation.

If I decide to take a position on this I will be buying plenty of time because it has been in consolidation unlike other names on my watchlist that have been in strong trends.

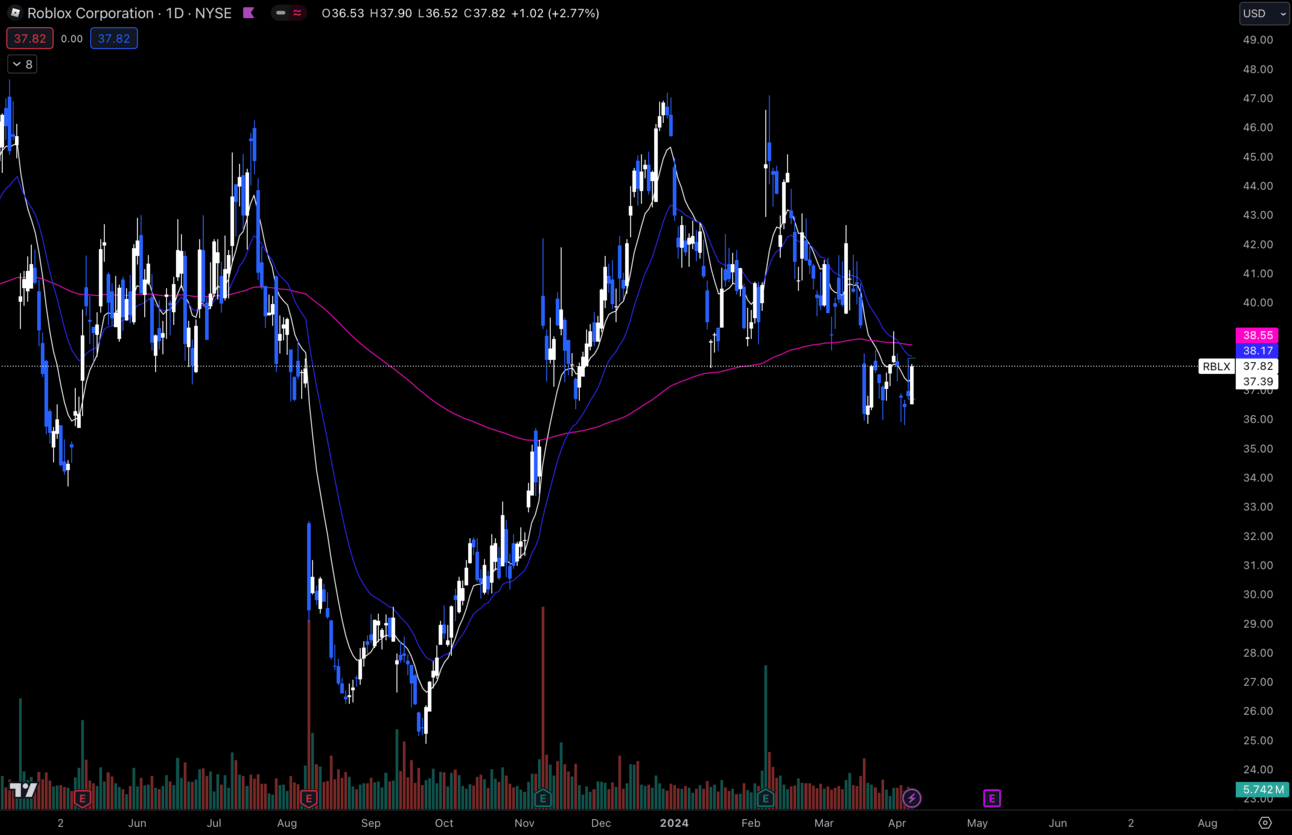

$RBLX Daily

$RBLX had an amazing day on Friday, so I’m looking to see continuation of the momentum into next week.

Risk/reward is pretty simple for me here. If $RBLX is trading under $36, I don’t want anything to do with it, but if we can hold that I will definitely be looking for some upside here.

2. $UBER

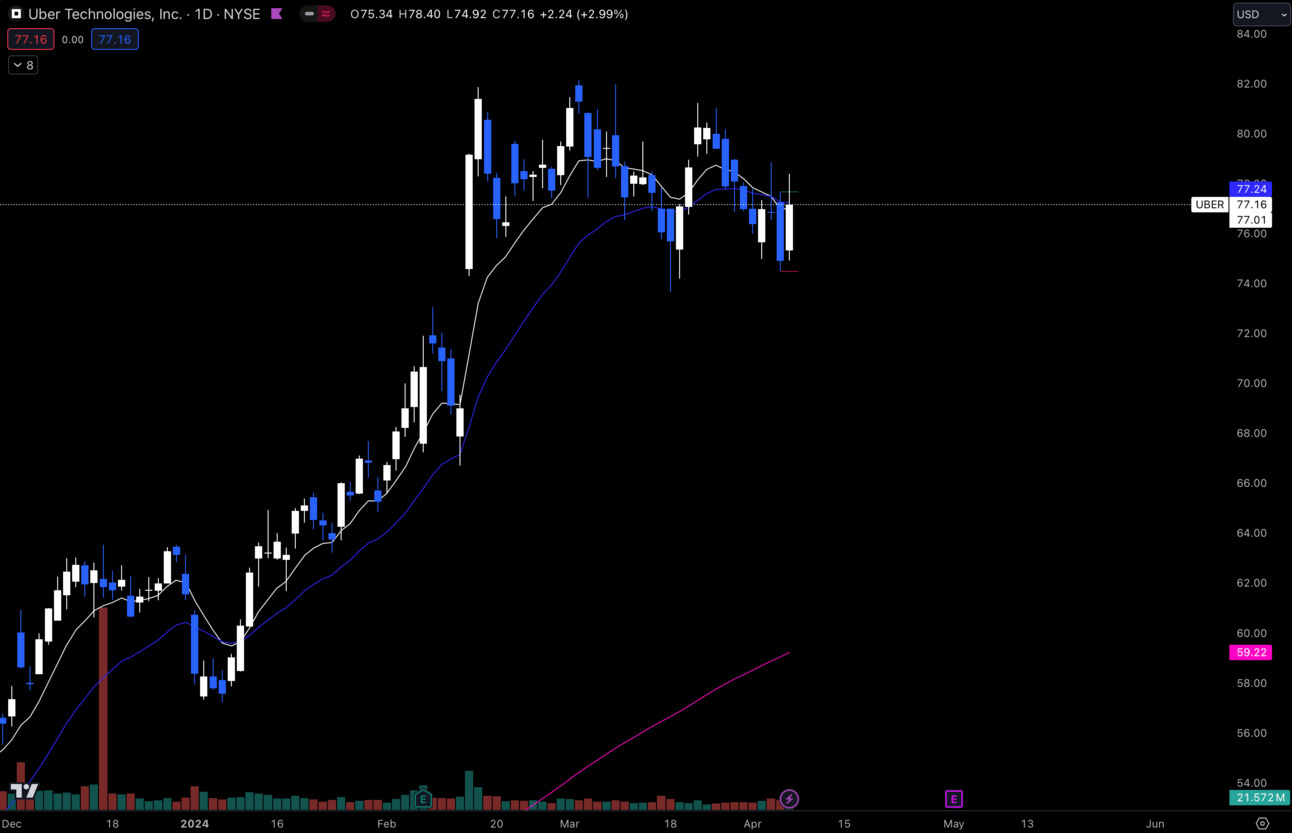

$UBER Daily

$UBER is interesting here. It could really go either way, but I’m interested to see which direction she chooses outside of this consolidation.

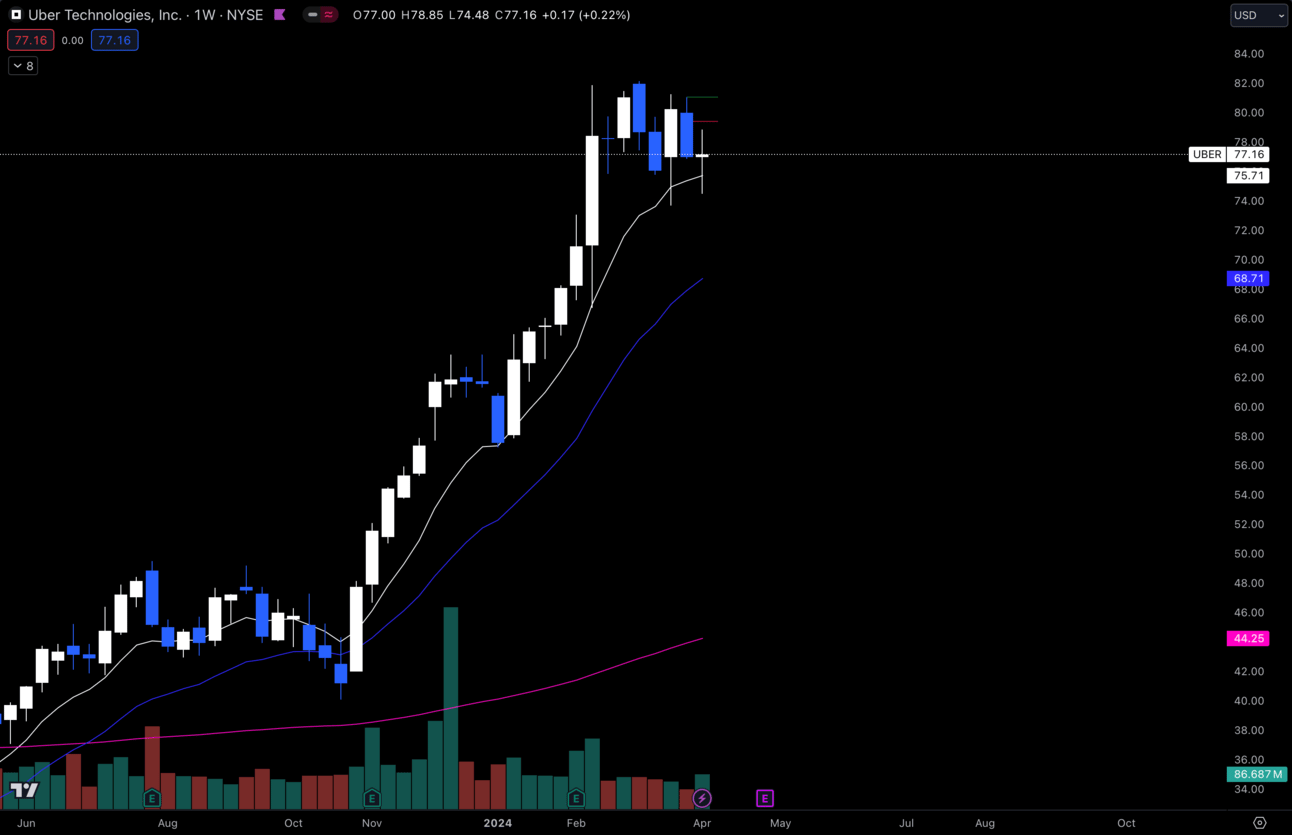

$UBER Weekly

$UBER is holding the 9 EMA on the weekly, but I’m willing to let this drop to my 21 EMA at $68.70 and see if we get bought up there.

If this wants to hold the 9 EMA and keep ripping, I am all for it.

However I think it would be healthy to see that dip towards $70, so I’ll keep my eyes on it and decide want I want to do throughout the week.

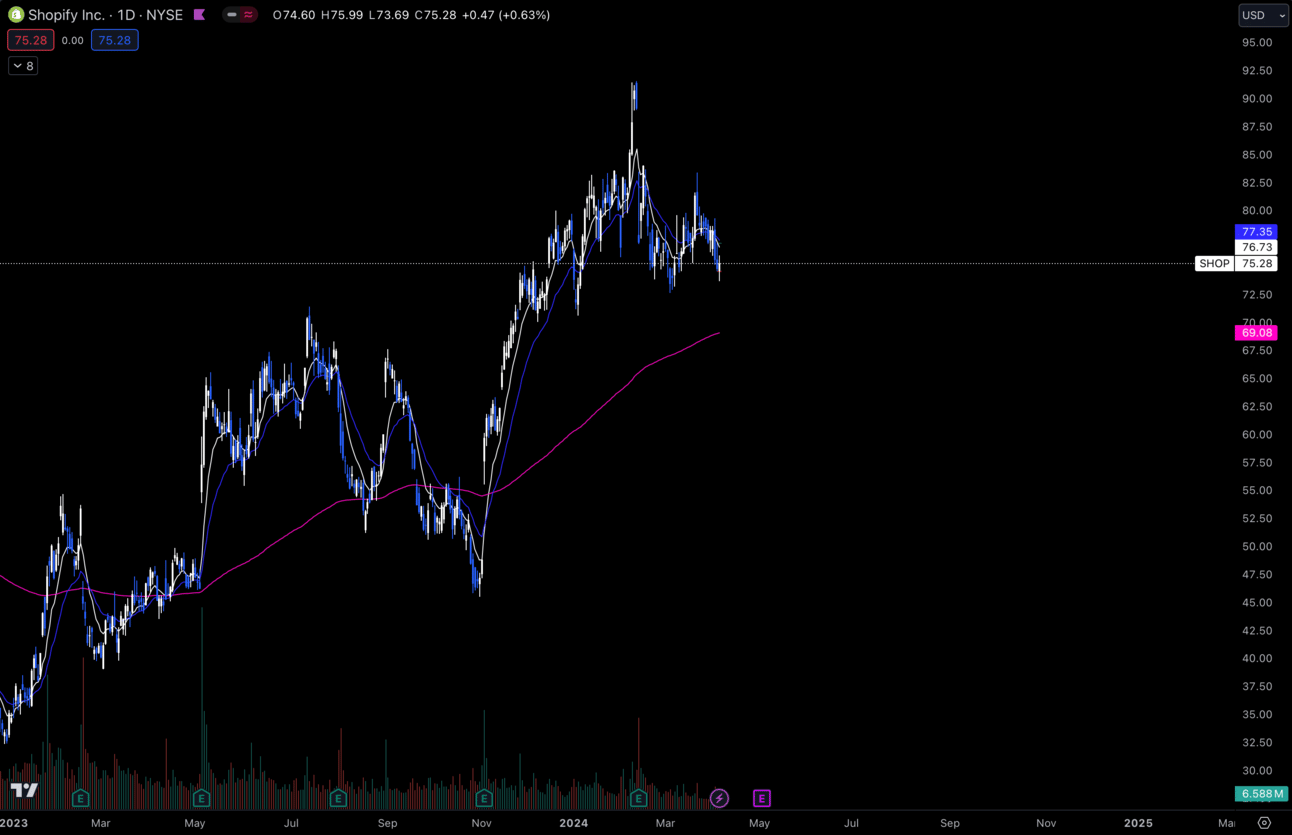

3. $SHOP

$SHOP Daily

I see $SHOP trying to make a higher low on the daily chart above the 200 EMA at $69.08.

I’m open to seeing a dip down to $69.08, but for me to stay leaning bullish on this name it NEEDS to hold that level.

It’s much healthier to see continuous higher lows like we are seeing currently, so I’d like to see this continue.

Long-Term Setups This Week:

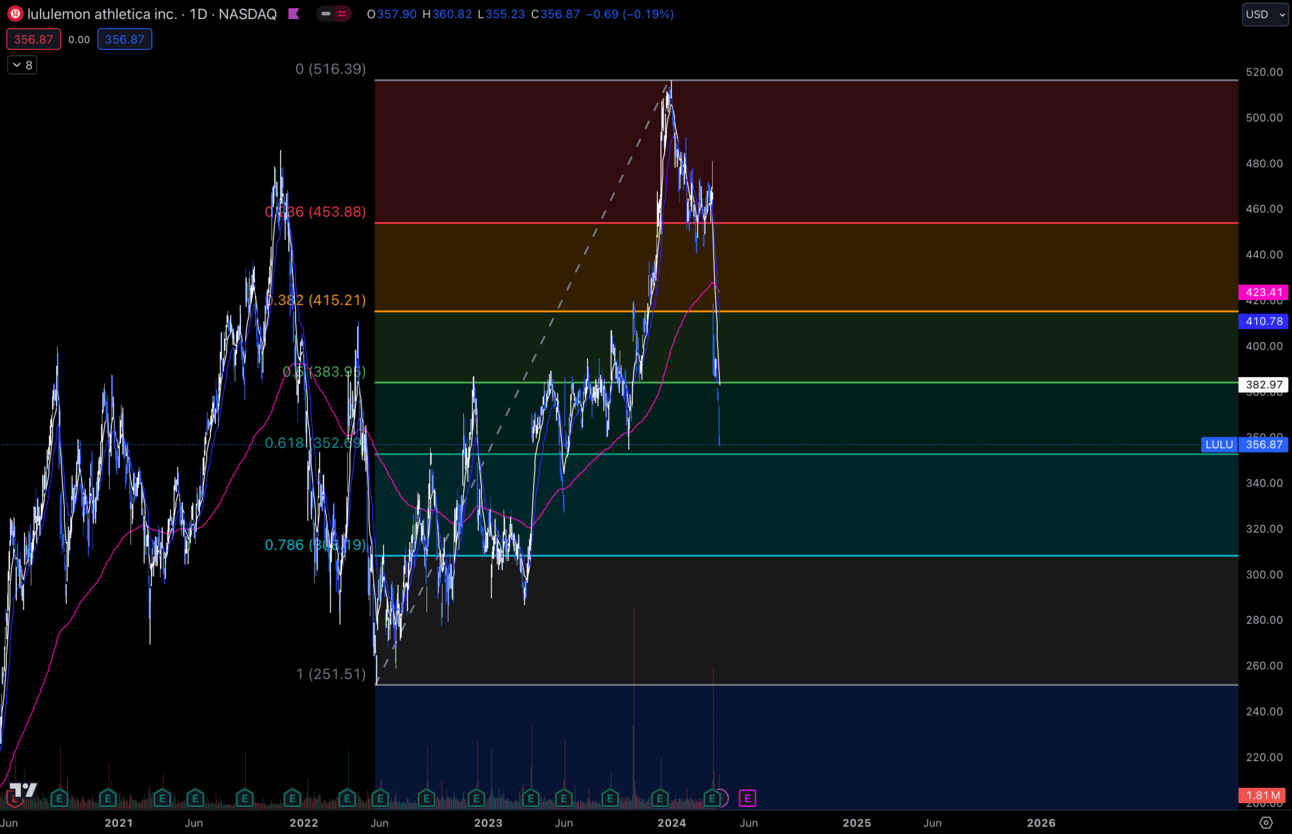

1. $LULU

$LULU Daily

I absolutely love this name to add to my long-term portfolio.

Why?

Companies such as $LULU, $ULTA, and $ELF I really believe in because I don’t think those businesses are going anywhere.

Especially because women are some of the biggest consumers of those products.

Any significant dips I want to be adding to these names.

It is approaching the .618 fib I have, but I think it’s definitely possible we get down towards that $300.

I would love to get some more shares there personally.

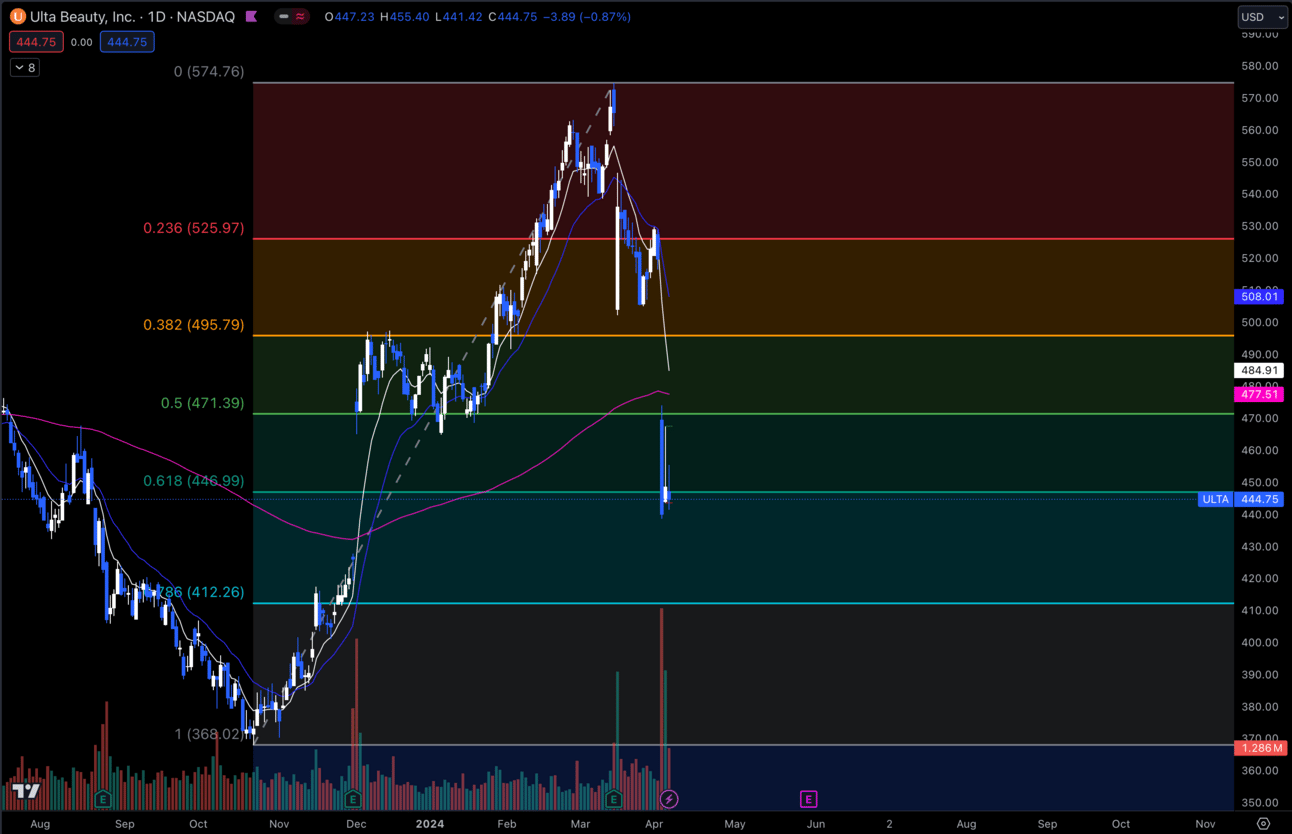

2. $ULTA

$ULTA Daily

As I just said, I am looking to buy dips on $ULTA and she is finally giving us a significant dip.

I would love to see this gap fill to the downside and start a long-term position at that gap fill around $420.

I don’t own this name currently, but will likely start a position this upcoming week.

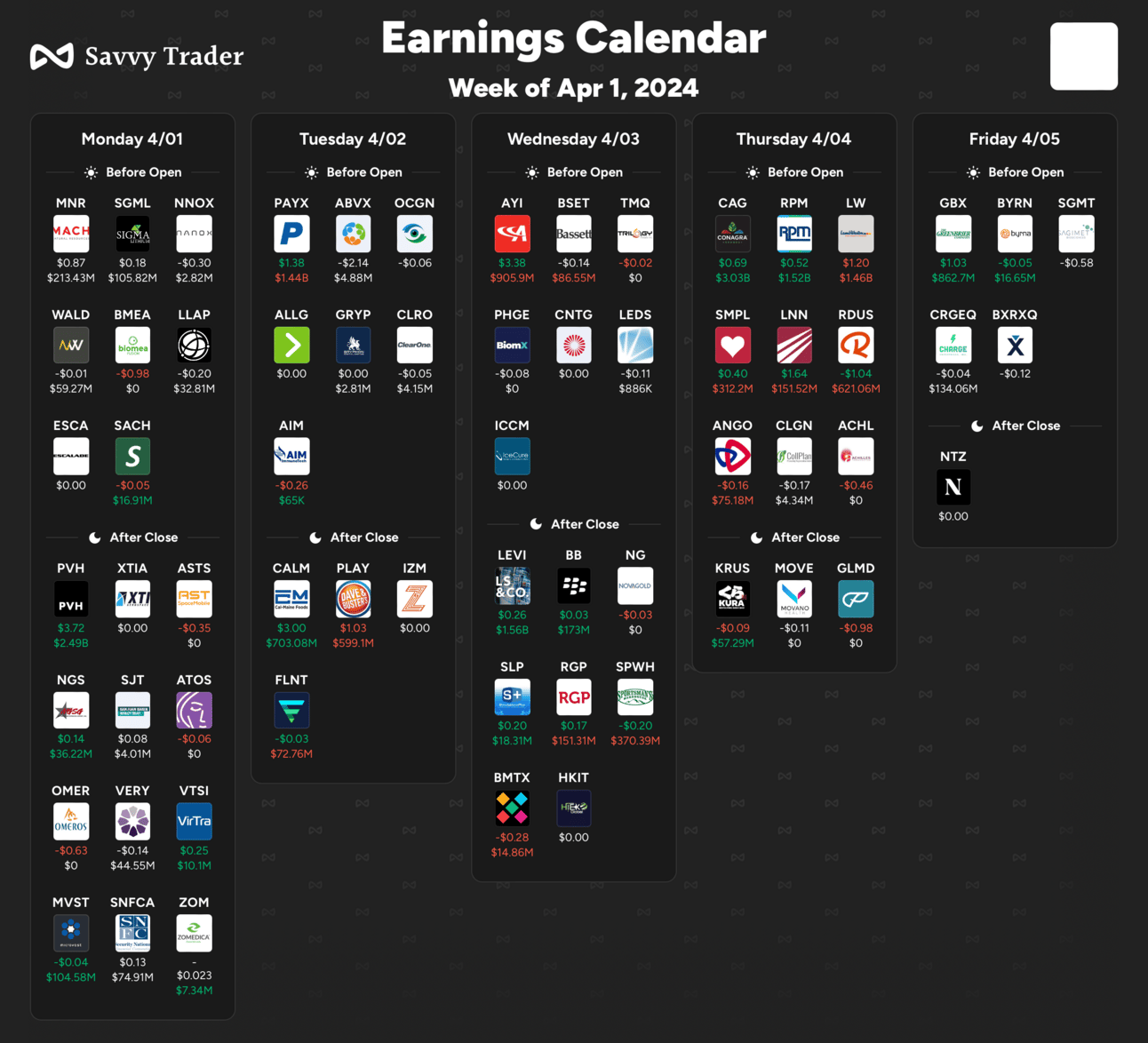

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday market:

Wednesday 8:30 EST, CPI

Wednesday 10:00 EST, Crude Oil Inventories

Wednesday 2:00 EST, FOMC Meeting Minutes

Thursday 8:30 EST, PPI

Thursday 1:00 EST, 30-Year Bond Auction

Trending Sectors

Communication Services, Energy, Materials, and the Industrial Sectors were performing well this last week.

The momentum on $META to the upside was also worth noting.

Top trending tickers from last week:

$MDIA

$CADL

$ACB

$TARA

$CGC

$DNUT

$CAG

$ESPR

$GERN

$VNO

Have A Great Week!

I hope everybody trades safe and enjoys the week!

I will be back on spaces and my twitch streams on Tuesday!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.