- Ace in the Hole

- Posts

- Ace in the Hole - Edition #14

Ace in the Hole - Edition #14

Your Secret Weapon to Beat The Market

Happy Monday Traders!

I hope everybody had an amazing weekend!

Another great week of trading is ahead of us!

The whole market has been going absolutely crazy, but last week we actually saw the S&P 500 close red on the week for the 2nd week in a row.

$SPY hasn’t done that since October of 2023.

We have a BIG week in terms of data, so get ready!

Day Trading Thoughts

My mindset is neutral to bullish at the moment.

Bulls have bought the dip over and over again and now $SPY on Friday was testing the 21 EMA on the daily which is a perfect spot for them to buy the dip.

I would definitely love to see a bigger dip, but if bulls continue to buy so will I.

Again, I am just following the price action where it goes.

Short-Term Setups For This Week:

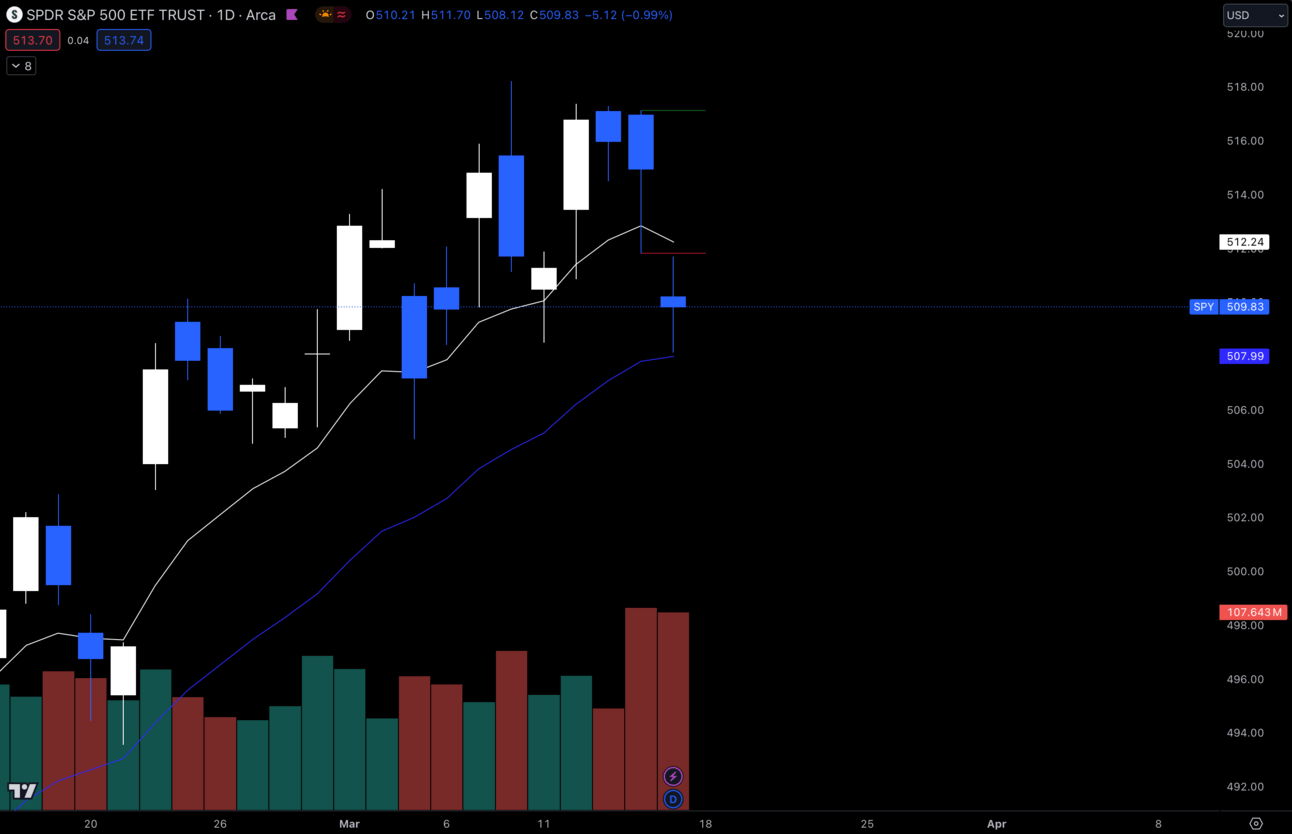

1. $SPY

$SPY Daily

On Friday, $SPY dipped to the 21 EMA (Blue Line) and held it perfectly.

As much as i’m sure we’d all like to see more of a dip, this is the spot in my opinion where bulls step in again if they want to continue the move.

If we get trading under the 21 EMA at $508 then my thesis would be invalidated.

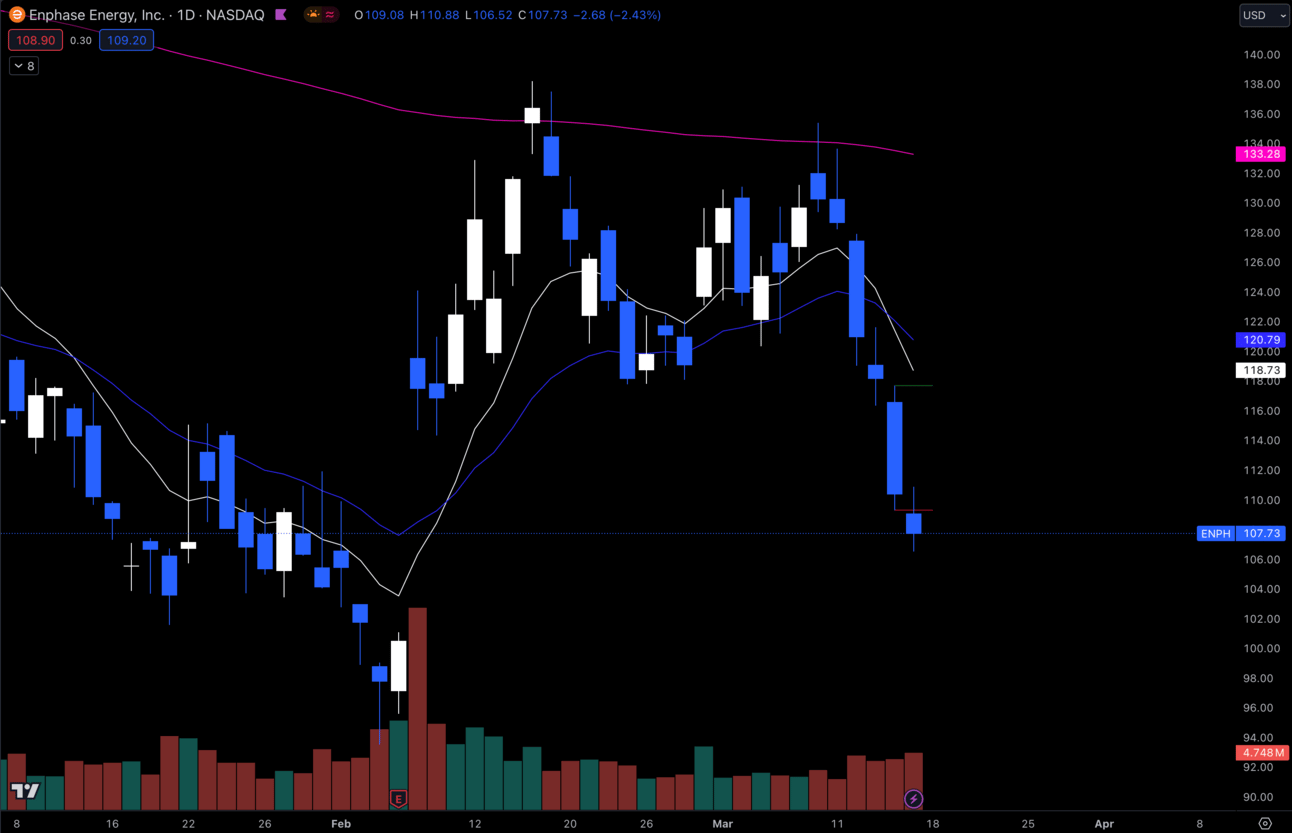

2. $ENPH

$ENPH Daily

$ENPH made a lower high off of the 200 EMA at $133.28 and is now trading in the gap.

This gap goes down to $101.10 and I think that’s where this is headed.

If bulls step in and buy this up off the gap fill then I would look for longs off the gap fill after shorting through the rest of this gap.

Long-Term Setups For This Week:

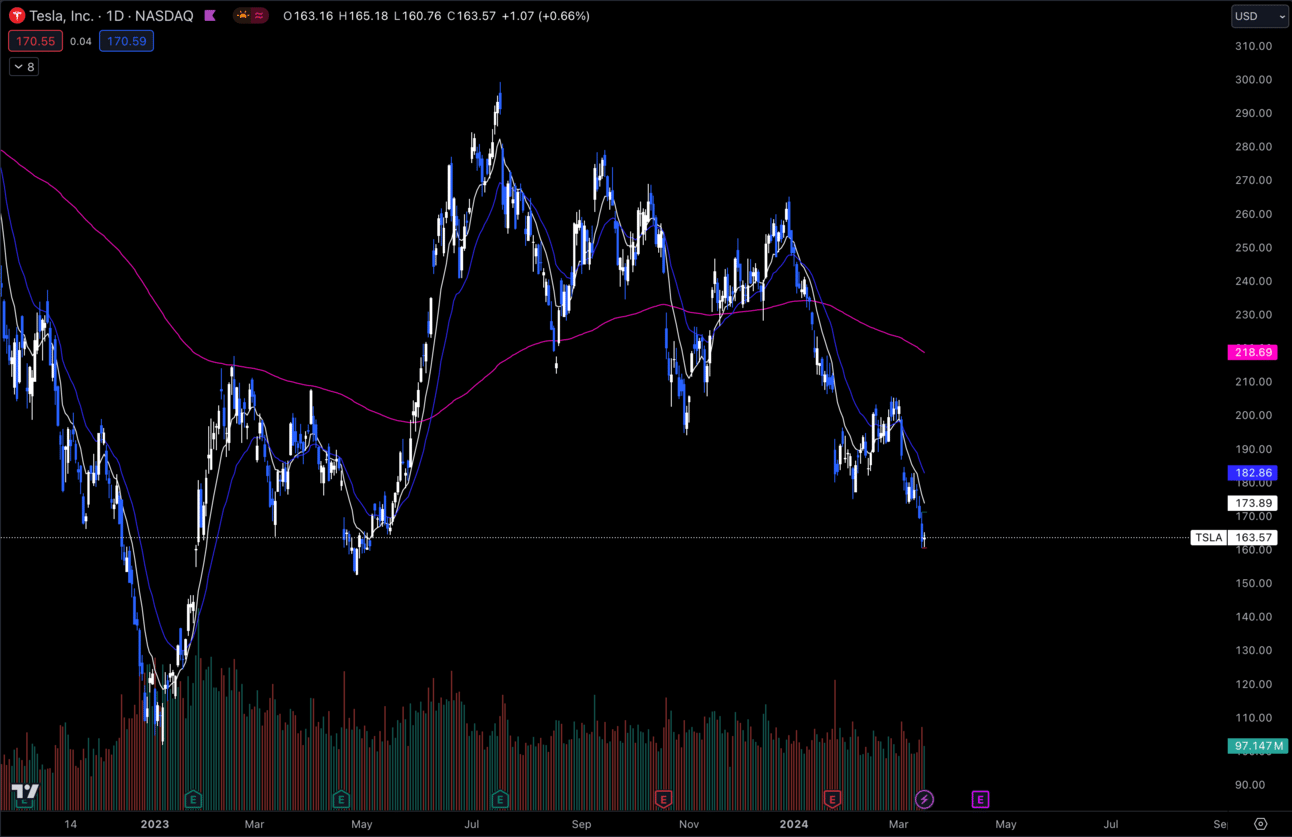

1. $TSLA

$TSLA Daily

Poor $TSLA has just gotten beat up over and over again.

It actually got under my average in my portfolio for the first time in a while.

I wasn't super happy to see that, but that’s part of the game especially when you are playing long-term.

I’d like to get some more shares around these $160s and bring down my average slightly.

Everything else is flying and In my opinion there isn’t much to buy for me at this time.

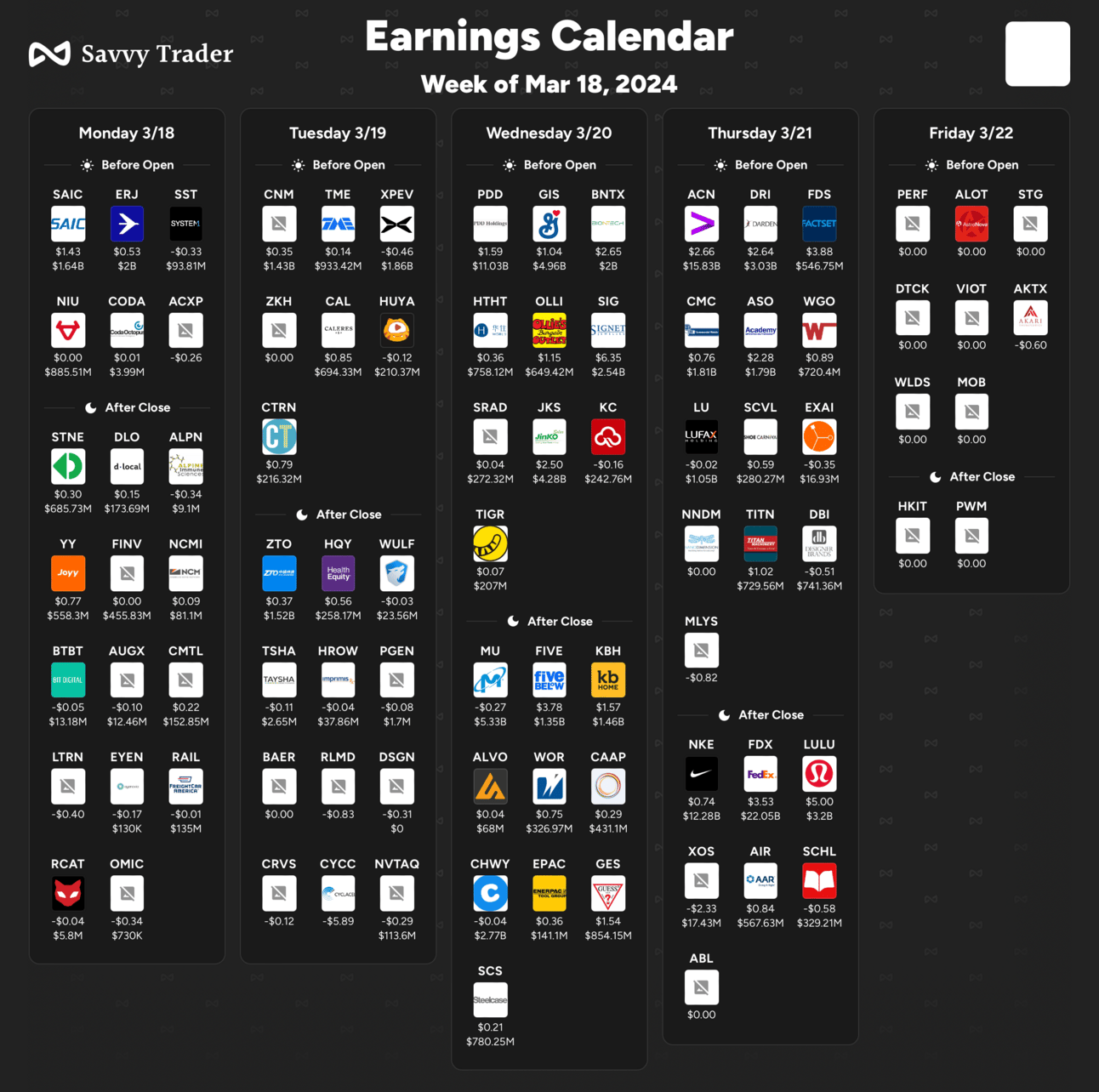

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 1:00 EST, 20-Year Bond Auction

Wednesday 10:30 EST, Crude Oil Inventories

Wednesday 2:00 EST, FOMC Statement

Thursday 10:00 EST, Existing Home Sales

Friday 9:00 EST, Fed Chair Powell Speaks

Trending Sectors

Again, Technology was leading last week with AI names such as $NVDA and $ON

Top trending tickers from last week:

$GERN

$FSR

$MDGL

$ADIL

$TBIO

$BTTX

$IVP

$AMPE

$TNON

$GNS

Have A Great Week!

It’s a BIG week with FOMC, so be careful and trade smart!

Let’s make some $$!

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.