- Ace in the Hole

- Posts

- Ace in the Hole - Edition #15

Ace in the Hole - Edition #15

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had a great weekend.

This market has been unstoppable gaining another 2.23% on the week.

The FOMC meeting brought a lot of volatility which provided some juicy setups on the intraday.

No FOMC this week, but we do have GDP and PCE coming out which could bring some volatility to the market.

Day Trading Thoughts

Keep it simple and keep riding the trend.

Every time $SPY dips to the 21 EMA on the daily, I am a buyer.

There will be a time when it doesn’t hold and when that time comes, it’s probably best to stay hands off.

Until then I will keep buying.

On pullback days, the puts have paid, but price gets quickly bought up by bulls because they are controlling this market.

I will continue to trade the trend until it breaks.

Short-Term Setups For This Week:

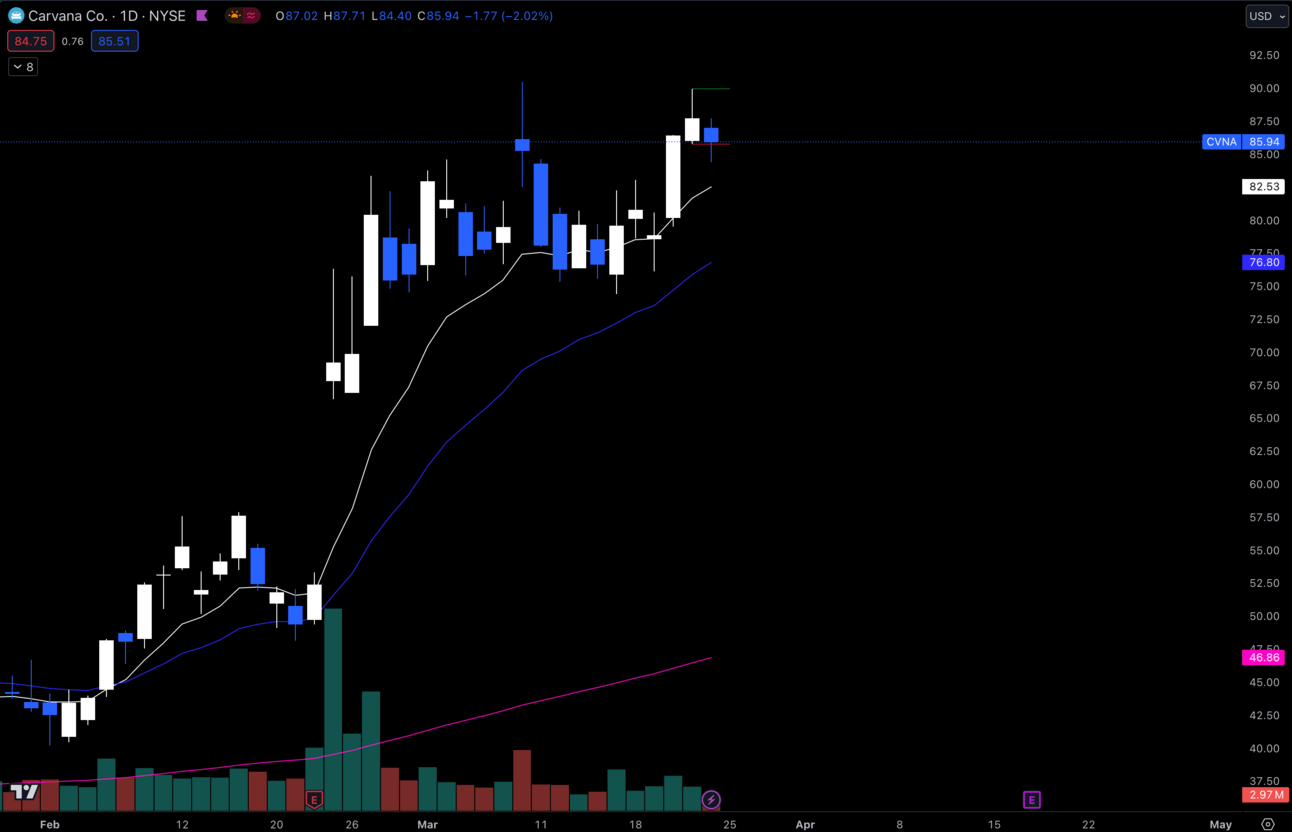

1. $CVNA

$CVNA Daily

I’m personally long in a swing on $CVNA, but i’m liking the breakout potential here.

Looking to hold that $82.50 and break new highs to test previous support at $97.70.

If this gets under $82 I likely won’t be long anymore and will accept that my thesis was invalidated.

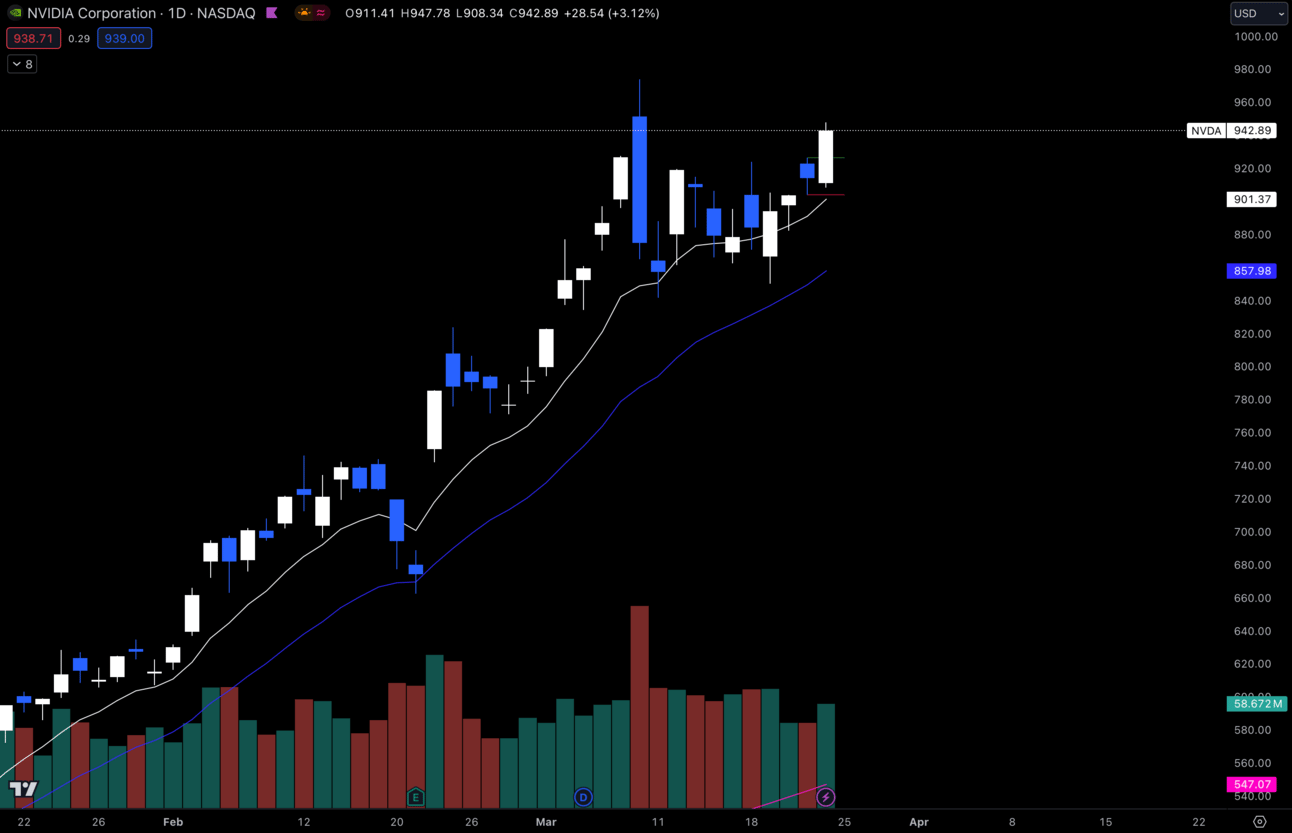

2. $NVDA

$NVDA Daily

$NVDA already starting the breakout out of consolidation.

As much as people think this can’t go higher, I think it’s about to run more.

Holding over $900 I think we breakout to new highs, but losing $900 would likely invalidate my thesis for the breakout.

Long-Term Setups For This Week:

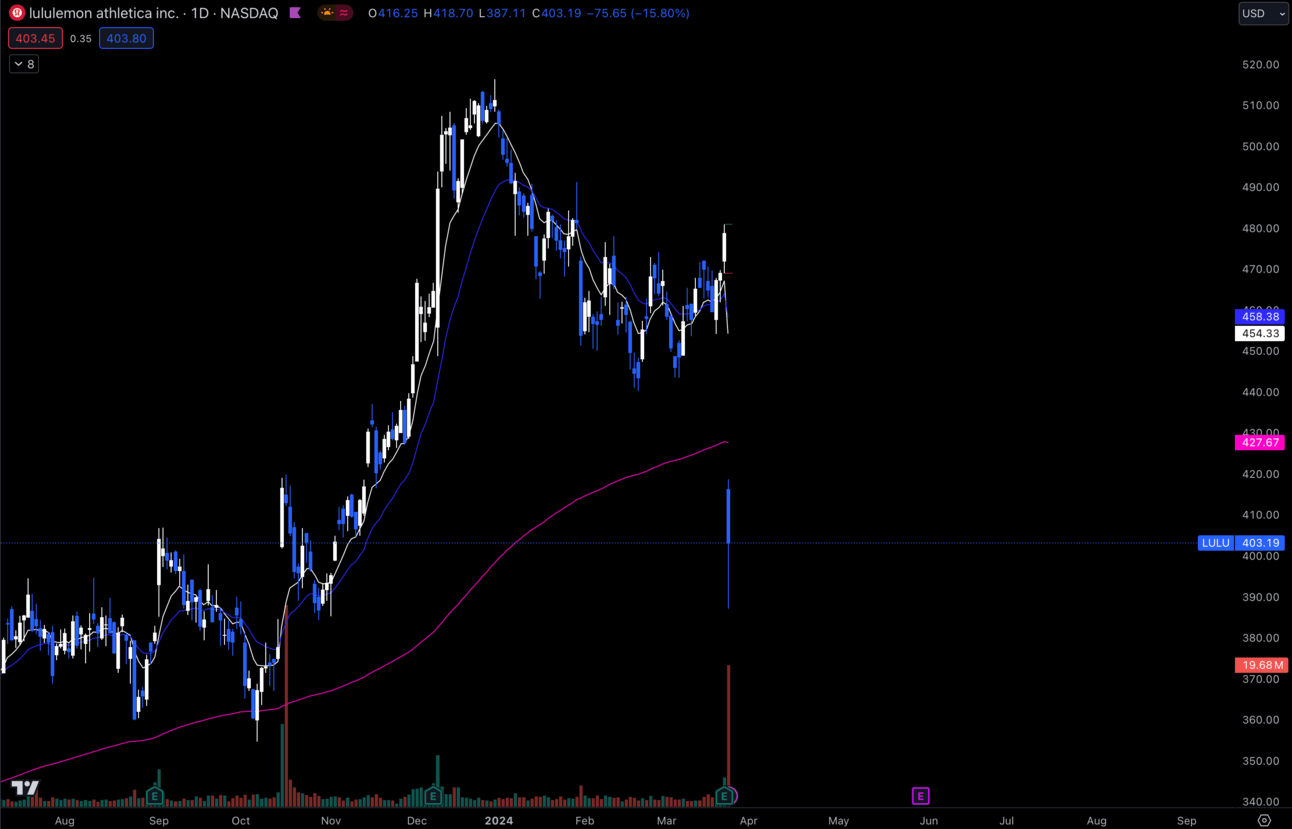

1. $LULU

$LULU Daily

$LULU has been a name i’ve missed out on and I’ve been waiting for an opportunity to start a long term position.

I finally got that dip on earnings down just below $400.

I started a position down here on Friday and will be looking to add more.

Names like $LULU, $ULTA, $ELF, etc. have been amazing investments and for good reason.

Look at their consumers!

It’s women. Women will never stop wearing makeup and never stop buying their leggings. (Might not be a bad idea to listen to what kind of companies your girlfriend is buying!)

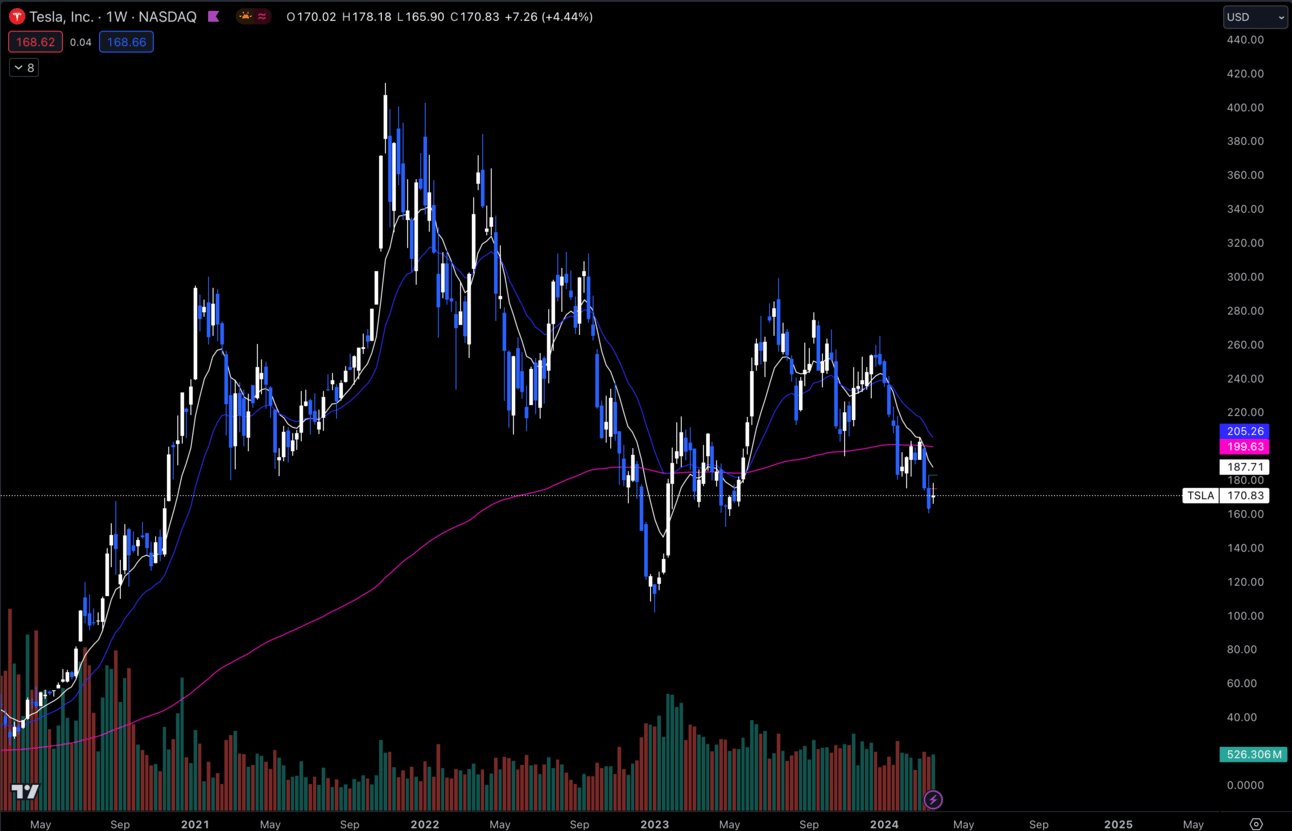

2. $TSLA

$TSLA Daily

I can’t wait for $TSLA to be off of my long term list lol.

She is still underperforming and I am being patient.

Just know if you don’t see her in the long-term section, it’s because she is finally making moves up, but until then she will remain in buying territory.

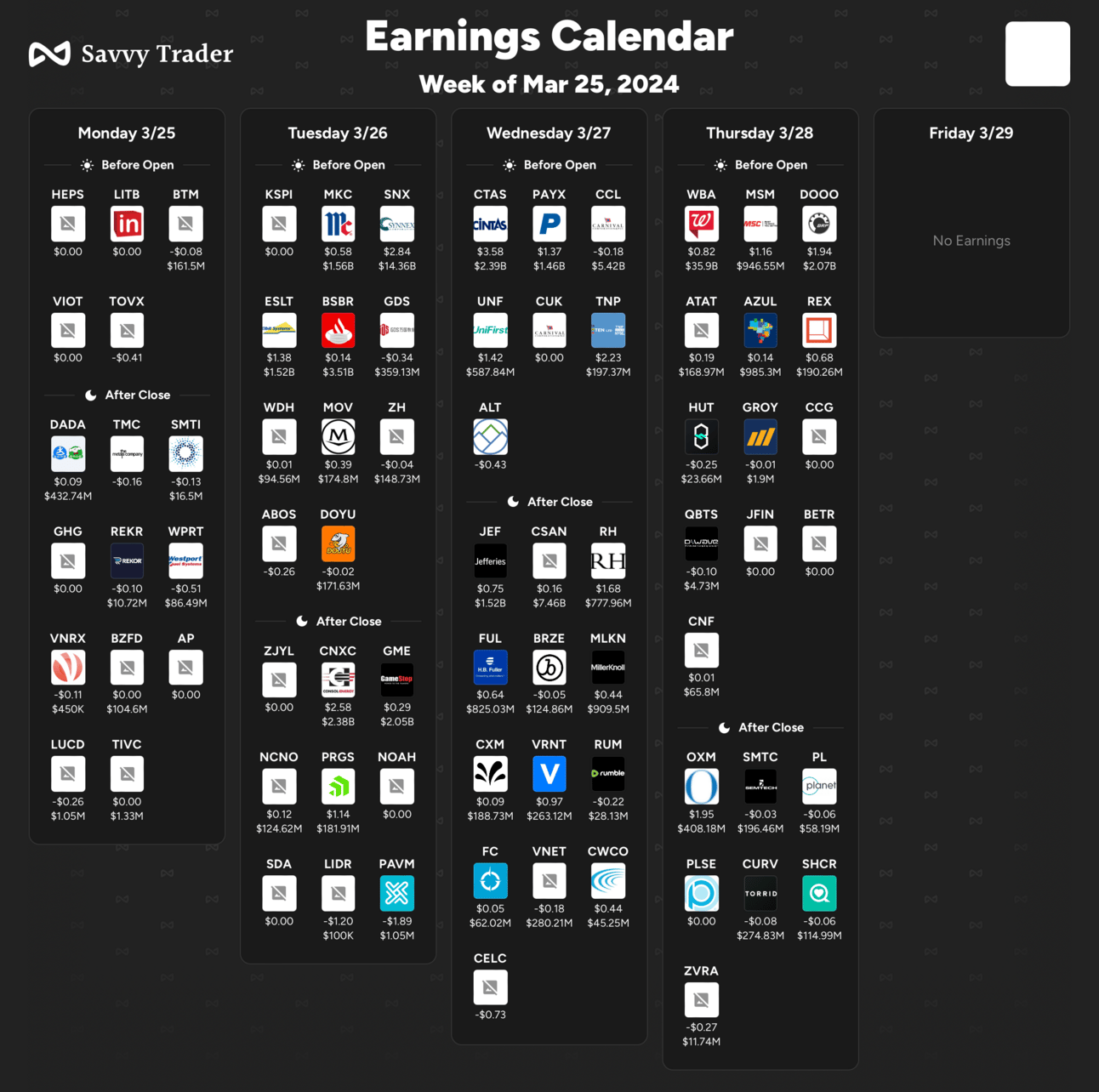

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Monday 10:00 EST, New Home Sales

Tuesday 10:00 EST, CB Consumer Confidence

Wednesday 10:30 EST, Crude Oil Inventories

Thursday 8:30 EST, GDP

Thursday 9:45 EST, Chicago PMI

Trending Sectors

Technology and AI related companies as well as Communication Services continue to perform well while the Real Estate sectors has been underperforming.

Top trending tickers from last week:

$BROS

$BBY

$HUM

$BRK.A

$JNJ

Have A Great Week!

As always, enjoy the week and trade safe! Remember to follow your plan, let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.