- Ace in the Hole

- Posts

- Ace in the Hole - Edition #16

Ace in the Hole - Edition #16

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great long weekend, but now it’s time to get back to work!

Last week we saw the $SPY rise another .36% which made a new all time high of $524.61.

GDP came out at 3.4% previous was 4.9% and 3.2% was expected.

PCE came out at 2.8% which was in line with expectations and previous was 2.9%.

We have some pretty significant data coming out this week that i’ll touch on later in the newsletter.

Market Thoughts

If you have been day trading this market over the past few weeks and have had a tough time, don’t beat yourself up.

This market has been super tough to trade on the intraday even for experienced traders.

Low volume markets like we’ve had are a recipe to get chopped up on options.

That’s exactly why i’ve been buying more time on my contracts.

Long story short, this market continues to perform and until it stops i’m going to keep on riding the trend.

Every dip to the daily 21 EMA has gotten bought up. One of these times it will break, but until then i’m still on the bullish side of things.

Short-Term Setups This Week:

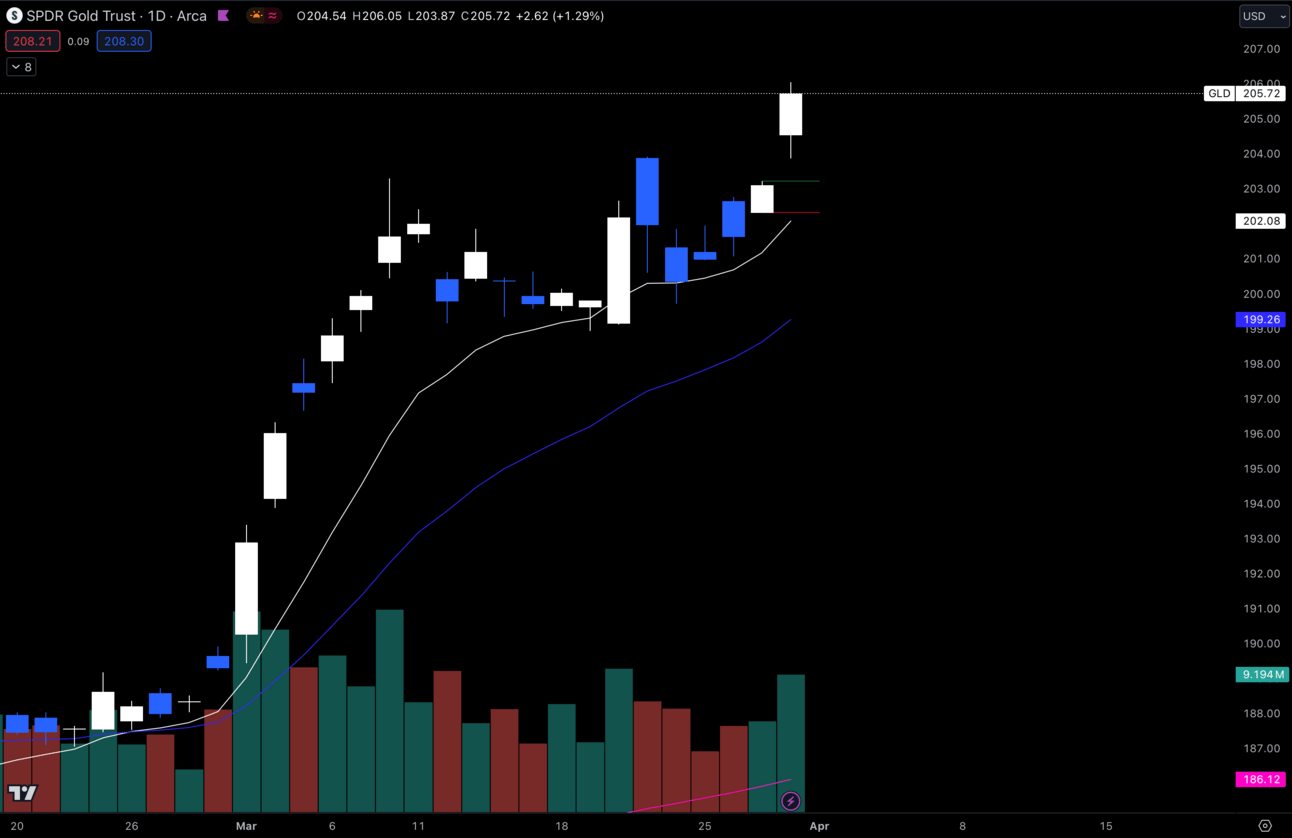

1. $GLD

$GLD Daily

Gold has had some beautiful consolidation on the daily which it broke out of on Thursday last week hitting new all time highs.

I think this is the beginning of a larger move, but keep in mind that Gold is in price discovery mode.

It’s never been at these prices before, which means the price action can be a little crazy since there are no levels up here for us to go off of.

Either way, I think it’s worth it to keep my eyes on $GLD this week to see if we get continuation of this move.

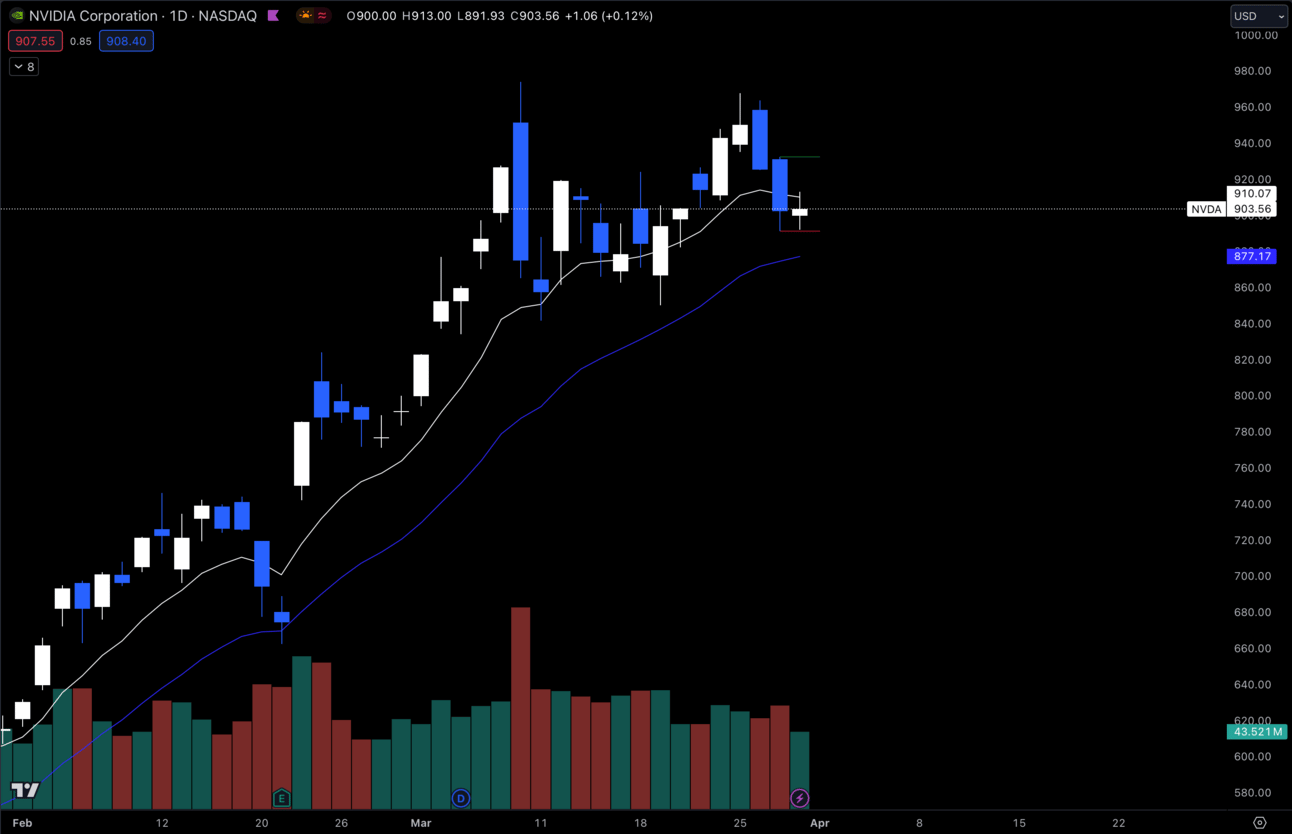

2. $NVDA

$NVDA Daily

$NVDA is looking interesting hitting some rejection at that $960 area.

This name (like $SPY) has held the daily 21 EMA every time it dips to it.

I would anticipate $NVDA holds the 21 EMA again at $877.17 and bounces to make another leg up.

If $NVDA loses the 21 EMA then my thesis is invalidated and I can look for different trades.

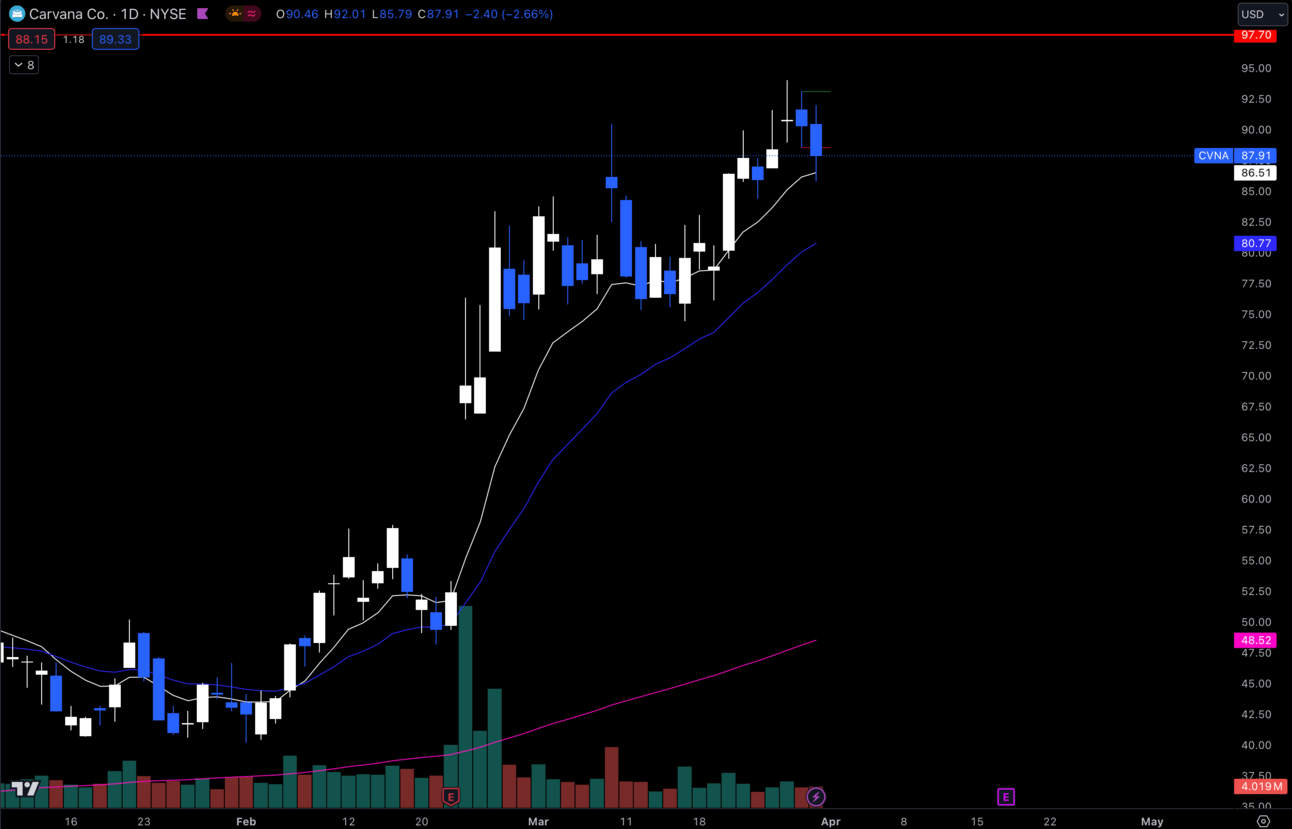

3. $CVNA

$CVNA Daily

$CVNA has been looking great on this breakout. I’ve caught some of this move, but i’m looking for reentries if I can get it.

It’s holding the daily 9 EMA, but i’d like to get some contracts off of the 21 EMA.

I might be being a little greedy wanting that big of a dip, but i’m going to wait and see if it’s possible.

If not, I might make the decision to enter higher, but we’ll see when the time comes.

Long-Term Setups This Week:

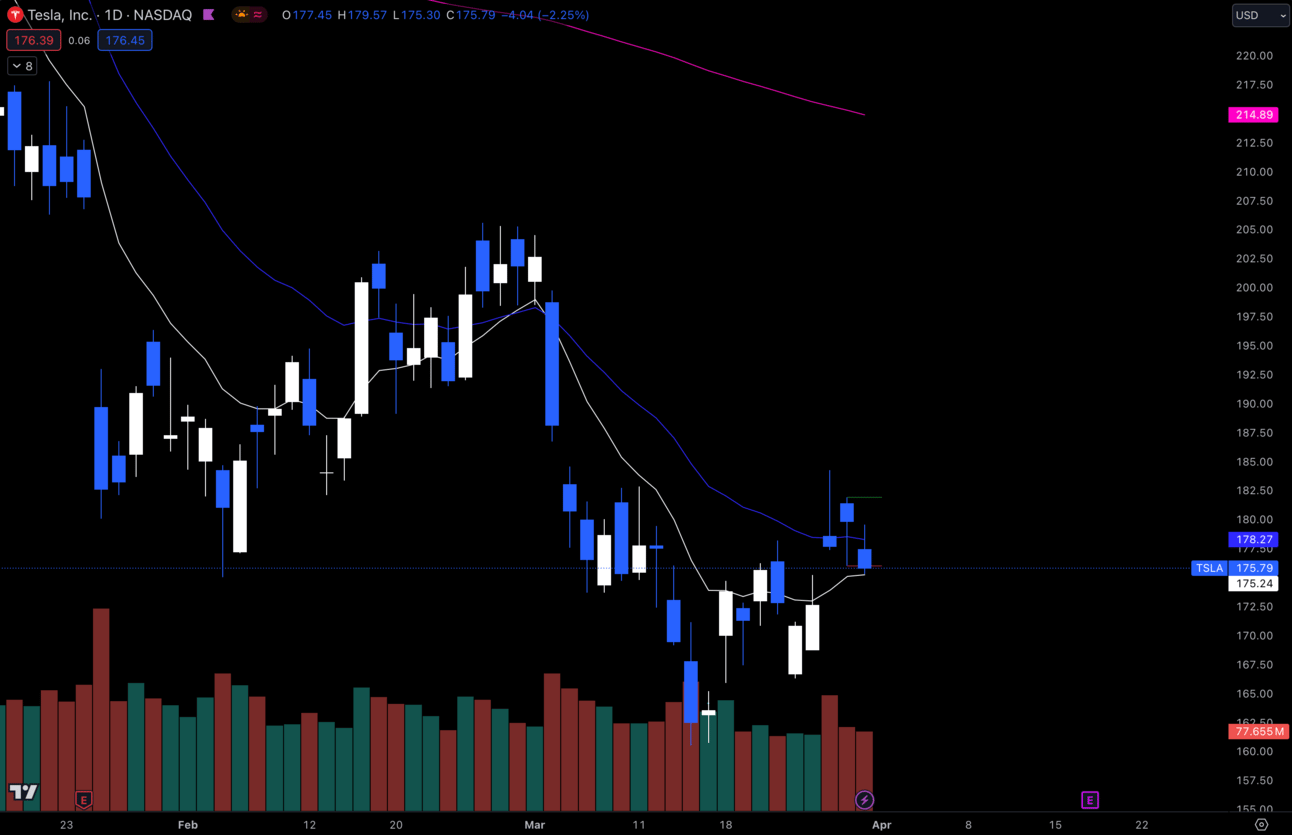

1. $TSLA

$TSLA Daily

Oh $TSLA this poor stock has been beat up over and over again.

It got a decent bounce off of $160 and since then has reclaimed the daily EMAs and is retesting them.

It is now starting to make higher lows and higher highs on the daily which could be an indication of a trend flip.

I’d like to see $TSLA bounce off the daily 9 EMA and head towards the gap up top from $184.59 —> $186.72.

If this loses $172.50 then my thesis will be invalidated.

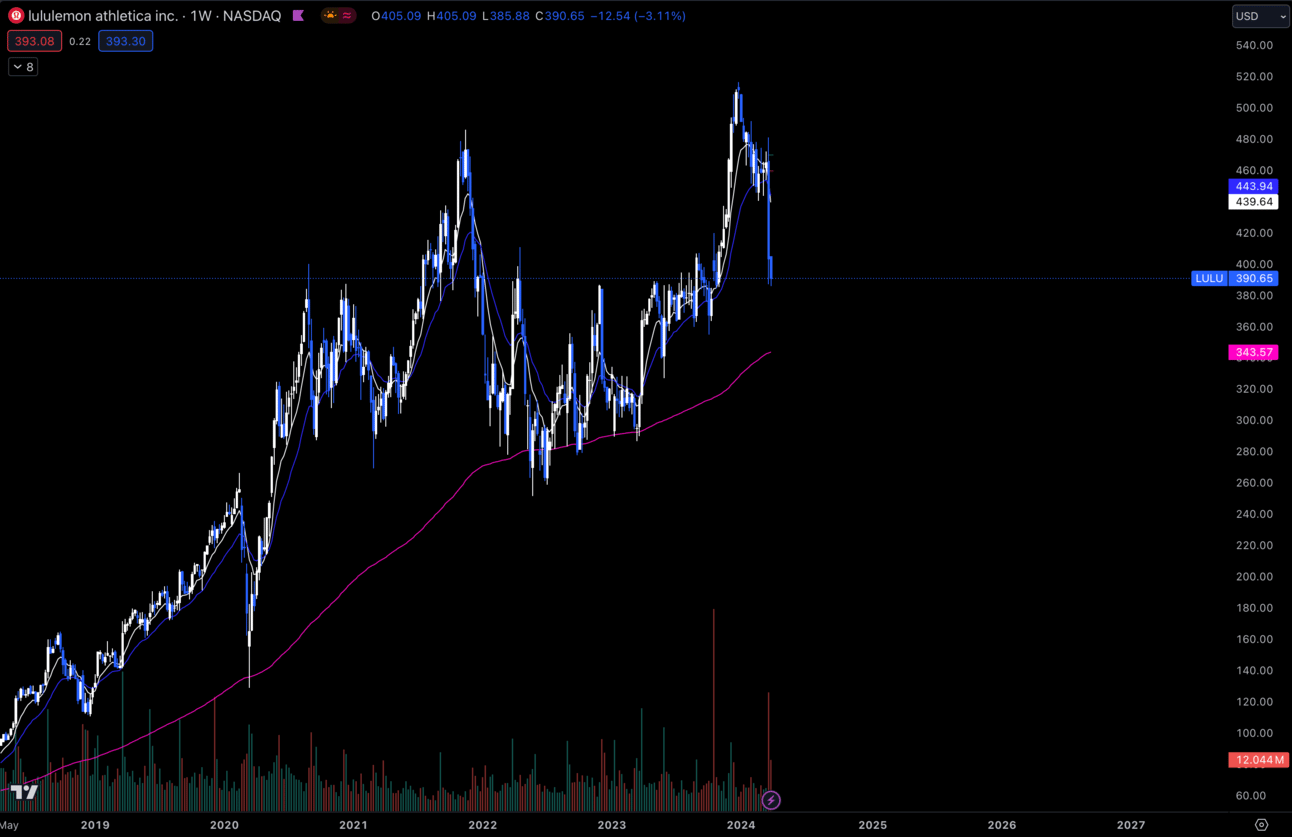

2. $LULU

$LULU Weekly

$LULU has taken a pretty significant drop from the highs.

I personally love this name for my long-term portfolio, but I never took the opportunity to get in and then it ran without me.

Names like this, $ULTA, and $ELF are great companies for investing because of the retail clientele that they have.

Makeup isn’t going anywhere and in my opinion neither is a company like $LULU.

I started a position on this last week and will continue to add shares.

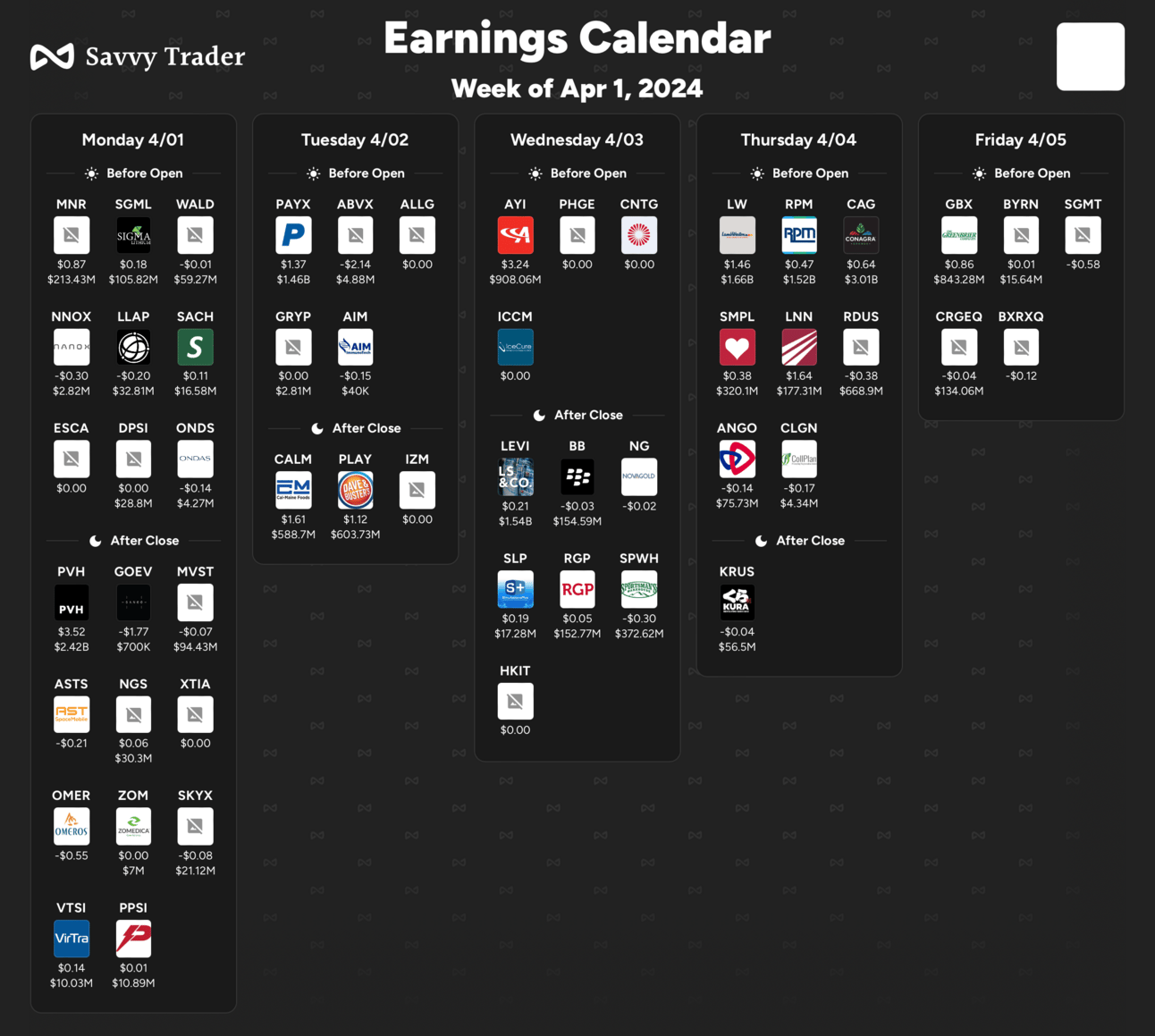

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, ISM Manufacturing PMI

Tuesday 10:00 EST, JOLTs Job Openings

Wednesday 9:45, S&P Global Services PMI

Wednesday 10:00 EST, ISM Non-Manufacturing PMI

Thursday 8:30 EST, Initial Jobless Claims

Friday 8:30 EST, Nonfarm Payrolls

Trending Sectors

Technology, Consumer Discretionary, and Real Estate were at the top of the list for trending sectors.

Top trending tickers from last week:

$TSLA

$LCID

$NVO

$AAPL

$AMZN

$MSFT

$GOOGL

$META

$NVDA

$NFLX

Have A Great Week!

Enjoy the week everybody and trade safe!

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.