- Ace in the Hole

- Posts

- Ace in the Hole - Edition #13

Ace in the Hole - Edition #13

Your Secret Weapon to Beat The Market

Happy Monday Traders!

We’ve had back to back crazy weeks in this market. This past week $SPY actually ended up closing down .22% after making all time highs 3 more times.

We also saw Jerome Powell testify on the economic outlook and the recent monetary policy before the Joint Economic Committee.

This week we have a decent amount of economic data and some notable companies reporting earnings that I’m keeping eyes on.

Day Trading Thoughts

This market continues to perform relentlessly. Puts have been valid for a few down days that we’ve had, but the bulls continue to buy the dip.

There was a decent move down on Friday from the highs, but still only ended the day down .60%.

I’m ready to play puts more consistently if the setups are there, but I just don’t see it quite yet.

It’s possible CPI and PPI bring some downside in this market, although I’ve thought that the past few times and that obviously hasn’t worked out.

Either way, I will be approaching the market from a very neutral standpoint this week. I’ll be ready to play whichever way this market wants to go.

Short-Term Setups For This Week:

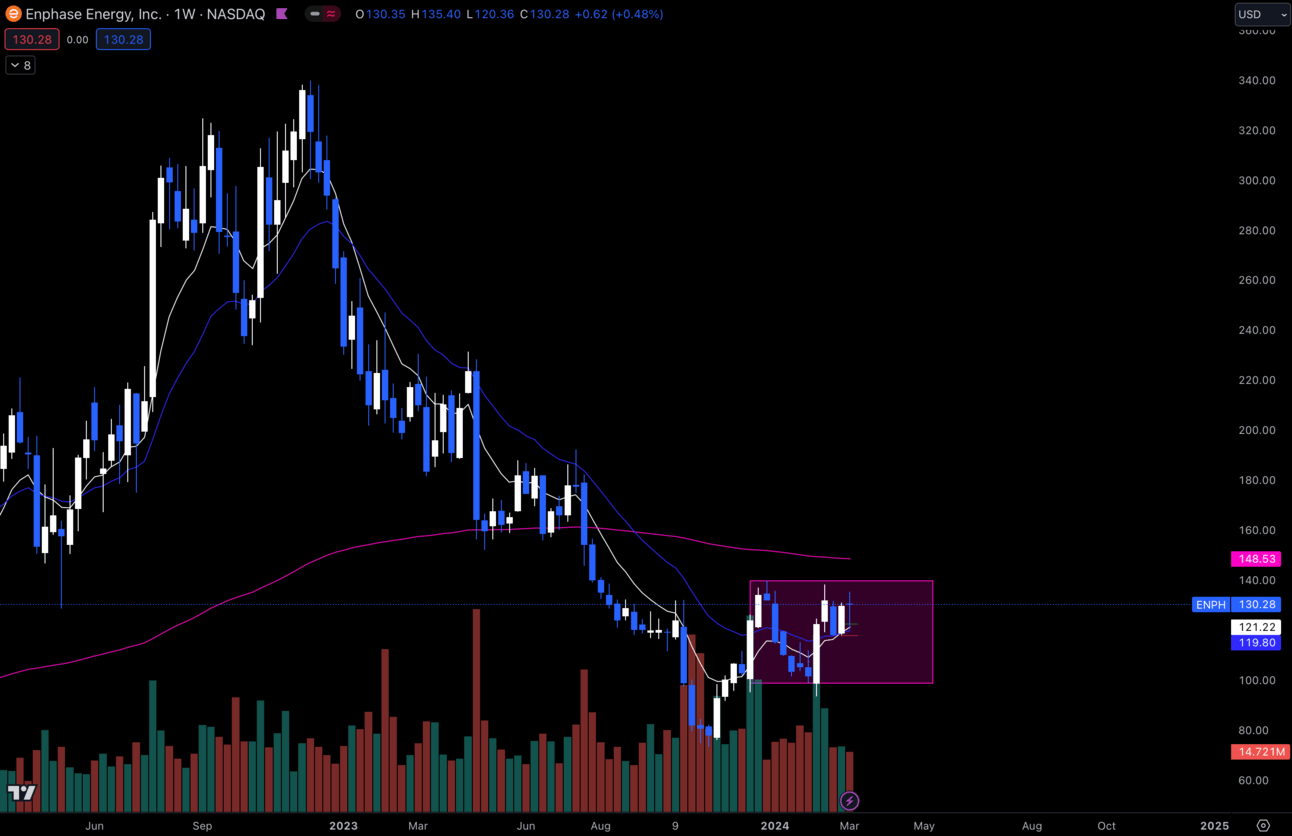

1. $ENPH

$ENPH Weekly

I’m seeing a solid higher low on the weekly off of a big psychological level of $100.

Resistance is sitting from $139-$140, so that’s what I’m watching for $ENPH to break through.

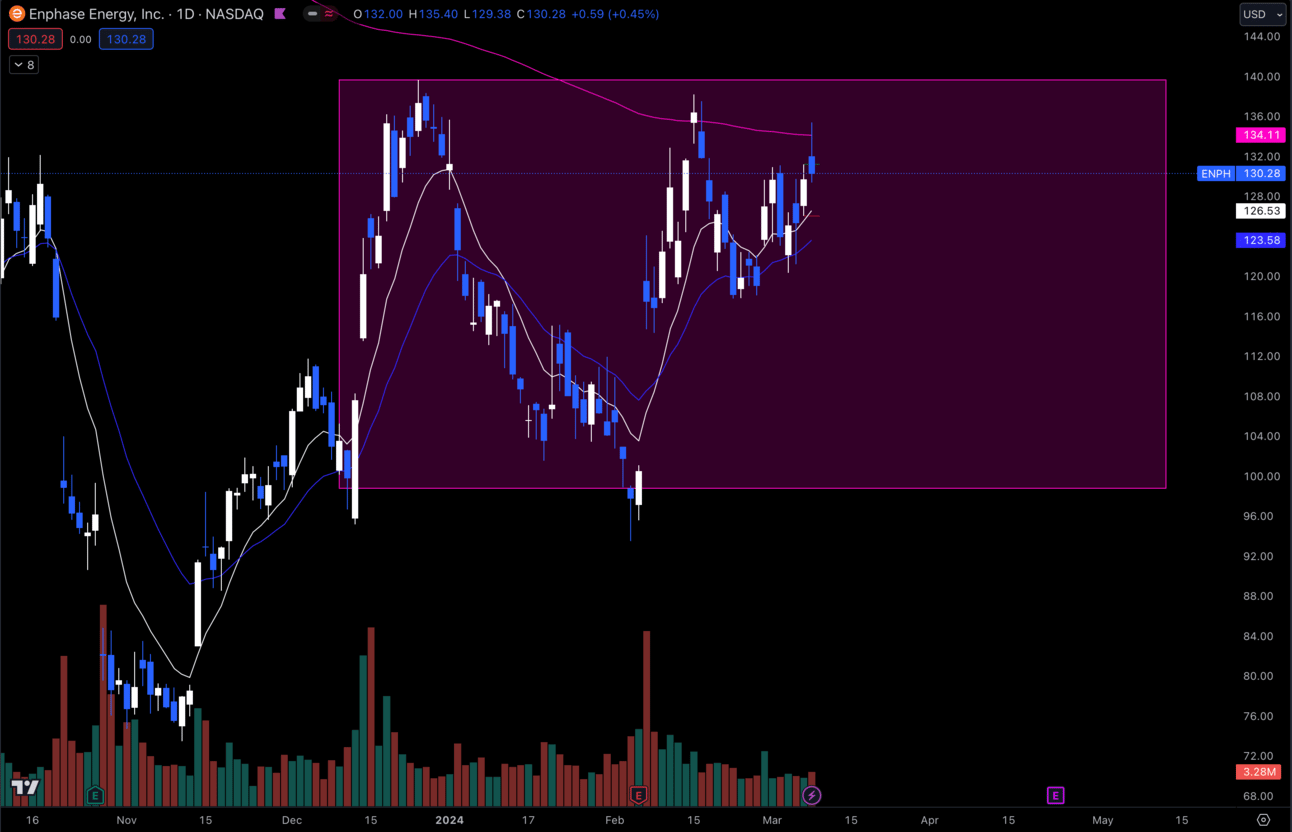

$ENPH Daily

Zooming into a daily chart, I’m seeing rejection off my 200 EMA (Purple Line).

As long as $ENPH is trading above $120, I think it has potential for a weekly breakout.

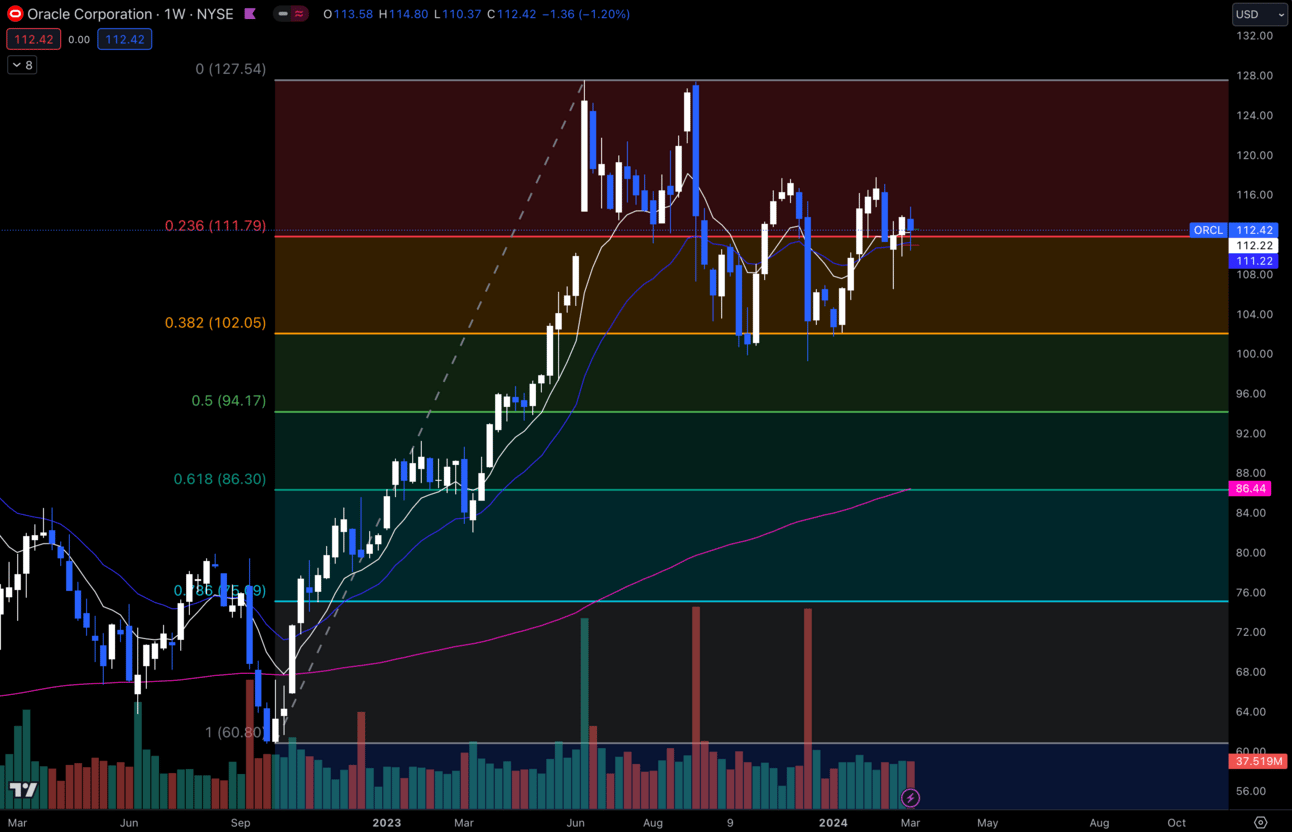

2. $ORCL

$ORCL Weekly

Earnings coming up on this name which might invalidate the setup I’m watching completely, but I thought it was worth a mention.

Seeing higher lows on the weekly after retesting the .382 fibonacci level I have.

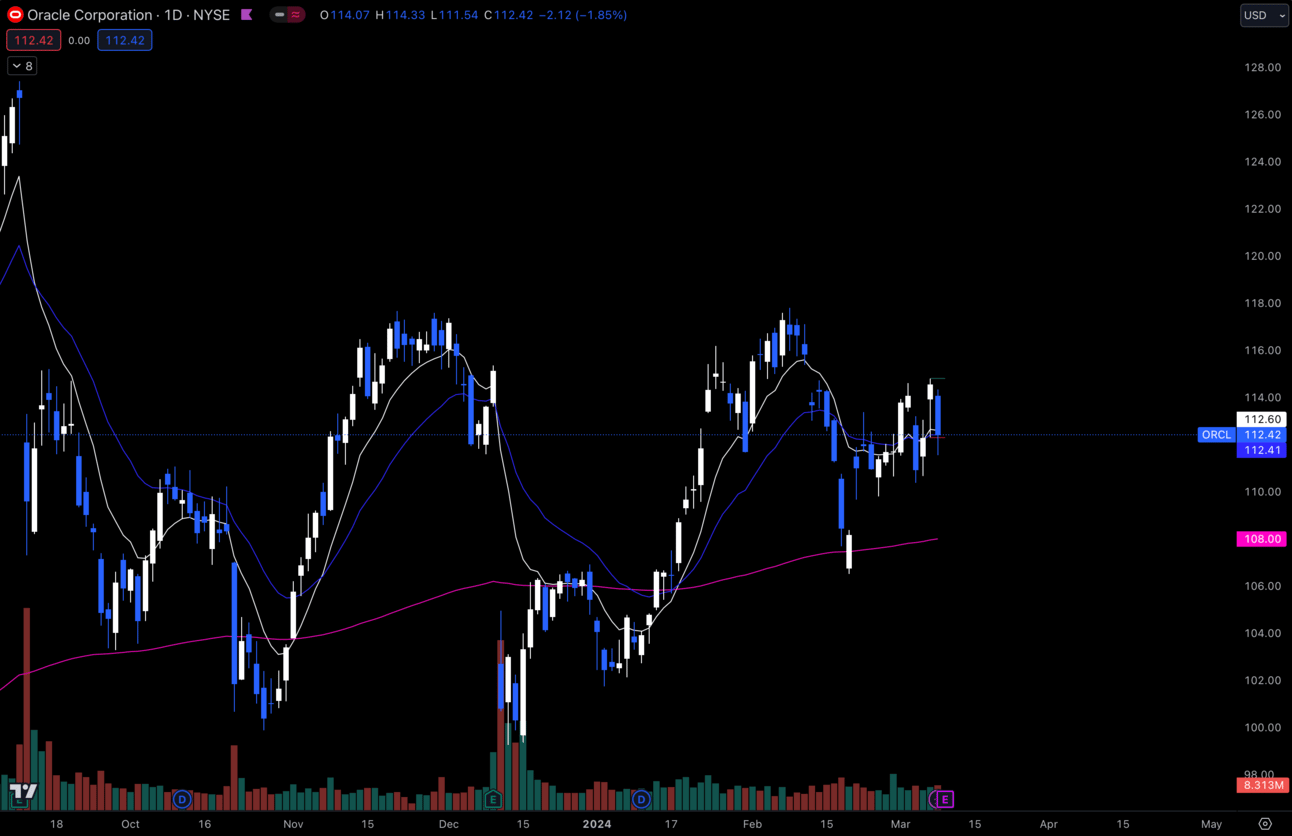

$ORCL Daily

Zooming into the daily, I see us just consolidating back and forth but making higher lows.

I’m wondering if we see a bit of a pre-earnings run up on Monday, but there is no way to know for certain, so I’ll just be keeping eyes on it for now.

Definitely want to be long if $ORCL tries to fill the gap on the daily from $114.72 —> $115.38.

I don’t want to be long if this gets below $110.

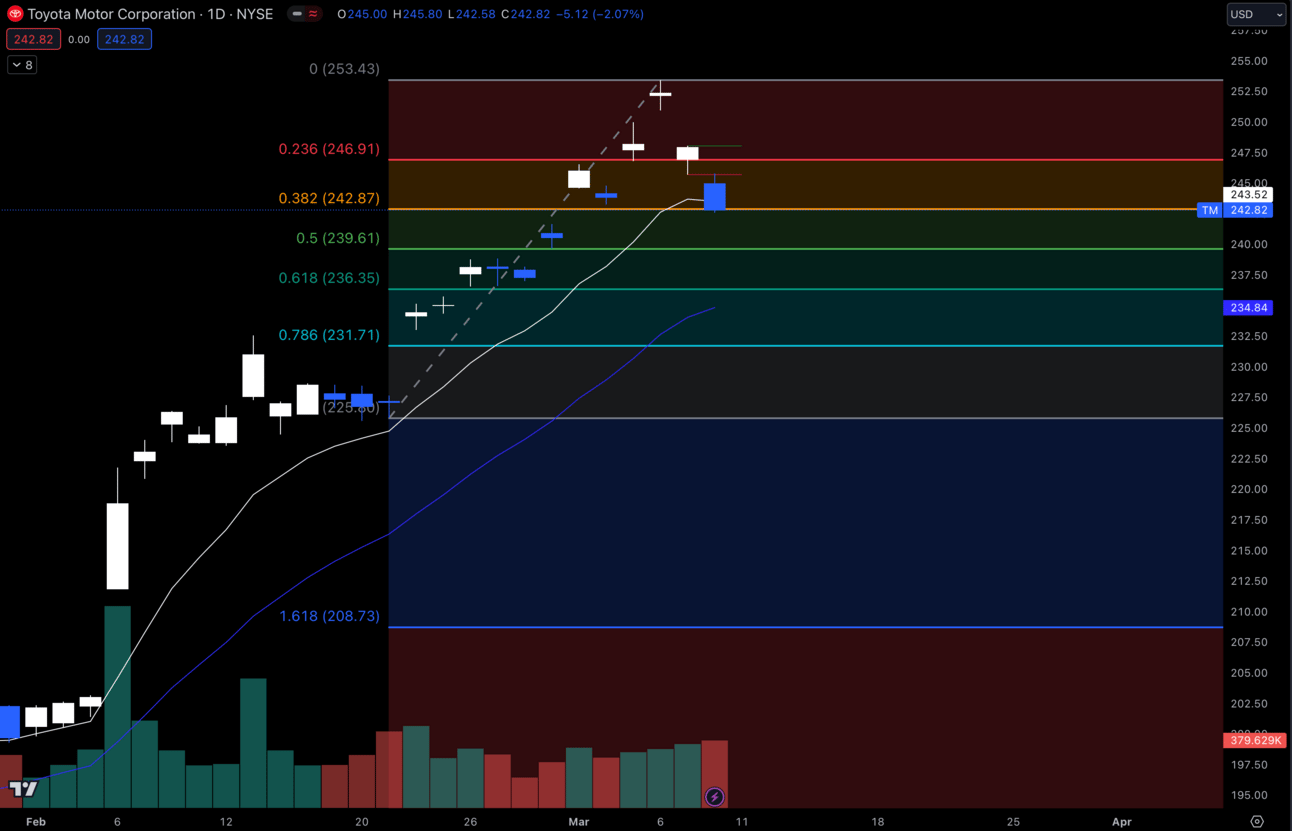

3. $TM

$TM Daily

Toyota is looking interesting on this dip. They are also making a new combustion engine to compete with EVs which I think definitely has potential.

I think we could fall to my .5 fib and I’d look for a bounce there.

If we get more selling pressure, I wouldn’t be surprised if this came down to my .786 fib to retest the previous breakout.

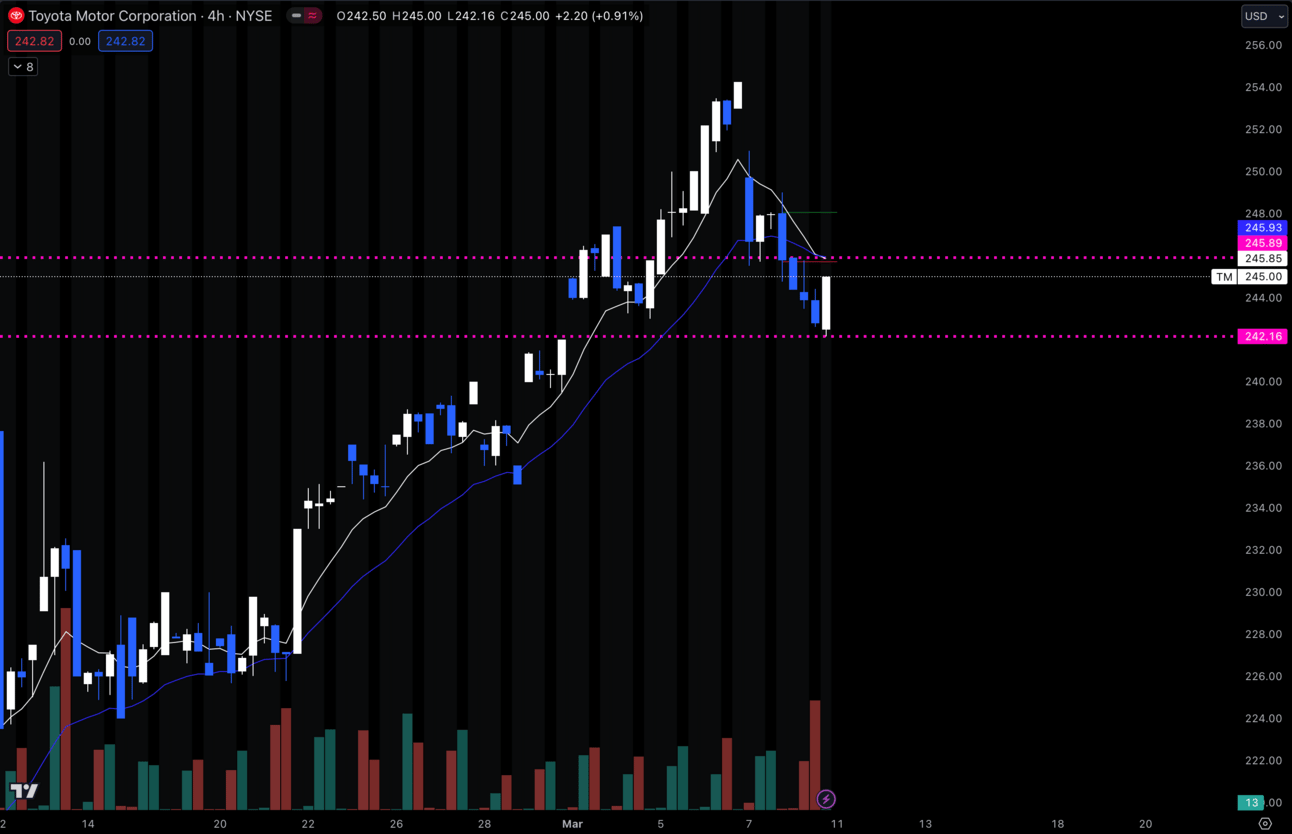

$TM 4 Hour

Zooming into a 4 hour chart, I’m seeing some momentum off the Friday pre market lows.

I’ll be keeping eyes for possible trades throughout the week.

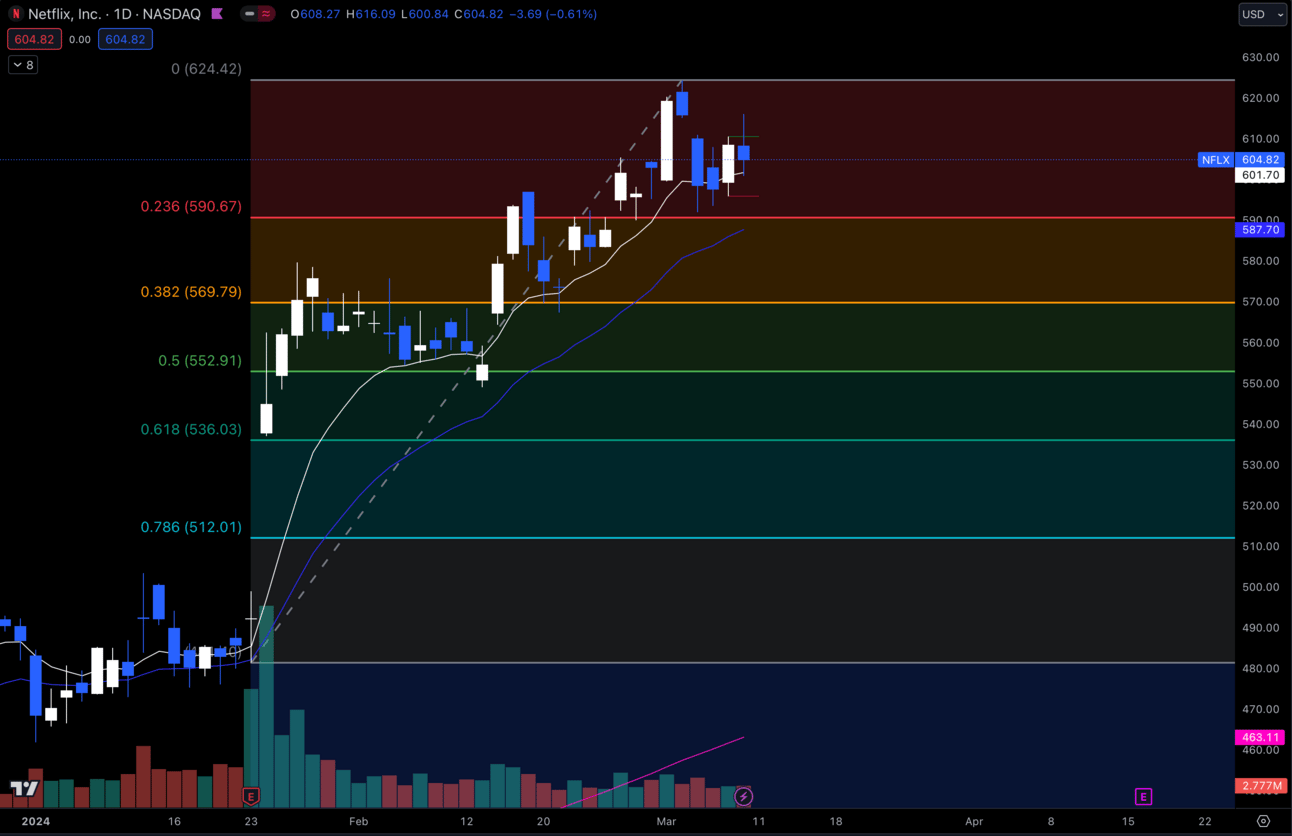

4. $NFLX

$NFLX Daily

$NFLX is on the board again for setups this week.

It continues to get bought up on pull backs and is holding the .236 fib I have drawn.

Looking for another leg up this week, but if it loses the .236 fib it might need more time.

Long-Term Setups:

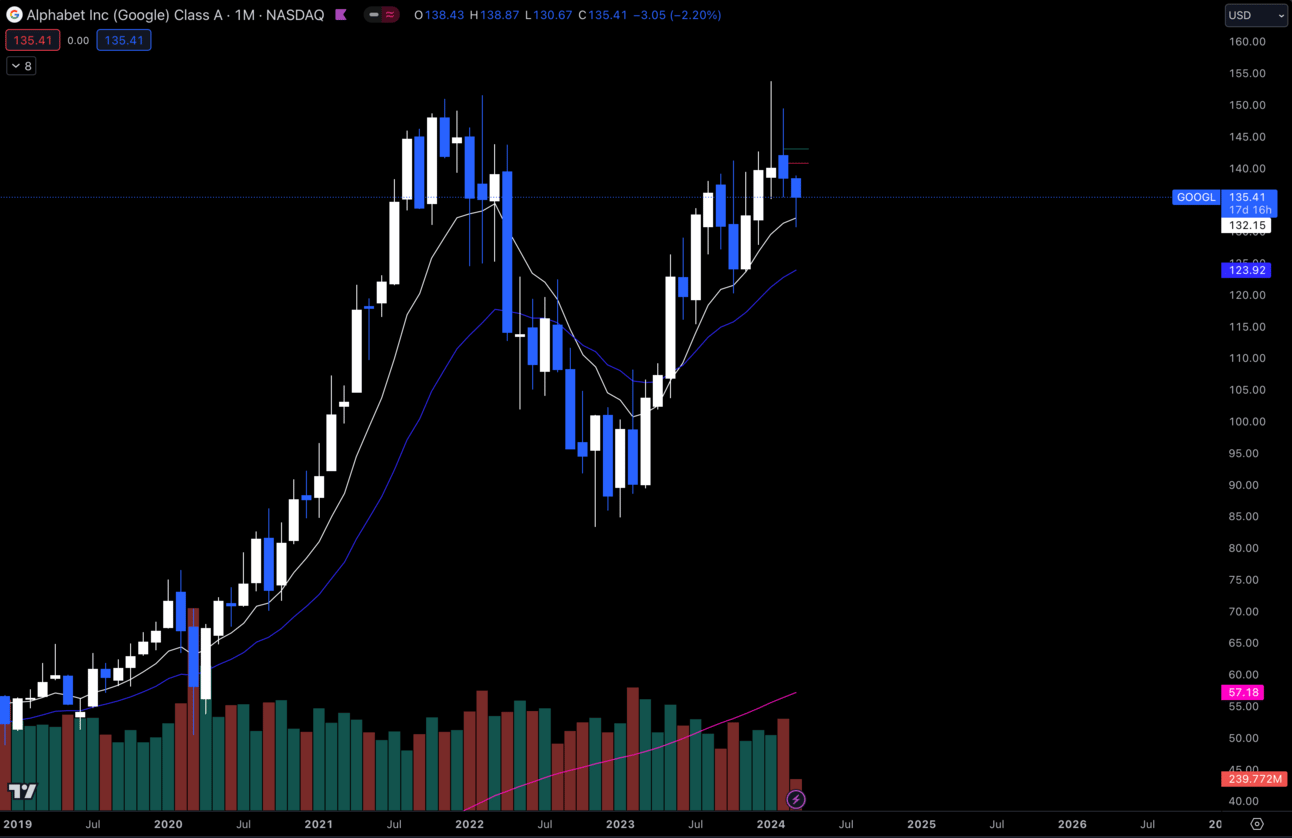

1. $GOOGL

$GOOGL Monthly

$GOOGL is one of the very few tickers I like that is getting a dip.

Holding the 9 EMA on the monthly and keeps making higher lows which leads me to think it wants to breakout.

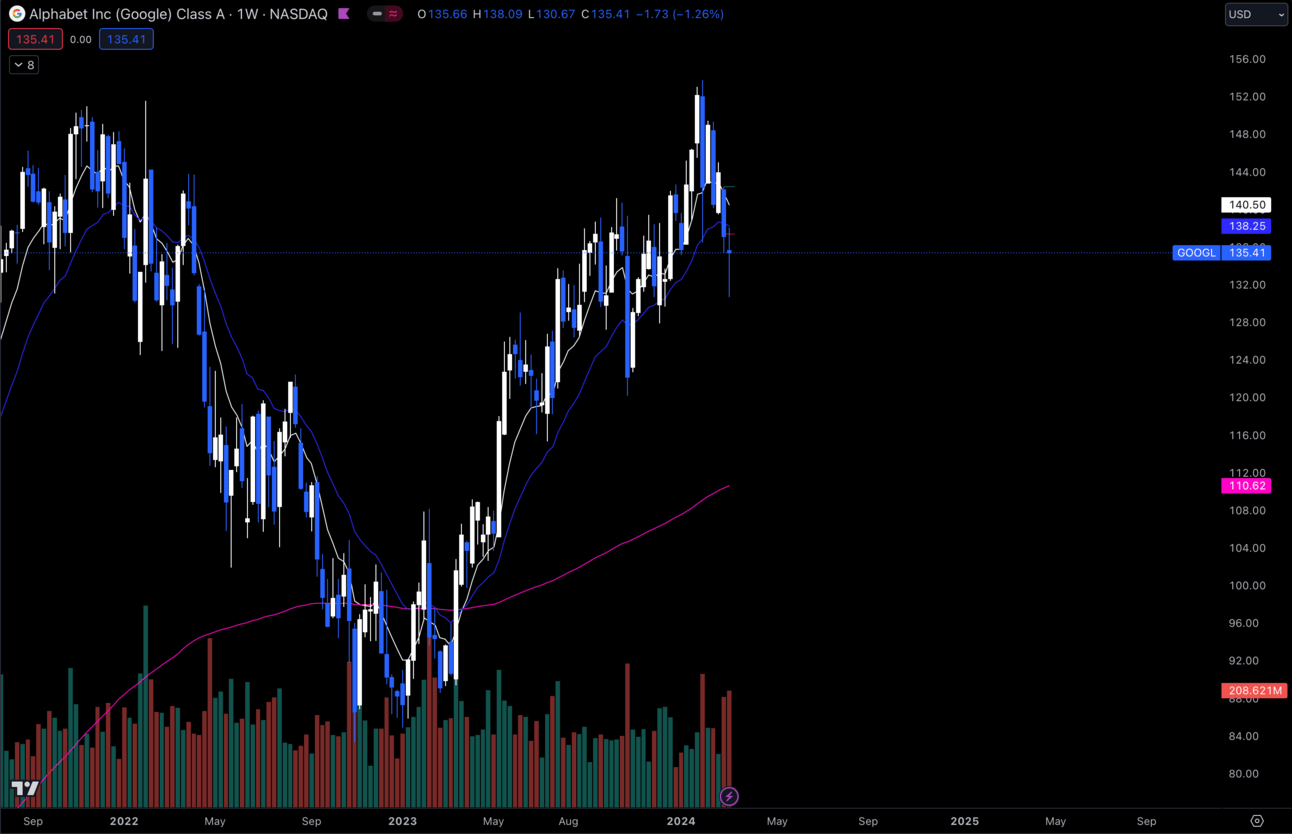

$GOOGL Weekly

Zooming into a weekly, I see its holding 130 well from last week.

As long as we can hold that I’d like to add some shares, but if it breaks below previous week low I have to wait.

2. $SNOW

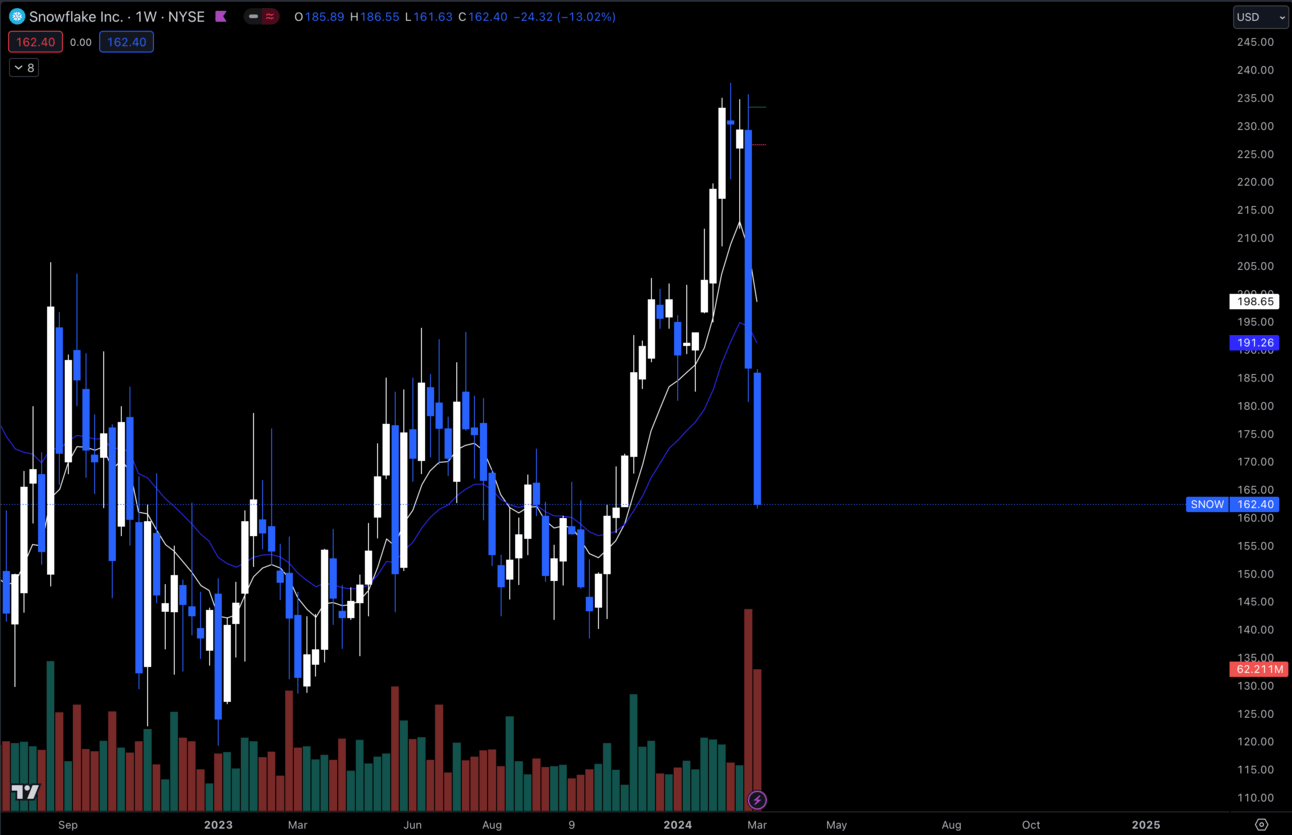

$SNOW Weekly

Okay so $SNOW is an interesting one.

Initially I was immediately going to buy the dip off of earnings until I heard the CEO was leaving.

This has definitely scared me away from buying as of now, but I do think there is still potential here.

I personally just need to see more positive headlines and hear what king of actions this new CEO will be taking.

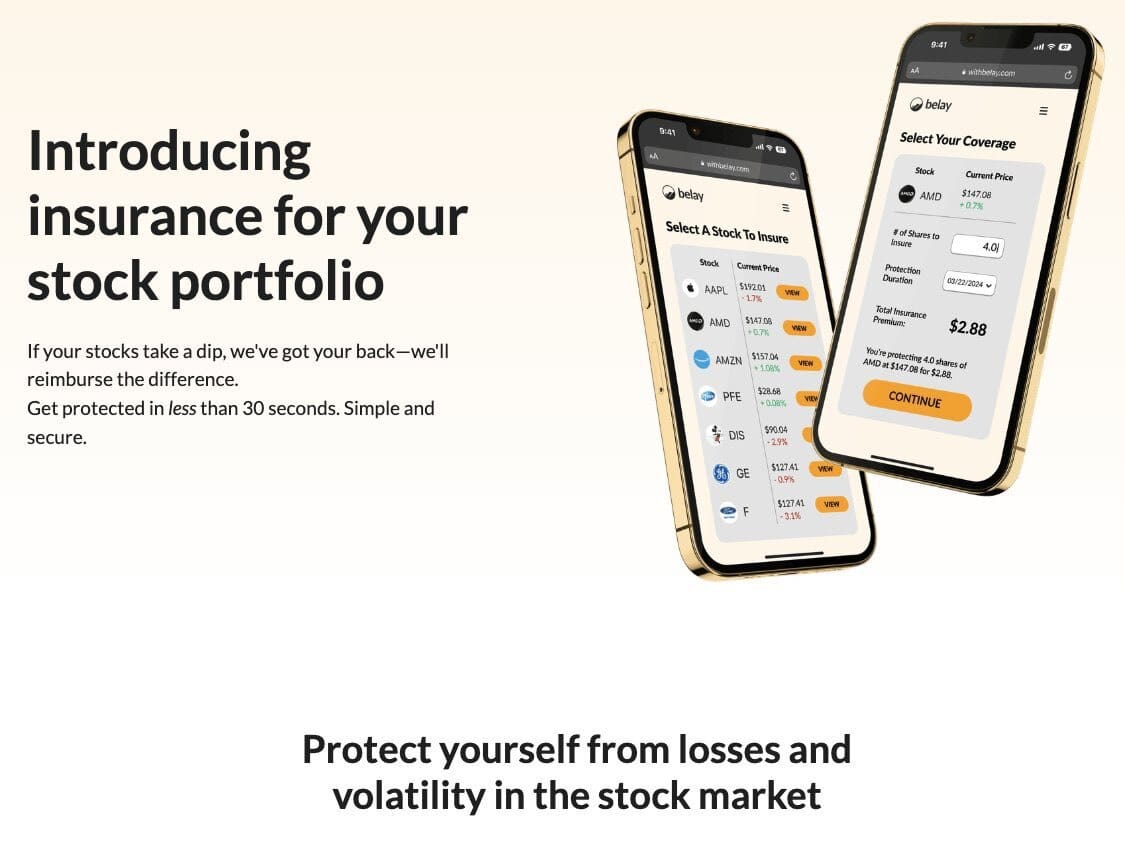

Hedge Your Portfolio!

Do you own less than 100 shares of stock, but still want to be able to properly hedge your positions?

Here is the tool myself and the spaces crew has been using:

Premiums are insanely cheap as market is flying and use code belay-50 and get 50% off!

I highly recommend any of the smaller fish that want to protect their investments to check this out ASAP!

Premiums for a policy are insanely cheap right now!

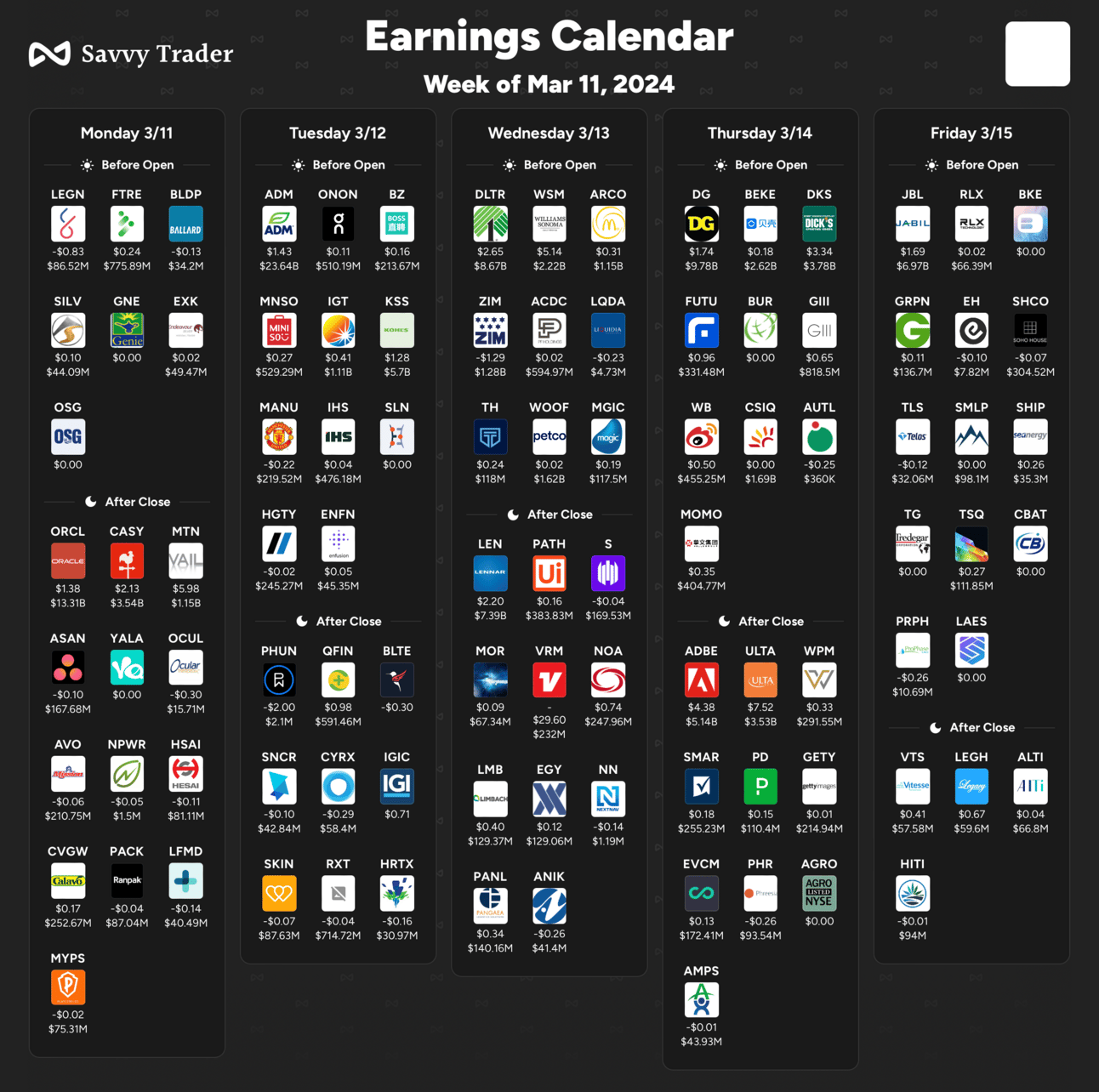

Earnings Calendar

Economic Calendar

These data points are known to bring volatility during the intraday:

Tuesday 8:30 EST, CPI

Tuesday 1:00 EST, 10-Year Note Auction

Wednesday 10:30 EST, Crude Oil Inventories

Wednesday 1:00 EST, 30-Year Bond Auction

Thursday 8:30 EST, PPI

Trending Sectors

Technology and Renewable Energy were at the top of the list for most trending sectors last week.

Top trending tickers from last week:

$SMME

$DNA

$MPW

$PLUG

$DNN

$ATUS

$NKLA

TELL

$BBAI

$FSR

Have A Great Week!

I hope everybody enjoys the week and trades safely! Follow your rules and lets make some $$.

Discord:

Access to all of my trades as well as 5 other analysts’ trades.

Daily livestreams from my mentor.

EDU Channels/Access to EDU Content.

Easy access to talk with me.